IBC’s Strong Earnings Continue in the First Quarter of 2024

May 02 2024 - 1:43PM

Business Wire

International Bancshares Corporation (NASDAQ:IBOC), one of the

largest independent bank holding companies in Texas, today reported

net income for the three months ended March 31, 2024 of

$97.3 million or $1.56 diluted earnings per common

share ($1.57 per share basic) compared to $101.6

million or $1.63 diluted earnings per common share

($1.64 per share basic), which represents a decrease of

4.3% in diluted earnings per share and a 4.2%

decrease in net income over the corresponding period in 2023.

Net income for the first quarter of 2024 continues to be

positively impacted by an increase in interest income earned on our

investment and loan portfolios. The increase in interest is being

driven by both an increase in the size of our investment and loan

portfolios as well as rate changes as a result of the Federal

Reserve Board actions to raise interest rates in 2022 and 2023. Net

interest income has been impacted by an increase in interest

expense, primarily driven by increases in rates paid on deposits

throughout the latter part of 2023. We continue to closely monitor

and adjust rates paid on deposits to remain competitive in the

current economic environment and retain deposits. Net income for

the period was negatively impacted by an increase in our provision

for credit losses, which was primarily impacted by a charge-down of

an impaired credit after the results of a bankruptcy related

foreclosure.

“We are pleased with our continued success in 2024. We are also

extremely pleased to have been ranked first in the S&P Global

Market Intelligence best-performing Public Banks for 2023 listing

and third in the Forbes America’s Best Banks listing. Our team is

highly focused on ‘Doing More’ to deliver exceptional service and

innovative products to our customers, as well as continuing our

long-standing practices of balance sheet, asset liability and

liquidity management. Those initiatives, coupled with strong cost

controls and continued identification of opportunities for

efficiencies across our system will continue to deliver positive

financial results and ideally keep us at the top of the rankings in

2024,” said Dennis E. Nixon, president and CEO.

Total assets at March 31, 2024 were $15.4 billion

compared to $15.1 billion at Dec. 31, 2023. Total net loans

were $8.0 billion at March 31, 2024 compared to $7.9

billion at Dec. 31, 2023. Deposits were $12.0 billion at

March 31, 2024 compared to $11.8 billion at Dec. 31,

2023.

IBC is a multi-bank financial holding company headquartered in

Laredo, Texas, with 166 facilities and 256 ATMs serving 75

communities in Texas and Oklahoma.

“Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: The statements contained in this release which

are not historical facts contain forward-looking information with

respect to plans, projections or future performance of IBC and its

subsidiaries, the occurrence of which involve certain risks and

uncertainties detailed in IBC’s filings with the Securities and

Exchange Commission.

Copies of IBC’s SEC filings and Annual Report (as an exhibit to

the 10-K) may be downloaded from the SEC filings site located at

http://www.sec.gov/edgar.shtml.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502974647/en/

Judith Wawroski Treasurer and Principal Financial Officer

International Bancshares Corporation (956) 722-7611

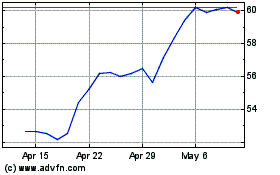

International Bancshares (NASDAQ:IBOC)

Historical Stock Chart

From May 2024 to Jun 2024

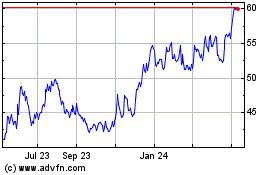

International Bancshares (NASDAQ:IBOC)

Historical Stock Chart

From Jun 2023 to Jun 2024