- Interim clinical update on ACTengine®

IMA203 TCR-T monotherapy targeting PRAME demonstrated high

confirmed objective response rate (cORR) of 50% (6/12) at or above

target dose across Phase 1a and Phase 1b; confirmed responses seen

across different solid tumor types: cutaneous melanoma, ovarian

cancer, head and neck cancer, uveal melanoma, and synovial

sarcoma

- First patient

treated with IMA203CD8, a 2nd generation ACTengine® TCR-T

monotherapy product candidate targeting PRAME in Phase 1b expansion

cohort C; patient treatment ongoing in all three Phase 1b expansion

cohorts

- Next-generation

TCR Bispecific, TCER® IMA402 targeting PRAME showed high anti-tumor

activity in vivo, low T cell engager-associated toxicities and

favorable pharmacodynamic characteristics in preclinical studies;

Phase 1/2 clinical trial on track to start in 2023

- Joint

publication with University of Pennsylvania in Science

Translational Medicine on Immatics’ novel proprietary target COL6A3

exon 6

- $110 million

underwritten offering of 10,905,000 ordinary shares successfully

completed on Oct 12, 2022

- Cash and cash

equivalents as well as other financial assets of $301.5 million1

(€309.3 million) as of September 30, 2022. Additional cash from the

recent public offering in October 2022 funds company operations

into 2025

Tuebingen,

Germany and Houston,

Texas, November

17,

2022 – Immatics N.V. (NASDAQ: IMTX, “Immatics”), a

clinical-stage biopharmaceutical company active in the discovery

and development of T cell-redirecting cancer immunotherapies, today

provided a business update and reported financial results for the

quarter ended September 30, 2022.

“The initial results from our Phase 1a and Phase

1b cohort A showed a highly encouraging confirmed objective

response rate of 50% for patients treated at or above target dose.

Early data from cohort A alone have shown a confirmed objective

response rate of 80%. With these encouraging results, we have built

momentum for our multi-cohort strategy designed to leverage the

full clinical potential of targeting PRAME,” commented Harpreet

Singh, Ph.D., CEO and Co-Founder of Immatics. “We look forward to

sharing the next data readouts from all three Phase 1b expansion

cohorts in 2023, as well as initiating the Phase 1/2 clinical trial

of our TCR Bispecific candidate, TCER® IMA402, targeting PRAME.

With the recent addition of new capital, we have the resources to

deliver on our corporate objectives for 2023 and to fund operations

into 2025.”

Third Quarter 2022 and

Subsequent Company Progress

Adoptive Cell Therapy

Programs

-

ACTengine® IMA203 (PRAME) – In October, Immatics

provided an interim update from the ongoing IMA203 TCR-T

monotherapy. The update covered data from 27 patients in the

completed Phase 1a dose escalation and first 5 patients in the

Phase 1b dose expansion (cohort A) treated with IMA203 monotherapy.

- Treatment with

IMA203 continues to show manageable tolerability.

- Confirmed objective response rate

(cORR): 50% (6/12) at target dose or above with at least 1 billion

infused TCR-T cells across Phase 1a and 1b; thereof 80% cORR (4/5)

in Phase 1b patients alone with all responses ongoing at data

cut-off.

- Confirmed responses observed across

different solid tumor types: cutaneous melanoma, ovarian cancer,

head and neck cancer, uveal melanoma, and synovial sarcoma.

- Immatics has

introduced improvements that may influence clinical outcomes,

including higher cell doses, optimizing the cell product through

manufacturing enhancements and working with disease area experts to

gradually reduce the patient fraction that are very heavily

pre-treated with extreme tumor burden. Immatics continues to

implement such improvements to the IMA203 trial.

- ACTengine®

IMA203 is currently being evaluated in three ongoing Phase 1b dose

expansion cohorts:

- Cohort A -

IMA203 monotherapy interim analysis demonstrated cORR in 4 of 5

patients (80%) with early signs of prolonged durability at 12 weeks

of follow-up. All responses were ongoing at data cut-off. Patients

are treated at provisional recommended phase 2 dose (RP2D) and dose

level (DL) 5.

