false000174646600017464662023-08-092023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): August 9, 2023

EQUILLIUM, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-38692 |

82-1554746 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

2223 Avenida de la Playa, Suite 105, La Jolla, CA |

|

92037 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (858) 412-5302

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.0001 per share |

|

EQ |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 9, 2023, Equillium, Inc. ("the Company”) announced its financial results for the second quarter ended June 30, 2023 in the press release attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 2.02 of this Current Report on 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, whether made before or after today’s date, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific references in such filing.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

EQUILLIUM, INC.

|

|

Date: August 9, 2023 |

By: /s/ Bruce D. Steel |

|

Bruce D. Steel |

|

President and Chief Executive Officer |

Exhibit 99.1

Equillium Reports Second Quarter 2023 Financial Results and Provides Corporate and Clinical Updates

$48.4 million in cash at the end of Q2 2023 expected to provide operating runway into 2025

Fully prepaid and retired debt facility

Authorized $7.5 million stock repurchase program

LA JOLLA, California, August 9, 2023 – Equillium, Inc. (Nasdaq: EQ), a clinical-stage biotechnology company leveraging a deep understanding of immunobiology to develop novel therapeutics to treat severe autoimmune and inflammatory disorders with high unmet medical need, today announced financial results for the second quarter 2023 and provided corporate and clinical development updates.

“We continue to advance our pipeline of wholly-owned and partnered clinical programs, and have deleveraged our balance sheet through the prepayment of our outstanding debt in the second quarter of 2023,” said Bruce Steel, chief executive officer at Equillium. “Additionally, we recently announced a stock repurchase program which demonstrates our belief in the intrinsic value and potential of Equillium, particularly in light of our strong cash position, reduced operating burn and potential for additional near-term cash income related to our strategic partnership with Ono Pharmaceutical. We believe the stock repurchase program can potentially create stockholder value without meaningfully affecting our cash runway and has the potential to be accretive if Ono exercises its option to acquire itolizumab.”

Mr. Steel added, “We also have multiple anticipated upcoming milestones, including initial data from the EQ101 Phase 2 study in alopecia areata expected before the end of this year. While we continue to view the multi-cytokine programs as a significant source of long-term value, we remain highly engaged in the ongoing development of itolizumab and plan to report topline data from the EQUALISE study in lupus nephritis, which is fully enrolled, in early 2024, and remain on track for the interim review of the Phase 3 EQUATOR study during 2024. The EQUALISE and EQUATOR milestones will establish Ono’s option exercise timeline for itolizumab, which if exercised would result in a payment of approximately $351 million and significantly extend Equillium’s cash runway.”

Highlights Since Beginning of Second Quarter:

•Promoted Maple Fung, M.D., from SVP of Clinical Development to the position of Chief Medical Officer, where she will oversee Equillium’s clinical development programs and the ongoing integration of the Company’s development and translational research efforts to advance programs through all phases of clinical development.

•Announced a poster presentation at IMMUNOLOGY2023, the annual meeting of The American Association of Immunologists, highlighting that EQ102 selectively blocks IL-15 and IL-21 signaling while preserving signaling of other gamma chain family members. The data suggests that selective blockade of IL-15 and IL-21 inhibits the synergistic signaling that mediates NK and T cell responses in multiple immune disorders including celiac disease.

•Announced an ePoster presentation at the 49th Annual Meeting of the European Society for Blood and Marrow Transplantation highlighting data from the EQUATE study in acute graft-versus-host disease (aGVHD). The data demonstrate Day 29 response rates were associated with improved

1 Option exercise payment is denominated in Japanese yen (5 billion) and subject to currency exchange rates at the time of payment.

progression-free survival through 1 year and that itolizumab combined with systemic corticosteroids was associated with high rates of overall clinical response.

Anticipated Upcoming Milestones:

•EQ101: Phase 2 clinical study in subjects with alopecia areata – initial data anticipated in 2H 2023, topline data anticipated in mid-2024

•EQ102: Phase 1 first-in-human study in healthy volunteers and subjects with celiac disease – single ascending dose/multiple ascending dose data anticipated in 2H 2023, celiac disease patient data anticipated in 2024

•Itolizumab: EQUALISE lupus nephritis topline data anticipated in early 2024, EQUATOR aGVHD interim review anticipated in 2024

Second Quarter 2023 Financial Results

Revenue for the second quarter of 2023 was $9.1 million, which was derived from itolizumab development funding from Ono Pharmaceutical Co, Ltd. (Ono) and amortization of the upfront payment from Ono.

Research and development (R&D) expenses for the second quarter of 2023 were $9.6 million, compared with $9.5 million for the same period in 2022. The increase was primarily due to greater clinical development expenses driven by the EQ101, EQ102 and EQUATOR clinical studies partially offset by lower costs for our other itolizumab (EQ001) studies, and further offset by a greater estimated Australian R&D tax incentive benefit, a decrease in non-clinical research expenses, and a decrease in employee compensation and benefits related to lower headcount.

