UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

(Commission File No. 001-40634)

Gambling.com Group Limited

(Translation of registrant’s name into English)

22 Grenville Street

St. Helier, Jersey

JE4 8PX, Channel Islands

(Address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7):

EXPLANATORY NOTE

On August 17, 2023, Gambling.com Group Limited (NASDAQ: GAMB) (the “Company”) issued a press release announcing its financial results for the period ended June 30, 2023. A copy of the press release is furnished hereto as Exhibit 99.1 and is incorporated by reference herein.

In conjunction with the conference call being held on August 17, 2023 to discuss such financial results, the Company is furnishing a copy of the slide presentation that provides supplemental information regarding the Company’s business and its financial results, which will be referenced on such conference call. A copy of the presentation is furnished hereto as Exhibit 99.2 and is incorporated by reference herein.

The information in this Form 6-K (including in Exhibits 99.1 and 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

EXHIBIT INDEX

| | | | | | | | |

| | |

Exhibit | | Description |

| 99.1 | | |

| 99.2 | | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

| | | | | | | | |

| | |

| Gambling.com Group Limited |

| (Registrant) |

| | |

| By: | /s/ Elias Mark |

| Name: | Elias Mark |

| Title: | Chief Financial Officer |

Date: August 17, 2023

| | | | | | | | |

| PRESS RELEASE | | |

August 17, 2023 at 7:00 a.m. ET |

Gambling.com Group Revenue Grows 63% to a Q2 Record of $26.0 Million, Net Income Rises to $0.3 Million, and Adjusted EBITDA Increases to a Q2 Record of $9.4 Million

Raises 2023 Revenue Guidance to $100-$104 Million and Adjusted EBITDA Guidance to $36-$40 Million; Mid-Points Imply Revenue Growth of 33% and Adjusted EBITDA Growth of 58% over the Full Year 2022

Charlotte, N.C. – August 17, 2023 – Gambling.com Group Limited (Nasdaq: GAMB) (“Gambling.com Group” or the “Company”), a leading provider of digital marketing services for the global online gambling industry, today reported record second quarter financial results for the three months ended June 30, 2023. The Company also increased its guidance for full-year revenue and Adjusted EBITDA.

Second Quarter 2023 vs. Second Quarter 2022 Financial Highlights

(USD in thousands, except per share data, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Change | | | | |

| 2023 | | 2022 | | | | % | | | | | | |

| | | | | | | | | | | |

| Revenue | 25,972 | | | 15,924 | | | | | 63 | % | | | | | | |

Net income for the period attributable to shareholders (1) | 278 | | | 56 | | | | | 396 | % | | | | | | |

Net income per share attributable to shareholders, diluted (1) | 0.01 | | | 0.00 | | | | | 100 | % | | | | | | |

Net income margin (1) | 1 | % | | — | % | | | | | | | | | | |

Adjusted net income for the period attributable to shareholders (1)(2) | 6,535 | | | 3,065 | | | | | 113 | % | | | | | | |

Adjusted net income per share attributable to shareholders, diluted (1)(2) | 0.17 | | | 0.08 | | | | | 113 | % | | | | | | |

Adjusted EBITDA (1)(2) | 9,424 | | | 3,617 | | | | | 161 | % | | | | | | |

Adjusted EBITDA Margin (1)(2) | 36 | % | | 23 | % | | | | | | | | | | |

| Cash flows generated by operating activities | 4,586 | | | 3,368 | | | | | 36 | % | | | | | | |

Free Cash Flow (2) | 8,526 | | | 2,822 | | | | | 202 | % | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1) For the three months ended June 30, 2023, Net income and Net income per share include, and Adjusted net income and Adjusted net income per share exclude, adjustments related to the Company's 2022 acquisitions of RotoWire and BonusFinder of $6.1 million, or $0.17 per share. Similarly, these adjustments totaled $3.0 million, or $0.08, per share for the three months ended June 30, 2022. See “Supplemental Information - Non-IFRS Financial Measures” and the tables at the end of this release for an explanation of the adjustments.

(2) Represents a non-IFRS measure. See “Supplemental Information - Non-IFRS Financial Measures” and the tables at the end of this release for reconciliations to the comparable IFRS numbers.

Charles Gillespie, Chief Executive Officer and Co-Founder of Gambling.com Group, commented, “The business performed phenomenally in the second quarter with record operating results reflecting another quarter of significant organic revenue growth and strong Free Cash Flow generation. The growth highlights our success in scaling our North American operations as well as continued growth in our more established markets. New depositing customers rose 60% year-over-year to over 91,000, which helped drive a 63% revenue increase to $26.0 million, 161% growth in Adjusted EBITDA to $9.4 million, and $8.5 million of Free Cash Flow.

“Despite North America already being our largest reporting market, it still represents a significant growth opportunity for Gambling.com Group and we remain very confident in our ability to continue to increase market share in existing states as they continue to grow. This expected growth will be complemented by an overall expansion of the addressable market as new states such as North Carolina and Kentucky come online with sports betting, and iGaming is authorized in additional states. As we continue to scale our North American operations, Gambling.com Group will benefit from other attractive near- and long-term growth drivers, including valuable media partnerships with leading domestic digital media publishers, McClatchy and Gannett, and the significant long-term global opportunity provided by the recently launched Casinos.com. In addition, we are well positioned to continue growing in our more established markets where we continue to take market share and have signed our first international media partnership with The Independent for the U.K. market.

“With each quarter of consistent profitable organic growth delivered by Gambling.com Group, we are demonstrating the benefits of what we believe to be the most attractive business model in the industry as we leverage our many growth drivers and capital efficiency. Our excellence in SEO and proprietary data science allows us to consistently generate top-line growth, Adjusted EBITDA margins that exceed 30%, and strong Free Cash Flow conversion. As a result, we are confident Gambling.com Group will continue to create added value for our shareholders, clients and our valued team members.”

Second Quarter 2023 and Recent Business Highlights

•Grew North American revenue 115% to $13.4 million

•Delivered more than 91,000 new depositing customers

•Entered into first international media partnership with The Independent, one of the U.K.’s largest digital media publishers with more than 20 million unique monthly users

•Negotiated a final, deferred consideration payment of €18 million related the acquisition of BonusFinder in exchange for the early termination of the earn-out period, providing the Company with the ability to accelerate the realization of synergies

•Repurchased 77,683 ordinary shares at an average price of $9.83 per share

Elias Mark, Chief Financial Officer of Gambling.com Group, added, “The operating leverage we generated on 63% year-over-year revenue growth and 161% Adjusted EBITDA growth in the second quarter grew Free Cash Flow growth of 202% to $8.5 million. As a result, we have significant flexibility to simultaneously continue to strategically invest in growth opportunities, including the buildout of Casinos.com and the development of our media partnerships, and to evaluate strategic transactions that we believe create new shareholder value. Reflecting our strong operating results through the first six months of the year, which outperformed our expectations, and our confidence for continued strong performance over the balance of 2023, we are raising our full year revenue and Adjusted EBITDA outlook with the mid-point of the new ranges representing year-over-year growth of 33% and 58%, respectively.”

