Revolution Medicines, Inc. (“Revolution Medicines” or the

“Company”) (Nasdaq: RVMD), a clinical-stage oncology company

developing targeted therapies for RAS-addicted cancers, and EQRx,

Inc. (“EQRx”) (Nasdaq: EQRX) today announced a definitive agreement

through which Revolution Medicines plans to acquire EQRx in an

all-stock transaction intended to add more than $1 billion in net

cash to Revolution Medicines’ balance sheet. The total number of

shares of Revolution Medicines common stock to be issued to EQRx

security holders will be determined in close proximity to the

closing of the stockholder votes on the transaction based on the

formula described below (see Transaction Details section). The

deal, which was overseen by independent committees of Revolution

Medicines’ and EQRx’s respective boards of directors, has been

approved by the directors of each company. The transaction, which

is subject to customary closing conditions, will enhance Revolution

Medicines’ efforts to fulfill its vision to discover, develop and

deliver pioneering RAS(ON) Inhibitor drugs on behalf of patients

with RAS-addicted cancers.

This proposed transaction is intended to reinforce and sustain

Revolution Medicines’ parallel development approach for its

extensive RAS(ON) Inhibitor pipeline in multiple RAS-driven cancers

by enhancing its balance sheet, increasing financial certainty in a

challenging macroenvironment. With encouraging data trends thus far

for its RASMULTI(ON) Inhibitor RMC-6236, planning is underway for

one or more single agent pivotal clinical trials potentially to

begin in 2024. Likewise, with encouraging initial clinical

experience with its KRASG12C(ON) Inhibitor RMC-6291, planning is

underway for a Phase 1/1b clinical trial to evaluate the

combination of RMC-6236 and RMC-6291 potentially to begin in early

2024, while continuing single agent evaluation of RMC-6291.

Revolution Medicines’ acquisition of EQRx reflects both companies’

confidence in Revolution Medicines’ ability to deploy this amount

of capital effectively. With the additional capital, Revolution

Medicines will be positioned to maximize the potential clinical

impact of its targeted drug pipeline across multiple oncology

indications, and thereby offers the potential for shareholder value

creation while retaining strategic control of its RAS(ON) Inhibitor

pipeline.

“This deal marks a decisive step toward advancing Revolution

Medicines’ vision as a self-sufficient organization that discovers

and develops highly innovative drug candidates with the goal of

delivering high-impact targeted medicines into oncology practice on

behalf of patients with RAS-addicted cancers,” said Mark A.

Goldsmith, M.D., Ph.D., chief executive officer and chairman of

Revolution Medicines. “This singular acquisition of a sizable

quantum of capital signifies the growing confidence we have in our

RAS-focused drug candidate pipeline, and substantially increases

our capacity to continue advancing high-performing oncology assets,

particularly our priority clinical-stage RAS(ON) Inhibitors,

RMC-6236, RMC-6291 and RMC-9805, with the potential to create

significant long-term value for our shareholders.”

“Today’s announcement is a result of a rigorous process run by

an independent committee of directors of the EQRx board that

thoroughly explored and considered strategic alternatives to

maximize value to EQRx stockholders,” said Melanie Nallicheri,

president and chief executive officer of EQRx. “With its pioneering

portfolio of RAS(ON) inhibitors, designed to defeat RAS-addicted

cancers which represent 30% of all human cancers, Revolution

Medicines has the opportunity to address one of the largest areas

of unmet need in oncology. Deploying our significant capital not

only enhances this important vision, it also provides a compelling

opportunity for our stockholders to participate in the upside

potential of both near-term and long-term value catalysts.”

Transaction Details

Under the terms of the merger agreement, Revolution Medicines

will acquire EQRx in an all-stock transaction. The stock exchange

ratio formula in the merger agreement uses a blended average to

account for developments in Revolution Medicines’ ongoing business

and potential movement in its stock price. Approximately 80% of the

stock exchange ratio is based on Revolution Medicines’ public

market stock price measured in close proximity to the EQRx

stockholder vote and the remaining 20% of the exchange ratio is a

determined price per share of Revolution Medicines’ stock as of the

signing of the merger agreement. Specifically, at closing, EQRx

stockholders will receive the number of shares of Revolution

Medicines common stock equal to the sum of 7,692,308 Revolution

Medicines shares (determined as $200 million divided by $26.00 per

share) plus a number of shares equal to $870 million divided by a

price that is a 6% discount to the 5-day volume-weighted average

Revolution Medicines share price measured in close proximity to the

stockholder vote.

