FILED

BY HUT 8 MINING CORP.

COMMISSION

FILE NO. 001-40487

PURSUANT

TO RULE 425 UNDER THE SECURITIES ACT OF 1933, AS AMENDED

SUBJECT

COMPANY: U.S. DATA MINING GROUP, INC.

Hut

8 Mining Corp.

Analyst

and Investor Call

Event

Date/Time: February 7, 2023 — 8:30 a.m. E.T.

Length:

25 minutes

"While Cision has used commercially reasonable efforts to produce this transcript, it does not represent or warrant that this transcript

is error-free. Cision will not be responsible for any direct, indirect, incidental, special, consequential, loss of profits or other damages

or liabilities which may arise out of or result from any use made of this transcript or any error contained therein."

« Bien que

Cision ait fait des efforts commercialement raisonnables afin de produire cette transcription, la société ne peut affirmer

ou garantir qu’elle ne contient aucune erreur. Cision ne peut être tenue responsable pour toute perte de profits ou autres

dommage ou responsabilité causé par ou découlant directement, indirectement, accessoirement ou spécialement

de toute erreur liée à l’utilisation de ce texte ou à toute erreur qu’il contiendrait. »

Corporate

participants

Jaime

Leverton

Hut

8 Mining Corp. — CEO

Shenif

Visram

Hut

8 Mining Corp. — CFO

Michael

Ho

US

Bitcoin Corp — Co-founder & CEO

Asher

Genoot

US

Bitcoin Corp — President & Co-founder

Conference

Call Participants

Bill

Papanastasiou

Stifel

— Analyst

Maxwell

Carr

M

Partners — Analyst

George

Sutton

Craig

Hallum — Analyst

Kevin

Dede

HCW

— Analyst

PRESENTATION

Operator

Welcome

to the Analyst and Investor call. This call will discuss the announcement made at 6:30 a.m. today on the merger between Hut 8 and US

Bitcoin Corp. In addition to the media release issued earlier today, you can find Hut 8’s financial statements and MD&A on

the Company’s website at www.hut8mining.com, under the Company’s SEDAR profile at www.sedar.com, and under the Company’s

EDGAR profile at www.sec.gov.

Unless

noted otherwise, all amounts referred to during this call are denominated in Canadian dollars.

Any

comments made during this call may include forward-looking statements within the meaning of applicable securities legislation regarding

the future performance of Hut 8 Mining Corp., US Bitcoin Corp, and its subsidiaries. Statements made reflect current expectations and,

as such, are subject to a variety of risks and uncertainties that could cause actual results to differ materially from current expectations.

These risks and uncertainties include, but are not limited to, the factors discussed in the press release, as well as Hut 8’s MD&A,

and Annual Information Form for the year ended December 31, 2021.

I

would now like to turn the call over to Hut 8’s CEO, Jaime Leverton.

Jaime

Leverton — CEO, Hut 8 Mining Corp.

Thank

you so much, Joelle (phon). Hello, everyone, and thank you for joining the call this morning.

I

am joined today by our CFO, Shenif Visram, and US Bitcoin co-founders Mike Ho and Asher Genoot. And the four of us, our boards, and our

leadership teams are thrilled about today’s announcement.

As

you know, Hut 8 and US Bitcoin announced a merger of equals to create a preeminent digital asset mining, hosting, managed infrastructure

operations, and high-performance computing organization. We are incredibly excited about this announcement and think the USBTC team and

their operations are an excellent complement to Hut 8.

We

expect that this union will accelerate the diversification strategy we’ve been operating under since we opened our MicroBT repair

centre and acquired five traditional cloud and co-location data centres. These data centres not only support traditional enterprise customers

but also customers in the blockchain and Web 3.0 space.

In

addition, we are very bullish about expanding into the US because it will give us the opportunity to be included in new indices such

as the Russell 2000 and enjoy improved access to capital, which will allow us to continue to operate opportunistically during this bear

market.

Notably,

the combination will see us with established self-mining operations at five mines, two in Canada and three in the US, running a total

of 5.6 exahash with 244 megawatts of total energy availability. It will give us 6 exahash of installed hosting capacity powered by 220

megawatts of hosting Infrastructure at a site in Texas, with clients that include some of the largest miners in the industry. It will

take us into the very nascent space of managed infrastructure operations at two US sites where USBTC has pioneered a new business model

to capture untapped value from the mining ecosystem, which is incredibly exciting.

