Completes Public Sector Acquisition

Authorizes $50 Million Share Repurchase

Program

i3 Verticals, Inc. (Nasdaq: IIIV) (“i3 Verticals” or the

“Company”) today reported its financial results for the fiscal

third quarter ended June 30, 2024.

Highlights for the three and nine months ended June 30, 2024

vs. 2023 from continuing operations1

- Third quarter revenue from continuing operations was $56.0

million, a decrease of 2% over the prior year's third quarter.

Revenue from continuing operations for the nine months ended June

30, 2024, was $169.1 million, an increase of 1% over the prior

year's first nine months.

- Third quarter net loss from continuing operations was $13.8

million, compared to net loss from continuing operations of $10.9

million in the prior year's third quarter. Net loss from continuing

operations for the nine months ended June 30, 2024, was $20.4

million, compared to a net loss from continuing operations of $22.4

million in the prior year's first nine months.

- Third quarter net loss from continuing operations attributable

to i3 Verticals, Inc. was $11.4 million, compared to net loss from

continuing operations attributable to i3 Verticals, Inc. of $8.5

million in the prior year's third quarter. Net loss from continuing

operations attributable to i3 Verticals, Inc. for the nine months

ended June 30, 2024, was $16.4 million, compared to net loss from

continuing operations attributable to i3 Verticals, Inc. of $16.7

million in the prior year's first nine months.

- Third quarter adjusted EBITDA from continuing operations2 was

$12.9 million, a decrease of 11% over the prior year's third

quarter. Adjusted EBITDA from continuing operations2 for the nine

months ended June 30, 2024, was $42.1 million, a decrease of 4%

over the prior year's first nine months.

- Third quarter Adjusted EBITDA from continuing operations2 as a

percentage of revenue was 23%, compared to 25% in the prior year's

third quarter. Adjusted EBITDA2 from continuing operations as a

percentage of revenue for the nine months ended June 30, 2024, was

25%, compared to 26% in the prior year's first nine months.

- Third quarter diluted net loss per share attributable to Class

A common stock from continuing operations was $0.49, compared to

diluted net loss per share attributable to Class A common stock

from continuing operations of $0.37 in the prior year's third

quarter. Diluted net loss per share attributable to Class A common

stock from continuing operations was $0.70 for the nine months

ended June 30, 2024, compared to diluted net loss per share

attributable to Class A common stock from continuing operations of

$0.72 in the prior year's first nine months.

- Third quarter pro forma adjusted diluted earnings per share

from continuing operations2, which gives pro forma effect to the

Company's tax rate, was $0.07 compared to $0.15 for the prior

year's third quarter. Pro forma adjusted diluted earnings per share

from continuing operations2 for the nine months ended June 30,

2024, was $0.31 compared to $0.49 for the prior year's first nine

months.

- Diluted net loss per share attributable to Class A common stock

from continuing operations and pro forma adjusted diluted earnings

per share from continuing operations both exclude discontinued

operations but include the consolidated cash interest expense. Cash

interest expense for the three and nine months ended June 30, 2024,

was $7.7 million and $21.4 million, respectively. The Company's

fully diluted share count for the three and nine months ended June

30, 2024, was 33,707,331 and 33,781,826, respectively. The per

share impact, on a fully diluted basis of the cash interest expense

on these measures for the three and nine months ended June 30,

2024, was $0.23 and $0.63.

- Annualized Recurring Revenue ("ARR") from continuing

operations3 for the three months ended June 30, 2024 and 2023 was

$181.3 million and $174.5 million, respectively, representing a

period-to-period growth rate of 4%.

- As of June 30, 2024, consolidated interest coverage ratio was

3.5x and total leverage ratio was 3.6x. These ratios are defined in

the Company's 2023 Credit Agreement.

- On August 1, 2024, the Company acquired a permitting and

licensing business for $18.0 million in cash consideration, the

issuance of 311,634 shares of the Company's Class A Common Stock,

and an amount of contingent consideration (in an amount not to

exceed $22.0 million), which is still being valued.