2023 Outlook

The Company raised its full-year 2023 revenue guidance to between $100 million and $104 million, and Adjusted EBITDA guidance to between $36 million and $40 million. The Company’s guidance assumes:

•Kentucky goes live on September 28th with online sports betting

•Beyond Kentucky, no online sports betting or iGaming going live in any additional North American markets for the balance of 2023

•No contribution from any new acquisitions

•New investments throughout 2023 for the development of Casinos.com and support to our media partners, including Gannett, McClatchy and The Independent

•An average EUR/USD exchange rate of 1.095 throughout the remainder of 2023

First Half 2023 vs. First Half 2022 Financial Highlights

(USD in thousands, except per share data, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Six Months Ended June 30, | | | Change |

| | | | | | | | | 2023 | | 2022 | | | % |

| | | | | | | | | | | | |

| Revenue | | | | | | | | | 52,664 | | | 35,509 | | | | 48 | % |

Net income for the period attributable to shareholders (1) | | | | | | | | | 6,873 | | | 4,542 | | | | 51 | % |

Net income per share attributable to shareholders, diluted (1) | | | | | | | | | 0.18 | | | 0.12 | | | | 50 | % |

Net income margin (1) | | | | | | | | | 13 | % | | 13 | % | | | |

Adjusted net income for the period attributable to shareholders (1)(2) | | | | | | | | | 14,086 | | | 7,551 | | | | 87 | % |

Adjusted net income per share attributable to shareholders, diluted (1)(2) | | | | | | | | | 0.37 | | | 0.21 | | | | 76 | % |

Adjusted EBITDA (1)(2) | | | | | | | | | 20,097 | | | 10,719 | | | | 87 | % |

Adjusted EBITDA Margin (1)(2) | | | | | | | | | 38 | % | | 30 | % | | | |

| Cash flows generated by operating activities | | | | | | | | | 11,669 | | | 6,944 | | | | 68 | % |

Free Cash Flow (2) | | | | | | | | | 14,732 | | | 4,186 | | | | 252 | % |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

(1) For the six months ended June 30, 2023, Net income and Net income per share include, and Adjusted net income and Adjusted net income per share exclude, adjustments related to the Company's 2022 acquisitions of RotoWire and BonusFinder of $7.0 million, or $0.19 per share. Similarly, these adjustments totaled $3.0 million, or $0.09, per share for the six months ended June 30, 2022. See “Supplemental Information - Non-IFRS Financial Measures” and the tables at the end of this release for an explanation of the adjustments.

(2) Represents a non-IFRS measure. See “Supplemental Information - Non-IFRS Financial Measures” and the tables at the end of this release for reconciliations to the comparable IFRS numbers.

Conference Call Details

| | | | | |

| Date/Time: | Thursday, August 17, 2023, at 8:00 a.m. ET |

| Webcast: | https://www.webcast-eqs.com/gamb20230817/en |

| U.S. Toll-Free Dial In: | 877-407-0890 |

| International Dial In: | +1-201-389-0918 |

To access, please dial in approximately 10 minutes before the start of the call. An archived webcast of the conference call will also be available in the News & Events section of the Company’s website at gambling.com/corporate/investors/news-events. Information contained on the Company’s website is not incorporated into this press release.

###

For further information, please contact:

Investors: Peter McGough, Gambling.com Group, investors@gdcgroup.com

Richard Land, Norberto Aja, JCIR, GAMB@jcir.com, 212-835-8500

Media: Jordan Bieber, 5W Public Relations, gdc@5wpr.com

About Gambling.com Group Limited

Gambling.com Group Limited (Nasdaq: GAMB) (the "Group") is a multi-award-winning performance marketing company and a leading provider of digital marketing services active in the online gambling industry. Founded in 2006, the Group has offices globally, primarily operating in the United States and Ireland. Through its proprietary technology platform, the Group publishes a portfolio of premier branded websites including Gambling.com, Bookies.com, Casinos.com and RotoWire.com. Gambling.com Group owns and operates more than 50 websites in seven languages across 15 national markets covering all aspects of the online gambling industry, including iGaming and sports betting, and the fantasy sports industry.

Use of Non-IFRS Measures

This press release contains certain non-IFRS financial measures, such as Adjusted Net Income, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, and related ratios. See “Supplemental Information - Non-IFRS Financial Measures” and the tables at the end of this release for an explanation of the adjustments and reconciliations to the comparable IFRS numbers.

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, that relate to our current expectations and views of future events. All statements other than statements of historical facts contained in this press release, including statements relating to our expectation of continued growth in the North American market and other established markets, whether strategic transactions will create new shareholder value, and our 2023 outlook, are all forward-looking statements. These statements represent our opinions, expectations, beliefs, intentions, estimates or strategies regarding the future, which may not be realized. In some cases, you can identify forward-looking statements by terms such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” “could,” “will,” “would,” “ongoing,” “future” or the negative of these terms or other similar expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are based largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements involve known and unknown risks, uncertainties, contingencies, changes in circumstances that are difficult to predict and other important factors that may cause our actual results, performance, or achievements to be materially and/or significantly different from any future results, performance or achievements expressed or implied by the forward-looking statement. Important factors that could cause actual results to differ materially from our expectations are discussed under “Item 3. Key Information - Risk Factors” in Gambling.com Group’s annual report filed on Form 20-F for the year ended December 31, 2022 with the U.S. Securities and Exchange Commission (the “SEC”) on March 23, 2023, and Gambling.com Group’s other filings with the SEC as such factors may be updated from time to time. Any forward-looking statements contained in this press release speak only as of the date hereof and accordingly undue reliance should not be placed on such statements. Gambling.com Group disclaims any obligation or undertaking to update or revise any forward-looking statements contained in this press release, whether as a result of new information, future events or otherwise, other than to the extent required by applicable law.

Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

(USD in thousands, except per share amounts)

The following table details the consolidated statements of comprehensive income for the three and six months ended June 30, 2023 and 2022 in the Company's reporting currency and constant currency.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reporting Currency | | | | | | | Constant Currency | | Reporting Currency | | | | | | | Constant Currency |

| Three Months Ended June 30, | | | Change | | | | | Change | | Six months ended June 30, | | | Change | | | | | Change |

| 2023 | | 2022 | | | % | | | | | | | % | | 2023 | | 2022 | | | % | | | | | | | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | 25,972 | | | 15,924 | | | | 63 | % | | | | | | | 60 | % | | 52,664 | | | 35,509 | | | | 48 | % | | | | | | | 49 | % |

| Cost of sales | (896) | | | (495) | | | | 81 | % | | | | | | | 77 | % | | (1,887) | | | (1,724) | | | | 9 | % | | | | | | | 10 | % |

| Gross profit | 25,076 | | | 15,429 | | | | 63 | % | | | | | | | 59 | % | | 50,777 | | | 33,785 | | | | 50 | % | | | | | | | 51 | % |

| Sales and marketing expenses | (8,403) | | | (8,454) | | | | (1) | % | | | | | | | (2) | % | | (16,441) | | | (15,816) | | | | 4 | % | | | | | | | 4 | % |

| Technology expenses | (2,447) | | | (1,499) | | | | 63 | % | | | | | | | 60 | % | | (4,670) | | | (2,862) | | | | 63 | % | | | | | | | 64 | % |

