FILED BY HUT 8 MINING CORP.

COMMISSION FILE NO. 001-40487

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF

1933, AS AMENDED

SUBJECT COMPANY: U.S. DATA MINING GROUP, INC. AND

HUT 8 CORP.

The following interview was made available by

Talkin’ Investing on YouTube on February 17, 2023.

Transcript: What You Need To Know About The $HUT

Hut 8 Merger... | FULL INTERVIEW With Hut 8’s Sue Ennis!

YouTube

Tom

All right. Welcome to Talking Investing, everybody.

Today we have a special guest. We have Sue Ennis from HUT 8 And they had a big announcement very recently. So we've talked about this

a lot on the channel, but I really was hoping to get Sue in here and she was nice enough to agree to come and talk to us because I know

this is a complicated transaction. So I think, you know, hearing from Sue is going to help. So let me just throw it over to you, Sue,

just to remind everybody who you are. I know everybody knows who you are already, but you know who you are. And like maybe the CliffsNotes

of what's going on.

Sue

Yeah, absolutely. So I'm Sue, VP Corp Dev at

HUT 8, one of the oldest and largest miners. And we're also in the traditional data infrastructure space. We announced last week a

merger of equals with U.S. Bitcoin Corp. We're incredibly excited about it. And yeah, we're here to answer some of the questions

that have come up today on today's show.

Tom

All right, great. We have gotten a lot of questions,

obviously, on the channel. We cover the Bitcoin miners a lot and we cover your company a lot. And I just want to have some things clarified

because I'm not 100% sure everybody understands – due to the complicated nature of what you're doing – that they understand

what's going on. So the first thing I wanted to talk about was really even just simply go through. You just mentioned a merger of equals.

So can you explain how that's going to work as far as the stock goes? Because the way it reads, I think a lot of people are interpreting

that somehow U.S. Bitcoin is going to end up with more stock and somehow there's additional dilution. And so can you explain because I

know inside of that effectively, I think you're doing, you know, what ends up being a reverse stock split. So because it's more than one

thing at once, it's a little confusing

Sue

For sure, And that's why I'm here to chat with

you guys today just so we can hopefully clear up some of the gray areas. Okay. So let's just quickly go over stock consolidation versus

dilution, the definitions in corporate finance. So share consolidate consolidation, like you said, is a reverse stock split. And it involves

dividing the existing total quantity of shares by a number such as five or ten, which obviously reduces the total number of shares outstanding.

And this process decreases the total number of outstanding shares of a company, but should proportionally increase the value of each share

– of each outstanding share. Following the consolidation, because you have a reduction in supply but an increase in value versus

so for example, a two for one share consolidation would have the number of outstanding shares of a company, but should result in a halve

of each value of the share. So we proposed a share consolidation. Dilution, on the other hand, refers to an increase in the number of

outstanding shares of a company, which in turn generally reduces the value of each Share. So we did not propose dilution. We proposed

consolidation. And I think we're going to pull up the chart here and show that. So on our website, we produced an FAQ document under investor

materials that walks through what this strategic merger of Hut 8 mining and U.S. Bitcoin Corp would look like from an actual share breakdown.

So what Hut 8 is starting with going into this transaction is 220, about 220 million common shares outstanding. Okay. And then fully diluted

in the money shares outstanding is about 221 million. US Bitcoin Corp. has current capital stock outstanding of about 64 million shares

outstanding and fully diluted in the money. It's about 65 million shares outstanding. So in order to make it a merger, a 50/50 merger,

50% US Bitcoin Corp shareholders and 50% HUT shareholders, we need to make it 50/50 so the exchange ratio for New HUT is .2 and then following

that exchange ratio, the current HUT 8 shares will be exchanged for 44 million New Hut shares following the transaction. And then the

New HUT shares outstanding for U.S. BTC Corp is also going to be 44 million approximately shares outstanding. So this means that each

current shareholder of Hut 8 will hold fewer shares than they did immediately prior to closing. But the value of each New HUT share is

expected to be worth proportionately more so. So does that explain it a little bit?

Tom

Yeah. And if I could just say a few things

back at you to make sure we're on the same page. I think one of the critical takeaways that you just provided that it didn't talk

about in the initial press release, you know, and it's just another layer of detail is right now there's 221 million shares fully

diluted for HUT 8. When this is all said and done with, it sounds like for what? You know what the press release is calling New HUT.

There's going to be 88 million shares.

Sue

Of New HUT. The proposed merger, again, this is

pending shareholder approval. This is you know, we've got a lot of steps in place. But, yes, the new company proposed share of shares

outstanding is proposed for about 88 million shares outstanding.

