Highlights for the third quarter include:

- Record quarterly net income of $8.4 million, and adjusted

net income of $10.0 million when excluding a $2.1 million pre-tax

write-down of legacy other real estate owned (“OREO”)

- Record quarterly diluted earnings per share of $0.86 and

$1.03 adjusted diluted earnings per share, excluding the OREO

write-down

- Total revenue of $28.7 million, a 48.1% increase from the

second quarter, driven by record mortgage banking revenue, higher

net interest income and increased SBA loan sales

- Net interest margin and fully-taxable equivalent net

interest margin increased 16 and 17 basis points (“bps”),

respectively, from the second quarter, driven by a 43 bp decrease

in the cost of interest-bearing deposits

- As of October 16, 2020, loan balances of $20.8 million, or

0.7% of total loans, remained on deferral programs, down

significantly from $365.8 million on July 17, 2020

First Internet Bancorp (the “Company”) (Nasdaq: INBK), the

parent company of First Internet Bank (the “Bank”), announced today

financial and operational results for the third quarter of 2020.

Net income for the third quarter of 2020 was a record $8.4 million,

or $0.86 diluted earnings per share. This compares to net income of

$3.9 million, or $0.40 diluted earnings per share, for the second

quarter of 2020, and net income of $6.3 million, or $0.63 diluted

earnings per share, for the third quarter of 2019.

“We generated record net income in the quarter, driven by very

strong revenue growth, an improvement in net interest margin, and

moderate loan growth. We are very pleased with our ability to

navigate the challenges imposed by the pandemic and deliver for our

customers and shareholders,” said David Becker, Chairman, President

and Chief Executive Officer. “Additionally, we continued to

experience a significant reduction in loan deferrals, and by

quarter-end, over 99% of our borrowers who needed payment relief

early in the pandemic had resumed making payments. We are proud to

support our customers in their time of need and are glad that

nearly all have been able to return to their normal payment

schedules in such short order.

“Our direct-to-consumer mortgage business had a record quarter,

almost tripling revenue compared to the second quarter. We

capitalized on the ongoing market strength created by historically

low mortgage rates, and our mortgage pipeline remains strong

heading into the fourth quarter. Furthermore, our SBA business

gained additional traction during the quarter, as our accelerated

national expansion contributed to increased loan production and

higher gain-on-sale revenue. Our SBA pipeline is robust, and we

anticipate driving increased fee income in the quarters to come as

this government-guaranteed lending business continues to

ramp-up.”

Mr. Becker concluded, “As always, I would like to thank the

entire First Internet team for their very hard work in delivering

record revenue and earnings performance during these challenging

times. Our employees are the key to our success, and we are proud

of the strong culture and workplace environment we have created.

First Internet was recognized for the seventh consecutive year on

The Indianapolis Star’s 'Top Workplaces in Central Indiana' list,

placing in the top ten in the medium-sized company category.”

Net Interest Income and Net Interest Margin

Net interest income for the third quarter of 2020 was $16.2

million, compared to $14.4 million for the second quarter of 2020,

and $15.2 million for the third quarter of 2019. On a fully-taxable

equivalent basis, net interest income for the third quarter of 2020

was $17.7 million, compared to $15.9 million for the second quarter

of 2020, and $16.8 million for the third quarter of 2019.

Total interest income for the third quarter of 2020 was $32.8

million, a decrease of 4.3%, compared to the second quarter of

2020, and a decrease of 13.1% compared to the third quarter of

2019. On a fully-taxable equivalent basis, total interest income

for the third quarter of 2020 was $34.2 million, a decrease of 4.2%

compared to the second quarter of 2020, and a decrease of 13.0%

compared to the third quarter of 2019. The decline in total

interest income compared to the second quarter of 2020 was driven

primarily by a decrease in income from the securities portfolio due

to accelerated premium amortization and continued declines in short

term interest rate indices.

Total interest expense for the third quarter of 2020 was $16.5

million, a decrease of 16.6%, compared to the second quarter of

2020, and a decrease of 26.4% compared to the third quarter of

2019. The decrease in total interest expense compared to the linked

quarter was due primarily to a 43 bp decline in the cost of

interest-bearing deposits. The decrease in deposit costs reflects a

continued decline in the rates paid on interest-bearing deposits as

well as a shift in the deposit mix due to the growth in money

market accounts.

During the third quarter of 2020, the cost of money market

deposits decreased by 56 bps while the average balance of these

deposits grew $206.2 million, or 18.9%. Furthermore, the cost of

certificates and brokered deposits decreased 22 bps and average

balances decreased $222.3 million, or 11.1%. During the third

quarter, new certificates and brokered deposits were originated at

a weighted average cost of 84 bps while maturing deposits had a

weighted average cost of 225 bps; a difference of 141 bps.

Net interest margin (“NIM”) improved to 1.53% for the third

quarter of 2020, up from 1.37% for the second quarter of 2020 and

relatively stable with 1.54% for the third quarter of 2019.

