Dragonfly Energy Holdings Corp. (“Dragonfly Energy” or the

“Company”) (Nasdaq: DFLI), maker of Battle Born Batteries® and an

industry leader in energy storage, today reported its financial and

operational results for the fourth quarter and full year ended

December 31, 2023.

Fourth Quarter 2023 Financial

Highlights

- Net Sales were $10.4 million,

compared to $20.2 million in Q4 2022

- Gross Profit was $2.0 million,

compared to $4.0 million in Q4 2022

- Operating expenses were $(5.4)

million, compared to $(32.9) million in Q4 2022

- Net Income of $3.0 million,

compared to a Net Loss of $(32.5) million in Q4 2022

- Diluted Net Income per share was

$0.05, compared to a Net Loss of $(0.76) per share in Q4 2022

- EBITDA was $7.4 million, compared

to $(28.0) million in Q4 2022

- Adjusted EBITDA was $(2.1) million,

compared to $(4.7) million in Q4 2022

Full Year 2023 Financial

Highlights

- Net Sales of $64.4 million,

compared to $86.3 million in 2022

- Gross Profit of $15.4 million,

compared to $23.6 million in 2022

- Operating expenses of $(42.9)

million, compared to $(58.0) million in 2022

- EBITDA for the full year 2023 was

$3.4 million, compared to $(32.8) million in 2022

- Adjusted EBITDA for the full year

2023 was $(17.1) million, compared to $(7.9) million in 2022

Operational and Business

Highlights

- Announced expanded market share

with inclusion as standard equipment by recreational vehicle (“RV”)

giant, Forest River (link)

- Announced the John Lennon

Educational Tour Bus is now powered by Battle Born Batteries,

moving the nonprofit mobile recording studio toward improved

sustainability (link)

- Announced partnership with Ameresco

to boost renewable energy and power system applications (link)

- Announced Coachmen RVs will include

Battle Born Batteries as an optional upgrade on its Entourage Class

C Motorhomes (link)

- Announced entrance into heavy-duty

trucking market, with new Battle Born All-Electric APU, enabling

reduced fuel costs, increased uptime and payload, and lower harmful

emissions (link)

- Announced successful cathode

electrode dry deposition, at scale, for American made lithium

batteries (link)

“Despite the near-term growth and market

headwinds, we have continued to execute and achieve our stated

targets and milestones,” said Denis Phares, Chief Executive Officer

of Dragonfly Energy. “In 2023, we completed the pilot line for our

patented chemistry-agnostic dry deposition process, proving that we

could produce anode and cathode materials at scale, and are now in

the process of delivering sample battery cells to customers across

several different industries and markets. We are extremely excited

about 2024 as the convergence of the new cell manufacturing, the

expansion of our customer base and market segments, and the

stabilization and return to growth of the RV markets sets the stage

for an expected return to growth.”

Fourth Quarter and Full Year 2022

Financial and Operating ResultsFourth quarter 2023 Net

Sales were $10.4 million, compared to $20.2 million in the fourth

quarter of 2022. Full year 2023 Net Sales were $64.4 million,

compared to $86.3 million in 2022. Direct-To-Consumer (“DTC”)

revenue decreased by $15.6 million as a result of decreased

customer demand, particularly in the RV market, due to rising

interest rates and inflation.

Fourth quarter 2023 Gross Profit was $2.0

million, compared to $4.0 million in the fourth quarter of 2022.

Full year 2023 Gross Profit was $15.4 million, down from $23.6

million in 2023. The year-over-year decline in 2023 gross profit

was primarily driven by lower unit volume sales, a change in

revenue mix that included a larger percentage of lower margin OEM

sales, as well as higher material costs.

Operating Expenses in the fourth quarter of 2023

were $(5.4) million, compared to $(32.9) million in the fourth

quarter of 2022. Full year 2023 Operating Expenses were $(42.9)

million, down from $(58.0) million. The decrease was primarily

driven by the absence of expenses associated with the Business

Combination in 2022 and lower overall employee-related costs,

partially offset by an increase in stock-based compensation costs,

as well as higher compliance, insurance, and professional fees

related to public company costs.

