First Internet Bancorp (the “Company”) (Nasdaq: INBK), the

parent company of First Internet Bank (the “Bank”), announced today

financial and operational results for the first quarter ended March

31, 2023.

Addressing Recent Market

Events

- Deposit growth of $181.0 million in the first quarter, a

5.3% increase from the fourth quarter of 2022

- Estimated uninsured deposits represented 26% of total

deposits at March 31, 2023, and 19% of total deposits after

adjusting for insured/collateralized public funds and contractual

deposits

- No additional borrowing from either the FHLB or the Federal

Reserve during the first quarter; total borrowing availability of

$628 million across all facilities at quarter end

- Office commercial real estate exposure represents less than

1% of total loan balances and is primarily limited to suburban and

medical offices

- Total after-tax unrealized securities losses in both the

available-for-sale and held-to-maturity portfolios represented

13.3% of tangible shareholders’ equity at quarter end

- Tangible common equity to tangible assets of 7.47%; CET1

ratio of 10.35%; tangible book value per share of $39.43

First Quarter 2023 Financial

Highlights

- Net loss of $1.3 million and a diluted loss per share of

$0.14

- Net loss was impacted by a partial charge-off of $4.7

million related to one C&I participation loan

- Adjusted net income of $4.8 million, or $0.53 adjusted

diluted earnings per share, when excluding (i) net pre-tax costs of

$3.0 million incurred as a result of the previously announced exit

of the Bank's consumer mortgage operations and (ii) the

aforementioned $4.7 million partial charge-off of the C&I

participation loan

- Net interest margin of 1.76% and fully-taxable equivalent

net interest margin of 1.89%, compared to 2.09% and 2.22%,

respectively, for the fourth quarter of 2022

- Repurchased 161,691 shares

“Our active management of liquidity, capital and revenue streams

in preparation for a dynamic economic environment positioned us to

effectively withstand the recent challenges to the banking system,”

said David Becker, Chairman and Chief Executive Officer. “Early in

the first quarter, we focused on growing deposits and building

liquidity, which we successfully accomplished despite intense

competition amid the overall decline in system-wide deposits. While

we experienced a modest decline in deposits from mid-March through

quarter-end, balances have rebounded and are up $135 million thus

far in April.

“We remain focused on our strategies to bolster the resilience

of our balance sheet and our revenue channels. We continue to

improve the composition of the loan portfolio towards a more

favorable mix of variable rate and higher yielding loans. New

origination yields were up significantly during the quarter,

positioning us to achieve stronger earnings and profitability once

deposit costs stabilize. In addition, our SBA lending team

generated a very strong quarter with gain on sale revenue up over

40% compared to the fourth quarter.”

Mr. Becker concluded, “Despite an issue late in the quarter on

one commercial participation loan, our exposure to similar-type

loans is very limited and all others are performing well. Our

overall asset quality remains solid, and our capital levels are

strong.”

Net Interest Income and Net Interest Margin

Net interest income for the first quarter of 2023 was $19.6

million, compared to $21.7 million for the fourth quarter of 2022,

and $25.8 million for the first quarter of 2022. On a fully-taxable

equivalent basis, net interest income for the first quarter of 2023

was $21.0 million, compared to $23.1 million for the fourth quarter

of 2022, and $27.1 million for the first quarter of 2022.

Total interest income for the first quarter of 2023 was $52.0

million, an increase of 13.9% compared to the fourth quarter of

2022, and an increase of 44.4% compared to the first quarter of

2022. On a fully-taxable equivalent basis, total interest income

for the first quarter of 2023 was $53.4 million, an increase of

13.5% compared to the fourth quarter of 2022, and an increase of

43.0% compared to the first quarter of 2022. The increase from the

linked quarter was due primarily to growth in interest income

earned on loans, other earning assets and securities. The yield on

average interest-earning assets for the first quarter of 2023

increased to 4.69% from 4.40% for the fourth quarter of 2022 due

primarily to a 24 basis point (“bp”) increase in the average loan

yield, a 94 bp increase in the yield earned on other earning assets

and a 36 bp increase in the yield earned on securities. Compared to

the linked quarter, average loan balances increased $191.9 million,

or 5.7%, while the average balance of other earning assets

increased $181.4 million, or 121.0%, and the average balance of

securities increased $6.7 million, or 1.2%.

Interest income earned on commercial loans was higher due to

increased average balances and the positive impact of higher rates

in the variable rate SBA, construction and investor commercial real

estate portfolios, as well as strong growth and higher new

origination yields in the franchise finance portfolio. This was

partially offset by lower average balances and prepayment fees in

the healthcare finance portfolio, as well as lower prepayment fees

in the single tenant lease financing portfolio.

In the consumer portfolio, interest income was up due to higher

new origination yields, increases in the average balance of

residential mortgage, trailers and recreational vehicles

portfolios, and higher rates in the variable rate home equity

portfolio.

The yield on funded portfolio originations was 7.76% in the

first quarter, an increase of 161 bps compared to the fourth

quarter of 2022 and an increase of 297 basis points compared to the

first quarter of 2022. Because of the fixed-rate nature of certain

larger portfolios, there is a lagging impact of origination yields

on the portfolio, which are expected to increase over time.