Fully-taxable equivalent NIM (“FTE NIM”) increased by 17 bps to

1.67% for the third quarter of 2020, up from 1.50% for the second

quarter of 2020 and relatively stable with 1.70% for the third

quarter of 2019. The increases in NIM and FTE NIM compared to the

linked quarter were driven primarily by lower interest-bearing

deposit costs, which more than offset the impact of the lower

interest rate environment on interest-earning asset yields and the

continued effect of elevated cash balances.

Noninterest Income

Noninterest income for the third quarter of 2020 was $12.5

million, compared to $5.0 million for the second quarter of 2020

and $5.6 million for the third quarter of 2019. The increase

compared to the linked quarter was driven primarily by an increase

in revenue from mortgage banking activities and gain on sale of

loans. Mortgage banking revenue totaled $9.6 million for the third

quarter of 2020, increasing $6.2 million, or 182.6%, compared to

the prior quarter on increased loan sale volume and higher margins

as mortgage interest rates continued to decline during the quarter.

Gain on sale of loans totaled $2.0 million for the quarter,

increasing $1.3 million compared to the second quarter of 2020

driven by a higher amount of U.S. Small Business Administration

(“SBA”) 7(a) guaranteed loan sales in the quarter as well as a gain

on the sale of a portfolio of single tenant lease financing

loans.

Noninterest Expense

Noninterest expense for the third quarter of 2020 was $16.4

million, compared to $13.2 million for the second quarter of 2020

and $11.2 million for the third quarter of 2019. The increase from

the second quarter of 2020 was due primarily to a $2.1 million

write-down of two legacy commercial OREO properties and a $1.7

million increase in salaries and employee benefits but was

partially offset by a $0.4 million decrease in other expense and a

$0.3 million decrease in consulting and professional fees. The

higher salaries and employee benefits expense was due mainly to

higher incentive compensation related to the increased mortgage

production as well as an increase in headcount and incentive

compensation in the Company’s small business lending division.

Income Taxes

Income tax expense was $1.4 million, reflecting an effective tax

rate of 14.2%, for the third quarter of 2020, compared to an income

tax benefit of $0.3 million for the second quarter of 2020 and a

$0.4 million expense and an effective tax rate of 6.6% for the

third quarter of 2019. The increase in income taxes during the

quarter was due primarily to the increase in pre-tax earnings

driven by a higher proportion of taxable revenue from mortgage

banking and gain on sale of loans.

Loans and Credit Quality

Total loans as of September 30, 2020 were $3.0 billion, an

increase of $39.2 million, or 1.3%, compared to June 30, 2020, and

an increase of $131.6 million, or 4.6%, compared to September 30,

2019. Total commercial loan balances were $2.4 billion as of

September 30, 2020, an increase of $56.2 million, or 2.4%, compared

to June 30, 2020 and an increase of $248.7 million, or 11.3%,

compared to September 30, 2019. Compared to the linked quarter, the

growth in commercial loan balances was driven largely by production

in healthcare finance and construction lending as businesses

resumed operations following limited activity in the second

quarter.

Total consumer loan balances were $507.7 million as of September

30, 2020, a decrease of $15.3 million, or 2.9%, compared to June

30, 2020 and a decrease of $134.4 million, or 20.9%, compared to

September 30, 2019. The decline in consumer loan balances from June

30, 2020 was due primarily to increased prepayment activity across

the portfolio.

Total delinquencies 30 days or more past due decreased to 0.22%

of total loans as of September 30, 2020, down from 0.25% as of June

30, 2020 and up from 0.13% as of September 30, 2019. Overall credit

quality remained relatively stable as nonperforming loans to total

loans was 0.32% as of September 30, 2020, compared to 0.28% at June

30, 2020 and 0.20% as of September 30, 2019.

The allowance for loan losses as a percentage of total loans was

0.89% as of September 30, 2020, or 0.91% when excluding SBA PPP

loans, compared to 0.82% as of June 30, 2020 and 0.75% as of

September 30, 2019. During the quarter, the Company continued to

make additional adjustments to qualitative factors in its allowance

model to reflect the continued economic uncertainty resulting from

the COVID-19 pandemic. As a result, both the amount of the

allowance for loan losses and the allowance as a percentage of

total loans increased compared to June 30, 2020.

Net charge-offs of $0.1 million were recognized during the third

quarter of 2020, resulting in net charge-offs to average loans of

0.01%, as compared to 0.12% in the second quarter of 2020 and 0.15%

in the third quarter of 2019. The provision for loan losses in the

third quarter of 2020 was $2.5 million, consistent with the second

quarter of 2020 and down from $2.8 million for the third quarter of

2019.

Capital

As of September 30, 2020, total shareholders’ equity was $318.1

million, an increase of $10.4 million, or 3.4%, compared to June

30, 2020, due primarily to the net income earned during the quarter

and an increase in the after-tax valuations of the Company’s

available-for-sale securities portfolio and cash flow hedges. Book

value per common share increased to $32.46 as of September 30,

2020, up from $31.40 as of June 30, 2020 and $30.30 as of September

30, 2019. Tangible book value per common share increased to $31.98,

up from $30.92 and $29.82, each as of the same reference dates.

