Freeline Therapeutics Holdings plc (Nasdaq: FRLN) (“Freeline”) and

Syncona Ltd (“Syncona”) today announced that, in connection with

Syncona’s acquisition of Freeline by way of a scheme of arrangement

(the “Scheme”), the Scheme has been sanctioned by the Court and the

court order (together with a copy of the scheme circular published

by Freeline on January 18, 2024 (the “Scheme Circular”) has been

delivered to the Registrar of Companies. Accordingly,

the Scheme has become Effective in accordance with its terms and

the entire issued share capital of Freeline is now owned or

controlled by Syncona Portfolio Limited.

Capitalized terms in this announcement, unless otherwise

defined, have the same meanings as set out in the Scheme

Circular.

Next steps and timetableScheme Shareholders on

the register of shareholders of Freeline at 6.00 p.m. GMT on

February 19, 2024 will be entitled to receive $0.433333 in cash for

each Scheme Share held or $6.50 in cash per American Depositary

Share of Freeline (“ADSs”).

Settlement of the consideration to which any Scheme Shareholder

is entitled will be effected by the dispatch of a check or

electronic payment to the Scheme Shareholder's specified account

(for Scheme Shareholders holding Scheme Shares in certificated

form) or the crediting of a Scheme Shareholder’s CREST account (for

Scheme Shareholders holding Scheme Shares in uncertificated form)

as soon as practicable and, in any event, not later than 14 days

after the Effective Date. Accordingly, March 4, 2024 is the latest

date for the dispatch of checks and settlement of the consideration

as set out in the Scheme Circular. Payment of the consideration,

without interest and net of any applicable withholding taxes and

Depositary fees, will be made to Freeline ADS Holders as soon as

practicable after Citibank, N.A., the ADS depositary, receives the

aggregate consideration payable to Freeline ADS Holders from

Computershare, the Company’s receiving agent.

In connection with the Scheme becoming Effective, the ADSs will

be de-listed from the Nasdaq Capital Market (“Nasdaq”), and the

last day of trading in the ADSs on Nasdaq was February 16,

2024.

Board changesAs the Scheme has now become

Effective, Julia Gregory, Martin Andrews, Jeffrey Chodakewitz,

Colin Love and Paul Schneider have stepped down from the Freeline

Board.

About Freeline TherapeuticsFreeline is a

clinical-stage biotechnology company focused on developing

transformative gene therapies for chronic debilitating diseases.

Freeline uses its proprietary, rationally designed AAV vector and

capsid (AAVS3), along with novel promoters and transgenes, to

deliver a functional copy of a therapeutic gene into human liver

cells, thereby expressing a persistent functional level of the

missing or dysfunctional protein into a patient’s bloodstream.

Freeline is currently advancing FLT201, a highly differentiated

gene therapy candidate that delivers a novel transgene, in a Phase

½ clinical trial in people with Gaucher disease type 1. Freeline

has additional programs in research, including one focused on

GBA1-linked Parkinson’s disease that leverages the same novel

transgene as FLT201. Freeline is headquartered in the UK and has

operations in the United States. For more information, visit

www.freeline.life or connect with Freeline on

LinkedIn and X.

About SynconaSyncona’s purpose is to invest to

extend and enhance human life. Syncona does this by creating and

building companies to deliver transformational treatments to

patients in areas of high unmet need. Syncona’s strategy is to

create, build and scale companies around exceptional science to

create a diversified portfolio of 20-25 globally leading healthcare

businesses, across development stage and therapeutic areas, for the

benefit of all its stakeholders. Syncona focuses on developing

treatments for patients by working in close partnership with

world-class academic founders and management teams. Syncona’s

balance sheet underpins its strategy enabling it to take a

long-term view as it looks to improve the lives of patients with no

or poor treatment options, build sustainable life science companies

and deliver strong risk-adjusted returns to shareholders.

Syncona Limited seeks to achieve returns over the long term.

Investors should seek to ensure they understand the risks and

opportunities of an investment in Syncona Limited, including the

information in our published documentation, before investing.

Forward-Looking StatementsThis announcement

contains statements that constitute “forward-looking statements” as

that term is defined in the United States Private Securities

Litigation Reform Act of 1995, including statements that express

the opinions, expectations, beliefs, plans, objectives, assumptions

or projections of Freeline regarding future events or future

results, in contrast with statements that reflect historical facts.

All statements, other than historical facts, including statements

regarding the anticipated benefits of the Acquisition, the closing

of the Acquisition and de-listing of the ADSs, are forward-looking

statements. In some cases, you can identify such forward-looking

statements by terminology such as “anticipate,” “intend,”

“believe,” “estimate,” “plan,” “seek,” “project,” “expect,” “may,”

“will,” “would,” “could” or “should,” the negative of these terms

or similar expressions. Forward-looking statements are based on

management’s current beliefs and assumptions and on information

currently available to Freeline, and you should not place undue

reliance on such statements. Forward-looking statements are subject

to many risks and uncertainties, including (1) the risk that the

Acquisition disrupts the parties’ current operations or affects

their ability to retain or recruit key employees; (2) the possible

diversion of management time on Acquisition-related issues; (3)

litigation relating to the Acquisition; (4) unexpected costs,

charges or expenses resulting from the Acquisition; and (5)

potential adverse reactions or changes to business relationships

resulting from the announcement or completion of the Acquisition.

Such risks and uncertainties may cause the statements to be

inaccurate and readers are cautioned not to place undue reliance on

such statements. Freeline cannot guarantee that any forward-looking

statement will be realized. Should known or unknown risks or

uncertainties materialize or should underlying assumptions prove

inaccurate, actual results could vary materially from past results

and those anticipated, estimated, or projected. Investors are

cautioned not to put undue reliance on forward-looking statements.

A further list and description of risks, uncertainties, and other

matters can be found in Freeline’s Annual Report on

Form 20-F for the fiscal year ended December 31, 2022,

and in subsequent reports on Form 6-K, in each case

including in the sections thereof captioned “Cautionary Statement

Regarding Forward-Looking Statements” and “Item 3.D. Risk factors.”

Many of these risks are outside of Freeline’s control and could

cause its actual results to differ materially from those it thought

would occur. The forward-looking statements included in this

announcement are made only as of the date hereof. Freeline does not

undertake, and specifically declines, any obligation to update any

such statements or to publicly announce the results of any

revisions to any such statements to reflect future events or

developments, except as required by law. For further information,

please refer to Freeline’s reports and documents filed with the

SEC. You may review these documents by visiting EDGAR on the SEC

website at www.sec.gov.

Freeline Investor and Media Contact

Naomi Aokinaomi.aoki@freeline.lifeSenior Vice President, Head of

Investor Relations & Corporate Communications+ 1 617 283

4298

Syncona Investor and Media Contacts

Syncona LtdAnnabel Clark / Fergus WittTel: +44 (0) 20 3981

7940

FTI ConsultingBen Atwell / Natalie Garland-Collins / Tim

StamperTel: +44 (0) 20 3727 1000

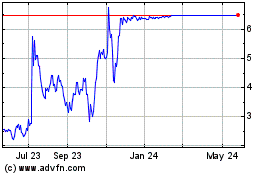

Freeline Therapeutics (NASDAQ:FRLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Freeline Therapeutics (NASDAQ:FRLN)

Historical Stock Chart

From Jan 2024 to Jan 2025