0001562463false00015624632023-07-262023-07-260001562463us-gaap:CommonStockMember2023-07-262023-07-260001562463inbk:A60FixedToFloatingSubordinatedNotesDue2029Member2023-07-262023-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 26, 2023

| | | | | | | | | | | | | | |

| First Internet Bancorp |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | |

| Indiana |

| (State or Other Jurisdiction of Incorporation) |

| | | | |

| 001-35750 | | 20-3489991 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 8701 E. 116th Street | | 46038 |

Fishers, Indiana | |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | |

(317) 532-7900 |

| (Registrant's Telephone Number, Including Area Code) |

| | | | |

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

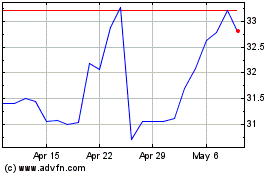

| Common Stock, without par value | | INBK | | The Nasdaq Stock Market LLC |

| 6.0% Fixed to Floating Subordinated Notes due 2029 | | INBKZ | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On July 26, 2023, First Internet Bancorp (the "Company") issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated by reference herein.

On July 27, 2023 at 2:00 p.m. (Eastern Time), the Company will host a conference call and webcast to discuss its financial results for the quarter ended June 30, 2023. The electronic presentation slides, which will accompany the call and webcast, are furnished as Exhibit 99.2 and are incorporated by reference herein.

The information contained in this Item 2.02, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing made by us under the Exchange Act or Securities Act of 1933, as amended, regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | | | | | | | |

| Number | | Description | | Method of filing |

| | | | Furnished electronically |

| | | | Furnished electronically |

| 104 | | Cover Page Interactive Data File (embedded in the cover page formatted in inline XBRL) | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | Dated: | July 26, 2023 |

| | | | |

| | FIRST INTERNET BANCORP |

| | | | |

| | By: | /s/ Kenneth J. Lovik |

| | | Kenneth J. Lovik, Executive Vice President & Chief Financial Officer |

First Internet Bancorp Reports Second Quarter 2023 Results

Fishers, Indiana, July 26, 2023 – First Internet Bancorp (the “Company”) (Nasdaq: INBK), the parent company of First Internet Bank (the “Bank”), announced today financial and operational results for the second quarter ended June 30, 2023.

Second Quarter 2023 Financial Highlights

•Net income of $3.9 million and diluted earnings per share of $0.44

•Deposit growth of $232.0 million, a 6.4% increase from the first quarter of 2023

•Loan growth of $39.6 million, a 1.1% increase from the first quarter of 2023

•The loans to deposits ratio was 94.6%, compared to 99.6% in the first quarter of 2023

•Net interest margin of 1.53% and fully-taxable equivalent net interest margin of 1.64%, compared to 1.76% and 1.89%, respectively, for the first quarter of 2023

•Nonperforming loans declined to 0.17% of total loans

•Repurchased 203,000 common shares at an average price of $13.52 per share

•Tangible common equity to tangible assets of 7.07%; CET1 ratio of 10.10%; tangible book value per share of $39.85, a 1.6% increase from the first quarter of 2023

•

“Following the events in the banking sector that occurred in March, we responded quickly to further enhance our balance sheet liquidity,” said David Becker, Chairman and Chief Executive Officer. “These actions resulted in higher deposit costs and cash balances, which impacted our earnings, but further solidified our strong foundation. Moreover, credit measures improved during the second quarter, asset quality overall remains sound, and our capital position is strong, leaving us well-positioned for the road ahead. At the same time, we continued to execute our strategy of optimizing the loan portfolio composition through funding high quality variable rate and higher yielding loans. New origination yields continued to meaningfully improve during the quarter, and our SBA team delivered strong results, setting the stage for us to achieve stronger earnings and profitability as deposit costs stabilize.”

Net Interest Income and Net Interest Margin

Net interest income for the second quarter of 2023 was $18.1 million, compared to $19.6 million for the first quarter of 2023, and $25.7 million for the second quarter of 2022. On a fully-taxable

equivalent basis, net interest income for the second quarter of 2023 was $19.5 million, compared to $21.0 million for the first quarter of 2023, and $27.1 million for the second quarter of 2022.

Total interest income for the second quarter of 2023 was $58.1 million, an increase of 11.7% compared to the first quarter of 2023, and an increase of 61.0% compared to the second quarter of 2022. On a fully-taxable equivalent basis, total interest income for the second quarter of 2023 was $59.5 million, an increase of 11.3% compared to the first quarter of 2023 and an increase of 58.7% compared to the second quarter of 2022. The increase from the linked quarter was due primarily to growth in interest income earned on loans, other earning assets and securities. The yield on average interest-earning assets for the second quarter of 2023 increased to 4.89% from 4.69% for the first quarter of 2023 due primarily to a 19 basis point (“bp”) increase in the average loan yield, a 49 bp increase in the yield earned on other earning assets, and a 7 bp increase in the yield earned on securities. Compared to the linked quarter, average loan balances increased $72.9 million, or 2.0%, while the average balance of other earning assets increased $180.0 million, or 54.3%, and the average balance of securities increased $18.9 million, or 3.2%.

Interest income earned on commercial loans was higher due to increased average balances and the positive impact of higher rates in the variable rate small business lending, construction and investor commercial real estate portfolios, as well as growth and higher yields on new originations in the franchise finance portfolio. This was partially offset by lower average balances in the healthcare finance and public finance portfolios.

In the consumer portfolio, interest income was up due to higher yields on new originations and growth in the average balances of the trailers, recreational vehicles and other consumer loans portfolios. Additionally, the average balance in the residential mortgage portfolio increased due to draws on existing construction/perm loans.

The yield on funded portfolio originations was 8.42% in the second quarter of 2023, an increase of 66 bps compared to the first quarter of 2023, and an increase of 366 bps compared to the second quarter of 2022. Because of the fixed-rate nature of certain larger portfolios, there is a lagging impact of origination yields on the portfolio, which are expected to increase over time.

Interest earned on cash and other earning asset balances increased $2.7 million, or 72.2%, during the quarter due to the impact of higher short-term interest rates on cash balances as well as a $180.0 million, or 60.0%, increase in average cash balances. Furthermore, interest income earned on securities increased $0.3 million, or 6.6%, during the second quarter of 2023 due to an increase in the yield earned on the portfolio and an increase in average balances. The yield on the portfolio increased 7 bps to 3.12%, driven primarily by variable rate securities resetting higher and higher yields on new purchases.

Total interest expense for the second quarter of 2023 was $40.0 million, an increase of $7.5 million, or 23.2%, compared to the linked quarter, due to increases in both market interest rates and average interest-bearing deposit balances throughout the quarter. Interest expense related to interest-bearing deposits increased $7.4 million, or 27.2%, driven primarily by higher costs on CDs and brokered deposits and, to a lesser extent, interest-bearing demand deposits. The cost of interest-bearing deposits was 3.75% for the second quarter, compared to 3.24% for the first quarter of 2023. The pace of increase in deposit costs during the second quarter was the slowest experienced by the Company in the past four quarters.

Average CD balances increased $231.1 million, or 21.9%, while the cost of funds increased 72 bps, as strong consumer and small business demand resumed during the quarter. The average balance of brokered deposits increased $147.3 million, or 24.9%, due in part to funding early in the quarter to supplement on-balance sheet liquidity, while the cost of funds increased 54 bps.

The average balance of BaaS deposits increased by $62.3 million, or 137.3%, from the first quarter of 2023 and totaled $154.5 million at quarter-end as existing programs grew and other Fintech programs were onboarded during the quarter.

Net interest margin (“NIM”) was 1.53% for the second quarter of 2023, down from 1.76% for the first quarter of 2023, and 2.60% for the second quarter of 2022. Fully-taxable equivalent NIM (“FTE NIM”) was 1.64% for the second quarter of 2023, down from 1.89% for the first quarter of 2023, and 2.74% for the second quarter of 2022. The decreases in NIM and FTE NIM compared to the linked quarter were driven primarily by the effect of higher interest-bearing deposit costs, partially offset by higher yields on loans, other earning assets and securities. Additionally, given the volatility in the banking industry over the last several months, the Company carried higher cash balances during the quarter, which were estimated to have negatively impacted NIM and FTE NIM by 6 to 7 bps.

Noninterest Income

Noninterest income for the second quarter of 2023 was $5.9 million, up $0.4 million, or 7.8%, from the first quarter of 2023, and up $1.6 million, or 36.1%, from the second quarter of 2022. Gain on sale of loans totaled $4.9 million for the second quarter of 2023, up $0.8 million, or 19.9%, from the linked quarter. Gain on sale revenue in the quarter consisted entirely of gain on the sales of U.S. Small Business Administration (“SBA”) 7(a) guaranteed loans, which increased due to a higher volume of loan sales, as well as modestly higher net premiums. Net loan servicing revenue declined $0.2 million during the quarter due to amortization and a lower fair value adjustment to the loan servicing asset.

