UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 8, 2023 (March 7, 2023)

The Growth for Good Acquisition Corporation

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

001-41149 |

66-0987010 |

| (State or other jurisdiction |

(Commission |

(I.R.S. Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 12 E 49th Street, 11th

Floor |

|

| New York, NY |

10017 |

| (Address of principal executive offices) |

(Zip Code) |

(646) 450-1265

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities

Exchange Act of 1934:

| Title of

each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units,

each consisting of one Class A ordinary share, on right and one-half of one redeemable warrant |

|

GFGDU |

|

The Nasdaq Stock Market LLC |

| Class

A ordinary shares, par value $0.0001 per share |

|

GFGD |

|

The Nasdaq Stock Market LLC |

| Right

to acquire one-sixteenth of one Class A ordinary share |

|

GFGDR |

|

The Nasdaq Stock Market LLC |

| Warrants,

each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

GFGDW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

Merger Agreement

The

Growth for Good Acquisition Corporation is a blank check company incorporated as a Cayman Islands exempted company and formed for

the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination

with one or more businesses (“G4G”). On March 7, 2023, G4G entered

into an Agreement and Plan of Merger (the “Merger Agreement”) with

Zero Nox, Inc., a Wyoming corporation (“ZeroNox”), and G4G Merger

Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of G4G (“Merger

Sub”). Capitalized terms used in this Current Report on Form 8-K but not otherwise

defined herein have the meanings given to them in the Merger Agreement.

The

Merger

The

Merger Agreement provides that, among other things and upon the terms and subject to the conditions thereof, the following transactions

will occur (together with the other agreements and transactions contemplated by the Merger Agreement, the “Business Combination”):

(i) at

the closing of the transactions contemplated by the Merger Agreement (the “Closing”), upon the terms and subject to

the conditions of the Merger Agreement, in accordance with the General Corporation Law of the State of Delaware, as amended (the “DGCL”),

and the Wyoming Business Corporation Act, Merger Sub will merge with and into ZeroNox, the separate corporate existence of Merger Sub

will cease and ZeroNox will be the surviving corporation and a wholly owned subsidiary of G4G (the “Merger”);

(ii) as

a result of the Merger, among other things, all outstanding shares of ZeroNox common stock will be canceled in exchange for the

right to receive, in the aggregate, a number of shares of G4G Common Stock (as defined below) equal to the quotient obtained by

dividing (x) $225,000,000 by (y) $10.00; and

(iv) upon

the effective time of the Domestication (as defined below), G4G will immediately be renamed “ZeroNox Holdings, Inc.”

The

Merger Agreement also provides, among other thing, that the ZeroNox stockholders may receive an earnout payment following the

Closing of up to 7,500,000 shares of G4G Common Stock, in three equal tranches of 2,500,000 shares of G4G Common Stock, subject to

the following achievement triggers, respectively:

(i) the

dollar volume-weighted average price of G4G Common Stock is greater than or equal to $12.50 for any ten (10) trading days

within a period of twenty (20) consecutive trading days at any time following the Closing Date until December 31, 2025;

(ii) the

dollar volume-weighted average price of G4G Common Stock is greater than or equal to $15.00 for any ten (10) trading days

within a period of twenty (20) consecutive trading days at any time following the Closing Date until December 31, 2026; and

(iii) the

dollar volume-weighted average price of G4G Common Stock is greater than or equal to $20.00 for any ten (10) trading days

within a period of twenty (20) consecutive trading days at any time following the Closing Date until December 31, 2027;

provided

that each achievement trigger will only occur once, if at all, and in no event will the ZeroNox stockholders be entitled to receive more

than an aggregate of 7,500,000 earnout shares.

The

Board of Directors of G4G (the “Board”) has unanimously (i) approved and declared advisable the Merger Agreement,

the Business Combination and the other transactions contemplated thereby and (ii) resolved to recommend approval of the Merger Agreement

and related matters by the shareholders of G4G.

The

Domestication

Prior

to the Closing, subject to the approval of G4G’s shareholders, and in accordance with the DGCL, Part XII of the Companies Act (Revised)

of the Cayman Islands (the “CICA”) and G4G’s Amended and Restated Memorandum and Articles of Association (as

may be amended from time to time, the “Cayman Constitutional Documents”), G4G will effect a deregistration from the

Register of Companies in the Cayman Islands by way of continuation out of the Cayman Islands and into the State of Delaware so as to migrate

to and domesticate as a Delaware corporation (the “Domestication”).

