Largest Public Companies Continue to Hoard Cash at Record Levels

December 08 2011 - 9:30AM

Business Wire

Large public companies in the U.S. are continuing to hoard cash

at record levels, and 1000 of the largest are now holding $850

billion, according to new research from REL Consulting, a division

of The Hackett Group, Inc. (NASDAQ: HCKT).

REL's research, which is based on corporate filings through June

of 2011, shows that as revenues have increased over the past year,

so has cash on hand, with companies now holding 11 percent more

cash than they did in Q2 of 2010. Total debt also increased by 7

percent during the period, indicating that companies are taking

advantage of low-cost borrowing opportunities to increase their

cash on hand. REL's research also found that companies are

beginning to incrementally increase the amount of cash they are

putting to use for purposes such as paying dividends, making

capital expenditures, and share buy-backs.

At the same time, REL's research shows that working capital

performance for 1000 of the largest public companies degraded

slightly. Companies are now taking 2 percent longer to collect from

customers, and are holding nearly 2.5 percent more in inventory.

Companies actually improved payables performance slightly,

offsetting some of the losses in other areas. These companies now

have nearly $800 billion unnecessarily tied up in receivables,

payables, and inventory due to sub-optimized working capital

management.

"Cash hoarding continues to be the trend. But high cash balances

don't necessarily indicate strong performance," said REL Associate

Principal Dan Ginsberg. "The working capital numbers clearly show

that while companies managed to right-size their working capital in

late 2009, in response to economic challenges, they quickly lost

focus once revenue growth returned, and the improvements they made

were not sustainable. Companies are now taking their eyes off the

ball when it comes to efficiently running their business. Accounts

receivables are bloated, and companies are holding more inventory

for various reasons, only some of which are strategic."

Full details on REL's research findings, including information

on individual company metrics and industry performance, is

available at:

www.relconsultancy.com/media/twc-research/q211data/.

About REL

REL, a division of The Hackett Group, Inc. (NASDAQ: HCKT), is a

world-leading consulting firm dedicated to delivering sustainable

cash flow improvement from working capital and across business

operations. REL’s tailored working capital management solutions

balance client trade-offs between working capital, operating costs,

service performance and risk. REL’s expertise has helped clients

free up billions of dollars in cash, creating the financial freedom

to fund acquisitions, product development, debt reduction and share

buy-back programs. In-depth process expertise, analytical rigor and

collaborative client relationships enable REL to deliver an

exceptional return on investment in a short timeframe. REL has

delivered work in over 60 countries for Fortune 500 and global

Fortune 500 companies.

More information on REL is available: by phone at (770)

225-7300; by e-mail at info@relconsultancy.com; or on the Web at

www.relconsultancy.com.

About The Hackett Group, Inc.

The Hackett Group (NASDAQ: HCKT), a global strategic business

advisory and operations improvement consulting firm, is a leader in

best practice advisory, benchmarking, and transformation consulting

services including strategy and operations, working capital

management, and globalization advice. Utilizing best practices and

implementation insights from more than 5,000 benchmarking

engagements, executives use The Hackett Group's empirically-based

approach to quickly define and implement initiatives to enable

world-class performance. Through its REL group, The Hackett Group

offers working capital solutions focused on delivering significant

cash flow improvements. Through its Archstone Consulting group, The

Hackett Group offers Strategy & Operations consulting services

in the Consumer and Industrial Products, Pharmaceutical,

Manufacturing and Financial Services industry sectors. Through its

Hackett Technology Solutions group, The Hackett Group offers

business application consulting services that help maximize returns

on IT investments. The Hackett Group has completed benchmark

studies with over 3,000 major corporations and government agencies,

including 97% of the Dow Jones Industrials, 84% of the Fortune 100,

80% of the DAX 30 and 49% of the FTSE 100.

More information on The Hackett Group is available: by phone at

(770) 225-7300; by e-mail at info@thehackettgroup.com.

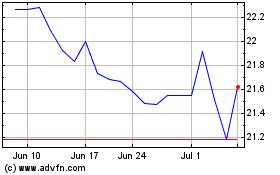

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Dec 2024 to Jan 2025

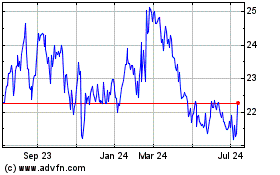

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jan 2024 to Jan 2025