UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

–––––––––––––––––––––––––––––––––––––

FORM 8-K

–––––––––––––––––––––––––––––––––––––

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report: August 28, 2014

(Date of earliest event reported)

–––––––––––––––––––––––––––––––––––––

Papa Murphy’s Holdings, Inc.

(Exact name of registrant as specified in its charter)

–––––––––––––––––––––––––––––––––––––

|

| | | | |

Delaware (State or Other Jurisdiction of Incorporation or Organization) | | 001-36432 (Commission File Number) | | 27-2349094 (IRS Employer Identification No.) |

|

| | |

8000 NE Parkway Drive, Suite 350

Vancouver, WA (Address of principal executive offices) | | 98662 (Zip Code) |

(360) 260-7272

(Registrant's telephone number, including area code)

–––––––––––––––––––––––––––––––––––––

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

On August 28, 2014, PMI Holdings, Inc. ("PMI"), a wholly-owned subsidiary of Papa Murphy's Holdings, Inc. (the "Company") entered into a senior secured credit facility (the "New Credit Facility") with PMI as the borrower, the guarantors party thereto, General Electric Capital Corporation, for itself, as a lender and swingline lender, and as agent for all lenders, and the other financial institutions party thereto as lenders. The New Credit Facility, provides for senior secured financing of up to $132.0 million, consisting of a term loan of $112.0 million, which was fully drawn at closing, and a revolving credit facility of $20.0 million, which includes a $2.5 million letter of credit sub-facility and a $1.0 million swing-line loan sub-facility.

The New Credit Facility is being used to refinance the Company's Prior Credit Facility (as defined in Item 1.02 below) and will also be available for working capital, capital expenditures and other general corporate purposes. PMI's obligations under the New Credit Facility are guaranteed by certain domestic subsidiaries of the Company and are secured by substantially all of the assets of the Company and its subsidiaries.

Borrowings under the New Credit Facility bear interest at a rate per annum equal to an applicable margin based on the Company's consolidated leverage ratio, plus, at our option, either (a) a base rate determined by reference to the highest of (i) the "Prime Rate" publicly quoted by The Wall Street Journal, (ii) the federal funds rate plus 50 basis points, or (iii) the LIBOR rate with a one-month interest period plus 100 basis points, or (b) a LIBOR rate determined for the specified interest period. The applicable margin for borrowings under the New Credit Facility ranges from 150 to 225 basis points for base rate borrowings and 250 to 325 basis points for LIBOR rate borrowings. The Company's initial applicable margins are 225 basis points for base rate borrowings or 325 basis points for LIBOR rate borrowings. The New Credit Facility includes customary fees for loan facilities of this type, including a commitment fee on the revolving credit facility.

The term loan requires scheduled quarterly principal payments of $0.7 million commencing in March 2015. These payments increase to $1.4 million beginning in September 2016 and continue until the term loan matures in August 2019. The Company will be required to make certain mandatory prepayments under certain circumstances and will have the option to make certain prepayments.

The New Credit Facility contains customary affirmative negative covenants that are usual and customary for loan facilities of this type, including covenants that, among other things, restrict our ability and the ability of our subsidiaries to incur indebtedness, issue certain types of equity, incur liens, enter into fundamental changes, including mergers and consolidations, sell assets, make dividends, distributions and investments, and prepay subordinated indebtedness, subject to customary exceptions. The New Credit Facility also includes certain financial covenants with respect to a maximum consolidated leverage ratio and a minimum interest coverage ratio.

The New Credit Facility also includes customary events of default that include, among other things, payment defaults, material inaccuracy of representations and warranties, covenant defaults, cross-defaults to certain material indebtedness, certain events of bankruptcy or insolvency, material judgments, material defects with respect to lenders' perfection on the collateral, invalidity of subordination provisions of the subordinated debt and changes of control. The occurrence of an event of default could result in the acceleration of the obligations under the New Credit Facility.

Certain lenders that are parties to the New Credit Facility have performed and may continue to perform investment banking, financial advisory, lending or commercial banking services for the Company and its subsidiaries and affiliates, for which they have and may in the future receive customary compensation and reimbursement of expenses.

The above description of the material terms and conditions of the New Credit Facility does not purport to be complete and is qualified in its entirety by reference to the full text of the New Credit Facility, copies of which will be filed as exhibits to the Company's Quarterly Report on Form 10-Q for the quarter ended September 29, 2014.

For additional information, see the press release attached hereto as Exhibit 99.1, which is hereby incorporated by reference.

Item 1.02 Termination of a Material Definitive Agreement

On October 25, 2013, the Company entered into a Credit Facility (the “Prior Credit Facility") with PMI as borrower, the other Persons party thereto that are designated as Credit Parties, Golub Capital, LLC, as agent for all lenders party thereto and for itself as a lender, and the other financial institutions party thereto as lenders.