In connection with the Domestication,

(i) each of the then issued and outstanding Class A ordinary shares, par value $0.0001 per share, of G4G (“G4G Class A Common

Shares”), will convert automatically into one share of common stock, par value $0.0001, of G4G (after its Domestication) (the

“Domesticated G4G Common Stock”), (ii) each of the then issued and outstanding Class B ordinary shares, par value $0.0001

per share, of G4G (“G4G Class B Common Shares”), will convert automatically into one share of Domesticated G4G Common

Stock, (iii) each then issued and outstanding warrant of G4G will convert automatically into one warrant to acquire one share of Domesticated

G4G Common Stock (“Domesticated G4G Warrant”), pursuant to the Warrant Agreement, dated December 9, 2021, between G4G

and Continental Stock Transfer & Trust Company, as warrant agent, (iv) each then issued and outstanding unit of G4G will separate

and convert automatically into one share of Domesticated G4G Common Stock, one-half of one Domesticated G4G Warrant and one Domesticated

G4G Right (as defined below), and (v) each then issued and outstanding right of G4G entitling the holder thereof to receive one-sixteenth

(1/16) of one G4G Class A Common Share upon the consummation of G4G’s Business Combination shall convert automatically into one

right to acquire one-sixteenth (1/16) of one share of Domesticated G4G Common Stock upon the consummation of G4G’s Business Combination,

pursuant to the terms of the Rights Agreement, dated as of December 9, 2021, between G4G and Continental Stock Transfer & Trust Company,

as rights agent (a “Domesticated G4G Right”).

Conditions to Closing

The Merger Agreement is subject

to the satisfaction or waiver of certain customary closing conditions, including, among others, (i) approval of the Business Combination

and related agreements and transactions by the shareholders of G4G and ZeroNox, (ii) effectiveness of the registration statement on Form

S-4 to be filed by G4G in connection with the Business Combination, (iii) receipt of approval for listing on Nasdaq or an alternative

exchange, as applicable, the shares of Domesticated G4G Common Stock to be issued in connection with the Merger, (v) that G4G have at

least $5,000,001 of net tangible assets (as determined in accordance with Rule 3a51-1(g)(1) of the Exchange Act), except in the event

that G4G’s governing documents shall have been amended to remove such requirement prior to or concurrently with the Closing, and

(vi) the absence of any injunctions.

Among others, one condition

to ZeroNox’s obligations to consummate the Merger is that the Domestication has been completed. Further, another condition to G4G’s

obligations to consummate the Merger is the absence of a Company Material Adverse Effect (as defined in the Merger Agreement) on ZeroNox.

Covenants

The Merger Agreement contains

additional covenants, including, among others, providing for (i) the parties to conduct their respective businesses in the ordinary course

through the Closing, (ii) the parties to not initiate any negotiations or enter into any agreements for certain alternative transactions,

(iii) ZeroNox using reasonable best efforts to prepare and deliver to G4G certain audited and unaudited consolidated financial statements

of ZeroNox, (iv) G4G to approve and adopt an incentive award plan, (v) G4G using reasonable best efforts to obtain approval for the listing

on Nasdaq or an alternative exchange, as applicable, of the shares issuable in accordance with the Merger Agreement, including the Merger

and the Domestication, (vi) G4G to prepare and file a registration statement on Form S-4 and take certain other actions to obtain the

requisite approval of G4G shareholders of certain proposals regarding the Business Combination (including the Domestication) and (vii)

the parties to use reasonable best efforts to obtain necessary approvals from governmental agencies. The parties also agreed to use commercially

reasonable efforts to finalize a committed equity facility.

Representations

and Warranties

The

Merger Agreement contains customary representations and warranties by G4G, Merger Sub, and ZeroNox. The representations and warranties

of the respective parties to the Merger Agreement generally will not survive the Closing.