1.

As a result of the anticipated sale of i3

Verticals' merchant services business pursuant to the terms of the

securities purchase agreement dated as of June 26, 2024, entered

into by the Company with Payroc, the historical results of i3

Verticals' merchant services business have been reflected in

discontinued operations in the consolidated statement of operations

included in this earnings release, and continuing operations

reflect the Company's remaining operations after giving effect to

such classification. Prior period results have been recast to

reflect this presentation.

2.

Represents a non-GAAP financial measure.

For additional information (including reconciliation information),

see the attached schedules to this release.

3.

Annualized Recurring Revenue (ARR) is the

annualized revenue derived from software-as-a-service (“SaaS”)

arrangements, transaction-based software-revenue, software

maintenance, recurring software-based services, payments revenue

and other recurring revenue sources within the quarter. This

excludes contracts that are not recurring or are one-time in

nature. The Company focuses on ARR because it helps i3 Verticals to

assess the health and trajectory of the business. ARR does not have

a standardized definition and is therefore unlikely to be

comparable to similarly titled measures presented by other

companies. It should be reviewed independently of revenue, and it

is not a forecast. Additionally, ARR does not take into account

seasonality. The active contracts at the end of a reporting period

used in calculating ARR may or may not be extended or renewed by i3

Verticals' customers.

Greg Daily, Chairman and CEO of i3 Verticals, commented, "At the

end of June, we announced the definitive agreement for the sale of

our Merchant Services Business. Following the closing, we will be a

pure vertical market software business focused entirely on the

Public Sector, Education and Healthcare markets. I am confident the

remaining business has a very bright future. ARR grew 4% this

quarter. We have a deep pipeline and still expect to grow revenue

in the high-single digits in our fiscal 2025. While margins will

initially take a step back after the Merchant Services transaction,

we expect them to steadily improve as revenue scales.

"One of the outcomes of the sale of the Merchant Services

Business is that we plan to pay off all of our revolving credit

facility. We are excited about this circumstance as it will set the

table for additional vertical market software M&A. We continue

to find businesses who want to be a part of what we are

building.

"One such business was acquired by i3 this month. It is a

permitting and licensing company that has one of the absolute best

products in the market. This business is a great fit with our

existing public sector products and is led by a talented team. We

expect it to be a driver of revenue growth going forward.”

Definitive Agreement Regarding the Sale of i3 Verticals'

Merchant Services Business

As previously announced, on June 26, 2024, i3 Verticals, Inc.,

i3 Verticals, LLC, and i3 Holdings Sub, Inc., a wholly-owned

subsidiary of i3 Verticals, LLC, entered into a Securities Purchase

Agreement (the “Purchase Agreement”) with Payroc Buyer, LLC

(“Payroc”) and Payroc WorldAccess LLC. Pursuant to the terms of the

Purchase Agreement, Payroc would purchase the equity interests of

certain direct and indirect wholly-owned subsidiaries (the

“Acquired Entities”) of i3 Verticals, LLC and i3 Holdings Sub, Inc.

comprising the Merchant Services segment as well as certain assets

within the Company's Software and Services segment related to the

Non-profit and Property Management vertical markets, including its

associated proprietary technology (collectively, the "Merchant

Services Business"). The purchase price payable by Payroc to the

Company for the equity interests of the Acquired Entities would be

$440 million (the “Purchase Price”), payable in cash upon the

closing of the transactions under the Purchase Agreement (the

"Transactions"), subject to adjustments for closing net working

capital and other purchase price adjustments provided in the

Purchase Agreement.

The closing of the Transactions is subject to certain closing

conditions set forth in the Purchase Agreement. We continue to

expect the consummation of the Transactions to occur during the

three months ending September 30, 2024.