Total Other Income in the fourth quarter of 2023

was $6.3 million, compared to a Total Other Expense of $(2.7)

million in the prior year quarter. Other Income for fiscal 2023 was

approximately $13.6 million, compared to an Other Expenses of

$(6.3) million in 2022. The income contribution in 2023 was

primarily due to a change in fair market value of a warrant

liability in the amount of $29.6 million, partially offset by

interest expense of $16.0 million.

The Company had Net Income of $3.0 million, or

$0.05 per diluted share in the fourth quarter of 2023, compared to

a Net Loss of $(32.5) million or $(0.76) per diluted share in the

prior year quarter. For the full year 2023, the Company had a Net

Loss of $(13.8) million, or $(0.26) per diluted share, compared to

a Net Loss of $(40.0) million or $(1.04) per diluted share for the

full year 2022. The full year results were driven by reduced demand

in the RV market, partially offset by lower cost of goods sold,

lower operating expenses and increased other income.

EBITDA in the fourth quarter of 2023 was $7.4

million, compared to a negative $(28.0) million in the fourth

quarter of 2022. Full year 2023 EBITDA totaled $3.4 million,

compared to a negative $(32.8) million in 2022.

In the fourth quarter of 2023, Adjusted EBITDA

excluding stock-based compensation, changes in the fair market

value of our warrants, and other one-time expenses, was a negative

$(2.1) million, compared to a negative $(4.7) million for the

fourth quarter of 2022.

For the full year 2023, Adjusted EBITDA

excluding stock-based compensation, changes in the fair market

value of Dragonfly Energy’s warrants, and other one-time expenses,

was a negative $(17.1) million, compared to negative $(7.9) million

for the year ended December 31, 2022.

Q1 2024 OutlookThe Company

believes that the RV market appears to have stabilized and is

showing early signs of recovery. In addition, the Company’s entry

into the heavy-duty trucking market, while still in its early

stages, is gaining traction and has the potential to be a more

meaningful revenue contributor in the second half of 2024.

- Net Sales are expected to range between $12.0 - $13.0

million

- Gross Margin is expected in the range of 24.0% - 26.0%

- Operating Expenses are expected to be in a range of $(8.0) -

$(9.0) million

- Other Income (Expense) is expected be an expense in the range

of $(3.5) – $(4.5) million

- Net Loss is expected to be between $(8.0) - $(10.5) million for

the first quarter of 2024, or $(0.13) - $(0.17) per share based on

approximately 61.0 million shares outstanding

Webcast InformationThe

Dragonfly Energy management team will host a conference call to

discuss its fourth quarter and full year 2023 financial results

this afternoon, Monday, April 15, 2024, at 5:00 pm E.T. The call

can also be accessed live via live webcast by clicking here, or

through the Events and Presentations page within the Investor

Relations section of Dragonfly Energy’s website at

https://investors.dragonflyenergy.com/events-and-presentations/default.aspx.

The call can also be accessed live via telephone by dialing (206)

962-3782, toll-free in North America (888) 259-6580, or for

international callers +1 (416) 764-8624, and referencing conference

ID: 94560450. Please log in to the webcast or dial in to the call

at least 10 minutes prior to the start of the event.

An archive of the webcast will be available for

a period of time shortly after the call on the Events and

Presentations page on the Investor Relations section of Dragonfly

Energy’s website, along with the earnings press release.

About Dragonfly Energy

Dragonfly Energy Holdings Corp. (Nasdaq: DFLI)

is a comprehensive lithium battery technology company, specializing

in cell manufacturing, battery pack assembly, and full system

integration. Through its renowned Battle Born Batteries® brand,

Dragonfly Energy has established itself as a frontrunner in the

lithium battery industry, with hundreds of thousands of reliable

battery packs deployed in the field through top-tier OEMs and a

diverse retail customer base. At the forefront of domestic lithium

battery cell production, Dragonfly Energy’s patented dry electrode

manufacturing process can deliver chemistry-agnostic power

solutions for a broad spectrum of applications, including energy

storage systems, electric vehicles, and consumer electronics. The

Company's overarching mission is the future deployment of its

proprietary, nonflammable, all-solid-state battery cells.