Termination

The

Merger Agreement may be terminated at any time prior to the Closing (i) by mutual written consent of G4G and ZeroNox, (ii) by ZeroNox,

if there is a Modification in Recommendation (as defined in the Merger Agreement), (iiii) by G4G, if Company Equityholder Approval (as

defined in the Merger Agreement) is not obtained by the twentieth (20th) day after the date of the Merger Agreement and (iv) by either

G4G or ZeroNox in certain other circumstances set forth in the Merger Agreement, including (a) if certain approvals of the shareholders

of G4G, to the extent required under the Merger Agreement, are not obtained as set forth therein (b) if any Governmental Authority (as

defined in the Merger Agreement) shall have issued or otherwise entered a final, nonappealable order making consummation of the Merger

illegal or otherwise preventing or prohibiting consummation of the Merger, (c) in the event of certain uncured breaches by the other party

or (d) if the Closing has not occurred on or before the latest of (A) June 14, 2023, (B) if an extension without ZeroNox’s approval

is obtained at the election of G4G, with or without G4G shareholder vote, in accordance with G4G’s governing documents, September

14, 2023 and (C) if one or more extensions to a date following September 14, 2023 with ZeroNox’s approval are obtained at the election

of G4G, with G4G shareholder vote, in accordance with G4G’s governing documents, the last date for G4G to consummate a Business

Combination pursuant to such Extensions, unless G4G or ZeroNox, as applicable, is in material breach of the Merger Agreement.

The

foregoing description of the Merger Agreement is qualified in its entirety by reference to the full text of the Merger Agreement, a copy

of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is hereby incorporated by reference into this Item

1.01.

Certain

Related Agreements

Sponsor

Support Agreement

On

March 7, 2023, G4G also entered into a Sponsor Support Agreement (the “Sponsor Support Agreement”), by and among

ZeroNox, G4G, G4G Sponsor LLC, a Delaware limited liability company (the “Sponsor Holdco”), and the other parties

thereto (collectively with the Sponsor Holdco, the “Sponsors”), pursuant to which each Sponsor agreed to, among other

things, vote in favor of the Merger Agreement and the transactions contemplated thereby, in each case, subject to the terms and conditions

contemplated by the Sponsor Support Agreement.

Each

Sponsor additionally agreed that, effective as of and conditioned upon the Closing, (i) the Sponsor Holdco will forfeit 790,625

G4G Class B Common Shares, together with all shares of Domesticated G4G Common Stock issued upon conversion thereof.

Each

Sponsor further agreed that, effective as of and conditioned upon the Closing, the Sponsor Holdco will forfeit up to 1,000,000 additional

G4G Class B Common Shares, together with all shares of Domesticated G4G Common Stock issued upon conversion thereof (the “Redemption

Forfeited Shares”), as follows:

(i) 1,000,000

Redemption Forfeited Shares will be forfeited if public shareholders of G4G holding 95% or more of G4G Class A Common Shares elect

to effect an Acquiror Share Redemption (as defined in the Merger Agreement) prior to the Effective Time;

(ii) 750,000

Redemption Forfeited Shares will be forfeited if public shareholders of G4G holding 90% or more but less than 95% of G4G Class A

Common Shares elect to effect an Acquiror Share Redemption prior to the Effective Time;

(iii) 250,000

Redemption Forfeited Shares will be forfeited if public shareholders of G4G holding more than 85% but less than 90% of G4G Class A

Common Shares elect to effect an Acquiror Share Redemption prior to the Effective Time; and

(iv) no

Redemption Forfeited Shares will be forfeited if public shareholders of G4G holding 85% or less of G4G Class A Common Shares elect

to effect an Acquiror Share Redemption.

Each

Sponsor additionally agreed that the Sponsor Holdco will not transfer, assign or sell its Acquiror Common Shares, together with all shares

of Domesticated G4G Common Stock issued upon conversion thereof (the “Lock-Up Shares”), (i) in the case of Basic Lock-Up

Shares (as defined in the Sponsor Support Agreement), until the 360th day after the Closing Date; (ii) in the case of 790,625

Deferral Pool Lock-Up Shares (as defined in the Sponsor Support Agreement), until the VWAP (as defined in the Sponsor Support Agreement)

of one share of Domesticated G4G Common Stock equals or exceeds $12.50 per share for 10 of any 20 consecutive trading days during the