Unlike

hosting where miners bring their servers and plug them into our sites, with managed infrastructure operations, the team goes into a miner’s

existing site and runs the day-to-day operations, manages the property, performs maintenance, and, importantly, optimizes it using USBTC’s

purpose-driven software. The software is designed to provide real-time monitoring capabilities to optimize the energy consumption of

thousands of machines across the site, maximizing hardware efficiency. It also enables profitable participation in demand response programs

and can help to balance out the grid, improving grid stability while reducing energy costs.

And

speaking of energy, the US Bitcoin team brings outstanding energy-sourcing management and hedging capabilities to New Hut, significantly

enhancing our ability to better plan around stable and predictable energy usage and mitigate fluctuating prices across markets.

On

the environmental front, we expect that this merger will allow us to achieve our ESG objectives more quickly by adding renewable and

zero-carbon-emission energy sources to the mix. USBTC’s Niagara Falls alpha facility is fueled by a minimum of 91 percent zero-carbon-emission

energy sources. The echo facility at King Mountain is co-located behind the metre at a wind farm and, at peak wind-generation period,

can draw up to 100 percent of the energy the wind project produces to power mining and hosting. The rest of the time the energy is sourced

from ERCOT, which includes more than 40 percent zero-carbon-emission sources.

The

Nebraska site is powered by 62 percent zero-carbon-emission sources, including 46.9 percent nuclear, 7.9 percent wind, and 7.6 percent

hydro.

Before

I pass it over to our CFO, Shenif, I want to take a minute to say that I believe the most compelling aspect of this merger is a cultural

fit between our two teams. You have heard me say for some time now that we are opportunistic, and we are focused on growing organically

and inorganically. But what makes this combination truly powerful is a like-mindedness we share between our teams and the complementary

skill sets our teams, especially our leadership teams, have. There is very little overlap between us.

Mike

and Asher and our leadership team have deep entrepreneurial experience, software development capabilities, energy hedging and demand

response expertise, as well as excellent business development skills in the mining space. This is an incredible complement to our experience,

leading in large public companies, our deep governance expertise, excellent H2C business acumen, and strong balance-sheet-first track

record.

So

we’ve definitely been opportunistic, as promised, but more importantly, we’ve been incredibly thorough and thoughtful in

selecting a great partner. I am incredibly excited about this union and think it represents a massive, massive step forward for both

of us, our teams, our customers, and our shareholders.

Now

I’ll ask Shenif Visram, our CFO, to share the details of the transaction. Shenif?

Shenif

Visram — CFO, Hut 8 Mining Corp.

Hi

everyone. I am very pleased to be here today, The transaction is an all-share merger of equals. Hut 8 shareholders will receive, for

each Hut 8 share, 0.2 of a share of New Hut common stock, which will effectively result in a consolidation of the Hut 8 shares on a five-to-one

basis.

Stockholders

of USBTC will receive, for each share of USBTC common stock, 0.6716 of a share of New Hut common stock. Based on the five-day volume-weighted

average price of US$2.2381 for the Hut 8 shares on the NASDAQ as of the last trading day prior to today’s announcement, the aggregate

consideration implies a combined market capitalization of approximately US$990 million.

Upon

closing, each Hut 8 shareholder and USBTC stockholder are expected to each collectively own, on a fully diluted, in-the-money basis,

approximately 50 percent and 50 percent of the stock of the combined companies respectively.

Following

completion of the transaction, Hut 8 and USBTC will each become wholly owned subsidiaries of New Hut, which will be headquartered in

the United States. Moving Hut 8’s headquarters to the United States will give us the opportunity to be included in new indices,

such as Russell 2000 Index, and enjoy improved access to capital, which will allow us to continue to operate opportunistically during

this bear market.

I

also want to confirm that Bill Tai will continue as Chair of the Board. Jaime Leverton will continue as CEO. Michael Ho will become Chief

Strategy Officer. Asher Genoot will continue as President. I will continue as CFO. Our team will be approximately 210 people strong with

key members across North America. Thank you.

Mike,

over to you.

Michael

Ho — Co-founder & CEO, US Bitcoin Corp

Thanks,

Shenif, and hello, everyone. I’m truly thrilled to be joining you today.

I

would like to start by saying that I couldn’t agree with Jaime more. We have long admired Hut 8 for their track record managing

through multiple markets, for their treasury, their Canadian operations, dual listing, and like-minded approach to diversified lines

of business.

When

Asher and I set out, our vision was to build a company focused on operational excellence at scale. Meeting Jaime for the first time,

she and I immediately clicked on our shared commitment to doing things right. I couldn’t be more excited to work with her and the

entire Hut 8 team to continue building a worldclass enterprise.