The following table presents the Company’s and the Bank’s

regulatory and other capital ratios as of September 30, 2020.

As of September 30, 2020

Company

Bank

Total shareholders' equity to assets

7.34%

8.12%

Tangible common equity to tangible assets

1

7.24%

8.02%

Tier 1 leverage ratio 2

7.72%

8.50%

Common equity tier 1 capital ratio 2

11.13%

12.27%

Tier 1 capital ratio 2

11.13%

12.27%

Total risk-based capital ratio 2

14.38%

13.17%

1 This information represents a non-GAAP

financial measure. For a discussion of non-GAAP financial measures,

see the section below entitled "Non-GAAP Financial Measures."

2 Regulatory capital ratios are

preliminary pending filing of the Company's and the Bank's

regulatory reports.

Conference Call and Webcast

The Company will host a conference call and webcast at 12:00

p.m. Eastern Time on Thursday, October 22, 2020 to discuss its

quarterly financial results. The call can be accessed via telephone

at (888) 348-3664. A recorded replay can be accessed through

November 22, 2020 by dialing (877) 344-7529; passcode:

10148690.

Additionally, interested parties can listen to a live webcast of

the call on the Company's website at www.firstinternetbancorp.com. An archived version

of the webcast will be available in the same location shortly after

the live call has ended.

About First Internet Bancorp

First Internet Bancorp is a bank holding company with assets of

$4.3 billion as of September 30, 2020. The Company’s subsidiary,

First Internet Bank, opened for business in 1999 as an industry

pioneer in the branchless delivery of banking services. The Bank

provides consumer and small business deposit, consumer loan,

residential mortgage, and specialty finance services nationally as

well as commercial real estate loans, commercial and industrial

loans, SBA financing and treasury management services. First

Internet Bancorp’s common stock trades on the Nasdaq Global Select

Market under the symbol “INBK” and is a component of the Russell

2000® Index. Additional information about the Company is available

at www.firstinternetbancorp.com and additional information about

the Bank, including its products and services, is available at

www.firstib.com.

Forward-Looking Statements

This press release may contain forward-looking statements with

respect to the financial condition, results of operations, trends

in lending policies, plans, objectives, future performance or

business of the Company. Forward-looking statements are generally

identifiable by the use of words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,”

“outlook,” “pending,” “plan,” “position,” “preliminary,” “remain,”

“should,” “will,” “would” or other similar expressions.

Forward-looking statements are not a guarantee of future

performance or results, are based on information available at the

time the statements are made and involve known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from the information in the forward-looking

statements. The COVID-19 pandemic has resulted in deterioration of

general business and economic conditions and continued to impact

us, our customers, counterparties, employees, and third-party

service providers. Sustained deterioration in market conditions

could adversely affect our revenues and the values of our assets

and liabilities, reduce the availability of funding, lead to a

tightening of credit and further increase stock price volatility.

In addition, changes to statutes, regulations, or regulatory

policies or practices as a result of, or in response to COVID-19,

could affect us in substantial and unpredictable ways. The ultimate

magnitude and duration of the pandemic is still unknown at this

time, therefore, the extent of the impact on our business,

financial position, results of operations, liquidity and prospects

remains uncertain. Other factors that may cause such differences

include: failures or breaches of or interruptions in the

communications and information systems on which we rely to conduct

our business; failure of our plans to grow our commercial real

estate, commercial and industrial, public finance, SBA and

healthcare finance loan portfolios; competition with national,

regional and community financial institutions; the loss of any key

members of senior management; fluctuations in interest rates;

general economic conditions; risks relating to the regulation of

financial institutions; and other factors identified in reports we

file with the U.S. Securities and Exchange Commission. All

statements in this press release, including forward-looking

statements, speak only as of the date they are made, and the

Company undertakes no obligation to update any statement in light

of new information or future events.

Non-GAAP Financial Measures

This press release contains financial information determined by

methods other than in accordance with U.S. generally accepted

accounting principles (“GAAP”). Non-GAAP financial measures,

specifically tangible common equity, tangible assets, tangible book

value per common share, tangible common equity to tangible assets,

average tangible common equity, return on average tangible common

equity, total interest income – FTE, net interest income – FTE, net

interest margin – FTE, allowance for loan losses to loans,

excluding PPP loans, adjusted income before income taxes, adjusted

income tax provision (benefit), adjusted net income, adjusted

diluted earnings per share, adjusted return on average assets,

adjusted return on shareholders’ equity, adjusted return on average

tangible common equity and adjusted effective income tax rate are

used by the Company’s management to measure the strength of its

capital and analyze profitability, including its ability to

generate earnings on tangible capital invested by its shareholders.

Although management believes these non-GAAP measures are useful to

investors by providing a greater understanding of its business,

they should not be considered a substitute for financial measures

determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures that may be presented

by other companies. Reconciliations of these non-GAAP financial

measures to the most directly comparable GAAP financial measures

are included in the table at the end of this release under the

caption “Reconciliation of Non-GAAP Financial Measures.”