- Cohort B – The

first patient in the Phase 1b expansion cohort B was treated with

IMA203 in combination with the PD-1 immune checkpoint inhibitor

nivolumab in May 2022. Patients will be treated at RP2D.

- Cohort C – The

first patient was treated in August 2022 with IMA203CD8, Immatics’

2nd -generation monotherapy product candidate in which IMA203

engineered T cells are co-transduced with a CD8αβ co-receptor that

engages functional CD4 and CD8 T cells directed against PRAME. As

IMA203CD8 is a novel product candidate under a new IND2 amendment,

a staggered enrollment is being implemented with the first three

patients being treated at DL3. Following the initial DL3, patients

will be treated at DL4 and DL5.

- Further data

read-outs on all three individual cohorts are planned throughout

2023.

2) IND = Investigational New Drug

- ACTengine®

IMA204 (COL6A3 exon 6) – Immatics and the University of

Pennsylvania co-authored a research paper published in the

peer-reviewed journal, Science Translational Medicine, that

highlighted Immatics’ differentiated approach to develop TCR-based

therapies through its proprietary discovery platforms, XPRESIDENT®

and XCEPTOR®. With this approach, Immatics identified a novel

proprietary HLA-A*02:01-presented target generated by a

tumor-specific alternative splicing event in the abundantly

expressed protein collagen type VI alpha-3 (COL6A3). This target is

expressed at high target density across multiple solid cancer

indications and specific to the tumor stroma. Targeting tumor

stroma provides an innovative therapeutic opportunity to disrupt

the tumor microenvironment. Immatics has engineered

target-specific, affinity-enhanced proprietary TCRs, one of them

being CD8-independent and thus facilitating targeting of COL6A3

exon 6 positive cells by both CD4 and CD8 T cells. The TCR-T

candidate, IMA204 was able to eliminate tumor cells at

physiological target levels in in vitro studies and in vivo mouse

models. Due to Immatics focusing its clinical resources on the

three IMA203 Phase 1b cohorts as well as accelerating the clinical

development for the PRAME TCER® IMA402, the company has delayed the

IND submission for an ACTengine® candidate directed against COL6A3

exon 6.

TCR Bispecifics Programs

- TCER®

IMA401 (MAGEA4/8) – IMA401 is being developed in

collaboration with Bristol Myers Squibb; 9 centers in Germany have

been activated and are enrolling patients.

- TCER® IMA402

(PRAME) – In preclinical data presented at the European

Society for Medical Oncology (ESMO) Congress in September 2022,

TCER® IMA402 showed potent and selective activity against

PRAME-positive tumor cell lines in vitro. In vivo studies in mice

demonstrated dose-dependent anti-tumor activity confirming that

sufficiently high drug doses are key to achieving the desired

anti-tumor effects over a prolonged time period. Pharmacokinetic

characteristics of the half-life extended IMA402 suggest the

potential for a favorable dosing regimen in patients with prolonged

drug exposure at therapeutic levels. Immatics has completed the

manufacturing process development for IMA402, and manufacturing of

the clinical batch is on track for 2H 2022 with a planned start of

the Phase 1/2 trial in 2023. The submission of the CTA/IND3

application is planned for 2Q 2023.

3) Clinical Trial Application (CTA) is the equivalent of an

Investigational New Drug (IND) application in Europe

-

TCER® Platform – In November,

Immatics presented preclinical data of its next-generation,

half-life extended TCR Bispecific format which showed higher

potency in vitro than multiple other established formats, at the

37th Annual Meeting of the Society for Immunotherapy of Cancer

(SITC). The proprietary TCER® format consists of three distinct

elements designed for optimal efficacy and minimal toxicity risk in

patients: 1) high affinity TCR domains targeting tumor-specific

peptide HLA molecules 2) low affinity T cell recruiter against

CD3/TCR, and 3) a human IgG Fc region (silenced) for half-life

extension, favorable stability and manufacturability. The poster

can be accessed on Immatics’ website here.