As

we look ahead, our shared goal is to be the leading provider of sustainable and efficient mining, setting a new standard in the industry.

I believe our combined resources and expertise will enable us to capitalize on new opportunities and drive growth for both companies.

Throughout

this process, it’s become clear that the strategic impact this transaction will drive is significant. We see a clear path to leveraging

our collective vision to drive innovative technology advancements and become a second-to-none operator.

Thank

you and over to you, Asher.

Asher

Genoot — President and Co-founder, US Bitcoin Corp

Thanks,

Mike, and hi, everyone.

Mike

and I founded US Bitcoin in 2020 with the conviction that we could raise the bar for companies in the Bitcoin mining industry. We wanted

to build a company that would challenge the industry paradigms and recognize the importance of building the right team and culture to

do so. From day one, this has always been a priority for us as leaders of US Bitcoin.

Several

months ago, Mike and I took a moment to reflect on how far we’ve come in the Company. We realized how grateful we are to have built

USBTC with a team of such hardworking, passionate, smart, and good-hearted people. The USBTC team truly embodies the operating principles

we challenge it to live by each day: relentless work ethic, radical transparency, and a belief that merit is what matters.

Looking

ahead to this next chapter, we are incredibly excited to have found a team that embodies the same values as ours. This was a non-negotiable

factor in our search for the right partner. I’m incredibly excited by the cultural alignment between the Hut 8 and USBTC teams

and the innovation and growth we will achieve as a single team.

The

combination of Hut 8 and USBTC is an important step, but it’s truly just the beginning. We are laser-focused on identifying the

opportunities to capture untapped value across the mining ecosystem. Together, I believe we will be an exceptional self-mining operator,

hosting provider, strategic operator of managed infrastructure, purveyor of high-performance computing infrastructure, and industry-leading

ASIC repair and sales hub, underpinned by the outstanding operating technology and IP to drive growth.

Operator,

I’ll turn it back to you now.

Q&A

Operator

Thank

you. Ladies and gentlemen, we will now begin the question-and-answer session. Should you have a question, please press the *, followed

by the 1 on your touch-tone phone. You will hear a three-tone prompt acknowledging your request, and your questions will be polled in

the order they are received. Should you wish to decline from the polling process, please press *, followed by the 2. If you are using

a speakerphone, please lift the handset before pressing any keys. One moment, please, for your first question.

Your

first question comes from the line of Bill Papanastasiou with Stifel. Please go ahead.

Bill

Papanastasiou — Stifel

Hey,

guys. Congrats on the merger. Thanks for taking my call.

Jaime

Leverton

No

problem. Good morning, Bill.

Bill

Papanastasiou

So,

this transaction will provide Hut with substantial scale and, as you mentioned, access to low-costed energy across the sites managed

by US Bitcoin Corp. Are you able to provide any colour today on how the merger will impact the overall margin profile and profitability

of Hut?

Any

colour in terms of how this cost of power at these facilities may compare to Hut’s existing sites?

Jaime

Leverton

So,

Bill, we’ll be able to get into more specific details on the financials in due course, but that’s not something I can comment

on at this point in time.

Bill

Papanastasiou

Okay.

No problem.

In

terms of the software that’s been developed by US Bitcoin Corp, really attractive. Seems like it’s well used across the managed

infrastructure operations. Can you remind us if Hut is currently using similar software applications right now?

And

are you able to highlight some of the synergies that may flow over to Hut in terms of really being able to drill down on miner-specific

work orders and so on and so forth?

Jaime

Leverton

The

software that USBTC has developed is really unique in the space across two different platforms. And we have not built specific synergy

calculations into this transaction but are obviously really excited, when the transaction closes, to be able to apply some of the software

and operational excellence that we’ve seen from the USBTC team.

Bill

Papanastasiou

Great.

Thank you. And then in regards to the managed infrastructure operations side of US Bitcoin Corp’s line of service, we’ve

seen a lot of nontraditional operators enter the space and acquire or build infrastructure assets. Perhaps you can speak a bit more and

highlight the competitive advantages US Bitcoin Corp has on this segment.

And

could we see more potential new entrants work with US Bitcoin Corp? How does that look into the future?

Jaime

Leverton

Yeah.

I mean I think the managed infrastructure operations category that they’re really pioneering as a group is incredibly exciting,

and they’re truly first movers in this space. And between the operating teams that they have in place as well as their proprietary

software they’ve developed, I think puts the team in an incredibly powerful position for future growth. And, as you mentioned,

I think there are going to be increasing opportunities in this space.

