CNinsure Inc, (Nasdaq:CISG), (the "Company" or "CNinsure"), a

leading independent online-to-offline ("O2O") financial services

provider in China, today announced its unaudited financial results

for the fourth quarter and fiscal year ended December 31, 20151.

Financial Highlights for

Fourth Quarter of

2015:

|

(In thousands, except per ADS) |

2014

Q4(RMB) |

2015 Q4(RMB) |

2015 Q4 (US$) |

Change % |

|

Total net revenues |

|

632,619 |

|

860,003 |

132,762 |

|

35.9 |

% |

|

Operating (loss) income |

|

(1,911 |

) |

32,827 |

5,068 |

|

- |

|

|

Online spending expenses (1) |

|

30,935 |

|

28,258 |

4,362 |

|

-8.7 |

% |

|

Net income attributable to the Company’s shareholders |

|

27,068 |

|

55,089 |

8,505 |

|

103.5 |

% |

|

Adjusted EBITDA (2) |

|

22,332 |

|

49,514 |

7,644 |

|

121.7 |

% |

|

Basic net income per ADS |

|

0.53 |

|

0.96 |

0.15 |

|

81.1 |

% |

|

Diluted Adjusted EBITDA Per ADS |

|

0.43 |

|

0.82 |

0.13 |

|

90.7 |

% |

| (1) Online spending expenses is defined as expenses

incurred by online and mobile initiatives, such as expenses

relating to the development, implementation and support of CNpad,

Baoxian.com, eHuzhu and Chetong.net. Chetong.net was disposed in

the third quarter of 2015 and expenses related to Chetong.net were

not included in online spending expenses starting from the third

quarter of 2015.(2) Adjusted EBITDA is defined as net income before

income tax expense, investment income, interest income,

depreciation, amortization, and compensation expenses associated

with stock options. |

| |

Financial Highlights for Year

of 2015

|

(In thousands, except per ADS) |

2014

(RMB) |

2015 (RMB) |

2015 (US$) |

Change % |

|

Total net revenues |

2,150,011 |

2,828,308 |

436,616 |

|

31.5 |

% |

|

Operating income |

30,899 |

78,522 |

12,123 |

|

154.1 |

% |

|

Online spending expenses (1) |

62,943 |

89,685 |

13,845 |

|

42.5 |

% |

|

Net income attributable to the Company’s shareholders |

161,760 |

210,086 |

32,432 |

|

29.9 |

% |

|

Adjusted EBITDA (2) |

132,537 |

166,095 |

25,641 |

|

25.3 |

% |

|

Basic net income per ADS |

3.22 |

3.65 |

0.56 |

|

13.4 |

% |

|

Diluted Adjusted EBITDA Per ADS |

2.62 |

2.76 |

0.43 |

|

5.3 |

% |

| (1) Online spending expenses is defined as expenses

incurred by online and mobile initiatives, such as expenses

relating to the development, implementation and support of CNpad,

Baoxian.com, eHuzhu and Chetong.net. Chetong.net was disposed in

the third quarter of 2015 and expenses related to Chetong.net were

not included in online spending expenses starting from the third

quarter of 2015.(2) Adjusted EBITDA is defined as net income before

income tax expense, investment income, interest income,

depreciation, amortization, and compensation expenses associated

with stock options. |

| |

Key Operational Metrics for CNinsure's Online

Initiatives for Year 2015:

- CNpad Mobile Application ("CNpad App"):

- CNpad App was downloaded and activated 109,784

times as of December 31, 2015, representing an increase of

98.6% from 55,273 times as of December 31, 2014;

- The number of active users2 of CNpad

App was 63,591 in 2015, representing an increase of 81.9%

from 34,960 in 2014;

- Insurance premiums generated

through CNpad App were

approximately RMB2.9 billion (US$454.9 million) in 2015,

representing an increase of 131.7% from RMB1.3 billion in 2014 and

accounted for 30.2% of our total insurance premiums in 2015 as

compared to 15.6% in 2014.

- eHuzhu:

- The number of registered members was 678,547

as of December 31, 2015, representing an increase of 154.0% from

267,176 as of December 31, 2014.

- Baoxian.com:

- The number of active customer accounts3 was

72,745 in 2015, representing an approximately 8-fold increase

from 8,104 in 2014;

- Insurance premiums generated on or through

Baoxian.com was RMB48.3 million in 2015, representing an

increase of approximately 189.2% from RMB16.7 million in 2014;

- The number of insurance policies sold on

Baoxian.com was 517,000 in 2015, representing an increase

of approximately 79.5% from 288,000 in 2014.

Commenting

on the fourth quarter and year 2015 financial results, Mr. Chunlin

Wang, chief executive officer of CNinsure, stated, "We ended 2015

on a high note, achieving approximately RMB10 billion in insurance

premiums and over RMB200 million in net income, which are

generally in line with our annual targets. Our solid financial

performance underscored the strengths of our business model and the

successful execution of our growth strategies.

"Our management constantly and carefully

assesses and monitors the market environment and competitive

landscape of our industry. We see attractive growth opportunities

for independent insurance intermediaries like us, presented by a

favorable regulatory environment and changes in consumer

preferences resulting from easier and faster internet access in

China. However, we are also aware that competition is intensifying

as leading insurance companies and e-commerce companies explore

ways to establish a foothold in the online insurance services

market, and as the number of new online platforms providing

professional insurance services increase quickly in China. We

believe we are well positioned to take advantage of the attractive

growth opportunities in our industry to significantly increase

market shares despite the challenges.

"After assessing the current market environment

and encouraged by our success in executing our online-to-offline

strategies, we have decided to invest no less than RMB500 million

in marketing campaigns, expanding our sales and service network and

in O2O platform development in 2016. We plan to continue investing

in these areas over the next few years. Our goal is to achieve over

RMB100 billion in insurance premiums within the next 8 years.

