First Internet Bancorp (the “Company”) (Nasdaq: INBK), the

parent company of First Internet Bank (the “Bank”), announced today

financial and operational results for the third quarter ended

September 30, 2023.

Third Quarter 2023 Financial

Highlights

- Net income of $3.4 million and diluted earnings per share of

$0.39

- Deposit growth of $229.2 million, a 5.9% increase from the

second quarter of 2023

- Loan growth of $88.2 million, a 2.4% increase from the

second quarter of 2023

- The loans to deposits ratio was 91.5%, compared to 94.6% at

the prior quarter-end

- Net interest margin of 1.39% and fully-taxable equivalent

net interest margin of 1.49%, compared to 1.53% and 1.64%,

respectively, for the second quarter of 2023

- Nonperforming loans declined to 0.16% of total

loans

- Repurchased 97,834 common shares at an average price of

$18.29 per share

- Tangible common equity to tangible assets of 6.64%; CET1

ratio of 9.59%

- Tangible book value per share of $39.57, compared to $39.85

at the prior quarter-end

“We experienced strong deposit growth and bolstered our balance

sheet liquidity during the third quarter,” said David Becker,

Chairman and Chief Executive Officer. “At the same time, we further

optimized our loan portfolio composition and overall balance sheet

mix as new origination yields continued to improve while the pace

of deposit cost increases and the compression in our net interest

margin was the slowest it has been in five quarters.

“Growth in noninterest income was fueled by our SBA lending

team, which delivered another strong quarter with gain on sale

revenue up 14% from the prior quarter. We ended the SBA fiscal year

among the top ten most active lenders. I am proud of the continued

success of this team.

“Amidst economic and geopolitical uncertainty, our stalwart

foundation remains intact. Overall asset quality is sound. Our

capital position is strong. Our teams are focused. We believe we

are well-positioned to improve our earnings and profitability

profile as funding costs stabilize.”

Net Interest Income and Net Interest Margin

Net interest income for the third quarter of 2023 was $17.4

million, compared to $18.1 million for the second quarter of 2023,

and $24.0 million for the third quarter of 2022. On a fully-taxable

equivalent basis, net interest income for the third quarter of 2023

was $18.6 million, compared to $19.5 million for the second quarter

of 2023, and $25.3 million for the third quarter of 2022.

Total interest income for the third quarter of 2023 was $63.0

million, an increase of 8.4% compared to the second quarter of

2023, and an increase of 61.2% compared to the third quarter of

2022. On a fully-taxable equivalent basis, total interest income

for the third quarter of 2023 was $64.3 million, an increase of

8.1% compared to the second quarter of 2023, and an increase of

59.2% compared to the third quarter of 2022. The yield on average

interest-earning assets for the third quarter of 2023 increased to

5.02% from 4.89% for the second quarter of 2023 due to a 29 basis

point (“bp”) increase in the yield earned on other earning assets,

a 9 bp increase in the yield earned on loans, and a 20 bp increase

in the yield earned on securities. Compared to the linked quarter,

the average balance of other earning assets increased $142.1

million, or 27.8%, while average loan balances increased $44.9

million, or 1.2%, and the average balance of securities increased

$18.0 million, or 3.0%.

Interest income earned on commercial loans was higher due to

increased average balances and the positive impact of higher rates

in the variable rate construction and small business lending

portfolios, as well as growth and higher yields on new originations

in the franchise finance portfolio. This was partially offset by

lower average balances in the public finance, healthcare finance,

single tenant lease financing and investor commercial real estate

portfolios. The shift in loan mix is the result of a strategic

initiative to focus on variable rate and higher-yielding products

during a historic period of rapidly rising rates.

In the consumer loan portfolio, interest income was up due to

higher yields on new originations and growth in the average

balances of trailers, recreational vehicles and other consumer

loans portfolios.

The yield on funded portfolio loan originations was 8.92% in the

third quarter of 2023, an increase of 50 bps compared to the second

quarter of 2023, and an increase of 362 bps compared to the third

quarter of 2022. Because certain larger portfolios consist of

longer duration, fixed rate loans, new origination yields have a

gradual effect on the overall loan portfolio.

Interest earned on cash and other earning asset balances

increased $2.4 million, or 36.5%, during the quarter due to the

impact of higher short-term interest rates on cash balances as well

as a $142.1 million, or 29.6%, increase in average cash balances.

Furthermore, interest income earned on securities increased $0.5

million, or 11.0%, during the third quarter of 2023 due to an

increase in the yield earned on the portfolio and an increase in

average balances. The yield on the securities portfolio increased

20 bps to 3.32%, driven primarily by variable rate securities

repricing higher and increased yields on new purchases.

Total interest expense for the third quarter of 2023 was $45.6

million, an increase of $5.7 million, or 14.2%, compared to the

linked quarter, due to increases in both deposit rates and average

interest-bearing deposit balances throughout the quarter. Interest

expense related to interest-bearing deposits increased $5.7

million, or 16.3%, driven primarily by higher costs on CDs,

interest-bearing demand deposits and money market accounts. The

cost of interest-bearing deposits was 4.09% for the third quarter

of 2023, compared to 3.75% for the second quarter of 2023. The pace

of increase in deposit costs during the third quarter was the

slowest experienced by the Company in the past five quarters.

Average CD balances increased $273.1 million, or 21.2%, while

the cost of funds increased 53 bps. Early in the quarter, the

Company strategically bolstered its liquidity position ahead of the

anticipated Fed Funds rate increase in late July. The average

balance of interest-bearing demand deposits increased $27.5

million, or 7.7%, due to higher average Banking-as-a-Service

balances, while the cost of funds increased 50 bps.

These increases were partially offset by lower average brokered

deposit balances, which decreased $63.6 million, or 8.6%, from the

second quarter of 2023, as the Company reduced the balance of

higher cost brokered funding over the last two quarters.

