Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 16 2023 - 9:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of February 2023

Commission

File Number: 001-39833

EZGO

Technologies Ltd.

(Translation

of registrant’s name into English)

Building

#A, Floor 2, Changzhou Institute of Dalian University of Technology,

Science

and Education Town,

Wujin

District, Changzhou City

Jiangsu,

China 213164

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INFORMATION

CONTAINED IN THIS FORM 6-K REPORT

Entry

into Material Agreement

On

February 13, 2023, Jiangsu EZGO Electric Technologies Co., Ltd. (the “VIE”), the variable interest entity of EZGO Technologies

Ltd., and Tianjin Jiahao Bicycle Co., Ltd. (“Tianjin Jiahao”), a wholly-owned subsidiary of the VIE, entered into an equity

transfer agreement (the “Agreement”) with Sutai (Tianjin) Packaging Materials Co., Ltd. (the “Buyer”) for the

transfer of 100% of the equity interests of Tianjin Jiahao from the VIE to the Buyer for an aggregate cash consideration of RMB 44 million

(approximately US$6,454,831). Pursuant to the Agreement, the Buyer paid RMB 4 million (approximately US$586,803) as an advance payment

on the date of signing of the Agreement. In addition, the Buyer is required to pay (i) RMB 20 million (approximately US$2,934,014) as

a first installment payment within 20 business days after the transfer of all 100% of the equity interests of Tianjin Jiahao to a special

purpose vehicle (the “SPV”), but no later than March 31, 2023, (ii) RMB 8 million (approximately US$1,173,606) as a second

installment payment after the completion of the government record filing of a 100% equity transfer of the SPV to the Buyer (i.e. industrial

and commercial change registration), but before May 10, 2023 and (iii) the remaining RMB 12 million (approximately US$1,760,408) and

a capital occupation fee at an simple interest of 6% per annum as the third installment payment, payable quarterly, for a period of two

years from August 10, 2023 to May 10, 2025. The actual control person of the Buyer will provide liability guarantee for the second and

third installment payments. The Buyer has also agreed to pledge 25% of Tianjin Jiahao’s equity interests to the VIE or its designee

by June 30, 2023, to secure the payment of all amounts due and payable by the Buyer, which pledge will expire on May 10, 2025. The VIE,

Tianjin Jiahao and the Buyer have each made customary representations, warranties and covenants.

The

Buyer has the right to terminate the Agreement if the transfer cannot be completed due to (a) any failure by the VIE to perform its obligations

under the terms of the Agreement, (b) the discovery of any undisclosed material debt of Tianjin Jiahao or (c) any defects in the rights

of third parties with respect to the land or property being transferred by Tianjin Jiahao. The VIE has the right to terminate the Agreement

and retain RMB 2 million (approximately US$293,401) of the advance payment as default payment, in the event that the Buyer is unable

to secure a bank loan to make the required payments, unless such failure is not the fault of the Buyer, or the Buyer cannot make the

first installment payment by March 31, 2023; however, if the failure to secure a bank loan is the result of any acts or omissions of

the VIE, the Agreement will be terminated automatically and the VIE will be required to refund the entire amount of advance payment to

the Buyer. Any late payments by the Buyer after the transfer of the equity interests will be assessed interest at the applicable China

Loan Prime Rate. If any payment is past due for more than 10 days, the VIE has the right to terminate the Agreement and is entitled to

liquidated damages equal to 10% of the remaining amounts owed.

All

U.S. Dollar amounts provided in this Current Report on Form 6-K (the “Form 6-K”) are based on the currency exchange rate

on February 13, 2023 of 6.8166 RMB to 1 USD.

A

copy of the Agreement is filed as Exhibit 99.1 to this Form 6-K and is incorporated herein by reference. The foregoing is only a brief

description of the material terms of the Agreement, and does not purport to be a complete description of the rights and obligations of

the parties thereunder and is qualified in its entirety by reference to such exhibit.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

EZGO Technologies Ltd. |

| |

|

| |

By: |

/s/

Jianhui Ye |

| |

Name: |

Jianhui Ye |

| |

Title: |

Chief Executive Officer |

Date:

February 16, 2023

3

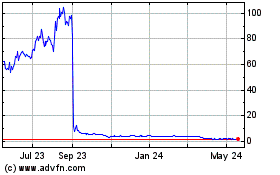

EZGO Technologies (NASDAQ:EZGO)

Historical Stock Chart

From Jun 2024 to Jul 2024

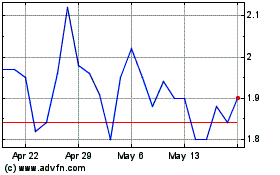

EZGO Technologies (NASDAQ:EZGO)

Historical Stock Chart

From Jul 2023 to Jul 2024