"Although these investments may put pressure on

our bottom line in the near term, we believe the optimal strategic

approach is to focus on rapidly expanding our insurance premiums

and further solidifying our market leadership, which will enable us

to capture more market share and ultimately achieve higher

profitability and higher returns to our shareholders over the long

run."

Financial Results for the

Fourth

Quarter of

2015

Total net revenues were

RMB860.0 million (US$132.8 million) for the fourth quarter of 2015,

representing an increase of 35.9% from RMB632.6 million for the

corresponding period in 2014.

- Net revenues for the insurance agency business

were RMB668.4 million (US$103.2 million) for the fourth quarter of

2015, representing an increase of 36.8% from RMB488.7 million for

the corresponding period in 2014. The increase was primarily driven

by a 29.2% increase in net revenues derived from the P&C

insurance agency business from RMB434.1 million for the fourth

quarter of 2014 to RMB561.1 million (US$86.6 million) for the

fourth quarter of 2015, and a 96.5% increase in net revenues

derived from the life insurance agency business from RMB54.6

million for the fourth quarter of 2014 to RMB107.3 million (US$16.6

million) for the fourth quarter of 2015. The growth of the P&C

insurance agency business was primarily due to a 22.8% growth in

insurance premiums as a result of enhanced marketing efforts. The

increase in net revenues generated from the life insurance agency

business was primarily due to a 100% increase in commissions

derived from new long term life insurance policy sales, primarily

driven by enhanced marketing efforts and the successful

implementation of our cross-selling strategy. Revenues generated

from the insurance agency business accounted for 77.7% of total net

revenues in the fourth quarter of 2015.

- Net revenues for the insurance brokerage

business were RMB95.0 million (US$14.7 million) for the

fourth quarter of 2015, representing an increase of 62.0% from

RMB58.7 million for the corresponding period in 2014. This growth

was primarily attributable to continued efforts to cultivate

markets and build customer relationships in recent years. Revenues

generated from the insurance brokerage business accounted for 11.1%

of total net revenues in the fourth quarter of 2015.

- Net revenues for the claims adjusting business

were RMB96.6 million (US$14.9 million) for the fourth quarter of

2015, representing an increase of 13.4% from RMB85.2 million for

the corresponding period in 2014. The increase was primarily due to

increased marketing efforts during the quarter. Revenues generated

from the claims adjusting business accounted for 11.2% of total net

revenues in the fourth quarter of 2015.

Total operating costs and

expenses were RMB827.2 million (US$127.7 million) for the

fourth quarter of 2015, representing an increase of 30.4% from

RMB634.5 million for the corresponding period in 2014.

- Total operating costs were RMB642.7 million

(US$99.2 million) for the fourth quarter of 2015, representing an

increase of 34.3% from RMB478.5 million for the corresponding

period in 2014. The increase was primarily due to sales growth.

- Costs of insurance agency business were

RMB514.4 million (US$79.4 million) for the fourth quarter of 2015,

representing an increase of 33.2% from RMB386.1 million for the

corresponding period in 2014, primarily driven by a 27.9% increase

in costs for the P&C insurance agency business to RMB448.1

million (US$69.2 million) for the fourth quarter of 2015, and a

85.3% increase in costs for the life insurance agency business to

RMB66.3 million (US$10.2 million) for the fourth quarter of 2015.

Costs incurred by the insurance agency business accounted for 80.0%

of total operating costs in the fourth quarter of 2015.

- Costs of insurance brokerage business were

RMB75.6 million (US$11.7 million) for the fourth quarter of 2015,

representing an increase of 60.6% from RMB47.1 million for the

corresponding period in 2014. The increase was primarily due to

sales growth. Costs incurred by the insurance brokerage business

accounted for 11.8% of total operating costs in the fourth quarter

of 2015.

- Costs of claims adjusting business were

RMB52.7 million (US$8.1 million) for the fourth quarter of 2015,

representing an increase of 16.5% from RMB45.2 million for the

corresponding period in 2014. The increase was primarily due to

sales growth. Costs incurred by the claims adjusting business

accounted for 8.2% of total operating costs in the fourth quarter

of 2015.

- Selling expenses were RMB56.6 million (US$8.7

million) for the fourth quarter of 2015, representing an increase

of 78.4% from RMB31.7 million for the corresponding period in 2014,

primarily attributable to RMB19.5 million (US$3.0 million) for

enhanced marketing efforts to promote CNpad App among sales agents

in the fourth quarter of the year.

- General and administrative expenses were

RMB127.9 million (US$19.7 million) for the fourth quarter of 2015,

representing an increase of 2.9% from RMB124.3 million for the

corresponding period in 2014. The increase was primarily due to

increases in payroll and conference expenses, offset by a slight

decline in share-based compensation expense, depreciation and

amortization expenses and research and development expense.

As a result of the preceding factors,

operating income was RMB32.8 million (US$5.1

million) for the fourth quarter of 2015, as compared to an

operating loss of RMB1.9 million for the corresponding period in

2014.

Operating margin was 3.8% for

the fourth quarter of 2015, compared with -0.3% for the

corresponding period in 2014.

Investment income was RMB20.9

million (US$3.2 million) for the fourth quarter of 2015,

representing an increase of 86.8% from RMB11.2 million for the

corresponding period in 2014, primarily due to the increased

short-term investments in financial products that generate higher

yields than term deposits. These investments mainly consisted of

inter-bank deposits or collective trust products with a term of

half a year to two years, which pay interest on a quarterly,

semi-annual or annual basis. Our investment income may fluctuate

from quarter to quarter because these investments are classified as

available for sales and because investment income is recognized

when received.

Interest income was RMB9.2

million (US$1.4 million) for the fourth quarter of 2015,

representing a decrease of 51.0% from RMB18.8 million for the

corresponding period in 2014. The decrease in interest income was

primarily due to decreases in interest rates and term deposits as a

result of an increase in short-term investments.