First Internet Bancorp Summary Financial Information

(unaudited)Dollar amounts in thousands, except per share data

Three Months Ended Nine Months Ended

September 30,2020 June 30,2020

September 30,2019 September 30,2020

September 30,2019 Net income

$

8,411

$

3,932

$

6,326

$

18,362

$

18,143

Per share and share information Earnings per share - basic

$

0.86

$

0.40

$

0.63

$

1.87

$

1.79

Earnings per share - diluted

0.86

0.40

0.63

1.87

1.79

Dividends declared per share

0.06

0.06

0.06

0.18

0.18

Book value per common share

32.46

31.40

30.30

32.46

30.30

Tangible book value per common share 1

31.98

30.92

29.82

31.98

29.82

Common shares outstanding

9,800,569

9,799,047

9,741,800

9,800,569

9,741,800

Average common shares outstanding: Basic

9,773,175

9,768,227

9,979,603

9,825,683

10,114,303

Diluted

9,773,224

9,768,227

9,980,612

9,827,182

10,116,507

Performance ratios Return on average assets

0.78

%

0.37

%

0.63

%

0.58

%

0.64

%

Return on average shareholders' equity

10.67

%

5.15

%

8.40

%

7.90

%

8.20

%

Return on average tangible common equity 1

10.83

%

5.23

%

8.53

%

8.02

%

8.33

%

Net interest margin

1.53

%

1.37

%

1.54

%

1.47

%

1.70

%

Net interest margin - FTE 1,2

1.67

%

1.50

%

1.70

%

1.61

%

1.87

%

Capital ratios 3 Total shareholders' equity to assets

7.34

%

7.12

%

7.21

%

7.34

%

7.21

%

Tangible common equity to tangible assets 1

7.24

%

7.01

%

7.10

%

7.24

%

7.10

%

Tier 1 leverage ratio

7.72

%

7.49

%

7.66

%

7.72

%

7.66

%

Common equity tier 1 capital ratio

11.13

%

10.94

%

10.93

%

11.13

%

10.93

%

Tier 1 capital ratio

11.13

%

10.94

%

10.93

%

11.13

%

10.93

%

Total risk-based capital ratio

14.38

%

14.13

%

14.17

%

14.38

%

14.17

%

Asset quality Nonperforming loans

$

9,774

$

8,195

$

5,783

$

9,774

$

5,783

Nonperforming assets

9,782

10,304

8,497

9,782

8,497

Nonperforming loans to loans

0.32

%

0.28

%

0.20

%

0.32

%

0.20

%

Nonperforming assets to total assets

0.23

%

0.24

%

0.21

%

0.23

%

0.21

%

Allowance for loan losses to: Loans

0.89

%

0.82

%

0.75

%

0.89

%

0.75

%

Loans, excluding PPP loans 1

0.91

%

0.84

%

0.75

%

0.91

%

0.75

%

Nonperforming loans

275.4

%

298.5

%

374.9

%

275.4

%

374.9

%

Net charge-offs to average loans

0.01

%

0.12

%

0.15

%

0.06

%

0.08

%

Average balance sheet information Loans

$

2,996,641

$

2,943,165

$

2,865,258

$

2,957,116

$

2,838,685

Total securities

633,552

657,622

561,780

640,659

547,940

Other earning assets

552,058

594,296

469,454

520,875

322,544

Total interest-earning assets

4,216,634

4,241,690

3,933,315

4,161,245

3,735,286

Total assets

4,307,819

4,330,174

4,015,433

4,246,201

3,817,408

Noninterest-bearing deposits

75,901

73,758

43,972

70,060

43,035

Interest-bearing deposits

3,279,621

3,270,720

3,031,095

3,213,372

2,880,701

Total deposits

3,355,522

3,344,478

3,075,067

3,283,432

2,923,736

Shareholders' equity

313,611

306,868

298,782

310,506

295,963

1 Refer to "Non-GAAP Financial Measures" section above and

"Reconciliation of Non-GAAP Financial Measures" below 2 On a

fully-taxable equivalent ("FTE") basis assuming a 21% tax rate 3

Regulatory capital ratios are preliminary pending filing of the

Company's regulatory reports

First Internet

BancorpCondensed Consolidated Balance Sheets (unaudited)

Amounts in thousands

September 30,2020

June 30,2020 September 30,2019

Assets Cash and due from banks

$

5,804

$

7,016

$

6,283

Interest-bearing deposits

482,649

491,603

410,119

Securities available-for-sale, at fair value

528,311

589,017

544,742

Securities held-to-maturity, at amortized cost

68,254

68,295

46,807

Loans held-for-sale

76,208

38,813

41,119

Loans

3,012,914

2,973,674

2,881,272

Allowance for loan losses

(26,917

)

(24,465

)

(21,683

)