Net interest margin (“NIM”) was 1.39% for the third quarter of

2023, down from 1.53% for the second quarter of 2023, and 2.40% for

the third quarter of 2022. Fully-taxable equivalent NIM (“FTE NIM”)

was 1.49% for the third quarter of 2023, down from 1.64% for the

second quarter of 2023, and 2.53% for the third quarter of 2022.

The decreases in NIM and FTE NIM compared to the linked quarter

were driven primarily by the effect of higher interest-bearing

deposit costs, partially offset by higher yields on loans, other

earning assets and securities. Higher cash balances, which the

Company continued to carry given the volatility in the banking

industry over the last several months, were estimated to have

negatively impacted both NIM and FTE NIM by 10 to 12 bps.

Noninterest Income

Noninterest income for the third quarter of 2023 was $7.4

million, up $1.5 million, or 26.2%, from the second quarter of

2023, and up $3.1 million, or 71.6%, from the third quarter of

2022. Gain on sale of loans totaled $5.6 million for the third

quarter of 2023, up $0.7 million, or 14.4%, from the linked

quarter. Gain on sale revenue in the quarter, which consisted

entirely of sales of U.S. Small Business Administration (“SBA”)

7(a) guaranteed loans, increased due to a higher volume of loan

sales, partially offset by modestly lower net premiums. The

Company’s SBA lending team closed out the SBA fiscal year ended

September 30, 2023 as the ninth most active 7(a) lender in the

nation by loan dollars. Net loan servicing revenue increased $0.3

million during the quarter due to growth in the servicing portfolio

as well as a lower fair value adjustment to the loan servicing

asset. Other income increased $0.5 million from the prior quarter

due primarily to income from fund investments.

Noninterest Expense

Noninterest expense for the third quarter of 2023 was $19.8

million, up $1.1 million, or 5.8%, from the second quarter of 2023,

and up $1.8 million, or 9.8%, from the third quarter of 2022.

Salaries and employee benefits expense increased $1.1 million, or

9.9%, compared to the second quarter of 2023 due mainly to higher

benefit plan costs as well as higher incentive compensation in SBA

and construction lending. Loan expenses increased from the linked

quarter due to higher third party loan servicing fees and other

miscellaneous lending costs. Data processing costs increased due to

variable deposit activity-based expenses. These increases were

partially offset by declines in premises and equipment, marketing

expenses and consulting and professional fees.

Income Taxes

The Company recognized an income tax benefit of $0.3 million for

the third quarter of 2023, compared to an income tax benefit of

$0.2 million for the second quarter of 2023, and an income tax

expense of $1.0 million and an effective tax rate of 10.5% for the

third quarter of 2022. The income tax benefit in the third quarter

of 2023 reflects the benefit of tax-exempt income relative to the

amount of stated pre-tax income.

Loans and Credit Quality

Total loans as of September 30, 2023 were $3.7 billion, an

increase of $88.2 million, or 2.4%, compared to June 30, 2023, and

an increase of $479.2 million, or 14.7%, compared to September 30,

2022. Total commercial loan balances were $2.9 billion as of

September 30, 2023, an increase of $77.2 million, or 2.7%, compared

to June 30, 2023, and an increase of $373.2 million, or 14.7%,

compared to September 30, 2022. Compared to the linked quarter, the

increase in commercial loan balances was driven primarily by

strategic growth in higher yielding franchise finance, construction

and small business lending balances. These items were partially

offset by planned decreases in the fixed-rate public finance,

single tenant lease financing and investor commercial real estate

portfolios as well as continued runoff in the healthcare finance

portfolio.

Total consumer loan balances were $786.5 million as of September

30, 2023, an increase of $13.8 million, or 1.8%, compared to June

30, 2023, and an increase of $114.3 million, or 17.0%, compared to

September 30, 2022. The increase compared to the linked quarter was

due primarily to higher balances in the trailers, recreational

vehicles and other consumer loans portfolios.

Total delinquencies 30 days or more past due were 0.22% of total

loans as of September 30, 2023, compared to 0.09% at June 30, 2023,

and 0.06% as of September 30, 2022. Nonperforming loans were 0.16%

of total loans as of September 30, 2023, compared to 0.17% as of

June 30, 2023, and 0.18% as of September 30, 2022. Nonperforming

loans totaled $5.9 million at September 30, 2023, down from $6.2

million at June 30, 2023. The decrease was due primarily to an

owner-occupied commercial real estate relationship that was

returned to accrual status during the third quarter of 2023.

The allowance for credit losses (“ACL”) as a percentage of total

loans was 0.98% as of September 30, 2023, compared to 0.99% as of

June 30, 2023, and 0.92% as of September 30, 2022. The slight

decrease in the ACL reflects the positive impact of economic data

on forecasted loss rates and adjustments to qualitative factors on

certain portfolios, partially offset by specific reserves placed on

certain loans.

Net charge-offs of $1.5 million were recognized during the third

quarter of 2023, resulting in net charge-offs to average loans of

0.16%, compared to $1.6 million, or 0.17%, for the second quarter

of 2023 and $0.2 million, or 0.02%, for the third quarter of 2022.

Net charge-offs during the third quarter of 2023 were driven

primarily by small business lending as well as a loss on the sale

of a commercial and industrial participation loan executed by the

lead bank.

The provision for credit losses in the third quarter was $1.9

million, compared to $1.7 million for the second quarter of 2023

and $0.9 million for the third quarter of 2022. The provision for

the quarter was driven primarily by net charge-offs as well as

increases in specific reserves and unfunded commitments, partially

offset by the positive impact of economic forecasts on certain

portfolios.