Income tax expense was RMB8.9

million (US$1.4 million) for the fourth quarter of 2015,

representing an increase of 59.6% from RMB5.6 million for the

corresponding period in 2014. The increase was primarily due to an

increase in operating income. The effective tax rate for the fourth

quarter of 2015 was 13.1% compared with 19.4% for the corresponding

period in 2014. The decrease in effective tax rate was primarily

due to preferential tax treatment enjoyed by one of our

subsidiaries.

Share of income of affiliates

was RMB2.5 million (US$0.4 million) for the fourth quarter of 2015,

representing a decrease of 69.9% from RMB8.2 million for the

corresponding period in 2014, mainly attributable to a decrease of

profits from Sincere Fame International Limited, in which the

Company owns 20.6% of the equity interests, resulting from (i)

narrower interest spreads as a result of reduction in interest

rates charged to customers for retail loans; and (ii) increased

marketing expenses related to its online platform.

Net income attributable to the Company’s

shareholders was RMB55.1 million (US$8.5 million) for the

fourth quarter of 2015, representing an increase of 103.5% from

RMB27.1 million for the corresponding period in 2014.

Net margin was 6.4% for the

fourth quarter of 2015 compared with 4.3% for the corresponding

period in 2014.

Basic and

diluted net income per ADS were RMB 0.96

(US$0.15) and RMB 0.91 (US$0.14) for the fourth quarter of 2015,

respectively, representing an increase of 81.1% and 75.0% from

RMB0.53 and RMB0.52 for the corresponding period in 2014,

respectively.

Adjusted

EBITDA was RMB49.5 million (US$7.6 million) for

the fourth quarter of 2015, representing an increase of 121.7% from

RMB22.3 million for the corresponding period in 2014.

Adjusted EBITDA

margin was 5.8% for the fourth quarter of 2015, compared

with 3.5% for the corresponding period in 2014.

Diluted adjusted EBITDA per ADS was RMB0.82

(US$0.13) for the fourth quarter of 2015, representing an increase

of 90.7% from RMB0.43 for the corresponding period in 2014.

Financial Results for the Year Ended

December 31, 2015

Total net revenues were RMB2.8

billion (US$436.6 million) for year 2015, representing an increase

of 31.5% from RMB2.2 billion in year 2014.

- Net revenues of insurance agency business were

RMB2.2 billion (US$332.7 million) for 2015, representing an

increase of 32.7% from RMB1.6 billion in 2014. The increase was

primarily driven by (i) a 28.6% increase in net revenues derived

from the P&C insurance agency business from RMB1.4 billion for

2014 to RMB1.8 billion (US$283.3 million) for 2015, and (ii) a

62.2% increase in net revenues derived from the life insurance

agency business from RMB197.2 million for 2014 to RMB319.9 million

(US$49.4 million) for 2015. The growth of the P&C insurance

agency business was primarily due to insurance premiums growth, as

a result of increased marketing efforts and an increase in

commission rates that we received from insurance companies. The

increase in net revenues generated from the life insurance agency

business was primarily driven by enhanced marketing efforts and the

successful implementation of our cross-selling strategy. Revenues

generated from the insurance agency business accounted for 76.2% of

total net revenues in 2015.

- Net revenues of insurance brokerage business

were RMB369.2 million (US$57.0 million) for 2015, representing an

increase of 58.7% from RMB232.6 million in 2014. The increase was

primarily attributable to continued efforts to develop new markets

and sales channels. Revenues generated from the insurance brokerage

business accounted for 13.1% of total net revenues in 2015.

- Net revenues of claims adjusting business were

RMB303.8 million (US$46.9 million) for 2015, representing an

increase of 3.7% from RMB293.0 million in 2014. Revenues generated

from the claims adjusting business accounted for 10.7% of total net

revenues in 2015.

Total operating costs and

expenses were RMB2.7 billion (US$424.5 million) for 2015,

representing an increase of 29.8% from RMB2.1 billion in 2014.

- Total operating costs were RMB2.2 billion

(US$332.0 million) for 2015, representing an increase of 33.1% from

RMB1.6 billion in 2014.

- Costs of insurance agency business were RMB1.7

billion (US$258.6 million) for 2015, representing an increase of

32.8% from RMB1.3 billion in 2014, primarily driven by an increase

of 29.8% in costs for the P&C insurance agency business

to RMB1.5 billion (US$226.9 million) and an increase of 58.7%

in costs for the life insurance agency business to RMB205.3 million

(US$31.7 million), which were largely in line with the growth in

net revenues of the P&C and life insurance agency businesses.

Costs incurred by the insurance agency business accounted for 77.9%

of total operating costs in 2015.

- Costs of insurance brokerage business were

RMB293.9 million (US$45.4 million) for 2015, representing an

increase of 58.3% from RMB185.6 million in 2014. The increase was

primarily due to sales growth. Costs incurred by the insurance

brokerage business accounted for 13.7% of total operating costs in

2015.

- Costs of claims adjusting business were

RMB181.4 million (US$28.0 million) for 2015, representing an

increase of 8.2% from RMB167.7 million in 2014. The increase was

primarily attributable to sales growth and the increased average

salaries for claims adjustors. Costs incurred by the claims

adjusting business accounted for 8.4% of total operating costs in

2015.

- Selling expenses were RMB143.3 million

(US$22.1 million) for 2015, representing an increase of 33.6% from

RMB107.3 million in 2014, primarily attributable to RMB19.5 million

(US$3.0 million) of marketing expenses to promote CNpad App among

sales agents in the fourth quarter of the year.

- General and administrative expenses were

RMB456.0 million (US$70.4 million) for 2015, representing an

increase of 15.0% from RMB396.7 million in 2014. The increase was

primarily due to increases in research and development expenses

associated with our online initiatives, payroll expenses and

conference expenses, though partially offset by the decline in

share-based compensation, amortization and depreciation expenses.

The percentage increase in general and administrative expenses was

lower than that of net revenues primarily because of a reduction in

back office operational expenses as a result of the increased use

of CNpad App by our sales agents.

As a result of the preceding factors,

operating income was RMB78.5 million (US$12.1

million) for 2015, representing an increase of 154.1% from RMB30.9

million in 2014.

