FANHUA Inc. (Nasdaq: FANH) (the “Company” or “FANHUA”), a leading

independent financial services provider in China, today announced

its unaudited financial results for the third quarter ended

September 30, 20231.

Financial Highlights for the Third

Quarter of 2023:

|

(In thousands, except per ADS data and percentages) |

2022Q3 (RMB) |

2023Q3 (RMB) |

2023Q3 (US$) |

Change % |

|

Total net revenues |

624,746 |

634,620 |

86,982 |

1.6 |

|

|

Operating income |

32,165 |

33,196 |

4,549 |

3.2 |

|

|

Net income attributable to shareholders |

35,371 |

170,699 |

23,396 |

382.6 |

|

|

Diluted net income per ADS |

0.66 |

3.18 |

0.44 |

381.8 |

|

|

Cash, cash equivalent, short-term investments at end of the

period |

917,901 |

1,498,417 |

205,375 |

63.2 |

|

|

Key operating metrics |

|

|

|

|

|

Total life gross written premiums (“GWP”) |

2,789,859 |

3,437,045 |

471,086 |

23.2 |

|

|

- First year premium (“FYP”) |

529,720 |

584,437 |

80,104 |

10.3 |

|

|

- Renewal premium |

2,260,139 |

2,852,608 |

390,982 |

26.2 |

|

|

Number of life insurance performing agents |

7,598 |

5,117 |

- |

(32.7 |

) |

|

FYP per life insurance performing agent |

59,113 |

81,081 |

- |

37.2 |

|

Mr. Yinan Hu, Co-Chairman and Chief

Executive Officer, commented: “Due to the pricing rate

change in traditional life insurance, China’s life insurance

industry has witnessed substantial fluctuations in premium growth,

with overall growth coming under pressure.”

He added, “In the face of challenges stemming

from policy shifts, we are delighted that our various strategic

initiatives have made commendable progress. The effective

implementation of our established strategies has contributed to the

resilience of our operations.

“We believe that although the changes in pricing

rates and the impending new rule requiring consistency in

commissions reported with the level actually paid may have

short-term impact on the industry, in the long run, they will drive

the industry towards more standardized and sustainable high-quality

development.

“We anticipate that the industry will gradually

transition from being primarily driven by products and fees to

being driven by technology and services in the future. This shift

will enhance the competitiveness of companies with innovative

services and technological capabilities. The industry is likely to

become more concentrated with large insurance intermediary

companies transitioning towards platform-based operations, and

current market challenges will drive more small and medium-sized

intermediary firms to choose collaboration with major platforms to

reduce costs and enhance service capabilities.

“For FANHUA, this trend presents significant

opportunities for our platform-centric development which will

accelerate our transformation from a sales-oriented company to a

platform-centric one, and further foster the growth of our business

scale and market share. We will also continue to strengthen

collaborations with small and medium-sized insurance companies,

creating greater value for them through technology and customer

service, thereby securing more substantial value distribution.”

Ben Lin, co-chairman and chief strategy

officer of FANHUA, commented: “The third quarter was a

very exciting period for FANHUA with many significant developments.

Firstly, together with Tencent Cloud, we hosted our inaugural Open

Platform Day on September 25, 2023 and officially introduced our

sales technology expertise to the broader market. We are pleased to

say that following such event, we have received numerous enquiries

from independent brokers and insurers respectively and have so far

successfully signed up two independent brokers as our digital

tenants.

“The second major development relate to our

overseas expansion. On October 23, 2023, we announced the

establishment of two non-wholly owned subsidiaries with Asia

Insurance Co., Ltd., or Asia Insurance as a noncontrolling

shareholder, which marked our expansion outside of mainland China.

FANHUA will be the majority shareholder of both companies with a

60% equity interest in each. We are confident that by working

closely with Asia Insurance we can extend our strategy of building

quality independent financial distribution and technology-driven

open platform to markets outside of mainland China.

“Thirdly, we have completed most of the IT

integration with Zhongronghuijin ("ZRHJ"), which we acquired 57.73%

equity interests in January 2023. Full completion of the

integration is expected to take place over the fourth quarter and

upon completion, we expect that ZRHJ will realize no less than

RMB5.0 million in annual IT savings in 2024. This acquisition and

its deliverable cost savings serve as strong evidence of the

successful implementation of our acquisition strategy.

“Lastly, while the weak investment market

environment over the quarters has impacted many of our listed

insurance peers, FANHUA was able to report significant increase in

net profit due to an unrealized holding gain on fair value change

over an equity investment as a result of the Nasdaq listing of

Cheche Group Inc., or Cheche, in September 2023. FANHUA currently

holds a 2.8% equity interest in Cheche Group as part of our P&C

disposal transaction with Cheche in 2017. We are very excited to

see Cheche to have completed its going public process.

“Over the coming quarters, taking advantage of

the opportunities presented by the regulatory changes, our

strategic focus will remain on executing on our core strategies

which include driving growth in our Open Platform and Digital

Tenant and exploring value accretive consolidation opportunities

while driving organic growth through enhancing the quality of our

distribution team. In Hong Kong, we will continue to work with Asia

Insurance to map out our business opportunities and build up our

human resources in the two subsidiaries we have established.”