To learn more about Dragonfly Energy and its

commitment to clean energy advancements, visit

www.dragonflyenergy.com/investors.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements include all statements that

are not historical statements of fact and statements regarding the

Company’s intent, belief or expectations, including, but not

limited to, statements regarding the Company’s guidance for 2024

results of operations and financial position, planned products and

services, business strategy and plans, market size and growth

opportunities, competitive position and technological and market

trends. Some of these forward-looking statements can be identified

by the use of forward-looking words, including “may,” “should,”

“expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,”

“predict,” “plan,” “targets,” “projects,” “could,” “would,”

“continue,” “forecast” or the negatives of these terms or

variations of them or similar expressions.

These forward-looking statements are subject to

risks, uncertainties, and other factors (some of which are beyond

the Company’s control) which could cause actual results to differ

materially from those expressed or implied by such forward-looking

statements. Factors that may impact such forward-looking statements

include, but are not limited to: improved recovery in the Company’s

core markets, including the RV market; the Company’s ability to

successfully increase market penetration into target markets; the

Company’s ability to penetrate the heavy-duty trucking and other

new markets; the growth of the addressable markets that the Company

intends to target; the Company’s ability to retain members of its

senior management team and other key personnel; the Company’s

ability to maintain relationships with key suppliers including

suppliers in China; the Company’s ability to maintain relationships

with key customers; the Company’s ability to access capital as and

when needed under its $150 million ChEF Equity Facility; the

Company’s ability to protect its patents and other intellectual

property; the Company’s ability to successfully utilize its

patented dry electrode battery manufacturing process and optimize

solid state cells as well as to produce commercially viable solid

state cells in a timely manner or at all, and to scale to mass

production; the Company’s ability to achieve the anticipated

benefits of its customer arrangements with THOR Industries and THOR

Industries’ affiliated brands (including Keystone RV Company); the

impact of the coronavirus disease pandemic, including any mutations

or variants thereof and/or the Russian/Ukrainian conflict; the

Company’s ability to generate revenue from future product sales and

its ability to achieve and maintain profitability; and the

Company’s ability to compete with other manufacturers in the

industry and its ability to engage target customers and

successfully convert these customers into meaningful orders in the

future. These and other risks and uncertainties are described more

fully in the sections entitled “Risk Factors” and “Cautionary Note

Regarding Forward-Looking Statements” in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023 to be

filed with the SEC and in the Company’s subsequent filings with the

SEC available at www.sec.gov.

If any of these risks materialize or any of the

Company’s assumptions prove incorrect, actual results could differ

materially from the results implied by these forward-looking

statements. There may be additional risks that the Company

presently does not know or that it currently believes are

immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. All

forward-looking statements contained in this press release speak

only as of the date they were made. Except to the extent required

by law, the Company undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date on which they were made.

