The Herzfeld Caribbean Basin Fund, Inc. (NASDAQ: CUBA) (the

“Fund”) today announced the preliminary results of its

non-transferable rights offering (the “Offering”) that expired on

December 13, 2023 (the “Expiration Date”). In the Offering, the

Fund received subscription requests for 14,371,838 shares of common

stock from rights holders.

The Offering’s final subscription price per

share was determined to be $2.35. The subscription price was

established pursuant to the terms of the Offering and based on a

formula equal to 92% of the volume-weighted average closing sales

price of a share of Common Stock on the NASDAQ Capital Market on

the Expiration Date of the Offering and the four preceding trading

days.

The Offering was oversubscribed and the

over-subscription requests exceeded the primary subscription shares

available. Accordingly, a minimum of 7,150,673 shares will be

issued as part of the Primary Subscription as described in the

registration statement related to the Offering. The Fund may, but

is not required to, issue an additional number of shares (up to

200% of the Primary Subscription) to meet over-subscription

requests. The Fund will make a determination of whether to allocate

available shares pro rata among fully exercising stockholders

(pursuant to the formula as described in the prospectus) and to

what extent to honor over-subscription requests upon receipt of

final results of the Offering and receipt of payment for

“delivery-guaranteed” subscriptions, on or about December 18, 2023.

Gross proceeds from the Offering are expected to total

approximately $16.8 million to up to $33.7 million, before

expenses, depending upon the amount of additional over-subscription

shares, if any, issued by the Fund.

The foregoing numbers are estimates only. The

Fund will announce the final results of the Rights Offering in a

press release on or about December 18, 2023.

The final subscription price is lower than the

original estimated subscription price of $2.57 per share.

Accordingly, any excess payments will be returned to subscribing

rights holders as soon as practicable, in accordance with the

prospectus supplement and accompanying prospectus, filed with the

Securities and Exchange Commission on November 22, 2023.

This press release shall not constitute an offer

to sell or constitute a solicitation of an offer to buy.

For additional information on the Fund, please

contact the Fund at 800-TJH-FUND or visit us on the web

at www.herzfeld.com/cuba.

The Fund is a non-diversified, closed-end fund

managed by HERZFELD/CUBA, a division of Thomas J. Herzfeld

Advisors, Inc. (based in Miami Beach). The Fund seeks

long-term capital appreciation. To achieve its objective the

Fund invests in issuers that are likely, in the Advisor’s view, to

benefit from economic, political, structural and technological

developments in countries in the Caribbean Basin, which the Fund

considers to consist of Cuba, Jamaica, Trinidad and Tobago, the

Bahamas, the Dominican Republic, Barbados, Aruba, Haiti, the

Netherlands Antilles, the Commonwealth of Puerto Rico, Mexico,

Honduras, Guatemala, Belize, Costa Rica, Panama, Colombia,

Venezuela, Guyana and the United States (Caribbean Basin

Countries).

Investments in the Fund involve

risks. Investing in companies of Caribbean Basin Countries may

present certain unique risks not associated with domestic

investments, such as currency fluctuation, political and economic

changes and market risks. These factors may result in greater

share price volatility.

Shares of closed-end funds frequently trade at a

discount to their net asset value (NAV). The price of the

Fund’s shares is determined by a number of factors, several of

which are beyond the control of the Fund. Therefore, the Fund

cannot predict whether its shares will trade at, below or above

NAV.

Before investing in the Fund, investors should

carefully consider the investment objective, risks, and charges and

expenses of the Fund. This information can be found in the

Fund’s prospectus on file with the Securities and Exchange

Commission. An investor should carefully read the Fund’s

prospectus before investing.

Participating stockholders will be required to

initially pay for the Shares subscribed for in the offer as well as

any additional shares subscribed for as part of the

over-subscription privilege at the estimated subscription

price.

About Thomas J. Herzfeld Advisors, Inc.

Thomas J. Herzfeld Advisors, Inc., founded in

1984, is an SEC-registered investment advisor, specializing in

investment analysis and account management in closed-end funds. The

Firm also specializes in investment in the Caribbean Basin. The

HERZFELD/CUBA division of Thomas J. Herzfeld Advisors, Inc. serves

as the investment advisor to The Herzfeld Caribbean Basin Fund,

Inc. a publicly traded closed-end fund (NASDAQ: CUBA).

More information about the advisor can be found

at www.herzfeld.com.

Past performance is no guarantee of future

performance. An investment in the Fund is subject to certain risks,

including market risk. In general, shares of closed-end funds often

trade at a discount from their net asset value and at the time of

sale may be trading on the exchange at a price which is more or

less than the original purchase price or the net asset value. An

investor should carefully consider the Fund’s investment objective,

risks, charges and expenses. Please read the Fund’s disclosure

documents before investing.

NASDAQ Capital Market: CUBACUSIP: 42804T106

Contact Information:

For further information contact:Tom

Morgan305.777.1660

Thomas J. Herzfeld Advisors, Inc.119 Washington Avenue, Suite

504Miami Beach, FL 33139www.herzfeld.com

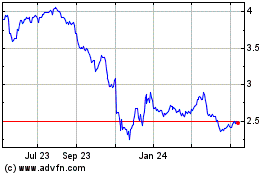

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Oct 2024 to Nov 2024

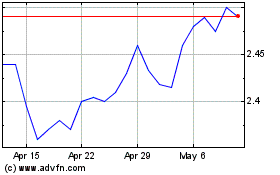

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Nov 2023 to Nov 2024