Net loans

2,985,997

2,949,209

2,859,589

Accrued interest receivable

17,768

21,093

16,652

Federal Home Loan Bank of Indianapolis stock

25,650

25,650

25,650

Cash surrender value of bank-owned life insurance

37,714

37,474

36,764

Premises and equipment, net

31,262

23,939

14,512

Goodwill

4,687

4,687

4,687

Servicing asset

2,818

2,522

-

Other real estate owned

-

2,065

2,619

Accrued income and other assets

66,502

63,217

85,948

Total assets

$

4,333,624

$

4,324,600

$

4,095,491

Liabilities Noninterest-bearing deposits

$

86,088

$

82,864

$

50,560

Interest-bearing deposits

3,286,303

3,297,925

3,097,682

Total deposits

3,372,391

3,380,789

3,148,242

Advances from Federal Home Loan Bank

514,914

514,913

514,908

Subordinated debt

69,758

69,681

69,452

Accrued interest payable

1,249

1,073

2,635

Accrued expenses and other liabilities

57,210

50,433

65,114

Total liabilities

4,015,522

4,016,889

3,800,351

Shareholders' equity Voting common stock

220,951

220,418

219,013

Retained earnings

116,241

108,431

93,182

Accumulated other comprehensive loss

(19,090

)

(21,138

)

(17,055

)

Total shareholders' equity

318,102

307,711

295,140

Total liabilities and shareholders' equity

$

4,333,624

$

4,324,600

$

4,095,491

First Internet Bancorp Condensed Consolidated Statements

of Income (unaudited)Amounts in thousands, except per share

data

Three Months Ended Nine Months Ended

September 30,2020 June 30,2020

September 30,2019 September 30,2020

September 30,2019 Interest income Loans

$

29,560

$

29,730

$

30,594

$

89,698

$

90,654

Securities - taxable

2,240

3,276

3,468

9,135

10,332

Securities - non-taxable

381

457

639

1,410

1,991

Other earning assets

569

759

2,993

2,973

6,560

Total interest income

32,750

34,222

37,694

103,216

109,537

Interest expense Deposits

12,428

15,763

18,363

45,399

50,896

Other borrowed funds

4,090

4,033

4,087

12,141

11,048

Total interest expense

16,518

19,796

22,450

57,540

61,944

Net interest income

16,232

14,426

15,244

45,676

47,593

Provision for loan losses

2,509

2,491

2,824

6,461

5,498

Net interest income after provision for loan losses

13,723

11,935

12,420

39,215

42,095

Noninterest income Service charges and fees

224

182

211

618

672

Loan servicing revenue

274

255

-

780

-

Loan servicing asset revaluation

(103

)

(90

)

-

(372

)

-

Mortgage banking activities

9,630

3,408

4,307

16,706

8,588

Gain on sale of loans

2,033

762

523

4,596

353

Gain (loss) on sale of securities

98

-

-

139

(458

)

Other

339

456

517

1,212

2,229

Total noninterest income

12,495

4,973

5,558

23,679

11,384

Noninterest expense Salaries and employee benefits

9,533

7,789

6,883

25,096

19,846

Marketing, advertising and promotion

426

411

456

1,212

1,391

Consulting and professional fees

614

932

778

2,723

2,427

Data processing

388

339

381

1,102

1,026

Loan expenses

408

399

247

1,406

853

Premises and equipment

1,568

1,602

1,506

4,795

4,503

Deposit insurance premium

440

435

-

1,360

1,302

Write-down of other real estate owned

2,065

-

-

2,065

-

Other

970

1,337

952

3,383

2,673

Total noninterest expense

16,412

13,244

11,203

43,142

34,021

Income before income taxes

9,806

3,664

6,775

19,752

19,458

Income tax provision (benefit)

1,395

(268

)

449

1,390

1,315

Net income

$

8,411

$

3,932

$

6,326

$

18,362

$

18,143

Per common share data Earnings per share - basic

$

0.86

$

0.40

$

0.63

$

1.87

$

1.79

Earnings per share - diluted

$

0.86

$

0.40

$

0.63

$

1.87

$

1.79

Dividends declared per share

$

0.06

$

0.06

$

0.06

$

0.18

$

0.18

All periods presented have been reclassified to conform to

the current period classification.

First Internet Bancorp

Average Balances and Rates (unaudited)Dollar amounts in

thousands

Three Months Ended September 30,

2020 June 30, 2020 September 30, 2019

AverageBalance Interest /Dividends

Yield /Cost AverageBalance Interest

/Dividends Yield /Cost

AverageBalance Interest /Dividends

Yield /Cost Assets Interest-earning

assets Loans, including loans held-for-sale 1

$

3,031,024

$

29,560

3.88

%

$

2,989,772

$

29,730

4.00

%

$

2,902,081

$

30,594

4.18

%

Securities - taxable

539,154

2,240

1.65

%

560,947

3,276

2.35

%

462,490

$

3,468

2.97

%

Securities - non-taxable

94,398

381

1.61

%

96,675

457

1.90

%

99,290

$

639

2.55

%

Other earning assets

552,058

569

0.41

%

594,296

759

0.51

%

469,454

$

2,993

2.53

%

Total interest-earning assets

4,216,634

32,750

3.09

%

4,241,690

34,222

3.24

%

3,933,315

37,694

3.80

%

Allowance for loan losses

(25,347

)