- PRAME

Target (IMA203, IMA402) – In November,

Immatics presented comprehensive target characterization and

validation data at the SITC Annual Meeting. The data support PRAME

as a highly relevant target for Immatics’ TCR-based therapies,

ACTengine® IMA203 and TCER® IMA402. These therapies have the

potential to address a wide variety of cancer indications such as

cutaneous melanoma, ovarian cancer, uterine cancer, non-small cell

lung cancer, triple-negative breast cancer, head and neck cancer

and uveal melanoma, among others. The poster can be accessed on

Immatics’ website here.

Corporate

Developments

In October 2022, Immatics successfully completed

the underwritten public offering of 10,905,000 ordinary shares at a

price of $10.09 per ordinary share, raising approximately $110

million before deducting underwriting discount and offering

expenses. The offering included participation from investors

including Armistice Capital Master Fund Ltd., Dellora Investments,

EcoR1 Capital, Nantahala Capital, Perceptive Advisors, Rock Springs

Capital, RTW Investments, LP, Samsara BioCapital, SilverArc

Capital, Sofinnova Investments, Wellington Management, 683 Capital

and other specialist biotech investors.

On October 24, 2022, GSK provided Immatics with

notice of its decision to terminate their collaboration. Initially

announced on February 20, 2020, the terms of the agreement included

a €45 Million (~$50 Million) upfront payment to Immatics and the

potential for additional milestone and royalty payments in return

for access to two of Immatics’ TCR-T programs. As communicated to

Immatics, GSK’s decision was made unrelated to the programs and the

progress achieved in the collaboration to date. The

termination will be effective on December 26, 2022.

Third Quarter 2022

Financial Results

Cash Position: Cash and cash equivalents as well

as other financial assets total €309.3 million ($301.5 million1) as

of September 30, 2022 compared to €324.4 million ($316.2 million1)

as of June 30, 2022. The decrease is mainly due to our ongoing

research and development activities. This does not include $110

million gross proceeds from our public offering in October 2022.

Adding those proceeds, the Company projects a cash runway into

2025.Revenue: Total revenue, consisting of revenue from

collaboration agreements, was €15.1 million ($14.7 million1) for

the three months ended September 30, 2022, compared to €6.4 million

($6.2 million1) for the three months ended September 30, 2021. The

increase is mainly related to the increased recognition of revenue

for the multiple ongoing collaboration agreements.Research and

Development Expenses: R&D expenses were €28.6 million ($27.9

million1) for the three months ended September 30, 2022, compared

to €21.2 million ($20.7 million1) for the three months ended

September 30, 2021. The increase is mainly related to increased

expenses for clinical trials.General and Administrative Expenses:

G&A expenses were €8.4 million ($8.2 million1) for the three

months ended September 30, 2022, compared to €8.3 million ($8.1

million1) for the three months ended September 30, 2021.

Net Income/Loss: Net loss was €20.9 million

($20.4 million1) for the three months ended September 30, 2022,

compared to a net loss of €27.2 million ($26.5 million1) for the

three months ended September 30, 2021. The decrease was primarily

the result of the increased revenue from multiple collaboration

agreements.

Full financial statements can be found in the

current report on Form 6-K filed with the Securities and Exchange

Commission (SEC) and published on the SEC website under

www.sec.gov.

1 All amounts translated using the exchange rate

published by the European Central Bank in effect as of September

30, 2022 (1 EUR = 0.9748 USD).

To see the full list of events and

presentations, visit

https://investors.immatics.com/events-presentations

– END –

About ImmaticsImmatics combines

the discovery of true targets for cancer immunotherapies with the

development of the right T cell receptors with the goal of enabling

a robust and specific T cell response against these targets. This

deep know-how is the foundation for our pipeline of Adoptive Cell

Therapies and TCR Bispecifics as well as our partnerships with

global leaders in the pharmaceutical industry. We are committed to

delivering the power of T cells and to unlocking new avenues for

patients in their fight against cancer.

For regular updates about Immatics, visit www.immatics.com. You

can also follow us on Instagram, Twitter and LinkedIn.

