FILED BY HUT 8 MINING CORP.

COMMISSION FILE NO. 001-40487

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF

1933, AS AMENDED

SUBJECT COMPANY: U.S. DATA MINING GROUP, INC. AND

HUT 8 CORP.

The following interview was made available by

McNallie Money on YouTube on February 27, 2023.

Transcript: Hut 8 Merger Q&A | Bitcoin News

Today | Bitcoin Stock to Watch | Sue Ennis | USBTC | Hut 8 Mining YouTube

Interviewer: Hey guys, welcome back

to the channel McNallie Money, home of all things stock investment and personal finance related. Now for today's video, we've got a

special guest joining us from Hut 8 Mining to answer some questions related to their proposed merger with US Bitcoin. This is

massive news, one of the biggest mergers in the Bitcoin or crypto mining space. And we've got exclusive coverage today. So buckle

up, you guys, we're gonna get right into it. But before we do, please take a second, hit the like button, it's a big help to myself

and the channel. If you're not already subscribed, McNallie Money, feel free to do so. And let me know in the comment section below.

If you're currently holding shares of Hut 8, what are your thought about this big merger announcement and how you think they stack

up moving forward compared to some of their peers in this space? And with that being said, let's get into today's video.

Interviewer: Okay, guys, so that's right,

today's video, we've got a special guest, I think you're back for your third time, Sue, always a great pleasure having you on the channel.

But this time, we wanted to ask some specific questions about the big merger proposal with US Bitcoin from Hut 8 Mining. So, Sue Ennis.

She's the VP of Corporate Development of Hut 8. And we're going to be answering some of your questions today. So Sue, thanks so much for

being here with us.

Sue Ennis: Hey, guys, so happy to be back

here chatting on your channel. And yeah, let's get into it. Lots of exciting stuff going on.

Interviewer: Definitely. Now I know we've

covered this quite a bit on the channel. But for those of us who maybe are unfamiliar with Hut 8 or their core operations, can you give

us just a quick background Sue on yourself? And what Hut 8 Mining is all about?

Sue Ennis: Yeah, absolutely. So Hut 8 is

one of the oldest and largest Bitcoin miners in North America. We also play in the traditional data center space. In January of 2022,

we bought five traditional data centers. We also have one of the highest amounts of self-mined Bitcoin on our balance sheet of any publicly

traded company. And yeah, we recently announced that we're proposing a merger of equals, with a company called US Bitcoin Corp, south

of the border out of the US, and we're incredibly excited about it. And so we're gonna get into it today.

Interviewer: Awesome. Yeah, there's been

a ton of chatter on the forums about this. It's a big merger in the Bitcoin or crypto mining space. So we'll get right into that. Can

you talk to us a little bit about this announcement and what it's going to mean for how Hut 8 Mining is going forward?

Sue Ennis: Yeah, so if this merger

does move forward, this will mean that Hut 8, the combined new Hut company, will have 825 megawatts of energy under management, just

eight, this will really catapult Hut’s diversification strategy moving forward. So we're going to have multiple lines of Fiat

based in ancillary lines of revenue. This also maintains our commitment to advancing High Performance Computing from our traditional

data center business. This creates a strengthened, proven and trusted leadership team and an incredible board of directors with a

track record of value creation. This is going to grow our pipeline of opportunities south of the border, which means, you know,

hypothetically speaking, if this gets approved, which means there's an opportunity for us to be included in some meaningful indexes

that we haven't been able to be included in because we weren't us domicile. This enhances our position and one of the world's

highest potential Bitcoin mining regions. It also advances our commitment to driving improvements across all of our ESG metrics,

because we're increasing our percentage of renewable power. If this, you know, in a post-merger world, we've also got an incredible

amount of energy expertise and hedging capabilities that comes with this deal, which is a very big deal when energy is one of the

number one inputs to your business, being able to be strategic to hedge to effectively arbitrage electrons in a strategic way, is

what this deal brings for us and our shareholders as well. So we're incredibly excited about it. And yeah, we certainly hope that it

happens, for sure.

Interviewer: Yeah, it's an amazing deal.

There's a lot going on a lot of synergies as shareholder of Hut 8 Mining, this is one that I'm really looking forward to. And I know Sue,

last time you're on you kind of hinted at some potential M&A or inorganic growth and obviously this has now come to fruition or proposed

to be. So US Bitcoin is a privately held company from my understanding, can you give us any information into their operations, their financials?

I know you talk about the power capacity or the number of megawatts but do you have any detail on like their current hash rate, their

current Bitcoin per month, anything like that you can share with the viewers?

