Healthcare Services Group, Inc. Reports Results for the Three and Six Months Ended June 30, 2017 and Announces Increased Seco...

July 11 2017 - 4:15PM

Healthcare Services Group, Inc. (NASDAQ:HCSG) reported that

revenues for the three months ended June 30, 2017 increased

approximately 22% to $470.9 million. Net income for the three

months ended June 30, 2017 was $22.6 million, or $0.31 per basic

and $0.30 per diluted common share, compared to the three months

ended June 30, 2016 net income of $18.8

million, or $0.26 per basic and diluted common

share.

Revenues for the six months ended June 30, 2017

increased approximately 13% to $875.4 million. Net income for the

six months ended June 30, 2017 was $44.6 million, or $0.61 per

basic and $0.60 per diluted common share, compared to the six

months ended June 30, 2016 net income of $37.4

million, or $0.52 per basic and $0.51 per diluted

common share.

In addition, our Board of Directors declared a

quarterly cash dividend of $0.18875 per common share, payable on

September 22, 2017 to shareholders of record at the close of

business on August 18, 2017. This represents the 57th

consecutive quarterly cash dividend payment, as well as the 56th

consecutive increase since our initiation of quarterly cash

dividend payments in 2003.

The Company will host a conference call on

Wednesday, July 12, 2017 at 8:30 a.m. Eastern Time to discuss

its results for the three and six months ended June 30, 2017. The

call may be accessed via phone at 800-893-5360. The call will be

simultaneously webcast under the “Events & Presentations”

section of the investor relations page on our website,

www.hcsg.com. A replay of the earnings call may be accessed through

the phone number above through approximately 10:00 p.m. Eastern

Time on Wednesday, July 12, 2017. The webcast will also be

available on our website for one year following the date of the

earnings call.

Cautionary Statement Regarding

Forward-Looking Statements

This release and any schedules incorporated by

reference into it may contain forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934 (the

“Exchange Act”), as amended, which are not historical facts but

rather are based on current expectations, estimates and projections

about our business and industry, and our beliefs and assumptions.

Words such as “believes,” “anticipates,” “plans,” “expects,”

“will,” “goal,” and similar expressions are intended to identify

forward-looking statements. The inclusion of forward-looking

statements should not be regarded as a representation by us that

any of our plans will be achieved. We undertake no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise. Such

forward-looking information is also subject to various risks and

uncertainties. Such risks and uncertainties include, but are not

limited to, risks arising from our providing services exclusively

to the health care industry, primarily providers of long-term care;

having one client which accounted for 12.9% of our total

consolidated revenues for the six months ended June 30, 2017;

credit and collection risks associated with this industry; our

claims experience related to workers’ compensation and general

liability insurance; the effects of changes in, or interpretations

of laws and regulations governing the industry, our workforce and

services provided, including state and local regulations pertaining

to the taxability of our services and other labor related matters

such as minimum wage increases; tax benefits arising from our

corporate reorganization and self-funded health insurance program

transition; risks associated with the reorganization of our

corporate structure; perceived or real risks related to the food

industry; and the risk factors described in our Form 10-K

filed with the Securities and Exchange Commission for the year

ended December 31, 2016 in Part I thereof under “Government

Regulation of Clients,” “Competition’’ and “Service

Agreements/Collections,” and under Item IA “Risk Factors.”

These factors, in addition to delays in payments

from clients, have resulted in, and could continue to result in,

significant additional bad debts in the near future. Additionally,

our operating results would be adversely affected if unexpected

increases in the costs of labor and labor-related costs, materials,

supplies and equipment used in performing services could not be

passed on to our clients.

In addition, we believe that to improve our

financial performance we must continue to obtain service agreements

with new clients, retain and provide new services to existing

clients, achieve modest price increases on current service

agreements with existing clients and maintain internal cost

reduction strategies at our various operational levels.

Furthermore, we believe that our ability to sustain the internal

development of managerial personnel is an important factor

impacting future operating results and the successful execution of

our projected growth strategies.