Open Platform and M&A Contributions

over the Third Quarter of 2023

- The number of platform professional

users who used our Open Platform reached 791 as of September 30,

2023, generating RMB165.6 million in first year premiums for the

third quarter of 2023 which accounted for 28.3% of our life

insurance FYP;

- 21.6% of our life insurance FYP and

21.3% of our net revenues for the life insurance business were

generated from entities we acquired within the past 12 months.

Share Repurchase Program

On December 20, 2022, the Company’s board of

directors announced a share repurchase program under which the

Company may repurchase its American depositary shares, or ADSs,

with an aggregate value of US$20 million from time to time. As of

September 30, 2023, the Company had repurchased an aggregate of

495,459ADSs, at an average price of approximately US$7.9 per ADS

for a total amount of approximately US$3.9 million under this share

repurchase program.

Business Outlook and GuidanceWe

expect to deliver 50% year-over-year growth in life insurance first

year premiums and 50% year-over-year growth in adjusted EBITDA2 for

2023.

This forecast is based on the current market

conditions and reflects FANHUA’s preliminary estimate, which is

subject to change caused by various uncertainties.

Analysis of our Financial Results for

the Third Quarter of 2023

Revenues

Total net revenues were

RMB634.6 million (US$86.9 million) for the third quarter of 2023,

representing an increase of 1.6% from RMB624.7 million for the

corresponding period in 2022.

-

Net revenues for agency business were RMB524.1

million (US$71.8 million) for the third quarter of 2023, which

remained relatively stable compared to RMB522.7 million for the

corresponding period in 2022. Total GWP increased by 22.8%

year-over-year to RMB3,525.1 million, of which FYP grew by 10.1%

year-over-year to RMB672.5 million while renewal premiums increased

by 26.2% year-over-year to RMB2,852.6 million.

- Net

revenues for the life insurance business were RMB483.8

million (US$66.3million) for the third quarter of 2023, which

remained relatively stable compared to RMB480.6 million for the

corresponding period in 2022. The slight increase was a net result

mainly due to (i) the business fluctuation caused by the pricing

rate change to life insurance products from 3.5% to 3% effective on

August 1, 2023 which caused a spike in new business sales in July

and then followed by a slow-down in sales in August and September

and (ii) contribution from newly acquired entities, partially

offset by the decrease in renewal commission income as a result of

the decreased portfolio based average renewal commission rate of

renewal premiums collected, and to a lesser extent, due to changes

in product mix.Net revenues generated from our life insurance

business accounted for 76.2% of our total net revenues in the third

quarter of 2023, as compared to 76.9% in the same period of

2022.

- Net

revenues for the non-life insurance business (formerly categorized

as “property and casualty insurance business”) were

RMB40.3 million (US$5.5 million) for the third quarter of 2023,

representing a decrease of 4.3% from RMB42.1 million for the

corresponding period in 2022. Net revenues generated from the

non-life insurance business accounted for 6.4% of our total net

revenues in the third quarter of 2023, as compared to 6.8% in the

same period of 2022.

-

Net revenues for the claims adjusting business

were RMB110.5 million (US$15.1 million) for the third quarter of

2023, representing an increase of 8.3% from RMB102.0 million for

the corresponding period in 2022. The increase was mainly due to

business recovery after the pandemic. Net revenues generated from

the claims adjusting business accounted for 17.4% of our total net

revenues in the third quarter of 2023, as compared to 16.3% in the

same period of 2022.

Gross profit

Total gross profit was RMB235.2

million (US$32.2 million) for the third quarter of 2023,

representing an increase of 1.7% from RMB231.3 for the

corresponding period in 2022. By product line, the results

were:

-

Life insurance business recorded a gross profit of

RMB182.0 million (US$24.9 million), as compared with RMB181.7

million for the third quarter of 2022. Gross margin for the period

was 37.6%, as compared with 37.8% in the same period of 2022.

-

Non-life insurance business recorded a gross

profit of RMB12.8 million (US$1.8 million), representing a decrease

of 23.8% from RMB16.8 million for the third quarter of 2022. Gross

margin for the period was 31.8%, as compared with 40.0% in the same

period of 2022. The decrease in gross margin was mainly due to

changes in product mix.

-

Claims adjusting business recorded a gross profit

of RMB 40.4million (US$5.5 million), representing an increase of

23.2% from RMB32.8 million for the third quarter of 2022. Gross

margin for the period was 36.6%, as compared with 32.1% in the same

period of 2022.

Operating expenses

Selling expenses were RMB59.2

million (US$8.1 million) for the third quarter of 2023,

representing a decrease of 14.6% from RMB69.3 million for the

corresponding period in 2022. The decrease was due to expenses

savings from personnel optimization and decreased number of sales

outlets, partially offset by the increase in sales training events

and the recognition of RMB5.0 million (US$0.7 million) share-based

compensation expenses related to shares options granted to

Million-Dollar Roundtable Members, or MDRT, under the Company’s

MDRT ("Million-Dollar Roundtable Members") Share Incentive Plan in

the first quarter of 2023.

General and administrative

expenses were RMB142.9 million (US$19.6 million) for the

third quarter of 2023, representing an increase of 10.1% from

RMB129.8 million for the corresponding period in 2022. The increase

was mainly due to the expenses incurred by the acquired business

which was consolidated since the first quarter of 2023 amounting to

approximately RMB19.6 million (US$2.7million), partially offset by

cost savings from personnel optimization and decrease in the number

of branches since 2022.