Bill

Papanastasiou

Great.

And how may we see the management team at Hut and US Bitcoin Corp kind of form this synergy in terms of Hut 8 perhaps moving more closely

and working more closely with the traditional high-performance computing segment of the business and US Bitcoin Corp maybe overlooking

the Bitcoin operations? Are you able to provide a bit more colour and some of the opportunities that you see that that could really set

the New Hut apart?

Jaime

Leverton

So

we’ve highlighted some of the key roles that are already predetermined, but the further details about the org chart will continue

to be released as we get further into the process and ultimately close.

But

I think the most important part, as I referenced in my speaking notes directly, is we see these two teams as very distinct in their skill

set. We see a really, really natural fit for the teams to come together and drive incremental value as a combined unit.

Bill

Papanastasiou

Great.

Thank you, Jaime and Mike and the rest of the team. That’s all the questions I have. Congrats again. Look forward to the road ahead.

Jaime

Leverton

Thank

you so much, Bill. Appreciate the time this morning.

Operator

Your

next question comes from the line of Maxwell Carr with M Partners. Please go ahead.

Maxwell

Carr — M Partners

Hi.

Congratulations on the merger. Looks great from our perspective. Just a couple of questions.

First

question would be, I guess you’re expecting the deal to close sometime late Q2, Q3, 2023. Would that be an appropriate estimation?

Jaime

Leverton

Yeah.

We’re hopeful by the end of Q2.

Maxwell

Carr

Okay.

And then supplementary to that question. Obviously, we’ve seen some issues with current partners in terms of the power. How long

do you think it would take you to deploy current miners that are maybe underutilized or can’t be used, generally speaking, based

on energy constraints, to facilities in the US?

Jaime

Leverton

Well,

it’s difficult to give that kind of guidance, but where there’s available capacity, it doesn’t take an inordinate amount

of time to crate miners and move them between sites. But, obviously, our focus right now is getting this transaction closed.

Maxwell

Carr

Perfect.

And last question for me is going to be, the proprietary software; is that optimizing energy utilization? Or is it making the machines

run better? How would you describe it in explain like M5 format?

Jaime

Leverton

I’ll

turn it over to Asher to do that for you.

Maxwell

Carr

Thank

you.

Asher

Genoot

Thanks,

Jaime. So USBTC’s purpose-built energy and site management software provides additional opportunities for efficiency, especially

at the combined company’s Canadian site. So the software’s designed to provide real-time monitoring capabilities to optimize

the energy consumption of thousands of machines across the sites and maximizing the hardware’s efficiency. And we also have a service

software layer for energy consumption that enables basic profitability consumption.

So

we have two software focuses. One is on energy management and really being able to maximize profitability and efficiency around miners,

and then the second is around site and fleet optimization, to be able to manage uptime and efficiency of the machine to make sure that

we’re able to utilize them highly across all of our facilities.

Maxwell

Carr

Perfect.

Thank you very much. And I guess we can expect financials to come as we get closer to the end of Q2?

Jaime

Leverton

That’s

correct. We’ll share as they become available, of course.

Maxwell

Carr

Okay.

Thank you so much. That’s all for me. Congratulations again.

Jaime

Leverton

Appreciate

it.

Operator

Your

next question comes from the line of George Sutton with Craig Hallum. Please go ahead.

Jaime

Leverton

Good

morning, George.

George

Sutton — Craig Hallum

Thanks.

Good morning and my congrats as well. I have to ask, did you contemplate a name change to Hut 16?

Jaime

Leverton

We

did not, George. You forget our origin story. We’re sticking with Hut 8.

George

Sutton

I

know. So, my question, Jaime, on the press release, you talked about potentially using the HODL for helping to finance some of this.

Can you just give us any more specifics there? And I assume everything today is still completely unencumbered.

Jaime

Leverton

Correct.

Everything today is unencumbered. But during the interim period, we do plan to cover our operating costs through a combination of selling

the Bitcoin we mine and potentially from the stack or exploring other debt options.

George

Sutton

So

my complicated question is, if I look out five years from now and I look at all the different allocation options you have—

Jaime

Leverton

Yes.

George

Sutton

—what

will this company look like?

Jaime

Leverton

Do

you know how long five years are in this industry, George?

George

Sutton

Fair.

Let’s look out three.

Jaime

Leverton

So

look. You know me well enough now. It’s been over two years that I’ve been here. And we are patient. We are opportunistic.