General and administrative (G&A) expenses for the second quarter of 2023 were $3.1 million, compared with $4.1 million for the same period in 2022. The decrease was primarily driven by lower employee compensation and benefits, legal and other professional fees, and consulting expenses.

Net loss for the second quarter of 2023 was $3.3 million, or $(0.10) per basic and diluted share, compared with a net loss of $14.1 million, or $(0.41) per basic and diluted share for the same period in 2022. The decrease in net loss was primarily attributable to revenue related to the Ono partnership recognized in the second quarter of 2023, whereas no such revenue was recorded in the second quarter of 2022 as it was prior to the Ono partnership. Lower total operating expenses and greater interest income in the second quarter of 2023 also contributed to the decrease in net loss compared to the same period last year.

Cash, cash equivalents and short-term investments totaled $48.4 million as of June 30, 2023, compared to $62.0 million as of March 31, 2023. Net cash used in operating activities in the second quarter of 2023 was $6.2 million. Net cash used in financing activities in the second quarter of 2023 was $7.6 million, which was driven by the prepayment and retirement of our former debt facility. Equillium believes that its cash, cash equivalents and short-term investments as of June 30, 2023, including after giving effect to its stock repurchase program, will be sufficient to fund its operations into 2025.

About Multi-Cytokine Platform and EQ101 & EQ102

Our proprietary multi-cytokine platform generates rationally designed composite peptides that selectively block key cytokines at the shared receptor level targeting pathogenic cytokine redundancies and synergies while preserving non-pathogenic signaling. This approach is expected to avoid the broad immuno-suppression and off-target safety liabilities that may be associated with other therapeutic classes, such as Janus kinase inhibitors. Many immune-mediated diseases are driven by the same combination of dysregulated cytokines, and we believe identifying the key cytokines for these diseases will allow us to target and develop customized treatment strategies for multiple autoimmune and inflammatory diseases.

Current platform assets include EQ101, a first-in-class, selective, tri-specific inhibitor of IL-2, IL-9 and IL-15, and EQ102, a first-in-class, selective, bi-specific inhibitor of IL-15 and IL-21.

About Itolizumab

Itolizumab is a clinical-stage, first-in-class anti-CD6 monoclonal antibody that selectively targets the CD6-ALCAM signaling pathway to downregulate pathogenic T effector cells while preserving T regulatory cells critical for maintaining a balanced immune response. This pathway plays a central role in modulating the activity and trafficking of T cells that drive a number of immuno-inflammatory diseases.

About Equillium

Equillium is a clinical-stage biotechnology company leveraging a deep understanding of immunobiology to develop novel therapeutics to treat severe autoimmune and inflammatory disorders with high unmet medical need. The company’s pipeline consists of the following novel first-in-class immunomodulatory assets targeting immuno-inflammatory pathways. EQ101: a tri-specific cytokine inhibitor that selectively targets IL-2, IL-9, and IL-15; currently under evaluation in a Phase 2 proof-of-concept clinical study of patients with alopecia areata. EQ102: a bi-specific cytokine inhibitor that selectively targets IL-15 and IL-21; currently under evaluation in a Phase 1 first-in-human clinical study to include healthy volunteers and celiac disease patients. Itolizumab: a monoclonal antibody that targets the CD6-ALCAM signaling pathway which plays a central role in the modulation of effector T cells; currently under evaluation in a Phase 3 clinical study of patients with acute graft-versus-host disease (aGVHD) and a Phase 1b clinical study of patients with lupus/lupus nephritis. Equillium acquired rights to itolizumab through an exclusive partnership with Biocon Limited and has entered a strategic partnership with Ono Pharmaceutical Co., Ltd. for the development and commercialization of itolizumab under an option and asset purchase agreement.

For more information, visit www.equilliumbio.com.

Forward Looking Statements

Statements contained in this press release regarding matters that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "anticipate", "believe", “could”, “continue”, "expect", "estimate", “may”, "plan", "outlook", “future” and "project" and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Because such statements are subject to risks and uncertainties, many of which are outside of