(23,388

)

(20,050

)

Noninterest-earning assets

116,532

111,872

102,168

Total assets

$

4,307,819

$

4,330,174

$

4,015,433

Liabilities Interest-bearing liabilities

Interest-bearing demand deposits

$

154,275

$

228

0.59

%

$

137,487

$

237

0.69

%

$

126,130

$

233

0.73

%

Savings accounts

45,466

79

0.69

%

37,204

92

0.99

%

32,434

91

1.11

%

Money market accounts

1,295,249

2,442

0.75

%

1,089,063

3,541

1.31

%

639,181

3,261

2.02

%

Certificates and brokered deposits

1,784,631

9,679

2.16

%

2,006,966

11,893

2.38

%

2,233,350

14,778

2.63

%

Total interest-bearing deposits

3,279,621

12,428

1.51

%

3,270,720

15,763

1.94

%

3,031,095

18,363

2.40

%

Other borrowed funds

584,634

4,090

2.78

%

584,543

4,033

2.77

%

584,308

4,087

2.78

%

Total interest-bearing liabilities

3,864,255

16,518

1.70

%

3,855,263

19,796

2.07

%

3,615,403

22,450

2.46

%

Noninterest-bearing deposits

75,901

73,758

43,972

Other noninterest-bearing liabilities

54,052

94,285

57,276

Total liabilities

3,994,208

4,023,306

3,716,651

Shareholders' equity

313,611

306,868

298,782

Total liabilities and shareholders' equity

$

4,307,819

$

4,330,174

$

4,015,433

Net interest income

$

16,232

$

14,426

$

15,244

Interest rate spread

1.39

%

1.17

%

1.34

%

Net interest margin

1.53

%

1.37

%

1.54

%

Net interest margin - FTE 2,3

1.67

%

1.50

%

1.70

%

1 Includes nonaccrual loans 2 On a fully-taxable equivalent

("FTE") basis assuming a 21% tax rate 3 Refer to "Non-GAAP

Financial Measures" section above and "Reconciliation of Non-GAAP

Financial Measures" below

First Internet Bancorp Average

Balances and Rates (unaudited)Dollar amounts in thousands

Nine Months Ended September 30, 2020

September 30, 2019 AverageBalance

Interest /Dividends Yield /Cost

AverageBalance Interest /Dividends

Yield /Cost Assets Interest-earning

assets Loans, including loans held-for-sale 1

$

2,999,711

$

89,698

3.99

%

$

2,864,802

$

90,654

4.23

%

Securities - taxable

543,699

9,135

2.24

%

450,898

10,332

3.06

%

Securities - non-taxable

96,960

1,410

1.94

%

97,042

1,991

2.74

%

Other earning assets

520,875

2,973

0.76

%

322,544

6,560

2.72

%

Total interest-earning assets

4,161,245

103,216

3.31

%

3,735,286

109,537

3.92

%

Allowance for loan losses

(23,605

)

(19,191

)

