The First of Long Island Corporation (Nasdaq: FLIC), the parent

company of The First National Bank of Long Island, reported

increases in net income and earnings per share for the three and

nine months ended September 30, 2018. In the highlights that

follow, all comparisons are of the current three or nine-month

period to the same period last year unless otherwise

indicated.

THIRD QUARTER HIGHLIGHTS

- Net Income increased 7.7% to $10.1 million from $9.3

million

- EPS increased 2.6% to $.39 from $.38

- Net Income includes an after-tax loss on the sale of

securities of $3.5 million, or $.14 per share

- Net Income also includes a tax benefit of $717,000, or

$.03 per share, resulting from accelerated tax

depreciation

- Steps taken to reduce margin compression have been

effective and additional steps are likely. Quarterly net interest

margin is expected to increase in the fourth quarter.

- Effective Tax Rate of 5.1% versus 26.4%

- Cash Dividends Per Share increased 13.3% to $.17 from

$.15

- The Credit Quality of the Bank’s loan and securities

portfolios remains excellent

NINE MONTH HIGHLIGHTS

- Net Income increased 14.3% to $31.5 million from $27.6

million

- EPS increased 9.7% to $1.24 from $1.13

- Book Value Per Share increased 6.3% to $14.96 at

9/30/18 from $14.07 at 9/30/17

- Effective Tax Rate of 9.3% versus 24.3%

Analysis of Earnings – Nine Months Ended

September 30, 2018

Net income for the first nine months of 2018 was

$31.5 million, an increase of $3.9 million, or 14.3%, over the same

period last year. The increase is attributable to increases

in net interest income of $4.2 million, or 5.8%, and noninterest

income, before securities gains and losses, of $1.1 million, or

15.1%, and decreases in the provision for loan losses and income

tax expense of $2.7 million and $5.6 million, respectively.

These items were partially offset by an increase in noninterest

expense of $4.6 million, or 11.5%, and securities losses of $5.0

million in the current nine-month period versus gains of $74,000 in

the same period last year.

The increase in net interest income is primarily

attributable to growth in the average balance of loans of $439.6

million, or 16.2%. Loans grew primarily because of increases

in commercial and residential mortgage loans. Growth in the

average balance of loans was funded by increases in the average

balances of noninterest-bearing checking deposits of $83.9 million,

or 9.8%, interest-bearing deposits of $297.9 million, or 15.4%,

borrowings of $74.4 million, or 13.8%, and stockholders’ equity of

$43.4 million, or 13.2%. Substantial contributors to the

growth in deposits were new branch openings, the Bank’s ongoing

municipal deposit initiative, deposit promotions with emphasis on

time deposits and the issuance of brokered certificates of deposit

toward the end of the first quarter. Substantial contributors

to the growth in stockholders’ equity were net income and the

issuance of shares under the Corporation’s Dividend Reinvestment

and Stock Purchase Plan (the “DRP Plan”), partially offset by cash

dividends declared and a decline in the after-tax value of

available-for-sale securities. During the nine and three

months ended September 30, 2018, the sale of shares under the DRP

Plan contributed $17.0 million and $1.2 million to capital,

respectively.

Net interest margin for the first nine months of

2018 was 2.63%, down 29 basis points from 2.92% for the same period

last year. The decrease in net interest margin is largely

attributable to: (1) yield curve flattening resulting from a

significant increase in the federal funds target rate with lesser

increases in intermediate and longer-term interest rates; (2)

timing differences between the repricing of interest-earning assets

and interest-bearing liabilities in a rising rate environment; (3)

competitive pressure to raise deposit rates to fund growth and

protect against deposit outflows; (4) a reduction in prepayment

penalties and late charges from $1.8 million for the first nine

months of 2017 to $793,000 for the current nine-month period, thus

reducing net interest margin by 4 basis points; and (5) a reduction

in the statutory federal income tax rate from 35% for the first

nine months of 2017 to 21% for the current nine-month period, thus

reducing the tax-equivalent amount of each dollar of tax-exempt

income and causing a 9 basis point decline in net interest

margin. When comparing the first nine months of this year to

the same period last year, these factors largely account for the

significant increases experienced by the Bank in the cost of its

non-maturity deposits and short-term borrowings of 26 basis points

and 119 basis points, respectively, with a much more modest

increase occurring in its loan portfolio yield of 1 basis point and

decrease in the securities portfolio yield of 15 basis

points. Unlike non-maturity deposits and short-term

borrowings, the Bank’s securities and almost all of its loans are

not subject to immediate repricing with changes in market interest

rates.

Beginning in the second quarter of this year,

management began implementing a variety of measures designed to

stabilize and improve net interest margin and reduce expenses.

