GRAVITY Co., Ltd. (NasdaqGM: GRVY) (“Gravity” or “Company”), a

developer and publisher of online and mobile games based in South

Korea, today announced its unaudited financial results for the

first quarter ended March 31, 2021, prepared in accordance with

international Financial Reporting Standards as issued by the

International Accounting Standards Board and business updates.

FIRST QUARTER 2021

HIGHLIGHTS

- Total revenues were KRW 105,059

million (US$ 93,243 thousand), representing a 6.6% decrease from

the fourth quarter ended December 31, 2020 (“QoQ”) and a 43.4%

increase from the first quarter ended March 31, 2020 (“YoY”).

- Operating profit was KRW 27,953

million (US$ 24,809 thousand), representing a 2.2% increase QoQ and

a 169.9% increase YoY.

- Profit before income tax expenses

was KRW 28,620 million (US$ 25,401 thousand), representing a 7.0%

increase QoQ and a 154.4% increase YoY.

- Net profit attributable to parent

company was KRW 23,565 million (US$ 20,915 thousand), representing

a 56.4% increase QoQ and a 154.4% increase YoY.

REVIEW OF FIRST QUARTER 2021 FINANCIAL

RESULTS

Revenues

Online game revenues for the first quarter of

2021 were KRW 19,458 million (US$ 17,270 thousand), representing a

26.6 % increase QoQ from KRW 15,370 million and a 44.8% increase

YoY from KRW 13,436 million. The increase QoQ was mainly

attributable to increased revenues from Ragnarok Online in Taiwan

and Japan. The increase YoY was largely due to increased revenues

from Ragnarok Online in Thailand and Japan.

Mobile game revenues were KRW 82,438 million

(US$ 73,166 thousand) for the first quarter of 2021, representing a

10.9% decrease QoQ from KRW 92,562 million and a 47.3% increase YoY

from KRW 55,982 million. The decrease QoQ resulted primarily from

decreased revenues from Ragnarok X: Next Generation in Taiwan, Hong

Kong and Macau and Ragnarok Origin in Korea. Such decrease was

partially offset by increased revenues from Tera Classic in Japan

that was launched on January 29, 2021 and Ragnarok M: Eternal Love

in Southeast Asia. The increase YoY was primarily due to revenues

from Ragnarok X: Next Generation in Taiwan, Hong Kong and Macau and

Ragnarok Origin in Korea. This increase was partially offset by

decreased revenues from Ragnarok M: Eternal Love in Taiwan,

Southeast Asia, North America, Japan, Korea and Europe and Ragnarok

Tactics.

Other revenues were KRW 3,163 million (US$ 2,807

thousand) for the first quarter of 2021, representing 29.8%

decrease QoQ from KRW 4,508 million and an 17.7% decrease YoY from

KRW 3,842 million.

Cost of Revenue

Cost of revenue was KRW 57,553 million (US$

51,080 thousand) for the first quarter of 2021, representing a

11.4% decrease QoQ from KRW 64,966 million and a 17.8% increase YoY

from KRW 48,874 million. The decrease QoQ was mainly due to

decreased commission paid for mobile game services related to

Ragnarok X: Next Generation in Taiwan, Hong Kong and Macau and

Ragnarok Origin in Korea. The increase YoY was mostly from

increased commission paid for mobile game services related to

Ragnarok X: Next Generation in Taiwan, Hong Kong and Macau and

Ragnarok Origin in Korea.

Operating Expenses

Operating expenses were KRW 19,553 million (US$

17,354 thousand) for the first quarter of 2021, representing a 2.9%

decrease QoQ from KRW 20,131 million and a 39.4% increase YoY from

KRW 14,030 million. The decrease QoQ was mainly attributable to

decreased advertising expenses for Ragnarok Origin in Korea and The

Labyrinth of Ragnarok in Southeast Asia, and research and

development expenses. The increase YoY was mostly resulted from

increased advertising expenses for Tera Classic in Japan, The

Labyrinth of Ragnarok in global and The Lord in Thailand, research

and development expenses and commission paid.