Share Repurchase Program

The Company's Board of Directors has approved a new share

repurchase program for the Company’s Class A common stock, under

which the Company may repurchase up to $50 million of outstanding

shares of Class A common stock. This share repurchase program will

terminate on the earlier of August 8, 2025, or when the maximum

dollar amount under the program has been expended. Pursuant to this

authorization, repurchases may be made from time to time in the

open market, through privately negotiated transactions, or

otherwise. In addition, any repurchases under the authorization

will be subject to prevailing market conditions, liquidity and cash

flow considerations, applicable securities laws requirements

(including under Rule 10b-18 and Rule 10b5-1 of the Securities

Exchange Act of 1934, as applicable), and other factors.

Taking into account restrictions under the Company’s credit

agreement, the Company does not anticipate making any repurchases

under this authorization until the closing of the transactions

under the Purchase Agreement. This share repurchase program does

not require the Company to acquire any amount of shares of Class A

common stock, and may be extended, modified, suspended or

discontinued at any time.

Outlook for Continuing Operations for Fiscal Year 2024 and

Fiscal Year 2025

The Company's practice is to provide annual guidance, excluding

the impact of acquisitions, dispositions and transaction-related

costs. In connection with the anticipated sale of the Merchant

Services Business pursuant to the terms of the Purchase Agreement

and the classification of the Merchant Services Business as

discontinued operations as noted above, the Company has provided an

outlook for continuing operations for the fiscal year ending

September 30, 2024, and for the fiscal year ending September 30,

2025. Further, in light of these developments, the Company is

withdrawing the consolidated-level guidance previously provided in

the Company's earnings release issued on May 10, 2024.

The Company is providing the following outlook for continuing

operations:

(in thousands, except share and per share

amounts)

FY24 Continuing Operations

Outlook Range

FY25 Continuing Operations

Outlook Range

Revenue

$

228,000

-

$

234,000

$

243,000

-

$

263,000

Adjusted EBITDA (non-GAAP)

$

56,000

-

$

60,000

$

63,000

-

$

71,500

Depreciation and internally developed

software amortization

$

12,000

-

$

14,000

Cash interest expense, net

$

1,000

-

$

2,000

Pro forma adjusted diluted earnings per

share(1)(non-GAAP)

$

1.05

-

$

1.25

________________

1.

Assumes an effective pro forma tax rate of

25.0% (non-GAAP).

With respect to the “Outlook for Continuing Operations for

Fiscal Year 2024 and Fiscal Year 2025” above, reconciliations of

adjusted EBITDA from continuing operations and pro forma adjusted

diluted earnings per share from continuing operations guidance to

the closest corresponding GAAP measure on a forward-looking basis

is not available without unreasonable efforts. This inability

results from the inherent difficulty in forecasting generally and

quantifying certain projected amounts that are necessary for such

reconciliations. In particular, sufficient information is not

available to calculate certain adjustments required for such

reconciliations, including changes in the fair value of contingent

consideration, income tax expense of i3 Verticals, Inc. and

equity-based compensation expense. The Company expects these

adjustments may have a potentially significant impact on future

GAAP financial results.

Conference Call

The Company will host a conference call on Friday, August 9,

2024, at 8:30 a.m. ET, to discuss financial results and operations.

To listen to the call live via telephone, participants should dial

(844) 887-9399 approximately 10 minutes prior to the start of the

call. A telephonic replay will be available from 11:30 a.m. ET on

August 9, 2024, through August 16, 2024, by dialing (877) 344-7529

and entering Confirmation Code 2697756.

To listen to the call live via webcast, participants should

visit the “Investors” section of the Company’s website,

www.i3verticals.com, and go to the “Events” page approximately 10

minutes prior to the start of the call. The online replay will be

available on this page of the Company’s website beginning shortly

after the conclusion of the call and will remain available for 30

days.

Non-GAAP Measures

This press release contains information prepared in conformity

with GAAP as well as non-GAAP information. It is management’s

intent to provide non-GAAP financial information to enhance

understanding of the Company's consolidated financial information

as prepared in accordance with GAAP. This non-GAAP information

should be considered by the reader in addition to, but not instead

of, the financial statements prepared in accordance with GAAP. Each

non-GAAP financial measure and the most directly comparable GAAP

financial measure are presented for historical periods so as not to

imply that more emphasis should be placed on the non-GAAP measure.