Additional steps are likely. These measures include, among

others, reducing overall balance sheet growth by slowing loan

growth and the related need for funding, changing the mix of loans

being originated, restructuring the securities portfolio and

hedging a portion of overnight borrowings with an interest rate

swap. Slowing loan growth has resulted in reducing the

provision for loan losses. Diminished funding needs have

enabled management to mitigate growth in noninterest expense and

the cost of deposits by slowing the pace of new branch openings,

offering fewer deposit rate promotions and being more selective in

offering higher rates to new and existing customers.

Restructuring the securities portfolio, as discussed hereinafter,

is immediately accretive to net interest margin and hedging

overnight borrowings with an interest rate swap provides some net

interest margin protection in the event of an increase in overnight

borrowing rates. Management also continues to explore a

variety of cost saving measures aimed at further improving an

already very strong efficiency ratio.

The mortgage loan pipeline at quarter-end was a

modest $54 million, reflecting management’s decision to slow loan

growth. In an attempt to improve overall loan portfolio

yield, the mix of loan originations is being more heavily weighted

towards commercial mortgages and commercial and industrial loans

with less emphasis on residential mortgage loans.

We believe that the measures discussed above

contributed to a slower decline in net interest margin for the

third quarter than that which occurred in the first and second

quarters. Excluding the impact of prepayment penalties and

late charges and the aforementioned reduction in the statutory

federal income tax rate, the quarterly decline in net interest

margin was 6 basis points in the first quarter of 2018, 13 basis

points in the second quarter and 1 basis point in the third

quarter. The second quarter decline reflects the full quarter

impact of robust first quarter growth. Management believes

that fourth quarter net interest margin will be higher than that

reported for the third quarter.

Employing the measures discussed above and

assuming a continued flattening of the yield curve, net interest

margin could range from approximately 2.50% to 2.55% in 2019

and then begin to increase in 2020. If the yield curve

flattens less than anticipated or steepens, net interest margin

could be better than that currently anticipated for 2019.

The deliberate slowing of balance sheet growth

has eliminated the need to raise capital through the DRP

Plan. As a result, effective with the second quarter cash

dividend paid in July, the Corporation reduced the optional

quarterly cash purchase limit per shareholder from $75,000 to

$5,000. This change reduced the number of shares issued under

the DRP Plan from 269,361 and 322,420 in the first and second

quarters, respectively, to 48,053 and 59,792 in the third and

fourth quarters, respectively, resulting in less dilution to

earnings per share.

The reduction in the provision for loan losses

for the first nine months of 2018 versus the same period last year

is mainly due to improved economic conditions and historical loss

rates, less loan growth in the current year and a larger increase

in specific reserves in the 2017 period. The impact of these

items was partially offset by higher net chargeoffs in the current

nine-month period. Net chargeoffs in the first nine months of

2018 of $780,000 include chargeoffs of $382,000 on loans

transferred to held-for-sale and carried at fair value at September

30, 2018.

The increase in noninterest income, before

securities gains and losses, of $1.1 million, or 15.1%, is

primarily attributable to an increase of $432,000 in cash value

accretion on bank-owned life insurance (“BOLI”), a $565,000 BOLI

death benefit and an increase of $267,000 in the net credit

relating to the non-service cost components of the Bank’s defined

benefit pension plan. These increases were partially offset

by refunds of $155,000 related to sales tax and telecommunications

charges and the elimination of $77,000 in accrued circuit

termination charges in the 2017 period. Cash value accretion

increased because of purchases of BOLI during the first quarters of

2017 and 2018 of $25 million and $20 million, respectively.

These purchases contributed $22.1 million to the growth in average

other assets for the first nine months of 2018 compared to the same

period last year.

The increase in noninterest expense of $4.6

million, or 11.5%, is primarily attributable to increases in

salaries of $2.0 million, or 10.8%, employee benefits and other

personnel expense of $936,000, or 17.0%, occupancy and equipment

expense of $1.2 million, or 16.2%, other real estate owned (“OREO”)

expense of $124,000 and growth-related increases in the Bank’s FDIC

and OCC assessments amounting to $98,000. The increase in

salaries is primarily due to new branch openings, additions to

staff in the back office, normal annual salary adjustments and

special salary-related accruals in the second quarter of

2018. The increase in employee benefits and other personnel

expense is largely due to increases in group health insurance

expense of $281,000 resulting from increases in staff count and the

rates being charged by insurance carriers, placement and agency

fees of $101,000 relating to branch and back office staffing,

payroll tax expense of $152,000 and incentive compensation expense

of $230,000. The increase in occupancy and equipment expense

is primarily due to the operating costs of new branches, increases

in maintenance and repairs expense and a growth-related increase in

depreciation on the Bank’s facilities and equipment. OREO

expense of $124,000 in the 2018 period relates to one commercial

property acquired by deed-in-lieu of foreclosure during the fourth

quarter of 2017 and sold during the first quarter of 2018.