| General and administrative expenses | (7,286) | | | (4,804) | | | | 52 | % | | | | | | | 49 | % | | (13,067) | | | (9,632) | | | | 36 | % | | | | | | | 36 | % |

| Movements in credit losses allowance | (118) | | | (72) | | | | 64 | % | | | | | | | 60 | % | | (767) | | | (597) | | | | 28 | % | | | | | | | 29 | % |

| Fair value movement on contingent consideration | (6,087) | | | (2,849) | | | | 114 | % | | | | | | | 110 | % | | (6,939) | | | (2,849) | | | | 144 | % | | | | | | | 145 | % |

| Operating profit (loss) | 735 | | | (2,249) | | | | 133 | % | | | | | | | 132 | % | | 8,893 | | | 2,029 | | | | 338 | % | | | | | | | 340 | % |

| Finance income | 606 | | | 3,491 | | | | (83) | % | | | | | | | (83) | % | | 706 | | | 4,319 | | | | (84) | % | | | | | | | (84) | % |

| Finance expenses | (420) | | | (1,056) | | | | (60) | % | | | | | | | (61) | % | | (983) | | | (1,307) | | | | (25) | % | | | | | | | (24) | % |

| Income before tax | 921 | | | 186 | | | | 395 | % | | | | | | | 385 | % | | 8,616 | | | 5,041 | | | | 71 | % | | | | | | | 72 | % |

| Income tax charge | (643) | | | (130) | | | | 395 | % | | | | | | | 386 | % | | (1,743) | | | (499) | | | | 249 | % | | | | | | | 251 | % |

| Net income for the period attributable to shareholders | 278 | | | 56 | | | | 396 | % | | | | | | | 388 | % | | 6,873 | | | 4,542 | | | | 51 | % | | | | | | | 52 | % |

| Other comprehensive income (loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange differences on translating foreign currencies | (676) | | | (6,559) | | | | (90) | % | | | | | | | (90) | % | | 692 | | | (7,928) | | | | (109) | % | | | | | | | (109) | % |

| Total comprehensive income for the period attributable to shareholders | (398) | | | (6,503) | | | | 94 | % | | | | | | | 94 | % | | 7,565 | | | (3,386) | | | | 323 | % | | | | | | | 325 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated Statements of Financial Position (Unaudited)

(USD in thousands)

| | | | | | | | | | | |

| JUNE 30,

2023 | | DECEMBER 31,

2022 |

| ASSETS | | | |

| Non-current assets | | | |

| Property and equipment | 805 | | | 714 | |

| Right-of-use assets | 1,615 | | | 1,818 | |

| Intangible assets | 89,928 | | | 88,521 | |

| Deferred compensation cost | — | | | 29 | |

| Deferred tax asset | 6,220 | | | 5,832 | |

| Total non-current assets | 98,568 | | | 96,914 | |

| Current assets | | | |

| Trade and other receivables | 13,249 | | | 12,222 | |

| Inventories | 13 | | | 75 | |

| Cash and cash equivalents | 31,311 | | | 29,664 | |

| Total current assets | 44,573 | | | 41,961 | |

| Total assets | 143,141 | | | 138,875 | |

| EQUITY AND LIABILITIES | | | |

| Equity | | | |

| Share capital | — | | | — | |

| Capital reserve | 73,952 | | | 63,723 | |

| Treasury shares | (1,107) | | | (348) | |

| Share options and warrants reserve | 6,009 | | | 4,411 | |

| Foreign exchange translation reserve | (6,383) | | | (7,075) | |

| Retained earnings | 33,271 | | | 26,398 | |

| Total equity | 105,742 | | | 87,109 | |

| Non-current liabilities | | | |

| Other payables | — | | | 290 | |

| Deferred consideration | — | | | 4,774 | |

| Contingent consideration | — | | | 11,297 | |

| Lease liability | 1,347 | | | 1,518 | |

| Deferred tax liability | 2,212 | | | 2,179 | |

| Total non-current liabilities | 3,559 | | | 20,058 | |

| Current liabilities | | | |

| Trade and other payables | 6,896 | | | 6,342 | |

| Deferred income | 1,784 | | | 1,692 | |

| Deferred consideration | 23,380 | | | 2,800 | |

| Contingent consideration | — | | | 19,378 | |

| Other liability | 282 | | | 226 | |

| | | |

| Lease liability | 542 | | | 554 | |

| Income tax payable | 956 | | | 716 | |

| Total current liabilities | 33,840 | | | 31,708 | |

| Total liabilities | 37,399 | | | 51,766 | |

| Total equity and liabilities | 143,141 | | | 138,875 | |

Consolidated Statements of Cash Flows (Unaudited)

(USD in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Cash flow from operating activities | | | | | | | |

| Income before tax | 921 | | | 186 | | | 8,616 | | | 5,041 | |

| Finance expenses (income), net | (187) | | | (2,435) | | | 277 | | | (3,012) | |

| Adjustments for non-cash items: | | | | | | | |

| Depreciation and amortization | 480 | | | 1,952 | | | 1,025 | | | 3,778 | |

| Movements in credit loss allowance | 118 | | | 72 | | | 767 | | | 597 | |

| Fair value movement on contingent consideration | 6,087 | | | 2,849 | | | 6,939 | | | 2,849 | |

| Share-based payment expense | 1,253 | | | 885 | | | 2,099 | | | 1,609 | |

| Warrants repurchased | — | | | (800) | | | — | | | (800) | |

| Income tax paid | (1,899) | | | (783) | | | (1,789) | | | (783) | |

| Payment of contingent consideration | (4,621) | | | — | | | (4,621) | | | — | |

| | | | | | | |

| Cash flows from operating activities before changes in working capital | 2,152 | | | 1,926 | | | 13,313 | | | 9,279 | |

| Changes in working capital | | | | | | | |

| Trade and other receivables | 1,971 | | | 2,456 | | | (1,892) | | | (2,639) | |

| Trade and other payables | 401 | | | (1,014) | | | 186 | | | 304 | |

| Inventories | 62 | | | — | | | 62 | | | — | |

| | | | | | | |

| | | | | | | |

| Cash flows generated by operating activities | 4,586 | | | 3,368 | | | 11,669 | | | 6,944 | |

| Cash flows from investing activities | | | | | | | |

| Acquisition of property and equipment | (51) | | | (99) | | | (204) | | | (242) | |

| Acquisition of intangible assets | (630) | | | (447) | | | (1,354) | | | (2,516) | |

| Acquisition of subsidiaries, net of cash acquired | — | | | (4,114) | | | — | | | (23,409) | |

| Payment of deferred consideration | — | | | — | | | (2,390) | | | — | |

| Payment of contingent consideration | (5,557) | | | — | | | (5,557) | | | — | |

| Cash flows used in investing activities | (6,238) | | | (4,660) | | | (9,505) | | | (26,167) | |

| Cash flows from financing activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| Treasury shares acquired | (759) | | | — | | | (759) | | | — | |

| | | | | | | |

| Interest payment attributable to third party borrowings | — | | | — | | | — | | | (120) | |

| Interest payment attributable to deferred consideration settled | — | | | — | | | (110) | | | — | |