Noninterest-earning assets

108,561

101,313

Total assets

$

4,246,201

$

3,817,408

Liabilities Interest-bearing liabilities

Interest-bearing demand deposits

$

138,288

$

684

0.66

%

$

117,811

$

659

0.75

%

Savings accounts

37,700

249

0.88

%

36,241

304

1.12

%

Money market accounts

1,084,411

9,726

1.20

%

598,410

9,009

2.01

%

Certificates and brokered deposits

1,952,973

34,740

2.38

%

2,128,239

40,924

2.57

%

Total interest-bearing deposits

3,213,372

45,399

1.89

%

2,880,701

50,896

2.36

%

Other borrowed funds

584,547

12,141

2.77

%

558,141

11,048

2.65

%

Total interest-bearing liabilities

3,797,919

57,540

2.02

%

3,438,842

61,944

2.41

%

Noninterest-bearing deposits

70,060

43,035

Other noninterest-bearing liabilities

67,716

39,568

Total liabilities

3,935,695

3,521,445

Shareholders' equity

310,506

295,963

Total liabilities and shareholders' equity

$

4,246,201

$

3,817,408

Net interest income

$

45,676

$

47,593

Interest rate spread

1.29

%

1.51

%

Net interest margin

1.47

%

1.70

%

Net interest margin - FTE 2,3

1.61

%

1.87

%

1 Includes nonaccrual loans 2 On a fully-taxable equivalent

("FTE") basis assuming a 21% tax rate 3 Refer to "Non-GAAP

Financial Measures" section above and "Reconciliation of Non-GAAP

Financial Measures" below

First Internet Bancorp Loans

and Deposits (unaudited)Dollar amounts in thousands

September 30, 2020 June 30, 2020 September

30, 2019 Amount Percent Amount

Percent Amount Percent Commercial

loans Commercial and industrial

$

77,116

2.6

%

$

81,687

2.7

%

$

83,481

2.9

%

Owner-occupied commercial real estate

89,095

3.0

%

86,897

2.9

%

86,357

3.0

%

Investor commercial real estate

13,084

0.4

%

13,286

0.4

%

11,852

0.4

%

Construction

92,154

3.1

%

77,591

2.6

%

54,131

1.9

%

Single tenant lease financing

960,505

31.9

%

980,292

33.0

%

1,008,247

35.0

%

Public finance

625,638

20.8

%

647,107

21.8

%

686,622

23.8

%

Healthcare finance

461,740

15.3

%

380,956

12.8

%

251,530

8.6

%

Small business lending

123,168

4.1

%

118,526

4.0

%

11,597

0.4

%

Total commercial loans

2,442,500

81.2

%

2,386,342

80.2

%

2,193,817

76.0

%

Consumer loans Residential mortgage

203,041

6.7

%

208,728

7.0

%

320,451

11.1

%

Home equity

22,169

0.7

%

22,640

0.8

%

25,042

0.9

%

Trailers

145,775

4.8

%

147,326

5.0

%

145,600

5.1

%

Recreational vehicles

96,910

3.2

%

102,088

3.4

%

102,698

3.6

%

Other consumer loans

39,765

1.3

%

42,218

1.4

%

48,275

1.7

%

Total consumer loans

507,660

16.7

%

523,000

17.6

%

642,066

22.4

%

Net deferred loan fees, premiums, discounts and other 1

62,754

2.1

%

64,332

2.2

%

45,389

1.6

%

Total loans

$

3,012,914

100.0

%

$

2,973,674

100.0

%

$

2,881,272

100.0

%

September 30, 2020 June 30, 2020

September 30, 2019 Amount Percent

Amount Percent Amount Percent

Deposits Noninterest-bearing deposits

$

86,088

2.6

%

$

82,864

2.5

%

$

50,560

1.6

%

Interest-bearing demand deposits

155,054

4.6

%

152,391

4.5

%

122,551

3.9

%

Savings accounts

49,890

1.5

%

43,366

1.3

%

34,886

1.1

%

Money market accounts

1,359,178

40.3

%

1,241,874

36.7

%

698,077

22.2

%

Certificates of deposits

1,360,575

40.3

%

1,470,905

43.5

%

1,681,377

53.4

%

Brokered deposits

361,606

10.7

%

389,389

11.5

%

560,791

17.8

%

Total deposits

$

3,372,391

100.0

%

$

3,380,789

100.0

%

$

3,148,242

100.0

%

1 Includes carrying value adjustments of $44.3 million and

$46.0 million related to terminated interest rate swaps associated

with public finance loans as of September 30, 2020 and June 30,

2020, respectively, and $27.6 million as of September 30, 2019

related to interest rate swaps associated with public finance

loans.

First Internet Bancorp Reconciliation of Non-GAAP

Financial MeasuresDollar amounts in thousands, except per share

data

Three Months Ended Nine Months Ended

September 30,2020 June 30,2020

September 30,2019 September 30,2020

September 30,2019 Total equity - GAAP

$

318,102

$

307,711

$

295,140

$

318,102

$

295,140

Adjustments: Goodwill

(4,687

)

(4,687

)

(4,687

)

(4,687

)

(4,687

)

Tangible common equity

$

313,415

$

303,024

$

290,453

$

313,415

$

290,453

Total assets - GAAP

$

4,333,624

$

4,324,600

$

4,095,491

$

4,333,624

$

4,095,491

Adjustments: Goodwill

(4,687

)

(4,687

)

(4,687

)

(4,687

)

(4,687

)

Tangible assets

$

4,328,937

$

4,319,913

$

4,090,804

$

4,328,937

$

4,090,804

Common shares outstanding

9,800,569

9,799,047

9,741,800

9,800,569

9,741,800

Book value per common share

$

32.46

$

31.40

$

30.30

$

32.46

$

30.30

Effect of goodwill

(0.48

)

(0.48

)

(0.48

)

(0.48

)

(0.48

)

Tangible book value per common share

$

31.98

$

30.92

$

29.82

$

31.98

$

29.82

Total shareholders' equity to assets

7.34

%

7.12

%

7.21

%

7.34

%

7.21

%

Effect of goodwill

(0.10

%)

(0.11

%)

(0.11

%)

(0.10

%)

(0.11

%)

Tangible common equity to tangible assets

7.24

%

7.01

%

7.10

%

7.24

%

7.10

%

Total average equity - GAAP

$

313,611

$

306,868

$

298,782

$

310,506

$

295,963

Adjustments: Average goodwill

(4,687

)

(4,687

)

(4,687

)

(4,687

)

(4,687

)