As a result of the foregoing factors, we

recorded operating income of RMB33.2 million

(US$4.5 million) for the third quarter of 2023, representing an

increase of 3.2% from RMB32.2 million for the corresponding period

in 2022.

Operating margin was 5.2% for

the third quarter of 2023, compared to 5.1% for the corresponding

period in 2022.

Fair value change in an equity

investment represents an unrealized holding gain of

RMB164.3 million (US$22.5 million) in the third quarter of 2023,

which was recognized based on the fair value of Cheche in which the

Company owns 2.8% equity interests, following its listing in

September 2023.

Investment income was RMB1.9

million (US$0.3 million) for the third quarter of 2023, as compared

with RMB2.8 million for the corresponding period in 2022. The

investment income in the third quarter of 2023 consisted of yields

from short-term investments in financial products and is recognized

when the investment matures or is disposed of.

Income tax expense was RMB16.1

million (US$2.2 million) for the third quarter of 2023,

representing an increase of 87.2% from RMB8.6 million for the

corresponding period in 2022. The effective tax rate for the third

quarter of 2023 was 9.1% compared with 20.2% for the corresponding

period in 2022. The decrease of effective tax rate is mainly due to

the recognition of a nontaxable unrealized holding gain of equity

interest amounting to RMB164.3 million (US$22.5 million) in the

third quarter of 2023.

Net income was RMB160.8 million

(US$22.0 million) for the third quarter of 2023, representing an

increase of 384.3% from RMB33.2 million for the corresponding

period in 2022.

Net income attributable to the Company’s

shareholders was RMB170.7million (US$23.4 million) for the

third quarter of 2023, representing an increase of 382.6% from

RMB35.4 million for the corresponding period in 2022.

Net margin was 26.9% for the

third quarter of 2023, as compared to 5.7% for the corresponding

period in 2022.

Adjusted

EBITDA2 was RMB24.9 million (US$3.4

million) for the third quarter of 2023, representing an decrease of

32.0% as compared to RMB36.6 million for the corresponding period

in 2022. The decrease was mainly due to a provision of expected

credit loss on other receivables amounting to RMB18.5 million

(US$2.5 million) for the third quarter of 2023.

Adjusted EBITDA margin3 was

3.9% for the third quarter of 2023, as compared to 5.9% for the

corresponding period in 2022.

Basic and diluted net income per

ADS were RMB3.18 (US$0.44) and RMB3.18 (US$0.44) for the

third quarter of 2023, respectively, representing an increase of

381.8% and 381.8% from RMB0.66 and RMB0.66 for the corresponding

period in 2022, respectively.

Basic4

and diluted5 adjusted

EBITDA per ADS were RMB0.46 (US$0.06) and RMB0.46

(US$0.06) for the third quarter of 2023, representing a decrease of

32.4% and 32.4% from RMB0.68 and RMB0.68 for the corresponding

period in 2022, respectively.

As of September 30, 2023, the Company had

RMB1,498.4 million (US$205.4 million) in cash,

cash equivalents and short-term

investments.

FANHUA’s Insurance Sales and Service

Distribution Network:

- As of

September 30, 2023, excluding newly acquired entities, FANHUA’s

distribution network consisted of 592 sales outlets in 23 provinces

and 81 services outlets in 31 provinces as of September 30, 2023,

compared with 697 sales outlets in 23 provinces and 100 services

outlets in 31 provinces as of September 30, 2022. The decrease in

the number of sales outlets reflected our focus on growing

profitable branches, coupled with the challenging decisions to

close those which were not yielding profits. The number of the

Company's in-house claims adjustors was 2,215 as of September 30,

2023, compared with 2,221 as of September 30, 2022.

Conference Call

The Company will host a conference call to

discuss its third quarter 2023 financial results as per the

following details.

Time: 8:00 p.m. Eastern Standard Time on November 20, 2023

or 9:00 a.m. Beijing/Hong Kong Time on

November 21, 2023

Please pre-register online in advance to join

the conference call by navigating to the link provided below and

dial in 10 minutes before the call is scheduled to begin.

Conference call details will be provided upon registration.

Conference Call Preregistration:

https://register.vevent.com/register/BIf20d116c9e8d48fb981b734c1aae6e2d

Additionally, a live and archived webcast of the

conference call will be available at FANHUA’s investor relations

website:

https://edge.media-server.com/mmc/p/c9t3fais

About FANHUA Inc.

Driven by its digital technologies and

professional expertise in the insurance industry, FANHUA Inc. is

the leading independent financial service provider in China,

focusing on providing insurance-oriented family asset allocation

services that covers customers’ full lifecycle and a one-stop

service platform for individual sales agents and independent

insurance intermediaries.

With strategic focus on long-term life insurance

products, we offer a broad range of insurance products, claims

adjusting services and various value-added services to meet

customers’ diverse needs, through an extensive network of digitally

empowered sales agents and professional claims adjustors. We also

operate Baowang (www.baoxian.com), an online insurance platform

that provides customers with a one-stop insurance shopping

experience.

For more information about FANHUA Inc., please visit

https://ir.fanhgroup.com.