Forward-Looking

Statements:Certain statements in this press release may be

considered forward-looking statements. Forward-looking statements

generally relate to future events or Immatics’ future financial or

operating performance. For example, statements concerning the

timing of product candidates and Immatics’ focus on partnerships to

advance its strategy are forward-looking statements. In some cases,

you can identify forward-looking statements by terminology such as

“may”, “should”, “expect”, “intend”, “will”, “estimate”,

“anticipate”, “believe”, “predict”, “potential” or “continue”, or

the negatives of these terms or variations of them or similar

terminology. Such forward-looking statements are subject to risks,

uncertainties, and other factors which could cause actual results

to differ materially from those expressed or implied by such

forward looking statements. These forward-looking statements are

based upon estimates and assumptions that, while considered

reasonable by Immatics and its management, are inherently

uncertain. New risks and uncertainties may emerge from time to

time, and it is not possible to predict all risks and

uncertainties. Factors that may cause actual results to differ

materially from current expectations include, but are not limited

to, various factors beyond management's control including general

economic conditions and other risks, uncertainties and factors set

forth in filings with the SEC. Nothing in this presentation should

be regarded as a representation by any person that the

forward-looking statements set forth herein will be achieved or

that any of the contemplated results of such forward-looking

statements will be achieved. You should not place undue reliance on

forward-looking statements, which speak only as of the date they

are made. Immatics undertakes no duty to update these

forward-looking statements. All the scientific and clinical data

presented within this press release are – by definition prior to

completion of the clinical trial and a clinical study report –

preliminary in nature and subject to further quality checks

including customary source data verification.

For more information, please

contact:

|

Media and Investor Relations Contact |

|

Jacob Verghese or Eva Mulder |

|

Trophic Communications |

|

Phone: +49 89 2070 89831 or +31 6 52 33 1579 |

|

immatics@trophic.eu |

|

Immatics N.V. |

|

|

Anja Heuer |

Jordan Silverstein |

|

Director, Corporate Communications |

Head of Strategy |

|

Phone: +49 89 540415-606 |

Phone: +1 281 810 7545 |

|

media@immatics.com |

InvestorRelations@immatics.com |

Unaudited Condensed Consolidated Statement of Financial

Position of Immatics N.V.

| |

|

|

|

|

|

As of |

|

|

|

September 30, 2022 |

December 31, 2021

|

|

|

|

|

|

|

|

|

(Euros in thousands) |

|

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash

equivalents |

178,047 |

132,994 |

|

|

Other financial

assets |

131,287 |

12,123 |

|

|

Accounts

receivable |

1,139 |

682 |

|

|

Other current

assets |

11,838 |

6,408 |

|

|

|

|

|

|

|

Total current

assets |

322,311 |

152,207 |

|

|

Non-current assets |

|

|

|

|

Property, plant and

equipment |

11,737 |

10,506 |

|

|

Intangible

assets |

1,542 |

1,315 |

|

|

Right-of-use assets

|

14,688 |

9,982 |

|

|

Other non-current

assets |

4,015 |

636 |

|

|

|

|

|

|

|

Total non-current

assets |

31,982 |

22,439 |

|

|

|

|

|

|

|

Total

assets |

354,293 |

174,646 |

|

|

|

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

Current liabilities |

|

|

|

|

Provisions |

4,372 |

51 |

|

|

Accounts

payable |

12,828 |

11,624 |

|

|

Deferred

revenue |

80,150 |

50,402 |

|

|

Other financial

liabilities |

19,982 |

27,859 |

|

|

Lease

liabilities |

2,424 |

2,711 |

|

|

Other current

liabilities |

4,366 |

2,501 |

|

|

|

|

|

|

|

Total current

liabilities |

124,122 |

95,148 |

|

|

Non-current liabilities |

|

|

|

|

Deferred

revenue |

103,215 |

48,225 |

|

|

Lease

liabilities |

13,857 |

7,142 |

|

|

Other non-current

liabilities |

55 |

68 |

|

|

|

|

|

|

|

Total non-current

liabilities |

117,127 |

55,435 |

|

|

Shareholders’ equity |

|

|

|

|

Share capital |

657 |

629 |

|

|

Share premium |

602,272 |

565,192 |

|

|

Accumulated

deficit |

(487,067) |

(537,813) |

|

|

Other reserves |

(2,818) |

(3,945) |

|

|

|

|

|

|

|

Total shareholders’

equity |

113,044 |

24,063 |

|

|

|

|

|

|

|

Total liabilities and shareholders’

equity |

354,293 |

174,646 |

|

|

|

|

|

|

Unaudited Condensed Consolidated Statement of

Profit/(Loss) of Immatics N.V.