Noninterest Expense

Noninterest expense for the second quarter of 2023 was $18.7 million, down $2.3 million, or 10.9%, from the first quarter of 2023, and up $0.7 million, or 3.8%, from the second quarter of 2022. Excluding $3.1 million of mortgage operation and exit costs, noninterest expense totaled $17.9 million for the first quarter of 2023. On a comparable basis, noninterest expense increased $0.8 million, or 4.3%, in the second quarter as compared to the adjusted noninterest expense for the first quarter. Salaries and employee benefits expense increased $1.1 million in the second quarter due primarily to higher SBA incentive compensation driven by increased origination activity. In addition, deposit insurance premiums increased from the linked quarter due primarily to year-over-year asset growth and changes in the composition of the loan and deposit portfolios. These increases were partially offset by declines in loan expenses, consulting and professional fees and data processing expenses.

Income Taxes

The Company recognized an income tax benefit of $0.2 million for the second quarter of 2023, compared to an income tax benefit of $2.3 million for the first quarter of 2023, and an income tax expense of $1.3 million and an effective tax rate of 11.8% for the second quarter of 2022. The income tax benefit in the second quarter of 2023 reflects the benefit of tax-exempt income relative to the lower amount of stated pre-tax income.

Loans and Credit Quality

Total loans as of June 30, 2023 were $3.6 billion, an increase of $39.6 million, or 1.1%, compared to March 31, 2023, and an increase of $564.7 million, or 18.3%, compared to June 30, 2022. Total commercial loan balances were $2.8 billion as of June 30, 2023, an increase of $25.2 million, or 0.9%, compared to March 31, 2023, and an increase of $393.3 million, or 16.1%, compared to June 30, 2022. Compared to the linked quarter, the increase in commercial loan balances was driven primarily by growth in construction and small business lending balances, as well as modest growth in franchise finance balances. These items were partially offset by decreases in the public finance and single tenant lease financing portfolios as well as continued runoff in the healthcare finance portfolio.

Total consumer loan balances were $772.7 million as of June 30, 2023, an increase of $16.3 million, or 2.2%, compared to March 31, 2023, and an increase of $178.6 million, or 30.1%, compared to June 30, 2022. The increase compared to the linked quarter was due primarily to higher balances in the trailers, recreational vehicles and other consumer loans portfolios, as well as draws on existing residential mortgage construction/perm loans.

Total delinquencies 30 days or more past due were 0.09% of total loans as of June 30, 2023, compared to 0.13% at March 31, 2023, and 0.06% as of June 30, 2022. Nonperforming loans to total loans was 0.17% as of June 30, 2023, compared to 0.26% at March 31, 2023, and 0.15% as of June 30, 2022. Nonperforming loans totaled $6.2 million at June 30, 2023, down from $9.2 million at March 31, 2023. The decrease was due primarily to the resolution of one C&I participation loan that was placed on nonaccrual status in the first quarter of 2023.

The allowance for credit losses (“ACL”) as a percentage of total loans was 0.99% as of June 30, 2023, compared to 1.02% as of March 31, 2023, and 0.95% as of June 30, 2022. The decrease in the ACL reflects the positive impact of economic data on forecasted loss rates for certain portfolios.

Net charge-offs were $1.6 million in the second quarter of 2023, compared to net charge-offs of $7.2 million in the first quarter of 2023. The linked quarter decline was due to the partial charge-off of the aforementioned C&I participation loan in the first quarter, which totaled $6.9 million. Net charge-offs in the second quarter were driven primarily by small business lending, as well as one franchise finance loan. As a result, net charge-offs to average loans totaled 17 bps in the second quarter, down from 82 bps in the first quarter.

The provision for credit losses in the second quarter was $1.7 million, compared to $9.4 million for the first quarter of 2023, which included the charge-off of the C&I participation loan mentioned above. The provision for the second quarter was driven primarily by net charge-offs and an increase in the reserve for unfunded commitments, partially offset by the positive impact of economic forecasts on certain portfolios.

Capital

As of June 30, 2023, total shareholders’ equity was $354.3 million, a decrease of $1.2 million, or 0.3%, compared to March 31, 2023, and a decrease of $11.0 million, or 3.0%, compared to June 30, 2022. The decrease in shareholders’ equity during the second quarter of 2023 was due primarily to stock repurchase activity and an increase in accumulated other comprehensive loss, partially offset by net income earned during the quarter. Book value per common share was $40.38 as of June 30, 2023, up from $39.76 as of March 31, 2023, and up from $38.85 as of June 30, 2022. Tangible book

value per share was $39.85, up from $39.23 as of March 31, 2023, and up from $38.35 as of June 30, 2022.

In connection with its previously announced stock repurchase program, the Company repurchased 203,000 shares of its common stock during the second quarter of 2023 at an average price of $13.52 per share. The Company has repurchased $38.9 million of stock under its authorized programs since November of 2021.

The following table presents the Company’s and the Bank’s regulatory and other capital ratios as of June 30, 2023.

| | | | | | | | | | | | | | |

| | As of June 30, 2023 |

| | Company | | Bank |

| | | | |

| Total shareholders’ equity to assets | | 7.16% | | 8.86% |

Tangible common equity to tangible assets 1 | | 7.07% | | 8.77% |

Tier 1 leverage ratio 2 | | 7.63% | | 9.35% |

Common equity tier 1 capital ratio 2 | | 10.10% | | 12.39% |

Tier 1 capital ratio 2 | | 10.10% | | 12.39% |

Total risk-based capital ratio 2 | | 13.87% | | 13.37% |

| | | | |

1 This information represents a non-GAAP financial measure. For a discussion of non-GAAP financial measures, see the section below entitled "Non-GAAP Financial Measures." |

2 Regulatory capital ratios are preliminary pending filing of the Company's and the Bank's regulatory reports. |

Conference Call and Webcast

The Company will host a conference call and webcast at 2:00 p.m. Eastern Time on Thursday, July 27, 2023 to discuss its quarterly financial results. The call can be accessed via telephone at (888) 259-6580; access code: 24458732. A recorded replay can be accessed through August 26, 2023 by dialing (877) 674-7070; access code: 458732

Additionally, interested parties can listen to a live webcast of the call on the Company's website at www.firstinternetbancorp.com. An archived version of the webcast will be available in the same location shortly after the live call has ended.

About First Internet Bancorp

First Internet Bancorp is a financial holding company with assets of $4.9 billion as of June 30, 2023. The Company’s subsidiary, First Internet Bank, opened for business in 1999 as an industry pioneer in the branchless delivery of banking services. First Internet Bank provides consumer and small business deposit, SBA financing, franchise finance, consumer loans, and specialty finance services nationally as well as commercial real estate loans, construction loans, commercial and industrial loans, and treasury management services on a regional basis. First Internet Bancorp’s common stock trades on the Nasdaq Global Select Market under the symbol “INBK”. Additional information about the Company is available at www.firstinternetbancorp.com and additional information about First Internet Bank, including its products and services, is available at www.firstib.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements with respect to the financial condition, results of operations, trends in lending policies and loan programs, plans and prospective business partnerships, objectives, future performance and business of the Company. Forward-looking statements are generally identifiable by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “growth,” “help,” “may,” “opportunities,” “pending,” “plan,” “position,” “preliminary,” “remain,” “should,” “thereafter,” “well-positioned,” “will,” or other similar expressions. Forward-looking statements are not a guarantee of future performance or results, are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that could cause actual results to

differ materially from the information in the forward-looking statements. Such statements are subject to certain risks and uncertainties including: our business and operations and the business and operations of our vendors and customers: general economic conditions, whether national or regional, and conditions in the lending markets in which we participate that may have an adverse effect on the demand for our loans and other products; our credit quality and related levels of nonperforming assets and loan losses, and the value and salability of the real estate that is the collateral for our loans. Other factors that may cause such differences include: failures or breaches of or interruptions in the communications and information systems on which we rely to conduct our business; failure of our plans to grow our commercial and industrial, construction, SBA, and franchise finance loan portfolios; competition with national, regional and community financial institutions; the loss of any key members of senior management; the anticipated impacts of inflation and rising interest rates on the general economy; risks relating to the regulation of financial institutions; and other factors identified in reports we file with the U.S. Securities and Exchange Commission. All statements in this press release, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events.