| Principal paid on lease liability | (94) | | | (79) | | | (199) | | | (165) | |

| Interest paid on lease liability | (40) | | | (45) | | | (87) | | | (95) | |

| Cash flows used in financing activities | (893) | | | (124) | | | (1,155) | | | (380) | |

| Net movement in cash and cash equivalents | (2,545) | | | (1,416) | | | 1,009 | | | (19,603) | |

| Cash and cash equivalents at the beginning of the period | 33,564 | | | 33,069 | | | 29,664 | | | 51,047 | |

| Net foreign exchange differences on cash and cash equivalents | 292 | | | (551) | | | 638 | | | (342) | |

| Cash and cash equivalents at the end of the period | 31,311 | | | 31,102 | | | 31,311 | | | 31,102 | |

| | | | | | | |

Earnings Per Share

Below is a reconciliation of basic and diluted earnings per share as presented in the Consolidated Statement of Comprehensive Income for the period specified, stated in USD thousands, except per share amounts:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | Reporting Currency Change | | | | | Constant Currency Change | | Six Months Ended June 30, | | | Reporting Currency Change | | | | | Constant Currency Change |

| 2023 | | 2022 | | | % | | | | | | | % | | 2023 | | 2022 | | | % | | | | | | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income for the period attributable to shareholders | 278 | | | 56 | | | | 396 | % | | | | | | | 388 | % | | 6,873 | | | 4,542 | | | | 51 | % | | | | | | | 52 | % |

| Weighted-average number of ordinary shares, basic | 37,082,794 | | 35,443,258 | | | 5 | % | | | | | | | 5 | % | | 36,757,214 | | 35,176,469 | | | 4 | % | | | | | | | 4 | % |

| Net income per share attributable to shareholders, basic | 0.01 | | | 0.00 | | | | 100 | % | | | | | | | 100 | % | | 0.19 | | | 0.13 | | | | 46 | % | | | | | | | 46 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income for the period attributable to shareholders | 278 | | | 56 | | | | 396 | % | | | | | | | 388 | % | | 6,873 | | | 4,542 | | | | 51 | % | | | | | | | 52 | % |

| Weighted-average number of ordinary shares, diluted | 38,462,183 | | 36,534,091 | | | 5 | % | | | | | | | 5 | % | | 38,123,560 | | 36,608,017 | | | 4 | % | | | | | | | 4 | % |

| Net income per share attributable to shareholders, diluted | 0.01 | | | 0.00 | | | | 100 | % | | | | | | | 100 | % | | 0.18 | | | 0.12 | | | | 50 | % | | | | | | | 50 | % |

Supplemental Information

Rounding

We have made rounding adjustments to some of the figures included in the discussion and analysis of our financial condition and results of operations together with our consolidated financial statements and the related notes thereto. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

Non-IFRS Financial Measures

Management uses several financial measures, both IFRS and non-IFRS financial measures in analyzing and assessing the overall performance of the business and for making operational decisions.

Adjusted Net Income and Adjusted Net Income Per Share

Adjusted net income is a non-IFRS financial measure defined as net income attributable to equity holders excluding the fair value gain or loss related to contingent consideration, unwinding of deferred consideration, and certain employee bonuses related to acquisitions. Adjusted net income per diluted share is a non-IFRS financial measure defined as adjusted net income attributable to equity holders divided by the diluted weighted average number of common shares outstanding.

We believe adjusted net income and adjusted net income per diluted share are useful to our management as a measure of comparative performance from period to period as these measures remove the effect of the fair value gain or loss related to the contingent consideration, unwinding of deferred consideration, and certain employee bonuses, all associated with our acquisitions, during the limited period where these items are incurred. We expect to incur gains or losses related to the contingent consideration and expenses related to the unwinding of deferred consideration and employee bonuses until December 2023. See Note 5 of the

consolidated financial statements for the three months ended June 30, 2023 for a description of the contingent and deferred considerations associated with our acquisitions.

Below is a reconciliation to Adjusted net income attributable to equity holders and Adjusted net income per share, diluted from net income for the period attributable to the equity holders and net income per share attributed to ordinary shareholders, diluted as presented in the Consolidated Statements of Comprehensive Income (Loss) and for the period specified stated in the Company's reporting currency and constant currency:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reporting Currency | | | | | | Constant Currency | Reporting Currency | | | | | | Constant Currency |

| Three Months Ended June 30, | | | | Change | | | | | Change | Six Months Ended June 30, | | | | Change | | | | | Change |

| 2023 | | 2022 | | | | % | | | | | | % | 2023 | | 2022 | | | | % | | | | | | % |

| | | | | | | | | | | | | | | | | | | | |

| Revenue | 25,972 | | 15,924 | | | | 63 | % | | | | | | 60 | % | 52,664 | | 35,509 | | | | 48 | % | | | | | | 49 | % |

| Net income for the period attributable to shareholders | 278 | | 56 | | | | 396 | % | | | | | | 388 | % | 6,873 | | 4,542 | | | | 51 | % | | | | | | 52 | % |

| Net income margin | 1 | % | | — | % | | | | | | | | | | | 13 | % | | 13 | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income for the period attributable to shareholders | 278 | | 56 | | | | 396 | % | | | | | | 388 | % | 6,873 | | 4,542 | | | | 51 | % | | | | | | 52 | % |

| Fair value movement on contingent consideration (1) | 6,087 | | 2,849 | | | | 114 | % | | | | | | 110 | % | 6,939 | | 2,849 | | | | 144 | % | | | | | | 145 | % |

| Unwinding of deferred consideration (1) | 55 | | 160 | | | | (66) | % | | | | | | (66) | % | 109 | | 160 | | | | (32) | % | | | | | | (31) | % |

Employees' bonuses related to acquisition(1) | 115 | | 0 | | | | 100 | % | | | | | | 100 | % | 165 | | 0 | | | | 100 | % | | | | | | 100 | % |

| Adjusted net income for the period attributable to shareholders | 6,535 | | 3,065 | | | | 113 | % | | | | | | 109 | % | 14,086 | | 7,551 | | | | 87 | % | | | | | | 87 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income per share attributable to shareholders, basic | 0.01 | | 0.00 | | | | 100 | % | | | | | | 100 | % | 0.19 | | 0.13 | | | | 46 | % | | | | | | 46 | % |

| Effect of adjustments for fair value movements on contingent consideration, basic | 0.16 | | 0.08 | | | | 100 | % | | | | | | 100 | % | 0.19 | | 0.08 | | | | 138 | % | | | | | | 138 | % |

| Effect of adjustments for unwinding on deferred consideration, basic | 0.00 | | 0.00 | | | | — | % | | | | | | — | % | 0.00 | | 0.00 | | | | — | % | | | | | | — | % |

| Effect of adjustments for bonuses related to acquisition, basic | 0.00 | | 0.00 | | | | — | % | | | | | | — | % | 0.00 | | 0.00 | | | | — | % | | | | | | — | % |

| Adjusted net income per share attributable to shareholders, basic | 0.18 | | 0.09 | | | | 100 | % | | | | | | 100 | % | 0.38 | | 0.21 | | | | 81 | % | | | | | | 81 | % |

| Net income per share attributable to ordinary shareholders, diluted | 0.01 | | 0.00 | | | | 100 | % | | | | | | 100 | % | 0.18 | | 0.12 | | | | 50 | % | | | | | | 50 | % |

| Adjusted net income per share attributable to shareholders, diluted | 0.17 | | 0.08 | | | | 113 | % | | | | | | 89 | % | 0.37 | | 0.21 | | | | 76 | % | | | | | | 76 | % |