The non-GAAP financial information presented may be determined or

calculated differently by other companies.

Additional information about non-GAAP financial measures,

including, but not limited to, pro forma adjusted net income from

continuing operations, adjusted EBITDA from continuing operations

and pro forma adjusted diluted EPS from continuing operations, and

a reconciliation of those measures to the most directly comparable

GAAP measures is included in the financial schedules of this

release.

About i3 Verticals

The Company delivers seamless integrated software and services

to customers in strategic vertical markets. Building on its

sophisticated and diverse platform of software and services

solutions, the Company creates and acquires software products to

serve the specific needs of public and private organizations in its

strategic verticals, including its Public Sector (including

Education) and Healthcare verticals.

Forward-Looking Statements

This release contains forward-looking statements that are

subject to risks and uncertainties. All statements other than

statements of historical fact or relating to present facts or

current conditions included in this release are forward-looking

statements, including any statements regarding the Company's fiscal

2024 and fiscal 2025 financial outlook for continuing operations

and statements of a general economic or industry specific nature.

Forward-looking statements give the Company's current expectations

and projections relating to its financial condition, results of

operations, guidance, plans, objectives, future performance and

business. You can identify forward-looking statements by the fact

that they do not relate strictly to historical or current facts.

These statements may include words such as “anticipate,”

“estimate,” “expect,” “project,” “plan,” “intend,” “believe,”

“may,” “will,” “should,” “could have,” “exceed,” “significantly,”

“likely” and other words and terms of similar meaning in connection

with any discussion of the timing or nature of future operating or

financial performance or other events.

The forward-looking statements contained in this release are

based on assumptions that we have made in light of the Company's

industry experience and its perceptions of historical trends,

current conditions, expected future developments and other factors

we believe are appropriate under the circumstances. As you review

and consider information presented herein, you should understand

that these statements are not guarantees of future performance or

results. They depend upon future events and are subject to risks,

uncertainties (many of which are beyond the Company's control) and

assumptions. Factors that could cause actual results to differ from

those expressed or implied by our forward-looking statements

include, among other things: the impact the anticipated sale of our

Merchant Services Business pursuant to the terms of the Purchase

Agreement, including the risks that the parties to the Purchase

Agreement may be unable to complete the Transactions in a timely

manner or at all, because, among other reasons, conditions to the

closing of the Transactions set forth in the Purchase Agreement may

not be satisfied or waived, uncertainty as to the timing of

completion of the Transactions, the occurrence of any event, change

or other circumstances that could give rise to the termination of

the Purchase Agreement, risks related to disruption of management’s

attention from ongoing business operations, post-closing risks

related to the transition services agreement, the processing

services agreement, the restrictive covenant agreement, and other

ancillary agreements to be entered into at closing, and the ability

of the Company to execute on its strategy and achieve its goals and

other expectations after any completion of the Transactions;

ongoing economic and geopolitical conditions, including the impact

of inflation and elevated interest rates, competition in our

industry and our ability to compete effectively, and regulatory

developments; the successful integration of acquired businesses;

and future decisions made by us and our competitors. All of these

factors are difficult or impossible to predict accurately and many

of them are beyond our control. For a further list and description

of these and other important risks and uncertainties that may

affect our future operations, see Part I, Item 1A - Risk Factors in

our most recent Annual Report on Form 10-K filed with the

Securities and Exchange Commission, which we have updated and may

further update in Part II, Item 1A - Risk Factors in Quarterly

Reports on Form 10-Q we have filed or will file hereafter.

Any forward-looking statement made by us in this release speaks

only as of the date of this release and we undertake no obligation

to publicly update any forward-looking statement, whether as a

result of new information, future developments or otherwise, except

as may be required by law.

i3 Verticals, Inc.

