Potential $1.76 Trillion in Working Capital

Opportunity Revealed

The Hackett Group, Inc., (NASDAQ: HCKT) reports that for the

first time in a decade, the largest publicly traded companies in

the U.S. have experienced simultaneous degradation across all major

working capital metrics, according to their new research. This

triple threat points to a critical turning point, revealing a

staggering $1.76 trillion in untapped working capital opportunity,

stressing the urgency for companies to optimize and free up cash

amidst ongoing economic uncertainties.

After a year of growth despite inflationary and recessionary

risks, the largest U.S. companies experienced a dramatic shift in

2023. For the first time in a decade, an analysis of data from

1,000 of the largest U.S. public companies showed that all three

key working capital metrics – days sales outstanding (DSO), days

inventory outstanding (DIO) and days payables outstanding (DPO) –

deteriorated simultaneously. DSO increased by 3% to 40.1 days and

DIO saw a slight rise of 0.01 days, while DPO declined by 0.1 days,

highlighting a significant shift in the financial and operational

performance of the largest publicly traded companies in the

country.

This presents a concerning trend for businesses because

macroeconomic uncertainties and inflationary pressures are expected

to persist, imposing additional external constraints on working

capital. This effect is compounded by persistently higher interest

rates, significantly increasing the carrying cost of money trapped

in working capital compared to previous years. As a result,

redoubling efforts on working capital optimization is more urgent

than ever before to navigate the increasingly volatile market

conditions effectively.

Equally alarming is the softening of aggregate revenue figures.

Over the past decade, excluding the pandemic year, revenue has

averaged a 10% year-over-year increase. However, this year has seen

a stark contrast, with revenue growth remaining essentially flat at

just a 0.3% increase. This trend illustrates the complex dynamic

between efforts to manage inflation and the risk of economic

stagnation due to high interest rates.

The widening gap between best-in-class and median companies

continued to expand, driven primarily by the significant

improvements of top performers rather than the degradation of

median ones. Historically, the ratio of top-to-median performance

has averaged around 2.95-to-1, but this year it has increased by 8%

to reach a record 3.2-to-1.

“This widening gap underscores the imperative for businesses to

diligently manage their financial resources to remain competitive.

As the disparity grows, so does the opportunity for competitive

advantage,” said Istvan Bodo, director of Strategy and Operations

at The Hackett Group.

One of the most notable changes is the substantial degradation

in DSO, which increased by 3% this year to reach 40.1 days, marking

the first time since the pandemic began that DSO has shown

degradation. It’s essential to note, however, that the gains from

the previous two years more than offset this year’s degradation,

resulting in DSO performance comparable to the pre-pandemic average

of around 40 days. Additionally, industries with a heavy

business-to-business focus lead the pack in DSO degradation,

potentially signaling a leverage shift to buyers within these

sectors, emphasizing the evolving dynamics of supplier-customer

relationships in response to changing market conditions.

DIO saw a slight rise of 0.01 days, marking its first

degradation since the pandemic. Despite this marginal increase, DIO

remains significantly improved from the pandemic peak of nearly 58

days. Industries with the most significant downturn in inventory

performance were those heavily dependent on energy in their cost of

goods sold, reflecting potential advance buying to hedge against

geopolitical uncertainties.

DPO declined by 0.1 days this year, continuing a trend of

deterioration seen since the pandemic, with an overall 7% decline,

particularly for industries relying on high-tech equipment – like

computer chips – where the leverage is still with the suppliers

given the supply constraints in that sector.

Additionally, The Hackett Group’s research identified $1.76

trillion in untapped working capital opportunity, emphasizing the

need for finance executives to proactively partner with internal

business partners to optimize working capital across the balance

sheet. In the face of persistent macroeconomic uncertainties and

inflationary pressures, the need for effective working capital

management is more critical than ever. With the transformation

generative artificial intelligence (Gen AI) will have on business

operations, organizations must target and prioritize Gen AI

capabilities to optimize the revenue and disbursement cycles, and

better anticipate customer demand and inventory needs.

“Gen AI will provide new enablement opportunities that will

enhance working capital management across the board,” said Shawn

Townsend, director of Strategy and Operations at The Hackett Group.

“Leading businesses will use Gen AI to improve cash flow

forecasting accuracy, predict optimal inventories that meet

ever-changing customer demand, develop more robust just-in-time

sourcing demand planning and more.”

The increased carrying cost of money trapped in working capital,

driven by high interest rates, underscores the necessity for

companies to intensify their efforts to optimize working capital

and effectively navigate volatile market conditions.

The Hackett Group’s 2024 Working Capital Survey is currently

featured on CFO.com. A summary of the research findings, including

detailed industry analysis and working capital improvement

recommendations, is available on a complimentary basis, with

registration.

About The Hackett Group

The Hackett Group, Inc. (NASDAQ: HCKT) is an IP-based, Gen AI

strategic consulting and executive advisory firm that enables

Digital World Class® performance. Using AI XPLR™ – our AI

assessment platform – our experienced professionals guide

organizations to harness the power of Gen AI to digitally transform

their operations and achieve quantifiable, breakthrough results,

allowing us to be key architects of their Gen AI journey.

Our expertise is grounded in unparalleled best practices

insights from benchmarking the world’s leading businesses –

including 97% of the Dow Jones Industrials, 89% of the Fortune 100,

70% of the DAX 40 and 55% of the FTSE 100 – and are delivered

leveraging our Digital Transformation Platform, Hackett Connect™

and Quantum Leap®.

For more information on The Hackett Group, visit:

https://www.thehackettgroup.com/ or email:

media@thehackettgroup.com.

Trademarks

The Hackett Group, quadrant logo, Quantum Leap and Digital World

Class are the registered marks of The Hackett Group.

Cautionary Statement Regarding “Forward-Looking”

Statements

This release contains “forward-looking” statements within the

meaning of Section 27A of the Securities Act of 1933 as amended and

Section 21E of the Securities Exchange Act of 1934, as amended.

Statements including without limitation, words such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” seeks,” “estimates,”

or other similar phrases or variations of such words or similar

expressions indicating, present or future anticipated or expected

occurrences or outcomes are intended to identify such

forward-looking statements. Forward-looking statements are not

statements of historical fact and involve known and unknown risks,

uncertainties and other factors that may cause the Company’s actual

results, performance or achievements to be materially different

from the results, performance or achievements expressed or implied

by the forward-looking statements. Factors that may impact such

forward-looking statements include without limitation, the ability

of The Hackett Group to effectively market its digital

transformation, artificial intelligence, and other consulting

services, competition from other consulting and technology

companies that may have or develop in the future, similar

offerings, the commercial viability of The Hackett Group and its

services as well as other risk detailed in The Hackett Group’s

reports filed with the United States Securities and Exchange

Commission. The Hackett Group does not undertake any duty to update

this release or any forward-looking statements contained

herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240829955745/en/

media@thehackettgroup.com

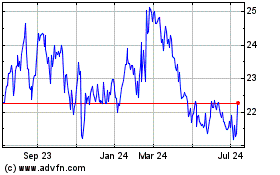

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Dec 2024 to Jan 2025

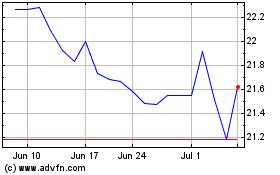

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jan 2024 to Jan 2025