Capital

As of September 30, 2023, total shareholders’ equity was $347.7

million, a decrease of $6.6 million, or 1.9%, compared to June 30,

2023, and a decrease of $13.1 million, or 3.6%, compared to

September 30, 2022. The decrease in shareholders’ equity during the

third quarter of 2023 was due primarily to an increase in

accumulated other comprehensive loss and stock repurchase activity,

partially offset by net income earned during the quarter. Book

value per common share was $40.11 as of September 30, 2023,

compared to $40.38 as of June 30, 2023, and $38.84 as of September

30, 2022. Tangible book value per share was $39.57, compared to

$39.85 as of June 30, 2023 and $38.34 as of September 30, 2022.

In connection with its previously announced stock repurchase

program, the Company repurchased 97,834 shares of its common stock

during the third quarter of 2023 at an average price of $18.29 per

share. The Company has repurchased $40.7 million of stock under its

authorized programs since November of 2021.

The following table presents the Company’s and the Bank’s

regulatory and other capital ratios as of September 30, 2023.

As of September 30, 2023

Company

Bank

Total shareholders' equity to assets

6.73

%

8.35

%

Tangible common equity to tangible assets

1

6.64

%

8.26

%

Tier 1 leverage ratio 2

7.31

%

8.97

%

Common equity tier 1 capital ratio 2

9.59

%

11.77

%

Tier 1 capital ratio 2

9.59

%

11.77

%

Total risk-based capital ratio 2

13.18

%

12.71

%

1 This information represents a non-GAAP

financial measure. For a discussion of non-GAAP financial measures,

see the section below entitled "Non-GAAP Financial Measures."

2 Regulatory capital ratios are

preliminary pending filing of the Company's and the Bank's

regulatory reports.

Conference Call and Webcast

The Company will host a conference call and webcast at 2:00 p.m.

Eastern Time on Thursday, October 26, 2023 to discuss its quarterly

financial results. The call can be accessed via telephone at (888)

259-6580; access code: 53091613. A recorded replay can be accessed

through November 24, 2023 by dialing (877) 674-7070; access code:

091613.

Additionally, interested parties can listen to a live webcast of

the call on the Company's website at www.firstinternetbancorp.com.

An archived version of the webcast will be available in the same

location shortly after the live call has ended.

About First Internet Bancorp

First Internet Bancorp is a financial holding company with

assets of $5.2 billion as of September 30, 2023. The Company’s

subsidiary, First Internet Bank, opened for business in 1999 as an

industry pioneer in the branchless delivery of banking services.

First Internet Bank provides consumer and small business deposit,

SBA financing, franchise finance, consumer loans, and specialty

finance services nationally as well as commercial real estate

loans, construction loans, commercial and industrial loans, and

treasury management services on a regional basis. First Internet

Bancorp’s common stock trades on the Nasdaq Global Select Market

under the symbol “INBK”. Additional information about the Company

is available at www.firstinternetbancorp.com and additional

information about First Internet Bank, including its products and

services, is available at www.firstib.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including statements with respect to

the financial condition, results of operations, trends in lending

policies and loan programs, plans and prospective business

partnerships, objectives, future performance and business of the

Company. Forward-looking statements are generally identifiable by

the use of words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “growth,” “help,” “may,”

“opportunities,” “pending,” “plan,” “position,” “preliminary,”

“remain,” “should,” “thereafter,” “well-positioned,” “will,” or

other similar expressions. Forward-looking statements are not a

guarantee of future performance or results, are based on

information available at the time the statements are made and

involve known and unknown risks, uncertainties and other factors

that could cause actual results to differ materially from the

information in the forward-looking statements. Such statements are

subject to certain risks and uncertainties including: our business

and operations and the business and operations of our vendors and

customers: general economic conditions, whether national or

regional, and conditions in the lending markets in which we

participate that may have an adverse effect on the demand for our

loans and other products; our credit quality and related levels of

nonperforming assets and loan losses, and the value and salability

of the real estate that is the collateral for our loans. Other

factors that may cause such differences include: failures or

breaches of or interruptions in the communications and information

systems on which we rely to conduct our business; failure of our

plans to grow our commercial and industrial, construction, SBA, and

franchise finance loan portfolios; competition with national,

regional and community financial institutions; the loss of any key

members of senior management; the anticipated impacts of inflation

and rising interest rates on the general economy; risks relating to

the regulation of financial institutions; and other factors

identified in reports we file with the U.S. Securities and Exchange

Commission. All statements in this press release, including

forward-looking statements, speak only as of the date they are

made, and the Company undertakes no obligation to update any

statement in light of new information or future events.

Non-GAAP Financial Measures

This press release contains financial information determined by

methods other than in accordance with U.S. generally accepted

accounting principles (“GAAP”). Non-GAAP financial measures,

specifically tangible common equity, tangible assets, tangible book

value per common share, tangible common equity to tangible assets,

average tangible common equity, return on average tangible common

equity, total interest income – FTE, net interest income – FTE, net

interest margin – FTE, adjusted total revenue, adjusted noninterest

income, adjusted noninterest expense, adjusted income before income

taxes, adjusted income tax (benefit) provision, adjusted net

income, adjusted diluted earnings per share, adjusted return on

average assets, adjusted return on average shareholders’ equity,

and adjusted return on average tangible common equity used by the

Company’s management to measure the strength of its capital and

analyze profitability, including its ability to generate earnings

on tangible capital invested by its shareholders. Although

management believes these non-GAAP measures are useful to investors

by providing a greater understanding of its business, they should

not be considered a substitute for financial measures determined in

accordance with GAAP, nor are they necessarily comparable to

non-GAAP performance measures that may be presented by other

companies. Reconciliations of these non-GAAP financial measures to

the most directly comparable GAAP financial measures are included

in the table at the end of this release under the caption

“Reconciliation of Non-GAAP Financial Measures.”