Consolidated Statements of Operations

(Unaudited)

($ in thousands, except share and

per share amounts)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

% Change

2024

2023

% Change

Revenue

$

56,037

$

57,260

(2)%

$

169,059

$

168,138

1%

Operating expenses

Other costs of services

4,722

3,944

20%

13,540

11,272

20%

Selling, general and administrative

45,033

45,045

—%

131,548

132,510

(1)%

Depreciation and amortization

6,969

6,665

5%

21,216

19,289

10%

Change in fair value of contingent

consideration

(18

)

6,183

n/m

(545

)

9,891

n/m

Total operating expenses

56,706

61,837

(8)%

165,759

172,962

(4)%

(Loss) income from operations

(669

)

(4,577

)

(85)%

3,300

(4,824

)

n/m

Other expenses (income)

Interest expense, net

7,906

6,725

18%

22,307

18,414

21%

Other income

—

(92

)

(100)%

(2,150

)

(295

)

629%

Total other expenses

7,906

6,633

19%

20,157

18,119

11%

Loss before income taxes from continuing

operations

(8,575

)

(11,210

)

(24)%

(16,857

)

(22,943

)

(27)%

Provision for (benefit from) income

taxes

5,271

(292

)

n/m

3,507

(500

)

n/m

Net loss from continuing operations

(13,846

)

(10,918

)

(20,364

)

(22,443

)

Net income from discontinued operations,

net of income taxes

5,548

4,840

16,950

16,342

Net loss

(8,298

)

(6,078

)

37%

(3,414

)

(6,101

)

(44)%

Net loss from continuing operations

attributable to non-controlling interest

(2,416

)

(2,392

)

(3,944

)

(5,702

)

Net income from discontinued operations

attributable to non-controlling interest

1,663

1,469

5,099

4,960

Net (loss) income attributable to

non-controlling interest

(753

)

(923

)

(18)%

1,155

(742

)

n/m

Net loss from continuing operations

attributable to i3 Verticals, Inc.

$

(11,430

)

$

(8,526

)

$

(16,420

)

$

(16,741

)

Net income from discontinued operations

attributable to i3 Verticals, Inc.

$

3,885

$

3,371

$

11,851

$

11,382

Net loss attributable to i3 Verticals,

Inc.

$

(7,545

)

$

(5,155

)

46%

$

(4,569

)

$

(5,359

)

(15)%

Net loss per share attributable to Class A

common stockholders from continuing operations:

Basic

$

(0.49

)

$

(0.37

)

$

(0.70

)

$

(0.72

)

Diluted

$

(0.49

)

$

(0.37

)

$

(0.70

)

$

(0.72

)

Net income per share attributable to Class

A common stockholders from discontinuing operations:

Basic

$

0.17

$

0.15

$

0.51

$

0.49

Diluted

$

0.15

$

0.13

$

0.46

$

0.44

Net loss per share attributable to Class A

common stockholders:

Basic and diluted

$

(0.32

)

$

(0.22

)

$

(0.20

)

$

(0.23

)

Weighted average shares of Class A common

stock outstanding:

Basic

23,420,811

23,179,638

23,339,598

23,104,212

Diluted, for continuing operations

23,420,811

23,179,638

23,339,598

23,104,212

Diluted, for discontinued operations

33,707,331

33,845,584

33,781,826

33,956,879

i3 Verticals, Inc.

Consolidated Balance Sheets

(Unaudited)

($ in thousands, except share and

per share amounts)