The decrease in income tax expense of $5.6

million is due to: (1) a reduction in the statutory federal income

tax rate from 35% last year to 21% effective January 1, 2018; (2)

recognition in the current nine-month period of tax benefits of New

York State and New York City net operating loss carryforwards that

originated in 2017 of $542,000; (3) recognition of $717,000 in tax

benefits related to accelerated tax depreciation resulting from a

cost segregation study; (4) higher tax benefits in the 2018 period

from BOLI; and (5) tax benefits of a $5.0 million securities loss

resulting from the restructuring of the securities portfolio in the

third quarter of 2018. These items resulted in lower

effective tax rates in the first three quarters of 2018 as compared

to the comparable 2017 periods. The Corporation’s effective

tax rate was 7.9% in the first quarter of this year, 14.4% in the

second quarter, 5.1% in the third quarter and 9.3% for the

nine-month period. This compares to 24.2% for the first

quarter of last year, 22.0% for the second quarter, 26.4% for the

third quarter and 24.3% for the nine-month period. Management

expects the Corporation’s quarterly effective tax rate to normalize

in the range of 14% to 16%.

Late in the third quarter of 2018, the Bank

restructured the available-for-sale securities portfolio by selling

$135 million of mortgage-backed securities and $39.6 million of

short-term municipal bonds with yields of 2.51% and 2.90%,

respectively, and reinvested the proceeds in mortgage-backed

securities and corporate bonds with an overall yield of

4.02%. The Bank recorded a loss of $5.0 million ($3.5 million

after-tax) on the sale and the payback period for the loss is

approximately 2.4 years. Because of the timing of this

restructuring, it had little impact on net interest margin for the

current quarter or nine-month period. On a going forward

basis, it will improve the Bank’s net interest margin by

approximately 5 basis points. The securities loss negatively

impacted ROA and ROE by 11 and 124 basis points, respectively, for

the first nine months of 2018, and 32 and 362 basis points,

respectively, for the third quarter of 2018. In early October

2018, the Bank further restructured the securities portfolio

by selling $61.6 million of mortgage-backed securities with a yield

of 2.51% at a loss of approximately $3.2 million ($2.3 million

after-tax) and used the proceeds to pay down overnight borrowings

with a cost of 2.47%. This transaction eliminated some

inefficient leverage and, on a full quarter basis, will add 4 basis

points to net interest margin.

Analysis of Earnings – Third Quarter 2018

Versus Third Quarter 2017

Net income for the third quarter of 2018 was

$10.1 million, representing an increase of $715,000, or 7.7%, over

$9.3 million earned in the same quarter of last year. The

increase is primarily attributable to increases in net interest

income of $588,000 and noninterest income, before securities gains

and losses, of $251,000, and decreases in the provision for loan

losses and income tax expense of $2.9 million and $2.8 million,

respectively. The positive impact on earnings of these items

was largely offset by an increase in noninterest expense of

$848,000, or 6.3%, and the aforementioned loss on the sale of

securities of $5.0 million. The increase in net interest

income was due to growth in the average balance of loans partially

offset by higher funding costs and a decline in prepayment

penalties and late charges of $825,000. The decrease in the

provision for loan losses was primarily attributable to improved

economic conditions and a decline in loans in the current quarter

versus an increase in the 2017 quarter, partially offset by higher

net chargeoffs in the 2018 quarter and a decrease in specific

reserves on loans individually deemed to be impaired in the 2017

period. The increase in noninterest income, before securities

gains and losses, is mainly due to higher cash value accretion on

BOLI and an increase in the net credit relating to the non-service

cost components of the Bank’s defined benefit pension plan in the

2018 quarter. The increase in noninterest expense is mainly

due to increases in salaries, employee benefits and other personnel

expense and occupancy and equipment expense for substantially the

same reasons discussed above with respect to the nine-month

periods. The decrease in income tax expense is mainly due to

lower pre-tax income in the current quarter as compared to the 2017

quarter, a lower statutory federal income tax rate, tax benefits

resulting from the aforementioned cost segregation study and

securities losses and higher tax benefits in the 2018 quarter from

the vesting and exercise of stock awards.

Analysis of Earnings – Third Quarter

Versus Second Quarter 2018

Net income for the third quarter of 2018

declined $258,000 from $10.3 million earned in the second quarter

of this year. The decrease is primarily attributable to a

decrease in net interest income of $594,000 and the aforementioned

securities loss in the third quarter of 2018 of $5.0 million.

The decrease in net interest income was mainly due to a 7

basis point increase in funding costs in the third quarter and a

reduction in prepayment penalties and late charges of $325,000.