Profit Before Income Tax Expenses

Profit before income tax expenses was KRW 28,620

million (US$ 25,401 thousand) for the first quarter of 2021

compared with profit before income tax expense of KRW 26,751

million for the fourth quarter of 2020 and profit before income tax

expenses of KRW 11,250 million for the first quarter of 2020.

Net Profit

As a result of the foregoing factors, Gravity

recorded a net profit attributable to parent company of KRW 23,565

million (US$ 20,915 thousand) for the first quarter of 2021

compared with net profit attributable to parent company of KRW

15,064 million for the fourth quarter of 2020 and a net profit

attributable to parent company of KRW 9,263 million for the first

quarter of 2020.

Liquidity

The balance of cash and cash equivalents and

short-term financial instruments was KRW 194,754 million (US$

172,850 thousand) as of March 31, 2021.

Note: For convenience purposes only, the KRW

amounts have been expressed in U.S. dollars at the exchange rate of

KRW 1,126.72 to US$ 1.00, the noon buying rate in effect on March

31, 2021 as quoted by the Federal Reserve Bank of New York.

GRAVITY BUSINESS UPDATE

Ragnarok Online IP-based

Games

- Ragnarok Origin, a MMORPG mobile

game

Ragnarok Origin is being prepared for launch in

Japan in the second quarter of 2021. The closed beta test (“CBT”)

has completed on April 22 with users’ positive feedbacks.

- Ragnarok X: Next Generation, a

MMORPG mobile game

Ragnarok X: Next Generation has started the CBT

and pre-registration on April 23, 2021. The game is being prepared

for launch in Southeast Asia in June 2021.

- The Labyrinth of Ragnarok, a Time

Effective MMORPG mobile game

The Labyrinth of Ragnarok was launched in global

including Korea (except Taiwan, Hong Kong, Macau, China and Japan)

on March 23, 2021.

- Ragnarok: Poring Merge, a Time

Effective RPG

Ragnarok: Poring Merge was launched in global on

April 12, 2021.

- Other Ragnarok Online IP-based

games

The Lost Memories: a Song of Valkyrie, a Story

RPG mobile game, is expected to be launched in Thailand, North

America and global in the second half of 2021. The game was

developed by Gravity NeoCyon, Inc., our subsidiary in Korea.

Project S (Tentative title), a MMORPG mobile

game, is scheduled to start the CBT in the second half of 2021.

Other IP games

The Lord, a SRPG mobile game, is expected to be

launched in Indonesia, Vietnam, Taiwan, Hong Kong and Macau in the

second half of 2021.

CPBL Pro-baseball 2021, a Sports mobile game,

will be launched in Taiwan, Hong Kong and Macau on June 17,

2021.

Investor Presentation

Gravity issued an investor presentation. The

presentation contains the Company’s recent business updates,

results of the first quarter in 2021 and Gravity’s business plan.

The presentation can be found on the Company’s website under the IR

Archives section at http://www.gravity.co.kr/en/ir/pds/list.asp.

Korean and Japanese versions of the presentation are also provided

on the website.

About GRAVITY Co., Ltd.

---------------------------------------------------

Gravity is a developer and publisher of online

and mobile games. Gravity's principal product, Ragnarok Online, is

a popular online game in many markets, including Japan and Taiwan,

and is currently commercially offered in 93 markets and countries.

For more information about Gravity, please visit

http://www.gravity.co.kr.

Forward-Looking Statements:

Certain statements in this press release may

include, in addition to historical information, “forward-looking

statements” within the meaning of the “safe-harbor” provisions of

the U.S. Private Securities Litigation Reform Act 1995.

Forward-looking statements can generally be identified by the use

of forward-looking terminology, such as “may,” “will,” “expect,”

“intend,” “estimate,” “anticipate,” “believe”, “project,” or

“continue” or the negative thereof or other similar words, although

not all forward-looking statements contain these words. Investors

should consider the information contained in our submissions and

filings with the United States Securities and Exchange Commission

(the “SEC”), including our annual report for the fiscal year ended

December 31, 2020 on Form 20-F, together with such other documents

that we may submit to or file with the SEC from time to time, on

Form 6-K. The forward-looking statements speak only as of this

press release and we assume no duty to update them to reflect new,

changing or unanticipated events or circumstances.