Non-GAAP Financial Measures

This press release contains financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures, specifically tangible common equity, tangible assets, tangible book value per common share, tangible common equity to tangible assets, average tangible common equity, return on average tangible common equity, total interest income – FTE, net interest income – FTE, net interest margin – FTE, adjusted total revenue, adjusted noninterest income, adjusted noninterest expense, adjusted income (loss) before income taxes, adjusted income tax (benefit) provision, adjusted net income, adjusted diluted earnings per share, adjusted return on average assets, adjusted return on average shareholders’ equity and adjusted return on average tangible common equity used by the Company’s management to measure the strength of its capital and analyze profitability, including its ability to generate earnings on tangible capital invested by its shareholders. Although management believes these non-GAAP measures are useful to investors by providing a greater understanding of its business, they should not be considered a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the table at the end of this release under the caption “Reconciliation of Non-GAAP Financial Measures.”

| | | | | | | | | | | |

| Contact Information: | | | |

| Investors/Analysts | | Media | |

| Paula Deemer | | Nicole Lorch | |

| Director of Corporate Administration | | President & Chief Operating Officer |

| (317) 428-4628 | | (317) 532-7906 | |

| investors@firstib.com | | nlorch@firstib.com | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Internet Bancorp | | | | | | | |

| Summary Financial Information (unaudited) | | | | | | |

| Dollar amounts in thousands, except per share data | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30,

2023 | | March 31, 2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Net Income (loss) | | $ | 3,882 | | | (3,017) | | | $ | 9,545 | | | $ | 865 | | | $ | 20,754 | |

| | | | | | | | | | |

| Per share and share information | | | | | | | | | | |

| Earnings (loss) per share - basic | | $ | 0.44 | | | $ | (0.33) | | | $ | 0.99 | | | $ | 0.10 | | | $ | 2.14 | |

| Earnings(loss) per share - diluted | | 0.44 | | | (0.33) | | | 0.99 | | | 0.10 | | | 2.13 | |

| Dividends declared per share | | 0.06 | | | 0.06 | | | 0.06 | | | 0.12 | | | 0.12 | |

| Book value per common share | | 40.38 | | | 39.76 | | | 38.85 | | | 40.38 | | | 38.85 | |

Tangible book value per common share 1 | | 39.85 | | | 39.23 | | | 38.35 | | | 39.85 | | | 38.35 | |

| Common shares outstanding | | 8,774,507 | | | 8,943,477 | | | 9,404,000 | | | 8,774,507 | | | 9,404,000 | |

| Average common shares outstanding: | | | | | | | | | | |

| Basic | | 8,903,213 | | | 9,024,072 | | | 9,600,383 | | | 8,963,308 | | | 9,694,729 | |

| Diluted | | 8,908,180 | | | 9,024,072 | | | 9,658,689 | | | 8,980,262 | | | 9,764,232 | |

| Performance ratios | | | | | | | | | | |

| Return on average assets | | 0.32 | % | | (0.26 | %) | | 0.93 | % | | 0.04 | % | | 1.01 | % |

| Return on average shareholders' equity | | 4.35 | % | | (3.37 | %) | | 10.23 | % | | 0.48 | % | | 11.09 | % |

Return on average tangible common equity 1 | | 4.40 | % | | (3.41 | %) | | 10.36 | % | | 0.49 | % | | 11.23 | % |

| Net interest margin | | 1.53 | % | | 1.76 | % | | 2.60 | % | | 1.64 | % | | 2.58 | % |

Net interest margin - FTE 1,2 | | 1.64 | % | | 1.89 | % | | 2.74 | % | | 1.76 | % | | 2.71 | % |

Capital ratios 3 | | | | | | | | | | |

| Total shareholders' equity to assets | | 7.16 | % | | 7.53 | % | | 8.91 | % | | 7.16 | % | | 8.91 | % |

Tangible common equity to tangible assets 1 | | 7.07 | % | | 7.44 | % | | 8.81 | % | | 7.07 | % | | 8.81 | % |

| Tier 1 leverage ratio | | 7.63 | % | | 8.10 | % | | 9.45 | % | | 7.63 | % | | 9.45 | % |

| Common equity tier 1 capital ratio | | 10.10 | % | | 10.30 | % | | 12.46 | % | | 10.10 | % | | 12.46 | % |

| Tier 1 capital ratio | | 10.10 | % | | 10.30 | % | | 12.46 | % | | 10.10 | % | | 12.46 | % |

| Total risk-based capital ratio | | 13.87 | % | | 14.13 | % | | 16.74 | % | | 13.87 | % | | 16.74 | % |

| Asset quality | | | | | | | | | | |

| Nonperforming loans | | $ | 6,227 | | | $ | 9,221 | | | $ | 4,527 | | | $ | 6,227 | | | $ | 4.527 | |

| Nonperforming assets | | 6,397 | | | 9,346 | | | 4,550 | | | 6,397 | | | 4,550 | |

| Nonperforming loans to loans | | 0.17 | % | | 0.26 | % | | 0.15 | % | | 0.17 | % | | 0.15 | % |

| Nonperforming assets to total assets | | 0.13 | % | | 0.20 | % | | 0.11 | % | | 0.13 | % | | 0.11 | % |

| Allowance for credit losses - loans to: | | | | | | | | | | |

| Loans | | 0.99 | % | | 1.02 | % | | 0.95 | % | | 0.99 | % | | 0.95 | % |

| | | | | | | | | | |

| Nonperforming loans | | 579.1 | % | | 400.0 | % | | 644.0 | % | | 579.1 | % | | 644.0 | % |

| Net charge-offs to average loans | | 0.17 | % | | 0.82 | % | | 0.04 | % | | 0.49 | % | | 0.05 | % |

| | | | | | | | | | |

| Average balance sheet information | | | | | | | | | | |

| Loans | | $ | 3,653,839 | | | $ | 3,573,827 | | | $ | 2,998,144 | | | $ | 3,614,054 | | | $ | 2,973,173 | |

| Total securities | | 604,182 | | | 585,270 | | | 620,396 | | | 594,777 | | | 634,485 | |

| Other earning assets | | 511,295 | | | 331,294 | | | 322,302 | | | 421,793 | | | 388,760 | |

| Total interest-earning assets | | 4,771,623 | | | 4,499,782 | | | 3,962,589 | | | 4,636,453 | | | 4,021,330 | |

| Total assets | | 4,927,712 | | | 4,647,156 | | | 4,097,865 | | | 4,788,209 | | | 4,156,068 | |

| Noninterest-bearing deposits | | 117,496 | | | 134,988 | | | 108,980 | | | 126,194 | | | 110,605 | |

| Interest-bearing deposits | | 3,713,086 | | | 3,411,969 | | | 3,018,422 | | | 3,563,359 | | | 3,044,775 | |

| Total deposits | | 3,830,582 | | | 3,546,957 | | | 3,127,402 | | | 3,689,553 | | | 3,155,380 | |

| Shareholders' equity | | 358,312 | | | 363,273 | | | 374,274 | | | 360,779 | | | 377,504 | |

1 Refer to "Non-GAAP Financial Measures" section above and "Reconciliation of Non-GAAP Financial Measures" below

2 On a fully-taxable equivalent (“FTE”) basis assuming a 21% tax rate

3 Regulatory capital ratios are preliminary pending filing of the Company's regulatory reports

| | | | | | | | | | | | | | | | | | | | |

| First Internet Bancorp | | | | | | |

| Condensed Consolidated Balance Sheets (unaudited) |

| Dollar amounts in thousands | | | | | | |

| | June 30,

2023 | | March 31,

2023 | | June 30,

2022 |

| Assets | | | | | | |

| Cash and due from banks | | $ | 9,503 | | | $ | 27,741 | | | $ | 6,155 | |

| Interest-bearing deposits | | 456,128 | | | 276,231 | | | 201,798 | |

| Securities available-for-sale, at fair value | | 379,394 | | | 395,833 | | | 425,489 | |

| Securities held-to-maturity, at amortized cost, net of allowance for credit losses | | 230,605 | | | 210,761 | | | 185,113 | |

| Loans held-for-sale | | 32,001 | | | 18,144 | | | 31,580 | |

| Loans | | 3,646,832 | | | 3,607,242 | | | 3,082,127 | |

| Allowance for credit losses - loans | | (36,058) | | | (36,879) | | | (29,153) | |

| Net loans | | 3,610,774 | | | 3,570,363 | | | 3,052,974 | |

| Accrued interest receivable | | 24,101 | | | 22,322 | | | 17,466 | |

| Federal Home Loan Bank of Indianapolis stock | | 28,350 | | | 28,350 | | | 25,219 | |

| Cash surrender value of bank-owned life insurance | | 40,357 | | | 40,105 | | | 39,369 | |

| Premises and equipment, net | | 73,525 | | | 74,248 | | | 70,288 | |

| Goodwill | | 4,687 | | | 4,687 | | | 4,687 | |

| Servicing asset | | 8,252 | | | 7,312 | | | 5,345 | |

| Other real estate owned | | 106 | | | 106 | | | — | |

| Accrued income and other assets | | 49,266 | | | 45,116 | | | 34,323 | |

| Total assets | | $ | 4,947,049 | | | $ | 4,721,319 | | | $ | 4,099,806 | |

| | | | | | |

| Liabilities | | | | | | |

| Noninterest-bearing deposits | | $ | 119,291 | | | $ | 140,449 | | | $ | 126,153 | |

| Interest-bearing deposits | | 3,735,017 | | | 3,481,841 | | | 3,025,948 | |

| Total deposits | | 3,854,308 | | | 3,622,290 | | | 3,152,101 | |

| Advances from Federal Home Loan Bank | | 614,931 | | | 614,929 | | | 464,925 | |

| Subordinated debt | | 104,684 | | | 104,608 | | | 104,381 | |

| Accrued interest payable | | 3,338 | | | 2,592 | | | 2,005 | |

| Accrued expenses and other liabilities | | 15,456 | | | 21,328 | | | 11,062 | |

| Total liabilities | | 4,592,717 | | | 4,365,747 | | | 3,734,474 | |

| Shareholders' equity | | | | | | |

| Voting common stock | | 186,545 | | | 189,202 | | | 204,071 | |

| Retained earnings | | 200,973 | | | 197,623 | | | 192,011 | |

| Accumulated other comprehensive loss | | (33,186) | | | (31,253) | | | (30,750) | |