Sue Ennis: Yeah, so I'm a little limited

as to what I can talk about right now guys on video, and as soon as I can disclose more information, I certainly will. I can tell you,

though, that our S-4 was filed on Tuesday morning. You can find it on Edgar, under Hut 8 Corp. And that has the preliminary financials

and some of our rationale behind the thinking of this merger. The financials was there only the audited financials of US Bitcoin Corp

as at September 30 2022. So as we continue our process of closing this merger, and that includes just additional filings and conversations

with the SEC, you will see those more materials become available, but I do urge your listeners, go on Edgar, see the filings there, I

can certainly tell you that the three prongs of US Bitcoin Corp business are hosting, managed infrastructure operations, and also self-mining.

So the managed infrastructure operations is very interesting, because it's effectively like someone owns a site, but then they hand the

keys to US Bitcoin Corp to manage the site repairs, potentially acquire customers. But there's also a layer of a software layer that is

included in this operations call. That's a purpose-built platform. A purpose-built platform that effectively helps arbitrage electrons.

So it looks at it's effectively like a software layer that can sit on top of infrastructure that says, okay, power is at this particular

price. Should I have this miner mining a Bitcoin? Or should I have this minor selling power back to the grid, and so it helps you get

more effective, efficient with how you arbitrage electrons and effectively manage your business. So those are the three pieces of their

business that we're really excited about are very unique in terms of what this post combination means for shareholders and the amount

of opportunity we have. And yeah, so that's, that's the most that I can talk about it. But I urge people go on Edgar to Hut 8 Mining Corp

and you should find more of the info. They're also available on our website.

Interviewer: Okay, sounds good. I was

gonna mention, I'll leave a link to the Hut 8 website, here, you got a pretty good deck put together a presentation specifically

about the merger. So I was in there last night, taking a look. And it has some pretty good points laid out. And as we start to get

into the share structure and share consolidation a little bit later, in today's video, I'll leave a link to that visual as well. But

see, I know we've talked about kind of that diversified revenue strategy as a differentiator for Hut in the past. And it sounds like

this is just an extension of that are kind of taking that to the next level. Now one of the big questions and this came up in my

mind as well, in the press release, it talks about selling some bitcoin to kind of finance the merger and some of the events leading

up to it. I know we've talked about the HODL or hold on for dear life strategy before and yourself saying you're very steadfast on

that, obviously, now deviating a little bit. Can you tell us why you decided now's the right time to sell some bitcoin? How many are

you selling? And how long is the selling gonna last?

Sue Ennis: Yeah, absolutely. So I certainly

cannot confirm as to how long the selling is going to last but I can see a little bit about how our how we're thinking about this from

a philosophical perspective, and strategic perspective. So we obviously can't control the macro economy. But the one thing that we can

control is how we manage our balance sheet and how we manage our treasury. And so we have been intentional and strategic in pursuing our

HODL strategy by building obviously a large, unencumbered stack and we're very bullish on Bitcoin. We believe in the asset class, we believe

in this new financial paradigm. Okay. But thanks to our ability of building this unencumbered stack, we afforded ourselves the optionality

to strategically use a portion of it to cover operating expenses, instead of having to seek financing options with less attractive terms.

Now, we saw what happened with our competitors. In 2022, a lot of people lost their shirt from being, you know, in a plethora of different

reasons. And so, we are looking at this as a strategic value add to Hut, the transformation of Hut’s business, and ultimately creation

of shareholder value. So, you know, that's sort of the most I can say about this. I can tell you, though, that we are still bullish on

Bitcoin, you know, we still have a lot of ideas for what we would potentially do with the remainder of our stack. You know, we love the

idea that in 2022, we were earning yield and putting that stack to work. None of our interest in that strategy has changed. This is just

something that we're doing right now, with the intention of, you know, again, shareholder value creation,

Interviewer: So, okay, and can you share

the number of Bitcoin or have you made any initial sales or anything?

Sue Ennis: I can't - we haven't disclosed

that yet. But we will certainly let you guys know, our monthly production updates.

Interviewer: Sure. Yeah. And I saw the

one for January I think you mind 118 Bitcoin or something? And I think it mentioned that you were going to sell those Bitcoin.

Sue Ennis: Yes. Yeah. So we did signal

that we would we would sell those. Okay.

Interviewer: And now the next question,

I'm going to put you on the spot a little bit for this one too. So obviously, the Reddit forums and Yahoo and everything have been lighting

up with this merger news, a lot of controversy the share price has dipped quite a bit since the announcement. But realistically, if you

look at Bitcoin and some of the other miners, it's in line. What are people missing from the comments that I read? There's some confusion

about what a share consolidation means why we would partner equal values here? How it's going to work on an equity standpoint with with

people invested in US Bitcoin? Yeah. Can you clarify that? Like, what are people missing here? That may be driving some of that confusion?