Contact:

Mr. Heung Gon KimChief Financial

OfficerGravity Co., Ltd.Email: kheung@gravity.co.kr

Ms. Jin LeeMs. Hye Ji An IR UnitGravity

Co., Ltd.Email: ir@gravity.co.kr Telephone: +82-2-2132-7800

# # #

GRAVITY Co.,

Ltd.Consolidated Statements of Financial

Position

(In millions of KRW and thousands of US$)

|

|

|

As of |

|

|

|

|

31-Dec-20 |

|

|

31-Mar-21 |

|

|

|

|

KRW |

|

|

US$ |

|

|

KRW |

|

|

US$ |

|

|

|

|

(audited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

110,632 |

|

|

|

|

98,189 |

|

|

|

|

116,754 |

|

|

|

103,623 |

|

|

Short-term financial instruments |

|

|

71,000 |

|

|

|

|

63,015 |

|

|

|

|

78,000 |

|

|

|

69,227 |

|

|

Accounts receivable, net |

|

|

59,761 |

|

|

|

|

53,040 |

|

|

|

|

62,994 |

|

|

|

55,909 |

|

|

Other receivables, net |

|

|

8 |

|

|

|

|

7 |

|

|

|

|

183 |

|

|

|

162 |

|

|

Prepaid expenses |

|

|

2,238 |

|

|

|

|

1,986 |

|

|

|

|

1,989 |

|

|

|

1,765 |

|

|

Other current assets |

|

|

2,946 |

|

|

|

|

2,615 |

|

|

|

|

3,220 |

|

|

|

2,859 |

|

|

Total current assets |

|

|

246,585 |

|

|

|

|

218,852 |

|

|

|

|

263,140 |

|

|

|

233,545 |

|

|

Property and equipment, net |

|

|

7,695 |

|

|

|

|

6,830 |

|

|

|

|

8,286 |

|

|

|

7,354 |

|

|

Intangible assets, net |

|

|

3,363 |

|

|

|

|

2,985 |

|

|

|

|

3,746 |

|

|

|

3,325 |

|

|

Deferred tax assets |

|

|

3,590 |

|

|

|

|

3,186 |

|

|

|

|

2,810 |

|

|

|

2,494 |

|

|

Other non-current financial assets |

|

|

1,324 |

|

|

|

|

1,175 |

|

|

|

|

2,070 |

|

|

|

1,837 |

|

|

Other non-current assets |

|

|

2,815 |

|

|

|

|

2,498 |

|

|

|

|

1,916 |

|

|

|

1,701 |

|

|

Total assets |

|

|

265,372 |

|

|

|

|

235,526 |

|

|

|

|

281,968 |

|

|

|

250,256 |

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

52,688 |

|

|

|

|

46,762 |

|

|

|

|

47,651 |

|

|

|

42,292 |

|

|

Deferred revenue |

|

|

13,692 |

|

|

|

|

12,152 |

|

|

|

|

11,902 |

|

|

|

10,563 |

|

|

Withholdings |

|

|

2,851 |

|

|

|

|

2,530 |

|

|

|

|

2,991 |

|

|

|

2,655 |

|

|

Accrued expense |

|

|

1,365 |

|

|

|

|

1,211 |

|

|

|

|

1,261 |

|

|

|

1,119 |

|

|

Income tax payable |

|

|

9,470 |

|

|

|

|

8,405 |

|

|

|

|

8,575 |

|

|

|

7,611 |

|

|

Other current liabilities |

|

|

2,654 |

|

|

|

|

2,356 |

|

|

|

|

2,745 |

|

|

|

2,436 |

|

|

Total current liabilities |

|

|

82,720 |

|

|

|

|

73,416 |

|

|

|

|

75,125 |

|

|

|

66,676 |

|

|

Long-term deferred revenue |

|

|

101 |

|

|

|

|

90 |

|

|

|

|

185 |

|

|

|

164 |

|

|

Other non-current liabilities |

|

|

5,203 |

|

|

|

|

4,618 |

|

|

|

|

4,593 |

|

|

|

4,077 |

|

|

Total liabilities |

|

|

88,024 |

|

|

|

|

78,124 |

|

|

|

|

79,903 |

|

|

|

70,917 |

|

|

Share capital |

|

|

3,474 |

|

|

|

|

3,083 |

|

|

|

|

3,474 |

|

|

|

3,083 |

|

|

Capital surplus |

|

|

27,110 |

|

|

|

|

24,061 |

|

|

|

|

27,110 |

|

|

|

24,061 |

|

|

Other components of equity |

|

|

(1,045 |

) |

|

|

|

(927 |

) |

|

|

|

112 |

|

|

|

99 |

|

|

Retained earnings |

|

|

147,371 |

|

|

|

|

130,796 |

|

|

|

|

170,936 |

|

|

|

151,711 |

|

|

Equity attributable to owners of the Parent Company |

|

|

176,910 |

|

|

|

|

157,013 |

|

|

|

|

201,632 |

|

|

|

178,954 |

|

|

Non-controlling interest |

|

|

438 |

|

|

|

|

389 |

|

|

|

|

433 |

|

|

|

385 |

|

|

Total equity |

|

|

177,348 |

|

|

|

|

157,402 |

|

|

|

|

202,065 |

|

|

|

179,339 |

|

|

Total liabilities and equity |

|

|

265,372 |

|

|

|

|

235,526 |

|

|

|

|

281,968 |

|

|

|

250,256 |

|

* For convenience purposes only, the KRW amounts

are expressed in U.S. dollars at the rate of KRW 1,126.72 to US$

1.00, the noon buying rate in effect on March 31, 2021 as quoted by

the Federal Reserve Bank of New York.

GRAVITY Co.,

Ltd.Consolidated Statements of Comprehensive

Income

(In millions of KRW and thousands of US$ except

for share and ADS data)