| Total shareholders' equity | | 354,332 | | | 355,572 | | | 365,332 | |

| Total liabilities and shareholders' equity | | $ | 4,947,049 | | | $ | 4,721,319 | | | $ | 4,099,806 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Internet Bancorp | | | | | | | | | |

| Condensed Consolidated Statements of Income (unaudited) |

| Dollar amounts in thousands, except per share data | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Interest income | | | | | | | | | |

| Loans | $ | 46,906 | | | $ | 43,843 | | | $ | 32,415 | | | $ | 90,749 | | | $ | 65,603 | |

| Securities - taxable | 3,835 | | | 3,606 | | | 2,567 | | | 7,441 | | | 4,788 | |

| Securities - non-taxable | 860 | | | 798 | | | 328 | | | 1,658 | | | 577 | |

| Other earning assets | 6,521 | | | 3,786 | | | 796 | | | 10,307 | | | 1,172 | |

| Total interest income | 58,122 | | | 52,033 | | | 36,106 | | | 110,155 | | | 72,140 | |

| Interest expense | | | | | | | | | |

| Deposits | 34,676 | | | 27,270 | | | 6,408 | | | 61,946 | | | 12,505 | |

| Other borrowed funds | 5,301 | | | 5,189 | | | 4,018 | | | 10,490 | | | 8,205 | |

| Total interest expense | 39,977 | | | 32,459 | | | 10,426 | | | 72,436 | | | 20,710 | |

| Net interest income | 18,145 | | | 19,574 | | | 25,680 | | | 37,719 | | | 51,430 | |

| Provision for credit losses | 1,698 | | | 9,415 | | | 1,185 | | | 11,113 | | | 1,976 | |

| Net interest income after provision for credit losses | 16,447 | | | 10,159 | | | 24,495 | | | 26,606 | | | 49,454 | |

| Noninterest income | | | | | | | | | |

| Service charges and fees | 218 | | | 209 | | | 281 | | | 427 | | | 597 | |

| Loan servicing revenue | 850 | | | 785 | | | 620 | | | 1,635 | | | 1,205 | |

| Loan servicing asset revaluation | (358) | | | (55) | | | (470) | | | (413) | | | (767) | |

| Mortgage banking activities | — | | | 76 | | | 1,710 | | | 76 | | | 3,583 | |

| Gain on sale of loans | 4,868 | | | 4,061 | | | 1,952 | | | 8,929 | | | 5,797 | |

| | | | | | | | | |

| | | | | | | | | |

| Other | 293 | | | 370 | | | 221 | | | 663 | | | 719 | |

| Total noninterest income | 5,871 | | | 5,446 | | | 4,314 | | | 11,317 | | | 11,134 | |

| Noninterest expense | | | | | | | | | |

| Salaries and employee benefits | 10,706 | | | 11,794 | | | 10,832 | | | 22,500 | | | 20,710 | |

| Marketing, advertising and promotion | 705 | | | 844 | | | 920 | | | 1,549 | | | 1,676 | |

| Consulting and professional fees | 711 | | | 926 | | | 1,197 | | | 1,637 | | | 3,122 | |

| Data processing | 520 | | | 659 | | | 490 | | | 1,179 | | | 939 | |

| Loan expenses | 1,072 | | | 1,977 | | | 693 | | | 3,049 | | | 2,275 | |

| Premises and equipment | 2,661 | | | 2,777 | | | 2,419 | | | 5,438 | | | 4,959 | |

| Deposit insurance premium | 936 | | | 543 | | | 287 | | | 1,479 | | | 568 | |

| | | | | | | | | |

| Other | 1,359 | | | 1,434 | | | 1,147 | | | 2,793 | | | 2,516 | |

| Total noninterest expense | 18,670 | | | 20,954 | | | 17,985 | | | 39,624 | | | 36,765 | |

| Income (loss) before income taxes | 3,648 | | | (5,349) | | | 10,824 | | | (1,701) | | | 23,823 | |

| Income tax (benefit) provision | (234) | | | (2,332) | | | 1,279 | | | (2,566) | | | 3,069 | |

| Net income (loss) | $ | 3,882 | | | $ | (3,017) | | | $ | 9,545 | | | $ | 865 | | | $ | 20,754 | |

| | | | | | | | | |

| Per common share data | | | | | | | | | |

| Earnings (loss) per share - basic | $ | 0.44 | | | $ | (0.33) | | | $ | 0.99 | | | $ | 0.10 | | | $ | 2.14 | |

| Earnings (loss) per share - diluted | $ | 0.44 | | | $ | (0.33) | | | $ | 0.99 | | | $ | 0.10 | | | $ | 2.13 | |

| Dividends declared per share | $ | 0.06 | | | $ | 0.06 | | | $ | 0.06 | | | $ | 0.12 | | | $ | 0.12 | |

| | | | | | | | | |

| | | | | | | | | |

All periods presented have been reclassified to conform to the current period classification

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Internet Bancorp | | | | | | | | | | | | | | | | | |

| Average Balances and Rates (unaudited) | | | | | | | | | | | | | | | | |

| Dollar amounts in thousands | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| Average Balance | | Interest / Dividends | | Yield / Cost | | Average Balance | | Interest / Dividends | | Yield / Cost | | Average Balance | | Interest / Dividends | | Yield / Cost |

| Assets | | | | | | | | | | | | | | | | | |

| Interest-earning assets | | | | | | | | | | | | | | | | | |

Loans, including loans held-for-sale 1 | $ | 3,656,146 | | | $ | 46,906 | | | 5.15 | % | | $ | 3,583,218 | | | $ | 43,843 | | | 4.96 | % | | $ | 3,019,891 | | | $ | 32,415 | | | 4.31 | % |

| Securities - taxable | 531,040 | | | 3,835 | | | 2.90 | % | | 511,923 | | | 3,606 | | | 2.86 | % | | 543,422 | | | 2,567 | | | 1.89 | % |

| Securities - non-taxable | 73,142 | | | 860 | | | 4.72 | % | | 73,347 | | | 798 | | | 4.41 | % | | 76,974 | | | 328 | | | 1.71 | % |

| Other earning assets | 511,295 | | | 6,521 | | | 5.12 | % | | 331,294 | | | 3,786 | | | 4.63 | % | | 322,302 | | | 796 | | | 0.99 | % |

| Total interest-earning assets | 4,771,623 | | | 58,122 | | | 4.89 | % | | 4,499,782 | | | 52,033 | | | 4.69 | % | | 3,962,589 | | | 36,106 | | | 3.65 | % |

| Allowance for credit losses - loans | (36,671) | | | | | | | (35,075) | | | | | | | (28,599) | | | | | |

| Noninterest-earning assets | 192,760 | | | | | | | 182,449 | | | | | | | 163,875 | | | | | |

| Total assets | $ | 4,927,712 | | | | | | | $ | 4,647,156 | | | | | | | $ | 4,097,865 | | | | | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities | | | | | | | | | | | | | | | | | |

| Interest-bearing demand deposits | $ | 359,969 | | | $ | 1,509 | | | 1.68 | % | | $ | 333,642 | | | $ | 900 | | | 1.09 | % | | $ | 348,274 | | | $ | 466 | | | 0.54 | % |

| Savings accounts | 29,915 | | | 64 | | | 0.86 | % | | 38,482 | | | 82 | | | 0.86 | % | | 66,657 | | | 68 | | | 0.41 | % |

| Money market accounts | 1,274,453 | | | 12,314 | | | 3.88 | % | | 1,377,600 | | | 12,300 | | | 3.62 | % | | 1,427,665 | | | 1,921 | | | 0.54 | % |

| BaaS - brokered deposits | 22,918 | | | 230 | | | 4.03 | % | | 14,741 | | | 138 | | | 3.80 | % | | 71,234 | | | 154 | | | 0.87 | % |

| Certificates and brokered deposits | 2,025,831 | | | 20,559 | | | 4.07 | % | | 1,647,504 | | | 13,850 | | | 3.41 | % | | 1,104,592 | | | 3,799 | | | 1.38 | % |

| Total interest-bearing deposits | 3,713,086 | | | 34,676 | | | 3.75 | % | | 3,411,969 | | | 27,270 | | | 3.24 | % | | 3,018,422 | | | 6,408 | | | 0.85 | % |

| Other borrowed funds | 719,577 | | | 5,301 | | | 2.95 | % | | 719,499 | | | 5,189 | | | 2.92 | % | | 583,553 | | | 4,018 | | | 2.76 | % |

| Total interest-bearing liabilities | 4,432,663 | | | 39,977 | | | 3.62 | % | | 4,131,468 | | | 32,459 | | | 3.19 | % | | 3,601,975 | | | 10,426 | | | 1.16 | % |

| Noninterest-bearing deposits | 117,496 | | | | | | | 134,988 | | | | | | | 108,980 | | | | | |

| Other noninterest-bearing liabilities | 19,241 | | | | | | | 17,427 | | | | | | | 12,636 | | | | | |

| Total liabilities | 4,569,400 | | | | | | | 4,283,883 | | | | | | | 3,723,591 | | | | | |

| Shareholders' equity | 358,312 | | | | | | | 363,273 | | | | | | | 374,274 | | | | | |

| Total liabilities and shareholders' equity | $ | 4,927,712 | | | | | | | $ | 4,647,156 | | | | | | | $ | 4,097,865 | | | | | |

| | | | | | | | | | | | | | | | | |

| Net interest income | | | $ | 18,145 | | | | | | | $ | 19,574 | | | | | | | $ | 25,680 | | | |

| | | | | | | | | | | | | | | | | |

| Interest rate spread | | | | | 1.27 | % | | | | | | 1.50 | % | | | | | | 2.49 | % |

| Net interest margin | | | | | 1.53 | % | | | | | | 1.76 | % | | | | | | 2.60 | % |