Investor Relations:Sioban

HickieDragonflyIR@icrinc.com +1 (775) 221-8892

|

|

|

Dragonfly Energy Holdings Corp. |

|

Unaudited Condensed Consolidated Balance

Sheets |

|

(U.S. Dollars in Thousands, except share and per share data) |

|

|

|

|

December 31,2023 |

|

|

December 31,2022 |

|

| Current

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

$12,713 |

|

|

$17,781 |

|

|

Accounts receivable, net of allowance for credit losses |

1,639 |

|

|

1,444 |

|

|

Inventory |

38,778 |

|

|

50,189 |

|

|

Prepaid expenses |

772 |

|

|

1,624 |

|

|

Prepaid inventory |

1,381 |

|

|

2,002 |

|

|

Prepaid income tax |

519 |

|

|

525 |

|

|

Other current assets |

118 |

|

|

267 |

|

|

Total Current Assets |

55,920 |

|

|

73,832 |

|

| Property

and Equipment |

|

|

|

|

|

|

Machinery and equipment |

16,714 |

|

|

10,214 |

|

|

Office furniture and equipment |

319 |

|

|

275 |

|

|

Leasehold improvements |

1,727 |

|

|

1,709 |

|

|

Vehicle |

33 |

|

|

195 |

|

|

Total |

18,793 |

|

|

12,393 |

|

|

Less accumulated depreciation |

(2,824 |

) |

|

(1,633 |

) |

|

Property and Equipment |

15,969 |

|

|

10,760 |

|

|

Operating lease right of use asset, net |

3,315 |

|

|

4,513 |

|

|

Total Assets |

$75,204 |

|

|

$89,105 |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

Accounts payable |

$10,258 |

|

|

$13,475 |

|

|

Accrued payroll and other liabilities |

7,107 |

|

|

6,250 |

|

|

Accrued tariffs |

1,713 |

|

|

932 |

|

|

Customer deposits |

201 |

|

|

238 |

|

|

Uncertain tax position liability |

91 |

|

|

128 |

|

|

Notes payable, current portion, net of debt issuance costs |

19,683 |

|

|

19,242 |

|

|

Operating lease liability, current portion |

1,288 |

|

|

1,188 |

|

|

Financing lease liability, current portion |

36 |

|

|

10 |

|

|

Total Current Liabilities |

40,377 |

|

|

41,463 |

|

| Long‑Term

Liabilities |

|

|

|

|

|

| Warrant

liabilities |

4,463 |

|

|

32,831 |

|

| Accrued

expenses-long term |

152 |

|

|

492 |

|

| Operating lease

liability, net of current portion |

2,234 |

|

|

3,541 |

|

| Financing lease

liability, net of current portion |

66 |

|

|

35 |

|

|

Total Long‑Term Liabilities |

6,915 |

|

|

36,899 |

|

| Total

Liabilities |

47,292 |

|

|

78,362 |

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

Preferred stock, 5,000,000 shares at $0.0001 par value, authorized,

no shares issued and outstanding as of December 31, 2023 and

2022, respectively |

- |

|

|

- |

|

|

Common stock, 250,000,000 shares at $0.0001 par value, authorized,

60,260,282 and 43,272,728 shares issued and outstanding as of

December 31, 2023 and 2022, respectively |

6 |

|

|

4 |

|

| Additional paid in

capital |

69,445 |

|

|

38,461 |

|

| Accumulated

Deficit |

(41,539 |

) |

|

(27,722 |

) |

| Total

Stockholders' Equity |

27,912 |

|

|

10,743 |

|

| Total

Liabilities and Stockholders' Equity |

$75,204 |

|

|

$89,105 |

|

|

|

|

Dragonfly Energy Holdings Corp. |

|

Unaudited Condensed Interim Consolidated Statements of

Operations |

|

(U.S. Dollars in Thousands, except share and per share data) |

|

|

|

|

Three Months Ended |

|

|

Year Ended Ended |

|

|

|

December 31,2023 |

|

|

December 31,2022 |

|

|

December 31,2023 |

|

|

December 31,2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

$ |

10,438 |

|

|

$ |

20,209 |

|

|

$ |

64,392 |

|

|

$ |

86,251 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Goods Sold |

8,405 |

|

|

16,152 |

|

|

48,946 |

|

|

62,633 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

2,033 |

|

|

4,057 |

|

|

15,446 |

|

|

23,618 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

531 |

|

|

813 |

|

|

3,863 |

|

|

2,764 |

|

|

General and administrative |

3,275 |

|

|

27,788 |

|

|

26,389 |

|

|

41,566 |

|

|

Selling and marketing |

1,548 |

|

|

4,340 |

|

|

12,623 |

|

|

13,671 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

5,354 |

|

|

32,941 |

|

|

42,875 |

|

|

58,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss From Operations |

(3,321 |

) |

|

(28,884 |

) |

|

(27,429 |

) |

|

(34,383 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

19 |

|

|

40 |

|

|

19 |

|

|

40 |

|

|

Interest expense, net |

(4,110 |

) |

|

(3,322 |

) |

|

(16,015 |

) |

|

(6,979 |

) |

|

Change in fair market value of warrant liability |

10,400 |

|

|

5,446 |

|

|

29,582 |

|

|

5,446 |

|

|

Debt extinguishment |

- |

|

|

(4,824 |

) |

|

- |

|

|

(4,824 |

) |

|

Total Other Income (Expense) |

6,309 |

|

|

(2,660 |

) |

|

13,586 |

|

|

(6,317 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss Before Taxes |

2,988 |

|

|

(31,544 |

) |

|

(13,843 |

) |

|

(40,700 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Benefit |

(26 |

) |

|

991 |

|

|

(26 |

) |

|

(709 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

$ |

3,014 |

|

|

$ |

(32,535 |

) |

|

$ |

(13,817 |

) |

|

$ |

(39,991 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) Per Share‑ Basic |