|

|

|

Three months ended |

|

|

|

|

31-Dec-20 |

|

|

31-Mar-20 |

|

|

31-Mar-21 |

|

|

|

|

(KRW) |

|

|

(US$) |

|

|

(KRW) |

|

|

(US$) |

|

|

(KRW) |

|

|

(US$) |

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Online games |

|

|

15,370 |

|

|

|

|

13,641 |

|

|

|

|

13,436 |

|

|

|

|

11,925 |

|

|

|

|

19,458 |

|

|

|

|

17,270 |

|

|

|

Mobile games |

|

|

92,562 |

|

|

|

|

82,152 |

|

|

|

|

55,982 |

|

|

|

|

49,686 |

|

|

|

|

82,438 |

|

|

|

|

73,166 |

|

|

|

Other revenue |

|

|

4,508 |

|

|

|

|

4,001 |

|

|

|

|

3,842 |

|

|

|

|

3,410 |

|

|

|

|

3,163 |

|

|

|

|

2,807 |

|

|

|

Total net revenue |

|

|

112,440 |

|

|

|

|

99,794 |

|

|

|

|

73,260 |

|

|

|

|

65,021 |

|

|

|

|

105,059 |

|

|

|

|

93,243 |

|

|

|

Cost of revenue |

|

|

64,966 |

|

|

|

|

57,659 |

|

|

|

|

48,874 |

|

|

|

|

43,377 |

|

|

|

|

57,553 |

|

|

|

|

51,080 |

|

|

|

Gross profit |

|

|

47,474 |

|

|

|

|

42,135 |

|

|

|

|

24,386 |

|

|

|

|

21,644 |

|

|

|

|

47,506 |

|

|

|

|

42,163 |

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

15,708 |

|

|

|

|

13,941 |

|

|

|

|

11,007 |

|

|

|

|

9,769 |

|

|

|

|

15,508 |

|

|

|

|

13,764 |

|

|

|

Research and development |

|

|

4,358 |

|

|

|

|

3,868 |

|

|

|

|

2,872 |

|

|

|

|

2,549 |

|

|

|

|

4,009 |

|

|

|

|

3,558 |

|

|

|

Others, net |

|

|

65 |

|

|

|

|

58 |

|

|

|

|

151 |

|

|

|

|

134 |

|

|

|

|

36 |

|

|

|

|

32 |

|

|

|

Total operating expenses |

|

|

20,131 |

|

|

|

|

17,867 |

|

|

|

|

14,030 |

|

|

|

|

12,452 |

|

|

|

|

19,553 |

|

|

|

|

17,354 |

|

|

|

Operating profit |

|

|

27,343 |

|

|

|

|

24,268 |

|

|

|

|

10,356 |

|

|

|

|

9,192 |

|

|

|

|

27,953 |

|

|

|

|

24,809 |

|

|

|

Finance income(costs): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance income |

|

|

476 |

|

|

|

|

422 |

|

|

|

|

1,551 |

|

|

|

|

1,377 |

|

|

|

|

1,600 |

|

|

|

|

1,420 |

|