Net interest margin - FTE 2,3 | | | | | 1.64 | % | | | | | | 1.89 | % | | | | | | 2.74 | % |

1 Includes nonaccrual loans

2 On a fully-taxable equivalent (“FTE”) basis assuming a 21% tax rate

3 Refer to "Non-GAAP Financial Measures" section above and "Reconciliation of Non-GAAP Financial Measures" below

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Internet Bancorp | | | | | | | | | | | |

| Average Balances and Rates (unaudited) | | | | | | | | | | |

| Dollar amounts in thousands | | | | | | | | | | | |

| Six Months Ended |

| June 30, 2023 | | June 30, 2022 |

| Average Balance | | Interest / Dividends | | Yield / Cost | | Average Balance | | Interest / Dividends | | Yield / Cost |

| Assets | | | | | | | | | | | |

| Interest-earning assets | | | | | | | | | | | |

Loans, including loans held-for-sale 1 | $ | 3,619,883 | | | $ | 90,749 | | | 5.06 | % | | $ | 2,998,085 | | | $ | 65,603 | | | 4.41 | % |

| Securities - taxable | 521,533 | | | 7,441 | | | 2.88 | % | | 555,533 | | | 4,788 | | | 1.74 | % |

| Securities - non-taxable | 73,244 | | | 1,658 | | | 4.56 | % | | 78,952 | | | 577 | | | 1.47 | % |

| Other earning assets | 421,793 | | | 10,307 | | | 4.93 | % | | 388,760 | | | 1,172 | | | 0.61 | % |

| Total interest-earning assets | 4,636,453 | | | 110,155 | | | 4.79 | % | | 4,021,330 | | | 72,140 | | | 3.62 | % |

| Allowance for loan losses | (35,877) | | | | | | | (28,288) | | | | | |

| Noninterest-earning assets | 187,633 | | | | | | | 163,026 | | | | | |

| Total assets | $ | 4,788,209 | | | | | | | $ | 4,156,068 | | | | | |

| | | | | | | | | | | |

| Liabilities | | | | | | | | | | | |

| Interest-bearing liabilities | | | | | | | | | | | |

| Interest-bearing demand deposits | $ | 346,878 | | | $ | 2,409 | | | 1.40 | % | | $ | 333,361 | | | $ | 878 | | | 0.53 | % |

| Savings accounts | 34,175 | | | 145 | | | 0.86 | % | | 63,653 | | | 121 | | | 0.38 | % |

| Money market accounts | 1,325,741 | | | 24,614 | | | 3.74 | % | | 1,440,976 | | | 3,425 | | | 0.48 | % |

| BaaS - brokered deposits | 18,852 | | | 368 | | | 3.94 | % | | 41,836 | | | 160 | | | 0.77 | % |

| Certificates and brokered deposits | 1,837,713 | | | 34,410 | | | 3.78 | % | | 1,164,949 | | | 7,921 | | | 1.37 | % |

| Total interest-bearing deposits | 3,563,359 | | | 61,946 | | | 3.51 | % | | 3,044,775 | | | 12,505 | | | 0.83 | % |

| Other borrowed funds | 719,538 | | | 10,490 | | | 2.94 | % | | 601,274 | | | 8,205 | | | 2.75 | % |

| Total interest-bearing liabilities | 4,282,897 | | | 72,436 | | | 3.41 | % | | 3,646,049 | | | 20,710 | | | 1.15 | % |

| Noninterest-bearing deposits | 126,194 | | | | | | | 110,605 | | | | | |

| Other noninterest-bearing liabilities | 18,339 | | | | | | | 21,910 | | | | | |

| Total liabilities | 4,427,430 | | | | | | | 3,778,564 | | | | | |

| Shareholders' equity | 360,779 | | | | | | | 377,504 | | | | | |

| Total liabilities and shareholders' equity | $ | 4,788,209 | | | | | | | $ | 4,156,068 | | | | | |

| | | | | | | | | | | |

| Net interest income | | | $ | 37,719 | | | | | | | $ | 51,430 | | | |

| | | | | | | | | | | |

| Interest rate spread | | | | | 1.38 | % | | | | | | 2.47 | % |

| Net interest margin | | | | | 1.64 | % | | | | | | 2.58 | % |

Net interest margin - FTE 2,3 | | | | | 1.76 | % | | | | | | 2.71 | % |

1 Includes nonaccrual loans2 On a fully-taxable equivalent (“FTE”) basis assuming a 21% tax rate

3 Refer to "Non-GAAP Financial Measures" section above and "Reconciliation of Non-GAAP Financial Measures" below

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Internet Bancorp | | | | | | | | | | | | |

| Loans and Deposits (unaudited) | | | | | | | | | | | |

| Dollar amounts in thousands | | | | | | | | | | | | |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| | Amount | | Percent | | Amount | | Percent | | Amount | | Percent |

| Commercial loans | | | | | | | | | | | | |

| Commercial and industrial | | $ | 112,423 | | | 3.1 | % | | $ | 113,198 | | | 3.1 | % | | $ | 110,540 | | | 3.6 | % |

| Owner-occupied commercial real estate | | 59,564 | | | 1.6 | % | | 59,643 | | | 1.7 | % | | 61,277 | | | 2.0 | % |

| Investor commercial real estate | | 137,504 | | | 3.8 | % | | 142,174 | | | 3.9 | % | | 52,648 | | | 1.7 | % |

| Construction | | 192,453 | | | 5.3 | % | | 158,147 | | | 4.4 | % | | 143,475 | | | 4.7 | % |

| Single tenant lease financing | | 947,466 | | | 25.9 | % | | 952,533 | | | 26.4 | % | | 867,181 | | | 28.1 | % |

| Public finance | | 575,541 | | | 15.8 | % | | 604,898 | | | 16.8 | % | | 613,759 | | | 19.9 | % |

| Healthcare finance | | 245,072 | | | 6.7 | % | | 256,670 | | | 7.1 | % | | 317,180 | | | 10.3 | % |

| Small business lending | | 170,550 | | | 4.7 | % | | 136,382 | | | 3.8 | % | | 102,724 | | | 3.3 | % |

| Franchise finance | | 390,479 | | | 10.6 | % | | 382,161 | | | 10.6 | % | | 168,942 | | | 5.5 | % |

| | | | | | | | | | | | |

| Total commercial loans | | 2,831,052 | | | 77.5 | % | | 2,805,806 | | | 77.8 | % | | 2,437,726 | | | 79.1 | % |

| | | | | | | | | | | | |

| Consumer loans | | | | | | | | | | | | |

| Residential mortgage | | 396,154 | | | 10.9 | % | | 392,062 | | | 10.9 | % | | 281,124 | | | 9.1 | % |

| Home equity | | 24,375 | | | 0.7 | % | | 26,160 | | | 0.7 | % | | 19,928 | | | 0.6 | % |

| Trailers | | 178,035 | | | 4.9 | % | | 172,640 | | | 4.8 | % | | 154,555 | | | 5.0 | % |

| Recreational vehicles | | 133,283 | | | 3.7 | % | | 128,307 | | | 3.6 | % | | 105,876 | | | 3.4 | % |

| Other consumer loans | | 40,806 | | | 1.1 | % | | 37,186 | | | 1.0 | % | | 32,524 | | | 1.2 | % |

| | | | | | | | | | | | |

| Total consumer loans | | 772,653 | | | 21.3 | % | | 756,355 | | | 21.0 | % | | 594,007 | | | 19.3 | % |

| | | | | | | | | | | | |

Net deferred loan fees, premiums, discounts and other 1 | | 43,127 | | | 1.2 | % | | 45,081 | | | 1.2 | % | | 50,394 | | | 1.6 | % |

| | | | | | | | | | | | |

| Total loans | | $ | 3,646,832 | | | 100.0 | % | | $ | 3,607,242 | | | 100.0 | % | | $ | 3,082,127 | | | 100.0 | % |

| | | | | | | | | | | | |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| | Amount | | Percent | | Amount | | Percent | | Amount | | Percent |

| Deposits | | | | | | | | | | | | |

| Noninterest-bearing deposits | | $ | 119,291 | | | 3.1 | % | | $ | 140,449 | | | 3.9 | % | | $ | 126,153 | | | 4.0 | % |

| Interest-bearing demand deposits | | 398,899 | | | 10.3 | % | | 351,641 | | | 9.7 | % | | 350,551 | | | 11.1 | % |

| Savings accounts | | 28,239 | | | 0.7 | % | | 32,762 | | | 0.9 | % | | 65,365 | | | 2.1 | % |

| Money market accounts | | 1,232,719 | | | 32.0 | % | | 1,254,013 | | | 34.6 | % | | 1,363,424 | | | 43.3 | % |

| BaaS - brokered deposits | | 25,549 | | | 0.7 | % | | 25,725 | | | 0.7 | % | | 194,133 | | | 6.2 | % |

| Certificates of deposits | | 1,366,409 | | | 35.5 | % | | 1,170,094 | | | 32.3 | % | | 800,598 | | | 25.3 | % |

| Brokered deposits | | 683,202 | | | 17.7 | % | | 647,606 | | | 17.9 | % | | 251,877 | | | 8.0 | % |

| Total deposits | | $ | 3,854,308 | | | 100.0 | % | | $ | 3,622,290 | | | 100.0 | % | | $ | 3,152,101 | | | 100.0 | % |

