EUROPE MARKETS: European Markets Mixed As Investors Wait For Vote On Revised Brexit Deal

March 12 2019 - 9:21AM

Dow Jones News

By Emily Horton

European markets were mixed on Tuesday, as investors wait for

U.K. Prime Minister Theresa May's revised Brexit deal to be

accepted or rejected by parliament.

The FTSE 100 was initially under pressure, after the pound

maintained its recent optimistic rally, but evened out later after

the pound fell.

How did markets perform?

The Stoxx Europe 600 was marginally down on Tuesday at 372.60,

after finishing up 0.8% on Monday.

After an initial gain, sterling fell midmorning on news that

might reduce U.K. Prime Minister Theresa May's chances in a key

Brexit vote due today. That in turn eased early pressure on the

FTSE 100 , which traded largely flat at 7,136.71, after finishing

up 0.3% the previous day.

The U.K. market can move inversely to sterling, because a strong

pound hurts big U.K. firms that make most of their earnings in

foreign currency.

Meanwhile, Germany's DAX (DAX)declined by 0.3% to 11,511.89 and

France's CAC 40 also declined by 0.3% to 5,251.44.

Spain's IBEX 35 lost 0.2% to 9,151.60 and Italy's FTSE MIB index

fell 0.3% to 20,581.16.

The pound declined 0.5% to $1.3085, while the euro climbed to

$1.1285 from $1.1245 late in New York on Monday.

What's driving the markets?

May's Brexit deal faces a second parliamentary vote on Tuesday,

after talks with EU officials resulted in a revised agreement

(http://www.marketwatch.com/story/may-meets-with-eu-leaders-for-last-minute-talks-before-key-brexit-vote-2019-03-11)

on Monday. However, there is skepticism over whether May's revised

deal will get through today's vote.

"One feels right now that it won't be enough to persuade

Brexiteer MPs to budge as the text seems well caveated in favor of

the EU. Comments from Labour leader Jeremy Corbyn haven't been

encouraging for May to secure the majority she needs," Neil Wilson,

chief markets analyst for Markets.com told clients in a note.

On Tuesday morning, the U.K. government's Attorney General

published legal advice saying that the concessions don't make the

material changes Brexit-backers wanted; a heavy blow to May's

hopes. Sterling fell sharply on the news, reversing its early

gains.

"Defeat for the bill is expected to pave the way for MPs to vote

on a no-deal Brexit and a possible extension of Article 50. For

now, the only thing which remains certain is that without fresh

legislation, the default position is for the U.K. to leave the EU

without a deal in a little over two weeks' time," Russ Mould

investment director at AJ Bell, told clients in a note.

What stocks are active?

U.K.-listed banks were up, with Lloyds Group PLC (LLOY.LN)

adding 1.8%, the Royal Bank of Scotland PLC (RBS.LN) rising by 2.7%

and Bank of Ireland Group PLC (BIRG.DB) climbing 3%.

House builders were also up on Tuesday, Persimmon PLC (PSN.LN)

climbed 1.7% and Taylor Wimpey PLC (TW.LN) added by 1.4%.

Ryanair Holdings PLC rose by 1.8%, after its share price took a

hit on Monday after a Boeing Co. (BA) plane crashed while flying

for Ethiopian Airlines.

Meanwhile, G4S PLC lost 3.3% after the security company

announced its pretax profit plunged 63%

(http://www.marketwatch.com/story/g4s-pretax-profit-hit-by-california-settlement-2019-03-12-34852117)

in 2018 after a costly lawsuit in California hit its balance

sheet.

Heavyweight pharmaceutical companies were also down, with

AstraZeneca PLC (AZN.LN) declining by 0.7%.

(END) Dow Jones Newswires

March 12, 2019 09:06 ET (13:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

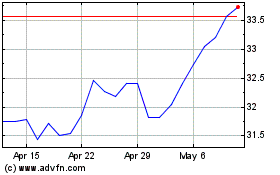

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

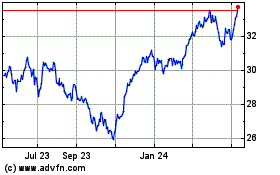

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024