Certain EQRx stockholders, representing more than 40% of voting

shares of EQRx, have entered into support and voting agreements to

vote their shares in favor of the transaction. At the close of the

transaction, one EQRx director will be designated by Revolution

Medicines to serve on its board of directors.

The transaction is expected to close in November 2023, subject

to satisfaction of customary closing conditions, including

regulatory review, and approval by Revolution Medicines’ and EQRx’s

stockholders. Upon completion of the transaction, EQRx shares will

cease trading on the Nasdaq Global Market.

Updates on Clinical-Stage RAS(ON)

Inhibitors

Revolution Medicines announces today that an update on the

clinical antitumor activity of RMC-6236 (RASMULTI) in patients with

non-small cell lung cancer (NSCLC) or pancreatic cancer will be

presented as a Proffered Paper (oral presentation) during the

Developmental Therapeutics session on Sunday, October 22 at the

2023 European Society for Medical Oncology Congress (ESMO), and

supporting clinical data will be presented at the 2023

AACR-NCI-EORTC International Conference on Molecular Targets and

Cancer Therapeutics (“Triple Meeting”) in October. Revolution

Medicines is an invited speaker in a plenary session at the Triple

Meeting delivering a presentation entitled “Targeting RAS-addicted

Cancers with Investigational RAS(ON) Inhibitors”. Furthermore, a

first report on initial clinical findings with RMC-6291 (KRASG12C),

including preliminary evidence of differentiation from RAS(OFF)

inhibitors, will be presented at the Triple Meeting. Additional

details on the above presentations will be provided when available.

The company also announces that study site activation is ongoing

under an investigational new drug (IND) application for a Phase

1/1b trial of RMC-9805 (KRASG12D).

Pipeline Focus and Disposition of Other

Assets

To maximize the likelihood of success and the breadth of

potential impact for Revolution Medicines’ most promising R&D

assets, the company has made the strategic decision to concentrate

its post-merger financial and human capital on its three priority

RAS-focused assets (RMC-6236, RMC-6291 and RMC-9805), as well as

its deep pipeline of mutant-selective RAS(ON) Inhibitors.

In line with Revolution Medicines’ continued prioritization and

focus of its resources on novel drug mechanisms of action targeting

RAS-addicted cancers, Revolution Medicines does not intend to

advance EQRx’s research and development portfolio following closing

of the transaction. EQRx will commence a process to wind down these

programs and return the associated intellectual property to its

partners, which would have the opportunity to independently decide

the next steps on development.

Advisors

Guggenheim Securities, LLC is acting as Revolution Medicines’

financial advisor and Latham & Watkins LLP is serving as legal

counsel. Goldman Sachs & Co. LLC is acting as lead financial

advisor to EQRx. MTS Health Partners, L.P. is also acting as

financial advisor to EQRx. Goodwin Procter LLP is acting as legal

counsel for EQRx.

Webcast

Revolution Medicines will host an Investor Call today, Tuesday,

August 1, at 8:30 a.m. Eastern Time (5:30 a.m. Pacific Time) to

discuss the proposed transaction and the other business updates

noted above. Participants may register for the conference call here

https://edge.media-server.com/mmc/p/f7eyx7zk/. A live webcast of

the call will also be available on the Investors section of

Revolution Medicines’ website at

https://ir.revmed.com/events-and-presentations. Following the live

webcast, a replay will be available on the company’s website for at

least 14 days.

About Revolution

Medicines, Inc.

Revolution Medicines is a clinical-stage oncology company

developing novel targeted therapies for RAS-addicted cancers. The

company’s R&D pipeline comprises RAS(ON) Inhibitors designed to

suppress diverse oncogenic variants of RAS proteins, and RAS

Companion Inhibitors for use in combination treatment strategies.

The company’s RAS(ON) Inhibitors RMC-6236 (RASMULTI),

RMC-6291(KRASG12C) and RMC-9805 (KRASG12D) are currently in

clinical development. Additional RAS(ON) Inhibitors in the

company’s pipeline include RMC-0708 (KRASQ61H) which is currently

in IND-enabling development, RMC-8839 (KRASG13C), and additional

compounds targeting other RAS variants. RAS Companion Inhibitors in

clinical development include RMC-4630 (SHP2) and RMC-5552

(mTORC1/4EBP1).

About

EQRx, Inc.

EQRx is a biopharmaceutical company committed to developing and

commercializing innovative medicines for some of the most prevalent

disease areas. To learn more, visit www.eqrx.com and follow us on

social media: Twitter: @EQRx_US, LinkedIn.