Forward-looking Statements

This press release contains statements of a

forward-looking nature. These statements, including the statements

relating to the Company’s future financial and operating results,

are made under the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. You can identify these

forward-looking statements by terminology such as “will,”

“expects,” “believes,” “anticipates,” “intends,” “estimates” and

similar statements. Among other things, management’s quotations and

the Business Outlook section contain forward-looking statements.

These forward-looking statements involve known and unknown risks

and uncertainties and are based on current expectations,

assumptions, estimates and projections about FANHUA and the

industry. Potential risks and uncertainties include, but are not

limited to, those relating to its ability to attract and retain

productive agents, especially entrepreneurial agents, its ability

to maintain existing and develop new business relationships with

insurance companies, its ability to execute its growth strategy,

its ability to adapt to the evolving regulatory environment in the

Chinese insurance industry, its ability to compete effectively

against its competitors, quarterly variations in its operating

results caused by factors beyond its control including

macroeconomic conditions in China. Except as otherwise indicated,

all information provided in this press release speaks as of the

date hereof, and FANHUA undertakes no obligation to update any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although FANHUA believes that the expectations

expressed in these forward-looking statements are reasonable, it

cannot assure you that its expectations will turn out to be

correct, and investors are cautioned that actual results may differ

materially from the anticipated results. Further information

regarding risks and uncertainties faced by FANHUA is included in

FANHUA’s filings with the U.S. Securities and Exchange Commission,

including its annual report on Form 20-F.

About Non-GAAP Financial

Measures

In addition to the Company’s consolidated

financial results under generally accepted accounting principles in

the United States (“GAAP”), the Company also provides adjusted

EBITDA, adjusted EBITDA margin and basic and diluted adjusted

EBITDA per ADS, all of which are non-GAAP financial measures, as

supplemental measures to review and assess operating performance.

Adjusted EBITDA is defined as net income before income tax expense,

share of income of affiliates, net of impairment, investment

income, interest income, financial cost, depreciation, amortization

of intangible assets, share-based compensation expenses and fair

value change in an equity investment. Adjusted EBITDA margin is

defined as adjusted EBITDA as a percentage of net revenues. Basic

adjusted EBITDA per ADS is defined as adjusted EBITDA divided by

total weighted average number of ADSs of the Company outstanding

during the period. Diluted adjusted EBITDA per ADS is defined as

adjusted EBITDA divided by total weighted average number of diluted

ADSs of the Company outstanding during the period. The Company

believes that both management and investors benefit from referring

to these non-GAAP financial measures in assessing the Company’s

performance and when planning and forecasting future periods. The

Company’s non-GAAP financial measures do not reflect all items of

income and expenses that affect the Company’s operations.

Specifically, the Company’s non-GAAP measures exclude interest

income, investment income, financial cost, income tax expense,

depreciation, amortization of intangible assets, share of income of

affiliates, net of impairment, share-based compensation expenses

and fair value change in an equity investment. Further, these

non-GAAP financial measures may not be comparable to similarly

titled measures presented by other companies, including peer

companies. The presentation of these non-GAAP financial measures

has limitations as analytical tools, and investors should not

consider them in isolation from, or as a substitute for analysis

of, the financial information prepared and presented in accordance

with GAAP. We encourage investors and other interested persons to

review our financial information in its entirety and not rely on a

single financial measure.

For more information on these non-GAAP financial

measures, please see the tables captioned “Reconciliations of Net

Income to Adjusted EBITDA and Adjusted EBITDA Margin” set forth at

the end of this press release.