Operating margin was 2.8% for

2015, compared with 1.4% in 2014.

Investment income was RMB65.6

million (US$10.1 million) for 2015, representing an increase of

48.3% from RMB44.2 million in 2014. The increase was primarily

attributable to an increase in short term investments in financial

products which mainly consisted of inter-bank deposits and

collective trust products.

Interest income was RMB57.2

million (US$8.8 million) for 2015, representing a decrease of 30.4%

from RMB82.3 million in 2014. The decrease in interest income was

primarily due to decreases in interest rates and term deposits as a

result of an increase in short-term investments.

Income tax expense was RMB25.9

million (US$4.0 million) for 2015, representing an increase of 6.5%

from RMB24.3 million in 2014. The effective tax rate for 2015 was

12.1% compared with 15.2% in 2014. The decrease in effective tax

rate was primarily due to preferential tax treatment enjoyed by one

of our subsidiaries.

Share of income of affiliates

was RMB26.9 million (US$4.2 million) for 2015, representing a

decrease of 12.2% from RMB30.6 million in 2014, mainly attributable

to a decrease of profits from Sincere Fame International Limited,

in which the Company owns 20.6% of the equity interests, resulting

from (i) narrower interest spreads as a result of reduction in

interest rates charged to customers for retail loans; and (ii)

increased marketing expenses related to its online platform.

Net income attributable to the Company’s

shareholders was RMB210.1 million (US$32.4 million) for

2015, representing an increase of 29.9% from RMB161.8 million in

2014.

Net margin was 7.4% for 2015

compared with 7.5% in 2014.

Basic and

diluted net income per ADS was RMB3.65

(US$0.56) and RMB3.49 (US$0.54) for 2015, respectively,

representing increases of 13.4% and 9.4% from RMB3.22 and RMB3.19

in 2014.

Adjusted EBITDA was RMB166.1

million (US$25.6 million) for 2015, representing an increase of

25.3% from RMB132.5 million in 2014.

Adjusted EBITDA margin was 5.9%

for 2015, compared with 6.2% in 2014.

Diluted adjusted EBITDA per ADS was RMB2.76

(US$0.43) for 2015, representing an increase of 5.3% from

RMB2.62 in 2014.

As of December 31, 2015, the Company had RMB1.1 billion

(US$172.2 million) in cash and cash

equivalents.

Year-end Operating Data:

- As of December 31, 2015, CNinsure’s distribution and service

network consisted of 574 sales and services outlets operating in 27

provinces, compared with 548 sales and service outlets operating in

27 provinces as of December 31, 2014. CNinsure had 116,164 sales

agents and 1,451 professional claims adjustors as of December 31,

2015, compared with 62,248 sales agents and 1,516 professional

claims adjustors as of December 31, 2014.

Business

Outlook

CNinsure expects its total net revenues to grow

by approximately 30% for the first quarter of 2016 compared with

the corresponding period in 2015. This forecast reflects CNinsure’s

current view, which is subject to change.

Conference Call

The Company will host a conference call to

discuss its fourth quarter and fiscal year 2015 results as per the

following details.

Time: 8:00 pm Eastern Standard Time on March 8, 2016

or 9:00 am Beijing/Hong Kong Time on March

9, 2016

| |

|

| The toll free dial-in numbers: |

|

| United States |

1-855-500-8701 |

| United Kingdom |

0800-015-9724 |

| France |

0800-918-648 |

| Germany |

0800-184-4876 |

| Australia |

1-300-713-759 |

| Canada |

1-855-757-1565 |

| Taiwan |

0080-665-1951 |

| Hong Kong |

800-906-606 |

| |

|

| The toll dial-in numbers: |

|

| China (Mainland) |

400-120-0654 |

| Singapore & Other Areas |

+65-6713-5440 |

| |

|

| Conference ID #: 55616195 |

|

| |

|

Additionally, a live and archived web cast of this call will be

available at: http://ir.cninsure.net/events.cfm

About CNinsure Inc.

CNinsure Inc. is a leading independent

online-to-offline financial services provider. Through our online

platforms and offline sales and service network, we offer a wide

variety of financial products and services to individuals and

businesses, including property and casualty and life insurance

products. We also provide insurance claims adjusting services, such

as damage assessments, surveys, authentications and loss

estimations, as well as value-added services, such as emergency

vehicle roadside assistance.

Our online platforms include (1) CNpad, a mobile

sales support application, (2) Baoxian.com, an online entry portal

for comparing and purchasing health, accident, travel and homeowner

insurance products; and (3) eHuzhu (www.ehuzhu.com), a non-profit

online mutual aid platform in China. Our extensive distribution and

service network covers 27 provinces in China, including most

economically developed regions and cities.

For more information about CNinsure Inc., please

visit http://ir.cninsure.net/.

Forward-looking Statements

This press release contains statements of a

forward-looking nature. These statements, including the statements

relating to the Company’s future financial and operating results,

are made under the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. You can identify these

forward-looking statements by terminology such as “will,”

“expects,” “believes,” “anticipates,” “intends,” “estimates” and

similar statements. Among other things, management's quotations and

the Business Outlook section contain forward-looking statements.

These forward-looking statements involve known and unknown risks

and uncertainties and are based on current expectations,

assumptions, estimates and projections about CNinsure and the

industry. Potential risks and uncertainties include, but are not

limited to, those relating to CNinsure's limited operating history,

especially its limited experience in selling life insurance

products, its ability to attract and retain productive agents,

especially entrepreneurial agents, its ability to maintain existing

and develop new business relationships with insurance companies,

its ability to execute its growth strategy, its ability to adapt to

the evolving regulatory environment in the Chinese insurance

industry, its ability to compete effectively against its

competitors, quarterly variations in its operating results caused

by factors beyond its control and macroeconomic conditions in China

and their potential impact on the sales of insurance products. All

information provided in this press release is as of the date

hereof, and CNinsure undertakes no obligation to update any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although CNinsure believes that the expectations

expressed in these forward-looking statements are reasonable, it

cannot assure you that its expectations will turn out to be

correct, and investors are cautioned that actual results may differ

materially from the anticipated results. Further information

regarding risks and uncertainties faced by CNinsure is included in

CNinsure's filings with the U.S. Securities and Exchange

Commission, including its annual report on Form 20-F.

