Dime Community Bancshares, Inc. (NASDAQ: DCOM) (the "Company" or

"Dime"), the parent company of The Dime Savings Bank of

Williamsburgh (the "Bank"), today reported consolidated net income

of $11.1 million, or 33 cents per diluted share, for the quarter

ended March 31, 2011, compared to $10.6 million, or 31 cents per

diluted share, for the quarter ended December 31, 2010, and $9.5

million, or 28 cents per diluted share, for the quarter ended March

31, 2010.

Vincent F. Palagiano, Chairman and CEO, commented, "The earnings

and credit trendlines continue to improve into the current year,

with no clear indication yet of when short term rates may rise. Net

interest margin remains near cyclical highs for the bank. The

refinance market for multifamily properties continues to gather

momentum. We see plenty of opportunity in this market for the next

two to three years, as loans that were originated in 2003 through

2006 continue to reach their contractual repricing date, but we

remain cautious not to inflate the balance sheet at what we view as

a cyclical low point for interest rates. It is a favorable

environment for multifamily owners to refinance, as offering rates

on multifamily loans remain at historically low levels. On the

retail side, we were very pleased to open our 26th branch with a

superb location at the heavily trafficked corner of 86th Street and

Fourth Avenue in Bay Ridge, Brooklyn, our tenth Brooklyn location.

If the boroughs of New York City were separate cities, Brooklyn

would be the third largest city in the United States after Los

Angeles and Chicago."

OPERATING RESULTS FOR THE QUARTER ENDED MARCH 31, 2011

Net Interest Income

Net interest income increased $2.3 million, or 7.0%, from the

March 2010 quarter, and was virtually unchanged (0.3% lower) on a

linked quarter basis. Net interest margin fell 9 basis points to

3.62% during the quarter ended March 31, 2011 from 3.71% in the

December 2010 quarter, due to the following: 1) the yield on

interest earning assets declined 16 basis points, reflecting lower

yields on new loans; and 2) a temporary accumulation of $86 million

in cash balances earning approximately 25 basis points. The

additional liquidity resulted primarily from $52.1 million of

deposit inflows from a combination of seasonal and new branch

promotional activities. This excess liquidity is expected to be

deployed between now and August 31, 2011, however, it will slightly

depress the net interest margin until that time.

The decline in portfolio yield was offset by prepayment fee

income, which contributed meaningfully to net interest margin this

quarter. Prepayment and late fee income together rose significantly

to $1.5 million in aggregate during the March 2011 quarter, from

$879,000 in aggregate during the December 2010 quarter. The

combined prepayment and late charge income levels experienced in

both the March 2011 and December 2010 quarters were significantly

higher than those experienced in the March 2010 quarter, during

which they approximated $301,000 in aggregate, primarily reflecting

increased marketplace refinance activity.

Average earning assets grew by $82.5 million during the quarter,

however, did not generate sufficient interest income to offset the

lower yields on interest earning assets. Yields on new real estate

loans during the quarter averaged 4.64%, while the average real

estate loan portfolio yield was 5.84%.

Although rates on new multifamily loans are lower than Dime's

existing portfolio rates and near historical lows, their spread to

5- and 10-year Treasury bonds [and Federal Home Loan Bank of New

York ("FHLBNY") advances] still remains favorable. As a result,

origination levels during the remaining quarters of 2011 will

likely approximate the March 2011 quarterly volume, as liquid funds

are more profitably deployed. It typically takes several quarters

for changes in new loan origination rates (either higher or lower)

to have an impact on the portfolio rate. The direction and

magnitude of the change in the loan portfolio yield over the next

several quarters will be impacted by the loan refinancing volume

from within the existing portfolio, additional growth in the loan

portfolio at these interest rate levels and the level of prepayment

fee income. The loan amortization rate experienced in the March

2011 quarter was 19% on an annualized basis, running slightly ahead

of management's 2011 annual forecast of 14%.

On the funding side, the average cost of interest bearing

liabilities declined by 3 basis points quarter-over-quarter, due to

reductions of 11 basis points and 2 basis points in the average

costs of borrowed funds and deposits, respectively. Lower rates on

new certificates of deposit ("CDs") combined with an additional

$4.7 million of average non-interest bearing checking balances were

the primary reason for the deposit cost decrease, as higher-rate

maturing CDs priced down to today's levels. The average cost of CDs

declined 4 basis points from the December 2010 quarter to the March

2011 quarter. The $4.7 million growth in the average balance of

non-interest bearing deposits reflected the ongoing success of the

Bank's commercial deposit gathering efforts. Despite the decline in

rate offerings on new deposits, total deposit balances increased by

2.2% during the most recent quarter.