EQRx™ and Remaking Medicine™ are trademarks of EQRx.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of federal securities laws, including the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995.

Such statements are based upon current plans, estimates and

expectations of management of Revolution Medicines and EQRx in

light of historical results and trends, current conditions and

potential future developments, and are subject to various risks and

uncertainties that could cause actual results to differ materially

from such statements. The inclusion of forward-looking statements

should not be regarded as a representation that such plans,

estimates and expectations will be achieved. Words such as

“anticipate,” “expect,” “project,” “intend,” “believe,” “may,”

“will,” “should,” “plan,” “could,” “continue,” “target,”

“contemplate,” “estimate,” “forecast,” “guidance,” “predict,”

“possible,” “potential,” “pursue,” “likely,” and words and terms of

similar substance used in connection with any discussion of future

plans, actions or events identify forward-looking statements. All

statements, other than historical facts, including express or

implied statements regarding the proposed transaction; the issuance

of common stock of Revolution Medicines contemplated by the merger

agreement; the expected timing of the closing of the proposed

transaction; the ability of the parties to complete the proposed

transaction considering the various closing conditions; the

expected benefits of the proposed transaction; the competitive

ability and position of the combined company; Revolution Medicines’

projections regarding cash runway; Revolution Medicines’

development plans and timelines and its ability to advance its

portfolio and research and development pipeline; progression of

clinical studies and findings from these studies, including the

tolerability and potential efficacy of Revolution Medicines’

candidates being studied; the potential advantages and

effectiveness of Revolution Medicines’ clinical and preclinical

candidates, including its RAS(ON) Inhibitors; the potential

clinical utility of RMC-6236 in patients with non-small cell lung

cancer and pancreatic cancer; the timing and completion of a

clinical trial for the combination of RMC-6236 and RMC-6291;

whether additional near-term and longer-term investments will

strengthen the clinical advancement of Revolution Medicines’

RAS(ON) Inhibitors; Revolution Medicines’ ability to enable

seamless program progression; Revolution Medicines’ ability to

advance its oncology assets and its intention to concentrate

development resources on its three priority RAS-focused assets

(RMC-6236, RMC-6291 and RMC-9805) following the proposed

transaction; Revolution Medicines’ expectation to not advance

EQRx’s research and development portfolio following closing of the

proposed transaction; EQRx’s expectation to wind down its programs;

and any assumptions underlying any of the foregoing, are

forward-looking statements. Important factors that could cause

actual results to differ materially from Revolution Medicines’ and

EQRx’s plans, estimates or expectations described in such

forward-looking statements could include, but are not limited to:

(i) the risk that the proposed transaction may not be completed in

a timely manner or at all, which may adversely affect Revolution

Medicines’ and EQRx’s businesses and the price of their respective

securities; (ii) uncertainties as to the timing of the consummation

of the proposed transaction; (iii) the potential failure to

receive, on a timely basis or otherwise, the required approvals of

the proposed transaction, including stockholder approvals by both

Revolution Medicines’ stockholders and EQRx’s stockholders, and the

potential failure to satisfy the other conditions to the

consummation of the transaction; (iv) that the proposed transaction

may involve unexpected costs, liabilities or delays; (v) the effect

of the announcement, pendency or completion of the proposed

transaction on each of Revolution Medicines’ or EQRx’s ability to

attract, motivate, retain and hire key personnel and maintain

relationships with customers, distributors, suppliers and others

with whom Revolution Medicines or EQRx does business, or on

Revolution Medicines’ or EQRx’s operating results and business

generally; (vi) that the proposed transaction may divert

management’s attention from each of Revolution Medicines’ and

EQRx’s ongoing business operations; (vii) the risk of any legal

proceedings related to the proposed transaction or otherwise, or

the impact of the proposed transaction thereupon, including

resulting expense or delay; (viii) that Revolution Medicines or

EQRx may be adversely affected by other economic, business and/or

competitive factors; (ix) the occurrence of any event, change or

other circumstance that could give rise to the termination of the

merger agreement relating to the proposed transaction, including in

circumstances which would require Revolution Medicines or EQRx to

pay a termination fee; (x) the risk that restrictions during the

pendency of the proposed transaction may impact Revolution

Medicines’ or EQRx’s ability to pursue certain business

opportunities or strategic transactions; (xi) the risk that

Revolution Medicines or EQRx may be unable to obtain governmental

and regulatory approvals required for the proposed transaction, or

that required governmental and regulatory approvals may delay the

consummation of the proposed transaction or result in the

imposition of conditions that could reduce the anticipated benefits

from the proposed transaction or cause the parties to abandon the

proposed transaction; (xii) the risk that the anticipated benefits

of the proposed transaction may otherwise not be fully realized or

may take longer to realize than expected; (xiii) the impact of

legislative, regulatory, economic, competitive and technological

changes; (xiv) risks relating to the value of the Revolution

Medicines securities to be issued in the proposed transaction; (xv)

the risk that integration of the proposed transaction post-closing

may not occur as anticipated or the combined company may not be

able to achieve the growth prospects expected from the transaction;