About Non-GAAP Financial

Measures

In addition to the Company’s consolidated

financial results under GAAP, the Company also provides adjusted

EBITDA, adjusted EBITDA margin and diluted adjusted EBITDA per ADS,

all of which are non-GAAP financial measures. Adjusted EBITDA is

defined as net income before income tax expense, investment income,

interest income, depreciation, amortization, and compensation

expenses associated with stock options. Adjusted EBITDA margin is

defined as adjusted EBITDA divided by total net revenues. Diluted

adjusted EBITDA per ADS is defined as adjusted EBITDA divided by

total number of ADS on a diluted basis. The Company believes that

both management and investors benefit from referring to these

non-GAAP financial measures in assessing the Company’s performance

and when planning and forecasting future periods. One limitation of

using these non-GAAP financial measures is that such measures

exclude items that were significant in the fourth quarter and year

of 2015 and the corresponding periods of 2014, and these items have

been, and will continue to be, significant recurring factors in our

business.

In light of these limitations, the presentation

of these non-GAAP financial measures is not intended to be

considered in isolation or as a substitute for the financial

information prepared and presented in accordance with GAAP. We

encourage investors and other interested persons to review our

financial information in its entirety and not rely on a single

financial measure. For more information on these non-GAAP financial

measures, please see the tables captioned “Reconciliations of Net

Income to Adjusted EBITDA and Adjusted EBITDA Margin” set forth at

the end of this release.

| |

| CNINSURE

INC. |

| Unaudited

Condensed Consolidated Balance Sheets |

| (In

thousands) |

| |

| |

As of

December 31, |

As

of December 31, |

As

of December 31, |

| |

|

2014 |

|

|

2015 |

|

|

2015 |

|

| |

RMB |

RMB |

US$ |

| ASSETS: |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

|

2,103,068 |

|

|

1,115,266 |

|

|

172,167 |

|

| Restricted cash |

|

7,478 |

|

|

17,585 |

|

|

2,715 |

|

| Short term investments |

|

688,900 |

|

|

2,026,256 |

|

|

312,800 |

|

| Accounts receivable, net |

|

186,150 |

|

|

241,264 |

|

|

37,245 |

|

| Insurance premium receivables |

|

472 |

|

|

1,526 |

|

|

236 |

|

| Other receivables |

|

88,149 |

|

|

51,828 |

|

|

8,001 |

|

| Amounts due from related parties |

|

209,601 |

|

|

36,508 |

|

|

5,636 |

|

| Other current assets |

|

17,908 |

|

|

22,828 |

|

|

3,524 |

|

| Total current assets |

|

3,301,726 |

|

|

3,513,061 |

|

|

542,324 |

|

| |

|

|

|

| Non-current assets: |

|

|

|

| Property, plant, and equipment, net |

|

47,171 |

|

|

34,145 |

|

|

5,271 |

|

| Goodwill and intangible assets, net |

|

165,072 |

|

|

153,182 |

|

|

23,647 |

|

| Deferred tax assets |

|

2,638 |

|

|

1,658 |

|

|

256 |

|

| Investment in affiliates |

|

219,703 |

|

|

284,194 |

|

|

43,872 |

|

| Other non-current assets |

|

12,176 |

|

|

28,188 |

|

|

4,351 |

|

| Total non-current assets |

|

446,760 |

|

|

501,367 |

|

|

77,397 |

|

| Total assets |

|

3,748,486 |

|

|

4,014,428 |

|

|

619,721 |

|

| |

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY: |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable (including accounts payable of

the consolidated variable interest entities ("VIEs") without

recourse to CNinsure Inc. of RMB4,453 and RMB4,141 (US$639) as of

December 31, 2014 and 2015, respectively) |

|

128,765 |

|

|

160,891 |

|

|

24,837 |

|

| Insurance premium payables (including insurance

premium payables of the consolidated VIEs without recourse to

CNinsure Inc. of RMB268 and RMB1,680 (US$259) as of December 31,

2014 and 2015, respectively) |

|

2,942 |

|

|

5,187 |

|

|

801 |

|

| Other payables and accrued expenses (including

other payables and accrued expense of the consolidated VIEs without

recourse to CNinsure Inc. of RMB7,099 and RMB5,720 (US$883) as of

December 31, 2014 and 2015, respectively) |

|

109,412 |

|

|

213,562 |

|

|

32,968 |

|

| Accrued payroll (including accrued payroll of the

consolidated VIEs without recourse to CNinsure Inc. of RMB1,083 and

RMB1,625 (US$251) as of December 31, 2014 and 2015,

respectively) |

|

40,096 |

|

|

48,150 |

|

|

7,433 |

|

| Income tax payable (including income tax payable

of the consolidated of VIEs without recourse to CNinsure Inc. of

RMB2,571 and RMB1,152 (US$178) as of December 31, 2014 and 2015,

respectively) |

|

54,225 |

|

|

60,658 |

|

|

9,364 |

|

| Total current liabilities |

|

335,440 |

|

|

488,448 |

|

|

75,403 |

|

| |

|

|

|

| Non-current liabilities: |

|

|

|

| Other tax liabilities |

|

53,855 |

|

|

70,354 |

|

|

10,861 |

|

| Deferred tax liabilities |

|

24,931 |

|

|

22,057 |

|

|

3,405 |

|

| Total non-current

liabilities |

|

78,786 |

|

|

92,411 |

|

|

14,266 |

|

| Total liabilities |

|

414,226 |

|

|

580,859 |

|

|

89,669 |

|

| |

|

|

|

| Ordinary shares |

|

8,563 |

|

|

8,592 |

|

|

1,326 |

|

| Additional paid-in capital |

|

2,601,401 |

|

|

2,454,244 |

|

|

378,870 |

|

| Statutory reserves |

|

198,422 |

|

|

302,115 |

|

|

46,639 |

|

| Retained earnings |

|

764,963 |

|

|

871,356 |

|

|

134,514 |

|

| Accumulated other comprehensive loss |

|

(105,106 |

) |

|

(50,048 |

) |

|

(7,726 |

) |

| Subscription receivables |

|

(257,491 |

) |

|

(268,829 |

) |

|

(41,500 |

) |

| Total CNinsure Inc. shareholders’

