UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

Commission File Number: 001-34656

H World Group Limited

(Registrant’s name)

No. 1299 Fenghua Road

Jiading District

Shanghai

People’s Republic of China

(86) 21 6195-2011

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F

⌧ Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (7): ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

H World Group

Limited |

| |

|

(Registrant) |

| |

|

|

| Date: July 25, 2023 |

By: |

/s/ Qi Ji |

| |

Name: |

Qi Ji |

| |

Title: |

Executive Chairman of the Board of Directors |

Exhibit 99.1

Contact Information

Investor Relations

Tel: +86 (21) 6195 9561

Email: ir@hworld.com

https://ir.hworld.com

H World Group Limited Announces Preliminary

Results for Hotel Operations

in the Second Quarter of 2023

Singapore/Shanghai, China, July 25, 2023

– H World Group Limited (NASDAQ: HTHT and HKEX: 1179) (“H World”, “we” or “our”),

a key player in the global hotel industry, today announced preliminary results for hotel operations in the second quarter (“Q2

2023”) ended June 30, 2023.

Business update

For our Legacy-Huazhu business, our RevPAR in

Q2 2023 recovered to 121% of the 2019 level. The recovery continued to be supported by strong travel demand in this quarter and

was primarily driven by ADR growth. Breaking down into monthly numbers, our RevPAR in April, May and June 2023 recovered to

127%, 115% and 123% of the 2019 levels, respectively. During this quarter, our hotel closures were mainly attributed to closures that

were carried over from last year due to the impact of COVID-19, as well as the continued

elimination of those lower-quality and underperforming economy hotels from our network. Our new hotel signing gained further momentum,

reaching over 1,000 new hotels during this quarter, which reflected the rising confidence level of franchisees.

Steigenberger Hotels GmbH and its subsidiaries

(“DH”, or “Legacy-DH”), after experiencing a season-related slowdown in Q1 2023, observed promising

business recovery in Q2 2023, with blended RevPAR having recovered to 111% of the 2019 level, mainly driven by ADR growth.

Operating Results:

Legacy-Huazhu(1)

| | |

Number of hotels | | |

Number of rooms | |

| | |

Opened

in Q2 2023 | | |

Closed (2)

in Q2 2023 | | |

Net added

in Q2 2023 | | |

As of

June 30, 2023 | | |

As of

June 30, 2023 | |

| Leased and owned hotels | |

| 2 | | |

| (6 | ) | |

| (4 | ) | |

| 616 | | |

| 86,846 | |

| Manachised and franchised hotels | |

| 372 | | |

| (210 | ) | |

| 162 | | |

| 8,006 | | |

| 731,399 | |

| Total | |

| 374 | | |

| (216 | ) | |

| 158 | | |

| 8,622 | | |

| 818,245 | |

(1) Legacy-Huazhu refers to H World and its subsidiaries, excluding DH.

(2) The reasons for hotel closures mainly included non-compliance with our brand standards, operating losses, and property-related issues. In Q2 2023, we temporarily closed 23 hotels for brand upgrade or business model change purposes.