Interest earned on cash and other interest-earning balances

increased $2.4 million, or 171.6%, during the quarter due to the

impact of higher short-term interest rates on cash balances as well

as a $181.4 million increase, or 152.5%, in average cash balances.

Furthermore, interest income earned on securities increased $0.5

million, or 12.3%, during the first quarter of 2023 as the yield on

the portfolio increased 36 bps to 3.05% driven primarily by

variable rate securities resetting higher, slower prepayment speeds

and an increase in the average balance of the portfolio.

Total interest expense for the first quarter was $32.5 million,

an increase of $8.5 million, or 35.2%, compared to the linked

quarter, due to increases in both market interest rates and average

interest-bearing deposit balances throughout the quarter. Interest

expense related to interest-bearing deposits increased $8.5

million, or 45.0%, driven primarily by higher costs on CD and

brokered deposits and money market accounts. Average CD balances

increased $261.4 million, or 32.9%, while the cost of funds

increased 108 bps, as the Company took advantage of strong consumer

and small business demand during the quarter and pulled forward

origination activity planned for later in the year. The average

balance of brokered deposits increased $165.1 million, or 38.6%,

driven by a full quarter’s impact of brokered CD issuances in late

2022, and the cost of funds increased 71 bps. Additionally, while

average money market balances decreased $64.0 million, or 4.4%,

during the quarter, the cost of these deposits increased 73 bps due

to the impact of continued Federal Reserve rate increases.

The average balance of BaaS – brokered deposits increased by

$10.2 million, reaching $25.7 million by quarter-end. In total,

BaaS deposits were $82.4 million as of March 31, 2023 as Fintech

programs were onboarded and existing programs grew during the

quarter.

Net interest margin (“NIM”) was 1.76% for the first quarter of

2023, down from 2.09% for the fourth quarter of 2022 and 2.56% for

the first quarter of 2022. Fully-taxable equivalent NIM (“FTE NIM”)

was 1.89% for the first quarter of 2023, down from 2.22% for the

fourth quarter of 2022 and 2.69% for the first quarter of 2022. The

decreases in NIM and FTE NIM compared to the linked quarter were

driven primarily by the effect of higher interest-bearing deposit

costs, partially offset by higher yields on loans, other earning

assets and securities.

Noninterest Income

Noninterest income for the first quarter of 2023 was $5.4

million, down $0.4 million, or 6.2%, from the fourth quarter of

2022, and down $1.4 million, or 20.1%, from the first quarter of

2022. Gain on sale of loans totaled $4.1 million for the first

quarter of 2023, up $1.2 million, or 41.9%, from the linked

quarter. Gain on sale revenue in the quarter consisted entirely of

gain on the sales of U.S. Small Business Administration (“SBA”)

7(a) guaranteed loans, which increased due to a higher volume of

loan sales, as well as higher net premiums. Other income totaled

$0.4 million for the first quarter of 2023, down $1.2 million

compared to the linked quarter due to distributions received on

certain Small Business Investment Company and venture capital fund

investments in the fourth quarter. Mortgage banking revenue totaled

only $0.1 million for the first quarter as the Company immediately

began winding down its existing pipeline following its announced

exit from the consumer mortgage business in January 2023.

Noninterest Expense

Noninterest expense for the first quarter of 2023 was $21.0

million, up $2.4 million, or 13.2%, from the fourth quarter of 2022

and up $2.2 million, or 11.6%, from the first quarter of 2022.

Excluding $3.1 million of mortgage operations and exit costs,

adjusted noninterest expense totaled $17.9 million for the first

quarter, declining $0.6 million, or 3.3%, compared to the linked

quarter. Excluding the mortgage operations and exit costs, salaries

and employee benefits expense decreased by $0.8 million compared to

the linked quarter due to lower incentive compensation and bonus

accruals. Also, marketing, advertising and promotion expense,

consulting and professional fees, premises and equipment costs and

other expenses decreased from the linked quarter, while loan

expenses and deposit insurance premiums were higher. The increase

in loan expenses reflects higher third party loan servicing costs

related to franchise finance loan volume. The increase in deposit

insurance premium was due primarily to asset growth, as well as the

composition of loans and deposits.

Income Taxes

The Company recognized an income tax benefit of $1.8 million for

the first quarter of 2023, compared to an income tax expense of

$0.5 million and an effective tax rate of 7.3% for the fourth

quarter of 2022 and an income tax expense of $1.8 million and an

effective tax rate of 13.8% for the first quarter of 2022. The

income tax benefit in the first quarter of 2023 reflects the net

loss resulting from the partial charge-off of the participation

loan and the recognition of mortgage exit costs described

above.

Loans and Credit Quality

Total loans as of March 31, 2023 were $3.6 billion, an increase

of $110.1 million, or 3.1%, compared to December 31, 2022, and an

increase of $728.7 million, or 25.3%, compared to March 31, 2022.

