false

0001755953

0001755953

2025-01-27

2025-01-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities Exchange

Act of 1934

Date of report (Date of

earliest event reported): January 27, 2025

GRYPHON DIGITAL MINING,

INC.

(Exact Name of Registrant

as Specified in Its Charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

| 001-39096 |

|

83-2242651 |

| (Commission File Number) |

|

(IRS Employer

Identification No.) |

| 1180 N. Town Center Drive, Suite 100 |

|

|

| Las Vegas, NV |

|

89144 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(702) 945-2700

(Registrant’s Telephone

Number, Including Area Code)

N/A

(Former Name or Former

Address, if Changed Since Last Report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.0001 per share |

|

GRYP |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-1 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01. Regulation

FD Disclosure

In

connection with the Acquisition (as defined below), Gryphon Digital Mining, Inc. (the “Company”) issued a press release attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

The

information provided in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished

and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of

that section. Such information shall not be deemed incorporated by reference into any filing of the Company under the Securities Act or

the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except

as otherwise expressly set forth by specific reference in such filing.

Item 8.01. Other Events

On

January 27, 2025, the Company acquired 1,900 S19JPro series machines with an extended warranty (the “Acquisition”) in

the amount of approximately $0.6 million from RepairBit LLC. Following the Acquisition, the Company now owns approximately 10,400

machines.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

GRYPHON DIGITAL MINING, INC. |

| |

|

|

| Date: January 27, 2025 |

By: |

/s/ Steve Gutterman |

| |

|

Name: |

Steve Gutterman |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit 99.1

Gryphon Digital Mining Expands Bitcoin Mining

Fleet by 22% and Evaluates Creation of a Bitcoin Strategic Reserve Designed to Strengthen Balance Sheet

Las Vegas, NV — January 27, 2025 –

Gryphon Digital Mining, Inc. (Nasdaq: GRYP) (“Gryphon” or the “Company”), an innovative venture in the bitcoin

and AI space dedicated to helping bring digital assets to the market, today announced the acquisition of 1,900 S19JPro series machines

with an extended warranty from RepairBit LLC (“RepairBit”) at a 20% discount to market rates provided by Hashrate Index.

This purchase will increase Gryphon’s mining

fleet by approximately 22%, from 8,500 to 10,400 machines, strengthening the company’s position in the bitcoin mining sector.

“This acquisition perfectly

exemplifies our strategic approach – bold when transformative opportunities arrive, as with our power agreements with Wildboy

and Captus, and scrappy when acquiring equipment and deploying capital,” said Steve Gutterman, CEO of Gryphon

Digital Mining. “Our developing relationship with RepairBit has enabled us to secure these machines at excellent, below-market

prices.”

Gryphon is also analyzing the creation of a strategic

bitcoin reserve that could strengthen the Company’s Balance Sheet. Said Gutterman, “We are dedicated to advancing our core

strategic initiatives by building out our power assets. We believe that adding Bitcoin to our balance sheet, if done deliberatively and

with the correct structure, could assist in that. We expect to make further announcements as we complete our evaluation.”

About Gryphon Digital Mining

Gryphon Digital Mining, Inc. is an innovative venture in the bitcoin

and AI space dedicated to helping bring digital assets to the market. With a talented leadership team coming from globally recognized

brands, Gryphon has assembled thought leaders to improve digital asset network infrastructure. More information is available on https://gryphondigitalmining.com/

About RepairBit LLC

RepairBit is one of the largest repair and maintenance companies in

North America, providing ASIC cleaning, processing, and chip-level repair as well as inventory and auditing solutions to large public

and private miners. The RepairBit team consists of 90+ full-time employees (including 40+ lab technicians) and can process 30,000+ ASICs

per month at its Ohio-based 60,000+ square foot facility. The RepairBit Lab is the largest lab of its kind in North America, and has certifications

from MicroBT and Bitmain.

https://repairbit.io/

Cautionary Statements Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). Statements that refer to projections, forecasts or other characterizations of

future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically

identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,”

“outlook,” “estimate,” “forecast,” “project,” “continue,” “could,”

“may,” “might,” “possible,” “potential,” “predict,” “should,”

“would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements may include, for example, statements about the Company’s ability to use the new mining machines at the

expected price and computing capacity, close the acquisition with Captus Energy and Ericsson; the total consideration for the acquisitions;

the ability of the assets acquired or to be acquired to produce energy at both the cost and the volume anticipated; the results of diligence

reviews; the engagement, and the results of such engagement, with regulatory bodies, First Nations, local stakeholders and norther communities;

green initiatives; plans to expand the Company’s business to include AI and high performance computing; the creation of a strategic

Bitcoin reserve, the funding for such a reserve, the impact of such a reserve on the balance sheet of the Company, the future financial

performance of the Company; changes in the Company’s strategy and future operations; financial position; estimated revenues and

losses; projected costs; prospects, plans and objectives of management; and future acquisition activity.

The forward-looking statements are based on management’s current

expectations and assumptions about future events and financial results and are based on currently available information as to the outcome

and timing of future events. The forward-looking statements speak only as of the date of this press release or as of the date they are

made. Except as otherwise required by applicable law, Gryphon disclaims any duty to update any forward-looking statements, all of which

are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Gryphon

cautions you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict

and many of which are beyond the control of Gryphon. In addition, Gryphon cautions you that the forward-looking statements contained in

this press release are subject to the risks set forth in our filings with the Securities and Exchange Commission (the “SEC”),

including the section titled “Risk Factors” in the Annual Report on Form 10-K filed with the SEC by Gryphon on April 1, 2024,

as updated by the Company’s subsequent filings.

INVESTOR CONTACT:

Name: James Carbonara

Company: Hayden IR

Phone: (646)-755-7412

Email: james@haydenir.com

v3.24.4

Cover

|

Jan. 27, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 27, 2025

|

| Entity File Number |

001-39096

|

| Entity Registrant Name |

GRYPHON DIGITAL MINING,

INC.

|

| Entity Central Index Key |

0001755953

|

| Entity Tax Identification Number |

83-2242651

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1180 N. Town Center Drive

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Las Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89144

|

| City Area Code |

702

|

| Local Phone Number |

945-2700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

GRYP

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

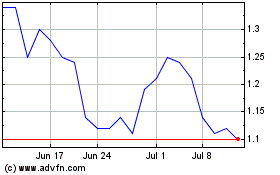

Gryphon Digital Mining (NASDAQ:GRYP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gryphon Digital Mining (NASDAQ:GRYP)

Historical Stock Chart

From Feb 2024 to Feb 2025