(1) There is no tax impact from fair value movement on contingent consideration, unwinding of deferred consideration or employee bonuses related to acquisition.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin

EBITDA is a non-IFRS financial measure defined as earnings excluding interest, income tax (charge) credit, depreciation, and amortization. Adjusted EBITDA is a non-IFRS financial measure defined as EBITDA adjusted to exclude the effect of non-recurring items, significant non-cash items, share-based payment expense, foreign exchange gains (losses), fair value of contingent consideration, and other items that our board of directors

believes do not reflect the underlying performance of the business including acquisition related expenses, such as acquisition related costs and bonuses. Adjusted EBITDA Margin is a non-IFRS measure defined as Adjusted EBITDA as a percentage of revenue.

We believe Adjusted EBITDA and Adjusted EBITDA Margin are useful to our management team as a measure of comparative operating performance from period to period as those measures remove the effect of items not directly resulting from our core operations including effects that are generated by differences in capital structure, depreciation, tax effects and non-recurring events.

While we use Adjusted EBITDA and Adjusted EBITDA Margin as tools to enhance our understanding of certain aspects of our financial performance, we do not believe that Adjusted EBITDA and Adjusted EBITDA Margin are substitutes for, or superior to, the information provided by IFRS results. As such, the presentation of Adjusted EBITDA and Adjusted EBITDA Margin is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with IFRS. The primary limitations associated with the use of Adjusted EBITDA and Adjusted EBITDA Margin as compared to IFRS results are that Adjusted EBITDA and Adjusted EBITDA Margin as we define them may not be comparable to similarly titled measures used by other companies in our industry and that Adjusted EBITDA and Adjusted EBITDA Margin may exclude financial information that some investors may consider important in evaluating our performance.

Below is a reconciliation to EBITDA, Adjusted EBITDA from net income for the period attributable to shareholders as presented in the Consolidated Statements of Comprehensive Income and for the period specified:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reporting Currency | | | | Constant Currency | | Reporting Currency | | | | Constant Currency |

| Three Months Ended June 30, | | | | Change | | | | Change | | Six Months Ended June 30, | | | | Change | | | | Change |

| 2023 | | 2022 | | | | % | | | | % | | 2023 | | 2022 | | | | % | | | | % |

| (USD in thousands) | | | | | | | | | (USD in thousands) | | | | | | | |

| Net income for the period attributable to shareholders | 278 | | 56 | | | | 396 | % | | | | 388 | % | | 6,873 | | 4,542 | | | | 51 | % | | | | 52 | % |

| Add back (deduct): | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expenses on borrowings and lease liability | 44 | | | 185 | | | | | (76) | % | | | | (77) | % | | 87 | | | 355 | | | | | (75) | % | | | | (75) | % |

| Income tax charge | 643 | | | 130 | | | | | 395 | % | | | | 386 | % | | 1,743 | | | 499 | | | | | 249 | % | | | | 251 | % |

| Depreciation expense | 63 | | | 44 | | | | | 43 | % | | | | 41 | % | | 120 | | | 87 | | | | | 38 | % | | | | 39 | % |

| Amortization expense | 417 | | | 1,908 | | | | | (78) | % | | | | (79) | % | | 905 | | | 3,691 | | | | | (75) | % | | | | (75) | % |

| EBITDA | 1,445 | | | 2,323 | | | | | (38) | % | | | | (39) | % | | 9,728 | | | 9,174 | | | | | 6 | % | | | | 7 | % |

| Share-based payment expense | 1,253 | | | 885 | | | | | 42 | % | | | | 39 | % | | 2,099 | | | 1,609 | | | | | 30 | % | | | | 31 | % |

| Fair value movement on contingent consideration | 6,087 | | | 2,849 | | | | | 114 | % | | | | 110 | % | | 6,939 | | | 2,849 | | | | | 144 | % | | | | 145 | % |

| Unwinding of deferred consideration | 55 | | | 160 | | | | | (66) | % | | | | (66) | % | | 109 | | | 160 | | | | | (32) | % | | | | (32) | % |

| Foreign currency translation losses (gains), net | (303) | | | (2,833) | | | | | (89) | % | | | | (90) | % | | 24 | | | (3,606) | | | | | (101) | % | | | | (101) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Other finance results | 18 | | | 53 | | | | | (66) | % | | | | (67) | % | | 57 | | | 79 | | | | | (28) | % | | | | (27) | % |

| Secondary offering related costs | 733 | | | — | | | | | 100 | % | | | | 100 | % | | 733 | | | — | | | | | 100 | % | | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Acquisition related costs (1) | 21 | | | 180 | | | | | (88) | % | | | | (89) | % | | 243 | | | 454 | | | | | (46) | % | | | | (46) | % |

| Employees' bonuses related to acquisition | 115 | | | — | | | | | 100 | % | | | | 100 | % | | 165 | | | — | | | | | 100 | % | | | | 100 | % |

| Adjusted EBITDA | 9,424 | | | 3,617 | | | | | 161 | % | | | | 156 | % | | 20,097 | | | 10,719 | | | | | 87 | % | | | | 89 | % |

(1) The acquisition costs are related to historical and potential business combinations of the Group.

Below is the Adjusted EBITDA Margin calculation for the period specified stated in the Company's reporting currency and constant currency:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reporting Currency | | | | Constant Currency | | Reporting Currency | | | | Constant Currency |

| Three Months Ended June 30, | | | | Change | | | | Change | | Six Months Ended June 30, | | | | Change | | | | Change |

| 2023 | | 2022 | | | | % | | | | % | | 2023 | | 2022 | | | | % | | | | % |

| (USD in thousands, except margin) | | | | | | | | | (in thousands USD, except margin) | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | 25,972 | | 15,924 | | | | 63 | % | | | | 60 | % | | 52,664 | | 35,509 | | | | 48 | % | | | | 49 | % |

| Adjusted EBITDA | 9,424 | | 3,617 | | | | 161 | % | | | | 156 | % | | 20,097 | | 10,719 | | | | 87 | % | | | | 89 | % |

| Adjusted EBITDA Margin | 36 | % | | 23 | % | | | | | | | | | | 38 | % | | 30 | % | | | | | | | | |

In regard to forward looking non-IFRS guidance, we are not able to reconcile the forward-looking non-IFRS Adjusted EBITDA measure to the closest corresponding IFRS measure without unreasonable efforts because we are unable to predict the ultimate outcome of certain significant items including, but not limited to, fair value movements, share-based payments for future awards, acquisition-related expenses and certain financing and tax items.

Free Cash Flow

Free Cash Flow is a non-IFRS liquidity financial measure defined as cash flow from operating activities adjusted for non-recurring items within operating cash flow less capital expenditures.