On August 28, 2014, PMI repaid all outstanding borrowings under the Prior Credit Facility with proceeds from the New Credit Facility described in Item 1.01 above and terminated the Prior Credit Facility. A prepayment fee of $1.1 million was paid to the lender in connection with the termination of the Prior Credit Facility.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information regarding the New Credit Facility set forth in Item 1.01 is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is filed with this report:

|

| | | |

EXHIBIT NUMBER | | DESCRIPTION | |

99.1 | | Press Release dated August 28, 2014 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

PAPA MURPHY’S HOLDINGS, INC. | |

| | |

By: | | /s/ Mark Hutchens | |

| | Name: Mark Hutchens | |

| | Title: Chief Financial Officer | |

Date: August 28, 2014

EXHIBIT INDEX

|

| | | |

EXHIBIT NUMBER | | DESCRIPTION | |

99.1 | | Press Release dated August 28, 2014. | |

FOR IMMEDIATE RELEASE

Papa Murphy’s Holdings, Inc. Announces New Credit Facility

Vancouver, WA, August 28, 2014 (Globe Newswire) - Papa Murphy’s Holdings, Inc. (NASDAQ: FRSH) today announced that it has successfully closed on a new $132 million senior secured credit facility. The new five year facility, consisting of a $112 million senior secured term loan and a $20 million revolving credit facility, replaces the Company’s existing $122 million facility, which consisted of a $112 million senior secured term loan and a $10 million revolving credit facility. As of the end of the Company’s fiscal second quarter on June 30, 2014, the balance outstanding under the existing credit facility was $112.1 million.

Based on current market conditions, the refinancing represents a 200 basis point reduction in borrowing costs and is estimated to reduce annual cash interest expense by approximately $2.25 million per year and benefit on-going annual earnings per share in the range of $0.09-$0.10, on a fully-diluted basis.

Ken Calwell, President and Chief Executive Officer of Papa Murphy’s Holdings, Inc. said, “We are pleased to have completed the refinancing of this new credit facility, which was made possible as a result of our improved credit profile as a public company. The new facility gives us even greater financial flexibility to support the tremendous growth potential of this business while at the same time significantly reducing our cost of debt and improving EPS.”

GE Capital Markets, Inc. was Sole Lead Arranger for the transaction. Citizens Bank, N.A. was Documentation Agent and Wells Fargo Banks, N.A. was Syndication Agent for the transaction.

About Papa Murphy’s

Papa Murphy's is a franchisor and operator of the largest Take 'N' Bake pizza chain in the United States, selling uncooked pizzas that customers bake at home. The Company was founded in 1981 and currently operates over 1,400 franchised and company-owned fresh pizza stores in 38 states, Canada and United Arab Emirates. Papa Murphy's core purpose is to bring all families together through food people love with a goal to create fun, convenient and fulfilling family dinners. In addition to scratch-made pizzas, the Company offers a growing menu of grab 'n' go items, including salads, sides and desserts.

Forward-looking Statements

Certain statements contained in this news release, as well as other information provided from time to time by Papa Murphy's Holdings, Inc. or its employees, may contain forward looking statements that involve risks and uncertainties that could cause actual results to differ materially from those in the forward looking statements. Forward-looking statements give the Company's current expectations and projections relating to the Company's future earnings, growth potential, and cost of capital. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "guidance," "anticipate," "estimate," "expect," "forecast," "project," "plan," "intend," "believe," "confident," "may," "should," "can have," "likely," "future" and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events.

Any such forward looking statements are not guarantees of performance or results, and involve risks, uncertainties (some of which are beyond the Company's control) and assumptions. Although the Company believes any forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results and cause them to differ materially from those anticipated in any forward-looking statements. Please refer to the risk factors discussed in the Company’s Registration Statement on Form S-1, as amended, (File No: 333-194488) as supplemented by the risk factors included in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2014 (each of which can be found at the SEC’s website www.sec.gov) and each such risk factor is specifically incorporated into this press release. Should one or more of these risks or uncertainties materialize, the Company's actual results may vary in material respects from those projected in any forward-looking statements.

Any forward-looking statement made by the Company in this press release speaks only as of the date on which it is made. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Investor Contact:

Fitzhugh Taylor, ICR

fitzhugh.taylor@icrinc.com

877-747-7272

Media Contact:

Jessica Liddell, ICR

jessica.liddell@icrinc.com

203-682-8208

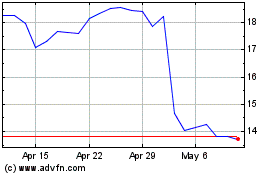

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jul 2023 to Jul 2024