| | |

As of June 30, 2023 | |

| | |

Number of hotels | | |

Unopened hotels in pipeline | |

| Economy hotels | |

| 4,856 | | |

1,079 | |

| Leased and owned hotels | |

| 345 | | |

1 | |

| Manachised and franchised hotels | |

| 4,511 | | |

1,078 | |

| Midscale and upscale hotels | |

| 3,766 | | |

1,729 | |

| Leased and owned hotels | |

| 271 | | |

14 | |

| Manachised and franchised hotels | |

| 3,495 | | |

1,715 | |

| Total | |

| 8,622 | | |

2,808 | |

| | |

For the quarter ended | | |

| |

| | |

June 30, | | |

March 31, | | |

June 30, | | |

yoy | |

| | |

2022 | | |

2023 | | |

2023 | | |

change | |

| Average daily room rate (in RMB) | |

| | | |

| | | |

| | | |

| | |

| Leased and owned hotels | |

| 243 | | |

| 337 | | |

| 384 | | |

| 57.7 | % |

| Manachised and franchised hotels | |

| 215 | | |

| 269 | | |

| 295 | | |

| 37.3 | % |

| Blended | |

| 218 | | |

| 277 | | |

| 305 | | |

| 39.8 | % |

| Occupancy rate (as a percentage) | |

| | | |

| | | |

| | | |

| | |

| Leased and owned hotels | |

| 62.9 | % | |

| 76.3 | % | |

| 83.6 | % | |

| +20.7 p.p. | |

| Manachised and franchised hotels | |

| 64.9 | % | |

| 75.5 | % | |

| 81.6 | % | |

| +16.7 p.p. | |

| Blended | |

| 64.6 | % | |

| 75.6 | % | |

| 81.8 | % | |

| +17.2 p.p. | |

| RevPAR (in RMB) | |

| | | |

| | | |

| | | |

| | |

| Leased and owned hotels | |

| 153 | | |

| 257 | | |

| 321 | | |

| 109.7 | % |

| Manachised and franchised hotels | |

| 139 | | |

| 203 | | |

| 241 | | |

| 72.8 | % |

| Blended | |

| 141 | | |

| 210 | | |

| 250 | | |

| 77.0 | % |

| | |

For the quarter ended | |

| | |

June 30, | | |

June 30, | | |

yoy | |

| | |

2019 | | |

2023 | | |

change | |

| Average daily room rate (in RMB) | |

| | | |

| | | |

| | |

| Leased and owned hotels | |

| 281 | | |

| 384 | | |

| 36.4 | % |

| Manachised and franchised hotels | |

| 225 | | |

| 295 | | |

| 30.9 | % |

| Blended | |

| 236 | | |

| 305 | | |

| 28.9 | % |

| Occupancy rate (as a percentage) | |

| | | |

| | | |

| | |

| Leased and owned hotels | |

| 89.4 | % | |

| 83.6 | % | |

| -5.8 p.p. | |

| Manachised and franchised hotels | |

| 86.3 | % | |

| 81.6 | % | |

| -4.7 p.p. | |

| Blended | |

| 86.9 | % | |

| 81.8 | % | |

| -5.1 p.p. | |

| RevPAR (in RMB) | |

| | | |

| | | |

| | |

| Leased and owned hotels | |

| 252 | | |

| 321 | | |

| 27.6 | % |

| Manachised and franchised hotels | |

| 194 | | |

| 241 | | |

| 23.8 | % |

| Blended | |

| 206 | | |

| 250 | | |

| 21.4 | % |

Same-hotel operational data by class

Mature hotels in operation for more than 18 months

| | |

Number

of hotels | | |

Same-hotel

RevPAR | | |

Same-hotel

ADR | | |

Same-hotel

Occupancy | |

| | |

As

of

June 30, | | |

For

the quarter

ended

June 30, | | |

yoy

change | | |

For

the quarter

ended

June 30, | | |

yoy

change | | |

For

the quarter

ended

June 30, | | |

yoy

change | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

| | |

2022 | | |

2023 | | |

| | |

2022 | | |

2023 | | |

(p.p.) | |

| Economy hotels | |

3,567 | | |

3,567 | | |

118 | | |

192 | | |

63.1 | % | |

168 | | |

231 | | |

37.3 | % | |

70.1 | % | |

83.3 | % | |

+13.2

| |

| Leased and owned hotels | |

325 | | |

325 | | |

124 | | |

237 | | |

90.4 | % | |

178 | | |

277 | | |

55.2 | % | |

69.7 | % | |

85.5 | % | |

+15.8

| |

| Manachised

and franchised hotels | |

3,242 | | |

3,242 | | |

117 | | |

186 | | |

58.8 | % | |

167 | | |

224 | | |

34.3 | % | |

70.2 | % | |

83.0 | % | |

+12.8

| |

| Midscale and upscale hotels | |

2,624 | | |

2,624 | | |

176 | | |

309 | | |

75.6 | % | |

284 | | |

378 | | |

33.4 | % | |

62.1 | % | |

81.7 | % | |

+19.6

| |

| Leased and owned hotels | |

253 | | |

253 | | |

194 | | |

395 | | |

104.1 | % | |

339 | | |

479 | | |

41.3 | % | |

57.2 | % | |

82.6 | % | |

+25.5

| |

| Manachised

and franchised hotels | |

2,371 | | |

2,371 | | |

173 | | |

295 | | |

70.3 | % | |

276 | | |

362 | | |

31.2 | % | |

62.8 | % | |

81.6 | % | |

+18.8

| |

| Total | |

6,191 | | |

6,191 | | |

146 | | |

251 | | |

71.8 | % | |

221 | | |

304 | | |

37.9 | % | |

66.2 | % | |

82.5 | % | |

+16.3

| |

Operating Results: Legacy-DH(3)