The negative impact on net income of these items was largely

offset by a decrease in the provision for loan losses of $2.6

million, a decrease in income tax expense of $1.2 million, a

reduction in salaries expense of $656,000 mainly due to special

salary-related accruals recorded in the second quarter, a decline

in maintenance and repairs expense on the Bank’s facilities and

equipment of $144,000 and lower marketing expense of

$415,000. The decrease in the provision for loan losses in

the current quarter was mainly due to improved economic conditions

and lower loan growth, partially offset by higher net

chargeoffs. The decrease in income tax expense was due to

lower pre-tax income in the third quarter, higher tax benefits from

the vesting and exercise of stock awards and tax benefits in the

third quarter from the aforementioned cost segregation study and

securities losses.

Asset Quality

The Bank’s allowance for loan losses to total

loans (reserve coverage ratio) was 1.15% at year-end 2017, 1.12% at

March 31, 2018, 1.10% at June 30, 2018 and 1.04% at September 30,

2018. The decrease in the reserve coverage ratio during 2018

is primarily due to improved economic conditions and reductions in

historical loss rates and growth rates on certain pools of

loans. The provision for loan losses was $547,000 and $3.2

million in the first nine months of 2018 and 2017,

respectively. The provision in each period was driven mainly

by loan growth and net chargeoffs and, in the 2017 period, an

increase in specific reserves, partially offset by improved

economic conditions and reductions in historical losses.

The credit quality of the Bank’s loan portfolio

remains excellent. Nonaccrual loans amounted to $4.9 million,

or .15% of total loans outstanding, at September 30, 2018, compared

to $1.8 million, or .06%, at June 30, 2018 and $1.0 million, or

.03%, at December 31, 2017. The increase in nonaccrual loans

during the first nine months of 2018 is due to loans of $4.5

million transferred to nonaccrual status, largely consisting of

loans to one borrower, partially offset by paydowns, loan sales and

chargeoffs. Total nonaccrual loans at the end of the third

quarter include loans held-for-sale of $671,000 that are carried at

fair value. Troubled debt restructurings amounted to $1.3

million, or .04% of total loans outstanding at September 30,

2018. Of the troubled debt restructurings, $1.2 million are

performing in accordance with their modified terms and $88,000 are

nonaccrual and included in the aforementioned amount of nonaccrual

loans. Loans past due 30 through 89 days amounted to $1.1

million, or .04% of total loans outstanding, at September 30, 2018,

compared to $2.8 million, or .09%, at December 31, 2017.

The credit quality of the Bank’s securities

portfolio also remains excellent. The Bank’s mortgage

securities are backed by mortgages underwritten on conventional

terms, with 81% of these securities being full faith and credit

obligations of the U.S. government and the balance being

obligations of U.S. government sponsored entities. The

remainder of the Bank’s securities portfolio principally consists

of high quality, general obligation municipal securities rated AA

or better by major rating agencies and investment grade corporate

bonds of large financial institutions. In selecting

securities for purchase, the Bank uses credit agency ratings for

screening purposes only and then performs its own credit

analysis. On an ongoing basis, the Bank periodically assesses

the credit strength of the securities in its portfolio and makes

decisions to hold or sell based on such assessments.

Capital

The Corporation’s Tier 1 leverage, Common Equity

Tier 1 risk-based, Tier 1 risk-based and Total risk-based capital

ratios were approximately 9.2%, 15.6%, 15.6% and 16.8%,

respectively, at September 30, 2018. The strength of the

Corporation’s balance sheet positions the Corporation for continued

growth in a measured and disciplined fashion.

Key Strategic Initiatives and Challenges

We Face

The Bank’s strategy remains focused on

increasing shareholder value through loan and deposit growth and

the maintenance of stellar credit quality, a strong efficiency

ratio and an optimal amount of capital. We will continue to

open new branches but at a slower pace.

As previously discussed, in response to the

flattening yield curve management has implemented a variety of

measures in an attempt to stabilize and improve net interest margin

and reduce operating expenses and thereby enable continued earnings

growth. Additional steps are likely. Quarterly net

interest margin is expected to increase in the fourth quarter of

2018 then be negatively impacted by additional increases in the

federal funds rate that the market expects in late 2018

and 2019. Management will continue to be measured and

disciplined in its approach to the extension of credit and will not

meaningfully loosen its underwriting standards in an attempt to

improve net interest margin.

With respect to its lending activities, the Bank

will continue to prudently manage concentration and credit risk and

maintain its broker and correspondent relationships.

Commercial mortgage loans will be emphasized over residential

mortgage loans. Small business credit scored loans, equipment

finance loans and SBA loans, along with the Bank’s traditional

commercial and industrial loan products, will be originated to

diversify the Bank’s loan portfolio and help mitigate the impact on

net interest margin of the flattening yield curve.

The Bank’s branch distribution system currently

consists of fifty-two branches in Nassau and Suffolk Counties, Long

Island and the New York City boroughs of Queens, Brooklyn and

Manhattan. The Bank expects to open more branches in the

foreseeable future. In addition, management is also focused

on growing noninterest income from existing and potential new

sources, which may include the development or acquisition of

fee-based businesses.