(xvi) the effect of the announcement, pendency or completion of the

proposed transaction on the market price of the common stock of

each of Revolution Medicines and the common stock and publicly

traded warrants of EQRx; (xvii) the implementation of each of

Revolution Medicines’ and EQRx’s business model and strategic plans

for product candidates and pipeline, and challenges inherent in

developing, commercializing, manufacturing, launching, marketing

and selling potential existing and new products; (xviii) the scope,

progress, results and costs of developing Revolution Medicines’ and

EQRx’s product candidates and any future product candidates,

including conducting preclinical studies and clinical trials, and

otherwise related to the research and development of Revolution

Medicines’ and EQRx’s pipeline; (xix) the timing and costs involved

in obtaining and maintaining regulatory approval for Revolution

Medicines’ and EQRx’s current or future product candidates, and any

related restrictions, limitations and/or warnings in the label of

an approved product; (xx) the market for, adoption (including rate

and degree of market acceptance) and pricing and reimbursement of

Revolution Medicines’ and EQRx’s product candidates and their

respective abilities to compete with therapies and procedures that

are rapidly growing and evolving; (xxi) uncertainties in

contractual relationships, including collaborations, partnerships,

licensing or other arrangements and the performance of third-party

suppliers and manufacturers; (xxii) the ability of each of

Revolution Medicines and EQRx to establish and maintain

intellectual property protection for products or avoid or defend

claims of infringement; (xxiii) exposure to inflation, currency

rate and interest rate fluctuations and risks associated with doing

business locally and internationally, as well as fluctuations in

the market price of each of Revolution Medicines’ and EQRx’s traded

securities; (xxiv) risks relating to competition within the

industry in which each of Revolution Medicines and EQRx operate;

(xxv) the unpredictability and severity of catastrophic events,

including, but not limited to, acts of terrorism or outbreak of war

or hostilities; (xxvi) whether the termination of EQRx’s license

agreements and/or discovery collaboration agreements may impact its

or Revolution Medicines’ ability to license in additional programs

in the future and the risk of delays or unforeseen costs in

terminating such arrangements; (xxvii) risks that restructuring

costs and charges may be greater than anticipated or incurred in

different periods than anticipated; (xxviii) the risk that EQRx’s

restructuring efforts may adversely affect its programs and its

ability to recruit and retain skilled and motivated personnel, and

may be distracting to employees and management; and (xxix) the risk

that EQRx’s restructuring or wind-down efforts may negatively

impact its business operations and reputation with or ability to

serve counterparties or may take longer to realize than expected,

as well as each of Revolution Medicines’ and EQRx’s response to any

of the aforementioned factors. Additional factors that may affect

the future results of Revolution Medicines and EQRx are set forth

in their respective filings with the U.S. Securities and Exchange

Commission (the “SEC”), including each of Revolution Medicines’ and

EQRx’s most recently filed Annual Reports on Form 10-K, subsequent

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and

other filings with the SEC, which are available on the SEC’s

website at www.sec.gov. See in particular Item 1A of Revolution

Medicines’ Quarterly Report on Form 10-Q for the quarterly period

ended March 31, 2023 under the heading “Risk Factors,” and Item 1A

of each of EQRx’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2022 and Quarterly Report on Form 10-Q for the

quarterly period ended March 31, 2023 under the headings “Risk

Factors.” The risks and uncertainties described above and in the

SEC filings cited above are not exclusive and further information

concerning Revolution Medicines and EQRx and their respective

businesses, including factors that potentially could materially

affect their respective businesses, financial conditions or

operating results, may emerge from time to time. Readers are urged

to consider these factors carefully in evaluating these

forward-looking statements, and not to place undue reliance on any

forward-looking statements, which speak only as of the date hereof.

Readers should also carefully review the risk factors described in

other documents that Revolution Medicines and EQRx file from time

to time with the SEC. Except as required by law, each of Revolution

Medicines and EQRx assume no obligation to update or revise these

forward-looking statements for any reason, even if new information

becomes available in the future.