First Internet Bancorp Summary Financial Information

(unaudited) Dollar amounts in thousands, except per share data

Three Months Ended Nine Months Ended

September 30, June 30, September 30,

September 30, September 30,

2023

2023

2022

2023

2022

Net income

$

3,409

$

3,882

$

8,436

$

4,274

$

29,190

Per share and share information Earnings per share -

basic

$

0.39

$

0.44

$

0.89

$

0.48

$

3.04

Earnings per share - diluted

0.39

0.44

0.89

0.48

3.01

Dividends declared per share

0.06

0.06

0.06

0.18

0.18

Book value per common share

40.11

40.38

38.84

40.11

38.84

Tangible book value per common share 1

39.57

39.85

38.34

39.57

38.34

Common shares outstanding

8,669,673

8,774,507

9,290,885

8,669,673

9,290,885

Average common shares outstanding: Basic

8,744,385

8,903,213

9,458,259

8,889,532

9,615,039

Diluted

8,767,217

8,908,180

9,525,855

8,907,748

9,681,742

Performance ratios Return on average assets

0.26

%

0.32

%

0.82

%

0.12

%

0.94

%

Return on average shareholders' equity

3.79

%

4.35

%

9.01

%

1.59

%

10.40

%

Return on average tangible common equity 1

3.84

%

4.40

%

9.13

%

1.61

%

10.53

%

Net interest margin

1.39

%

1.53

%

2.40

%

1.55

%

2.52

%

Net interest margin - FTE 1,2

1.49

%

1.64

%

2.53

%

1.66

%

2.65

%

Capital ratios 3 Total shareholders' equity to assets

6.73

%

7.16

%

8.46

%

6.73

%

8.46

%

Tangible common equity to tangible assets 1

6.64

%

7.07

%

8.36

%

6.64

%

8.36

%

Tier 1 leverage ratio

7.31

%

7.63

%

9.49

%

7.31

%

9.49

%

Common equity tier 1 capital ratio

9.59

%

10.10

%

11.72

%

9.59

%

11.72

%

Tier 1 capital ratio

9.59

%

10.10

%

11.72

%

9.59

%

11.72

%

Total risk-based capital ratio

13.18

%

13.87

%

15.73

%

13.18

%

15.73

%

Asset quality Nonperforming loans

$

5,885

$

6,227

$

6,006

$

5,885

$

6,006

Nonperforming assets

6,069

6,397

6,006

6,069

6,006

Nonperforming loans to loans

0.16

%

0.17

%

0.18

%

0.16

%

0.18

%

Nonperforming assets to total assets

0.12

%

0.13

%

0.14

%

0.12

%

0.14

%

Allowance for credit losses - loans to: Loans

0.98

%

0.99

%

0.92

%

0.98

%

0.92

%

Nonperforming loans

619.4

%

579.1

%

497.3

%

619.4

%

497.3

%

Net charge-offs to average loans

0.16

%

0.17

%

0.02

%

0.38

%

0.04

%

Average balance sheet information Loans

$

3,700,410

$

3,653,839

$

3,161,850

$

3,643,156

$

3,036,532

Total securities

622,220

604,182

606,329

604,026

624,995

Other earning assets

653,375

511,295

188,467

499,835

321,262

Total interest-earning assets

4,976,667

4,771,623

3,970,650

4,751,104

4,004,025

Total assets

5,137,474

4,927,712

4,105,688

4,905,910

4,138,866

Noninterest-bearing deposits

127,540

117,496

124,067

126,647

115,142

Interest-bearing deposits

3,911,696

3,713,086

2,961,327

3,680,746

3,016,652

Total deposits

4,039,236

3,830,582

3,085,394

3,807,393

3,131,794

Shareholders' equity

356,701

358,312

371,303

359,405

375,190

1 Refer to "Non-GAAP Financial Measures" section above and

"Reconciliation of Non-GAAP Financial Measures" below 2 On a

fully-taxable equivalent ("FTE") basis assuming a 21% tax rate 3

Regulatory capital ratios are preliminary pending filing of the

Company's regulatory reports

First Internet Bancorp

Condensed Consolidated Balance Sheets (unaudited) Dollar

amounts in thousands

September 30, June

30, September 30,

2023

2023

2022

Assets Cash and due from banks

$

3,595

$

9,503

$

14,743

Interest-bearing deposits

517,610

456,128

206,309

Securities available-for-sale, at fair value

450,827

379,394

393,565

Securities held-to-maturity, at amortized cost, net of allowance

for credit losses

231,928

230,605

191,057

Loans held-for-sale

31,669

32,001

23,103

Loans

3,735,068

3,646,832

3,255,906

Allowance for credit losses - loans

(36,452

)

(36,058

)

(29,866

)

Net loans

3,698,616

3,610,774

3,226,040

Accrued interest receivable

23,761

24,101

16,918

Federal Home Loan Bank of Indianapolis stock

28,350

28,350

28,350

Cash surrender value of bank-owned life insurance

40,619

40,357

39,612

Premises and equipment, net

74,197

73,525

70,747

Goodwill

4,687

4,687

4,687

Servicing asset

9,579

8,252

5,795

Other real estate owned

106

106

-

Accrued income and other assets

53,479

49,266

43,498

Total assets

$

5,169,023

$

4,947,049

$

4,264,424

Liabilities Noninterest-bearing deposits

$

125,265

$

119,291

$

142,875

Interest-bearing deposits

3,958,280

3,735,017

3,049,769

Total deposits

4,083,545

3,854,308

3,192,644

Advances from Federal Home Loan Bank

614,933

614,931

589,926

Subordinated debt

104,761

104,684

104,456

Accrued interest payable

2,968

3,338

1,887

Accrued expenses and other liabilities

15,072

15,456

14,654

Total liabilities

4,821,279

4,592,717

3,903,567

Shareholders' equity Voting common stock

185,085

186,545

200,123

Retained earnings

203,856

200,973

199,877

Accumulated other comprehensive loss

(41,197

)

(33,186

)

(39,143

)

