Gulf Resources, Inc. (Nasdaq:GURE) ("Gulf Resources" or the

"Company"), a leading manufacturer of bromine, crude salt and

specialty chemical products in China, today announced its financial

results for the fourth quarter and fiscal year ended December 31,

2015.

Fiscal Year 2015 Highlights

- Net revenues increased 43% to $162,317,120.

- Gross profit increased 67% to $53,281,250.

- Income from operations increased 90% to $45,164,710.

- Net income increased 91% to $34,068,037.

- Primary EPS increased 63% to $0.75 from $0.46.

- Fully diluted EPS increased 61% to $0.74.

- Cash flow from operations increased 51% to $70,401,210.

- Cash was $133,606,392 or $2.89 per share.

- Net net cash, (cash minus all liabilities) was $114,974,041

($2.48 per share*).

- Working capital was $174,794,678 ($3.78 per share*).

- Shareholders equity was $338,110,875 or $7.31 per share.

Fourth Quarter 2015

Highlights

- Net revenues increased 40.6% to $35.5 million

- Gross profit increased 67.5% to $11.2 million.

- Gross margin increased to 31.5% from 26.5%.

- Income from operations increased 140% to $9.6

million.

- Bromine income from operations increased 8.7%.

- Crude Salt income from operations increased 3.9%.

- Chemical income from operations increased 194.1%.

- Operating margin was 27.0% compared to 15.8% for the fourth

quarter of 2014.

- Net income was $7.3 million, or $0.16 per basic and diluted

share, versus $2.9 million.

- EPS increased 152% to $0.16 from $0.07 per share.

Fiscal Year 2015

Financial Results

Cash flow from operations increased 51% to $70,401,210 from

$46,573,777. This equals $1.51 per share. In the past two years, we

have generated cash flow from operations of $116,974,987 or $2.53

per share, well in excess of our current stock price.

| |

| Revenue by Segment |

|

Segment |

|

2015 |

|

|

2014 |

|

%change |

|

Bromine |

$ |

52,385,491 |

|

$ |

57,949,824 |

|

|

(10 |

)% |

|

Crude Salt |

$ |

10,494,939 |

|

$ |

10,752,226 |

|

|

(2 |

%) |

|

Chemicals |

$ |

99,436,690 |

|

$ |

44,958,281 |

|

|

121 |

% |

| |

|

| Income By Segment |

|

Segment |

|

2015 |

|

|

2014 |

|

%change |

|

Bromine |

$ |

10,854,711 |

|

$ |

9,500,428 |

|

|

14 |

% |

|

Crude Salt |

$ |

1,183,755 |

|

$ |

719,716 |

|

|

65 |

% |

|

Chemicals |

$ |

32,997,870 |

|

$ |

14,432,851 |

|

|

129 |

% |

| |

|

|

|

|

|

|

|

|

|

On a segment basis, Bromine sales to outside customers decreased

10% to $52,385,491 from $57,949,824. However, when intercompany

transactions by SCRC are included, the overall decline is estimated

to have been only 1.3%. Reported sales volume in tons decreased 17%

to 16,569 tons, but with the inclusion of intercompany sales, the

actual decline is much lower. The selling price of Bromine

increased 10% to $3,162. At the present time, Bromine pricing

remains strong. The decline in the value of the RMB has helped to

increase prices. Even if the economy in China does not improve, we

expect bromine prices to remain strong for 2016.

Gross profit margin in the Bromine segment was 30%, compared to

25% in the previous year. Income from operations increased 14% to

$10,854,711.

In 2015, Gulf spent approximately $22.5 million on enhancement

projects for the transmission channels and ducts and our existing

bromine extraction to enhance the productivity and improve

environmental controls in Factories No. 10 and 11. It expects to

spend $15 million on enhancement projects for factories No. 1 and 9

in 2016. With its strong capital position, Gulf believes this

spending will enable it to maintain an advantage over smaller

competitors.