1 Includes carrying value adjustments of $30.5 million, $31.5 million and 35.4 million related to terminated interest rate swaps associated with public finance loans as of June 30, 2023, March 31, 2023 and June 30, 2022, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Internet Bancorp | | | | | | | | | | |

| Reconciliation of Non-GAAP Financial Measures | | | | | | |

| Dollar amounts in thousands, except per share data | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Total equity - GAAP | | $ | 354,332 | | | $ | 355,572 | | | $ | 365,332 | | | $ | 354,332 | | | $ | 365,332 | |

| Adjustments: | | | | | | | | | | |

| Goodwill | | (4,687) | | | (4,687) | | | (4,687) | | | (4,687) | | | (4,687) | |

| Tangible common equity | | $ | 349,645 | | | $ | 350,885 | | | $ | 360,645 | | | $ | 349,645 | | | $ | 360,645 | |

| | | | | | | | | | |

| Total assets - GAAP | | $ | 4,947,049 | | | $ | 4,721,319 | | | $ | 4,099,806 | | | $ | 4,947,049 | | | $ | 4,099,806 | |

| Adjustments: | | | | | | | | | | |

| Goodwill | | (4,687) | | | (4,687) | | | (4,687) | | | (4,687) | | | (4,687) | |

| Tangible assets | | $ | 4,942,362 | | | $ | 4,716,632 | | | $ | 4,095,119 | | | $ | 4,942,362 | | | $ | 4,095,119 | |

| | | | | | | | | | |

| Common shares outstanding | | 8,774,507 | | | 8,943,477 | | | 9,404,000 | | | 8,774,507 | | | 9,404,000 | |

| | | | | | | | | | |

| Book value per common share | | $ | 40.38 | | | $ | 39.76 | | | $ | 38.85 | | | $ | 40.38 | | | $ | 38.85 | |

| Effect of goodwill | | (0.53) | | | (0.53) | | | (0.50) | | | (0.53) | | | (0.50) | |

| Tangible book value per common share | | $ | 39.85 | | | $ | 39.23 | | | $ | 38.35 | | | $ | 39.85 | | | $ | 38.35 | |

| | | | | | | | | | |

| Total shareholders' equity to assets | | 7.16 | % | | 7.53 | % | | 8.91 | % | | 7.16 | % | | 8.91 | % |

| Effect of goodwill | | (0.09 | %) | | (0.09 | %) | | (0.10 | %) | | (0.09 | %) | | (0.10 | %) |

| Tangible common equity to tangible assets | | 7.07 | % | | 7.44 | % | | 8.81 | % | | 7.07 | % | | 8.81 | % |

| | | | | | | | | | |

| Total average equity - GAAP | | $ | 358,312 | | | $ | 363,273 | | | $ | 374,274 | | | $ | 360,779 | | | $ | 377,504 | |

| Adjustments: | | | | | | | | | | |

| Average goodwill | | (4,687) | | | (4,687) | | | (4,687) | | | (4,687) | | | (4,687) | |

| Average tangible common equity | | $ | 353,625 | | | $ | 358,586 | | | $ | 369,587 | | | $ | 356,092 | | | $ | 372,817 | |

| | | | | | | | | | |

| Return on average shareholders' equity | | 4.35 | % | | (3.37 | %) | | 10.23 | % | | 0.48 | % | | 11.09 | % |

| Effect of goodwill | | 0.05 | % | | (0.04 | %) | | 0.13 | % | | 0.01 | % | | 0.14 | % |

| Return on average tangible common equity | | 4.40 | % | | (3.41 | %) | | 10.36 | % | | 0.49 | % | | 11.23 | % |

| | | | | | | | | | |

| Total interest income | | $ | 58,122 | | | $ | 52,033 | | | $ | 36,106 | | | $ | 110,155 | | | $ | 72,140 | |

| Adjustments: | | | | | | | | | | |

Fully-taxable equivalent adjustments 1 | | 1,347 | | | 1,383 | | | 1,377 | | | 2,731 | | | 2,691 | |

| Total interest income - FTE | | $ | 59,469 | | | $ | 53,416 | | | $ | 37,483 | | | $ | 112,886 | | | $ | 74,831 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net interest income | | $ | 18,145 | | | $ | 19,574 | | | $ | 25,680 | | | $ | 37,719 | | | $ | 51,430 | |

| Adjustments: | | | | | | | | | | |

Fully-taxable equivalent adjustments 1 | | 1,347 | | | 1,383 | | | 1,377 | | | 2,731 | | | 2,691 | |

| Net interest income - FTE | | $ | 19,492 | | | $ | 20,957 | | | $ | 27,057 | | | $ | 40,450 | | | $ | 54,121 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net interest margin | | 1.53 | % | | 1.76 | % | | 2.60 | % | | 1.64 | % | | 2.58 | % |

Effect of fully-taxable equivalent adjustments 1 | | 0.11 | % | | 0.13 | % | | 0.14 | % | | 0.12 | % | | 0.13 | % |

| Net interest margin - FTE | | 1.64 | % | | 1.89 | % | | 2.74 | % | | 1.76 | % | | 2.71 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

1Assuming a 21% tax rate

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Internet Bancorp | | | | | | | | | | |

| Reconciliation of Non-GAAP Financial Measures | | | | | | |

| Dollar amounts in thousands, except per share data | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Total revenue - GAAP | | $ | 24,016 | | | $ | 25,020 | | | $ | 29,994 | | | $ | 49,036 | | | $ | 62,564 | |

| Adjustments: | | | | | | | | | | |

| | | | | | | | | | |

| Mortgage-related revenue | | — | | | (65) | | | — | | | — | | | — | |

| Adjusted total revenue | | $ | 24,016 | | | $ | 24,955 | | | $ | 29,994 | | | $ | 49,036 | | | $ | 62,564 | |

| | | | | | | | | | |

| Noninterest income - GAAP | | $ | 5,871 | | | $ | 5,446 | | | $ | 4,314 | | | $ | 11,317 | | | $ | 11,134 | |

| Adjustments: | | | | | | | | | | |

| | | | | | | | | | |

| Mortgage-related revenue | | — | | | (65) | | | — | | | (65) | | | — | |

| Adjusted noninterest income | | $ | 5,871 | | | $ | 5,381 | | | $ | 4,314 | | | $ | 11,252 | | | $ | 11,134 | |

| | | | | | | | | | |

| Noninterest expense - GAAP | | $ | 18,670 | | | $ | 20,954 | | | $ | 17,985 | | | $ | 39,624 | | | $ | 36,765 | |

| Adjustments: | | | | | | | | | | |

| Mortgage-related costs | | — | | | (3,052) | | | — | | | (3,052) | | | — | |

| Acquisition-related expenses | | — | | | — | | | (103) | | | — | | | (273) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Nonrecurring consulting fee | | — | | | — | | | — | | | — | | | (875) | |

| Discretionary inflation bonus | | — | | | — | | | (531) | | | — | | | (531) | |

| Accelerated equity compensation | | — | | | — | | | (289) | | | — | | | (289) | |

| Adjusted noninterest expense | | $ | 18,670 | | | $ | 17,902 | | | $ | 17,062 | | | $ | 36,572 | | | $ | 34,797 | |

| | | | | | | | | | |

| Income (loss) before income taxes - GAAP | | $ | 3,648 | | | $ | (5,349) | | | $ | 10,824 | | | $ | (1,701) | | | $ | 23,823 | |

Adjustments:1 | | | | | | | | | | |

| Mortgage-related revenue | | — | | | (65) | | | — | | | (65) | | | — | |

| Mortgage-related costs | | — | | | 3,052 | | | — | | | 3,052 | | | — | |

| Acquisition-related expenses | | — | | | — | | | 103 | | | — | | | 273 | |

| Partial charge-off of C&I participation loan | | — | | | 6,914 | | | — | | | 6,914 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Nonrecurring consulting fee | | — | | | — | | | — | | | — | | | 875 | |

| Discretionary inflation bonus | | — | | | — | | | 531 | | | — | | | 531 | |

| Accelerated equity compensation | | — | | | — | | | 289 | | | — | | | 289 | |

| Adjusted income (loss) before income taxes | | $ | 3,648 | | | $ | 4,552 | | | $ | 11,747 | | | $ | 8,200 | | | $ | 25,791 | |

| | | | | | | | | | |

| Income tax (benefit) provision - GAAP | | $ | (234) | | | $ | (2,332) | | | $ | 1,279 | | | $ | (2,566) | | | $ | 3,069 | |