Average tangible common equity

$

308,924

$

302,181

$

294,095

$

305,819

$

291,276

Return on average shareholders' equity

10.67

%

5.15

%

8.40

%

7.90

%

8.20

%

Effect of goodwill

0.16

%

0.08

%

0.13

%

0.12

%

0.13

%

Return on average tangible common equity

10.83

%

5.23

%

8.53

%

8.02

%

8.33

%

Total interest income

$

32,750

$

34,222

$

37,694

$

103,216

$

109,537

Adjustments: Fully-taxable equivalent adjustments 1

1,424

1,437

1,595

4,396

4,764

Total interest income - FTE

$

34,174

$

35,659

$

39,289

$

107,612

$

114,301

Net interest income

$

16,232

$

14,426

$

15,244

$

45,676

$

47,593

Adjustments: Fully-taxable equivalent adjustments 1

1,424

1,437

1,595

4,396

4,764

Net interest income - FTE

$

17,656

$

15,863

$

16,839

$

50,072

$

52,357

Net interest margin

1.53

%

1.37

%

1.54

%

1.47

%

1.70

%

Effect of fully-taxable equivalent adjustments 1

0.14

%

0.13

%

0.16

%

0.14

%

0.17

%

Net interest margin - FTE

1.67

%

1.50

%

1.70

%

1.61

%

1.87

%

Allowance for loan losses

$

26,917

$

24,465

$

21,683

$

26,917

$

21,683

Loans

$

3,012,914

$

2,973,674

$

2,881,272

$

3,012,914

$

2,881,272

Adjustments: PPP loans

(58,337

)

(58,948

)

-

(58,337

)

-

Loans, excluding PPP loans

$

2,954,577

$

2,914,726

$

2,881,272

$

2,954,577

$

2,881,272

Allowance for loan losses to loans

0.89

%

0.82

%

0.75

%

0.89

%

0.75

%

Effect of PPP loans

0.02

%

0.02

%

0.00

%

0.02

%

0.00

%

Allowance for loan losses to loans, excluding PPP loans

0.91

%

0.84

%

0.75

%

0.91

%

0.75

%

1 Assuming a 21% tax rate

First Internet Bancorp

Reconciliation of Non-GAAP Financial MeasuresAmounts in

thousands, except per share data

Three Months

Ended Nine Months Ended September

30,2020 June 30,2020 September

30,2019 September 30,2020 September

30,2019 Income before income taxes - GAAP

$

9,806

$

3,664

$

6,775

$

19,752

$

19,458

Adjustments: Write-down of other real estate owned

2,065

-

-

2,065

-

Adjusted income before income taxes

$

11,871

$

3,664

$

6,775

$

21,817

$

19,458

Income tax provision (benefit) - GAAP

$

1,395

$

(268

)

$

449

$

1,390

$

1,315

Adjustments: Write-down of other real estate owned

434

-

-

434

-

Adjusted income tax provision (benefit)

$

1,829

$

(268

)

$

449

$

1,824

$

1,315

Net income - GAAP

$

8,411

$

3,932

$

6,326

$

18,362

$

18,143

Adjustments: Write-down of other real estate owned

1,631

-

-

1,631

-

Adjusted net income

$

10,042

$

3,932

$

6,326

$

19,993

$

18,143

Diluted average common shares outstanding

9,773,224

9,768,227

9,980,612

9,827,182

10,116,507

Diluted earnings per share - GAAP

$

0.86

$

0.40

$

0.63

$

1.87

$

1.79

Adjustments: Effect of write-down of other real estate owned

0.17

-

-

0.16

-

Adjusted diluted earnings per share

$

1.03

$

0.40

$

0.63

$

2.03

$

1.79

Return on average assets

0.78

%

0.37

%

0.63

%

0.58

%

0.64

%

Effect of write-down of other real estate owned

0.15

%

0.00

%

0.00

%

0.05

%

0.00

%

Adjusted return on average assets

0.93

%

0.37

%

0.63

%

0.63

%

0.64

%

Return on average shareholders' equity

10.67

%

5.15

%

8.40

%

7.90

%

8.20

%

Effect of write-down of other real estate owned

2.07

%

0.00

%

0.00

%

0.70

%

0.00

%

Adjusted return on average shareholders' equity

12.74

%

5.15

%

8.40

%

8.60

%

8.20

%

Return on average tangible common equity

10.83

%

5.23

%

8.53

%

8.02

%

8.33

%

Effect of write-down of other real estate owned

2.10

%

0.00

%

0.00

%

0.71

%

0.00

%

Adjusted return on average tangible common equity

12.93

%

5.23

%

8.53

%

8.73

%

8.33

%

Effective income tax rate

14.2

%

(7.3

%)

6.6

%

7.0

%

6.8

%

Effect of write-down of other real estate owned

1.2

%

0.0

%

0.0

%

1.4

%

0.0

%

Adjusted effective income tax rate

15.4

%

(7.3

%)

6.6

%

8.4

%

6.8

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201021005991/en/

Investors/Analysts Paula Deemer

Director of Corporate Administration (317) 428-4628

investors@firstib.com

Media Nicole Lorch Executive Vice

President & Chief Operating Officer (317) 532-7906

nlorch@firstib.com

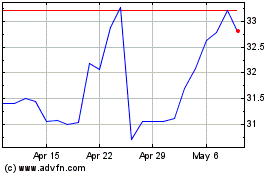

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Feb 2025 to Mar 2025

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Mar 2024 to Mar 2025