Total commercial loan balances were $2.8 billion as of March 31,

2023, an increase of $88.7 million, or 3.3%, compared to December

31, 2022, and an increase of $468.0 million, or 20.0%, compared to

March 31, 2022. Compared to the linked quarter, the increase in

commercial loan balances was driven primarily by growth in

franchise finance, single tenant lease financing and small business

lending balances, as well as combined growth in investor commercial

real estate and construction balances. These items were partially

offset by a decrease in the public finance portfolio as well as

continued runoff in the healthcare finance portfolio.

Total consumer loan balances were $756.4 million as of March 31,

2023, an increase of $23.1 million, or 3.1%, compared to December

31, 2022, and an increase of $267.6 million, or 54.7%, compared to

March 31, 2022. The increase compared to the linked quarter was due

primarily to higher balances in the recreational vehicles and

trailers loan portfolios as well as funded residential mortgages

that were in the pipeline prior to the announced exiting of the

business.

Total delinquencies 30 days or more past due were 0.13% of total

loans as of March 31, 2023, compared to 0.17% at December 31, 2022

and 0.03% as of March 31, 2022. The decrease in delinquencies

during the first quarter of 2023 was due primarily to a

construction loan that became current in the first quarter of 2023.

Nonperforming loans to total loans was 0.32% as of March 31, 2023,

compared to 0.22% at December 31, 2022 and 0.25% as of March 31,

2022. Nonperforming loans totaled $11.4 million at March 31, 2023,

up from $7.5 million at December 31, 2022. The increase was due

primarily to one commercial and industrial (“C&I”) credit with

a balance of $9.8 million that was moved to nonaccrual status late

in the quarter. The Company subsequently recognized a partial

charge-off of $4.7 million related to this loan due to negative

developments following quarter end.

The allowance for credit losses (“ACL”) as a percentage of total

loans was 1.02% as of March 31, 2023, compared to 0.91% as of

December 31, 2022 and 0.98% as of March 31, 2022. The increase in

the ACL reflects the day one Current Expected Credit Losses

(“CECL”) adjustment of $3.0 million, as well as overall growth in

the loan portfolio and changes in certain economic forecasts that

impacted quantitative factors for certain portfolios.

Net charge-offs were $5.0 million in the first quarter of 2023,

compared to net charge-offs of $0.2 million in the fourth quarter

2022. The increase was due almost wholly to the C&I

participation loan discussed above. Net charge-offs to average

loans totaled 57 bps in the first quarter.

The provision for loan losses in the first quarter was $7.2

million, compared to $2.1 million for the fourth quarter of 2022.

The increase in provision for the quarter reflects the partial

charge-off of the C&I participation loan discussed above as

well as growth in the loan portfolio and the impact of economic

forecasts on certain portfolios mentioned above.

Capital

As of March 31, 2023, total shareholders’ equity was $357.3

million, a decrease of $7.7 million, or 2.1%, compared to December

31, 2022, and a decrease of $17.4 million, or 4.6%, compared to

March 31, 2022. The decrease in shareholders’ equity during the

first quarter of 2023 was due primarily to stock repurchase

activity, the day one CECL adjustment and the net loss during the

quarter, partially offset by a decrease in accumulated other

comprehensive loss. Book value per common share was $39.95 as of

March 31, 2023, down from $40.26 as of December 31, 2022 and up

from $38.69 as of March 31, 2022. Tangible book value per share was

$39.43, down from $39.74 as of December 31, 2022 and up from $38.21

as of March 31, 2022.

In connection with its previously announced stock repurchase

program, the Company repurchased 161,691 shares of its common stock

during the first quarter of 2023 at an average price of $24.50 per

share. The Company has repurchased $36.2 million of stock under its

authorized programs to-date.

The following table presents the Company’s and the Bank’s

regulatory and other capital ratios as of March 31, 2023.

As of March 31, 2023

Company

Bank

Total shareholders' equity to assets

7.56%

9.32%

Tangible common equity to tangible assets

1

7.47%

9.23%

Tier 1 leverage ratio 2

8.14%

9.92%

Common equity tier 1 capital ratio 2

10.35%

12.63%

Tier 1 capital ratio 2

10.35%

12.63%

Total risk-based capital ratio 2

14.17%

13.62%

1 This information represents a non-GAAP

financial measure. For a discussion of non-GAAP financial measures,

see the section below entitled "Non-GAAP Financial Measures."

2 Regulatory capital ratios are

preliminary pending filing of the Company's and the Bank's

regulatory reports.

Conference Call and Webcast

The Company will host a conference call and webcast at 2:00 p.m.

Eastern Time on Thursday, April 27, 2023 to discuss its quarterly

financial results. The call can be accessed via telephone at (833)

470-1428; access code: 192191. A recorded replay can be accessed

through May 27, 2023 by dialing (866) 813-9403; access code:

451912.

Additionally, interested parties can listen to a live webcast of

the call on the Company's website at www.firstinternetbancorp.com. An archived version

of the webcast will be available in the same location shortly after

the live call has ended.