$ |

0.05 |

|

|

$ |

(0.76 |

) |

|

$ |

(0.26 |

) |

|

$ |

(1.04 |

) |

|

Income (Loss) Per Share‑ Diluted |

$ |

0.05 |

|

|

$ |

(0.76 |

) |

|

$ |

(0.26 |

) |

|

$ |

(1.04 |

) |

|

Weighted Average Number of Shares‑ Basic |

59,590,032 |

|

|

42,948,026 |

|

|

52,786,481 |

|

|

38,565,307 |

|

|

Weighted Average Number of Shares‑ Diluted |

60,597,708 |

|

|

42,948,026 |

|

|

52,786,481 |

|

|

38,565,307 |

|

|

|

|

|

|

|

|

|

Dragonfly Energy Holdings Corp. |

|

Unaudited Condensed Consolidated Statement of Cash

Flows |

|

(U.S. Dollars in Thousands) |

|

|

|

|

|

|

|

|

|

Year Ended |

|

|

|

December 31,2023 |

|

|

December 31,2022 |

|

|

Cash Flows From Operating Activities |

|

|

|

|

|

|

Net Loss |

$ |

(13,817 |

) |

|

$ |

(39,991 |

) |

|

Adjustments to Reconcile Net Loss to Net Cash |

|

|

|

|

|

| Used

in Operating Activities |

|

|

|

|

|

|

Stock based compensation |

6,710 |

|

|

2,467 |

|

|

Debt extinguishment |

- |

|

|

4,824 |

|

|

Assumption of warrant liability |

- |

|

|

1,990 |

|

|

Amortization of debt discount |

1,470 |

|

|

1,822 |

|

|

Change in fair market value of warrant liability |

(29,582 |

) |

|

(5,446 |

) |

|

Deferred tax liability |

- |

|

|

(453 |

) |

|

Non‑cash interest expense (paid‑in-kind) |

4,938 |

|

|

1,192 |

|

|

Provision for credit losses |

114 |

|

|

108 |

|

|

Depreciation |

1,237 |

|

|

891 |

|

|

Loss on disposal of property and equipment |

116 |

|

|

56 |

|

|

Write-off of prepaid inventory |

596 |

|

|

- |

|

|

Changes in Assets and Liabilities |

|

|

|

|

|

|

Accounts receivable |

(309 |

) |

|

(769 |

) |

|

Inventories |

11,411 |

|

|

(22,732 |

) |

|

Prepaid expenses |

852 |

|

|

(1,467 |

) |

|

Prepaid inventory |

25 |

|

|

5,459 |

|

|

Other current assets |

149 |

|

|

1,520 |

|

|

Other assets |

1,198 |

|

|

1,196 |

|

|

Income taxes payable |

6 |

|

|

(1,156 |

) |

|

Accounts payable and accrued expenses |

(3,527 |

) |

|

4,428 |

|

|

Accrued tariffs |

781 |

|

|

433 |

|

|

Uncertain tax position liability |

(37 |

) |

|

128 |

|

|

Customer deposits |

(37 |

) |

|

(196 |

) |

| Total

Adjustments |

(3,889 |

) |

|

(5,705 |

) |

|

Net Cash Used in Operating Activities |

(17,706 |

) |

|

(45,696 |

) |

|

|

|

|

|

|

|

|

Cash Flows From Investing Activities |

|

|

|

|

|

|

Proceeds from disposal of property and equipment |

- |

|

|

35 |

|

|

Purchase of property and equipment |

(6,885 |

) |

|

(6,862 |

) |

|

Net Cash Used in Investing Activities |

(6,885 |

) |

|

(6,827 |

) |

|

|

|

|

|

|

|

|

Cash Flows From Financing Activities |

|

|

|

|

|

|

Proceeds from public offering |

24,177 |

|

|

- |

|

|

Payments from public offering costs |

(1,258 |

) |

|

- |

|

|

Proceeds from note payable, related party |

1,000 |

|

|

- |

|

|

Repayment of note payable, related party |

(1,000 |

) |

|

- |

|

|

Proceeds from term loan |

- |

|

|

75,000 |

|

|

Repayment of note payable |

(5,275 |

) |

|

(45,000 |

) |

|