|

|

Finance costs |

|

|

(1,068 |

) |

|

|

|

(947 |

) |

|

|

|

(657 |

) |

|

|

|

(583 |

) |

|

|

|

(933 |

) |

|

|

|

(828 |

) |

|

|

Profit before income tax |

|

|

26,751 |

|

|

|

|

23,743 |

|

|

|

|

11,250 |

|

|

|

|

9,986 |

|

|

|

|

28,620 |

|

|

|

|

25,401 |

|

|

|

Income tax expense |

|

|

11,768 |

|

|

|

|

10,444 |

|

|

|

|

2,004 |

|

|

|

|

1,779 |

|

|

|

|

5,059 |

|

|

|

|

4,490 |

|

|

|

Profit for the year |

|

|

14,983 |

|

|

|

|

13,299 |

|

|

|

|

9,246 |

|

|

|

|

8,207 |

|

|

|

|

23,561 |

|

|

|

|

20,911 |

|

|

|

Profit attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest |

|

|

(81 |

) |

|

|

|

(71 |

) |

|

|

|

(17 |

) |

|

|

|

(15 |

) |

|

|

|

(4 |

) |

|

|

|

(4 |

) |

|

|

Owners of Parent company |

|

|

15,064 |

|

|

|

|

13,370 |

|

|

|

|

9,263 |

|

|

|

|

8,222 |

|

|

|

|

23,565 |

|

|

|

|

20,915 |

|

|

|

Earning per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Basic and diluted |

|

|

2,168 |

|

|

|

|

1.92 |

|

|

|

|

1,333 |

|

|

|

|

1.18 |

|

|

|

|

3,391 |

|

|

|

|

3.01 |

|

|

|

Weighted average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Basic and diluted |

|

|

6,948,900 |

|

|

|

|

6,948,900 |

|

|

|

|

6,948,900 |

|

|

|

|

6,948,900 |

|

|

|

|

6,948,900 |

|

|

|

|

6,948,900 |

|

|

|

Earning per ADS(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Basic and diluted |

|

|

2,168 |

|

|

|

|

1.92 |

|

|

|

|

1,333 |

|

|

|

|

1.18 |

|

|

|

|

3,391 |

|

|

|

|

3.01 |

|

|

* For convenience, the KRW amounts are expressed

in U.S. dollars at the rate of KRW 1,126.72 to US$1.00, the noon

buying rate in effect on March 31, 2021 as quoted by the Federal

Reserve Bank of New York.(1) Each ADS represents one common

share.

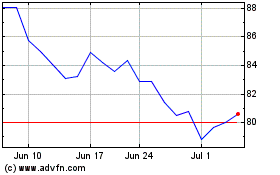

Gravity (NASDAQ:GRVY)

Historical Stock Chart

From Jun 2024 to Jul 2024

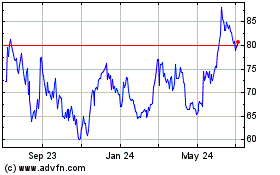

Gravity (NASDAQ:GRVY)

Historical Stock Chart

From Jul 2023 to Jul 2024