About First Internet Bancorp

First Internet Bancorp is a financial holding company with

assets of $4.7 billion as of March 31, 2023. The Company’s

subsidiary, First Internet Bank, opened for business in 1999 as an

industry pioneer in the branchless delivery of banking services.

First Internet Bank provides consumer and small business deposit,

SBA financing, franchise finance, consumer loans, and specialty

finance services nationally as well as commercial real estate

loans, construction loans, commercial and industrial loans, and

treasury management services on a regional basis. First Internet

Bancorp’s common stock trades on the Nasdaq Global Select Market

under the symbol “INBK” and is a component of the Russell 2000®

Index. Additional information about the Company is available at

www.firstinternetbancorp.com and additional information about First

Internet Bank, including its products and services, is available at

www.firstib.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including statements with respect to

the financial condition, results of operations, trends in lending

policies and loan programs, plans and prospective business

partnerships, objectives, future performance and business of the

Company. Forward-looking statements are generally identifiable by

the use of words such as “achieve,” “anticipate,” “believe,”

“build,” “continue,” “could,” “estimate,” “expect,” “growth,”

“help,” “improve,” “may,” “opportunities,” “pending,” “plan,”

“position,” “preliminary,” “remain,” “should,” “stabilize,”

“strategies,” “thereafter,” “well-positioned,” “will,” or other

similar expressions. Forward-looking statements are not a guarantee

of future performance or results, are based on information

available at the time the statements are made and involve known and

unknown risks, uncertainties and other factors that could cause

actual results to differ materially from the information in the

forward-looking statements. Such statements are subject to certain

risks and uncertainties including: our business and operations and

the business and operations of our vendors and customers: general

economic conditions, whether national or regional, and conditions

in the lending markets in which we participate that may have an

adverse effect on the demand for our loans and other products; our

credit quality and related levels of nonperforming assets and loan

losses, and the value and salability of the real estate that is the

collateral for our loans. Other factors that may cause such

differences include: failures or breaches of or interruptions in

the communications and information systems on which we rely to

conduct our business; failure of our plans to grow our commercial

and industrial, construction, SBA, and franchise finance loan

portfolios; competition with national, regional and community

financial institutions; the loss of any key members of senior

management; the anticipated impacts of inflation and rising

interest rates on the general economy; risks relating to the

regulation of financial institutions; and other factors identified

in reports we file with the U.S. Securities and Exchange

Commission. All statements in this press release, including

forward-looking statements, speak only as of the date they are

made, and the Company undertakes no obligation to update any

statement in light of new information or future events.

Non-GAAP Financial Measures

This press release contains financial information determined by

methods other than in accordance with U.S. generally accepted

accounting principles (“GAAP”). Non-GAAP financial measures,

specifically tangible common equity, tangible assets, tangible book

value per common share, tangible common equity to tangible assets,

average tangible common equity, return on average tangible common

equity, total interest income – FTE, net interest income – FTE, net

interest margin – FTE, adjusted total revenue, adjusted noninterest

income, adjusted noninterest expense, adjusted income before income

taxes, adjusted income tax (benefit) provision, adjusted net

income, adjusted diluted earnings per share, adjusted return on

average assets, adjusted return on average shareholders’ equity,

adjusted return on average tangible common equity and adjusted

effective income tax rate are used by the Company’s management to

measure the strength of its capital and analyze profitability,

including its ability to generate earnings on tangible capital

invested by its shareholders. Although management believes these

non-GAAP measures are useful to investors by providing a greater

understanding of its business, they should not be considered a

substitute for financial measures determined in accordance with

GAAP, nor are they necessarily comparable to non-GAAP performance

measures that may be presented by other companies. Reconciliations

of these non-GAAP financial measures to the most directly

comparable GAAP financial measures are included in the table at the

end of this release under the caption “Reconciliation of Non-GAAP

Financial Measures.”

First Internet Bancorp Summary Financial Information

(unaudited) Dollar amounts in thousands, except per share data

Three Months Ended March 31,

December 31, March 31,

2023

2022

2022

Net (loss) income

$

(1,305

)

$

6,351

$

11,209

Per share and share information (Loss) earnings per

share - basic

$

(0.14

)

$

0.68

$

1.14

(Loss) earnings per share - diluted

(0.14

)

0.68

1.14

Dividends declared per share

0.06

0.06

0.06

Book value per common share

39.95

40.26

38.69

Tangible book value per common share 1

39.43

39.74

38.21

Common shares outstanding

8,943,477

9,065,883

9,683,727

Average common shares outstanding: Basic

9,024,072

9,281,309

9,790,122

Diluted

9,051,890

9,343,533

9,870,394

Performance ratios Return on average assets

(0.11

%)

0.59

%

1.08

%

Return on average shareholders' equity

(1.46

%)

6.91

%

11.94

%

Return on average tangible common equity 1

(1.48

%)