We believe Free Cash Flow is useful to our management team as a measure of financial performance as it measures our ability to generate additional cash from our operations. While we use Free Cash Flow as a tool to enhance our understanding of certain aspects of our financial performance, we do not believe that Free Cash Flow is a substitute for, or superior to, the information provided by IFRS metrics. As such, the presentation of Free Cash Flow is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with IFRS.

The primary limitation associated with the use of Free Cash Flow as compared to IFRS metrics is that Free Cash Flow does not represent residual cash flows available for discretionary expenditures because the measure does not deduct the payments required for debt service and other obligations or payments made for business acquisitions. Free Cash Flow as we define it also may not be comparable to similarly titled measures used by other companies in the online gambling affiliate industry.

Below is a reconciliation to Free Cash Flow from cash flows generated by operating activities as presented in the Consolidated Statement of Cash Flows for the period specified in the Company's reporting currency:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Change | | Six Months Ended June 30, | | | | Change |

| 2023 | | 2022 | | | | % | | 2023 | | 2022 | | | | % |

| (in thousands USD, unaudited) | | | | | | (USD in thousands, unaudited) | | | | |

| Cash flows generated by operating activities | 4,586 | | | 3,368 | | | | | 36 | % | | 11,669 | | | 6,944 | | | | | 68 | % |

Payment of contingent consideration | 4,621 | | | — | | | | | 100 | % | | 4,621 | | | — | | | | | 100 | % |

Capital Expenditures (1) | (681) | | | (546) | | | | | 25 | % | | (1,558) | | | (2,758) | | | | | 44 | % |

| Free Cash Flow | 8,526 | | | 2,822 | | | | | 202 | % | | 14,732 | | | 4,186 | | | | | 252 | % |

(1) Capital expenditures are defined as the acquisition of property and equipment and the acquisition of intangible assets, and excludes cash flows related to business combinations.

Second Quarter 2023 Financial Results Call August 17, 2023 CONFIDENTIAL & PRIVATE

2 Safe Harbor Statement This presentation and any accompany ing oral presentation includes f orward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the saf e harbor prov isions of the U.S. Private Securities Litigation Reform Act of 1995, that relate to our current expectations and views of future events. All statements other than statements of historical facts contained in this presentation, including our 2023 outlook, are forward-looking statements. These statements represent our opinions, expectations, beliefs, intentions, estimates or strategies regarding the future, which may not be realized. In some cases, you can identify forward-looking statements by terms such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” “could,” “will,” “would,” “ongoing,” “future” or the negative of these terms or other similar expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are based largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements involve known and unknown risks, uncertainties, contingencies, changes in circumstances that are difficult to predict and other important factors that may cause our actual results, performance or achievements to be materially and/or significantly different from any future results, performance or achievements expressed or implied by the forward-looking statement. Such risks uncertainties, contingencies, and changes in circumstances are discussed under “Item 3. Key Information - Risk Factors” in our annual report filed on Form 20 -F for the year ended December 31, 2022 with the US Securities and Exchange Commission (the “SEC”) on March 23, 2023, and our other filings with the SEC as such factors may be updated from time to time. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward -looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. We caution you therefore against relying on these forward-looking statements, and we qualify all of our f orward-looking statements by these cautionary statements. The f orward-looking statements included in this presentation are made only as of the date hereof . Although we believ e that the expectations ref lected in the f orward-looking statements are reasonable, we cannot guarantee that the f uture results, lev els of activity, perf ormance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor our advisors nor any other person assumes responsibility for the accuracy and completeness of the forward -looking statements. Neither we nor our advisors undertake any obligation to revise, supplement or update any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations, even if new information becomes available in th e future, except as may be required by law. You should read this presentation with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect. Unless otherwise indicated, inf ormation contained in this presentation concerning our industry , competitiv e position and the markets in which we operate is based on inf ormation f rom independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, ass umptions and estimates of the future performance of the industry in which we operate and our f uture perf ormance are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by us. Industry publications, research, surveys and studies generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this presentation. The trademarks included herein are the property of the owners thereof and are used f or ref erence purposes only . Non-IFRS Financial Measures - Management uses sev eral f inancial measures, both IFRS and non-IFRS f inancial measures, in analy zing and assessing the ov erall perf ormance of the business and f or making operational decisions. Adjusted Operating Expense is a non-IFRS measure def ined as operating expense excluding the f air v alue gain or loss related to contingent consideration. Adjusted Operating Prof it is a non-IFRS f inancial measure def ined as operating prof it excluding the f air v alue gain or loss related to the contingent consideration. Adjusted Net Income is a non-IFRS f inancial measure def ined as net income attributable to equity holders excluding the f air v alue gain or loss related to contingent consideration and unwinding of def erred consideration. Adjusted net income per diluted share is a non- IFRS financial measure defined as adjusted net income attributable to equity holders divided by the diluted weighted average number of common shares outstanding. EBITDA is a non-IFRS f inancial measure def ined as earnings excluding interest, income tax charge, depreciation, and amortization. Adjusted EBITDA is a non-IFRS f inancial measure def ined as EBITDA adjusted to exclude the ef f ect of non-recurring items, signif icant non- cash items, share-based payment expense and other items that our board of directors believes do not reflect the underlying performance of the business. Adjusted EBITDA Margin is a non-IFRS measure defined as Adjusted EBITDA as a percentage of revenue. We believe EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are useful to our management team as a measure of comparative operating performance from period to period as those measures remove the effect of items not directly resulting from our core operations including effects that are generated by differences in capital structure, depreciation, tax effects and non-recurring events. While we use EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin as tools to enhance our understanding of certain aspects of our financial performance, we do not believe that EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are substitutes for, or superior to, the information provided by IFRS results. As such, the presentation of EBITDA, Adjusted EBITDA and Adjus ted EBITDA Margin is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with IFRS. The primary limitations associated with the use of EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin as compared to IFRS results are that EBITDA, Adjusted EBITDA and Ad justed EBITDA Margin as we define them may not be comparable to similarly titled measures used by other companies in our industry and that EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin may exclude financial information that some investors may consider important in evaluating our performance. With regards to forward-looking non-IFRS guidance, we are not able to reconcile the forward looking non-IFRS Adjusted EBITDA measure to the closest corresponding IFRS measure without unreasonable efforts because we are unable to predict the ultimate outcome of certain significant items including, but not limited to, fair value movements, share-based payments for future awards, acquisition-related expenses and certain financing and tax items. Free Cash Flow is a non-IFRS f inancial measure def ined as cash f low f rom operating activ ities less capital expenditures, or CAPEX. We believ e Free Cash Flow is usef ul to our management as a measure of f inancial perf ormance as it measures our ability to generate additional cash from our operations. While we use Free Cash Flow as a tool to enhance our understanding of certain aspects of our financ ial performance, we do not believe that Free Cash Flow is a substitute for, or superior to, the information provided by IFRS metrics. As such, the presentation of Free Cash Flow is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with IFRS. The primary limitation associated with the use of Free Cash Flow as compared to IFRS metrics is that Free Cash Flow does no t represent residual cash flows available for discretionary expenditures due to the f act that the measure does not deduct the pay ments required f or debt serv ice and other obligations or pay ments made f or business acquisitions. Free Cash Flow as we def ine it also may not be comparable to similarly titled measures used by other companies in the online gambling affiliate industry. For more inf ormation about non-IFRS inf ormation in this presentation, see the tables at the end of this presentation under “Appendix: Financial Tables” f or reconciliations to the comparable IFRS numbers .