Interest Rate Risk

Management sees significant risk of increased funding costs over

the 3-year planning horizon. For that reason, the Company continues

to take meaningful steps to lengthen the duration of liabilities to

more closely match the repricing duration of its primary

investment, the 5-year repricing multifamily loan. During the March

2011 quarter, the Company modified $50.0 million of existing

putable FHLBNY advances, representing approximately 5% of total

outstanding FHLBNY advances, bringing the cumulative amount of

short-term, putable advances modified since the beginning of the

4th quarter of 2010 to $110 million. The favorable interest rate

environment enabled the Company to lengthen the repricing term of

these liabilities and simultaneously lower their cost. The

modifications completed in the current quarter resulted in a 32

basis point reduction in their weighted average cost to 3.58%, as

well as a 2.4-year extension in their weighted average term to

maturity. The maturity of this pool of borrowings moves to the

first quarter of 2015. The result was a decline of 11 basis points

in average borrowing costs during the quarter ended March 31, 2011.

As a result of these modifications, the aggregate level of

remaining putable borrowings has declined to 13.7% of total

liabilities at March 31, 2011.

Provision/Allowance For Loan Losses

At March 31, 2011, the allowance for loan losses ("ALL") as a

percentage of total loans stood at 0.57%, an increase of 2 basis

points from 0.55% at the end of the prior quarter. The Bank charged

off all losses deemed probable to occur on problem loans during the

March 2011 quarter, recognizing approximately $980,000 of such

charge-offs against the ALL during the quarter. The Bank recorded a

$1.4 million provision to its ALL during the March 2011 quarter,

compared to $3.3 million recorded in the December 2010 quarter.

This decline reflected the stabilization of credit conditions and

lower levels of new problem loans. The allowance represented 102%

of non-performing loans at March 31, 2011, up from 95% at December

31, 2010.

Non-Interest Income

Non-interest income was $1.9 million for the quarter ended March

31, 2011, a reduction of $110,000 from the previous quarter. The

$110,000 reduction resulted from a decline of $185,000 in the net

gain or loss on loan sales, coupled with slightly lower fee income.

These were partially offset by reduction in pre-tax OTTI charges of

$100,000 recognized on the Bank's portfolio of pooled bank trust

preferred securities.

Non-Interest Expense

Non-interest expense increased $1.3 million from the previous

quarter, reflecting the following: 1) ongoing salary and benefits

increases, including additional expenses associated with the

Company's Benefit Maintenance Plan; 2) the acceleration of

depreciation on some leasehold fixed assets; 3) higher deposit

insurance costs in a transitional quarter between Federal Deposit

Insurance Corporation ("FDIC") recapitalization plans; and 4)

increased marketing costs compared to the December 2010 quarter for

seasonal factors.

Non-interest expense was 1.65% of average assets during the most

recent quarter, resulting in an efficiency ratio of 45.6%.

Income Tax Expense

The effective tax rate was 40.6% during the March 2011 quarter,

slightly above the 40% expected rate. During the December 2010

quarter, the effective tax rate approximated 42.3% as a result of

year-end reconciliation of the full year expected tax obligation.

The Company's consolidated effective tax rate is expected to

approximate 40%.

BALANCE SHEET

Total assets increased $102.4 million, to $4.14 billion at March

31, 2011. The growth in assets was concentrated in cash and due

from banks and investment securities available for sale (primarily

agency obligations). The funding for the balance sheet growth was

obtained primarily from deposits and seasonal mortgagor escrow

flows, which grew by $52.1 million and $40.3 million, respectively,

during the most recent quarter.

Real Estate Loans

Real estate loans (excluding loans held for sale) declined $12.9

million during the most recent quarter due to higher than

anticipated amortization. The market rate on new multifamily loans

is near historical lows, therefore, the Bank has taken a more

measured approach to originating new loans. Real estate loan

originations were $157.2 million during the most recent quarter at

an average rate of 4.64%. Loan amortization, excluding the

disposition of problem loans, totaled $168.1 million, or 19%

annualized of the average portfolio balance. The average rate on

amortized or satisfied loan balances was 5.69%.