|

|

|

FANHUA INC. |

|

Unaudited Condensed Consolidated Balance

Sheets |

|

(In thousands) |

|

|

|

|

As of December 31, |

|

As of September 30, |

|

As of September 30, |

|

|

2022 |

|

2023 |

|

2023 |

|

|

RMB |

|

RMB |

|

US$ |

|

ASSETS: |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash

equivalents |

567,525 |

|

554,897 |

|

76,055 |

|

Restricted

cash |

59,957 |

|

55,941 |

|

7,667 |

|

Short term

investments |

347,754 |

|

943,520 |

|

129,320 |

|

Accounts receivable,

net |

667,554 |

|

588,317 |

|

80,636 |

|

Other

receivables |

231,049 |

|

113,756 |

|

15,594 |

|

Other current

assets |

419,735 |

|

190,497 |

|

26,110 |

|

Total current

assets |

2,293,574 |

|

2,446,928 |

|

335,382 |

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

Restricted bank deposit –

non-current |

20,729 |

|

22,168 |

|

3,038 |

|

Contract assets, net -

non-current |

385,834 |

|

643,571 |

|

88,209 |

|

Property, plant, and equipment,

net |

98,459 |

|

91,968 |

|

12,605 |

|

Goodwill and intangible assets,

net |

109,997 |

|

476,672 |

|

65,333 |

|

Deferred tax

assets |

20,402 |

|

33,223 |

|

4,554 |

|

Investment in

affiliates |

4,035 |

|

3,271 |

|

448 |

|

Other non-current

assets |

11,400 |

|

176,972 |

|

24,256 |

|

Right of use

assets |

145,086 |

|

110,682 |

|

15,170 |

|

Total non-current

assets |

795,942 |

|

1,558,527 |

|

213,613 |

|

Total

assets |

3,089,516 |

|

4,005,455 |

|

548,995 |

|

Current liabilities: |

|

|

|

|

|

|

Short-term

loan |

35,679 |

|

199,980 |

|

27,410 |

|

Accounts payable

|

436,784 |

|

320,027 |

|

43,863 |

|

Insurance premium payables

|

16,580 |

|

24,755 |

|

3,393 |

|

Other payables and accrued

expenses |

174,326 |

|

210,745 |

|

28,885 |

|

Accrued payroll

|

96,279 |

|

88,596 |

|

12,143 |

|

Income tax

payable |

130,024 |

|

108,423 |

|

14,861 |

|

Current operating lease

liability |

62,304 |

|

48,363 |

|

6,629 |

|

Total current

liabilities |

951,976 |

|

1,000,889 |

|

137,184 |

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

Accounts payable – non-current

|

192,917 |

|

356,565 |

|

48,871 |

|

Other tax

liabilities |

36,647 |

|

33,656 |

|

4,613 |

|

Deferred tax

liabilities |

102,455 |

|

150,201 |

|

20,587 |

|

Non-current operating lease

liability |

74,190 |

|

55,800 |

|

7,648 |

|

Total non-current

liabilities |

406,209 |

|

596,222 |

|

81,719 |

|

Total

liabilities |

1,358,185 |

|

1,597,111 |

|

218,903 |

|

|

|

|

|

|

Ordinary

shares |

8,091 |

|

8,675 |

|

1,189 |

|

Treasury stock |

(10) |

|

(96) |

|

(13) |

|

Additional Paid-in

capital |

461 |

|

192,177 |

|

26,340 |

|

Statutory

reserves |

559,520 |

|

559,520 |

|

76,689 |

|

Retained

earnings |

1,087,984 |

|

1,395,650 |

|

191,290 |

|

Accumulated other comprehensive

loss |

(32,643) |

|

(15,958) |

|

(2,187) |

|

Total shareholders’