Total shareholders' equity

347,744

354,332

360,857

Total liabilities and shareholders' equity

$

5,169,023

$

4,947,049

$

4,264,424

First Internet Bancorp Condensed Consolidated Statements

of Income (unaudited) Dollar amounts in thousands, except per

share data

Three Months Ended Nine Months

Ended September 30, June 30, September

30, September 30, September 30,

2023

2023

2022

2023

2022

Interest income Loans

$

48,898

$

46,906

$

34,643

$

139,647

$

100,246

Securities - taxable

4,301

3,835

2,701

11,742

7,489

Securities - non-taxable

912

860

491

2,570

1,068

Other earning assets

8,904

6,521

1,264

19,211

2,436

Total interest income

63,015

58,122

39,099

173,170

111,239

Interest expense Deposits

40,339

34,676

10,520

102,285

23,025

Other borrowed funds

5,298

5,301

4,585

15,788

12,790

Total interest expense

45,637

39,977

15,105

118,073

35,815

Net interest income

17,378

18,145

23,994

55,097

75,424

Provision for credit losses

1,946

1,698

892

13,059

2,868

Net interest income after provision for credit losses

15,432

16,447

23,102

42,038

72,556

Noninterest income Service charges and fees

208

218

248

635

845

Loan servicing revenue

1,064

850

653

2,699

1,858

Loan servicing asset revaluation

(257

)

(358

)

(333

)

(670

)

(1,100

)

Mortgage banking activities

-

-

871

76

4,454

Gain on sale of loans

5,569

4,868

2,713

14,498

8,510

Other

823

293

164

1,486

883

Total noninterest income

7,407

5,871

4,316

18,724

15,450

Noninterest expense Salaries and employee benefits

11,767

10,706

10,439

34,267

31,149

Marketing, advertising and promotion

500

705

1,041

2,049

2,717

Consulting and professional fees

552

711

790

2,189

3,912

Data processing

701

520

483

1,880

1,422

Loan expenses

1,336

1,072

1,142

4,385

3,417

Premises and equipment

2,315

2,661

2,808

7,753

7,767

Deposit insurance premium

1,067

936

229

2,546

797

Other

1,518

1,359

1,063

4,311

3,579

Total noninterest expense

19,756

18,670

17,995

59,380

54,760

Income before income taxes

3,083

3,648

9,423

1,382

33,246

Income tax (benefit) provision

(326

)

(234

)

987

(2,892

)

4,056

Net income

$

3,409

$

3,882

$

8,436

$

4,274

$

29,190

Per common share data Earnings per share - basic

$

0.39

$

0.44

$

0.89

$

0.48

$

3.04

Earnings per share - diluted

$

0.39

$

0.44

$

0.89

$

0.48

$

3.01

Dividends declared per share

$

0.06

$

0.06

$

0.06

$

0.18

$

0.18

All periods presented have been reclassified to conform to the

current period classification

First Internet Bancorp

Average Balances and Rates (unaudited) Dollar amounts in

thousands

Three Months Ended

September 30, 2023 June 30, 2023 September 30,

2022 Average Interest / Yield /

Average Interest / Yield / Average

Interest / Yield / Balance Dividends

Cost Balance Dividends Cost

Balance Dividends Cost Assets

Interest-earning assets Loans, including loans held-for-sale 1

$

3,701,072

$

48,898

5.24

%

$

3,656,146

$

46,906

5.15

%

$

3,175,854

$

34,643

4.33

%

Securities - taxable

550,208

4,301

3.10

%

531,040

3,835

2.90

%

532,470

2,701

2.01

%

Securities - non-taxable

72,012

912

5.02

%

73,142

860

4.72

%

73,859

491

2.64

%

Other earning assets

653,375

8,904

5.41

%

511,295

6,521

5.12

%

188,467

1,264

2.66

%

Total interest-earning assets

4,976,667

63,015

5.02

%

4,771,623

58,122

4.89

%

3,970,650

39,099

3.91

%

Allowance for credit losses - loans

(35,601

)

(36,671

)

(29,423

)