We have a very, very keen eye on what’s happening in the industry and where we think the industry’s going. And we continue

to try to, to use a Canadian phrase, we continue to try to make sure we skate where the puck’s going.

And

so, I can’t foresee how things are going to look in three years. But what I can say is we’re going to continue to do exactly

what we’ve done for the last two years but now with even more strength and scale as a combined company under New Hut.

George

Sutton

Awesome.

We love the scale. Thank you.

Jaime

Leverton

Good.

Thank you, George.

Operator

Your

next question comes from Kevin Dede with HCW. Please go ahead.

Jaime

Leverton

Good

morning, Kevin.

Kevin

Dede — HCW

Hi,

Jamie. Hi, Asher. I guess, Jaime, I was kind of curious where Validus stood, if you can comment on that. I wasn’t sure how much

of a wrinkle that was in the works.

Jaime

Leverton

So

we didn’t include the Validus site or power into the numbers, as I referenced in the call. We shared on January 26th that we filed

a statement of claim against Validus and its subsidiary in Ontario over the ongoing dispute. And now that the matter is before the court,

we’re not going to comment on it further.

Kevin

Dede

Fair

enough. Could you give us a snapshot of what you think the balance sheet might look like, say, after the deal is done? I know it’s

kind of tough given there are so many balls in the air, but just kind of curious what you think it’ll look like.

Jaime

Leverton

I

can’t. I can’t do that today, Kevin. But again, as we move through this process, we’ll share financials as they become

available.

Kevin

Dede

Okay.

And I’m wondering, as you look at the US Bitcoin sites, are you considering building redundancy in there so that they might accommodate

HPC, given that’s a Hut objective?

Jaime

Leverton

I

would say nothing’s off the table, Kevin.

Kevin

Dede

OK.

Fair enough. Thanks for taking the questions. Congratulations to you and the team.

Jaime

Leverton

Thank

you so much. Appreciate it.

Operator

There

are no further questions at this time. Please proceed.

Jaime

Leverton

Okay.

So thank you again for making the time to join the call this morning. We couldn’t be more thrilled for this partnership and look

forward to sharing more as we move through the process over the next few months. Have a great day, everybody.

Operator

Ladies

and gentlemen, this concludes your conference call for today. We thank you for participating and ask that you please disconnect your

lines.

Additional information

about the transaction and where to find it

In connection with the transaction,

that, if completed, would result in Hut 8 Corp. (“New Hut”) becoming a new public company, New Hut is expected to file a

registration statement on Form S-4 (the “Form S-4”) with the U.S. Securities Exchange Commission (the “SEC”).

U.S. Data Mining Group, Inc. dba US Bitcoin Corp. (“USBTC”) and Hut 8 Mining Corp. (“Hut 8”) urge investors,

shareholders, and other interested persons to read, when available, the Form S-4, including any amendments thereto, the Hut 8 meeting

circular, as well as other documents to be filed with the SEC and documents to be filed with Canadian securities regulatory authorities

in connection with the transaction, as these materials will contain important information about USBTC, Hut, New Hut and the transaction.

New Hut also has, and will, file other documents regarding the Transaction with the SEC. This material is not a substitute for the Form

S-4 or any other documents that may be sent to Hut’s shareholders or USBTC's stockholders in connection with the Transaction. Investors

and security holders will be able to obtain free copies of the Form S-4 and all other relevant documents filed or that will be filed

with the SEC by New Hut through the website maintained by the SEC at www.sec.gov or by contacting the investor relations department

of Hut 8 at info@hut8.io and of USBTC at info@usbitcoin.com.

No Offer or

Solicitation

This material is not intended to and

shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”) or in a transaction

exempt from the registration requirements of the Securities Act.

Cautionary note regarding Forward–Looking

Information

This communication includes “forward-looking

information” and “forward-looking statements” within the meaning of Canadian securities laws and United States securities

laws, respectively (collectively, “forward looking information”). All information, other than statements of historical facts,

included in this communication that address activities, events or developments that Hut 8 expects or anticipates will or may occur in

the future, including such things as future business strategy, competitive strengths, goals, expansion and growth of Hut 8’s businesses,

operations, plans and other such matters is forward-looking information. Forward looking information is often identified by the words