Revenue in crude salt declined by 2% to $10,494,939. Sales

volume declined by 3%. The price per ton increased by 1%. Gross

profit increased by 32.7%. As percentage of sales, it was 21%

compared to 15% in the previous year. Income from operations

increased 65% to $1,183,755.

Sales of chemicals increased 121% to $99,436,690 from

$44,958,281.

| |

| Chemical Products |

|

Segment |

|

2015 |

|

|

2014 |

|

%change |

|

Oil & gas |

$ |

27,642,028 |

|

$ |

25,689,311 |

|

|

8 |

% |

|

Paper manufacturing |

$ |

4,908,057 |

|

$ |

4,506,581 |

|

|

9 |

% |

|

Pesticides |

$ |

15,611,616 |

|

$ |

14,762,389 |

|

|

6 |

% |

|

Pharmaceuticals |

$ |

36,488,364 |

|

|

|

By Products |

$ |

14,786,625 |

|

|

|

Total Chemical Sales |

$ |

99,436,690 |

|

$ |

44,958,281 |

|

|

121 |

% |

| |

|

|

|

|

|

|

|

|

|

Our original chemical business was quite strong with sales and

selling prices increasing in oil and gas, paper manufacturing, and

pesticides. We are especially pleased with these results, because

the end markets in these industries were generally weak, and we

believe we outperformed our competitors. Rongyuan reported sales of

$51,274,989 for the period of 2015 in which it was a subsidiary of

Gulf.

Gross margins in our traditional chemical business increased to

36% from 35%. Income from operations increased 129% to $32,997,870

from $14,432,851. Rongyuan earned $16,886,799, while our

traditional chemical business earned $16,111,071, an increase of

11.6% over 2014. Given the weakness in these segments of the

Chinese economy, we are very pleased with the results.

Net Income was $34,068,037 an increase of 91% compared to the

results in the previous year. The effective tax rates for 2015 and

2014 were 25% and 26% respectively.

In 2015, we generated $70,401,210 from operations compared to

$46,573,777 during 2014. We spent $66,305,606 on the purchase of

Rongyuan and $22,858,625 on capital expenditures, principally on

upgrading factories No. 10 and 11.

Our balance sheet remains extremely strong. We ended the year

with cash of $133,606,392 ($2.89 per share). While this is down

slightly from $146,585,601 in 2014, we managed to purchase Rongyuan

and upgrade our factories while still maintaining our strong cash

position.

Current assets were $190,821,115 down slightly from $194,127,792

in 2014. Total assets were $356,743,226 up from $322,982,152 in the

previous year.

Current liabilities were $16,076,437 up from $8,082,244 in 2014.

Working capital was $174,794,678 ($3.78 per share). Net net cash

(cash minus all liabilities) was $114,974,041 ($2.48 per share),

well in excess of our market price.

Shareholders equity was $338,110,875 or $7.31 per share.

Fourth Quarter 2015

Results

- Net revenues increased 40.6% to $35.5 million.

- Gross profit increased 67.5% to $11.2 million.

- Gross margin increased to 31.5% from 26.5%.

- Income from operations increased 140% to $9.6 million.

- Bromine income from operations increased 8.7%.

- Crude Salt income from operations increased 3.9%.

- Chemical income from operations increased 194.1%.

- Operating margin was 27.0% compared to 15.9% for the fourth

quarter of 2014.

- Net income was $7.3 million, or $0.16 per basic and diluted

share, versus $2.9 million.

- EPS increased 152% to $0.07 per share.

Gulf Resources' revenue was $35.5 million for the fourth quarter

of 2015, an increase of 40.6%, from $25.2 million for the fourth

quarter of 2014. Revenue from the bromine segment was $11.3

million, a decrease of 19%. Revenue from the crude salt segment was

$2.6 million, a decrease 5%. Revenue from the chemical products

segment was $21.5 million, an increase of 154% from the

corresponding period in 2014.

Gross profit for the fourth quarter of 2015 was $11.2 million,

an increase of 67.5%, from $6.7 million of the fourth quarter of

2014. Gross margins were 31.5% compared to 26.5% for the

corresponding period last year.