Noninterest-earning assets

196,408

192,760

164,461

Total assets

$

5,137,474

$

4,927,712

$

4,105,688

Liabilities Interest-bearing liabilities

Interest-bearing demand deposits

$

387,517

$

2,131

2.18

%

$

359,969

$

1,509

1.68

%

$

342,116

$

551

0.64

%

Savings accounts

26,221

56

0.85

%

29,915

64

0.86

%

57,700

111

0.76

%

Money market accounts

1,230,746

12,537

4.04

%

1,274,453

12,314

3.88

%

1,369,783

4,581

1.33

%

BaaS - brokered deposits

31,891

348

4.33

%

22,918

230

4.03

%

153,936

859

2.21

%

Certificates and brokered deposits

2,235,321

25,267

4.48

%

2,025,831

20,559

4.07

%

1,037,792

4,418

1.69

%

Total interest-bearing deposits

3,911,696

40,339

4.09

%

3,713,086

34,676

3.75

%

2,961,327

10,520

1.41

%

Other borrowed funds

719,655

5,298

2.92

%

719,577

5,301

2.95

%

637,877

4,585

2.85

%

Total interest-bearing liabilities

4,631,351

45,637

3.91

%

4,432,663

39,977

3.62

%

3,599,204

15,105

1.67

%

Noninterest-bearing deposits

127,540

117,496

124,067

Other noninterest-bearing liabilities

21,882

19,241

11,114

Total liabilities

4,780,773

4,569,400

3,734,385

Shareholders' equity

356,701

358,312

371,303

Total liabilities and shareholders' equity

$

5,137,474

$

4,927,712

$

4,105,688

Net interest income

$

17,378

$

18,145

$

23,994

Interest rate spread

1.11

%

1.27

%

2.24

%

Net interest margin

1.39

%

1.53

%

2.40

%

Net interest margin - FTE 2,3

1.49

%

1.64

%

2.53

%

1 Includes nonaccrual loans 2 On a fully-taxable equivalent ("FTE")

basis assuming a 21% tax rate 3 Refer to "Non-GAAP Financial

Measures" section above and "Reconciliation of Non-GAAP Financial

Measures" below

First Internet Bancorp Average Balances

and Rates (unaudited) Dollar amounts in thousands

Nine Months Ended September 30, 2023

September 30, 2022 Average Interest /

Yield / Average Interest / Yield /

Balance Dividends Cost Balance

Dividends Cost Assets Interest-earning

assets Loans, including loans held-for-sale 1

$

3,647,243

$

139,647

5.12

%

$

3,057,768

$

100,246

4.38

%

Securities - taxable

531,197

11,742

2.96

%

547,759

7,489

1.83

%

Securities - non-taxable

72,829

2,570

4.72

%

77,236

1,068

1.85

%

Other earning assets

499,835

19,211

5.14

%

321,262

2,436

1.01

%

Total interest-earning assets

4,751,104

173,170

4.87

%

4,004,025

111,239

3.71

%

-

Allowance for credit losses - loans

(35,784

)

(28,671

)

Noninterest-earning assets

190,590

163,512

Total assets

$

4,905,910

$

4,138,866

Liabilities Interest-bearing liabilities

Interest-bearing demand deposits

$

360,573

$

4,540

1.68

%

$

336,311

$

1,429

0.57

%

Savings accounts

31,494

202

0.86

%

61,647

232

0.50

%

Money market accounts

1,293,728

37,151

3.84

%

1,416,984

8,006

0.76

%

BaaS - brokered deposits

23,246

716

4.12

%

79,613

1,019

1.71

%

Certificates and brokered deposits

1,971,705

59,676

4.05

%

1,122,097

12,339

1.47

%

Total interest-bearing deposits

3,680,746

102,285

3.72

%

3,016,652

23,025

1.02

%

Other borrowed funds

719,577

15,788

2.93

%

613,609

12,790

2.79

%

Total interest-bearing liabilities

4,400,323

118,073

3.59

%

3,630,261

35,815

1.32

%

Noninterest-bearing deposits

126,647

115,142

Other noninterest-bearing liabilities

19,535

18,273

Total liabilities

4,546,505

3,763,676

Shareholders' equity

359,405

375,190

Total liabilities and shareholders' equity

$

4,905,910

$

4,138,866

Net interest income

$

55,097

$

75,424

Interest rate spread

1.28

%

2.39

%

Net interest margin

1.55

%

2.52

%

Net interest margin - FTE 2,3

1.66

%

2.65

%

1 Includes nonaccrual loans 2 On a fully-taxable equivalent ("FTE")

basis assuming a 21% tax rate 3 Refer to "Non-GAAP Financial

Measures" section above and "Reconciliation of Non-GAAP Financial

Measures" below

First Internet Bancorp Loans and Deposits

(unaudited) Dollar amounts in thousands

September 30, 2023 June 30, 2023 September 30,

2022 Amount Percent Amount

Percent Amount Percent Commercial

loans Commercial and industrial

$

114,265

3.1

%

$

112,423

3.1

%

$

104,780

3.2

%

Owner-occupied commercial real estate

58,486

1.6

%

59,564

1.6

%

58,615

1.8

%

Investor commercial real estate

129,831

3.5

%

137,504

3.8

%

91,021

2.8

%

Construction

252,105

6.7

%

192,453

5.3

%

139,509

4.3

%

Single tenant lease financing

933,873

25.0

%

947,466

25.9

%

895,302

27.4

%

Public finance

535,960

14.3

%

575,541

15.8

%

614,139

18.9

%

Healthcare finance

235,622

6.3

%

245,072

6.7

%

293,686

9.0

%

Small business lending

192,996

5.2

%

170,550

4.7

%

113,001

3.5

%

Franchise finance

455,094

12.2

%

390,479

10.6

%

225,012

6.8

%

Total commercial loans

2,908,232

77.9

%

2,831,052

77.5

%

2,535,065

77.7

%

Consumer loans Residential mortgage

393,501

10.5

%

396,154

10.9

%

337,565

10.4

%

Home equity

23,544

0.6

%

24,375

0.7

%

22,114

0.7

%

Trailers

186,424

5.0

%

178,035

4.9

%

162,161

5.0

%

Recreational vehicles

140,205

3.8

%

133,283

3.7

%

115,694

3.6

%

Other consumer loans

42,822

1.1

%

40,806

1.1

%

34,657

1.1

%

Total consumer loans

786,496

21.0

%

772,653

21.3

%

672,191

20.8

%

Net deferred loan fees, premiums, discounts and other 1

40,340

1.1

%

43,127

1.2

%

48,650

1.5

%

Total loans

$

3,735,068

100.0

%

$

3,646,832

100.0

%

$

3,255,906

100.0

%

September 30, 2023 June 30, 2023

September 30, 2022 Amount Percent

Amount Percent Amount Percent

Deposits Noninterest-bearing deposits

$

125,265

3.1

%

$

119,291

3.1

%

$

142,635

4.5

%

Interest-bearing demand deposits

374,915

9.2

%

398,899

10.3

%

337,765

10.6

%

Savings accounts

23,811

0.6

%

28,239

0.7

%

52,228

1.6

%

Money market accounts

1,222,511

29.9

%

1,232,719

32.0

%

1,378,087

43.2

%

BaaS - brokered deposits

41,884

1.0

%

25,549

0.7

%

96,287

3.0

%

Certificates of deposits

1,624,447

39.8

%

1,366,409

35.5

%

773,040

24.2

%

Brokered deposits

670,712

16.4

%

683,202

17.7

%

412,602

12.9

%

Total deposits

$

4,083,545

100.0

%

$

3,854,308

100.0

%

$

3,192,644

100.0

%

1 Includes carrying value adjustments of $29.0 million, $30.5

million and $33.9 million related to terminated interest rate swaps

associated with public finance loans as of September 30, 2023, June

30, 2023 and September 30, 2022, respectively.