7.00

%

12.09

%

Net interest margin

1.76

%

2.09

%

2.56

%

Net interest margin - FTE 1,2

1.89

%

2.22

%

2.69

%

Capital ratios 3 Total shareholders' equity to assets

7.56

%

8.03

%

8.87

%

Tangible common equity to tangible assets 1

7.47

%

7.94

%

8.77

%

Tier 1 leverage ratio

8.14

%

9.06

%

9.26

%

Common equity tier 1 capital ratio

10.35

%

10.93

%

13.16

%

Tier 1 capital ratio

10.35

%

10.93

%

13.16

%

Total risk-based capital ratio

14.17

%

14.75

%

17.62

%

Asset quality Nonperforming loans

$

11,432

$

7,529

$

7,084

Nonperforming assets

11,557

7,571

7,085

Nonperforming loans to loans

0.32

%

0.22

%

0.25

%

Nonperforming assets to total assets

0.24

%

0.17

%

0.17

%

Allowance for credit losses - loans to: Loans

1.02

%

0.91

%

0.98

%

Nonperforming loans

322.6

%

421.5

%

398.8

%

Net charge-offs to average loans

0.57

%

0.03

%

0.05

%

Average balance sheet information Loans

$

3,573,852

$

3,382,212

$

2,947,924

Total securities

585,270

578,608

648,728

Other earning assets

331,294

149,910

455,960

Total interest-earning assets

4,499,806

4,119,897

4,080,725

Total assets

4,647,175

4,263,246

4,214,918

Noninterest-bearing deposits

134,988

135,702

112,248

Interest-bearing deposits

3,411,969

3,041,022

3,071,420

Total deposits

3,546,957

3,176,724

3,183,668

Shareholders' equity

363,292

364,657

380,767

1 Refer to "Non-GAAP Financial Measures" section above and

"Reconciliation of Non-GAAP Financial Measures" below 2 On a

fully-taxable equivalent ("FTE") basis assuming a 21% tax rate 3

Regulatory capital ratios are preliminary pending filing of the

Company's regulatory reports

First Internet Bancorp

Condensed Consolidated Balance Sheets (unaudited, except for

December 31, 2022) Dollar amounts in thousands

March 31, December 31, March 31,

2023

2022

2022

Assets Cash and due from banks

$

27,741

$

17,426

$

20,976

Interest-bearing deposits

276,231

239,126

496,573

Securities available-for-sale, at fair value

395,833

390,384

465,288

Securities held-to-maturity, at amortized cost, net of allowance

for credit losses

210,761

189,168

163,370

Loans held-for-sale

18,144

21,511

33,991

Loans

3,609,454

3,499,401

2,880,780

Allowance for credit losses - loans

(36,879

)

(31,737

)

(28,251

)

Net loans

3,572,575

3,467,664

2,852,529

Accrued interest receivable

22,322

21,069

15,263

Federal Home Loan Bank of Indianapolis stock

28,350

28,350

25,219

Cash surrender value of bank-owned life insurance

40,105

39,859

39,133

Premises and equipment, net

74,248

72,711

68,632

Goodwill

4,687

4,687

4,687

Servicing asset

7,312

6,255

5,249

Other real estate owned

106

-

-

Accrued income and other assets

44,616

44,894

34,487

Total assets

$

4,723,031

$

4,543,104

$

4,225,397

Liabilities Noninterest-bearing deposits

$

140,449

$

175,315

$

119,196

Interest-bearing deposits

3,481,841

3,265,930

3,098,783

Total deposits

3,622,290

3,441,245

3,217,979

Advances from Federal Home Loan Bank

614,929

614,928

514,923

Subordinated debt

104,608

104,532

104,306

Accrued interest payable

2,592

2,913

1,532

Accrued expenses and other liabilities

21,328

14,512

12,002

Total liabilities

4,365,747

4,178,130

3,850,742

Shareholders' equity Voting common stock

189,202

192,935

214,473

Retained earnings

199,335

205,675

183,043

Accumulated other comprehensive loss

(31,253

)

(33,636

)

(22,861

)

Total shareholders' equity

357,284

364,974

374,655

Total liabilities and shareholders' equity

$

4,723,031

$

4,543,104

$

4,225,397

First Internet Bancorp Condensed Consolidated

Statements of Income (unaudited) Dollar amounts in thousands,

except per share data

Three Months Ended

March 31, December 31, March 31,

2023

2022

2022

Interest income Loans

$

43,843

$

40,354

$

33,188

Securities - taxable

3,606

3,222

2,221

Securities - non-taxable

798

699

249

Other earning assets

3,786

1,394

376

Total interest income

52,033

45,669

36,034

Interest expense Deposits

27,270

18,807

6,097

Other borrowed funds

5,189

5,193

4,187

Total interest expense

32,459

24,000

10,284

Net interest income

19,574

21,669

25,750

Provision for credit losses

7,204

2,109

791

Net interest income after provision for credit losses

12,370

19,560

24,959

Noninterest income Service charges and fees

209

226

316

Loan servicing revenue

785

715

585

Loan servicing asset revaluation

(55

)

(539

)

(297

)