Income from operations was $9.6 million, as compared to $4.0

million in Q4 2014. Operating margins were 27.0% compared to 15.8%

last year.

Net income was $7.3 million for the fourth quarter of 2015, an

increase of 153%, from $2.9 million for the fourth quarter of

2014.

Basic and diluted earnings per share in the fourth quarter of

2015 were $0.16 compared to $0.07 in the previous year.

Weighted average number of basic shares for the three months

ended December 31, 2015 was 46,007,120, as compared with 38,725,282

for the three months ended December 31, 2014.

Business Outlook

“We are extremely pleased with our results for 2014,” Gulf’s CEO

Xiaobin Liu stated. “Although the Chinese economy was very

weak, we posted strong results in all of our business segments,

acquired Rongyuan, upgraded two of our factories, and reached an

agreement with the government of Daying County in Sichuan Province

that may allow us to build a very large natural gas and brine

business in that province.”

“As we look to 2016,” Mr. Liu said, “we do not yet see signs of

recovery in China. However, all of our businesses remain strong.

Bromine prices have risen and show no signs of dropping. Our

chemical businesses are strong, and Rongyuan has great

opportunities in the pharmaceutical industry. This should lead to

higher sales and earnings in 2016.”

“We are making strong progress in Sichuan,” Mr. Liu said. “We

are moving ahead to build our factory and install the

infrastructure needed to allow us to become a producer of

natural gas.”

“We know our investors have been very patient,” Mr. Liu

concluded. “We are committed to recognizing shareholder value and

significantly improving the price of our stock. If our natural gas

business is as successful as we hope it will be, our company will

be transformed. If it is not as successful, we will find ways of

returning capital to shareholders.”

(* All per share calculations have not

been audited and have been calculated using the end of the year

share count of 46,276,269 as

shown on the balance sheet in the 10-K).

Conference Call

Gulf Resources' management will host a conference call on

Wednesday, March 16, 2016 at 8:00 AM Eastern Time to discuss its

financial results for the fourth quarter and fiscal year ended

December 31, 2015.

Hosting the call will be Mr. Xiaobin Liu, CEO of Gulf Resources.

The Company's management team will be available for investor

questions following the prepared remarks.

To participate in this live conference call, please dial +1

(877) 275-8968 five to ten minutes prior to the scheduled

conference call time. International callers should dial +1 (706)

643-1666. The conference participant pass code is

70563980.

The webcasting is also available then, just simply click on the

link below:

http://www.investorcalendar.com/IC/CEPage.asp?ID=174794

A replay of the conference call will be available two hours

after the call's completion during 03/16/2016 11:00 EDT -

04/16/2016 23:59 EDT. To access the replay, call +1 (855) 859-2056.

International callers should call +1 (404) 537-3406. The conference

ID is 70563980.

About Gulf Resources, Inc.Gulf Resources, Inc.

operates through four wholly-owned subsidiaries, Shouguang City

Haoyuan Chemical Company Limited ("SCHC"), Shouguang Yuxin Chemical

Industry Co., Limited ("SYCI"), Shouguang City Rongyuan Chemical

Co, Limited (“SCRC”) and Daying County Haoyuan Chemical Company

Limited (“DCHC”). The company believes that it is one of the

largest producers of bromine in China. Elemental Bromine is used to

manufacture a wide variety of compounds utilized in industry and

agriculture. Through SYCI, the company manufactures chemical

products utilized in a variety of applications, including oil and

gas field explorations and papermaking chemical agents. SCRC is a

leading manufacturer of materials for human and animal antibiotics

in China and other parts of Asia. DCHC was established to further

explore and develop natural gas and brine resources (including

bromine and crude salt) in China. For more information, visit

www.gulfresourcesinc.com.