Equillium’s control, actual results may differ materially from those expressed or implied by such forward-looking statements. Such statements include, but are not limited to statements regarding Equillium’s plans for developing EQ101 and EQ102 and the expected timing of results from the Phase 2 and Phase 1 clinical studies, respectively, Equillium’s plans for developing itolizumab and the expected timing of results from the EQUATOR and EQUALISE studies, anticipated upcoming milestones, the potential benefits of the stock repurchase program, the intrinsic value and potential of Equillium to generate long-term stockholder value, the potential for additional near-term cash income under the asset purchase agreement entered into between Equillium and Ono, the fluctuation of the foreign exchange rate, Equillium’s cash runway, and the potential benefits of Equillium’s product candidates. Risks that contribute to the uncertain nature of the forward-looking statements include: Equillium’s ability to execute its plans and strategies; risks related to performing clinical studies; the risk that initial and interim results of a clinical study do not necessarily predict final results and that one or more of the clinical outcomes may materially change as patient enrollment continues, following more comprehensive reviews of the data, and as more patient data become available; potential delays in the commencement, enrollment and completion of clinical studies and the reporting of data therefrom; risks and uncertainties regarding whether, when and on what terms Equillium repurchases its shares of common stock under the stock repurchase program; whether Equillium is able to grow its business and increase stockholder value over time; risks related to Ono’s financial condition, willingness to continue to fund the development of itolizumab, and decision to exercise its option, if ever, to purchase itolizumab or terminate the asset purchase agreement; uncertainties related to Equillium’s capital requirements; and having to use cash in ways or on timing other than expected and the impact of market volatility on cash reserves. These and other risks and uncertainties are described more fully under the caption "Risk Factors" and elsewhere in Equillium's filings and reports, which may be accessed for free by visiting the Securities and Exchange Commission’s website at www.sec.gov and on Equillium’s website under the heading “Investors.” Investors should take such risks into account and should not rely on forward-looking statements when making investment decisions. All forward-looking statements contained in this press release speak only as of the date on which they were made. Equillium undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Investor & Media Contact

Equillium, Inc.

Michael Moore

Vice President, Investor Relations Officer & Head of Corporate Communications

619-302-4431

ir@equilliumbio.com

Equillium, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

Cash, cash equivalents and short-term investments |

|

$ |

48,378 |

|

|

$ |

71,023 |

|

Accounts receivable |

|

|

3,743 |

|

|

|

2,838 |

|

Prepaid expenses and other assets |

|

|

5,651 |

|

|

|

3,369 |

|

Operating lease right-of-use assets |

|

|

992 |

|

|

|

1,191 |

|

Total assets |

|

$ |

58,764 |

|

|

$ |

78,421 |

|

Current liabilities |

|

|

|

|

|

|

Accounts payable and other current liabilities |

|

$ |

10,979 |

|

|

$ |

17,338 |

|

Current portion of deferred revenue |

|

|

14,239 |

|

|

|

14,700 |

|

Total current liabilities |

|

|

25,218 |

|

|

|

32,038 |

|

Long-term deferred revenue |

|

|

5,956 |

|

|

|

10,378 |

|

Other long-term liabilities |

|

|

609 |

|

|

|

4,063 |

|

Total liabilities |

|

|

31,783 |

|

|

|

46,479 |

|

Total stockholders' equity |

|

|

26,981 |

|

|

|

31,942 |

|

Total liabilities and stockholders' equity |

|

$ |

58,764 |

|

|

$ |

78,421 |

|

Equillium, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except share and per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue |

$ |

9,124 |

|

|

$ |

- |

|

|

$ |

18,003 |

|

|

$ |

- |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

9,610 |

|

|

|

9,488 |

|

|

|

18,882 |

|

|

|

20,251 |

|

Acquired in-process research and development |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

23,049 |

|

General and administrative |

|

3,105 |

|

|

|

4,064 |

|

|

|

6,820 |

|

|

|

7,581 |

|

Total operating expenses |

|

12,715 |

|

|

|

13,552 |

|

|

|

25,702 |

|

|

|

50,881 |

|

Loss from operations |

|

(3,591 |

) |

|

|

(13,552 |

) |

|

|

(7,699 |

) |

|

|

(50,881 |

) |

Other income (expense), net |

|

256 |

|

|

|

(577 |

) |

|

|

484 |

|

|

|

(665 |

) |

Loss before income taxes |

|

(3,335 |

) |

|

|

(14,129 |

) |

|

|

(7,215 |

) |

|

|

(51,546 |

) |

Income tax expense |

|

8 |

|

|

|

- |

|

|

|

68 |

|

|

|

- |

|

Net loss |

$ |

(3,343 |

) |

|

$ |

(14,129 |

) |

|

$ |

(7,283 |

) |

|

$ |

(51,546 |

) |

Net loss per common share, basic and diluted |

$ |

(0.10 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.21 |

) |

|

$ |

(1.56 |

) |

Weighted-average number of common shares

outstanding, basic and diluted |

|

34,449,769 |

|

|

|

34,292,642 |

|

|

|

34,432,057 |

|

|

|

33,085,917 |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

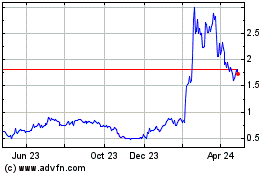

Equillium (NASDAQ:EQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

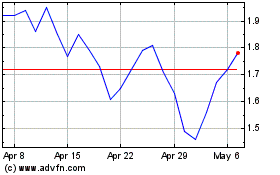

Equillium (NASDAQ:EQ)

Historical Stock Chart

From Jul 2023 to Jul 2024