Mortgage banking activities

76

1,010

1,873

Gain on sale of loans

4,061

2,862

3,845

Other

370

1,533

498

Total noninterest income

5,446

5,807

6,820

Noninterest expense Salaries and employee benefits

11,794

10,404

9,878

Marketing, advertising and promotion

844

837

756

Consulting and professional fees

926

914

1,925

Data processing

659

567

449

Loan expenses

1,977

1,018

1,582

Premises and equipment

2,777

2,921

2,540

Deposit insurance premium

543

355

281

Other

1,434

1,497

1,369

Total noninterest expense

20,954

18,513

18,780

(Loss) income before income taxes

(3,138

)

6,854

12,999

Income tax (benefit) provision

(1,833

)

503

1,790

Net (loss) income

$

(1,305

)

$

6,351

$

11,209

Per common share data (Loss) earnings per share -

basic

$

(0.14

)

$

0.68

$

1.14

(Loss) earnings per share - diluted

$

(0.14

)

$

0.68

$

1.14

Dividends declared per share

$

0.06

$

0.06

$

0.06

All periods presented have been reclassified to conform to

the current period classification

First Internet

Bancorp Average Balances and Rates (unaudited) Dollar

amounts in thousands

Three Months Ended

March 31, 2023 December 31, 2022 March 31,

2022 Average Interest / Yield /

Average Interest / Yield / Average

Interest / Yield / Balance Dividends

Cost Balance Dividends Cost

Balance Dividends Cost Assets

Interest-earning assets Loans, including loans held-for-sale 1

$

3,583,242

$

43,843

4.96

%

$

3,391,379

$

40,354

4.72

%

$

2,976,037

$

33,188

4.52

%

Securities - taxable

511,923

3,606

2.86

%

508,725

3,222

2.51

%

567,776

2,221

1.59

%

Securities - non-taxable

73,347

798

4.41

%

69,883

699

3.97

%

80,952

249

1.25

%

Other earning assets

331,294

3,786

4.63

%

149,910

1,394

3.69

%

455,960

376

0.33

%

Total interest-earning assets

4,499,806

52,033

4.69

%

4,119,897

45,669

4.40

%

4,080,725

36,034

3.58

%

Allowance for credit losses - loans

(35,075

)

(30,543

)

(27,974

)

