MARKET SNAPSHOT: Commerzbank, Deutsche Bank Lead European Markets Higher On Merger Talk

March 18 2019 - 6:30AM

Dow Jones News

By Dave Morris

European markets were modestly higher Monday, with gains led by

the banking sector after German lenders Deutsche Bank AG and

Commerzbank AG announced Sunday that they had entered merger

discussions.

In the U.S., financial payments services provider FIS (FIS)

Worldpay Inc. (WP) in a cash and stock transaction valuing the

latter at $43 billion. In 2018, the company formerly known as

Vantiv assumed the Worldpay name when it acquired the smaller firm,

which originated in the UK.

How did the markets perform?

A modest but broad-based rally in Asia carried over into the

European session. The Stoxx Europe 600 rose 0.2% to 381.97, up from

the close of 381.10 on Friday.

Germany's DAX (DAX) was flat at 11,686.35, while France's CAC 40

gained 0.15% to 5,416.5.

The U.K.'s FTSE 100 increased 0.7% to 7,278.78, after a gain

last week of 1.8%.

An Italian index was also rising strongly, with the FTSE Italia

All-Share index up 0.7% to 23,253.

The pound fell 0.4% to $1.3254 from $1.3242 late Friday as Prime

Minister Theresa May prepared to enter talks with Northern

Ireland's Democratic Unionist Party in a last-ditch bid to save her

Brexit deal. The euro was up 0.2% to $1.1348 after ending Friday at

$1.1307.

What's driving the markets?

After a weekend light on geopolitical news, markets seemed to be

taking stock ahead of the U.S. Federal Reserve's open market

committee minutes due Wednesday, when investors will be looking for

signs of further tightening of monetary policy.

Concerns over the state of China-U.S. trade talks seemingly had

little impact, as did the threat of a third vote in the U.K.

Parliament on May's Brexit deal, which Chancellor Phillip Hammond

said was unlikely to happen unless the government thought they

could win.

Which stocks are active?

Deutsche Bank(DBK.XE) (DBK.XE) and Commerzbank (CBK.XE) led

broad gains for European financials. Deutsche Bank was up 3.8% from

Friday's close, while Commerzbank climbed 5.8% from before the

weekend.

The banks said on Sunday that they had decided to open talks on

a possible merger

(http://www.marketwatch.com/story/deutsche-bank-commerzbank-end-rumors-announce-merger-talks-2019-03-17),

following months of speculation about such a combination. Neil

Wilson, chief market analyst, told clients in a note that it

there's a risk of "creating an even larger bank, but just as a weak

bank.

"Job cuts will be essential, and the unions will be all over it.

No one really wants this but it's probably essential," said Wilson.

"This has been talked about a long time and there have been talks

before, but this looks like the only answer for Deutsche Bank as it

struggles to return to profitability."

Mining giant Rio Tinto Plc (RIO.LN) (RIO.LN) rose 2.5% after a

price target increase by Citi analysts.

(END) Dow Jones Newswires

March 18, 2019 06:15 ET (10:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

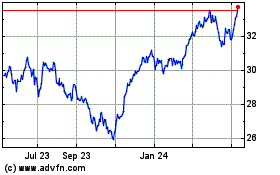

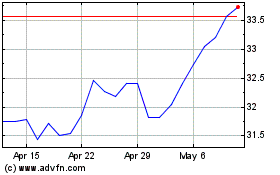

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024