In the current environment, banking regulators

are concerned about, among other things, growth, commercial real

estate concentrations, underwriting of commercial real estate and

commercial and industrial loans, capital levels, liquidity, cyber

security and predatory sales practices. Regulatory

requirements, the cost of compliance and vigilant supervisory

oversight are exerting downward pressure on revenues and upward

pressure on required capital levels and operating expenses.

|

|

|

|

|

|

|

|

| CONSOLIDATED BALANCE

SHEETS(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9/30/18 |

|

12/31/17 |

|

|

|

|

|

|

|

(dollars in thousands) |

|

Assets: |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

50,462 |

|

|

$ |

69,672 |

|

|

|

|

|

|

|

|

|

| Investment securities: |

|

|

|

|

|

|

| Held-to-maturity, at amortized cost (fair value of

$6,902 and $7,749) |

|

|

6,845 |

|

|

|

7,636 |

|

| Available-for-sale, at fair value |

|

|

802,839 |

|

|

|

720,128 |

|

|

|

|

|

809,684 |

|

|

|

727,764 |

|

|

|

|

|

|

|

|

|

| Loans held-for-sale |

|

|

671 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

| Loans: |

|

|

|

|

|

|

| Commercial and industrial |

|

|

93,901 |

|

|

|

109,623 |

|

| Secured by real estate: |

|

|

|

|

|

|

| Commercial mortgages |

|

|

1,259,286 |

|

|

|

1,193,007 |

|

| Residential mortgages |

|

|

1,788,145 |

|

|

|

1,558,564 |

|

| Home equity lines |

|

|

74,079 |

|

|

|

83,625 |

|

| Consumer and other |

|

|

5,884 |

|

|

|

5,533 |

|

|

|

|

|

3,221,295 |

|

|

|

2,950,352 |

|

| Allowance for loan losses |

|

|

(33,551 |

) |

|

|

(33,784 |

) |

|

|

|

|

3,187,744 |

|

|

|

2,916,568 |

|

|

|

|

|

|

|

|

|

| Restricted stock, at cost |

|

|

37,941 |

|

|

|

37,314 |

|

| Bank premises and equipment, net |

|

|

39,825 |

|

|

|

39,648 |

|

| Bank-owned life insurance |

|

|

80,380 |

|

|

|

59,665 |

|

| Pension plan assets, net |

|

|

19,391 |

|

|

|

19,152 |

|

| Deferred income tax benefit |

|

|

4,491 |

|

|

|

— |

|

| Other assets |

|

|

19,406 |

|

|

|

24,925 |

|

|

|

|

$ |

4,249,995 |

|

|

$ |

3,894,708 |

|

|

Liabilities: |

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

| Checking |

|

$ |

946,236 |

|

|

$ |

896,129 |

|

| Savings, NOW and money market |

|

|

1,679,617 |

|

|

|

1,602,460 |

|

| Time, $100,000 and over |

|

|

291,638 |

|

|

|

203,890 |

|

| Time, other |

|

|

243,018 |

|

|

|

119,518 |

|

|

|

|

|

3,160,509 |

|

|

|

2,821,997 |

|

|

|

|

|

|

|

|

|

|

Short-term borrowings |

|

|

292,176 |

|

|

|

281,141 |

|

|

Long-term debt |

|

|

403,027 |

|

|

|

423,797 |

|

|

Accrued expenses and other liabilities |

|

|

14,013 |

|

|

|

10,942 |

|

|

Deferred income taxes payable |

|

|

— |

|

|

|

2,381 |

|

|

|

|

|

3,869,725 |

|

|

|

3,540,258 |

|

|

Stockholders' Equity: |

|

|

|

|

|

|

|

Common stock, par value $.10 per share: |

|

|

|

|

|

|

| Authorized, 80,000,000 shares; |

|

|

|

|

|

|

| Issued and outstanding, 25,422,995 and 24,668,390

shares |

|

|

2,542 |

|

|

|

2,467 |

|

|

Surplus |

|

|

145,023 |

|

|

|

127,122 |

|

|

Retained earnings |

|

|

244,173 |

|

|

|

224,315 |

|

|

|

|

|

391,738 |

|

|

|

353,904 |

|

|

Accumulated other comprehensive income (loss), net of tax |

|

|

(11,468 |

) |

|

|

546 |

|

|

|

|

|

380,270 |

|

|

|

354,450 |

|

|

|

|

$ |

4,249,995 |

|

|

$ |

3,894,708 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS

OF INCOME(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

Three Months Ended |

|

|

|

9/30/18 |

|

9/30/17 |

|

9/30/18 |

|

9/30/17 |

|

|

|

|

|

|

|

(dollars in thousands) |

|

Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

83,641 |

|

|

$ |

71,810 |

|

$ |

28,471 |

|

|

$ |

25,173 |

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

|

|

8,275 |

|

|

|

5,883 |

|

|

3,065 |

|

|

|

1,806 |

| Nontaxable |

|

|

10,193 |

|

|

|

10,112 |

|

|

3,323 |

|

|

|

3,358 |

|

|

|

|

102,109 |

|

|

|

87,805 |

|

|

34,859 |

|

|

|

30,337 |

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Savings, NOW and money market deposits |