Noninterest-earning assets

182,444

173,892

162,167

Total assets

$

4,647,175

$

4,263,246

$

4,214,918

Liabilities Interest-bearing liabilities

Interest-bearing demand deposits

$

333,642

$

900

1.09

%

$

326,102

$

628

0.76

%

$

318,281

$

412

0.52

%

Savings accounts

38,482

82

0.86

%

47,799

104

0.86

%

60,616

53

0.35

%

Money market accounts

1,377,600

12,300

3.62

%

1,441,583

10,508

2.89

%

1,454,436

1,503

0.42

%

BaaS - brokered deposits

14,741

138

3.80

%

4,563

13

1.13

%

12,111

6

0.20

%

Certificates and brokered deposits

1,647,504

13,850

3.41

%

1,220,975

7,554

2.45

%

1,225,976

4,123

1.36

%

Total interest-bearing deposits

3,411,969

27,270

3.24

%

3,041,022

18,807

2.45

%

3,071,420

6,097

0.81

%

Other borrowed funds

719,499

5,189

2.92

%

712,465

5,193

2.89

%

619,191

4,187

2.74

%

Total interest-bearing liabilities

4,131,468

32,459

3.19

%

3,753,487

24,000

2.54

%

3,690,611

10,284

1.13

%

Noninterest-bearing deposits

134,988

135,702

112,248

Other noninterest-bearing liabilities

17,427

9,400

31,292

Total liabilities

4,283,883

3,898,589

3,834,151

Shareholders' equity

363,292

364,657

380,767

Total liabilities and shareholders' equity

$

4,647,175

$

4,263,246

$

4,214,918

Net interest income

$

19,574

$

21,669

$

25,750

Interest rate spread

1.50

%

1.86

%

2.45

%

Net interest margin

1.76

%

2.09

%

2.56

%

Net interest margin - FTE 2,3

1.89

%

2.22

%

2.69

%

1 Includes nonaccrual loans 2 On a fully-taxable equivalent

("FTE") basis assuming a 21% tax rate 3 Refer to "Non-GAAP

Financial Measures" section above and "Reconciliation of Non-GAAP

Financial Measures" below

First Internet Bancorp

Loans and Deposits (unaudited) Dollar amounts in thousands

March 31, 2023 December 31, 2022

March 31, 2022 Amount Percent

Amount Percent Amount Percent

Commercial loans Commercial and industrial

$

115,410

3.2

%

$

126,108

3.6

%

$

99,808

3.5

%

Owner-occupied commercial real estate

59,643

1.7

%

61,836

1.8

%

56,752

2.0

%

Investor commercial real estate

142,174

3.9

%

93,121

2.7

%

34,627

1.2

%

Construction

158,147

4.4

%

181,966

5.2

%

149,662

5.2

%

Single tenant lease financing

952,533

26.3

%

939,240

26.8

%

852,519

29.6

%

Public finance

604,898

16.8

%

621,032

17.7

%

587,817

20.4

%

Healthcare finance

256,670

7.1

%

272,461

7.8

%

354,574

12.3

%

Small business lending

136,382

3.8

%

123,750

3.5

%

97,040

3.4

%

Franchise finance

382,161

10.6

%

299,835

8.6

%

107,246

3.7

%

Total commercial loans

2,808,018

77.8

%

2,719,349

77.7

%

2,340,045

81.3

%

Consumer loans Residential mortgage

392,062

10.9

%

383,948

11.0

%

191,153

6.6

%

Home equity

26,160

0.7

%

24,712

0.7

%

18,100

0.6

%

Trailers

172,640

4.8

%

167,326

4.8

%

148,870

5.2

%

Recreational vehicles

128,307

3.6

%

121,808

3.5

%

93,458

3.2

%

Other consumer loans

37,186

1.0

%

35,464

1.0

%

28,002

1.0

%

Tax refund advance loans

-

0.0

%

-

0.0

%

9,177

0.3

%

Total consumer loans

756,355

21.0

%

733,258

21.0

%

488,760

16.9

%

Net deferred loan fees, premiums, discounts and other 1

45,081

1.2

%

46,794

1.3

%

51,975

1.8

%

Total loans

$

3,609,454

100.0

%

$

3,499,401

100.0

%

$

2,880,780

100.0

%

March 31, 2023 December 31, 2022

March 31, 2022 Amount Percent

Amount Percent Amount Percent

Deposits Noninterest-bearing deposits

$

140,449

3.9

%

$

175,315

5.1

%

$

119,197

3.7

%

Interest-bearing demand deposits

351,641

9.7

%

335,611

9.8

%

334,723

10.4

%

Savings accounts

32,762

0.9

%

44,819

1.3

%

66,320

2.1

%

Money market accounts

1,254,013

34.6

%

1,418,599

41.2

%

1,475,857

45.8

%

BaaS - brokered deposits

25,725

0.7

%

13,607

0.4

%

50,006

1.6

%

Certificates of deposits

1,170,094

32.3

%

874,490

25.4

%

889,789

27.6

%

Brokered deposits

647,606

17.9

%

578,804

16.8

%

282,087

8.8

%

Total deposits

$

3,622,290

100.0

%

$

3,441,245

100.0

%

$

3,217,979

100.0

%

1 Includes carrying value adjustments of $31.5 million,

$32.5 million and $36.4 million related to terminated interest rate

swaps associated with public finance loans as of March 31, 2023,

December 31, 2022 and March 31, 2022, respectively.

First Internet Bancorp Reconciliation of Non-GAAP

Financial Measures Dollar amounts in thousands, except per

share data

Three Months Ended March

31, December 31, March 31,

2023

2022

2022

Total equity - GAAP

$

357,284

$

364,974

$

374,655

Adjustments: Goodwill

(4,687

)

(4,687

)

(4,687

)

Tangible common equity

$

352,597

$

360,287

$

369,968

Total assets - GAAP

$

4,723,031

$

4,543,104

$

4,225,397

Adjustments: Goodwill

(4,687

)

(4,687

)

(4,687

)

Tangible assets

$

4,718,344

$

4,538,417

$

4,220,710

Common shares outstanding

8,943,477

9,065,883

9,683,727

Book value per common share

$

39.95

$

40.26

$

38.69

Effect of goodwill

(0.52

)

(0.52

)

(0.48

)

Tangible book value per common share

$

39.43

$

39.74

$

38.21

Total shareholders' equity to assets

7.56

%

8.03

%

8.87

%

Effect of goodwill

(0.09

%)

(0.09

%)

(0.10

%)

Tangible common equity to tangible assets

7.47

%

7.94

%

8.77

%

Total average equity - GAAP

$

363,292

$

364,657

$

380,767

Adjustments: Average goodwill

(4,687

)

(4,687

)

(4,687

)

Average tangible common equity

$

358,605

$

359,970

$

376,080

Return on average shareholders' equity

(1.46

%)

6.91

%

11.94

%

Effect of goodwill

(0.02

%)

0.09

%

0.15

%

Return on average tangible common equity

(1.48

%)

7.00

%

12.09

%

Total interest income

$

52,033

$

45,669

$

36,034

Adjustments: Fully-taxable equivalent adjustments 1

1,383

1,384

1,314

Total interest income - FTE

$

53,416

$

47,053

$

37,348

Net interest income

$

19,574

$

21,669

$

25,750

Adjustments: Fully-taxable equivalent adjustments 1

1,383

1,384

1,314

Net interest income - FTE

$

20,957

$

23,053

$

27,064

Net interest margin

1.76

%

2.09

%

2.56

%

Effect of fully-taxable equivalent adjustments 1

0.13

%

0.13

%

0.13

%

Net interest margin - FTE

1.89

%

2.22

%

2.69

%

1 Assuming a 21% tax rate

First Internet

Bancorp Reconciliation of Non-GAAP Financial Measures

Dollar amounts in thousands, except per share data

Three Months Ended March 31, December

31, March 31,

2023

2022

2022

Total revenue - GAAP

$

25,020

$

27,476

$

32,570

Adjustments: Mortgage-related revenue

(65

)