June 30,

September 30,

2024

2023

Assets

Current assets

Cash and cash equivalents

$

9,745

$

3,105

Accounts receivable, net

48,655

50,785

Settlement assets

1,355

4,873

Prepaid expenses and other current

assets

11,279

9,512

Current assets held for sale

237,002

17,269

Total current assets

308,036

85,544

Property and equipment, net

8,928

10,059

Restricted cash

2,396

4,215

Capitalized software, net

56,634

58,057

Goodwill

269,192

267,983

Intangible assets, net

154,039

163,149

Deferred tax asset

50,307

52,514

Operating lease right-of-use assets

9,564

11,815

Other assets

2,626

8,803

Long-term assets held for sale

—

219,354

Total assets

$

861,722

$

881,493

Liabilities and equity

Liabilities

Current liabilities

Accounts payable

$

5,955

$

6,369

Current portion of long-term debt

26,223

—

Accrued expenses and other current

liabilities

22,827

33,580

Settlement obligations

1,355

4,873

Deferred revenue

29,497

32,785

Current portion of operating lease

liabilities

3,477

3,657

Current liabilities held for sale

13,953

12,197

Total current liabilities

103,287

93,461

Long-term debt, less current portion and

debt issuance costs, net

347,892

385,081

Long-term tax receivable agreement

obligations

40,441

40,079

Operating lease liabilities, less current

portion

6,949

8,968

Other long-term liabilities

17,238

23,078

Long-term liabilities held for sale

—

2,530

Total liabilities

515,807

553,197

Commitments and contingencies

Stockholders' equity

Preferred stock, par value $0.0001 per

share, 10,000,000 shares authorized; 0 shares issued and

outstanding as of June 30, 2024 and September 30, 2023

—

—

Class A common stock, par value $0.0001

per share, 150,000,000 shares authorized; 23,442,698 and 23,253,272

shares issued and outstanding as of June 30, 2024 and September 30,

2023, respectively

2

2

Class B common stock, par value $0.0001

per share, 40,000,000 shares authorized; 10,032,676 and 10,093,394

shares issued and outstanding as of June 30, 2024 and September 30,

2023, respectively

1

1

Additional paid-in capital

267,176

249,688

Accumulated deficit

(17,513

)

(12,944

)

Total stockholders' equity

249,666

236,747

Non-controlling interest

96,249

91,549

Total equity

345,915

328,296

Total liabilities and equity

$

861,722

$

881,493

i3 Verticals, Inc.

Consolidated Cash Flow Data

(Unaudited)

($ in thousands)

Nine Months Ended June

30,

2024

2023

Net cash provided by operating

activities

$

33,266

$

26,370

Net cash used in investing activities

$

(16,755

)

$

(115,415

)

Net cash (used in) provided by financing

activities

$

(15,215

)

$

85,482

Reconciliation of GAAP to Non-GAAP Financial Measures

The Company believes that the non-GAAP financial measures

presented by the Company provide useful information to investors in

understanding and evaluating the Company's ongoing operating

results. Accordingly, the Company includes such non-GAAP financial

measures when reporting its financial results to shareholders and

potential investors in order to provide them with an additional

tool to evaluate the Company’s ongoing business operations. The

Company believes that these non-GAAP financial measures are

representative of comparative financial performance that reflects

the economic substance of the Company's current and ongoing

business operations.

Although these non-GAAP financial measures assist in measuring

the Company's operating results and assessing its financial

performance, they are not necessarily comparable to similarly

titled measures of other companies due to potential inconsistencies

in the method of calculation. The Company believes that the

disclosure of these non-GAAP financial measures provides investors

with important key financial performance indicators that are

utilized by management to assess the Company's operating results,

evaluate the business and make operational decisions on a

prospective, going-forward basis. Hence, management provides

disclosure of these non-GAAP financial measures to give

shareholders and potential investors an opportunity to see the

Company as viewed by management, to assess the Company with some of

the same tools that management utilizes internally and to be able

to compare such information with prior periods. The Company

believes that disclosure of these non-GAAP financial measures

provides investors with additional information to help them better

understand its financial statements just as management utilizes

these non-GAAP financial measures to better understand the

business, manage budgets and allocate resources.

i3 Verticals, Inc.

Reconciliation of GAAP Net Loss from Continuing Operations to

Non-GAAP Pro Forma Adjusted Net Income from Continuing Operations

and

Non-GAAP Adjusted EBITDA from

Continuing Operations

(Unaudited)

($ in thousands)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Net loss from continuing operations

attributable to i3 Verticals, Inc.