| | |

Number of hotels | | |

Number of

rooms | | |

Unopened hotels

in pipeline | |

| | |

Opened

in Q2 2023 | | |

Closed

in Q2 2023 | | |

Net added

in Q2 2023 | | |

As of

June 30, 2023(4) | | |

As of

June 30, 2023 | | |

As of

June 30, 2023 | |

| Leased hotels | |

| - | | |

- | | |

- | | |

80 | | |

15,497 | | |

26 | |

| Manachised and franchised hotels | |

| - | | |

- | | |

- | | |

48 | | |

10,675 | | |

11 | |

| Total | |

| - | | |

- | | |

- | | |

128 | | |

26,172 | | |

37 | |

| (3) | Legacy-DH

refers to DH. |

| (4) | As

of June 30, 2023, a total of 3 hotels were temporarily closed. 1 hotel was closed due

to flood damage, 1 hotel was closed due to repair work, and 1 hotel was not in operation

due to a legal proceeding in progress. |

| | |

For the quarter ended | | |

| |

| | |

June 30, | | |

March 31, | | |

June 30, | | |

yoy | |

| | |

2022 | | |

2023 | | |

2023 | | |

change | |

| Average daily room rate (in EUR) | |

| | | |

| | | |

| | | |

| | |

| Leased hotels | |

| 113 | | |

| 108 | | |

| 119 | | |

| 6.1 | % |

| Manachised and franchised hotels | |

| 107 | | |

| 97 | | |

| 112 | | |

| 5.0 | % |

| Blended | |

| 110 | | |

| 104 | | |

| 117 | | |

| 5.6 | % |

| Occupancy rate (as a percentage) | |

| | | |

| | | |

| | | |

| | |

| Leased hotels | |

| 61.2 | % | |

| 53.0 | % | |

| 69.4 | % | |

| +8.2 p.p. | |

| Manachised and franchised hotels | |

| 57.9 | % | |

| 54.1 | % | |

| 63.8 | % | |

| +5.9 p.p. | |

| Blended | |

| 59.8 | % | |

| 53.5 | % | |

| 67.1 | % | |

| +7.3 p.p. | |

| RevPAR (in EUR) | |

| | | |

| | | |

| | | |

| | |

| Leased hotels | |

| 69 | | |

| 57 | | |

| 83 | | |

| 20.3 | % |

| Manachised and franchised hotels | |

| 62 | | |

| 53 | | |

| 71 | | |

| 15.7 | % |

| Blended | |

| 66 | | |

| 55 | | |

| 78 | | |

| 18.5 | % |

Hotel Portfolio by Brand

| | |

As of June 30, 2023 | |

| | |

Hotels | | |

Rooms | | |

Unopened hotels | |

| | |

in operation | | |

in pipeline | |

| Economy hotels | |

| 4,872 | | |

| 392,231 | | |

| 1,092 | |

| HanTing Hotel | |

| 3,340 | | |

| 297,682 | | |

| 700 | |

| Hi Inn | |

| 442 | | |

| 23,650 | | |

| 160 | |

| Ni Hao Hotel | |

| 213 | | |

| 15,583 | | |

| 188 | |

| Elan Hotel | |

| 642 | | |

| 31,102 | | |

| 1 | |

| Ibis Hotel | |

| 219 | | |

| 22,318 | | |

| 30 | |

| Zleep Hotels | |

| 16 | | |

| 1,896 | | |

| 13 | |

| Midscale hotels | |

| 3,106 | | |

| 337,349 | | |

| 1,354 | |

| Ibis Styles Hotel | |

| 92 | | |

| 9,390 | | |

| 32 | |

| Starway Hotel | |

| 598 | | |

| 51,888 | | |

| 225 | |

| JI Hotel | |

| 1,839 | | |

| 214,630 | | |

| 838 | |

| Orange Hotel | |

| 577 | | |

| 61,441 | | |

| 259 | |

| Upper midscale hotels | |

| 618 | | |

| 88,649 | | |

| 331 | |

| Crystal Orange Hotel | |

| 167 | | |

| 21,748 | | |

| 84 | |

| CitiGo Hotel | |

| 34 | | |

| 5,326 | | |

| 5 | |

| Manxin Hotel | |

| 121 | | |

| 11,477 | | |

| 62 | |

| Madison Hotel | |

| 64 | | |

| 8,202 | | |

| 62 | |

| Mercure Hotel | |

| 148 | | |

| 24,667 | | |

| 62 | |

| Novotel Hotel | |

| 20 | | |

| 5,114 | | |

| 15 | |

| IntercityHotel(5) | |

| 56 | | |

| 10,742 | | |

| 36 | |

| MAXX (6) | |

| 8 | | |

| 1,373 | | |

| 5 | |

| Upscale hotels | |

| 129 | | |

| 20,644 | | |

| 60 | |

| Jaz in the City | |

| 3 | | |

| 587 | | |

| 1 | |

| Joya Hotel | |

| 7 | | |

| 1,234 | | |

| - | |

| Blossom House | |

| 56 | | |

| 2,605 | | |

| 46 | |

| Grand Mercure Hotel | |

| 9 | | |

| 1,823 | | |

| 4 | |

| Steigenberger Hotels& Resorts(7) | |

| 54 | | |

| 14,395 | | |

| 9 | |

| Luxury hotels | |

| 16 | | |

| 2,360 | | |

| 2 | |

| Steigenberger Icon(8) | |

| 9 | | |

