EUROPE MARKETS: Huawei Jitters Rattle European Markets

May 16 2019 - 6:29AM

Dow Jones News

By Dave Morris

European markets declined as an effective U.S. ban on Huawei

telecommunications equipment underscored the potential for ongoing

trade tensions with China.

How did markets perform?

The Stoxx 600 edged down 0.2% to 377.4. On Wednesday it climbed

0.5%.

The U.K.'s FTSE 100 was nearly flat at 7,289.7, down just 0.1%.

It closed 0.8% higher on Wednesday.

The pound ticked lower by 0.1% to $1.2833. It declined 0.4%

Wednesday.

In Germany, the DAX (DAX) sank 0.4% to 12,056.8, after

Wednesday's increase of 0.9%.

France's CAC 40 moved down 0.2% to 5,363.1. On Wednesday it

closed up 0.6%.

Italy's FTSE MIB was 0.2% lower at 20,812.2, adding to

Wednesday's fall of 0.1%.

What's moving the markets?

In a further sign that U.S. President Donald Trump is committed

to pressing China in trade negotiations, the president signed an

executive order

(http://www.marketwatch.com/story/trump-targets-huawei-in-move-to-ban-foreign-telecom-equipment-2019-05-15)declaring

a national emergency and imposing restrictions on the use of

equipment from countries considered "foreign adversaries". This has

widely been taken as a move to target Huawei. The Chinese firm

makes handsets as well as network infrastructure equipment that

companies are eyeing for the rollout of 5G networks. Huawei has

been placed on a list of entities engaged in activity contrary to

U.S. interests, due to fears it could be used by the Chinese

government as an espionage tool. The company denies it poses any

threat.

In the U.K., Prime Minister Theresa May is under renewed

pressure

(http://www.marketwatch.com/story/brexit-brief-make-or-break-moment-for-mays-leadership-as-uk-approaches-vote-on-deal-2019-05-16)

to set a date for her departure, as attempts to reach a cross party

Brexit agreement infuriated backbench Conservative MPs. May will

meet Thursday with a committee of Tory MPs who are expected to

demand that she either set a date by the end of summer or they will

move to oust her in June, though this would require a rule

change.

Which stocks are active?

Miners climbed Thursday as analysts were bullish on the

prospects for iron ore, which has been advancing since the start of

the year. In January, an accident at a Vale mine in Brazil that

caused the death of 230 people led to the company reducing supply,

sending the price higher. Analysts at Jefferies saw the price

remaining elevated based on limited supply and demand from China.

Shares in Anglo American PLC (AAL.LN) rose 2.9% BHP Group PLC

(BHP.LN) climbed 2.6% and Rio Tinto PLC (RIO.LN) also increased

2.6%.

Burberry Group PLC (BRBY.LN) sank 3.7% after reporting mediocre

full-year sales. Same-store sales rose only 2%, and pretax profit

rose 6.8% below analysts' expectations. The company appointed a new

creative director last year in an effort to shift its strategy amid

weak sales growth in the all-important Chinese market.

Ubisoft Entertainment SA (UBI.FR) plunged 13% after announcing

disappointing full year earnings as well as projections for 2020

that were lower than analysts expected. The videogame maker also

announced that the release of the pirate game Skull & Bones

would be delayed again. Videogame companies' share prices are often

heavily dependent on the timing of major titles.

(END) Dow Jones Newswires

May 16, 2019 06:14 ET (10:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

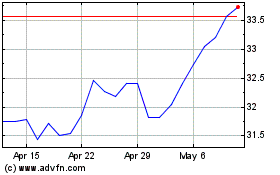

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

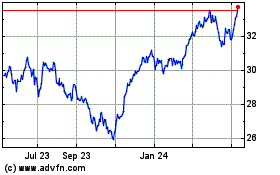

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024