equity |

|

3,210,752 |

|

|

3,317,430 |

|

|

512,123 |

|

| Non-controlling interests |

|

123,508 |

|

|

116,139 |

|

|

17,929 |

|

| Total equity |

|

3,334,260 |

|

|

3,433,569 |

|

|

530,052 |

|

| Total liabilities and

equity |

|

3,748,486 |

|

|

4,014,428 |

|

|

619,721 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| CNINSURE INC. |

| Unaudited Condensed

Consolidated Statements of Income and Comprehensive

Income |

| (In thousands, except for shares and per share

data) |

|

|

| |

For The Three Months Ended |

For The Twelve

Months Ended |

| |

December 31, |

December 31, |

| |

|

2014 |

|

|

2015 |

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2015 |

|

| |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

| Net

revenues: |

|

|

|

|

|

|

| Agency |

|

488,713 |

|

|

668,356 |

|

|

103,176 |

|

|

1,624,410 |

|

|

2,155,264 |

|

|

332,716 |

|

| Brokerage |

|

58,672 |

|

|

95,034 |

|

|

14,671 |

|

|

232,620 |

|

|

369,198 |

|

|

56,994 |

|

| Claims adjusting |

|

85,234 |

|

|

96,613 |

|

|

14,915 |

|

|

292,981 |

|

|

303,846 |

|

|

46,906 |

|

| Total net

revenues |

|

632,619 |

|

|

860,003 |

|

|

132,762 |

|

|

2,150,011 |

|

|

2,828,308 |

|

|

436,616 |

|

| Operating costs

and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Agency |

|

(386,149 |

) |

|

(514,350 |

) |

|

(79,402 |

) |

|

(1,261,888 |

) |

|

(1,675,261 |

) |

|

(258,616 |

) |

| Brokerage |

|

(47,093 |

) |

|

(75,620 |

) |

|

(11,674 |

) |

|

(185,593 |

) |

|

(293,875 |

) |

|

(45,366 |

) |

| Claims adjusting |

|

(45,245 |

) |

|

(52,691 |

) |

|

(8,134 |

) |

|

(167,676 |

) |

|

(181,370 |

) |

|

(27,999 |

) |

| Total operating

costs |

|

(478,487 |

) |

|

(642,661 |

) |

|

(99,210 |

) |

|

(1,615,157 |

) |

|

(2,150,506 |

) |

|

(331,981 |

) |

| Selling expenses |

|

(31,740 |

) |

|

(56,609 |

) |

|

(8,739 |

) |

|

(107,263 |

) |

|

(143,279 |

) |

|

(22,118 |

) |

| General and

administrative expenses |

|

(124,303 |

) |

|

(127,906 |

) |

|

(19,745 |

) |

|

(396,692 |

) |

|

(456,001 |

) |

|

(70,394 |

) |

| Total operating

costs and expenses |

|

(634,530 |

) |

|

(827,176 |

) |

|

(127,694 |

) |

|

(2,119,112 |

) |

|

(2,749,786 |

) |

|

(424,493 |

) |

|

(Loss) income from

operations |

|

(1,911 |

) |

|

32,827 |

|

|

5,068 |

|

|

30,899 |

|

|

78,522 |

|

|

12,123 |

|

| Other income,

net: |

|

|

|

|

|

|

| Investment income |

|

11,178 |

|

|

20,886 |

|

|

3,224 |

|

|

44,240 |

|

|

65,624 |

|

|

10,131 |

|

| Interest income |

|

18,789 |

|

|

9,206 |

|

|

1,421 |

|

|

82,251 |

|

|

57,234 |

|

|

8,835 |

|

| Others, net |

|

595 |

|

|

5,033 |

|

|

777 |

|

|

2,330 |

|

|

13,042 |

|

|

2,013 |

|

|

Income before income

taxes and income of affiliates |

|

28,651 |

|

|

67,952 |

|

|

10,490 |

|

|

159,720 |

|

|

214,422 |

|

|

33,102 |

|

| Income tax expense |

|

(5,563 |

) |

|

(8,876 |

) |

|

(1,370 |

) |

|

(24,289 |

) |

|

(25,865 |

) |

|

(3,993 |

) |

| Share of income of

affiliates |

|

8,228 |

|

|

2,480 |

|

|

383 |

|

|

30,649 |

|

|

26,924 |

|

|

4,156 |

|

| Net

income |

|

31,316 |

|

|

61,556 |

|

|

9,503 |

|

|

166,080 |

|

|

215,481 |

|

|

33,265 |

|

| less: net income

attributable to noncontrolling interests |

|

4,248 |

|

|

6,467 |

|

|

998 |

|

|

4,320 |

|

|

5,395 |

|

|

833 |

|

| Net income

attributable to the Company’s shareholders |

|

27,068 |

|

|

55,089 |

|

|

8,505 |

|

|

161,760 |

|

|

210,086 |

|

|

32,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

0.03 |

|

|

0.05 |

|

|

0.01 |

|

|

0.16 |

|

|

0.18 |

|

|

0.03 |

|

| Diluted |

|

0.03 |

|

|

0.05 |

|

|

0.01 |

|

|

0.16 |

|

|

0.17 |

|

|

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per

ADS: |

|

|

|

|

|

|

| Basic |

|

0.53 |

|

|

0.96 |

|

|

0.15 |

|

|

3.22 |

|

|

3.65 |

|

|

0.56 |

|

| Diluted |

|

0.52 |

|