Tom

So I think that's going to fill in a lot of the

gaps for a lot of people, because I received a lot of messages with all kind of different numbers. But knowing that final share count,

I think pulls the entire transaction together. And like you said, you've got your frequently asked questions on this that I think also

help clarify this quite a bit.

Sue

So yeah, yeah. And so the whole purpose was, was

to address the number of outstanding common shares like we've talked about to levels that are better aligned with companies of New HUT’s

expected size and scope. And it's another step in our journey into becoming a more diversified, resilient and stronger business, really.

So we thought it was a really important piece of this pie.

Tom

Okay, I appreciate that. I think that helps that.

The second biggest question I would say that I got is in regard to your hodl strategy. So you guys have been pretty adamant hodlers I

don't think you've sold a Bitcoin in a couple of years now. And as a function of what you're proposing to do here, at least on a short

term basis, that strategy is going to change. So I guess my question would be the way I read the press release is essentially in the interim

period of time, you guys are not going to hold all the Bitcoin that you're mining. And then, you know, the press release that, I guess

you would take a look at your Treasury strategy if and when the time comes, if all this goes through. So I guess the big question that

people have is what does this mean to your stack? So you guys have, you know, 9200 plus Bitcoin on your balance sheet. Is that going to

disappear or is that going to cut in half or what? And, you know, obviously, you can't give us an exact number, but in general, what kind

of impact do you think that's going to have on your never mind the bitcoin you're mining during these months? It sounds like you're selling,

but you know what your total Bitcoin situation going to look like.

Sue

Yeah. So again, I'm obviously limited only

to talking about publicly available information. But look, so we've as of yesterday or as of this morning's announcement, we've got

9274 unencumbered Bitcoin on our balance sheet. That is still the highest amount of self mined Bitcoin on our balance sheet of any

publicly traded company. Now one of the reasons why we've been able to successfully build for so long in both bear and bull markets

is because we've taken a balance sheet first approach to everything that we do. And what we mean by that in this case is you can't

control macroeconomic forces, which you and your audience know, but you can certainly control how you manage your cash and your

Bitcoin balance and whether or not you are reliant on unattractive financing terms. From a strategic perspective, we feel in order

to, you know, get to this next era of shareholder value creation and support this merger, that being strategic with our reserve, how

we use it and you know, selling piece of our production is one of the best options or is, is the option that we have deemed most

appropriate. Again, because so that we're not reliant on unattractive financing terms and you know going into what we hope is a

shareholder approved close on this transaction.

Tom

Okay and then obviously I think the rest of this

answer to this question happens if and when the merger occurs and you guys revisit your Treasury strategy.

Sue

Yeah. Well, yeah, I mean, in the sense that, you

know, we want to be smart business operators, right? And we want to be less reliant on dilutive sources of funding for the business. And

so part of the thing that we love about this, USBTC, you know, proposed merger is that it comes with CapEx light and scalable lines of

Fiat based revenues with our managed infrastructure operations, we've got now, you know, a hosting line, additional hosting in line of

business plus still, you know, a proposed 5.6 exahash of mining that would be available upon close in this New HUT company. So it's really

exciting the amount of CapEx light scaling opportunities here. And again, we haven't disclosed our growth plans beyond the proposed, you

know, hopeful, successful merger because again, we just need to make sure that we're staying conservative and yeah, we will certainly

update you with the growth plans once and if this goes through.

Tom

Well, I think that's consistent with what you

guys have done all along. You've known things, you know, when they're when you're ready. So I understand what you brought up. You brought

up a point in there that I want to follow up on. One of the things that the proposed new company will do is host. So I know looking at

a lot of the publicly traded companies, the hosting portion of their business has not necessarily been a strength. Let's just say that.

So do you guys have a different formula with what you're looking to go into, where you expect that to be a profit center?

Sue

Yeah. So again, I can't confirm any projected

values at all – We need to stay on side here with regulation. Absolutely. But look, we're very excited about this managed infrastructure

operations business. So this is a purpose built platform that has been built in-house for effectively electronic management. And it's

like a software layer that optimizes energy infrastructure businesses. So for example, what this platform can do is effectively power

up and power down on a miner by miner basis and effectively arbitrage. Where is the best ROI for this electron in this moment of time?

So is it do we sell that back to the grid? Do we put that towards mining? And also part of this sort of MIO business is it also includes

property management, maintenance, efficiency, uptime, strategic curtailment which i just talked about even bringing in hosting clients

for it, for our clients who are working with us. And so it's a very as I mentioned earlier, it's CapEx light, it's scalable and it's a

way to optimize infrastructure and infrastructure management and effectively arbitrage electrons. So this is not just a hosting business,

right? This is another layer that sits on top of a certain X amount of megawatts that is going to be dedicated to hosting.