|

|

8,823 |

|

|

|

4,974 |

|

|

3,125 |

|

|

|

1,909 |

| Time deposits |

|

|

7,529 |

|

|

|

3,986 |

|

|

2,952 |

|

|

|

1,437 |

| Short-term borrowings |

|

|

3,026 |

|

|

|

986 |

|

|

1,370 |

|

|

|

257 |

| Long-term debt |

|

|

6,399 |

|

|

|

5,703 |

|

|

2,121 |

|

|

|

2,031 |

|

|

|

|

25,777 |

|

|

|

15,649 |

|

|

9,568 |

|

|

|

5,634 |

| Net interest income |

|

|

76,332 |

|

|

|

72,156 |

|

|

25,291 |

|

|

|

24,703 |

|

Provision (credit) for loan losses |

|

|

547 |

|

|

|

3,203 |

|

|

(1,768 |

) |

|

|

1,122 |

| Net interest income after provision (credit) for

loan losses |

|

|

75,785 |

|

|

|

68,953 |

|

|

27,059 |

|

|

|

23,581 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

| Investment Management Division income |

|

|

1,665 |

|

|

|

1,565 |

|

|

508 |

|

|

|

515 |

| Service charges on deposit accounts |

|

|

1,945 |

|

|

|

2,119 |

|

|

658 |

|

|

|

725 |

| Net gains (losses) on sales of securities |

|

|

(4,960 |

) |

|

|

74 |

|

|

(4,960 |

) |

|

|

16 |

| Other |

|

|

5,096 |

|

|

|

3,877 |

|

|

1,569 |

|

|

|

1,244 |

|

|

|

|

3,746 |

|

|

|

7,635 |

|

|

(2,225 |

) |

|

|

2,500 |

|

Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries |

|

|

20,895 |

|

|

|

18,855 |

|

|

6,596 |

|

|

|

6,386 |

| Employee benefits and other personnel expense |

|

|

6,452 |

|

|

|

5,516 |

|

|

2,037 |

|

|

|

1,866 |

| Occupancy and equipment |

|

|

8,742 |

|

|

|

7,524 |

|

|

2,864 |

|

|

|

2,503 |

| Other |

|

|

8,728 |

|

|

|

8,314 |

|

|

2,745 |

|

|

|

2,639 |

|

|

|

|

44,817 |

|

|

|

40,209 |

|

|

14,242 |

|

|

|

13,394 |

| Income before income taxes |

|

|

34,714 |

|

|

|

36,379 |

|

|

10,592 |

|

|

|

12,687 |

|

Income tax expense |

|

|

3,231 |

|

|

|

8,823 |

|

|

535 |

|

|

|

3,345 |

| Net income |

|

$ |

31,483 |

|

|

$ |

27,556 |

|

$ |

10,057 |

|

|

$ |

9,342 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS PER

SHARE(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

Three Months Ended |

|

|

|

|

9/30/18 |

|

9/30/17 |

|

9/30/18 |

|

9/30/17 |

|

|

|

|

|

|

|

|

|

(dollars in thousands, except per

share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

|

31,483 |

|

$ |

|

27,556 |

|

$ |

10,057 |

|

$ |

9,342 |

|

|

Income allocated to participating securities |

|

|

|

86 |

|

|

|

101 |

|

|

26 |

|

|

34 |

|

| Income allocated to common stockholders |

|

$ |

|

31,397 |

|

$ |

|

27,455 |

|

$ |

10,031 |

|

$ |

9,308 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares |

|

|

|

25,236,889 |

|

|

|

24,096,079 |

|

|

25,409,087 |

|

|

24,332,939 |

|

| Dilutive stock options and restricted stock

units |

|

|

|

174,095 |

|

|

|

253,715 |

|

|

144,933 |

|

|

247,127 |

|

|

|

|

|

|

25,410,984 |

|

|

|

24,349,794 |

|

|

25,554,020 |

|

|

24,580,066 |

|

|

Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic EPS |

|

|

|

$1.24 |

|

|

|

$1.14 |

|

|

$.39 |

|

|

$.38 |

|

| Diluted EPS |

|

|

|

1.24 |

|

|

|

1.13 |

|

|

.39 |

|

|

.38 |

|

| Cash Dividends Declared |

|

|

.47 |

|

|

.43 |

|

|

.17 |

|

|

.15 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL

RATIOS(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ROA |

|

|

1.01 |

% |

|

1.01 |

% |

|

.94 |

% |

|

.99 |

% |

|

ROE |

|

|

11.34 |

% |

|

11.23 |

% |

|

10.50 |

% |

|

10.85 |

% |

|

Net Interest Margin |

|

|

2.63 |

% |

|

2.92 |

% |

|

2.57 |

% |

|

2.94 |

% |

|

Dividend Payout Ratio |

|

|

37.90 |

% |

|

38.05 |

% |

|

43.59 |

% |

|

39.47 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROBLEM AND POTENTIAL

PROBLEM LOANS AND ASSETS(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9/30/18 |

