EUROPE MARKETS: European Markets Drop As Strong Pound Weighs On FTSE 100 And Investors Wait For Trade Talk Clarity

February 26 2019 - 10:15AM

Dow Jones News

By Emily Horton

Europe's indexes dropped on Tuesday, with a boost in the pound

weighing on the FTSE 100, and investors waiting for clarity on

President Donald Trump's tariff deadline extension.

Results from the banking and mining sectors piled on

pressure.

How are markets performing?

The Stoxx Europe 600 lost 0.3% on Tuesday, after the index

finished up 0.3% on Monday.

The FTSE 100 was the region's biggest loser, falling 0.8% after

the British pound bounced higher to $1.3155. The pound responded

positively to news of a potential delay to Brexit and that the

leader of the U.K. opposition party, Jeremy Corbyn, said he would

support a second Brexit referendum

(http://www.marketwatch.com/story/as-brexit-clock-runs-the-pound-is-only-priced-for-a-soft-split-2019-02-25).

(http://www.marketwatch.com/story/as-brexit-clock-runs-the-pound-is-only-priced-for-a-soft-split-2019-02-25)

Since many FTSE 100 stocks earn substantial revenues outside the

country, strength in the U.K. currency can hurt the index.

France's CAC 40 dropped by 0.5% to 5,208.13, the German DAX

(DAX) lost 0.3% to 11,468.61 and Spain's IBEX 35 fell by 0.3% to

9,173.80.

Meanwhile, Italy's FTSE MIB index fared slightly better, only

losing 0.1% to 20,407.61.

The euro remained mostly flat at $1.1361.

What's driving the markets?

Other than a strong pound putting pressure on the FTSE 100,

Europe's markets responded to the latest corporate earnings in

banking and mining.

Standard Chartered PLC (STAN.LN) lost almost 2% on the news its

profits fell short of analysts' expectations

(http://www.marketwatch.com/story/standard-chartered-profit-falls-short-of-forecasts-2019-02-26).

For 2018 the bank reported a net profit of $618 million, down from

$774 million in 2017 and significantly lower than the $2.2 billion

expected by analysts polled by S&P Global Market

Intelligence.

UK-listed miner Fresnillo PLC (FRES.LN) tumbled 9% on Monday, on

the news that profit fell in 2018

(http://www.marketwatch.com/story/fresnillo-profit-down-sees-challenging-year-ahead-2019-02-26).

The miner also warned of a challenging year ahead, as the company

continues to "work through operational issues and lower grades at

certain mines during the year," Chief Executive Octavio Alvidrez

said.

Meanwhile, after Monday's market optimism over President Donald

Trump's dovish statements on a China trade deal, investors

retreated slightly, in line with Asian markets

(http://www.marketwatch.com/story/asian-markets-fall-as-trade-deal-enthusiasm-cools-ahead-of-trump-kim-summit-2019-02-25),

as they waited for more clarity on the president's

announcement.

In Germany, consumer sentiment is on track to remain stable in

March

(http://www.marketwatch.com/story/german-consumer-sentiment-seen-stable-gfk-2019-02-26)

against a backdrop of worsening economic expectation, according to

data from market-research group GfK.

What stocks are active?

Away from banking and mining, French car maker Peugeot SA

(UG.FR) lost 3% after it announced plans to relaunch in the U.S.

and Canada

(http://www.marketwatch.com/story/peugeot-to-re-enter-us-market-2019-02-26-24853843)

as part of a 10-year expansion strategy in the region.

Persimmon PLC(PSN.LN) gained 2%, subsequent to Monday's tumble,

after the U.K. house builder reported a strong profit rise for 2018

(http://www.marketwatch.com/story/persimmon-profit-up-house-completions-seen-flat-2019-02-26).

The FTSE 100 company reported a pretax profit of $1.43 billion, up

13% from the previous year.

"With these results set against strong prior year comparatives,

the numbers are. testament to the fact that the company continues

to make hay while the sun shines, whatever supply constraints may

currently be in force", Richard Hunter, head of markets at

Interactive Investor said.

In response, Taylor Wimpey PLC(TW.LN) also gained 2% and Barratt

Developments (BDEV.LN) share price rose by 1%.

Meanwhile, U.K. building-materials retailer Travis Perkins

PLC(TPK.LN) added 10% after the company beat profit expectations,

Reuters reported

(https://uk.reuters.com/article/uk-travis-perkins-results/travis-perkins-full-year-profit-beats-shares-rise-idUKKCN1QF0TM).

(END) Dow Jones Newswires

February 26, 2019 10:00 ET (15:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

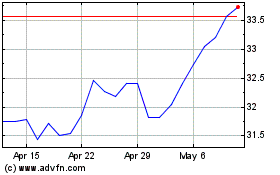

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

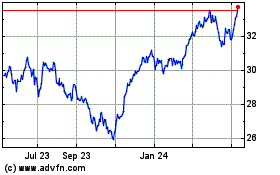

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024