Forward-Looking StatementsCertain statements in

this news release contain forward-looking information about Gulf

Resources and its subsidiaries business and products within the

meaning of Rule 175 under the Securities Act of 1933 and Rule 3b-6

under the Securities Exchange Act of 1934, and are subject to the

safe harbor created by those rules. The actual results may differ

materially depending on a number of risk factors including, but not

limited to, the general economic and business conditions in the

PRC, future product development and production capabilities,

shipments to end customers, market acceptance of new and existing

products, additional competition from existing and new competitors

for bromine and other oilfield and power production chemicals,

changes in technology, the ability to make future bromine asset

purchases, and various other factors beyond its control. All

forward-looking statements are expressly qualified in their

entirety by this Cautionary Statement and the risks factors

detailed in the company's reports filed with the Securities and

Exchange Commission. Gulf Resources undertakes no duty to revise or

update any forward-looking statements to reflect events or

circumstances after the date of this release.

| |

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (Expressed in U.S. dollars) |

| |

| |

|

As of December 31, |

| |

|

2015 |

|

|

2014 |

|

|

Current Assets |

|

|

|

|

|

|

|

Cash |

|

$ |

133,606,392 |

|

|

$ |

146,585,601 |

|

| Accounts

receivable |

|

|

49,980,358 |

|

|

|

41,997,862 |

|

|

Inventories |

|

|

7,180,800 |

|

|

|

5,367,868 |

|

|

Prepayments and deposits |

|

|

- |

|

|

|

86,301 |

|

|

Prepaid land leases |

|

|

49,833 |

|

|

|

51,024 |

|

| Other

receivables |

|

|

599 |

|

|

|

38,272 |

|

|

Deferred tax assets |

|

|

3,173 |

|

|

|

864 |

|

| Total

Current Assets |

|

|

190,821,115 |

|

|

|

194,127,792 |

|

| Non-Current Assets |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

127,871,323 |

|

|

|

124,350,781 |

|

|

Property, plant and equipment under capital leases, net |

|

|

927,218 |

|

|

|

1,339,602 |

|

|

Prepaid land leases, net of current portion |

|

|

5,197,216 |

|

|

|

733,560 |

|

|

Deferred tax assets |

|

|

2,367,180 |

|

|

|

2,430,417 |

|

|

Goodwill |

|

|

29,559,174 |

|

|

|

- |

|

| Total non-current

assets |

|

|

165,922,111 |

|

|

|

128,854,360 |

|

| Total

Assets |

|

$ |

356,743,226 |

|

|

$ |

322,982,152 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

9,929,700 |

|

|

$ |

4,004,728 |

|

|

Retention payable |

|

|

1,135,956 |

|

|

|

326,959 |

|

|

Capital lease obligation, current portion |

|

|

196,778 |

|

|

|

205,128 |

|

| Taxes

payable |

|

|

4,814,003 |

|

|

|

3,545,429 |

|

| Total

Current Liabilities |

|

|

16,076,437 |

|

|

|

8,082,244 |

|

|

Non-Current Liabilities |

|

|

|

|

|

|

|

|

|

Capital lease obligation, net of current portion |

|

|

2,555,914 |

|

|

|

2,826,495 |

|

| Total

Liabilities |

|

$ |

18,632,351 |

|

|

$ |

10,908,739 |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

| PREFERRED STOCK; $0.001

par value; 1,000,000 shares authorized; none outstanding |

|

|

|

|

|

|

|

|

| COMMON STOCK; $0.0005

par value; 80,000,000 shares authorized; 46,276,269 and 38,911,014

shares issued; and 46,007,120 and 38,672,865 shares outstanding as