Proceeds from exercise of public warrants |

747 |

|

|

- |

|

|

Payment of debt issuance costs |

- |

|

|

(4,032 |

) |

|

Proceeds from exercise of options |

586 |

|

|

706 |

|

|

Proceeds from stock purchase agreement |

- |

|

|

15,000 |

|

|

Proceeds from exercise of investor warrants |

546 |

|

|

- |

|

|

Net Cash Provided by Financing Activities |

19,523 |

|

|

41,674 |

|

|

|

|

|

|

|

|

| Net

Decrease in cash and cash equivalents |

(5,068 |

) |

|

(10,849 |

) |

| Cash

and cash equivalents - beginning of year |

17,781 |

|

|

28,630 |

|

|

Cash and cash equivalents - end of year |

$ |

12,713 |

|

|

$ |

17,781 |

|

Use of Non-GAAP Financial

Measures

The Company provides non-GAAP financial measures

including EBITDA and Adjusted EBITDA as a supplement to GAAP

financial information to enhance the overall understanding of the

Company’s financial performance and to assist investors in

evaluating the Company’s results of operations, period over period.

Adjusted non-GAAP measures exclude significant unusual items.

Investors should consider these non-GAAP measures as a supplement

to, and not a substitute for financial information prepared on a

GAAP basis.

Adjusted EBITDAAdjusted EBITDA

is considered a non-GAAP financial measure under the rules of the

SEC because it excludes certain amounts included in net loss

calculated in accordance with GAAP. Specifically, the Company

calculates Adjusted EBITDA by GAAP net loss adjusted to exclude

stock-based compensation expense, business combination related

expenses and other one-time, non-recurring items.

The Company has included Adjusted EBITDA because

it is a key measure used by Dragonfly’s management team to evaluate

its operating performance, generate future operating plans, and

make strategic decisions, including those relating to operating

expenses. As such, the Company believes Adjusted EBITDA is helpful

in highlighting trends in the ongoing core operating results of the

business.

Adjusted EBITDA has limitations as an analytical

tool, and it should not be considered in isolation or as a

substitute for analysis of net loss or other results as reported

under GAAP. Some of these limitations are:

- Adjusted EBITDA does not reflect

the Company’s cash expenditures, future requirements for capital

expenditures, or contractual commitments;

- Adjusted EBITDA does not reflect

changes in, or cash requirements for, the Company’s working capital

needs;

- Adjusted EBITDA does not reflect

the Company’s tax expense or the cash requirements to pay

taxes;

- although amortization and

depreciation are non-cash charges, the assets being amortized and

depreciated will often have to be replaced in the future and

Adjusted EBITDA does not reflect any cash requirements for such

replacements;

- Adjusted EBITDA should not be

construed as an inference that the Company’s future results will be

unaffected by unusual or non-recurring items for which the Company

may adjust in historical periods; and

- other companies in the industry may

calculate Adjusted EBITDA differently than the Company does,

limiting its usefulness as a comparative measure.