-

-

Adjusted total revenue

$

24,955

$

27,476

$

32,570

Noninterest income - GAAP

$

5,446

$

5,807

$

6,820

Adjustments: Mortgage-related revenue

(65

)

-

-

Adjusted noninterest income

$

5,381

$

5,807

$

6,820

Noninterest expense - GAAP

$

20,954

$

18,513

$

18,780

Adjustments: Mortgage-related costs

(3,052

)

-

-

Acquisition-related expenses

-

-

(170

)

Nonrecurring consulting fee

-

-

(875

)

Adjusted noninterest expense

$

17,902

$

18,513

$

17,735

(Loss) income before income taxes - GAAP

$

(3,138

)

$

6,854

$

12,999

Adjustments:1 Mortgage-related revenue

(65

)

-

-

Mortgage-related costs

3,052

-

-

Acquisition-related expenses

-

-

170

Nonrecurring consulting fee

-

-

875

Partial charge-off of C&I participation loan

4,703

-

-

Adjusted income before income taxes

$

4,552

$

6,854

$

14,044

Income tax (benefit) provision - GAAP

$

(1,833

)

$

503

$

1,790

Adjustments:1 Mortgage-related revenue

(14

)

-

-

Mortgage-related costs

641

-

-

Acquisition-related expenses

-

-

36

Nonrecurring consulting fee

-

-

184

Partial charge-off of C&I participation loan

988

-

-

Adjusted income tax (benefit) provision

$

(218

)

$

503

$

2,010

Net (loss) income - GAAP

$

(1,305

)

$

6,351

$

11,209

Adjustments: Mortgage-related revenue

(51

)

-

-

Mortgage-related costs

2,411

-

-

Acquisition-related expenses

-

-

134

Nonrecurring consulting fee

-

-

691

Partial charge-off of C&I participation loan

3,715

-

-

Adjusted net income

$

4,770

$

6,351

$

12,034

1 Assuming a 21% tax rate

First Internet

Bancorp Reconciliation of Non-GAAP Financial Measures

Dollar amounts in thousands, except per share data

Three Months Ended March 31, December

31, March 31,

2023

2022

2022

Diluted average common shares outstanding

9,051,890

9,343,533

9,870,394

Diluted (loss) earnings per share - GAAP

$

(0.14

)

$

0.68

$

1.14

Adjustments: Effect of mortgage-related revenue

(0.01

)

-

-

Effect of mortgage-related costs

0.27

-

-

Effect of acquisition-related expenses

-

-

0.01

Effect of nonrecurring consulting fee

-

-

0.07

Effect of partial charge-off of C&I participation loan

0.41

-

-

Adjusted diluted (loss) earnings per share

$

0.53

$

0.68

$

1.22

Return on average assets

(0.11

%)

0.59

%

1.08

%

Effect of mortgage-related revenue

0.00

%

0.00

%

0.00

%

Effect of mortgage-related costs

0.21

%

0.00

%

0.00

%

Effect of acquisition-related expenses

0.00

%

0.00

%

0.01

%

Effect of nonrecurring consulting fee

0.00

%

0.00

%

0.07

%

Effect of partial charge-off of C&I participation loan

0.32

%

0.00

%

0.00

%

Adjusted return on average assets

0.42

%

0.59

%

1.16

%

Return on average shareholders' equity

(1.46

%)

6.91

%

11.94

%

Effect of mortgage-related revenue

(0.06

%)

0.00

%

0.00

%

Effect of mortgage-related costs

2.69

%

0.00

%

0.00

%

Effect of acquisition-related expenses

0.00

%

0.00

%

0.14

%

Effect of nonrecurring consulting fee

0.00

%

0.00

%

0.74

%

Effect of partial charge-off of C&I participation loan

4.15

%

0.00

%

0.00

%

Adjusted return on average shareholders' equity

5.32

%

6.91

%

12.82

%

Return on average tangible common equity

(1.48

%)

7.00

%

12.09

%

Effect of mortgage-related revenue

(0.06

%)

0.00

%

0.00

%

Effect of mortgage-related costs

2.73

%

0.00

%

0.00

%

Effect of acquisition-related expenses

0.00

%

0.00

%

0.14

%

Effect of nonrecurring consulting fee

0.00

%

0.00

%

0.75

%

Effect of partial charge-off of C&I participation loan

4.20

%

0.00

%

0.00

%

Adjusted return on average tangible common equity

5.39

%

7.00

%

12.98

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230424005810/en/

Investors/Analysts Paula Deemer

Director of Corporate Administration (317) 428-4628

investors@firstib.com

Media Nicole Lorch President &

Chief Operating Officer (317) 532-7906

nlorch@firstib.com Investors/Analysts

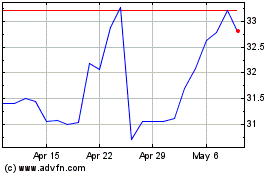

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Dec 2024 to Jan 2025

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Jan 2024 to Jan 2025