The loan pipeline stood at $121.8 million at March 31, 2011,

with a weighted average rate of 4.98%. Yields on new loan

commitments remain low, primarily driven by low Treasury yields and

aggressive competition for multifamily loans in the New York City

market. Dime will continue to be cautious about growing the loan

portfolio at the current yields, reflecting management's

expectations that interest rates will rise from their historically

low levels as the overall economy continues to improve.

Problem Loans

Non-accrual loans were $19.2 million, or 0.56% of total loans,

at March 31, 2011, a slight reduction from $20.2 million, or 0.58%

of loans, at December 31, 2010.

Loans delinquent between 30 and 89 days also declined to $12.1

million, or 0.35% of loans, at March 31, 2011, compared to $21.5

million, or 0.62% of loans at December 31, 2010. This decline

reflected both a continued stabilization in the multifamily

residential marketplace and the correction of a seasonal spike in

delinquencies that occurred during the December 2010 quarter.

As shown on page 13 of this release, the sum of non-performing

assets and accruing loans past due 90 days or more represented 6.7%

of tangible capital plus the ALL at March 31, 2011.

Within the remaining $361.0 million pool of loans sold to Fannie

Mae with recourse exposure, total delinquencies remained

negligible, declining from $3.7 million at December 31, 2010 to

$1.4 million at March 31, 2011. The $1.4 million delinquent balance

at March 31, 2011 was composed of one loan that was fully satisfied

in April 2011, with all principal and interest arrears

received.

Deposits and Borrowed Funds

Deposits increased $52.1 million during the most recent quarter,

led by growth of $29.4 million in promotional CDs and $22.7 million

in core (non-CD deposits). The Bank's deposit strategy during the

March 2011 quarter reflected both individual retirement account

("IRA") and new branch deposit promotional activities, all of which

were ultimately aimed at growing stable relationship balances. IRA

balances increased 19% during the March 2011 quarter as a result of

their promotional activities. Non-interest bearing checking

balances grew $9.9 million during the March 2011 quarter,

reflecting a combination of ongoing success in commercial deposit

gathering activities and seasonal inflows.

At March 31, 2011, average deposits in branches open in excess

of one year approximated $94.3 million, and core deposits comprised

55% of total deposits. Dime currently expects to continue its

measured de novo strategy. Late in the first quarter of 2011, Dime

opened its 26th retail banking office, located on 86th Street in

Bay Ridge, Brooklyn.

Since deposits provided sufficient funding during the most

recent quarter, management did not add any new wholesale borrowings

during the period, instead focusing efforts on restructuring its

existing portfolio. As a result, the weighted average maturity of

$50 million of existing borrowings was extended by an average of

2.4 years, with all associated put options fully eliminated. Their

weighted average cost was also reduced by 32 basis points.

Tangible Capital

Dime continues to grow tangible capital through retained

earnings, as reported earnings per share exceeded the quarterly

cash dividend rate per share by 136% during the most recent

quarter. Tangible book value per share increased $0.22 during the

most recent quarter to $8.29 at March 31, 2011. This growth was

fueled by a return of approximately 15.6% on average tangible

equity during the most recent quarter.

Dime's consolidated tangible capital was 7.04% of tangible

assets at March 31, 2011, up 3 basis points from December 31, 2010.

The Bank's tangible capital ratio was 8.21% at March 31, 2011, and

its total risk-based capital approximated 12.28%.

OUTLOOK FOR THE QUARTER ENDING JUNE 30, 2011

The average cost of deposits decreased to 1.16% during the March

2011 quarter from 1.18% during the December 2010 quarter, as Dime

continued to take advantage of historically low short-term interest

rates. Deposit funding costs should remain near this historically

low level at least through the second quarter of 2011.

Amortization rates (including prepayments and loan refinancing

activity), which approximated 19.5% on an annualized basis during

the most recent quarter, are expected to remain in this area during

the second quarter of 2011, up from the full year 2010 levels,

reflecting the current low interest rate environment. Loans

expected to mature or reprice during the remainder of the year

ending December 31, 2011 total $347.0 million, at an average rate

of 5.69%. Of this total, $169.6 million at an average rate of 5.66%

are expected to mature or reprice during the June 2011 quarter.

At March 31, 2011, the loan commitment pipeline was

approximately $121.8 million, comprised primarily of multifamily

residential loans, with an approximate weighted average rate of

4.98%.