of December 31, 2015 and 2014, respectively |

|

$ |

23,139 |

|

|

$ |

19,456 |

|

|

Treasury stock; 269,149 and 238,149 shares as of December 31, 2015

and 2014 |

|

|

(599,441 |

) |

|

|

(561,728 |

) |

|

Additional paid-in capital |

|

|

94,124,065 |

|

|

|

80,380,008 |

|

|

Retained earnings unappropriated |

|

|

215,286,395 |

|

|

|

183,480,402 |

|

|

Retained earnings appropriated |

|

|

20,340,436 |

|

|

18,078,392 |

|

|

Cumulative translation adjustment |

|

|

8,936,281 |

|

|

|

30,676,883 |

|

| Total

Stockholders’ Equity |

|

|

338,110,875 |

|

|

|

312,073,413 |

|

| Total

Liabilities and Stockholders’ Equity |

|

$ |

356,743,226 |

|

|

$ |

322,982,152 |

|

|

|

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE

INCOME |

| (Expressed in U.S. dollars) |

|

|

| |

|

Years Ended December 31, |

|

| |

|

2015 |

|

|

2014 |

|

| NET REVENUE |

|

|

|

|

|

|

|

| Net revenue |

|

$ |

162,317,120 |

|

|

$ |

113,660,331 |

|

|

| |

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES /

INCOME |

|

|

|

|

|

|

|

|

|

| Cost of net revenue |

|

|

(109,035,870 |

) |

|

|

(81,737,610 |

) |

|

| Sales, marketing and other

operating expenses |

|

|

(375,365 |

) |

|

|

(105,588 |

) |

|

| Research and development cost |

|

|

(230,590 |

) |

|

|

(134,292 |

) |

|

| Exploration cost |

|

|

(325,840 |

) |

|

|

(488,880 |

) |

|

| Write-off / Impairment on property,

plant and equipment |

|

|

(969,638 |

) |

|

|

(673,705 |

) |

|

| Loss from disposal of property,

plant and equipment |

|

|

- |

|

|

|

(9,866 |

) |

|

| General and administrative

expenses |

|

|

(6,668,838 |

) |

|

|

(7,161,047 |

) |

|

| Other operating income |

|

|

453,731 |

|

|

|

468,878 |

|

|

| |

|

|

(117,152,410 |

) |

|

|

(89,842,110 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| INCOME FROM

OPERATIONS |

|

|

45,164,710 |

|

|

|

23,818,221 |

|

|

| |

|

|

|

|

|

|

|

|

|

| OTHER INCOME

(EXPENSES) |

|

|

|

|

|

|

|

| Interest expense |

|

|

(194,036 |

) |

|

|

(203,296 |

) |

|

| Interest income |

|

|

469,271 |

|

|

|

482,885 |

|

|

| |

|

|

275,235 |

|

|

|

279,589 |

|

|

| INCOME BEFORE

TAXES |

|

|

45,439,945 |

|

|

|

24,097,810 |

|

|

| |

|

|

|

|

|

|

|

|

|

| INCOME TAXES |

|

|

(11,371,908 |

) |

|

|

(6,226,015 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

34,068,037 |

|

|

$ |

17,871,795 |

|

|

| |

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE

INCOME: |

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

|

34,068,037 |

|

|

|

17,871,795 |

|

|

| OTHER COMPREHENSIVE

INCOME |

|

|

|

|

|

|

|

|

|

| - Foreign

currency translation adjustments |

|

|

(21,740,602 |

) |

|

|

(1,077,846 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE

INCOME |

|

$ |

12,327,435 |

|

|

$ |

16,793,949 |

|

|

| |

|

|

|

|

|

|

|

|

|

| EARNINGS PER SHARE |

|

|

|

|

|

|

|

| BASIC |

|

$ |

0.75 |

|

|

$ |

0.46 |

|

|

| DILUTED |

|

$ |

0.74 |

|

|

$ |

0.46 |

|

|

| |

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE NUMBER

OF SHARES |

|

|

|

|

|

|

|

| BASIC |

|

|

45,167,288 |

|

|

|

38,694,567 |

|

|

| DILUTED |

|

|

46,109,404 |

|

|

|

39,260,627 |

|

|

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Expressed in U.S. dollars) |