Healthcare Services Group, Inc. is the largest

national provider of professional housekeeping, laundry and dietary

services to long-term care and related health care facilities.

| HEALTHCARE SERVICES GROUP, INC. |

| CONSOLIDATED STATEMENTS OF

INCOME |

| (Unaudited) |

| (in thousands, except per share

data) |

| |

| |

|

For the Three Months Ended |

|

For the Six Months Ended |

| |

|

June 30, |

|

June 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Revenues |

|

$ |

470,876 |

|

|

$ |

386,556 |

|

|

$ |

875,366 |

|

|

$ |

771,363 |

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

|

| Cost of services

provided |

|

407,322 |

|

|

332,211 |

|

|

752,892 |

|

|

662,255 |

|

| Selling, general

and administrative |

|

31,991 |

|

|

25,664 |

|

|

60,201 |

|

|

51,010 |

|

| Income from

operations |

|

31,563 |

|

|

28,681 |

|

|

62,273 |

|

|

58,098 |

|

| Other income: |

|

|

|

|

|

|

|

|

|

Investment and interest |

|

1,515 |

|

|

1,002 |

|

|

3,084 |

|

|

1,189 |

|

| Income before income

taxes |

|

33,078 |

|

|

29,683 |

|

|

65,357 |

|

|

59,287 |

|

| Income taxes |

|

10,527 |

|

|

10,923 |

|

|

20,789 |

|

|

21,901 |

|

| |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

22,551 |

|

|

$ |

18,760 |

|

|

$ |

44,568 |

|

|

$ |

37,386 |

|

| |

|

|

|

|

|

|

|

|

| Basic earnings per

common share |

|

$ |

0.31 |

|

|

$ |

0.26 |

|

|

$ |

0.61 |

|

|

$ |

0.52 |

|

| |

|

|

|

|

|

|

|

|

| Diluted earnings per

common share |

|

$ |

0.30 |

|

|

$ |

0.26 |

|

|

$ |

0.60 |

|

|

$ |

0.51 |

|

| |

|

|

|

|

|

|

|

|

| Cash dividends declared

per common share |

|

$ |

0.18875 |

|

|

$ |

0.18375 |

|

|

$ |

0.37625 |

|

|

$ |

0.36625 |

|

| |

|

|

|

|

|

|

|

|

| Basic weighted average

number of common shares outstanding |

|

73,276 |

|

|

72,568 |

|

|

73,176 |

|

|

72,466 |

|

| |

|

|

|

|

|

|

|

|

| Diluted weighted

average number of common shares outstanding |

|

74,269 |

|

|

73,316 |

|

|

74,108 |

|

|

73,165 |

|

| HEALTHCARE SERVICES GROUP, INC. |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (in thousands) |

| |

| |

|

June 30, 2017 |

|

December 31, 2016 |

| |

|

(Unaudited) |

|

|

| Cash and cash

equivalents |

|

$ |

7,058 |

|

|

$ |

23,853 |

|

| Marketable securities,

at fair value |

|

70,082 |

|

|

67,730 |

|

| Accounts and notes

receivable, net |

|

338,368 |

|

|

271,276 |

|

| Other current

assets |

|

60,675 |

|

|

51,765 |

|

| Total current

assets |

|

476,183 |

|

|

414,624 |

|

| |

|

|

|

|

| Property and equipment,

net |

|

13,399 |

|

|

13,455 |

|

| Notes receivable - long

term |

|

7,526 |

|

|

7,531 |

|

| Goodwill |

|

50,473 |

|

|

44,438 |

|

| Other intangible

assets, net |

|

31,330 |

|

|

14,409 |

|

| Deferred compensation

funding |

|

26,326 |

|

|

24,119 |

|

| Other assets |

|

10,509 |

|

|

9,870 |

|

| Total Assets |

|

$ |

615,746 |

|

|

$ |

528,446 |

|

| |

|

|

|

|

| Accrued insurance

claims - current |

|

$ |

23,975 |

|

|

$ |

23,573 |

|

| Other current

liabilities |

|

122,960 |

|

|

77,298 |

|

| Total current

liabilities |

|

146,935 |

|

|

100,871 |

|

| |

|

|

|

|

| Accrued insurance

claims - long term |

|

66,077 |

|

|

64,080 |

|

| Deferred compensation

liability |

|

26,657 |

|

|

24,653 |

|

| Stockholders'

equity |

|

376,077 |

|

|

338,842 |

|

| Total Liabilities and

Stockholders' Equity |

|

$ |

615,746 |

|

|

$ |

528,446 |

|

Company Contacts:

Theodore Wahl

President and Chief Executive Officer

Matthew J. McKee

Senior Vice President of Strategy

215-639-4274

investor-relations@hcsgcorp.com

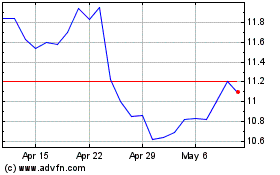

Healthcare Services (NASDAQ:HCSG)

Historical Stock Chart

From Jun 2024 to Jul 2024

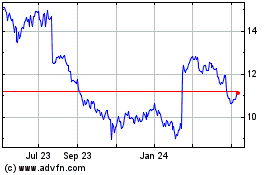

Healthcare Services (NASDAQ:HCSG)

Historical Stock Chart

From Jul 2023 to Jul 2024