Tom

All right. So that I'm going to jump to

another one of what I think was the most important question, because I think you just answered it. You know, this was obviously your

initial press release as shareholder I mean, they're going to do a shareholder vote on this. Is there more information coming prior

to obviously to shareholders having to make a decision? You know, yes. Do they want this merger? And, you know, what time frame is

that coming in?

Sue

Yeah. So I can't confirm a time frame, but I can

certainly tell you that we will have more publicly available information disclosed so that our shareholders can get a better understanding

as to the meaning and the numbers behind this business.

Tom

Okay. One of the other things that was mentioned

in there along those same lines is I think you're going to provide a bridge I'm calling a small bridge loan, but, you know, $6 or $8 million

or something to that effect, correct me if I'm wrong, is there more debt out there? Is that something you can talk about or do we need

to wait essentially for these additional information releases that you're going to be giving in the future?

Sue

I'm going to have public filings for you guys

as soon as possible, and then that'll show, like I said, the publicly disclosed numbers that you guys can have a look at. And again, I'm

happy to come on after – There's still a lot of questions outstanding. You know, we're happy to do another call with you if we need

to, to talk a little bit more about those materials when they become available.

Tom

Yeah, I think that's a key part of what's going

on next. A lot of it's a little bit early. Obviously, everybody's going to react to a press release like that. But the bottom line is

it seems like there's a lot more information to come and we should probably try to parse that information when we get it versus speculate

as to what it's going to be. So hopefully that means that you can come back on maybe, you know, after the next release of information

and we could talk some more.

Sue

I'd love that.

Tom

So I think you've hit most of my main questions.

I know you didn't have a lot of time, so I appreciate you taking some time out of your day. Hopefully this has shed some light on some

of the things it did for me, so hopefully this has for everybody else shed a little bit of light and clarified a few things that questions

that were floating around out there.

Sue

And just remember, my Twitter handle is at Big

SUEY b i g s u e y, my DMs are open. I'm happy to talk to shareholders one on one because again, this is obviously a very transformative

time for HUT 8 and for our shareholders. And so I'm happy to chat with you guys anytime.

Tom

I do have time to sneak in one more question on

you. Yes, I forgot to ask what does this mean for Sue?

Sue

What's it mean? So far, it's looking like Sue

is going to continue to be, you know, on the Corp Dev side head of IR so I'll certainly continue chatting with you guys. And yeah, I'm

you know, I'm personally very excited about what this means for our business.

Tom

Outstanding. I'm glad to hear it. And we look

forward to talking to you again when more information is available.

Sue

Okay. Thanks, guys.

Tom

Thanks so much Sue.

Sue

See you again. Bye. Okay. Thank you for having

me on. That was great. And you know how it is like.

Cautionary note regarding Forward–Looking Information

This communication includes “forward-looking information” and “forward-looking statements” within the meaning

of Canadian securities laws and United States securities laws, respectively (collectively, “forward looking information”).

All information, other than statements of historical facts, included in this communication that address activities, events or developments

that Hut 8 expects or anticipates will or may occur in the future, including such things as future business strategy, competitive strengths,

goals, expansion and growth of Hut 8’s businesses, operations, plans and other such matters is forward-looking information. Forward

looking information is often identified by the words “may”, “would”, “could”, “should”,

“will”, “intend”, “plan”, “anticipate”, “allow”, “believe”, “estimate”,

“expect”, “predict”, “can”, “might”, “potential”, “predict”, “is

designed to”, “likely” or similar expressions. In addition, any statements in this communication that refer to expectations,

projections or other characterizations of future events or circumstances contain forward-looking information and include, among others,

statements with respect to: (i) the expected outcomes of the Transaction, including New Hut's assets and financial position; (ii) the

ability of Hut 8 and USBTC to complete the Transaction on the terms described herein, or at all, including, receipt of required regulatory

approvals, shareholder approvals, court approvals, stock exchange approvals and satisfaction of other closing customary conditions; (iii)

the expected synergies related to the Transaction in respect of strategy, operations and other matters; (iv) projections related to expansion;

(v) expectations related to the Combined Company's hashrate and self-mining capacity; (vi) acceleration of ESG efforts and commitments;

and (vii) the ability of the Combined Company to execute on future opportunities, among others.