| |

|

|

|

|

|

|

|

Three months ended September 30,

|

Nine months ended September 30, |

|

|

|

2022 |

2021 |

2022 |

2021 |

|

|

|

(Euros in thousands, exceptshare and per

share data) |

(Euros in thousands, exceptshare

and per share data) |

|

|

Revenue from collaboration

agreements |

15,060 |

6,443 |

135,183 |

19,036 |

|

|

Research and development

expenses |

(28,572) |

(21,225) |

(78,933) |

(64,613) |

|

|

General and administrative

expenses |

(8,422) |

(8,266) |

(26,383) |

(24,968) |

|

|

Other income |

9 |

47 |

42 |

311 |

|

|

|

|

|

|

|

|

|

Operating

result |

(21,925) |

(23,001) |

29,909 |

(70,234) |

|

|

Financial

income |

7,839 |

1,421 |

16,613 |

4,474 |

|

|

Financial

expenses |

(426) |

(171) |

(1,950) |

(1,400) |

|

|

Change in fair value of warrant

liabilities |

(5,865) |

(5,452) |

7,877 |

(9,388) |

|

|

|

|

|

|

|

|

|

Financial

result |

1,548 |

(4,202) |

22,540 |

(6,314) |

|

|

|

|

|

|

|

|

|

Profit/(loss) before

taxes |

(20,377) |

(27,203) |

52,449 |

(76,548)

|

|

|

Taxes on

income |

(558) |

— |

(1,703) |

— |

|

|

Net

profit/(loss) |

(20,935) |

(27,203) |

50,746 |

(76,548)

|

|

|

|

|

|

|

|

|

|

Net profit/(loss) per

share: |

|

|

|

|

|

|

Basic |

(0.32) |

(0.43) |

0.79 |

(1.22) |

|

|

Diluted |

(0.32) |

(0.43) |

0.78 |

(1.22) |

|

|

Weighted average shares

outstanding: |

|

|

|

|

|

|

Basic |

65,634,347 |

62,911,465 |

64,508,091 |

62,909,797 |

|

|

Diluted |

65,634,347 |

62,911,465 |

65,239,279 |

62,909,797 |

|

Unaudited Condensed Consolidated Statement of

Comprehensive Income/(Loss) of Immatics N.V.

|

|

Three months ended

September 30, |

Nine months ended September 30,

|

|

|

2022 |

2021 |

2022 |

2021 |

|

|

(Euros in thousands) |

(Euros in thousands) |

|

Net

profit/(loss) |

(20,935) |

(27,203) |

50,746 |

(76,548) |

|

Other comprehensive income/(loss) |

|

|

|

|

|

Items that may be reclassified subsequently to profit or loss, net

of tax |

|

|

|

|

|

Currency translation differences from foreign

operations |

(211) |

1,252 |

1,127 |

2,576 |

|

|

|

|

|

|

|

Total comprehensive income/(loss) for the

period |

(21,146) |

(25,951) |

51,873 |

(73,972) |

|

|

|

|

|

|

Unaudited Condensed Consolidated Statement of Cash

Flows of Immatics N.V.

