Dime Savings Bank Purchases $200 Million Multifamily Loan Portfolio

February 21 2014 - 10:35AM

Marketwired

Dime Savings Bank Purchases $200 Million Multifamily Loan Portfolio

Transaction Accelerates Attainment of 2014 Loan Growth

Target

BROOKLYN, NY--(Marketwired - Feb 21, 2014) - Dime Community

Bancshares, Inc. (NASDAQ: DCOM) (the "Company"), the parent company

of The Dime Savings Bank of Williamsburgh ("Dime"), today announced

that Dime completed the repurchase of $200.1 million of loans

previously sold to a third party from December 2002 through

February 2009. All loans are current and performing.

Announcing the transaction, Vincent F. Palagiano, Chairman and

Chief Executive Officer of the Company, stated, "I am pleased to

report that the Company was able to capitalize on a unique

opportunity to repurchase $200 million in previously sold loans,

enabling us to make significant progress toward meeting our 2014

loan origination goals." Mr. Palagiano continued, "As originator

and servicer of these loans, we are intimately familiar with their

underwriting and credit quality. Furthermore, the repurchase was

appealing to us because of the relatively short nature of the

assets being acquired."

Dime remains one of the premier banks lending to owners of

multifamily properties in New York City.

ABOUT DIME COMMUNITY BANCSHARES The Company (NASDAQ: DCOM) had

$4.03 billion in consolidated assets as of December 31, 2013, and

is the parent company of Dime. Dime was founded in 1864, is

headquartered in Brooklyn, New York, and currently has twenty-five

branches located throughout Brooklyn, Queens, the Bronx and Nassau

County, New York. More information on the Company and Dime can be

found on the Dime's Internet website at www.dime.com.

Contact: Kenneth Ceonzo Director of Investor Relations

718-782-6200 extension 8279

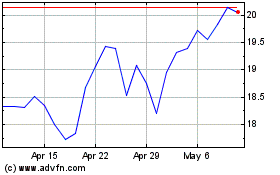

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Sep 2024 to Oct 2024

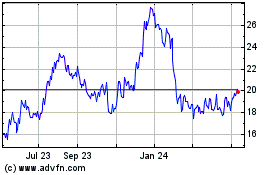

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Oct 2023 to Oct 2024