|

|

12/31/17 |

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

Loans, excluding troubled debt restructurings: |

|

|

|

|

|

|

|

|

| Past due 30 through 89 days |

|

$ |

1,138 |

|

|

$ |

2,594 |

|

| Past due 90 days or more and still accruing |

|

|

— |

|

|

|

— |

|

| Nonaccrual (includes $671,000 in loans

held-for-sale at 9/30/18) |

|

|

4,765 |

|

|

|

900 |

|

|

|

|

|

5,903 |

|

|

|

3,494 |

|

|

Troubled debt restructurings: |

|

|

|

|

|

|

|

|

| Performing according to their modified terms |

|

|

1,229 |

|

|

|

785 |

|

| Past due 30 through 89 days |

|

|

— |

|

|

|

162 |

|

| Past due 90 days or more and still accruing |

|

|

— |

|

|

|

— |

|

| Nonaccrual |

|

|

88 |

|

|

|

100 |

|

|

|

|

|

1,317 |

|

|

|

1,047 |

|

|

Total past due, nonaccrual and restructured loans: |

|

|

|

|

|

|

|

|

| Restructured and performing according to their

modified terms |

|

|

1,229 |

|

|

|

785 |

|

| Past due 30 through 89 days |

|

|

1,138 |

|

|

|

2,756 |

|

| Past due 90 days or more and still accruing |

|

|

— |

|

|

|

— |

|

| Nonaccrual |

|

|

4,853 |

|

|

|

1,000 |

|

|

|

|

|

7,220 |

|

|

|

4,541 |

|

|

Other real estate owned |

|

|

— |

|

|

|

5,125 |

|

|

|

|

$ |

7,220 |

|

|

$ |

9,666 |

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses |

|

$ |

33,551 |

|

|

$ |

33,784 |

|

|

Allowance for loan losses as a percentage of total loans |

|

|

1.04 |

% |

|

|

1.15 |

% |

|

Allowance for loan losses as a multiple of nonaccrual loans |

|

|

6.9 |

x |

|

|

33.8 |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE BALANCE SHEET,

INTEREST RATES AND INTEREST

DIFFERENTIAL(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September

30, |

|

|

|

2018 |

|

2017 |

|

|

|

Average |

|

Interest/ |

|

Average |

|

Average |

|

Interest/ |

|

Average |

| (dollars in thousands) |

|

Balance |

|

Dividends |

|

Rate |

|

Balance |

|

Dividends |

|

Rate |

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-earning bank balances |

|

$ |

30,096 |

|

|

$ |

400 |

|

1.78 |

% |

|

$ |

24,457 |

|

|

$ |

191 |

|

1.04 |

% |

|

Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

|

|

354,530 |

|

|

|

7,875 |

|

2.96 |

|

|

|

337,941 |

|

|

|

5,692 |

|

2.25 |

|

| Nontaxable (1) |

|

|

460,231 |

|

|

|

12,902 |

|

3.74 |

|

|

|

460,156 |

|

|

|

15,556 |

|

4.51 |

|

|

Loans (1) |

|

|

3,160,835 |

|

|

|

83,646 |

|

3.53 |

|

|

|

2,721,229 |

|

|

|

71,820 |

|

3.52 |

|

|

Total interest-earning assets |

|

|

4,005,692 |

|

|

|

104,823 |

|

3.49 |

|

|

|

3,543,783 |

|

|

|

93,259 |

|

3.51 |

|

|

Allowance for loan losses |

|

|

(35,382 |

) |

|

|

|

|

|

|

|

|

(31,604 |

) |

|

|

|

|

|

|

|

Net interest-earning assets |

|

|

3,970,310 |

|

|

|

|

|

|

|

|

|

3,512,179 |

|

|

|

|

|

|

|

|

Cash and due from banks |

|

|

36,931 |

|

|

|

|

|

|

|

|

|

31,791 |

|

|

|

|

|

|

|

|

Premises and equipment, net |

|

|

40,122 |

|

|

|

|

|

|

|

|

|

35,405 |

|

|

|

|

|

|

|

|

Other assets |

|

|

118,885 |

|

|

|

|

|

|

|

|

|

85,944 |

|

|

|

|

|

|

|

|

|

|

$ |

4,166,248 |

|

|

|

|

|

|

|

|

$ |

3,665,319 |

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings, NOW & money market deposits |

