Current Report Filing (8-k)

December 16 2022 - 4:33PM

Edgar (US Regulatory)

0001698530false00016985302022-12-152022-12-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 15, 2022

____________________

Exicure, Inc.

(Exact Name of Registrant as Specified in its Charter)

____________________

| | | | | | | | |

| Delaware | 001-39011

| 81-5333008 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | |

| 2430 N. Halsted St. | | |

Chicago, IL | | 60614 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (847) 673-1700

____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | XCUR | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

On December 15, 2022, James Sulat tendered his resignation from the Board of Directors (the “Board”) of Exicure, Inc. (the “Company”) as well as from the Audit Committee and Nominating and Corporate Governance Committee of the Board, effective as of the earlier of: (1) the closing date of the Private Placement (as defined below under Item 5.07), or (2) December 30, 2022.

On December 16, 2022, Bali Muralidhar, M.D., Ph.D. tendered his resignation from the Board as well as from the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee of the Board, effective as of the earlier of: (1) the closing date of the Private Placement (as defined below under Item 5.07), or (2) December 30, 2022.

Upon the effective date of the resignations of Mr. Sulat and Dr. Muralidhar, Jeffrey L. Cleland, Ph.D. will join the Audit Committee. The Audit Committee will then be composed of two independent directors, Elizabeth Garofalo, M.D. and Dr. Cleland. Therefore, upon the resignations of Mr. Sulat and Dr. Muralidhar, the Company will no longer be in compliance with Nasdaq Listing Rule 5605(c)(2)(A), which requires the Company’s Audit Committee be comprised of three independent directors.

Pursuant to Nasdaq Listing Rule 5605(c)(4)(B), the Company is entitled to a cure period to regain compliance with Listing Rule 5605(c)(2)(A) until the earlier of the Company’s next annual meeting of stockholders or one year from the occurrence of the event that caused the failure to comply with Nasdaq Listing Rule 5605(c)(2)(A). The Company expects to be compliant with the audit committee composition requirements of Nasdaq Listing Rule 5605(c)(2)(A) by the end of the cure period.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On December 15, 2022, the Company held a Special Meeting of Stockholders (the “Special Meeting”), at which a quorum was present. At the Special Meeting, the stockholders of the Company voted on the following two proposals: (1) to approve the issuance of 3,400,000 newly issued shares of common stock of the Company (“Common Stock”) by the Company to CBI USA, Inc. (“CBI USA”) in a private placement at a price per share of $1.60 (the “Private Placement”), which would result in a “change of control” of the Company under the applicable rules of Nasdaq (“Proposal 1”), and (2) to approve one or more adjournments of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposal (“Proposal 2”). The final results of the voting on each proposal are set forth below.

Proposal 1 – Approval of the issuance of shares of Common Stock in the Private Placement, which would result in a “change of control” of the Company under the applicable rules of Nasdaq.

The Company’s stockholders approved Proposal 1. The votes cast were as follows:

| | | | | | | | | | | | | | |

For | | Against | | Abstain |

2,392,643 | | 114,739 | | 17,829 |

Proposal 2 – Approval of one or more adjournments of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposal.

The Company’s stockholders approved Proposal 2. The votes cast were as follows:

| | | | | | | | | | | | | | |

For | | Against | | Abstain |

2,372,007

| | 134,749 | | 18,455

|

Item 7.01 Regulation FD Disclosure.

The Company and CBI USA expect to close the Private Placement no later than January 20, 2023, subject to the satisfaction or waiver of customary closing conditions described in the securities purchase agreement.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements including, but not limited to, those regarding the anticipated closing of the Private Placement. Forward-looking statements may contain words such as “expect,” “believe,” “may,” “can,” “should,” “will,” “forecast,” “anticipate” or similar expressions, and include the assumptions that underlie such

statements. These statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including, but not limited to: the ability of the parties to consummate the Private Placement in a timely manner or at all; satisfaction of the conditions precedent to consummation of the Private Placement, including the ability to secure regulatory approvals in a timely manner or at all; the possibility of litigation (including related to the Private Placement or change in control); and other risks described in the Company’s filings with the Securities and Exchange Commission. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof. Except as required under applicable law, the Company undertakes no obligation to update any forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: December 16, 2022 | EXICURE, INC. |

| | |

| By: | /s/ Elias D. Papadimas |

| | Elias D. Papadimas |

| | Chief Financial Officer |

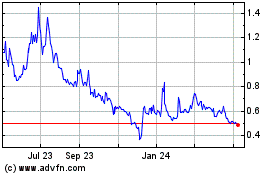

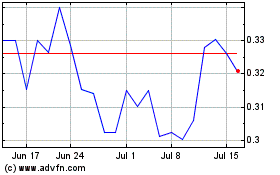

Exicure (NASDAQ:XCUR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Exicure (NASDAQ:XCUR)

Historical Stock Chart

From Jul 2023 to Jul 2024