Hackett Research Alert: Most Supplier Diversity Programs Simply Fail To Deliver

May 14 2010 - 9:30AM

Business Wire

While world-class procurement organizations continue to

outperform their peers in driving supplier diversity spending, a

new study by The Hackett Group, Inc. (NASDAQ: HCKT) identifies

several critical ways that most companies fail in their supplier

diversity programs.

Hackett’s latest research found that companies with world-class

procurement organizations commit 33% more of their spend to diverse

suppliers (13.3% of total spend for world-class versus 10.0% for

typical companies).

But according to Hackett’s research, most companies still make

major errors in how they operate and measure the performance of

their supplier diversity efforts. Most rely on overly simplistic

measures to evaluate the progress of supplier diversity programs,

and never truly assess whether programs are meeting corporate

objectives. Most companies also fail to consider whether a few

large suppliers or many smaller suppliers best supports their

corporate goals. Hackett’s research also quantified the positive

and negative impact that globalization is having on supplier

diversity efforts.

“What we see here is serious misalignment,” said Hackett’s North

American Procurement Advisory Program Lead Kurt Albertson. “Many

companies are taking the easy way out, and as a result aren’t

driving real supplier diversity benefits. They are focused on

making the numbers they need to meet government requirements, or

getting recognition from their customers or industry. But they

aren’t showing the attention to detail required to create programs

that have real impact.”

The Hackett study, which included results from nearly 40 Global

1000 companies, found that there are two primary drivers of

supplier diversity efforts. While business-to-business companies

are frequently focused on meeting supplier diversity requirements

of customers and/or government contracts, business-to-consumer

companies generally focus on the market value supplier diversity

offers, in the form of increasing market penetration in diversity

markets, driving social and economic benefits in targeted

communities, and improving corporate image.

But while supplier diversity programs are generally aligned with

high-level corporate objectives, most companies use relatively

simplistic performance metrics to measure progress, and do little

to ensure alignment at an operational level. About 90 percent of

all companies in the study rely on metrics such as “Percent Spend

with Diverse Suppliers” or “Recognition by Industry”. But less than

half of the companies in the study track the percentage of their

suppliers that diverse suppliers represent, and only about 10

percent of all companies assess the impact of supplier diversity

efforts on revenue or market share.

Another key mistake companies make, according to the Hackett

study, is failing to align program objectives with decisions

regarding the number of diverse suppliers with whom they work.

Hackett’s research found that nearly 70 percent of diverse

suppliers have less than $100,000 in annual diversity spending with

a particular company, and this collectively represents less than 6

percent of the total supplier diversity spend. According to

Hackett, while the objectives of business-to-business companies

might be best served by focusing on a few larger contracts to

satisfy government regulations, business-to-consumer companies

seeking to drive market awareness and penetration should consider

focusing their supplier diversity efforts on developing a larger

group of suppliers and smaller individual contracts.

Finally, Hackett’s research found that globalization of business

services presents both obstacles and opportunities for supplier

diversity programs. While nearly 80 percent of all companies

studied were global businesses, over 90 percent tracked metrics

only for U.S. suppliers. But more than two thirds of the companies

said globalization of supplier diversity programs is either very

important or critical. About half of the companies in the Hackett

study said they expect globalization to have a negative impact on

their smaller suppliers, while nearly 20 percent said they expect

the impact to be positive.

Overall, Hackett sees an opportunity for companies to align

supplier diversity programs with global sourcing initiatives.

Hackett believes that most diversity programs will eventually have

to address the challenges involved in tracking non-US diverse

supplier spend and certification; many will be forced to rethink

their definition of diversity to take into account responsible

supply, localization and other factors.

About The Hackett Group

The Hackett Group (NASDAQ: HCKT), a global strategic advisory

firm, is a leader in best practice advisory, benchmarking, and

transformation consulting services including strategy and

operations, working capital management, and globalization advice.

Utilizing best practices and implementation insights from more than

4,000 benchmarking engagements, executives use The Hackett Group's

empirically-based approach to quickly define and implement

initiatives to enable world-class performance.

Through its REL group, The Hackett Group offers working capital

solutions focused on delivering significant cash flow improvements.

Through its Archstone Consulting group, The Hackett Group offers

Strategy & Operations in the Consumer and Industrial Products,

Pharmaceutical, Manufacturing and Financial Services industry

sectors. Through its Hackett Technology Solutions group, The

Hackett Group offers business application consulting services that

help maximize returns on IT investments. The Hackett Group has

worked with 2,700 major corporations and government agencies,

including 97% of the Dow Jones Industrials, 73% of the Fortune 100,

73% of the DAX 30 and 50% of the FTSE 100.

Founded in 1991, The Hackett Group was acquired by Answerthink,

Inc. in 1997. Answerthink was renamed The Hackett Group, Inc. in

2008. The Hackett Group has global offices in the United States,

Europe and Asia/Pacific.

More information on The Hackett Group is available: by phone at

(770) 225-7300; by e-mail at info@thehackettgroup.com; or on the

Web at www.thehackettgroup.com.

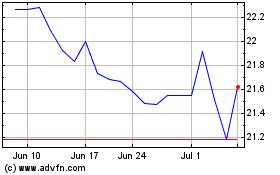

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Sep 2024 to Oct 2024

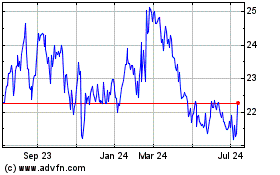

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Oct 2023 to Oct 2024