Adjustments:1 | | | | | | | | | | |

| Mortgage-related revenue | | — | | | (14) | | | — | | | (14) | | | — | |

| Mortgage-related costs | | — | | | 641 | | | — | | | 641 | | | — | |

| Acquisition-related expenses | | — | | | — | | | 21 | | | — | | | 57 | |

| Partial charge-off of C&I participation loan | | — | | | 1,452 | | | — | | | 1,452 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Nonrecurring consulting fee | | — | | | — | | | — | | | — | | | 184 | |

| Discretionary inflation bonus | | — | | | — | | | 112 | | | — | | | 112 | |

| Accelerated equity compensation | | — | | | — | | | 61 | | | — | | | 61 | |

| Adjusted income tax (benefit) provision | | $ | (234) | | | $ | (253) | | | $ | 1,473 | | | $ | (487) | | | $ | 3,483 | |

| | | | | | | | | | |

| Net income (loss) - GAAP | | $ | 3,882 | | | $ | (3,017) | | | $ | 9,545 | | | $ | 865 | | | $ | 20,754 | |

| Adjustments: | | | | | | | | | | |

| Mortgage-related revenue | | — | | | (51) | | | — | | | (51) | | | — | |

| Mortgage-related costs | | — | | | 2,411 | | | — | | | 2,411 | | | — | |

| Acquisition-related expenses | | — | | | — | | | 82 | | | — | | | 216 | |

| Partial charge-off of C&I participation loan | | — | | | 5,462 | | | — | | | 5,462 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Nonrecurring consulting fee | | — | | | — | | | — | | | — | | | 691 | |

| Discretionary inflation bonus | | — | | | — | | | 419 | | | — | | | 419 | |

| Accelerated equity compensation | | — | | | — | | | 228 | | | — | | | 228 | |

| Adjusted net income | | $ | 3,882 | | | $ | 4,805 | | | $ | 10,274 | | | $ | 8,687 | | | $ | 22,308 | |

1Assuming a 21% tax rate | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Internet Bancorp | | | | | | | | | | |

| Reconciliation of Non-GAAP Financial Measures | | | | | | |

| Dollar amounts in thousands, except per share data | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Diluted average common shares outstanding | | 8,908,180 | | | 9,024,072 | | | 9,658,689 | | | 8,980,262 | | | 9,764,232 | |

| | | | | | | | | | |

| Diluted (loss) earnings per share - GAAP | | $ | 0.44 | | | $ | (0.33) | | | $ | 0.99 | | | $ | 0.10 | | | $ | 2.13 | |

| Adjustments: | | | | | | | | | | |

| Effect of mortgage-related revenue | | — | | | (0.01) | | | — | | | (0.01) | | | — | |

| Effect of mortgage-related costs | | — | | | 0.27 | | | — | | | 0.27 | | | — | |

| Effect of partial charge-off of C&I participation loan | | — | | | 0.60 | | | — | | | 0.61 | | | — | |

| Effect of acquisition-related expenses | | — | | | — | | | 0.01 | | | — | | | 0.02 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Effect of nonrecurring consulting fee | | — | | | — | | | — | | | — | | | 0.07 | |

| | | | | | | | | | |

| Effect of discretionary inflation bonus | | — | | | — | | | 0.04 | | | — | | | 0.04 | |

| Effect of accelerated equity compensation | | — | | | — | | | 0.02 | | | — | | | 0.02 | |

| Adjusted diluted (loss) earnings per share | | $ | 0.44 | | | $ | 0.53 | | | $ | 1.06 | | | $ | 0.97 | | | $ | 2.28 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Return on average assets | | 0.32 | % | | (0.26 | %) | | 0.93 | % | | 0.04 | % | | 1.01 | % |

| Effect of mortgage-related revenue | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % |

| Effect of mortgage-related costs | | 0.00 | % | | 0.21 | % | | 0.00 | % | | 0.10 | % | | 0.00 | % |

| Effect of partial charge-off of C&I participation loan | | 0.00 | % | | 0.48 | % | | 0.00 | % | | 0.23 | % | | 0.00 | % |

| Effect of acquisition-related expenses | | 0.00 | % | | 0.00 | % | | 0.01 | % | | 0.00 | % | | 0.01 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Effect of nonrecurring consulting fee | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.03 | % |

| | | | | | | | | | |

| Effect of discretionary inflation bonus | | 0.00 | % | | 0.00 | % | | 0.04 | % | | 0.00 | % | | 0.02 | % |

| Effect of accelerated equity compensation | | 0.00 | % | | 0.00 | % | | 0.02 | % | | 0.00 | % | | 0.01 | % |

| Adjusted return on average assets | | 0.32 | % | | 0.43 | % | | 1.00 | % | | 0.37 | % | | 1.08 | % |

| | | | | | | | | | |

| Return on average shareholders' equity | | 4.35 | % | | (3.37 | %) | | 10.23 | % | | 0.48 | % | | 11.09 | % |

| Effect of mortgage-related revenue | | 0.00 | % | | (0.06 | %) | | 0.00 | % | | (0.03 | %) | | 0.00 | % |

| Effect of mortgage-related costs | | 0.00 | % | | 2.69 | % | | 0.00 | % | | 1.35 | % | | 0.00 | % |

| Effect of partial charge-off of C&I participation loan | | 0.00 | % | | 6.10 | % | | 0.00 | % | | 3.05 | % | | 0.00 | % |

| Effect of acquisition-related expenses | | 0.00 | % | | 0.00 | % | | 0.09 | % | | 0.00 | % | | 0.12 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| Effect of nonrecurring consulting fee | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.37 | % |

| Effect of discretionary inflation bonus | | 0.00 | % | | 0.00 | % | | 0.45 | % | | 0.00 | % | | 0.22 | % |

| Effect of accelerated equity compensation | | 0.00 | % | | 0.00 | % | | 0.24 | % | | 0.00 | % | | 0.12 | % |

| Adjusted return on average shareholders' equity | | 4.35 | % | | 5.36 | % | | 11.01 | % | | 4.85 | % | | 11.92 | % |

| | | | | | | | | | |

| Return on average tangible common equity | | 4.40 | % | | (3.41 | %) | | 10.36 | % | | 0.49 | % | | 11.23 | % |

| Effect of mortgage-related revenue | | 0.00 | % | | (0.06 | %) | | 0.00 | % | | (0.03 | %) | | 0.00 | % |

| Effect of mortgage-related costs | | 0.00 | % | | 2.73 | % | | 0.00 | % | | 1.37 | % | | 0.00 | % |

| Effect of partial charge-off of C&I participation loan | | 0.00 | % | | 6.18 | % | | 0.00 | % | | 3.09 | % | | 0.00 | % |

| Effect of acquisition-related expenses | | 0.00 | % | | 0.00 | % | | 0.09 | % | | 0.00 | % | | 0.12 | % |

| | | | | | | | | | |

| Effect of nonrecurring consulting fee | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.37 | % |

| | | | | | | | | | |

| Effect of discretionary inflation bonus | | 0.00 | % | | 0.00 | % | | 0.45 | % | | 0.00 | % | | 0.23 | % |

| Effect of accelerated equity compensation | | 0.00 | % | | 0.00 | % | | 0.25 | % | | 0.00 | % | | 0.12 | % |

| Adjusted return on average tangible common equity | | 4.40 | % | | 5.44 | % | | 11.15 | % | | 4.92 | % | | 12.07 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | |

| | | | | | | | |

| | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Financial Results Second Quarter 2023 Exhibit 99.2

Forward-Looking Statements & Non-GAAP Financial Measures This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements with respect to the financial condition, results of operations, trends in lending policies and loan programs, plans and prospective business partnerships, objectives, future performance and business of the Company. Forward-looking statements are generally identifiable by the use of words such as “believe,” “continue,” “could,” “decline,” “estimate,” “expect,” “grow,” “growth,” “improve,” “increase,” “may,” “pending,” “plan,” “position,” “preliminary,” “remain,” “rising,” “should,” “slow,” “strategy,” “well-positioned,” or other similar expressions. Forward- looking statements are not a guarantee of future performance or results, are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the information in the forward-looking statements. Such statements are subject to certain risks and uncertainties including: our business and operations and the business and operations of our vendors and customers: general economic conditions, whether national or regional, and conditions in the lending markets in which we participate may have an adverse effect on the demand for our loans and other products; our credit quality and related levels of nonperforming assets and loan losses, and the value and salability of the real estate that is the collateral for our loans. Other factors that may cause such differences include: failures or breaches of or interruptions in the communications and information systems on which we rely to conduct our business; failure of our plans to grow our commercial and industrial, construction, SBA, and franchise finance loan portfolios; competition with national, regional and community financial institutions; the loss of any key members of senior management; the impacts of inflation and rising interest rates on the general economy; risks relating to the regulation of financial institutions; and other factors identified in reports we file with the U.S. Securities and Exchange Commission. All statements in this presentation, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. This presentation contains financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures, specifically tangible common equity, tangible assets, tangible book value per common share, tangible common equity to tangible assets, total interest income – FTE, net interest income – FTE, net interest margin – FTE, adjusted noninterest income, adjusted noninterest expense, adjusted noninterest expense to average assets, adjusted income before income taxes, adjusted income tax provision (benefit), adjusted net income, adjusted diluted earnings per share, adjusted tangible common equity, adjusted tangible assets and adjusted tangible common equity to adjusted tangible assets are used by the Company’s management to measure the strength of its capital and analyze profitability, including its ability to generate earnings on tangible capital invested by its shareholders. Although management believes these non-GAAP measures are useful to investors by providing a greater understanding of its business, they should not be considered a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non- GAAP performance measures that may be presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the table at the end of this presentation under the caption “Reconciliation of Non-GAAP Financial Measures.” 2