Additional Information and Where to

Find It

In connection with the proposed transaction, Revolution

Medicines and EQRx plan to file with the SEC and mail or otherwise

provide to their respective security holders a joint proxy

statement/prospectus regarding the proposed transaction (as amended

or supplemented from time to time, the “Joint Proxy

Statement/Prospectus”). INVESTORS AND REVOLUTION MEDICINES’ AND

EQRX’S RESPECTIVE SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE

JOINT PROXY STATEMENT/PROSPECTUS IN ITS ENTIRETY WHEN IT BECOMES

AVAILABLE AND ANY OTHER DOCUMENTS FILED BY EACH OF REVOLUTION

MEDICINES AND EQRX WITH THE SEC IN CONNECTION WITH THE PROPOSED

TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND

THE PARTIES TO THE PROPOSED TRANSACTION.

Revolution Medicines’ investors and security holders may obtain

a free copy of the Joint Proxy Statement/Prospectus and other

documents that Revolution Medicines files with the SEC (when

available) from the SEC’s website at www.sec.gov and Revolution

Medicines’ website at ir.revmed.com. In addition, the Joint Proxy

Statement/Prospectus and other documents filed by Revolution

Medicines with the SEC (when available) may be obtained from

Revolution Medicines free of charge by directing a request to Eric

Bonach, H/Advisors Abernathy at eric.bonach@h-advisors.global.

EQRx’s investors and security holders may obtain a free copy of

the Joint Proxy Statement/Prospectus and other documents that EQRx

files with the SEC (when available) from the SEC’s website at

www.sec.gov and EQRx’s website at investors.eqrx.com. In addition,

the Joint Proxy Statement/Prospectus and other documents filed by

EQRx with the SEC (when available) may be obtained from EQRx free

of charge by directing a request to EQRx’s Investor Relations at

investors@eqrx.com.

No Offer or Solicitation

This communication is not intended to and shall not constitute

an offer to buy or sell or the solicitation of an offer to buy or

sell any securities, nor shall there be any offer, solicitation or

sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

Participants in the Solicitation

Revolution Medicines, EQRx and their respective directors,

executive officers, other members of management, certain employees

and other persons may be deemed to be participants in the

solicitation of proxies from the security holders of Revolution

Medicines and EQRx in connection with the proposed transaction.

Security holders may obtain information regarding the names,

affiliations and interests of Revolution Medicines’ directors and

executive officers in Revolution Medicines’ Annual Report on Form

10-K for the fiscal year ended December 31, 2022, which was filed

with the SEC on February 27, 2023, and Revolution Medicines’

definitive proxy statement on Schedule 14A for its 2023 annual

meeting of stockholders, which was filed with the SEC on April 26,

2023. To the extent holdings of Revolution Medicines’ securities by

Revolution Medicines’ directors and executive officers have changed

since the amounts set forth in such proxy statement, such changes

have been or will be reflected on subsequent Statements of Changes

in Beneficial Ownership on Form 4 filed with the SEC. Security

holders may obtain information regarding the names, affiliations

and interests of EQRx’s directors and executive officers in EQRx’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2022, which was filed with the SEC on February 23, 2023, and in

certain of EQRx’s Current Reports on Form 8-K. To the extent

holdings of EQRx’s securities by EQRx’s directors and executive

officers have changed since the amounts set forth in such Annual

Report on Form 10-K, such changes have been or will be reflected on

subsequent Statements of Changes in Beneficial Ownership on Form 4

filed with the SEC. Additional information regarding the interests

of such individuals in the proposed transaction will be included in

the Joint Proxy Statement/Prospectus relating to the proposed

transaction when it is filed with the SEC. These documents (when

available) may be obtained free of charge from the SEC’s website at

www.sec.gov, Revolution Medicines’ website at www.revmed.com and

EQRx’s website at www.eqrx.com.

Revolution Medicines Media &

Investor Contact: Eric BonachH/Advisors

Abernathyeric.bonach@h-advisors.global

EQRx

Media:Chris Kittredge/Stephen Pettibone/Hayley

CookFGS GlobalEQRx@fgsglobal.com

EQRx Investors:investors@eqrx.com

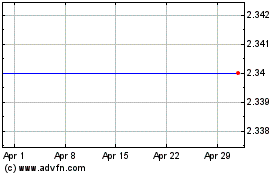

EQRx (NASDAQ:EQRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

EQRx (NASDAQ:EQRX)

Historical Stock Chart

From Nov 2023 to Nov 2024