Sue Ennis: I think what some people might

be missing is the real difference, the real difference between dilution versus consolidation. Okay, so let's just maybe walk through like

some of the actual dynamics here. And again, number, just to reiterate, there is some more information available on Edgar, in our S4 filing,

we also have a link on our website that has the S4 that has an FAQ that talks about the consolidation versus dilution. So I'm just going

to quickly go over the two definitions, okay, as corporate finance of share consolidation versus dilution, so has proposed a share consolidation

of five to one, okay, and so, share consolidation, also known as a reverse stock split, divides the total quantity of shares by a number

such as five or 10. In Hut’s case, it's five, yeah, reduces the total numbers of shares outstanding by combining multiple shares

into one share. So if you have five shares of five, you're now going to have those five are now going to equal one. So this process decreases

the total number of shares outstanding of a company, but should proportionately increase the value of each share following the consolidation.

So for example, a two for one chair consolidation means you have the number of outstanding shares of a company. But this was this should

result in a doubling of the value of the shares. Okay, yeah, versus dilution, on the other hand, refers to just an increase in the number

of shares outstanding of a company, which in turn greatly reduces the value of the shares. So those are very different things. And I think,

I think maybe, you know, I think there was some sort of misunderstanding as to the difference between those two corporate finance definitions.

Interviewer: I'll maybe add their suit

because we get a lot of anytime there's a stock split or verse split or anything on companies, there's always questions. So the two things

I'd add there is everybody's shares are proportionally changed, whether it's up or down, and the percentage of the company that you own

doesn't change. So whether you're saying you own a half of the company, or two quarters, or four eighths, or whatever fraction you're

using, the percentage of ownership doesn't change. And that's one question I saw on a lot of the forums saying, Oh, I'm getting ripped

off, I get less shares. No, you don't you get fewer shares worth more, and your equity in the company stays the same. So just to call

that out, because I definitely saw a lot of comments about that. But thanks for the clarification there. So and just explaining that in

a little bit more detail.

Sue Ennis: Okay, guys, let's walk

through this. So prior to this merge, Hut 8 has over 221, fully diluted in the money shares outstanding. And we're doing an exchange

ratio for the New Hut 8 of 0.2. US Bitcoin Corp has capital stock outstanding, fully diluted in the money shares outstanding of 65

million. And so their exchange ratio with the new Hut 8 is point six, seven, and this is so we can have a merger of 50% Hut

ownership 50% US Bitcoin Core ownership. So the new Hut 8 shares outstanding for current Hut 8 shares, shareholders is going to be

44,231,514 following the transaction. And then the new Hut 8 shares outstanding following the transaction for US Bitcoin Corp is

going to be the same amount. So as you can see, from the above calculation, the number of outstanding shares of new Hut 8 following

the completion of the transaction will be approximately 88 million. That means each current shareholder of Hut 8 is going to hold

fewer shares following the transaction than they did immediately prior to the closing, but the value of each share of new Hut 8 is

going to be expected to be worth proportionately more.

Interviewer: Yeah, and I saw in your video

with Zack Hartley, I would encourage you guys to go watch that one too. That was the key reason for this share consolidation was to match

up the number of shares in each company. So if people are wondering, Well, why do they need to consolidate shares? It's to get both of

them at 44 million. So it's 50/50. And I know we can get into price predictions and stuff so but if you're saying there's 88 million shares

on a fully diluted basis, I think the project market cap was close to a billion or 990? Or something? You guys can do the math for yourself

and figure out what those shares may be worth at that time. But yeah, I think I think that's fair to say, hey, Sue.

Sue Ennis: Yeah, so look, it's also just

another step in our journey to becoming a more diversified resilient and stronger business. Yeah. So this is again, in the benefit of

creating or for the purpose of creating shareholder value and a stronger business for the New Hut 8.

Interviewer: Yeah, for sure. Okay. Well,

thank you for going through that. And I know that was a source of confusion. Hopefully that clears it up. If you guys do have any other

questions, let me know. And I'll be sure to put the visual that kind of shows the share breakdown in the video here for you. Now, moving

on to kind of I want to talk about the North Bay site in a second here, but one viewer question that came up kind of controversial is

they've heard some rumors that the New York Campus for US Bitcoin has received some noise complaints and potential legal issues. Is there

any merit to that? Or have you heard anything there can comment on that, too?