3 Second Quarter Highlights (1) Represents a non-IFRS financial measure. See ”Safe Harbor Statement - Non-IFRS Financial Measures” and the tables at the end of this presentation under “Appendix: Financial Tables” for reconciliations to the comparable IFRS numbers • Total revenue grew 63% to $26 million • Adjusted EBITDA(1)of $9.4 million and an Adjusted EBITDA Margin of 36%(1) • Free cash flow(1) of $8.5 million • New depositing customers (NDCs) increased 60% to more than 91,000 compared to 57,000 in Q2 2022 • Signed media partnership with The Independent (UK) $10.4m $16m $26m 2021 2022 2023 Q2 Historic Revenue 26,000 57,000 91,000 2021 2022 2023 Q2 Historic NDCs

4 Second Quarter Drivers • North American revenue grew 115% to $13.4 million • UK and Ireland revenue increased 25% year- over-year • Strength in I-casino in North America and Europe continued • Outperformance of the North American sports business

5 Q2 2023 Financial Results(1) (1) This table contains non-IFRS financial measures. See ”Safe Harbor Statement - Non-IFRS Financial Measures” and the tables at the end of this presentation under “Appendix: Financial Tables” for reconciliations to the comparable IFRS numbers. IH/2023 2023 2022 Change Revenue (millions) $26.0 $15.9 63% Cost of Sales (millions) $0.9 $0.5 81% Operating Expense (millions) $24.3 $17.7 38% Operating Profit (millions) $0.7 $(2.2) 133% Net Income (millions) $0.3 $0.1 396% Net Income per Diluted Share $0.01 $0.00 100% Net Income Margin (% of Revenue) 1% —% Adjusted Net Income (millions) $6.5 $3.1 113% Adjusted Net Income per Diluted Share $0.17 $0.08 113% Adjusted EBITDA (millions) $9.4 $3.6 161% Adjusted EBITDA Margin (% of Revenue) 36% 23% Cash from Operations (millions) $4.6 $3.5 36% Free Cash Flow (millions) $8.5 $2.8 202% New Depositing Customers (thousands) 91 57 60%

6 First Half 2023 Financial Results(1) (1) This table contains non-IFRS financial measures. See ”Safe Harbor Statement - Non-IFRS Financial Measures” and the tables at the end of this presentation under “Appendix: Financial Tables” for reconciliations to the comparable IFRS numbers. 2023 2022 Change Revenue (millions) $52.7 $35.5 48% Cost of Sales (millions) $1.9 $1.7 9% Operating Expense (millions) $41.9 $31.8 32% Operating Profit (millions) $8.9 $2.0 338% Net Income (millions) $6.8 $4.5 51% Net Income per Diluted Share $0.18 $0.12 50% Net Income Margin (% of Revenue) 13% 13% Adjusted Net Income (millions) $14.1 $7.6 87% Adjusted Net Income per Diluted Share $0.37 $0.21 76% Adjusted EBITDA (millions) $20.1 $10.7 87% Adjusted EBITDA Margin (% of Revenue) 38% 30% Cash from Operations (millions) $11.7 $6.9 68% Free Cash Flow (millions) $14.7 $4.2 252% New Depositing Customers (thousands) 180 124 45%

7 FY 2023 Outlook(1) • For 2023, revenue is expected to be in the range of $100-104 million, which implies growth of 31-36% • For 2023, Adjusted EBITDA is expected to be in the range of $36-40 million, which implies growth of 49-66% Low Midpoint High FY 2022 Revenue (millions) $100 $102 $104 $76.5 Adjusted EBITDA (millions) $36 $38 $40 $24.1 Adjusted EBITDA Margin (% of Revenue) 36% 37% 38% 31% (1) This page contains non-IFRS financial measures. See ”Safe Harbor Statement - Non-IFRS Financial Measures” and the tables at the end of this presentation under “Appendix: Financial Tables” for reconciliations to the comparable IFRS numbers.

8CONFIDENTIAL & PRIVATE Appendix: Financial Tables

9 Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited) (USD in thousands, except per share amounts) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Revenue 25,972 15,924 52,664 35,509 Cost of sales (896) (495) (1,887) (1,724) Gross profit 25,076 15,429 50,777 33,785 Sales and marketing expenses (8,403) (8,454) (16,441) (15,816) Technology expenses (2,447) (1,499) (4,670) (2,862) General and administrative expenses (7,286) (4,804) (13,067) (9,632) Movements in credit losses allowance (118) (72) (767) (597) Fair value movement on contingent consideration (6,087) (2,849) (6,939) (2,849) Operating profit (loss) 735 (2,249) 8,893 2,029 Finance income 606 3,491 706 4,319 Finance expenses (420) (1,056) (983) (1,307) Income before tax 921 186 8,616 5,041 Income tax charge (643) (130) (1,743) (499) Net income for the period attributable to shareholders 278 56 6,873 4,542 Other comprehensive (loss) income Exchange differences on translating foreign currencies (676) (6,559) 692 (7,928) Total comprehensive (loss) income for the period attributable to the shareholders (398) (6,503) 7,565 (3,386) Net income per share attributable to shareholders, basic 0.01 0.00 0.19 0.13 Net income per share attributable to shareholders, diluted 0.01 0.00 0.18 0.12

10 Condensed Consolidated Statements of Financial Position (USD in thousands) June 30th, 2023 June 30th, 2022 Non-current assets Property and equipment 805 714 Right-of-use assets 1,615 1,818 Intangible assets 89,928 88,521 Deferred compensation cost — 29 Deferred tax asset 6,220 5,832 Total non-current assets 98,568 96,914 Current assets Trade and other receivables 13,249 12,222 Inventories 13 75 Cash and cash equivalents 31,311 29,664 Total current assets 44,573 41,961 Total assets 143,141 138,875 EQUITY AND LIABILITIES Equity Share capital — — Capital reserve 73,952 63,723 Share options and warrants reserve 6,009 4411 Foreign exchange translation reserve (6,383) (7,075) Retained earnings 33,271 26,398 Total equity 105,742 87,109 Non-current liabilities Other payables — 290 Deferred consideration — 4,774 Contingent consideration — 11,297 Lease liability 1,347 1,518 Deferred tax liability 2,212 2,179 Total non-current liabilities 3,559 20,058 Current liabilities Trade and other payables 6,896 6,342 Deferred income 1,784 1,692 Deferred consideration 23,380 2,800 Contingent consideration — 19,378 Other liability 282 226 Lease liability 542 554 Income tax payable 956 716 Total current liabilities 33,840 31,708 Total liabilities 37,399 51,766 Total equity and liabilities 143,141 138,875