Lock-Up Period (as defined below); and (iii) in the case of the remaining 790,625 Deferral Pool Lock-Up Shares, until such time as the

VWAP of one share of Domesticated G4G Common Stock equals or exceeds $15.00 per share for 10 of any 20 consecutive trading days during

the Lock-Up Period. Any Lock-Up Shares that have not been released upon the earlier of (x) the fifth (5th) anniversary of the Closing

Date and (y) the consummation of a Change in Control (as defined in the Sponsor Support Agreement) (the “Lock-Up Period”),

shall immediately and automatically upon the end of the Lock-Up Period be forfeited and surrendered to G4G without consideration.

The

foregoing description of the Sponsor Support Agreement is qualified in its entirety by reference to the full text of the Sponsor Support

Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is hereby incorporated by reference

into this Item 1.01.

Company

Support Agreement

On

March 7, 2023, G4G also entered into a Company Support Agreement (the “Company Support Agreement”), by and among

G4G, ZeroNox and certain shareholders of ZeroNox (the “ZeroNox Holders”), pursuant to which the ZeroNox Holders agreed

to, among other things, vote in favor of the Merger Agreement and the transactions contemplated thereby, in each case, subject to the

terms and conditions contemplated by the Company Support Agreement.

The

foregoing description of the Company Support Agreement is qualified in its entirety by reference to the full text of the Company Support

Agreement, a copy of which is filed as Exhibit 10.2 to this Current Report on Form 8-K and is hereby incorporated by reference

into this Item 1.01.

Registration

Rights Agreement

The

Merger Agreement contemplates that, at the Closing, G4G, the Sponsor and certain equityholders of ZeroNox and certain of their respective

affiliates will enter into an Amended and Restated Registration Rights Agreement (the “Registration Rights Agreement”), pursuant

to which G4G will agree to register for resale, pursuant to Rule 415 under the Securities Act, certain shares of Domesticated G4G

Common Stock and other equity securities of G4G that are held by the parties thereto from time to time.

The

Registration Rights Agreement contemplates that, at the Closing, the Lock-up Parties (as defined in the Registration Rights Agreement)

will agree not to transfer, assign or sell the Lock-up Shares (as defined in the Registration Rights Agreement) until the date that is

360 days after the Closing, other than to permitted transferees.

The

foregoing description of the Registration Rights Agreement is qualified in its entirety by reference to the full text of the Registration

Rights Agreement, a copy of which is filed as Exhibit 10.3 to this Current Report on Form 8-K and is hereby incorporated by

reference into this Item 1.01.

Additional

Information and Where to Find It

In

connection with the proposed transaction, G4G intends to file a registration statement on Form S-4 (the “registration statement”)

with the U.S. Securities and Exchange Commission (“SEC”), which will include a document that serves as a prospectus and a

proxy statement of G4G, referred to as a “proxy statement/prospectus.” The definitive proxy statement/prospectus will be

filed with the SEC as part of the registration statement and will be sent to all G4G stockholders as of the applicable record date to

be established. G4G may also file other relevant documents regarding the proposed transaction with the SEC. BEFORE MAKING ANY VOTING

OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF G4G ARE URGED TO READ THE REGISTRATION STATEMENT, THE DEFINITIVE PROXY

STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors

and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (if and when

available) and all other relevant documents that are filed or that will be filed with the SEC by G4G through the website maintained by

the SEC at www.sec.gov. The documents filed by G4G with the SEC also may be obtained by contacting G4G at 12 E 49th Street, 11th Floor,

New York, NY 10017, or by calling (646) 450-1265.

Participants

in the Solicitation

G4G

and ZeroNox and certain of their respective directors, executive officers and other members of management and employees may, under SEC

rules, be deemed to be participants in the solicitation of proxies from G4G’s stockholders in connection with the proposed transaction.

A list of the names of the directors and executive officers of G4G and ZeroNox and information regarding their interests in the business

combination will be contained in the proxy statement/prospectus when available. G4G’s stockholders and other interested parties

may obtain free copies of these documents free of charge by directing a written request to G4G.