$

(11,430

)

$

(8,526

)

$

(16,420

)

$

(16,741

)

Net loss from continuing operations

attributable to non-controlling interest

(2,416

)

(2,392

)

(3,944

)

(5,702

)

Non-GAAP adjustments:

Provision for (benefit from) income

taxes

5,271

(292

)

3,507

(500

)

Non-cash change in fair value of

contingent consideration(1)

(18

)

6,183

(545

)

9,891

Equity-based compensation from continuing

operations(2)

4,432

6,124

14,811

17,784

M&A-related expenses(3)

1,931

26

2,889

1,112

Acquisition intangible amortization(4)

4,788

4,932

14,474

14,656

Non-cash interest expense(5)

221

582

897

1,312

Other taxes(6)

230

75

404

465

Net gain on exchangeable note repurchases

and related transactions(7)

—

—

(2,257

)

—

Gain on investment(8)

—

(92

)

—

(295

)

Loss on disposal of property and

equipment(9)

—

—

107

—

Non-GAAP pro forma adjusted income

before taxes from continuing operations

$

3,009

$

6,620

$

13,923

$

21,982

Pro forma taxes at effective tax

rate(10)

(752

)

(1,655

)

(3,481

)

(5,496

)

Pro forma adjusted net income from

continuing operations(11)

$

2,257

$

4,965

$

10,442

$

16,486

Cash interest expense, net(12)

7,685

6,143

21,410

17,102

Pro forma taxes at effective tax

rate(10)

752

1,655

3,481

5,496

Depreciation and internally developed

software amortization(13)

2,181

1,733

6,742

4,633

Adjusted EBITDA from continuing

operations(14)

$

12,875

$

14,496

$

42,075

$

43,717

1.

Non-cash change in fair value of

contingent consideration reflects the changes in management’s

estimates of future cash consideration to be paid in connection

with prior acquisitions from the amount estimated as of the later

of the most recent balance sheet date forming the beginning of the

income statement period or the original estimates made at the

closing of the applicable acquisition.

2.

Equity-based compensation expense related

to stock options and restricted stock units issued under the

Company's 2018 Equity Incentive Plan and 2020 Acquisition Equity

Incentive Plan.

3.

M&A-related expenses are the

professional service and related costs directly related to any

merger, acquisition and disposition activity of the Company. i3

Verticals believes these expenses are not reflective of the

underlying operational performance of the Company. M&A-related

expenses included $1,826 and $2,626 of transaction costs related to

the anticipated sale of the Merchant Services Business for the

three and nine months ended June 30, 2024, respectively.

M&A-related expenses also includes financing costs related to

the administration of the Company's exchangeable notes.

4.

Acquisition intangible amortization

reflects amortization of intangible assets and software acquired

through business combinations, acquired customer portfolios,

acquired referral agreements and related asset acquisitions.

5.

Non-cash interest expense reflects

amortization of debt issuance costs and any write-offs of debt

issuance costs.

6.

Other taxes consist of franchise taxes,

commercial activity taxes, reserves for ongoing tax audit matters,

the employer portion of payroll taxes related to stock option

exercises and other non-income-based taxes. Taxes related to

salaries are not included.

7.

Net gain on exchangeable note repurchases

and related transactions reflects the gain on repurchases of

exchangeable notes and warrant unwinds, net of the loss on sale of

bond hedge unwinds, which occurred during the three months ended

June 30, 2024.

8.

Gain on investment reflects contingent

consideration received for an investment that was sold in a prior

year.

9.

Loss on disposal of property and equipment

is related to the sale of a building purchased through an

acquisition.

10.

Pro forma corporate income tax expense is

based on non-GAAP adjusted income before taxes from continuing

operations and is calculated using a tax rate of 25.0% for both

2024 and 2023, based on blended federal and state tax rates.

11.

Pro forma adjusted net income from

continuing operations represents a non-GAAP financial measure and

assumes that all net income during the period is available to the

holders of the Company's Class A common stock.

12.