Second Quarter 2023 Highlights Net income of $3.9 million Diluted earnings per share of $0.44 3 Net interest margin of 1.53% and FTE net interest margin of 1.64%1 Pace of increase in deposit costs slowed to lowest point in past four quarters Total deposits increased 6.4% from 1Q23 Total portfolio loan balances increased 1.1% from 1Q23 Capital position remains solid TCE / TA of 7.07%1; CET1 ratio of 10.10% SBA gain on sale revenue of $4.9 million NPAs to total assets declined to 0.13% Office CRE less than 1% of total loans Excluding AOCI and adjusting for normalized cash balances, adjusted TCE / TA was 8.01%1 Repurchased 203,000 shares at an average price of $13.52 under authorized repurchase program 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix Total revenue of $24.0 million Noninterest expense to average assets of 1.52% Tangible book value per share increased 1.6% to $39.85 Yield on funded loans increased to 8.42%, up 66 bps over 1Q23, under portfolio optimization strategy Loans to deposits ratio declined to 94.6%

Loan Portfolio Overview Total portfolio loan balances increased 1.1% from 1Q23 Commercial loan balances increased $25.2 million, or 0.9%, compared to 1Q23 Consumer loan balances increased $16.3 million, or 2.2%, compared to 1Q23 2Q23 funded portfolio loan origination yields were up 66 bps from 1Q23 and 366 bps from 2Q22 Office exposure continues to be less than 1% of total loan balances and is limited to suburban and medical 4 Loan Portfolio Mix1 1 Percentages may not add up to 100% due to rounding 2 Includes commercial and industrial and owner-occupied commercial real estate balances Dollars in millions 2 11% 10% 10% 10% 9% 9% 16% 16% 11% 8% 7% 12%3% 9% 1% 2% 4% 4% 4% 2% 4% 11% 17% 13% 8% 22% 26% 24% 20% 21% 18% 38% 34% 34% 31% 30% 27% 2% 2% 2% 4% 6% 8% 9% 7% 6% 6% 6% 5% $2,091 $2,716 $2,964 $3,059 $2,888 $3,499 $3,647 2017 2018 2019 2020 2021 2022 2Q23 Commercial and Industrial Construction and Investor CRE Single Tenant Lease Financing Public Finance Healthcare Finance Small Business Lending Franchise Finance Residential Mortgage/HE/HELOCs Consumer 5% 27% 8% 17% 7% 4% 12% 11% 9%

$1,479.7 38% $984.2 25% $368.4 10% $249.9 7% $154.4 4% $629.9 16% Consumer Small Business Commercial Public Funds BaaS Brokered2 $119.3 3% $270.0 7% $28.2 1% $434.9 11% $797.8 21%$154.4 4% $1,366.4 35% $683.2 18% Noninterest-bearing deposits Interest-bearing demand deposits Savings accounts Money market - Consumer Money market - SMB/Commercial BaaS deposits Certificates of deposits Brokered deposits Deposit Composition 5 Total deposits increased $232.0 million, or 6.4%, from 1Q23 and are up 22.3% from 2Q22 Diversified deposit base comprised of a combination of consumer, small business, commercial and public funds Deposit base is further diversified by product type among checking, money market/savings and CDs Larger balance deposit retention enhanced by IntraFi’s ICS reciprocal deposit product 1 Money market – SMB/Commercial includes small business, commercial, CRE and public funds 2 Public funds includes $53.3 million of deposits that are classified as brokered for regulatory purposes 1 Deposits by Customer Type - 6/30/23 Dollars in millions Total Deposits - $3.9B as of 6/30/23 Dollars in millions Average Balance (Dollars in thousands) $44.6 $104.2 $211.0 $652.5 $65.5

Uninsured Deposit Balances 6 Estimated uninsured deposit balances represent 24% of total deposits, down from 26% in 1Q23 – Decrease driven primarily by decline in money market balances, conversions to ICS reciprocal deposits and drawdowns on construction-related noninterest-bearing balances Uninsured balances include Indiana-based Public Funds which are insured by the Indiana Board for Depositories and neither require collateral nor are reported as “Preferred Deposits” on the Bank’s call report Uninsured balances also include certain large balance accounts under contractual deposit agreements that only allow withdrawal under certain conditions Estimated Uninsured Deposits Public Funds Contractual Deposits Adjusted Uninsured Deposits Uninsured Deposits Waterfall – 2Q23 Dollars in millions 24% of Total Deposits 18% of Total Deposits

Liquidity and 2Q23 Deposit Update 7 Cash and unused borrowing capacity totaled $1.2 billion at quarter end – Cash balances up over $160 million since 1Q23 – Currently represents 127% of total uninsured deposits and 174% of adjusted uninsured deposits CD production and growth in BaaS deposits drove increased balance sheet liquidity Strong deposit growth combined with modest total loan growth lowered the loans to deposits ratio to 94.6% 1 Money market – SMB/Commercial includes small business, commercial, CRE and public funds Cost of Funds by Deposit TypeTotal Deposits – Recent Activity Dollars in millions 5% 4% 3%9% 8% 7%1% 1% 1% 15% 13% 11% 26% 22% 21% 1% 2% 4% 43% 50% 53% 12/31/22 3/31/23 6/30/23 Noninterst-bearing deposits Interest-bearing demand deposits Savings accounts Money market - Consumer Money market - SMB/Commercial BaaS deposits Certificates and brokered deposits 1 $3,441.2 $3,622.3 $3,854.3 2Q23 1Q23 4Q22 Interest-bearing demand deposits 1.68% 1.09% 0.76% Savings accounts 0.86% 0.86% 0.86% Money market accounts 3.88% 3.62% 2.89% BaaS – brokered deposits 4.03% 3.80% 1.13% Certificates of deposits 3.84% 3.12% 2.04% Brokered deposits 4.47% 3.93% 3.22% Total interest-bearing deposits 3.75% 3.24% 2.45%

Net Interest Income and Net Interest Margin Net interest income on a GAAP and FTE basis were down 7.3% and 7.0%, respectively, from 1Q23 Improved loan mix and higher origination yields were offset by higher funding costs Total loan portfolio yield impacted by loan beta lag effect on fixed rate portfolios Pace of increase in deposit costs slowest in past four quarters 8 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix Yield on Loans and Cost of Interest-Bearing Deposits Net Interest Margin – GAAP and FTE1 4.31% 4.33% 4.72% 4.96% 5.15% 0.85% 1.41% 2.45% 3.24% 3.75% 2Q22 3Q22 4Q22 1Q23 2Q23 Yield on loans Cost of interest-bearing deposits $25.7 $24.0 $21.7 $19.6 $18.1 $27.1 $25.3 $23.1 $21.0 $19.5 2Q22 3Q22 4Q22 1Q23 2Q23 GAAP FTE 2.60% 2.40% 2.09% 1.76% 1.53% 2.74% 2.53% 2.22% 1.89% 1.64% 2Q22 3Q22 4Q22 1Q23 2Q23 GAAP FTE Net Interest Income – GAAP and FTE1 Dollars in millions

Net Interest Margin Drivers 9 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix 2 Impact of loans affected by day count for 1Q23 and 2Q23 rollforward Net Interest Margin – FTE1 Linked-Quarter Change Monthly Rate Paid on Int. Bearing Deposits vs. Fed Funds Linked-quarter FTE NIM decreased 25 bps, due primarily to higher deposit costs, partially offset by higher earning asset yields – Weighted average yield of 8.42% on funded portfolio originations during 2Q23, up 66 bps over 1Q23 – Other earning assets and securities yields increased 49 and 7 bps, respectively, from 1Q23 Deposit costs increased 51 bps from 1Q23 to 3.75% for 2Q23 – Strong deposit growth outpaced modest loan growth to provide greater liquidity – Carrying higher cash balances estimated to have negatively impacted NIM and FTE NIM by 6 - 7 bps +21 bps - 2 bps - 46 bps 1.89% 1.64% +2 bps 1.14% 1.41% 1.70% 2.10% 2.50% 2.75% 3.06% 3.26% 3.39% 3.59% 3.79% 3.85% 2.32% 2.33% 3.08% 3.08% 3.83% 4.33% 4.33% 4.58% 4.83% 4.83% 5.08% 5.08% Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Int. Bearing Deposits Fed Funds Effective 2

Noninterest Income 10 Dollars in millions Noninterest Income by Type Dollars in millions Noninterest Income by Quarter Noninterest income of $5.9 million, compared to $5.4 million in 1Q23 Gain on sale of loans of $4.9 million, up 19.9% compared to $4.1 million in 1Q23 – SBA loan sale volume increased 15.8% compared to 1Q23 – Net gain on sale premiums continued to improve, up 40 bps over 1Q23 $0.2 $0.5 $4.9 $0.3 Service charges and fees Net loan servicing revenue Gain on sale of loans Other $4.3 $4.3 $5.8 $5.4 $5.9 2Q22 3Q22 4Q22 1Q23 2Q23