Current Report Filing (8-k)

April 15 2022 - 8:28AM

Edgar (US Regulatory)

HEIDRICK & STRUGGLES INTERNATIONAL INC false 0001066605 0001066605 2022-04-12 2022-04-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 12, 2022

HEIDRICK & STRUGGLES INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-25837 |

|

36-2681268 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 233 South Wacker Drive, Suite 4900, Chicago, IL |

|

60606-6303 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (312) 496-1200

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.01 par value |

|

HSII |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On April 12, 2022, the Board of Directors of Heidrick & Struggles International, Inc. (the “Company”) amended and restated the Company’s Management Severance Pay Plan and Summary Plan Description (the “Severance Plan”) to provide for certain changes to the Severance Plan (as amended and restated, the “New Severance Plan”), including the changes described below:

| |

• |

|

If the Chief Executive Officer’s or a Tier I Executive’s (as defined in the New Severance Plan) employment with the Company and its subsidiaries is terminated by the Company or a subsidiary without Cause (as defined in the New Severance Plan), a number of outstanding and unvested restricted stock units issued under the Company’s GlobalShare Program or its successor (“RSUs”) (which will not include performance units or any other type of equity or equity-based awards, nor any RSUs that have already been forfeited in full pursuant to their terms prior to the Termination Date (as defined in the New Severance Plan)) will be accelerated, as follows: |

With respect to any RSU award that is less than fully vested as of the Termination Date, in addition to the number of RSUs that have previously vested as of the beginning of the then-current vesting period, a number of additional RSUs (rounded to the nearest whole share) will vest, determined as the number of RSUs that would have vested as of the Termination Date during the then-current vesting period in which the Termination Date occurs if the award had been issued with a continuous vesting schedule over such vesting period, rather than an annual (or other incremental) vesting schedule, based on a percentage (to four decimal places) equal to the number of days completed during such vesting period as of the Termination Date, divided by the total number of days in such vesting period. Any accelerated RSUs will be subject to the same terms, conditions and limitations as the remainder of the award.

| |

• |

|

The Chief Executive Officer and Tier I Executives will be subject to a 12-month non-compete and non-solicitation period following the Termination Date. |

| |

• |

|

Any arbitration relating to the New Severance Plan will be conducted in accordance with the Employment Arbitration Rules of the American Arbitration Association. |

This description of the amendments to the Severance Plan is qualified in its entirety by the terms and conditions of the New Severance Plan, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are being furnished as part of this Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HEIDRICK & STRUGGLES INTERNATIONAL, INC. (Registrant) |

|

|

|

|

| Date: April 15, 2022 |

|

|

|

By: |

|

/s/ Tracey Heaton |

|

|

|

|

Name: |

|

Tracey Heaton |

|

|

|

|

Title: |

|

Chief Legal Office & Secretary |

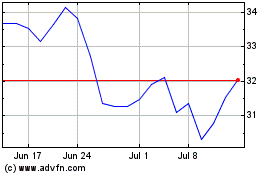

Heidrick and Struggles (NASDAQ:HSII)

Historical Stock Chart

From Jun 2024 to Jul 2024

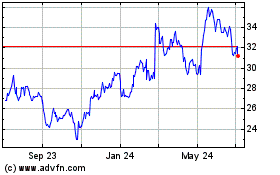

Heidrick and Struggles (NASDAQ:HSII)

Historical Stock Chart

From Jul 2023 to Jul 2024