equity |

1,623,403 |

|

2,139,968 |

|

293,308 |

|

Non-controlling

interests |

107,928 |

|

268,376 |

|

36,784 |

|

Total

equity |

1,731,331 |

|

2,408,344 |

|

330,092 |

|

Total liabilities and

equity |

3,089,516 |

|

4,005,455 |

|

548,995 |

|

|

| FANHUA

INC. |

| Unaudited

Condensed Consolidated Statements of Income and Comprehensive

Income |

| (In

thousands, except for shares and per share data) |

|

|

|

|

For the Three Months Ended |

For the Nine Months Ended |

|

|

September 30, |

|

September 30, |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

| |

RMB |

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

Net revenues: |

|

|

|

|

|

|

|

Agency |

522,702 |

|

|

524,154 |

|

|

71,841 |

|

|

1,714,096 |

|

|

2,276,896 |

|

|

312,075 |

|

|

Life insurance

business |

480,605 |

|

|

483,830 |

|

|

66,314 |

|

|

1,609,833 |

|

|

2,147,293 |

|

|

294,311 |

|

|

Non-life insurance

business |

42,097 |

|

|

40,324 |

|

|

5,527 |

|

|

104,263 |

|

|

129,603 |

|

|

17,764 |

|

|

Claims

adjusting |

102,044 |

|

|

110,466 |

|

|

15,141 |

|

|

300,153 |

|

|

318,101 |

|

|

43,599 |

|

|

Total net

revenues |

624,746 |

|

|

634,620 |

|

|

86,982 |

|

|

2,014,249 |

|

|

2,594,997 |

|

|

355,674 |

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

Agency |

(324,164 |

) |

|

(329,300 |

) |

|

(45,135 |

) |

|

(1,098,865 |

) |

|

(1,558,472 |

) |

|

(213,606 |

) |

|

Life insurance

business |

(298,915 |

) |

|

(301,812 |

) |

|

(41,367 |

) |

|

(1,030,418 |

) |

|

(1,465,314 |

) |

|

(200,838 |

) |

|

Non-life insurance

business |

(25,249 |

) |

|

(27,488 |

) |

|

(3,768 |

) |

|

(68,447 |

) |

|

(93,158 |

) |

|

(12,768 |

) |

|

Claims

adjusting |

(69,253 |

) |

|

(70,055 |

) |

|

(9,602 |

) |

|

(202,329 |

) |

|

(203,534 |

) |

|

(27,897 |

) |

|

Total operating costs |

(393,417 |

) |

|

(399,355 |

) |

|

(54,737 |

) |

|

(1,301,194 |

) |

|

(1,762,006 |

) |

|

(241,503 |

) |

|

Selling

expenses |

(69,323 |

) |

|

(59,176 |

) |

|

(8,111 |

) |

|

(210,952 |

) |

|

(189,978 |

) |

|

(26,039 |

) |

|

General and administrative

expenses |

(129,841 |

) |

|

(142,893 |

) |

|

(19,585 |

) |

|

(418,321 |

) |

|

(463,430 |

) |

|

(63,518 |

) |

|

Total operating costs and

expenses |

(592,581 |

) |

|

(601,424 |

) |

|

(82,433 |

) |

|

(1,930,467 |

) |

|

(2,415,414 |

) |

|

(331,060 |

) |

|

Income from

operations |

32,165 |

|

|

33,196 |

|

|

4,549 |

|

|

83,782 |

|

|

179,583 |

|

|

24,614 |

|

| Other income, net: |

|

|

|

|

|

|

|

Investment

income |

2,770 |

|

|

1,925 |

|

|

264 |

|

|

9,044 |

|

|

26,882 |

|

|

3,685 |

|

|

Fair value change in an equity investment |

— |

|

|

164,326 |

|

|

22,523 |

|

|

— |

|

|

164,326 |

|

|

22,523 |

|

|

Interest

income |

7,938 |

|

|

3,374 |

|

|

462 |

|

|

9,775 |

|

|

12,471 |

|

|

1,709 |

|

|

Financial cost |

— |

|

|

(2,666 |

) |

|

(365 |

) |

|

— |

|

|

(7,348 |

) |

|

(1,007 |

) |

|

Others, net |

(488 |

) |

|

(23,048 |

) |

|

(3,159 |

) |

|

8,920 |

|

|

(16,566 |

) |

|

(2,271 |

) |

|

Income from operations before income taxes and

share income of affiliates |

42,385 |

|

|

177,107 |

|

|

24,274 |

|

|

111,521 |

|

|

359,348 |

|

|

49,253 |

|

|

Income tax

expense |

(8,562 |

) |

|

(16,113 |

) |

|

(2,208 |

) |

|

(22,551 |

) |

|

(54,402 |

) |

|

(7,456 |

) |

|

Share of income of affiliates, net of impairment |

(621 |

) |

|

(223 |

) |

|

(31 |

) |

|

(68,755 |

) |

|

(763 |

) |

|

(105 |

) |

|

Net income

|

33,202 |

|

|

160,771 |

|

|

22,035 |

|

|

20,215 |

|

|

304,183 |

|

|

41,692 |

|

|

Less: net loss attributable to non controlling

interests |

(2,169 |

) |

|

(9,928 |

) |

|

(1,361 |

) |

|

(9,441 |

) |

|

(3,483 |

) |

|

(477 |

) |

|

Net income attributable to the Company’s

shareholders |

35,371 |

|

|

170,699 |

|

|

23,396 |

|

|

29,656 |

|

|

307,666 |

|

|

42,169 |

|

| |

|

FANHUA INC. |

|

Unaudited Condensed Consolidated Statements of Income and

Comprehensive Income-(Continued) |

|

(In thousands, except for shares and per

share data) |

| |

| |

For The Three Months Ended |

|

For The Nine Months Ended |

| |

September 30, |

|

September 30, |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

| Net income

per share: |

|

|

|

|

|

|

Basic |

0.03 |

|

|

0.16 |

|

|

0.02 |

|

|

0.03 |

|

|

0.29 |

|

|

0.04 |

|

|

Diluted |

0.03 |

|

|

0.16 |

|

|

0.02 |

|

|

0.03 |

|

|

0.29 |

|

|

0.04 |

|

| Net income per

ADS: |

|

|

|

|

|

|

|

|

Basic |

0.66 |

|

|

3.18 |

|

|

0.44 |

|

|

0.55 |

|

|

5.72 |

|

|

0.78 |

|

|

Diluted |

0.66 |

|

|

3.18 |

|

|

0.44 |

|

|

0.55 |