First Internet

Bancorp Reconciliation of Non-GAAP Financial Measures

Dollar amounts in thousands, except per share data

Three Months Ended Nine Months Ended

September 30, June 30, September 30,

September 30, September 30,

2023

2023

2022

2023

2022

Total equity - GAAP

$

347,744

$

354,332

$

360,857

$

347,744

$

360,857

Adjustments: Goodwill

(4,687

)

(4,687

)

(4,687

)

(4,687

)

(4,687

)

Tangible common equity

$

343,057

$

349,645

$

356,170

$

343,057

$

356,170

Total assets - GAAP

$

5,169,023

$

4,947,049

$

4,264,424

$

5,169,023

$

4,264,424

Adjustments: Goodwill

(4,687

)

(4,687

)

(4,687

)

(4,687

)

(4,687

)

Tangible assets

$

5,164,336

$

4,942,362

$

4,259,737

$

5,164,336

$

4,259,737

Common shares outstanding

8,669,673

8,774,507

9,290,885

8,669,673

9,290,885

Book value per common share

$

40.11

$

40.38

$

38.84

$

40.11

$

38.84

Effect of goodwill

(0.54

)

(0.53

)

(0.50

)

(0.54

)

(0.50

)

Tangible book value per common share

$

39.57

$

39.85

$

38.34

$

39.57

$

38.34

Total shareholders' equity to assets

6.73

%

7.16

%

8.46

%

6.73

%

8.46

%

Effect of goodwill

(0.09

%)

(0.09

%)

(0.10

%)

(0.09

%)

(0.10

%)

Tangible common equity to tangible assets

6.64

%

7.07

%

8.36

%

6.64

%

8.36

%

Total average equity - GAAP

$

356,701

$

358,312

$

371,303

$

359,405

$

375,190

Adjustments: Average goodwill

(4,687

)

(4,687

)

(4,687

)

(4,687

)

(4,687

)

Average tangible common equity

$

352,014

$

353,625

$

366,616

$

354,718

$

370,503

Return on average shareholders' equity

3.79

%

4.35

%

9.01

%

1.59

%

10.40

%

Effect of goodwill

0.05

%

0.05

%

0.12

%

0.02

%

0.13

%

Return on average tangible common equity

3.84

%

4.40

%

9.13

%

1.61

%

10.53

%

Total interest income

$

63,015

$

58,122

$

39,099

$

173,170

$

111,239

Adjustments: Fully-taxable equivalent adjustments 1

1,265

1,347

1,280

3,995

3,971

Total interest income - FTE

$

64,280

$

59,469

$

40,379

$

177,165

$

115,210

Net interest income

$

17,378

$

18,145

$

23,994

$

55,097

$

75,424

Adjustments: Fully-taxable equivalent adjustments 1

1,265

1,347

1,280

3,995

3,971

Net interest income - FTE

$

18,643

$

19,492

$

25,274

$

59,092

$

79,395

Net interest margin

1.39

%

1.53

%

2.40

%

1.55

%

2.52

%

Effect of fully-taxable equivalent adjustments 1

0.10

%

0.11

%

0.13

%

0.11

%

0.13

%

Net interest margin - FTE

1.49

%

1.64

%

2.53

%

1.66

%

2.65

%

1 Assuming a 21% tax rate

First Internet Bancorp

Reconciliation of Non-GAAP Financial Measures Dollar amounts

in thousands, except per share data

Three Months

Ended Nine Months Ended September 30,

June 30, September 30, September 30,

September 30,

2023

2023

2022

2023

2022

Total revenue - GAAP

$

24,785

$

24,016

$

28,310

$

73,821

$

90,874

Adjustments: Mortgage-related revenue

-

-

-

-

-

Adjusted total revenue

$

24,785

$

24,016

$

28,310

$

73,821

$

90,874

Noninterest income - GAAP

$

7,407

$

5,871

$

4,316

$

18,724

$

15,450

Adjustments: Mortgage-related revenue

-

-

-

(65

)

-

Adjusted noninterest income

$

7,407

$

5,871

$

4,316

$

18,659

$

15,450

Noninterest expense - GAAP

$

19,756

$

18,670

$

17,995

$

59,380

$

54,760

Adjustments: Mortgage-related costs

-

-

-

(3,052

)

-

Acquisition-related expenses

-

-

-

-

(273

)

Write-down of software

-

-

(125

)

-

(125

)

Nonrecurring consulting fee

-

-

-

-

(875

)

Discretionary inflation bonus

-

-

-

-

(531

)

Accelerated equity compensation

-

-

-

-

(289

)

Adjusted noninterest expense

$

19,756

$

18,670

$

17,870

$

56,328

$

52,667

Income before income taxes - GAAP

$

3,083

$

3,648

$

9,423

$

1,382

$

33,246

Adjustments:1 Mortgage-related revenue

-

-

-

(65

)

-

Mortgage-related costs

-

-

-

3,052

-

Partial charge-off of C&I participation loan

-

-

-

6,914

-

Acquisition-related expenses

-

-

-

-

273

Write-down of software

-

-

125

-

125

Nonrecurring consulting fee

-

-

-

-

875

Discretionary inflation bonus

-

-

-

-

531

Accelerated equity compensation

-

-

-

-

289

Adjusted income before income taxes

$

3,083

$

3,648

$

9,548

$

11,283

$

35,339

Income tax (benefit) provision - GAAP

$

(326

)

$

(234

)

$

987

$

(2,892

)

$

4,056

Adjustments:1 Mortgage-related revenue

-

-

-

(14

)

-

Mortgage-related costs

-

-

-

641

-

Partial charge-off of C&I participation loan

-

-

-

1,452

-

Acquisition-related expenses

-

-

-

-

57

Write-down of software

-

-

26

-

26

Nonrecurring consulting fee

-

-

-

-

184

Discretionary inflation bonus

-

-

-

-

112

Accelerated equity compensation

-

-

-

-

61

Adjusted income tax (benefit) provision

$

(326

)