Sue Ennis: Yeah. So I can't really comment

on anything other than I can certainly say that we have built relationships in all the jurisdictions where we operate, and that we do

have contingency plans in place for you know, we're very strategic in terms of how we manage our operations. I can't really comment on

it. But I can tell you that you know, the site is up and as hashing and, you know, we'll keep you guys posted.

Interviewer: Okay, sounds good. And

next one, again, viewer question, not sure how much color you can give? Can you speak to their debt obligations? I know it was

mentioned that some of the Bitcoin being sold is going to service some debt, I believe moving into the merger. Can you give us any

indication of their debt load pre merger for us? Bitcoin?

Sue Ennis: You know what? Go to the S-4.

Okay. I can't really put it on thing. Just take a look at the filings. And again, all publicly available information will be on Edgar.

Take a look at the S-4. And then hopefully in a post merger world, I can come back on and we can get into the nitty gritty. It's just

we got to wait until then.

Interviewer: Yeah, totally understandable.

And when is the merger expected to go through?

Sue Ennis: Well, if you know that, again,

it's pending shareholder approval pending regulatory approval. We are hoping for sometime in Q2.

Interviewer: Okay. Great. And then the

last question I had on script here, feel free to add anything you want to in relation to your North Bay site. I know that's going through

litigation right now. So again, it's kind of tight lipped. But as of right now, that site is shut down. Is that correct?

Sue Ennis: Right. Okay. And it has not

been included in any of our calculations with respect to this proposed merger. I'll grant, okay, 825 megawatts of energy under management

in a post merger world does not include the North Bay site.

Interviewer: Perfect. Okay. Thanks for

clarifying. All right. So I'll kick it back to you then Sue. Is there anything additional, you'd like to bring up anything maybe that

we haven't touched on in relation to the merger that you think is relevant? Or you want viewers to know about?

Sue Ennis: I think you know what, we covered

some of the basics. But I just want to close with we are incredibly excited about this. Also, again, my DMs on Twitter are always open.

happy to chat with you guys again, and happy to be back on once we have more financial information that's available, and we can go through

it together.

Interviewer: Yeah, great. And I'll make

sure to keep note of any questions that come up. In the meantime, I know it's kind of a difficult rock and a hard place, right. We want

to get as much information out but you also don't want to jeopardize anything with the deal. So that's totally understandable. Sue, thanks

so much for being here with us today. Again, I'll leave a link to the company website in the video description below. And you can go in

and take a look at some of those merger documents. If you're not currently subscribed to the channel, McNallie Money, feel free to do

so. And feel free to leave a comment in the section below if there's anything you want addressed in our next update. Sue, thanks so much

for being with us here today. And I'll throw up that visual on the screen right now for everyone.

Sue Ennis: Thanks so much for having me.

See you talk to you soon. Take care.

Cautionary note regarding Forward–Looking Information

This

communication includes “forward-looking information” and “forward-looking statements” within the meaning of Canadian

securities laws and United States securities laws, respectively (collectively, “forward looking information”). All information,

other than statements of historical facts, included in this communication that address activities, events or developments that Hut 8

expects or anticipates will or may occur in the future, including such things as future business strategy, competitive strengths, goals,

expansion and growth of Hut 8’s businesses, operations, plans and other such matters is forward-looking information. Forward looking

information is often identified by the words “may”, “would”, “could”, “should”, “will”,

“intend”, “plan”, “anticipate”, “allow”, “believe”, “estimate”,

“expect”, “predict”, “can”, “might”, “potential”, “predict”,

“is designed to”, “likely” or similar expressions. In addition, any statements in this communication that refer

to expectations, projections or other characterizations of future events or circumstances contain forward-looking information and include,

among others, statements with respect to: (i) the expected outcomes of the Transaction, including New Hut's assets and financial position;

(ii) the ability of Hut 8 and USBTC to complete the Transaction on the terms described herein, or at all, including, receipt of required

regulatory approvals, shareholder approvals, court approvals, stock exchange approvals and satisfaction of other closing customary conditions;

(iii) the expected synergies related to the Transaction in respect of strategy, operations and other matters; (iv) projections related

to expansion; (v) expectations related to the Combined Company's hashrate and self-mining capacity; (vi) acceleration of ESG efforts

and commitments; and (vii) the ability of the Combined Company to execute on future opportunities, among others.