| |

|

|

|

|

Nine months ended September 30,

|

|

|

2022 |

2021 |

|

|

|

|

|

|

(Euros in thousands) |

|

Cash flows from operating activities |

|

|

|

Net

profit/(loss) |

50,746 |

(76,548) |

|

Adjustments for: |

|

|

|

Interest

income |

(606) |

(102) |

|

Depreciation and

amortization |

5,218 |

3,967 |

|

Interest

expense |

748 |

213 |

|

Equity settled share-based

payment |

16,725 |

21,671 |

|

Net foreign exchange

differences* |

(11,974) |

(3,905) |

|

Change in fair value of warrant

liabilities |

(7,877) |

9,388 |

|

Changes in: |

|

|

|

(Increase)/decrease in accounts

receivable |

(457) |

525 |

|

(Increase) in other

assets |

(6,523) |

(390) |

|

Increase/(decrease) in accounts payable and other

liabilities |

85,888 |

(14,233) |

|

Interest

received |

213 |

144 |

|

Interest paid |

(521) |

(213) |

|

|

|

|

|

Net cash provided

by/(used in) operating

activities* |

131,580 |

(59,483) |

|

|

|

|

|

Cash flows from investing activities |

|

|

|

Payments for property, plant and

equipment |

(3,390) |

(3,277) |

|

Cash paid for investments classified in Other financial

assets |

(128,726) |

(11,362) |

|

Cash received from maturity of investments classified in Other

financial

assets |

12,695 |

24,447 |

|

Payments for intangible

assets |

(220) |

(487) |

|

Proceeds from disposal of property, plant and

equipment |

52 |

— |

|

|

|

|

|

Net cash (used in)/provided

by investing

activities |

(119,588) |

9,321 |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

Proceeds from issuance of shares to equity

holders |

21,009 |

75 |

|

Transaction costs deducted from

equity |

(626) |

— |

|

Payments for

leases |

(2,162) |

(2,102) |

|

|

|

|

|

Net cash provided

by/(used in) financing

activities |

18,221 |

(2,027) |

|

|

|

|

|

Net increase/(decrease) in cash and cash

equivalents* |

30,213 |

(52,189) |

|

|

|

|

|

Cash and cash equivalents at beginning of

period |

132,994 |

207,530 |

|

|

|

|

|

Effects of exchange rate changes on cash and cash

equivalents* |

14,840 |

5,953 |

|

|

|

|

|

Cash and cash equivalents at end of

period |

178,047 |

161,294 |

|

|

|

|

Unaudited Condensed Consolidated Statement of Changes in

Shareholders’ equity of Immatics N.V.

| |

|

|

|

|

|

|

| (Euros

in thousands) |

Sharecapital |

Sharepremium |

Accumulateddeficit |

Otherreserves |

Totalshare-holders’equity

|

|

|

Balance as of January 1,

2021 |

629 |

538,695 |

(444,478) |

(7,459) |

87,387 |

|

|

Other comprehensive

income |

— |

— |

— |

2,576 |

2,576 |

|

|

Net loss |

— |

— |

(76,548) |

— |

(76,548) |

|

|

Comprehensive income/(loss) for the

year |

— |

— |

(76,548) |

2,576 |

(73,972) |

|

|

Equity-settled share-based

compensation |

— |

21,671 |

— |

— |

21,671 |

|

|

Share options

exercised |

— |

75 |

— |

— |

75 |

|

|

|

|

|

|

|

|

|

|

Balance as of September 30,

2021 |

629 |

560,441 |

(521,026) |

(4,883) |

35,161 |

|

|

|

|

|

|

|

|

|

|

Balance as of January 1,

2022 |

629 |

565,192 |

(537,813) |

(3,945) |

24,063 |

|

|

Other comprehensive

income |

— |

— |

— |

1,127 |

1,127 |

|

|

Net profit |

— |

— |

50,746 |

— |

50,746 |

|

|

Comprehensive income for the

year |

— |

— |

50,746 |

1,127 |

51,873 |

|

|

Equity-settled share-based

compensation |

— |

16,725 |

— |

— |

16,725 |

|

|

Share options

exercised |

— |

202 |

— |

— |

202 |

|

|

Issue of share capital – net of transaction costs |

28 |

20,153 |

— |

— |

20,181 |

|

|

|

|

|

|

|

|

|

|

Balance as of September 30,

2022 |

657 |

602,272 |

(487,067) |

(2,818) |

113,044 |

|

|

|

|

|

|

|

|

|

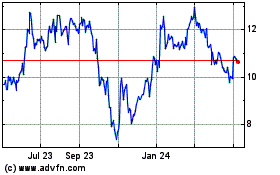

Immatics NV (NASDAQ:IMTX)

Historical Stock Chart

From Jun 2024 to Jul 2024

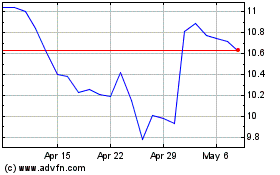

Immatics NV (NASDAQ:IMTX)

Historical Stock Chart

From Jul 2023 to Jul 2024