Statements containing forward-looking information are not historical

facts, but instead represent management’s expectations, estimates and projections regarding future events based on certain material

factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 and USBTC as of the date of this communication,

such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results,

level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information,

including but not limited to: the ability to obtain requisite shareholder approvals and the satisfaction of other conditions to the consummation

of the Transaction on the proposed terms or at all; the ability to obtain necessary stock exchange, regulatory, governmental or other

approvals in the time assumed or at all; the anticipated timeline for the completion of the Transaction; the ability to realize the anticipated

benefits of the Transaction or implementing the business plan for the Combined Company, including as a result of a delay in completing

the Transaction or difficulty in integrating the businesses of the companies involved (including the retention of key employees); the

ability to realize synergies and cost savings at the times, and to the extent, anticipated; the potential impact on mining activities;

the potential impact of the announcement or consummation of the Transaction on relationships, including with regulatory bodies, employees,

suppliers, customers, competitors and other key stakeholders; the outcome of any litigation proceedings in respect of USBTC's legal dispute

with the City of Niagara Falls, New York; security and cybersecurity threats and hacks; malicious actors or botnet obtaining control

of processing power on the Bitcoin network; further development and acceptance of the Bitcoin network; changes to Bitcoin mining difficulty;

loss or destruction of private keys; increases in fees for recording transactions in the Blockchain; internet and power disruptions;

geopolitical events; uncertainty in the development of cryptographic and algorithmic protocols; uncertainty about the acceptance or widespread

use of digital assets; failure to anticipate technology innovations; the COVID-19 pandemic; climate change; currency risk; lending risk

and recovery of potential losses; litigation risk; business integration risk; changes in market demand; changes in network and infrastructure;

system interruption; changes in leasing arrangements; failure to achieve intended benefits of power purchase agreements; potential for

interrupted delivery, or suspension of the delivery, of energy to the Combined Company’s mining sites. For a complete list of the

factors that could affect the Company, please see the “Risk Factors” section of the Company’s Annual Information Form

dated March 17, 2022 and Hut 8’s other continuous disclosure documents which are available on the Company’s profile on the

System for Electronic Document Analysis and Retrieval at www.sedar.com and on the EDGAR section of the U.S. Securities and Exchange

Commission’s ("SEC") website at www.sec.gov.

These risks are not intended to represent a complete

list of the factors that could affect Hut 8, USBTC, or New Hut; however, these factors should be considered carefully. There can be no

assurance that such estimates and assumptions will prove to be correct. Should one or more of these risks or uncertainties materialize,

or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described

in this communication as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected or targeted

and such forward-looking statements included in this communication should not be unduly relied upon. The impact of any one assumption,

risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent

and New Hut’s future decisions and actions will depend on management’s assessment of all information at the relevant time.

The forward-looking statements contained in this communication are made as of the date of this communication, and each of Hut 8 and USBTC

expressly disclaims any obligation to update or alter statements containing any forward-looking information, or the factors or assumptions

underlying them, whether as a result of new information, future events or otherwise, except as required by law. Except where otherwise

indicated herein, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future

date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing

or changes occurring after the date of preparation.

Additional information about the transaction

and where to find it

In connection with the transaction, that, if

completed, would result in Hut 8 Corp. (“New Hut”) becoming a new public company, New Hut has filed a registration

statement on Form S-4 (the “Form S-4”) with the U.S. Securities Exchange Commission (the “SEC”). U.S. Data

Mining Group, Inc. (“USBTC”) and Hut 8 Mining Corp. (“Hut 8”) urge investors, shareholders, and other

interested persons to read the Form S-4, including any amendments thereto, the Hut 8 meeting circular, as well as other documents

filed or to be filed with the SEC and documents to be filed with Canadian securities regulatory authorities in connection with the

transaction, as these materials do and will contain important information about USBTC, Hut 8, New Hut and the transaction. New Hut

also has, and will, file other documents regarding the transaction with the SEC. This communication is not a substitute for the Form

S-4 or any other documents that may be sent to Hut 8’s shareholders or USBTC's stockholders in connection with the

transaction. Investors and security holders are or will be able to obtain free copies of the Form S-4 and all other relevant

documents filed or that will be filed with the SEC by New Hut through the website maintained by the SEC at www.sec.gov or by

contacting the investor relations department of Hut 8 at info@hut8.io and of USBTC at info@usbitcoin.com.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer

to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”) or in a transaction exempt from the registration

requirements of the Securities Act.

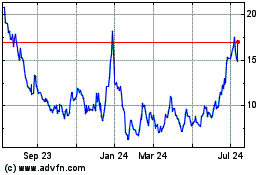

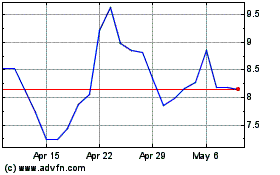

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jul 2023 to Jul 2024