$

(234

)

$

1,013

$

(813

)

$

4,496

Net income- GAAP

$

3,409

$

3,882

$

8,436

$

4,274

$

29,190

Adjustments: Mortgage-related revenue

-

-

-

(51

)

-

Mortgage-related costs

-

-

-

2,411

-

Partial charge-off of C&I participation loan

-

-

-

5,462

-

Acquisition-related expenses

-

-

-

-

216

Write-down of software

-

-

99

-

99

Nonrecurring consulting fee

-

-

-

-

691

Discretionary inflation bonus

-

-

-

-

419

Accelerated equity compensation

-

-

-

-

228

Adjusted net income

$

3,409

$

3,882

$

8,535

$

12,096

$

30,843

1 Assuming a 21% tax rate

First Internet Bancorp

Reconciliation of Non-GAAP Financial Measures Dollar amounts

in thousands, except per share data

Three Months

Ended Nine Months Ended September 30,

June 30, September 30, September 30,

September 30,

2023

2023

2022

2023

2022

Diluted average common shares outstanding

8,767,217

8,908,180

9,525,855

8,907,748

9,681,742

Diluted earnings per share - GAAP

$

0.39

$

0.44

$

0.89

$

0.48

$

3.01

Adjustments: Effect of mortgage-related revenue

-

-

-

(0.01

)

-

Effect of mortgage-related costs

-

-

-

0.27

-

Effect of partial charge-off of C&I participation loan

-

-

-

0.61

-

Effect of acquisition-related expenses

-

-

-

0.02

Effect of write-down of software

-

-

0.01

-

0.01

Effect of nonrecurring consulting fee

-

-

-

-

0.07

Effect of discretionary inflation bonus

-

-

-

-

0.04

Effect of accelerated equity compensation

-

-

-

0.02

Adjusted diluted earnings per share

$

0.39

$

0.44

$

0.90

$

1.35

$

3.17

Return on average assets

0.26

%

0.32

%

0.82

%

0.12

%

0.94

%

Effect of mortgage-related revenue

0.00

%

0.00

%

0.00

%

0.00

%

0.00

%

Effect of mortgage-related costs

0.00

%

0.00

%

0.00

%

0.07

%

0.00

%

Effect of partial charge-off of C&I participation loan

0.00

%

0.00

%

0.00

%

0.15

%

0.00

%

Effect of acquisition-related expenses

0.00

%

0.00

%

0.00

%

0.00

%

0.01

%

Effect of write-down of software

0.00

%

0.00

%

0.01

%

0.00

%

0.00

%

Effect of nonrecurring consulting fee

0.00

%

0.00

%

0.00

%

0.00

%

0.02

%

Effect of discretionary inflation bonus

0.00

%

0.00

%

0.00

%

0.00

%

0.01

%

Effect of accelerated equity compensation

0.00

%

0.00

%

0.00

%

0.00

%

0.01

%

Adjusted return on average assets

0.26

%

0.32

%

0.83

%

0.34

%

0.99

%

Return on average shareholders' equity

3.79

%

4.35

%

9.01

%

1.59

%

10.40

%

Effect of mortgage-related revenue

0.00

%

0.00

%

0.00

%

(0.02

%)

0.00

%

Effect of mortgage-related costs

0.00

%

0.00

%

0.00

%

0.90

%

0.00

%

Effect of partial charge-off of C&I participation loan

0.00

%

0.00

%

0.00

%

2.03

%

0.00

%

Effect of acquisition-related expenses

0.00

%

0.00

%

0.00

%

0.00

%

0.08

%

Effect of write-down of software

0.00

%

0.00

%

0.11

%

0.00

%

0.04

%

Effect of nonrecurring consulting fee

0.00

%

0.00

%

0.00

%

0.00

%

0.25

%

Effect of discretionary inflation bonus

0.00

%

0.00

%

0.00

%

0.00

%

0.15

%

Effect of accelerated equity compensation

0.00

%

0.00

%

0.00

%

0.00

%

0.08

%

Adjusted return on average shareholders' equity

3.79

%

4.35

%

9.12

%

4.50

%

11.00

%

Return on average tangible common equity

3.84

%

4.40

%

9.13

%

1.61

%

10.53

%

Effect of mortgage-related revenue

0.00

%

0.00

%

0.00

%

(0.02

%)

0.00

%

Effect of mortgage-related costs

0.00

%

0.00

%

0.00

%

0.91

%

0.00

%

Effect of partial charge-off of C&I participation loan

0.00

%

0.00

%

0.00

%

2.06

%

0.00

%

Effect of acquisition-related expenses

0.00

%

0.00

%

0.00

%

0.00

%

0.08

%

Effect of write-down of software

0.00

%

0.00

%

0.11

%

0.00

%

0.04

%

Effect of nonrecurring consulting fee

0.00

%

0.00

%

0.00

%

0.00

%

0.25

%

Effect of discretionary inflation bonus

0.00

%

0.00

%

0.00

%

0.00

%

0.15

%

Effect of accelerated equity compensation

0.00

%

0.00

%

0.00

%

0.00

%

0.08

%

Adjusted return on average tangible common equity

3.84

%

4.40

%

9.24

%

4.56

%

11.13

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231023839498/en/

Investors/Analysts Paula Deemer

Director of Corporate Administration (317) 428-4628

investors@firstib.com

Media BLASTmedia for First Internet

Bank Ryan Hecker firstib@blastmedia.com

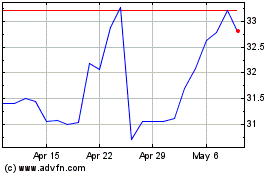

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Nov 2024 to Dec 2024

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Dec 2023 to Dec 2024