|

$ |

1,749,025 |

|

|

|

8,823 |

|

.67 |

|

|

$ |

1,627,152 |

|

|

|

4,974 |

|

.41 |

|

|

Time deposits |

|

|

477,535 |

|

|

|

7,529 |

|

2.11 |

|

|

|

301,499 |

|

|

|

3,986 |

|

1.77 |

|

|

Total interest-bearing deposits |

|

|

2,226,560 |

|

|

|

16,352 |

|

.98 |

|

|

|

1,928,651 |

|

|

|

8,960 |

|

.62 |

|

|

Short-term borrowings |

|

|

189,141 |

|

|

|

3,026 |

|

2.14 |

|

|

|

138,523 |

|

|

|

986 |

|

.95 |

|

|

Long-term debt |

|

|

425,712 |

|

|

|

6,399 |

|

2.01 |

|

|

|

401,889 |

|

|

|

5,703 |

|

1.90 |

|

|

Total interest-bearing liabilities |

|

|

2,841,413 |

|

|

|

25,777 |

|

1.21 |

|

|

|

2,469,063 |

|

|

|

15,649 |

|

.85 |

|

|

Checking deposits |

|

|

943,689 |

|

|

|

|

|

|

|

|

|

859,805 |

|

|

|

|

|

|

|

|

Other liabilities |

|

|

9,803 |

|

|

|

|

|

|

|

|

|

8,522 |

|

|

|

|

|

|

|

|

|

|

|

3,794,905 |

|

|

|

|

|

|

|

|

|

3,337,390 |

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

371,343 |

|

|

|

|

|

|

|

|

|

327,929 |

|

|

|

|

|

|

|

|

|

|

$ |

4,166,248 |

|

|

|

|

|

|

|

|

$ |

3,665,319 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income (1) |

|

|

|

|

$ |

79,046 |

|

|

|

|

|

|

|

$ |

77,610 |

|

|

|

|

Net interest spread (1) |

|

|

|

|

|

|

|

2.28 |

% |

|

|

|

|

|

|

|

2.66 |

% |

|

Net interest margin (1) |

|

|

|

|

|

|

|

2.63 |

% |

|

|

|

|

|

|

|

2.92 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| (1) Tax-equivalent basis. Interest income on

a tax-equivalent basis includes the additional amount of interest

income that would have been earned if the Corporation's investment

in tax-exempt loans and investment securities had been made in

loans and investment securities subject to federal income taxes

yielding the same after-tax income. For 2018, the

tax-equivalent amount of $1.00 of nontaxable income was $1.27 using

the statutory federal income tax rate of 21%. For 2017, the

tax-equivalent amount of $1.00 of nontaxable income was $1.54 using

the statutory federal income tax rate of 35%. |

| |

Forward Looking Information

This earnings release contains various

“forward-looking statements” within the meaning of that term as set

forth in Rule 175 of the Securities Act of 1933 and Rule 3b-6 of

the Securities Exchange Act of 1934. Such statements are

generally contained in sentences including the words “may” or

“expect” or “could” or “should” or “would” or “believe” or

“anticipate”. The Corporation cautions that these

forward-looking statements are subject to numerous assumptions,

risks and uncertainties that could cause actual results to differ

materially from those contemplated by the forward-looking

statements. Factors that could cause future results to vary

from current management expectations include, but are not limited

to, changing economic conditions; legislative and regulatory

changes; monetary and fiscal policies of the federal government;

changes in interest rates; deposit flows and the cost of funds;

demand for loan products; competition; changes in management’s

business strategies; changes in accounting principles, policies or

guidelines; changes in real estate values; and other factors

discussed in the “risk factors” section of the Corporation’s

filings with the Securities and Exchange Commission (“SEC”).

The forward-looking statements are made as of the date of this

press release, and the Corporation assumes no obligation to update

the forward-looking statements or to update the reasons why actual

results could differ from those projected in the forward-looking

statements.

For more detailed financial information please

see the Corporation’s quarterly report on Form 10-Q for the quarter

ended September 30, 2018. The Form 10-Q will be available

through the Bank’s website at www.fnbli.com on or about November 9,

2018, after it is electronically filed with the SEC. Our SEC

filings are also available on the SEC’s website at

www.sec.gov. You may also read and copy any document we file

with the SEC at the SEC’s public reference room at 100 F Street,

N.E., Room 1580, Washington, DC 20549. You should call

1-800-SEC-0330 for more information on the public reference

room.

For More Information Contact:Mark D. Curtis,

SEVP, CFO and Treasurer (516) 671-4900, Ext. 7413

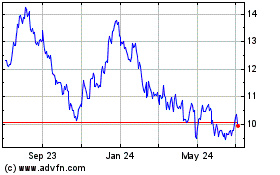

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Jul 2023 to Jul 2024