|

|

5.72 |

|

|

0.78 |

|

|

Shares used in calculating net income

per share: |

|

|

|

|

|

|

|

|

Basic |

1,074,291,784 |

|

|

1,072,848,471 |

|

|

1,072,848,471 |

|

|

1,074,193,616 |

|

|

1,075,669,859 |

|

|

1,075,669,859 |

|

|

Diluted |

1,074,500,364 |

|

|

1,073,480,335 |

|

|

1,073,480,335 |

|

|

1,074,262,500 |

|

|

1,076,119,487 |

|

|

1,076,119,487 |

|

| Net

income |

33,202 |

|

|

160,771 |

|

|

22,035 |

|

|

20,215 |

|

|

304,183 |

|

|

41,692 |

|

|

Other comprehensive income, net of tax: Foreign

currency translation

adjustments |

3,950 |

|

|

(277 |

) |

|

(38 |

) |

|

4,746 |

|

|

8,603 |

|

|

1,179 |

|

|

Share of other comprehensive income of

affiliates |

— |

|

|

— |

|

|

— |

|

|

4,688 |

|

|

— |

|

|

— |

|

|

Unrealized net gains on available-for-sale

investments |

1,848 |

|

|

5,388 |

|

|

738 |

|

|

1,238 |

|

|

8,083 |

|

|

1,108 |

|

|

Comprehensive

income |

39,000 |

|

|

165,882 |

|

|

22,735 |

|

|

30,887 |

|

|

320,869 |

|

|

43,979 |

|

|

Less: Comprehensive loss attributable to the non-controlling

interests |

(2,169 |

) |

|

(9,928 |

) |

|

(1,361 |

) |

|

(9,441 |

) |

|

(3,483 |

) |

|

(477 |

) |

|

Comprehensive income attributable to the Company’s

shareholders |

41,169 |

|

|

175,810 |

|

|

24,096 |

|

|

40,328 |

|

|

324,352 |

|

|

44,456 |

|

|

|

|

FANHUA INC. |

|

Unaudited Condensed Consolidated Statements of Cash

Flow |

|

(In thousands, except for shares and per

share data) |

|

|

|

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

|

September 30, |

|

September 30, |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

Net

income |

33,202 |

|

|

160,771 |

|

|

22,035 |

|

|

20,215 |

|

|

304,183 |

|

|

41,692 |

|

|

Adjustments to reconcile net income to net cash generated from

operating activities: |

|

|

|

|

|

|

|

Investment income

|

(1,133 |

) |

|

(1,579 |

) |

|

(216 |

) |

|

(2,931 |

) |

|

(8,568 |

) |

|

(1,174 |

) |

|

Share of income of affiliates, net of

impairment |

621 |

|

|

223 |

|

|

31 |

|

|

68,755 |

|

|

763 |

|

|

105 |

|

|

Other non-cash

adjustments |

35,027 |

|

|

(98,249 |

) |

|

(13,467 |

) |

|

115,076 |

|

|

(23,389 |

) |

|

(3,207 |

) |

|

Changes in operating assets and

liabilities |

(47,929 |

) |

|

(48,340 |

) |

|

(6,626 |

) |

|

(218,280 |

) |

|

(226,514 |

) |

|

(31,046 |

) |

|

Net cash generated from (used in) operating

activities |

19,788 |

|

|

12,826 |

|

|

1,757 |

|

|

(17,165 |

) |

|

46,475 |

|

|

6,370 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

Purchase of short-term

investments |

(452,760 |

) |

|

(815,300 |

) |

|

(111,746 |

) |

|

(1,993,760 |

) |

|

(2,918,310 |

) |

|

(399,988 |

) |

|

Proceeds from disposal of short-term

investments |

503,531 |

|

|

909,241 |

|

|

124,622 |

|

|

2,337,862 |

|

|

2,732,390 |

|

|

374,505 |

|

|

Prepayment for acquisition of short-term investments |

(240,000 |

) |

|

- |

|

|

- |

|

|

(340,000 |

) |

|

- |

|

|

- |

|

|

Cash rendered for loan receivables from a third party |

(105,800 |

) |

|

(30,000 |

) |

|

(4,112 |

) |

|

(205,800 |

) |

|

(110,000 |

) |

|

(15,077 |

) |

|

Cash received for loan receivables from a third party |

20,000 |

|

|

40,000 |

|

|

5,482 |

|

|

20,000 |

|

|

220,000 |

|

|

30,154 |

|

|

Net cash inflow (outflow) for business

acquisitions |

— |

|

|

(11,512 |

) |

|

(1,578 |

) |

|

— |

|

|

9,696 |

|

|

1,329 |

|

|

Purchase of a long-term

investment |

— |

|

|

(125,000 |

) |

|

(17,133 |

) |

|

— |

|

|

(125,000 |

) |

|

(17,133 |

) |

|

Others |

123,909 |

|

|

(1,420 |

) |

|

(194 |

) |

|

55,753 |

|

|

(7,605 |

) |

|

(1,043 |

) |

|

Net cash used in investing

activities |

(151,120 |

) |

|

(33,991 |

) |

|

(4,659 |

) |

|

(125,945 |

) |

|

(198,829 |

) |

|

(27,253 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

Dividends paid |

— |

|

|

— |

|

|

— |

|

|

(52,069 |

) |

|

— |

|

|

— |

|

|

Proceeds from bank and other

borrowings |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

182,268 |

|

|

24,982 |

|

|

Repayment of bank and other

borrowings |

— |

|

|

(2,889 |

) |

|

(396 |

) |

|

— |

|

|

(20,915 |

) |

|

(2,867 |

) |

|

Interests paid |

— |

|

|

(2,300 |

) |

|

(315 |

) |

|

— |

|

|

(6,428 |

) |

|

(881 |

) |

|

Acquisition of additional equity interests in non-wholly owned

subsidiaries |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(110 |

) |

|

(15 |

) |

|

Repurchase of ordinary shares from open

market |

— |

|

|

(1,925 |

) |

|

(264 |

) |

|

— |

|

|

(24,032 |

) |

|

(3,294 |

) |

|

Others |

— |

|

|

— |

|

|

— |

|

|

3 |

|

|

— |

|

|

— |

|

|