Statements containing forward-looking information are not historical

facts, but instead represent management’s expectations, estimates and projections regarding future events based on certain material

factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 and USBTC as of the date of this communication,

such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results,

level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information,

including but not limited to: the ability to obtain requisite shareholder approvals and the satisfaction of other conditions to the consummation

of the Transaction on the proposed terms or at all; the ability to obtain necessary stock exchange, regulatory, governmental or other

approvals in the time assumed or at all; the anticipated timeline for the completion of the Transaction; the ability to realize the anticipated

benefits of the Transaction or implementing the business plan for the Combined Company, including as a result of a delay in completing

the Transaction or difficulty in integrating the businesses of the companies involved (including the retention of key employees); the

ability to realize synergies and cost savings at the times, and to the extent, anticipated; the potential impact on mining activities;

the potential impact of the announcement or consummation of the Transaction on relationships, including with regulatory bodies, employees,

suppliers, customers, competitors and other key stakeholders; the outcome of any litigation proceedings in respect of USBTC's legal dispute

with the City of Niagara Falls, New York; security and cybersecurity threats and hacks; malicious actors or botnet obtaining control

of processing power on the Bitcoin network; further development and acceptance of the Bitcoin network; changes to Bitcoin mining difficulty;

loss or destruction of private keys; increases in fees for recording transactions in the Blockchain; internet and power disruptions;

geopolitical events; uncertainty in the development of cryptographic and algorithmic protocols; uncertainty about the acceptance or widespread

use of digital assets; failure to anticipate technology innovations; the COVID-19 pandemic; climate change; currency risk; lending risk

and recovery of potential losses; litigation risk; business integration risk; changes in market demand; changes in network and infrastructure;

system interruption; changes in leasing arrangements; failure to achieve intended benefits of power purchase agreements; potential for

interrupted delivery, or suspension of the delivery, of energy to the Combined Company’s mining sites. For a complete list of the

factors that could affect the Company, please see the “Risk Factors” section of the Company’s Annual Information Form

dated March 17, 2022 and Hut 8’s other continuous disclosure documents which are available on the Company’s profile on the

System for Electronic Document Analysis and Retrieval at www.sedar.com and on the EDGAR section of the U.S. Securities and Exchange

Commission’s ("SEC") website at www.sec.gov.

These risks are not intended to represent a complete

list of the factors that could affect Hut 8, USBTC, or New Hut; however, these factors should be considered carefully. There can be no

assurance that such estimates and assumptions will prove to be correct. Should one or more of these risks or uncertainties materialize,

or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described

in this communication as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected or targeted

and such forward-looking statements included in this communication should not be unduly relied upon. The impact of any one assumption,

risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent

and New Hut’s future decisions and actions will depend on management’s assessment of all information at the relevant time.

The forward-looking statements contained in this communication are made as of the date of this communication, and each of Hut 8 and USBTC

expressly disclaims any obligation to update or alter statements containing any forward-looking information, or the factors or assumptions

underlying them, whether as a result of new information, future events or otherwise, except as required by law. Except where otherwise

indicated herein, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future

date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing

or changes occurring after the date of preparation.

Additional information about the transaction

and where to find it

In connection with the transaction, that, if

completed, would result in Hut 8 Corp. (“New Hut”) becoming a new public company, New Hut has filed a registration

statement on Form S-4 (the “Form S-4”) with the U.S. Securities Exchange Commission (the “SEC”). U.S. Data

Mining Group, Inc. (“USBTC”) and Hut 8 Mining Corp. (“Hut 8”) urge investors, shareholders, and other

interested persons to read the Form S-4, including any amendments thereto, the Hut 8 meeting circular, as well as other documents

filed or to be filed with the SEC and documents to be filed with Canadian securities regulatory authorities in connection with the

transaction, as these materials do and will contain important information about USBTC, Hut 8, New Hut and the transaction. New Hut

also has, and will, file other documents regarding the transaction with the SEC. This communication is not a substitute for the Form

S-4 or any other documents that may be sent to Hut 8’s shareholders or USBTC's stockholders in connection with the

transaction. Investors and security holders are or will be able to obtain free copies of the Form S-4 and all other relevant

documents filed or that will be filed with the SEC by New Hut through the website maintained by the SEC at www.sec.gov or by

contacting the investor relations department of Hut 8 at info@hut8.io and of USBTC at info@usbitcoin.com.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer

to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”) or in a transaction exempt from the registration

requirements of the Securities Act.

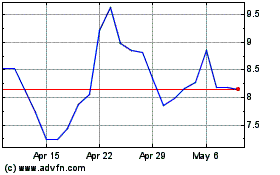

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

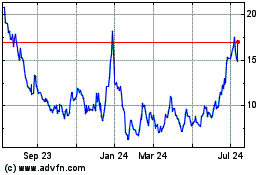

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jul 2023 to Jul 2024