On the liability side of the balance sheet, the Bank has $583.9

million of CD's maturing during the remainder of 2011 at an average

cost of 1.48%. Of this total, $222.0 million are maturing during

the June 2011 quarter, at an average cost of 1.61%. Rates on CDs

originated during the month ended March 31, 2011 approximated

1.50%. In addition, $105.8 million of FHLBNY advances with an

average cost of 3.68% are scheduled to mature or reprice during the

remainder of 2011, of which $50.8 million with an average cost of

4.11% are scheduled to mature during the June 2011 quarter.

Replacement rates on new FHLBNY advances range from 2.00% to 2.75%

for 4- to 5-year maturities, however, if the Company's consolidated

cash liquidity remains near its March 31, 2011 level, it is likely

that a portion of these maturing borrowings will not be

replaced.

Operating expenses for the June 2011 quarter are expected to

approximate $15.0 million, which is the estimated quarterly run

rate for the remainder of 2011, and reflects expected reductions in

the Company's deposit insurance costs resulting from the revised

FDIC recapitalization plan scheduled to commence in the June 2011

quarter.

Quarterly loan loss provisions were $1.4 million during the

March 2011 quarter, $3.3 million during the December 2010 quarter,

$667,000 during the September 2010 quarter, and $3.8 million during

the June 2010 quarter. If current trends hold for delinquent and

troubled loans, management expects loan loss provisioning to

continue to decline somewhat on a year-over-year basis.

ABOUT DIME COMMUNITY BANCSHARES

The Company (NASDAQ: DCOM) had $4.14 billion in consolidated

assets as of March 31, 2011, and is the parent company of the Bank.

The Bank was founded in 1864, is headquartered in Brooklyn, New

York, and currently has twenty-six branches located throughout

Brooklyn, Queens, the Bronx and Nassau County, New York. More

information on the Company and Dime can be found on the Dime's

Internet website at www.dime.com.

This News Release contains a number of forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended (the "Exchange Act"). These statements may be

identified by use of words such as "anticipate," "believe,"

"could," "estimate," "expect," "intend," "may," "outlook," "plan,"

"potential," "predict," "project," "should," "will," "would" and

similar terms and phrases, including references to assumptions.

Forward-looking statements are based upon various assumptions

and analyses made by the Company in light of management's

experience and its perception of historical trends, current

conditions and expected future developments, as well as other

factors it believes are appropriate under the circumstances. These

statements are not guarantees of future performance and are subject

to risks, uncertainties and other factors (many of which are beyond

the Company's control) that could cause actual results to differ

materially from future results expressed or implied by such

forward-looking statements. These factors include, without

limitation, the following: the timing and occurrence or

non-occurrence of events may be subject to circumstances beyond the

Company's control; there may be increases in competitive pressure

among financial institutions or from non-financial institutions;

changes in the interest rate environment may reduce interest

margins; changes in deposit flows, loan demand or real estate

values may adversely affect the business of Dime; changes in

accounting principles, policies or guidelines may cause the

Company's financial condition to be perceived differently; changes

in corporate and/or individual income tax laws may adversely affect

the Company's financial condition or results of operations; general

economic conditions, either nationally or locally in some or all

areas in which the Company conducts business, or conditions in the

securities markets or the banking industry may be less favorable

than the Company currently anticipates; legislation or regulatory

changes may adversely affect the Company's business; technological

changes may be more difficult or expensive than the Company

anticipates; success or consummation of new business initiatives

may be more difficult or expensive than the Company anticipates; or

litigation or other matters before regulatory agencies, whether

currently existing or commencing in the future, may delay the

occurrence or non-occurrence of events longer than the Company

anticipates.