“may”, “would”, “could”, “should”, “will”, “intend”, “plan”,

“anticipate”, “allow”, “believe”, “estimate”, “expect”, “predict”,

“can”, “might”, “potential”, “predict”, “is designed to”, “likely”

or similar expressions. In addition, any statements in this communication that refer to expectations, projections or other characterizations

of future events or circumstances contain forward-looking information and include, among others, statements with respect to: (i) the

expected outcomes of the Transaction, including New Hut's assets and financial position; (ii) the ability of Hut 8 and USBTC to complete

the Transaction on the terms described herein, or at all, including, receipt of required regulatory approvals, shareholder approvals,

court approvals, stock exchange approvals and satisfaction of other closing customary conditions; (iii) the expected synergies related

to the Transaction in respect of strategy, operations and other matters; (iv) projections related to expansion; (v) expectations related

to the Combined Company's hashrate and self-mining capacity; (vi) acceleration of ESG efforts and commitments; and (vii) the ability

of the Combined Company to execute on future opportunities, among others.

Statements containing forward-looking

information are not historical facts, but instead represent management’s expectations, estimates and projections regarding future

events based on certain material factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 and

USBTC as of the date of this communication, such statements are subject to known and unknown risks, uncertainties, assumptions and other

factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed

or implied by such forward-looking information, including but not limited to: the ability to obtain requisite shareholder approvals and

the satisfaction of other conditions to the consummation of the Transaction on the proposed terms or at all; the ability to obtain necessary

stock exchange, regulatory, governmental or other approvals in the time assumed or at all; the anticipated timeline for the completion

of the Transaction; the ability to realize the anticipated benefits of the Transaction or implementing the business plan for the Combined

Company, including as a result of a delay in completing the Transaction or difficulty in integrating the businesses of the companies

involved (including the retention of key employees); the ability to realize synergies and cost savings at the times, and to the extent,

anticipated; the potential impact on mining activities; the potential impact of the announcement or consummation of the Transaction on

relationships, including with regulatory bodies, employees, suppliers, customers, competitors and other key stakeholders; the outcome

of any litigation proceedings in respect of USBTC's legal dispute with the City of Niagara Falls, New York; security and cybersecurity

threats and hacks; malicious actors or botnet obtaining control of processing power on the Bitcoin network; further development and acceptance

of the Bitcoin network; changes to Bitcoin mining difficulty; loss or destruction of private keys; increases in fees for recording transactions

in the Blockchain; internet and power disruptions; geopolitical events; uncertainty in the development of cryptographic and algorithmic

protocols; uncertainty about the acceptance or widespread use of digital assets; failure to anticipate technology innovations; the COVID-19

pandemic; climate change; currency risk; lending risk and recovery of potential losses; litigation risk; business integration risk; changes

in market demand; changes in network and infrastructure; system interruption; changes in leasing arrangements; failure to achieve intended

benefits of power purchase agreements; potential for interrupted delivery, or suspension of the delivery, of energy to the Combined Company’s

mining sites. For a complete list of the factors that could affect the Company, please see the “Risk Factors” section of

the Company’s Annual Information Form dated March 17, 2022 and Hut 8’s other continuous disclosure documents which are available

on the Company’s profile on the System for Electronic Document Analysis and Retrieval at www.sedar.com and on the EDGAR section

of the U.S. Securities and Exchange Commission’s ("SEC") website at www.sec.gov.

These risks are not intended to represent

a complete list of the factors that could affect Hut 8, USBTC, or New Hut; however, these factors should be considered carefully. There

can be no assurance that such estimates and assumptions will prove to be correct. Should one or more of these risks or uncertainties

materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from

those described in this communication as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected,

projected or targeted and such forward-looking statements included in this communication should not be unduly relied upon. The impact

of any one assumption, risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty

because they are interdependent and New Hut’s future decisions and actions will depend on management’s assessment of all

information at the relevant time. The forward-looking statements contained in this communication are made as of the date of this communication,

and each of Hut 8 and USBTC expressly disclaims any obligation to update or alter statements containing any forward-looking information,

or the factors or assumptions underlying them, whether as a result of new information, future events or otherwise, except as required

by law. Except where otherwise indicated herein, the information provided herein is based on matters as they exist as of the date of

preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes

available, or circumstances existing or changes occurring after the date of preparation.

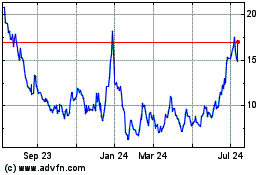

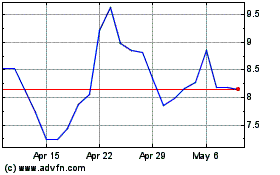

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jul 2023 to Jul 2024