Net cash (used in) generated from financing

activities

|

— |

|

|

(7,114 |

) |

|

(975 |

) |

|

(52,066 |

) |

|

130,783 |

|

|

17,925 |

|

|

Net decrease in cash, cash equivalents and restricted

cash |

(131,332 |

) |

|

(28,279 |

) |

|

(3,877 |

) |

|

(195,176 |

) |

|

(21,571 |

) |

|

(2,958 |

) |

|

Cash, cash equivalents and restricted cash at beginning of

period |

592,425 |

|

|

661,587 |

|

|

90,678 |

|

|

656,522 |

|

|

648,211 |

|

|

88,845 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

1,744 |

|

|

(302 |

) |

|

(41 |

) |

|

1,491 |

|

|

6,366 |

|

|

873 |

|

|

Cash, cash equivalents and restricted cash at end of

period |

462,837 |

|

|

633,006 |

|

|

86,760 |

|

|

462,837 |

|

|

633,006 |

|

|

86,760 |

|

| |

|

FANHUA INC. |

|

Reconciliations of Net Income to Adjusted EBITDA and

Adjusted EBITDA Margin |

|

(In thousands, except for shares and per share

data) |

| |

| |

For The Three Months Ended |

For The Nine Months Ended |

| |

September 30 |

September 30 |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

| |

RMB |

|

RMB |

|

|

USD |

|

|

RMB |

|

|

RMB |

|

|

USD |

|

| Net

income |

33,202 |

|

|

160,771 |

|

|

22,035 |

|

|

20,215 |

|

|

304,183 |

|

|

41,692 |

|

| Income tax expense |

8,562 |

|

|

16,113 |

|

|

2,208 |

|

|

22,551 |

|

|

54,402 |

|

|

7,456 |

|

| Share of income of affiliates,

net of impairment |

621 |

|

|

223 |

|

|

31 |

|

|

68,755 |

|

|

763 |

|

|

105 |

|

| Investment income |

(2,770 |

) |

|

(1,925 |

) |

|

(264 |

) |

|

(9,044 |

) |

|

(26,882 |

) |

|

(3,685 |

) |

| Interest income |

(7,938 |

) |

|

(3,374 |

) |

|

(462 |

) |

|

(9,775 |

) |

|

(12,471 |

) |

|

(1,709 |

) |

| Financial cost |

— |

|

|

2,666 |

|

|

365 |

|

|

— |

|

|

7,348 |

|

|

1,007 |

|

| Depreciation |

4,796 |

|

|

3,912 |

|

|

536 |

|

|

14,819 |

|

|

12,283 |

|

|

1,684 |

|

| Amortization of intangible

assets |

— |

|

|

4,864 |

|

|

667 |

|

|

— |

|

|

13,661 |

|

|

1,872 |

|

| Share-based compensation

expenses |

162 |

|

|

6,006 |

|

|

823 |

|

|

162 |

|

|

14,190 |

|

|

1,945 |

|

| Fair value change in an equity

investment |

— |

|

|

(164,326 |

) |

|

(22,523 |

) |

|

— |

|

|

(164,326 |

) |

|

(22,523 |

) |

| Adjusted

EBITDA |

36,635 |

|

|

24,930 |

|

|

3,416 |

|

|

107,683 |

|

|

203,151 |

|

|

27,844 |

|

| Total net revenues |

624,746 |

|

|

634,620 |

|

|

86,982 |

|

|

2,014,249 |

|

|

2,594,997 |

|

|

355,674 |

|

| Adjusted EBITDA Margin |

5.9 |

% |

|

3.9 |

% |

|

3.9 |

% |

|

5.3 |

% |

|

7.8 |

% |

|

7.8 |

% |

| Adjusted

EBITDA per ADS : |

|

|

|

|

|

|

Basic |

0.68 |

|

|

0.46 |

|

|

0.06 |

|

|

2.00 |

|

|

3.78 |

|

|

0.52 |

|

|

Diluted |

0.68 |

|

|

0.46 |

|

|

0.06 |

|

|

2.00 |

|

|

3.78 |

|

|

0.52 |

|

| Shares

used in calculating adjusted EBITDA per share: |

|

|

|

|

|

|

Basic |

1,074,291,784 |

|

|

1,072,848,471 |

|

|

1,072,848,471 |

|

|

1,074,193,616 |

|

|

1,075,669,859 |

|

|

1,075,669,859 |

|

|

Diluted |

1,074,500,364 |

|

|

1,073,480,335 |

|

|

1,073,480,335 |

|

|

1,074,262,500 |

|

|

1,076,119,487 |

|

|

1,076,119,487 |

|

For more information, please contact:

Investor Relations

Tel: +86 (20) 8388-3191

Email: qiusr@fanhgroup.com

Source: FANHUA Inc.

______________________

|

1 |

This announcement contains currency conversions of certain Renminbi

(“RMB”) amounts into U.S. dollars (US$) at specified rate solely

for the convenience of the reader. Unless otherwise noted, all

translations from RMB to U.S. dollars are made at a rate of

RMB7.296 to US$1.00, the effective noon buying rate as of September

29, 2023 in The City of New York for cable transfers of RMB as set

forth in the H.10 weekly statistical release of the Federal Reserve

Board. |

| 2 |

Adjusted EBITDA is defined as net income before income tax expense,

share of income of affiliates, net of impairment, investment

income, interest income, financial cost, depreciation, amortization

of intangible assets, share-based compensation expenses and fair

value change in an equity investment. |

| 3 |

Adjusted EBITDA margin is defined as adjusted EBITDA as a

percentage of net revenues. |

| 4 |

Basic adjusted EBITDA per ADS is defined as adjusted EBITDA divided

by total weighted average number of ADSs of the Company outstanding

during the period. |

| 5 |

Diluted adjusted EBITDA per ADS is defined as adjusted EBITDA

divided by total weighted average number of diluted ADSs of the

Company outstanding during the period. |

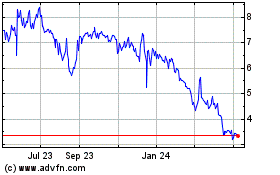

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jun 2024 to Jul 2024

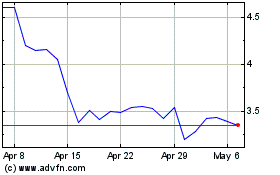

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jul 2023 to Jul 2024