|

0.91 |

|

|

0.14 |

|

|

3.19 |

|

|

3.49 |

|

|

0.54 |

|

| |

|

|

|

|

|

|

| Shares used in calculating

net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

1,023,391,993 |

|

|

1,152,826,984 |

|

|

1,152,826,984 |

|

|

1,005,842,212 |

|

|

1,151,705,374 |

|

|

1,151,705,374 |

|

| Diluted |

|

1,036,069,705 |

|

|

1,206,237,783 |

|

|

1,206,237,783 |

|

|

1,012,591,387 |

|

|

1,203,323,521 |

|

|

1,203,323,521 |

|

| Net

income |

|

31,316 |

|

|

61,556 |

|

|

9,503 |

|

|

166,080 |

|

|

215,481 |

|

|

33,265 |

|

| Other comprehensive income, net of

tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustments |

|

2,805 |

|

|

1,010 |

|

|

156 |

|

|

6,008 |

|

|

6,153 |

|

|

949 |

|

| Share of other comprehensive income

of affiliates, net of tax |

|

— |

|

|

37,567 |

|

|

5,799 |

|

|

— |

|

|

37,567 |

|

|

5,799 |

|

| Comprehensive

income |

|

34,121 |

|

|

100,133 |

|

|

15,458 |

|

|

172,088 |

|

|

259,201 |

|

|

40,013 |

|

| Less: Comprehensive income

attributable to the noncontrolling interests |

|

4,248 |

|

|

6,467 |

|

|

998 |

|

|

4,320 |

|

|

5,395 |

|

|

833 |

|

| Comprehensive income

attributable to the CNinsure Inc’s shareholders |

|

29,873 |

|

|

93,666 |

|

|

14,460 |

|

|

167,768 |

|

|

253,806 |

|

|

39,180 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| CNINSURE INC. |

| Unaudited Condensed

Consolidated Statements of Cash Flow |

| (In thousands) |

| |

|

|

For The Three Months Ended |

|

|

For The Twelve Months

Ended |

|

|

December 31, |

|

|

December 31, |

|

|

|

2014 |

|

|

2015 |

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2015 |

|

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

31,316 |

|

|

61,556 |

|

|

9,503 |

|

|

166,080 |

|

|

215,481 |

|

|

33,265 |

|

|

Adjustments to reconcile net income to net cash generated

from operating activities: |

|

|

|

|

|

|

|

Depreciation |

|

6,008 |

|

|

4,075 |

|

|

629 |

|

|

28,235 |

|

|

18,383 |

|

|

2,838 |

|

|

Amortization of intangible assets |

|

4,728 |

|

|

2,270 |

|

|

350 |

|

|

16,826 |

|

|

11,571 |

|

|

1,786 |

|

|

Allowance for doubtful receivables |

|

2,148 |

|

|

4,694 |

|

|

725 |

|

|

6,060 |

|

|

7,597 |

|

|

1,173 |

|

| Compensation expenses associated

with stock option |

|

4,684 |

|

|

2,829 |

|

|

437 |

|

|

23,598 |

|

|

17,653 |

|

|

2,725 |

|

|

Investment income |

|

(766 |

) |

|

(1,352 |

) |

|

(209 |

) |

|

(15,419 |

) |

|

(31,091 |

) |

|

(4,800 |

) |

| Loss

(gain) on disposal of property, plant and equipment |

|

243 |

|

|

(143 |

) |

|

(22 |

) |

|

292 |

|

|

(126 |

) |

|

(20 |

) |

| Share of

income of affiliates |

|

(8,228 |

) |

|

(2,480 |

) |

|

(383 |

) |

|

(30,649 |

) |

|

(26,924 |

) |

|

(4,156 |

) |

| Changes

in operating assets and liabilities |

|

33,310 |

|

|

101,951 |

|

|

15,738 |

|

|

66,626 |

|

|

68,760 |

|

|

10,615 |

|

|

Net cash generated from operating

activities |

|

73,443 |

|

|

173,400 |

|

|

26,768 |

|

|

261,649 |

|

|

281,304 |

|

|

43,426 |

|

|

Cash flows generated from (used in)

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase

of property, plant and equipment |

|

(1,626 |

) |

|

(2,845 |

) |

|

(439 |

) |

|

(6,209 |

) |

|

(6,663 |

) |

|

(1,029 |

) |

| Proceeds

from disposal of property and equipment |

|

248 |

|

|

159 |

|

|

25 |

|

|

614 |

|

|

539 |

|

|

83 |

|

| Purchase

of short term investments |

|

(16,600 |

) |

|

(1,353,956 |

) |

|

(209,015 |

) |

|

(546,600 |

) |

|

(2,308,956 |

) |

|

(356,441 |

) |

| Proceeds

from disposal of short term investments |

|

47,366 |

|

|

704,052 |

|

|

108,687 |

|

|

118,208 |

|

|

994,839 |

|

|

153,577 |

|

|

Acquisition of subsidiaries, net of cash |

|

— |

|

|

— |

|

|

— |

|

|

(62,709 |

) |

|

— |

|

|

— |

|

| Disposal

of subsidiaries, net of cash |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