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(In thousands except share amounts)

March 31, December 31,

2011 2010

------------ ------------

ASSETS:

Cash and due from banks $ 171,745 $ 86,193

Investment securities held to maturity 7,192 6,641

Investment securities available for sale 133,641 85,642

Trading securities 1,541 1,490

Mortgage-backed securities available for sale 128,732 144,518

Federal funds sold and other short-term

investments 4,461 4,536

Real Estate Loans:

One-to-four family and cooperative apartment 110,024 116,886

Multifamily and underlying cooperative (1) 2,507,570 2,497,339

Commercial real estate (1) 818,837 833,314

Construction and land acquisition 13,475 15,238

Unearned discounts and net deferred loan

fees 4,811 5,013

------------ ------------

Total real estate loans 3,454,717 3,467,790

------------ ------------

Other loans 2,070 2,394

Allowance for loan losses (19,663) (19,166)

------------ ------------

Total loans, net 3,437,124 3,451,018

------------ ------------

Loans held for sale 1,721 3,308

Premises and fixed assets, net 32,381 31,613

Federal Home Loan Bank of New York capital

stock 51,718 51,718

Other real estate owned, net - -

Goodwill 55,638 55,638

Other assets 116,816 117,980

------------ ------------

TOTAL ASSETS $ 4,142,710 $ 4,040,295

============ ============

LIABILITIES AND STOCKHOLDERS' EQUITY:

Deposits:

Non-interest bearing checking $ 135,661 $ 125,730

Interest Bearing Checking 104,929 108,078

Savings 337,509 329,182

Money Market 735,557 727,939

------------ ------------

Sub-total 1,313,656 1,290,929

------------ ------------

Certificates of deposit 1,089,029 1,059,652

------------ ------------

Total Due to Depositors 2,402,685 2,350,581

------------ ------------

Escrow and other deposits 108,865 68,542

Securities sold under agreements to repurchase 195,000 195,000

Federal Home Loan Bank of New York advances 990,525 990,525

Subordinated Notes Sold - -

Trust Preferred Notes Payable 70,680 70,680

Other liabilities 37,933 36,233

------------ ------------

TOTAL LIABILITIES 3,805,688 3,711,561

------------ ------------

STOCKHOLDERS' EQUITY:

Common stock ($0.01 par, 125,000,000 shares

authorized, 51,309,559 shares and 51,219,609

shares issued at March 31, 2011 and

December 31, 2010, respectively, and 34,683,130

shares and 34,593,180 shares outstanding at

March 31, 2011 and December 31, 2010,

respectively) 513 512

Additional paid-in capital 227,061 225,585

Retained earnings 336,060 329,668

Unallocated common stock of Employee Stock

Ownership Plan (3,412) (3,470)

Unearned common stock of Restricted Stock

Awards (2,376) (2,684)

Common stock held by the Benefit Maintenance

Plan (7,979) (7,979)

Treasury stock (16,626,429 shares and

16,626,429 shares at March 31, 2011,

and December 31, 2010, respectively) (206,546) (206,546)

Accumulated other comprehensive loss, net (6,299) (6,352)

------------ ------------

TOTAL STOCKHOLDERS' EQUITY 337,022 328,734

------------ ------------

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 4,142,710 $ 4,040,295

============ ============

(1) While the loans within both of these categories are often considered

"commercial real estate" in nature, they are classified separately in

the statement above to provide further emphasis upon the discrete

composition of their underlying real estate collateral.

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars In thousands except per share amounts)

For the Three Months Ended

----------------------------------

December

March 31, 31, March 31,

2011 2010 2010

---------- ---------- ----------

Interest income:

Loans secured by real estate $ 50,629 $ 50,752 $ 50,122

Other loans 26 26 39

Mortgage-backed securities 1,452 1,621 2,271

Investment securities 316 268 407

Federal funds sold and other

short-term investments 772 857 742

---------- ---------- ----------

Total interest income 53,195 53,524 53,581

---------- ---------- ----------

Interest expense:

Deposits and escrow 6,785 7,005 7,593

Borrowed funds 11,367 11,385 13,222

---------- ---------- ----------

Total interest expense 18,152 18,390 20,815

---------- ---------- ----------

Net interest income 35,043 35,134 32,766

Provision for loan losses 1,426 3,262 3,447

---------- ---------- ----------

Net interest income after

provision for loan losses 33,617 31,872 29,319

---------- ---------- ----------

Non-interest income:

Service charges and other fees 763 748 936

Mortgage banking income (loss),

net 93 240 211

Other than temporary impairment

("OTTI") charge on securities (1) (63) (163) (166)

Gain (loss) on sale of other real

estate owned and other assets - 9 327

Gain (loss) on trading securities 46 46 242

Other 1,071 1,140 960

---------- ---------- ----------

Total non-interest income

(loss) 1,910 2,020 2,510

---------- ---------- ----------

Non-interest expense:

Compensation and benefits 9,727 9,300 8,886

Occupancy and equipment 2,689 2,276 2,258

Other 4,444 4,026 4,548

---------- ---------- ----------

Total non-interest expense 16,860 15,602 15,692

---------- ---------- ----------

Income before taxes 18,667 18,290 16,137

Income tax expense 7,587 7,730 6,667

---------- ---------- ----------

Net Income $ 11,080 $ 10,560 $ 9,470

========== ========== ==========

Earnings per Share:

Basic $ 0.33 $ 0.32 $ 0.29

========== ========== ==========

Diluted $ 0.33 $ 0.31 $ 0.28

========== ========== ==========

Average common shares outstanding

for Diluted EPS 33,725,726 33,538,319 33,249,082

(1) Total OTTI charges on securities were $216 during the three months

ended March 31, 2010. The non-credit component of OTTI was $50 during

the three months ended March 31, 2010. There were no non-credit OTTI

charges recognized during the three months ended March 31, 2011 and

December 31, 2010, respectively.

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED SELECTED FINANCIAL HIGHLIGHTS

(Dollars In thousands except per share amounts)

For the Three Months Ended

-------------------------------------

March 31, December 31, March 31,

2011 2010 2010

----------- ----------- -----------

Performance Ratios (Based upon

Reported Earnings):

Reported EPS (Diluted) $ 0.33 $ 0.31 $ 0.28

Return on Average Assets 1.08% 1.05% 0.94%

Return on Average Stockholders'

Equity 13.31% 12.94% 12.59%

Return on Average Tangible

Stockholders' Equity 15.63% 15.29% 15.17%

Net Interest Spread 3.38% 3.51% 3.23%

Net Interest Margin 3.62% 3.71% 3.46%

Non-interest Expense to Average

Assets 1.65% 1.55% 1.56%

Efficiency Ratio 45.60% 41.87% 45.00%

Effective Tax Rate 40.64% 42.26% 41.31%

Book Value and Tangible Book Value

Per Share:

Stated Book Value Per Share $ 9.72 $ 9.50 $ 8.97

Tangible Book Value Per Share 8.29 8.07 7.49

Average Balance Data:

Average Assets $ 4,089,222 $ 4,016,457 $ 4,015,428

Average Interest Earning Assets 3,872,270 3,789,755 3,790,014

Average Stockholders' Equity 332,946 326,529 300,874

Average Tangible Stockholders'

Equity 283,473 276,184 249,781

Average Loans 3,470,051 3,454,730 3,447,529

Average Deposits 2,368,300 2,353,411 2,247,985

Asset Quality Summary:

Net charge-offs $ 980 $ 1,211 $ 769

Non-accrual Loans 19,200 20,168 29,520

Nonperforming Loans/ Total Loans 0.56% 0.58% 0.85%

Nonperforming Assets (1) 19,770 20,732 30,936

Nonperforming Assets/Total Assets 0.48% 0.51% 0.75%

Allowance for Loan Loss/Total Loans 0.57% 0.55% 0.71%

Allowance for Loan

Loss/Nonperforming Loans 102.41% 95.03% 83.40%

Loans Delinquent 30 to 89 Days at

period end $ 12,103 $ 21,483 $ 19,688

Regulatory Capital Ratios:

Consolidated Tangible Stockholders'

Equity to Tangible Assets at period

end 7.04% 7.01% 6.35%

Tangible Capital Ratio (Bank Only) 8.21% 8.22% 7.77%

Leverage Capital Ratio (Bank Only) 8.21% 8.22% 7.77%

Risk Based Capital Ratio (Bank Only) 12.28% 11.95% 11.79%

(1) Amount comprised of total non-accrual loans, other real estate owned

and the recorded balance of two pooled bank trust preferred security

investments for which the Bank has not received any contractual

payments of interest or principal in over 90 days.