| |

|

|

|

Years Ended December 31, |

|

|

|

|

|

2015 |

|

|

2014 |

|

|

|

| CASH FLOWS FROM

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

34,068,037 |

|

|

$ |

17,871,795 |

|

|

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

|

|

| Interest on capital lease

obligation |

|

|

193,162 |

|

|

|

202,656 |

|

|

|

| Amortization of prepaid land

leases |

|

|

774,512 |

|

|

|

680,551 |

|

|

|

| Depreciation and amortization |

|

|

29,095,648 |

|

|

|

27,642,222 |

|

|

|

| Allowance for obsolete and

slow-moving inventories |

|

|

9,236 |

|

|

|

(3,174 |

) |

|

|

| Write-off / Impairment loss on

property, plant and equipment |

|

|

969,638 |

|

|

|

673,705 |

|

|

|

| Loss from disposal of property,

plant and equipment |

|

|

- |

|

|

|

9,866 |

|

|

|

| Currency translation adjustment on

inter-company balances |

|

|

(1,575,397 |

) |

|

|

(92,412 |

) |

|

|

| Deferred tax asset |

|

|

(83,856 |

) |

|

|

(121,436 |

) |

|

|

| Stock-based compensation

expense |

|

|

374,600 |

|

|

|

346,100 |

|

|

|

| Changes in assets and liabilities,

net of effects of acquisition: |

|

|

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

7,387,941 |

|

|

|

2,751,676 |

|

|

|

| Inventories |

|

|

(592,841 |

) |

|

|

(84,777 |

) |

|

|

| Prepayment and deposits |

|

|

92,400 |

|

|

|

(80,673 |

) |

|

|

| Accounts payable and accrued

expenses |

|

|

(1,847,462 |

) |

|

|

(1,616,195 |

) |

|

|

| Retention payable |

|

|

841,225 |

|

|

|

117,905 |

|

|

|

| Other receivables |

|

|

37,713 |

|

|

|

(38,272 |

) |

|

|

| Taxes payable |

|

|

656,654 |

|

|

|

(1,685,760 |

) |

|

|

| Net cash provided by

operating activities |

|

|

70,401,210 |

|

|

|

46,573,777 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

| Additions of prepaid

land leases |

|

|

(683,129 |

) |

|

|

(664,106 |

) |

|

|

| Proceeds from sales of

property, plant and equipment |

|

|

- |

|

|

|

21,514 |

|

|

|

| Purchase of property,

plant and equipment |

|

|

(22,858,625 |

) |

|

|

(6,538,611 |

) |

|

|

| Consideration paid for

business acquisition |

|

|

(66,305,606 |

) |

|

|

- |

|

|

|

| Cash acquired from

acquisition |

|

|

14,074,720 |

|

|

|

- |

|

|

|

| Net cash used

in investing activities |

|

|

(75,772,640 |

) |

|

|

(7,181,203 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

| Repurchase of common

stock |

|

|

(37,713 |

) |

|

|

(61,728 |

) |

|

|

| Repayment of capital

lease obligation |

|

|

(306,683 |

) |

|

|

(304,806 |

) |

|

|

| Net cash used

in financing activities |

|

|

(344,396 |

) |

|

|

(366,534 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| EFFECTS OF EXCHANGE

RATE CHANGESON CASH AND CASH EQUIVALENTS |

|

|

(7,263,383 |

) |

|

|

(269,239 |

) |

|

|

| NET INCREASE/(DECREASE)

IN CASH AND CASH EQUIVALENTS |

|

|

(12,979,209 |

) |

|

|

38,756,801 |

|

|

|

| CASH AND CASH

EQUIVALENTS - BEGINNING OF YEAR |

|

|

146,585,601 |

|

|

|

107,828,800 |

|

|

|

| CASH AND CASH

EQUIVALENTS - END OF YEAR |

|

$ |

133,606,392 |

|

|

$ |

146,585,601 |

|

|

|

Gulf Resources, Inc.

Web: http://www.gulfresourcesinc.com

Director of Investor Relations

Helen Xu (Haiyan Xu)

beishengrong@vip.163.com

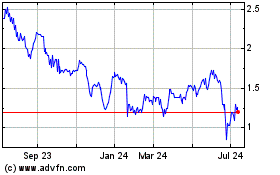

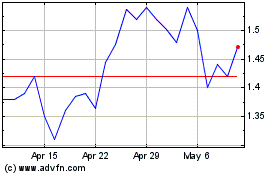

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Jul 2023 to Jul 2024