| 1,847 | | |

| 1 | |

| Song Hotels | |

| 7 | | |

| 513 | | |

| 1 | |

| Others | |

| 9 | | |

| 3,184 | | |

| 6 | |

| Other hotels(9) | |

| 9 | | |

| 3,184 | | |

| 6 | |

| Total | |

| 8,750 | | |

| 844,417 | | |

| 2,845 | |

(5) As

of June 30, 2023, 5 operational hotels and 22 pipeline hotels of IntercityHotel were in China.

(6) As

of June 30, 2023, 3 operational hotels and 5 pipeline hotels of MAXX were in China.

(7) As

of June 30, 2023, 11 operational hotels and 3 pipeline hotels of Steigenberger Hotels & Resorts were in China.

(8) As

of June 30, 2023, 3 operational hotels of Steigenberger Icon were in China.

(9) Other

hotels include other partner hotels and other hotel brands in Yongle Huazhu Hotel & Resort Group (excluding Steigenberger Hotels &

Resorts and Blossom House).

About H World Group Limited

Originated in China, H World Group Limited is

a key player in the global hotel industry. As of June 30, 2023, H World operated 8,750 hotels with 844,417 rooms in operation in

18 countries. H World’s brands include Hi Inn, Elan Hotel, HanTing Hotel, JI Hotel, Starway Hotel, Orange Hotel, Crystal Orange

Hotel, Manxin Hotel, Madison Hotel, Joya Hotel, Blossom House, Ni Hao Hotel, CitiGO Hotel, Steigenberger Hotels & Resorts, MAXX,

Jaz in the City, IntercityHotel, Zleep Hotels, Steigenberger Icon and Song Hotels. In addition, H World also has the rights as master

franchisee for Mercure, Ibis and Ibis Styles, and co-development rights for Grand Mercure and Novotel, in the pan-China region.

H World’s business includes leased and owned,

manachised and franchised models. Under the lease and ownership model, H World directly operates hotels typically located on leased or

owned properties. Under the manachise model, H World manages manachised hotels through the on-site hotel managers that H World appoints,

and H World collects fees from franchisees. Under the franchise model, H World provides training, reservations and support services to

the franchised hotels, and collects fees from franchisees but does not appoint on-site hotel managers. H World applies a consistent standard

and platform across all of its hotels. As of June 30, 2023, H World operates 12 percent of its hotel rooms under lease and ownership

model, and 88 percent under manachise and franchise models.

For more information, please visit H World’s

website: https://ir.hworld.com.

Safe Harbor Statement Under the U.S. Private Securities

Litigation Reform Act of 1995: The information in this release contains forward-looking statements which involve risks and uncertainties.

Such factors and risks include our anticipated growth strategies; our future results of operations and financial condition; economic conditions;

the regulatory environment; our ability to attract and retain customers and leverage our brands; trends and competition in the lodging

industry; the expected growth of demand for lodging; and other factors and risks detailed in our filings with the U.S. Securities and

Exchange Commission. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements,

which may be identified by terminology such as “may,” “should,” “will,” “expect,” “plan,”

“intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”

“forecast,” “project” or “continue,” the negative of such terms or other comparable terminology. Readers

should not rely on forward-looking statements as predictions of future events or results.

H World undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by applicable

law.

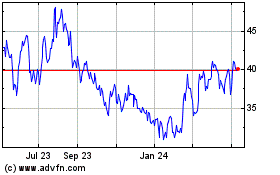

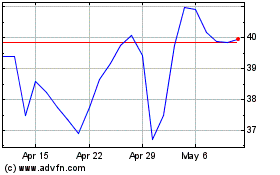

H World (NASDAQ:HTHT)

Historical Stock Chart

From Jun 2024 to Jul 2024

H World (NASDAQ:HTHT)

Historical Stock Chart

From Jul 2023 to Jul 2024