15,476 |

|

|

2,389 |

|

| Purchase

of intangible assets |

|

— |

|

|

— |

|

|

— |

|

|

(118 |

) |

|

— |

|

|

— |

|

| Decrease

(increase) in restricted cash |

|

2,677 |

|

|

(1,771 |

) |

|

(273 |

) |

|

3,622 |

|

|

(10,107 |

) |

|

(1,560 |

) |

|

(Increase) decrease in other receivables |

|

(9,000 |

) |

|

16,120 |

|

|

2,488 |

|

|

113,632 |

|

|

16,120 |

|

|

2,489 |

|

| Return

of investment in non-current assets |

|

— |

|

|

— |

|

|

— |

|

|

3,900 |

|

|

— |

|

|

— |

|

| Addition

in investment in non-current assets |

|

— |

|

|

(3,980 |

) |

|

(614 |

) |

|

(7,019 |

) |

|

(13,980 |

) |

|

(2,158 |

) |

|

(Increase) decrease in amounts due from related parties |

|

(3,866 |

) |

|

69,242 |

|

|

10,689 |

|

|

(62,716 |

) |

|

181,181 |

|

|

27,969 |

|

|

Net cash generated from

(used in) investing activities |

|

19,199 |

|

|

(572,979 |

) |

|

(88,452 |

) |

|

(445,395 |

) |

|

(1,131,551 |

) |

|

(174,681 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash

flows generated from

(used in) financing

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition of additional

interest in subsidiaries |

|

— |

|

|

— |

|

|

— |

|

|

(11,000 |

) |

|

(153,500 |

) |

|

(23,696 |

) |

| apital injection by

noncontrolling interests |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

17,000 |

|

|

2,624 |

|

| Dividend distributed to

noncontrolling interest |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,450 |

) |

|

(378 |

) |

| Repurchase of ordinary

shares |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(6,276 |

) |

|

(969 |

) |

| Proceeds on exercise of

stock options |

|

— |

|

|

397 |

|

|

61 |

|

|

3,183 |

|

|

1,518 |

|

|

234 |

|

| Net cash generated

from (used in) financing activities |

|

— |

|

|

397 |

|

|

61 |

|

|

(7,817 |

) |

|

(143,708 |

) |

|

(22,185 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

increase (decrease) in cash and

cash equivalents |

|

92,642 |

|

|

(399,182 |

) |

|

(61,623 |

) |

|

(191,563 |

) |

|

(993,955 |

) |

|

(153,440 |

) |

| Cash and cash

equivalents at beginning of period |

|

2,007,621 |

|

|

1,513,438 |

|

|

233,634 |

|

|

2,288,623 |

|

|

2,103,068 |

|

|

324,658 |

|

| Effect of exchange rate

changes on cash and cash equivalents |

|

2,805 |

|

|

1,010 |

|

|

156 |

|

|

6,008 |

|

|

6,153 |

|

|

949 |

|

| Cash and cash

equivalents at end of period. |

|

2,103,068 |

|

|

1,115,266 |

|

|

172,167 |

|

|

2,103,068 |

|

|

1,115,266 |

|

|

172,167 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest paid |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Income taxes paid |

|

1,265 |

|

|

534 |

|

|

82 |

|

|

19,135 |

|

|

4,383 |

|

|

677 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| CNINSURE INC. |

| Reconciliations of Net Income

to Adjusted EBITDA and Adjusted EBITDA Margin |

| (In

thousands,

unaudited) |

|

|

| |

For The Three Months Ended |

For The Twelve

Months Ended |

| |

December 31, |

December 31, |

| |

|

2014 |

|

|

2015 |

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2015 |

|

| |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

| Net

income |

|

31,316 |

|

|

61,556 |

|

|

9,503 |

|

|

166,080 |

|

|

215,481 |

|

|

33,265 |

|

| Income tax expense |

|

5,563 |

|

|

8,876 |

|

|

1,370 |

|

|

24,289 |

|

|

25,865 |

|

|

3,993 |

|

| Investment income |

|

(11,178 |

) |

|

(20,886 |

) |

|

(3,224 |

) |

|

(44,240 |

) |

|

(65,624 |

) |

|

(10,131 |

) |

| Interest income |

|

(18,789 |

) |

|

(9,206 |

) |

|

(1,421 |

) |

|

(82,251 |

) |

|

(57,234 |

) |

|

(8,835 |

) |

| Depreciation |

|

6,008 |

|

|

4,075 |

|

|

629 |

|

|

28,235 |

|

|

18,383 |

|

|

2,838 |

|

| Amortization of

intangible assets |

|

4,728 |

|

|

2,270 |

|

|

350 |

|

|

16,826 |

|

|

11,571 |

|

|

1,786 |

|

| Compensation expenses

associated with stock options |

|

4,684 |

|

|

2,829 |

|

|

437 |

|

|

23,598 |

|

|

17,653 |

|

|

2,725 |

|

| Adjusted

EBITDA |

|

22,332 |

|

|

49,514 |

|

|

7,644 |

|

|

132,537 |

|

|

166,095 |

|

|

25,641 |

|

| Total net revenues |

|

632,619 |

|

|

860,003 |

|

|

132,762 |

|

|

2,150,011 |

|

|

2,828,308 |

|

|

436,616 |

|

| Adjusted EBITDA

Margin |

|

3.5 |

% |

|

5.8 |

% |

|

5.8 |

% |

|

6.2 |

% |

|

5.9 |

% |

|

5.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 This announcement contains currency

conversions of certain Renminbi (RMB) amounts into U.S. dollars

(US$) at specified rates solely for the convenience of the reader.

Unless otherwise noted, all translations from RMB to U.S. dollars

are made at a rate of RMB6.4778 to US$1.00, the effective noon

buying rate as of December 31, 2015 in The City of New York for

cable transfers of RMB as set forth in H.10 weekly statistical

release of the Federal Reserve Board.

2 Active users are defined as users who made at least one

purchase through CNpad App during the specified period.

3 Active customer accounts are defined as

customer accounts that made at least one purchase directly through

www.baoxian.com or its mobile application during the specified

period.

For more information, please contact:

Oasis Qiu

Investor Relations Manager

Tel: +86 (20) 8388-3191

Email: qiusr@cninsure.net

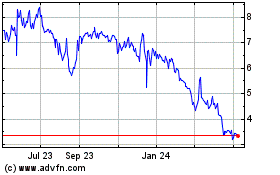

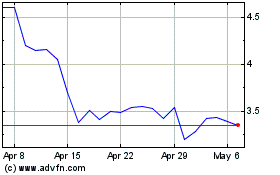

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jul 2023 to Jul 2024