No

Offer or Solicitation

This

Current Report on Form 8-K and the information contained herein do not constitute (i) (a) a solicitation of a proxy, consent

or authorization with respect to any securities or in respect of the proposed transaction or (b) an offer to sell or the solicitation

of an offer to buy any security, commodity or instrument or related derivative, nor shall there be any sale of securities in any jurisdiction

in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any

such jurisdiction or (ii) an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an

agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies.

No offer of securities in the United States or to or for the account or benefit of U.S. persons (as defined in Regulation S under the

U.S. Securities Act) shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act,

or an exemption therefrom. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself

of any exemption under the Securities Act.

Forward-Looking

Statements

This

Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws with respect

to the proposed transaction between G4G and ZeroNox. These forward-looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,”

“future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,”

“will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements

are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as

a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking

statements in this Current Report on Form 8-K, including but not limited to: (i) actual market adoption and growth rates of

electrification technologies for commercial and industrial vehicles; (ii) ZeroNox’s ability to convert trial deployments with

truck fleets into sales orders; (iii) delays in design, manufacturing and wide-spread deployment of ZeroNox’s products and

technologies; (iv) failure of ZeroNox’s products to perform as expected or any product recalls; (v) ZeroNox’s ability

to expand its relationships with OEMs and fleet owners, and its distribution network; (vi) ZeroNox’s ability to develop vehicles

of sufficient quality and appeal on schedule and on large scale; (vii) ZeroNox’s ability to raise capital as needed; (viii) management’s

ability to manage growth; (ix) the macroeconomic conditions and challenges in the markets in which ZeroNox operates; (x) the

effects of increased competition in the electrification technology business; (xi) ZeroNox’s ability to defend against any

intellectual property infringement or misappropriation claims; (xii) the risk that the transaction may not be completed in a timely

manner or at all, which may adversely affect the price of G4G’s securities, (xiii) the risk that the transaction may not be

completed by G4G’s business combination deadline and the potential failure to obtain an extension of the business combination deadline

if sought by G4G, (xiv) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of

the Merger Agreement by the shareholders of G4G and the receipt of certain governmental and regulatory approvals, (xv) the occurrence

of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (xvi) the effect of

the announcement or pendency of the transaction on ZeroNox’s business relationships, operating results and business generally,

(xvii) risks that the proposed transaction disrupts current plans and operations of ZeroNox and potential difficulties in ZeroNox

employee retention as a result of the transaction, (xviii) the outcome of any legal proceedings that may be instituted against ZeroNox

or against G4G related to the Merger Agreement or the proposed transaction, (xix) the ability to maintain the listing of G4G’s

securities on a national securities exchange, (xx) the price of G4G’s securities may be volatile due to a variety of factors,

including changes in the competitive industries in which G4G plans to operate or ZeroNox operates, variations in operating performance

across competitors, changes in laws and regulations affecting G4G’s or ZeroNox’s business and changes in the combined capital

structure, (xxi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed

transaction, and identify and realize additional opportunities, and (xxii) the risk of downturns and a changing regulatory landscape.

The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties

described in the “Risk Factors” section of G4G’s registration on Form S-1 (File No. 333-261369), the registration

statement on Form S-4 discussed above and other documents filed by G4G from time to time with the SEC. These filings identify and

address other important risks and uncertainties that could cause actual events and results to differ materially from those contained

in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and G4G and ZeroNox assume no obligation and do not intend to update or revise these forward-looking

statements, whether as a result of new information, future events, or otherwise. Neither G4G nor ZeroNox gives any assurance that either

G4G or ZeroNox or the combined company will achieve its expectations.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

The Growth for Good Acquisition Corporation |

| |

|

|

|

| |

|

|

|

| Date: March 8, 2023 |

By: |

/s/ Yana Watson Kakar |

| |

|

Name: |

Yana Watson Kakar |

| |

|

Title: |

Chief Executive Officer

(Principal Executive Officer) |

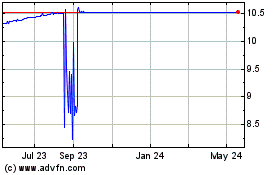

Growth for Good Acquisit... (NASDAQ:GFGD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Growth for Good Acquisit... (NASDAQ:GFGD)

Historical Stock Chart

From Jul 2023 to Jul 2024