11 Condensed Consolidated Statements of Cash Flows (Unaudited) (USD in thousands) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Cash flow from operating activities Income before tax 921 186 8,616 5,041 Finance expenses (income), net (187) (2,435) 277 (3,012) Adjustments for non-cash items: Depreciation and amortization 480 1,952 1,025 3,778 Movements in credit loss allow ance 118 72 767 597 Fair value movement on contingent consideration 6,087 2,849 6,939 2,849 Share-based payment expense 1,253 885 2,099 1,609 Warrants repurchased — (800) — (800) Income tax paid (1,899) (783) (1,789) (783) Payment of contingent consideration (4,621) — (4,621) — Cash flow s from operating activities before changes in w orking capital 2,152 1,926 13,313 9,279 Changes in w orking capital Trade and other receivables 1,971 2,549 (1,892) (2,639) Trade and other payables 401 (1,014) 186 304 Inventories 62 — 62 — Cash flows generated by operating activities 4,586 3,368 11,669 6,944 Cash flows from investing activities Acquisition of property and equipment (51) (99) (204) (242) Acquisition of intangible assets (630) (447) (1,354) (2,516) Acquisition of subsidiaries, net of cash acquired — (4,114) — (23,409) Payment of deferred consideration — — (2,390) — Payment of contingent consideration (5,557) — (5,557) — Cash flows used in investing activities (6,238) (4,660) (9,505) (26,167) Cash flows from financing activities Treasury shares acquired (759) — (759) — Interest payment attributable to third party borrowings — — — (120) Interest payment attributable to deferred consideration settled — — (110) — Principal paid on lease liability (94) (79) (199) (165) Interest paid on lease liability (40) (45) (87) (95) Cash flows used in financing activities (893) (124) (1,155) (380) Net movement in cash and cash equivalents (2,545) (1,416) 1,009 (19,603) Cash and cash equivalents at the beginning of the period 33,564 33,069 29,664 51,047 Net foreign exchange differences on cash and cash equivalents 292 (551) 638 (342) Cash and cash equivalents at the end of the period 31,311 31,102 31,311 31,102

12 Earnings Per Share Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 (in thousands USD, except for share and per share data, unaudited) (in thousands USD, except for share and per share data, unaudited) Net income for the period attributable to shareholders 278 56 6,873 4,542 Weighted-average number of ordinary shares, basic 37,082,794 35,443,258 36,757,214 35,176,469 Net income per share attributable to shareholders, basic 0.01 0 0.19 0.13 Net income for the period attributable to shareholders 278 56 6,873 4,542 Weighted-average number of ordinary shares, diluted 38,462,183 36,534,091 38,123,560 36,608,017 Net income per share attributable to shareholders, diluted 0.01 0.00 0.18 0.12

13 Adjusted Net Income and Adjusted Net Income Per Share Reconciliation 1) There is no tax impact from fair value movement on contingent consideration, unwinding of deferred consideration or employee bonuses related to acquisition. Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 (in thousands USD, except f or share and per share data, unaudited) (in thousands USD, except f or share and per share data, unaudited) Rev enue 25,972 15,924 52,664 35,509 Net income f or the period attributable to shareholders 278 56 6,873 4,542 Net income margin 1% — % 13% 13% Net income f or the period attributable to shareholders 278 56 6,873 4,542 Fair v alue mov ement on contingent consideration (1) 6,087 2,849 6,939 2,849 Unwinding of def erred consideration (1) 55 160 109 160 Employ ees' bonuses related to acquisition 115 0 165 0 Adjusted net income f or the period attributable to shareholders 6,535 3,065 14,086 7,551 Weighted-av erage number of ordinary shares, basic 37,082,794 35,443,258 36,757,214 35,176,469 Net income per share attributable to shareholders, basic 0.01 0 0.19 0.13 Ef f ect of adjustments f or fair v alue mov ements on contingent consideration, basic 0.16 0.08 0.19 0.08 Ef f ect of adjustments f or unwinding on def erred consideration, basic 0 0 0 0 Ef f ect of adjustments f or bonuses related to acquisition, basic 0 0 0 0 Adjusted net income per share attributable to shareholders, basic 0.18 0.09 0.38 0.21 Weighted-av erage number of ordinary shares, diluted 38,462,183 36,534,091 38,123,560 36,608,017 Net income per share attributable to ordinary shareholders, diluted 0.01 0 0.18 0.12 Adjusted net income per share attributable to shareholders, diluted 0.17 0.08 0.37 0.21

14 EBITDA and Adjusted EBITDA Reconciliation n/m = not meaningful 1. The acquisition costs are related to the business combinations of the Group. Three Months Ended June 30, Change Six Months Ended June 30, Change 2023 2022 % 2023 2022 % (in thousands USD, unaudited) (in thousands USD, unaudited) Net income for the period attributable to shareholders 278 56 396 % 6,873 4,542 51 % Add back (deduct): Interest expenses on borrowings 44 185 (76) % 87 355 (75) % Income tax charge 643 130 395 % 1,743 499 249 % Depreciation expense 63 44 43 % 120 87 38 % Amortization expense 417 1,908 (78) % 905 3,691 (75) % EBITDA 1,445 2,323 (38) % 9,728 9,174 6 % Share-based payment expense 1,253 885 42 % 2,099 1,609 30 % Unwinding of deferred consideration 55 160 (66) % 109 160 (32) % Fair value movement on contingent consideration 6,087 2,849 114 % 6,939 2,849 144 % Foreign currency translation losses (gains), net (303) (2,833) (89) % 24 (3,606) (101) % Secondary offering related costs 733 — 100 % 733 — 100 % Other finance results 18 53 (66) % 57 79 (28) % Acquisition related costs (1) 21 180 (88) % 243 454 (46) % Employees' bonuses related to acquisition 115 — 100 % 165 — 100 % Adjusted EBITDA 9,424 3,617 161 % 20,097 10,719 87 %

15 Adjusted EBITDA Margin Reconciliation Three Months Ended June 30, Change Six Months Ended June 30, Change 2023 2022 % 2023 2022 % (in thousands USD, unaudited) (in thousands USD, unaudited) Revenue 25,972 15,924 63 % 52,664 35,509 48 % Adjusted EBITDA 9,424 3,617 161 % 20,097 10,719 87 % Adjusted EBITDA Margin 36 % 23 % 38 % 30 %

16 Free Cash Flow Reconciliation (1) Capital expenditures are defined as the acquisition of property and equipment and the acquisition of intangible assets and excludes cash flows related to business combinations. Three Months Ended June 30, Change Six Months Ended June 30, Change 2023 2022 % 2023 2022 % (in thousands USD, unaudited) (in thousands USD, unaudited) Cash flows generated by operating activities 4,586 3,461 33 % 11,669 6,944 68 % Payment of contingent consideration 4,621 — 100 % 4,621 — 100 % Capital Expenditures (1) (681) (546) 25 % (1,558) (2,758) 44 % Free Cash Flow 8,526 2,915 192 % 14,732 4,186 252 %

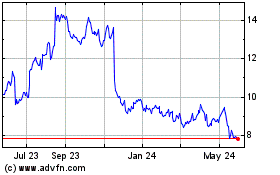

Gambling com (NASDAQ:GAMB)

Historical Stock Chart

From Jan 2025 to Feb 2025

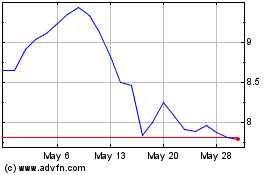

Gambling com (NASDAQ:GAMB)

Historical Stock Chart

From Feb 2024 to Feb 2025