Cash interest expense, net represents all

interest expense net of interest income recorded on the Company's

statement of operations other than non-cash interest expense, which

represents amortization of debt issuance costs and any write-offs

of debt issuance costs.

13.

Depreciation and internally developed

software amortization reflects depreciation on the Company's

property, plant and equipment, net, and amortization expense on its

internally developed capitalized software.

14.

Represents a non-GAAP financial

measure.

i3 Verticals, Inc. GAAP

Diluted EPS from Continuing Operations and

Non-GAAP Pro Forma Adjusted

Diluted EPS from Continuing Operations

(Unaudited)

($ in thousands, except share and

per share amounts)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Diluted net loss attributable to Class A

common stock per share from continuing operations

$

(0.49

)

$

(0.37

)

$

(0.70

)

$

(0.72

)

Pro forma adjusted diluted earnings per

share from continuing operations(1)(2)(3)

$

0.07

$

0.15

$

0.31

$

0.49

Pro forma adjusted net income from

continuing operations(2)

$

2,257

$

4,965

$

10,442

$

16,486

Pro forma weighted average shares of

adjusted diluted Class A common stock outstanding(4)

33,707,331

33,845,584

33,781,826

33,956,879

________________

1.

Pro forma adjusted diluted earnings per

share from continuing operations, a non-GAAP financial measure, is

calculated using pro forma adjusted net income from continuing

operations and the pro forma weighted average shares of adjusted

diluted Class A common stock outstanding.

2.

Pro forma adjusted net income from

continuing operations, a non-GAAP financial measure, assumes that

all net income from continuing operations during the period is

available to the holders of the Company's Class A common stock.

Further, pro forma adjusted diluted earnings per share from

continuing operations assumes that all Common Units in i3

Verticals, LLC and the associated non-voting Class B common stock

were exchanged for Class A common stock at the beginning of the

period on a one-for-one basis.

3.

Diluted net loss per share attributable to

Class A common stock from continuing operations and pro forma

adjusted diluted earnings per share from continuing operations both

exclude discontinued operations but include the consolidated cash

interest expense. Cash interest expense for the three months ended

June 30, 2024 and 2023 was $7.7 million and $6.1 million,

respectively, and $21.4 million and $17.1 million for the nine

months ended June 30, 2024 and 2023, respectively. The per share

impact, on a fully diluted basis of the cash interest expense on

these measures for the three months ended June 30, 2024 and 2023

was $0.23 and $0.18, respectively, and $0.63 and $0.50 for the nine

months ended June 30, 2024 and 2023, respectively.

4.

Pro forma weighted average shares of

adjusted diluted Class A common stock outstanding include

10,052,017 and 10,108,218 outstanding shares of Class A common

stock issuable upon the exchange of Common Units in i3 Verticals,

LLC and 234,503 and 557,728 shares resulting from estimated stock

option exercises and restricted stock units vesting as calculated

by the treasury stock method for the three months ended June 30,

2024 and 2023, respectively. Pro forma weighted average shares of

adjusted diluted Class A common stock outstanding include

10,079,057 and 10,112,471 outstanding shares of Class A common

stock issuable upon the exchange of Common Units in i3 Verticals,

LLC and 363,171 and 740,196 shares resulting from estimated stock

option exercises and restricted stock units vesting as calculated

by the treasury stock method for the nine months ended June 30,

2024 and 2023, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808184213/en/

Clay Whitson Chief Financial Officer (888) 251-0987

investorrelations@i3verticals.com

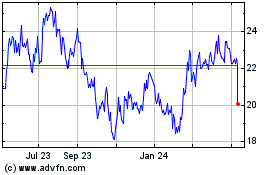

i3 Verticals (NASDAQ:IIIV)

Historical Stock Chart

From Oct 2024 to Nov 2024

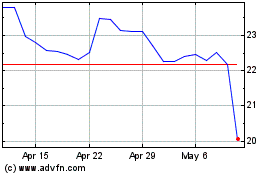

i3 Verticals (NASDAQ:IIIV)

Historical Stock Chart

From Nov 2023 to Nov 2024