Reconciliations of Non-GAAP Financial

Measures

EBITDA and Adjusted EBITDAThe

following table presents reconciliations of EBITDA and Adjusted

EBITDA to the most directly comparable GAAP financial measure for

each of the periods indicated.

| |

|

Dragonfly Energy Holdings Corp. |

|

Reconciliation of GAAP to Non-GAAP Measures

(Unaudited) |

|

(U.S. Dollars in Thousands) |

| |

| |

Three Months Ended |

|

|

Three Months Ended |

|

|

|

December 31,2023 |

|

|

December 31,2022 |

|

|

December 31,2023 |

|

|

December 31,2022 |

|

|

Net (loss) |

$ |

3,014 |

|

|

$ |

(32,535 |

) |

|

$ |

(13,817 |

) |

|

$ |

(39,991 |

) |

|

Interest Expense |

4,110 |

|

|

3,322 |

|

|

16,015 |

|

|

6,979 |

|

|

Taxes |

(26 |

) |

|

991 |

|

|

(26 |

) |

|

(709 |

) |

|

Depreciation |

328 |

|

|

243 |

|

|

1,237 |

|

|

891 |

|

| EBITDA |

$ |

7,426 |

|

|

$ |

(27,979 |

) |

|

$ |

3,409 |

|

|

$ |

(32,830 |

) |

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

Stock Based Compensation(1) |

323 |

|

|

1,312 |

|

|

6,710 |

|

|

2,467 |

|

|

June 2023 Offering Costs(2) |

- |

|

|

- |

|

|

904 |

|

|

- |

|

|

Promissory Note Forgiveness(3) |

- |

|

|

- |

|

|

- |

|

|

469 |

|

|

Loss on Disposal of Assets |

596 |

|

|

56 |

|

|

712 |

|

|

56 |

|

|

Separation Agreement(4) |

- |

|

|

1,197 |

|

|

720 |

|

|

1,197 |

|

|

Business Combination Expenses(5) |

- |

|

|

21,337 |

|

|

- |

|

|

21,337 |

|

|

Debt Extinguishment(6) |

- |

|

|

4,824 |

|

|

- |

|

|

4,824 |

|

|

Change in fair market value of warrant liability(7) |

(10,400 |

) |

|

(5,446 |

) |

|

(29,582 |

) |

|

(5,446 |

) |

| Adjusted

EBITDA |

$ |

(2,055 |

) |

|

$ |

(4,699 |

) |

|

$ |

(17,127 |

) |

|

$ |

(7,926 |

) |

|

(1) |

Stock-Based Compensation is comprised of costs associated with

option and RSU grants made to the Company's employees, consultants

and board members. |

| (2) |

June 2023 Offering Costs related to the warrant liability are

comprised of fees and expenses, including legal, accounting and

other expenses associated with this offering. |

| (3) |

Promissory Note Foregiveness is comprised of the loan that was

forgiven, prior to the Business Combination, in connection with the

promissory note, with a maturity date of March 1, 2026, between the

Company and John Marchetti, its Senior Vice President of Operations

and former Chief Financial Officer. |

| (4) |

Separation Agreement in 2022 is comprised of $1.2 million in cash

severance associated with the Separation Agreement dated October

25, 2022, as amended on November 14, 2022 between the Company and

Sean Nichols, its former Chief Operating Officer. Seperation

Agreement in 2023 is comprised of $720 in cash severance associated

with the Separation Agreement dated April 26, 2023, between the

Company and its former Chief Legal Officer. |

| (5) |

Business Combination Expenses is comprised of fees and expenses,

including legal, accounting and other expenses asscociated with the

Business Combination. |

| (6) |

Debt Extinguishment expenses are comprised of expenses incurred in

connection with the early debt repayment of the Series 2021-6 Notes

that occurred in conjunction with the Business Combination. |

| (7) |

Change in fair market value of warrant liability represents the

change in fair value from the date the warrants were issued through

December 31, 2023. |

Source: Dragonfly Energy Holdings Corp.

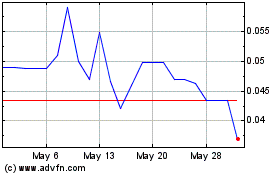

Dragonfly Energy (NASDAQ:DFLIW)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dragonfly Energy (NASDAQ:DFLIW)

Historical Stock Chart

From Nov 2023 to Nov 2024