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED AVERAGE BALANCES AND NET INTEREST INCOME

(Dollars In thousands)

For the Three Months Ended

-----------------------------------

March 31, 2011

-----------------------------------

Average

Average Yield/

Balance Interest Cost

----------- ---------- ----------

Assets:

Interest-earning assets:

Real estate loans $ 3,468,902 $ 50,629 5.84%

Other loans 1,149 26 9.05

Mortgage-backed securities 129,635 1,452 4.48

Investment securities 134,299 316 0.94

Other short-term investments 138,285 772 2.23

----------- ---------- ----------

Total interest earning assets 3,872,270 $ 53,195 5.49%

----------- ----------

Non-interest earning assets 216,952

-----------

Total assets $ 4,089,222

===========

Liabilities and Stockholders' Equity:

Interest-bearing liabilities:

Interest Bearing Checking $ 99,305 $ 110 0.45%

Money Market accounts 732,274 1,258 0.70

Savings accounts 333,129 193 0.23

Certificates of deposit 1,068,006 5,224 1.98

----------- ---------- ----------

Total interest bearing

deposits 2,232,714 6,785 1.23

Borrowed Funds 1,256,205 11,367 3.67

----------- ---------- ----------

Total interest-bearing

liabilities 3,488,919 $ 18,152 2.11%

----------- ---------- ----------

Non-interest bearing checking

accounts 135,586

Other non-interest-bearing

liabilities 131,771

-----------

Total liabilities 3,756,276

Stockholders' equity 332,946

-----------

Total liabilities and stockholders'

equity $ 4,089,222

===========

Net interest income $ 35,043

==========

Net interest spread 3.38%

==========

Net interest-earning assets $ 383,351

===========

Net interest margin 3.62%

==========

Ratio of interest-earning assets

to interest-bearing liabilities 110.99%

==========

Deposits (including non-interest

bearing checking accounts) $ 2,368,300 $ 6,785 1.16%

Interest earning assets (excluding

prepayment and other fees) 5.56%

For the Three Months Ended

----------------------------------

December 31, 2010

----------------------------------

Average

Average Yield/

Balance Interest Cost

----------- ---------- ----------

Assets:

Interest-earning assets:

Real estate loans $ 3,453,522 $ 50,752 5.88%

Other loans 1,208 26 8.61

Mortgage-backed securities 148,032 1,621 4.38

Investment securities 82,288 268 1.30

Other short-term investments 104,705 857 3.27

----------- ---------- ----------

Total interest earning assets 3,789,755 $ 53,524 5.65%

----------- ----------

Non-interest earning assets 226,702

-----------

Total assets $ 4,016,457

===========

Liabilities and Stockholders' Equity:

Interest-bearing liabilities:

Interest Bearing Checking $ 99,464 $ 129 0.51%

Money Market accounts 727,566 1,202 0.66

Savings accounts 321,825 206 0.25

Certificates of deposit 1,073,640 5,468 2.02

----------- ---------- ----------

Total interest bearing

deposits 2,222,495 7,005 1.25

Borrowed Funds 1,194,118 11,385 3.78

----------- ---------- ----------

Total interest-bearing

liabilities 3,416,613 $ 18,390 2.14%

----------- ---------- ----------

Non-interest bearing checking

accounts 130,916

Other non-interest-bearing

liabilities 142,399

-----------

Total liabilities 3,689,928

Stockholders' equity 326,529

-----------

Total liabilities and stockholders'

equity $ 4,016,457

===========

Net interest income $ 35,134

==========

Net interest spread 3.51%

==========

Net interest-earning assets $ 373,142

===========

Net interest margin 3.71%

==========

Ratio of interest-earning assets

to interest-bearing liabilities 110.92%

==========

Deposits (including non-interest

bearing checking accounts) $ 2,353,411 $ 7,005 1.18%

Interest earning assets (excluding

prepayment and other fees) 5.56%

For the Three Months Ended

----------------------------------

March 31, 2010

----------------------------------

Average

Average Yield/

Balance Interest Cost

----------- ---------- ----------

Assets:

Interest-earning assets:

Real estate loans $ 3,446,103 $ 50,122 5.82%

Other loans 1,426 39 10.94

Mortgage-backed securities 206,466 2,271 4.40

Investment securities 57,159 407 2.85

Other short-term investments 78,860 742 3.76

----------- ---------- ----------

Total interest earning assets 3,790,014 $ 53,581 5.65%

----------- ----------

Non-interest earning assets 225,414

-----------

Total assets $ 4,015,428

===========

Liabilities and Stockholders' Equity:

Interest-bearing liabilities:

Interest Bearing Checking $ 104,117 $ 182 0.71%

Money Market accounts 716,696 1,710 0.97

Savings accounts 302,151 200 0.27

Certificates of deposit 1,015,951 5,501 2.20

----------- ---------- ----------

Total interest bearing

deposits 2,138,915 7,593 1.44

Borrowed Funds 1,344,911 13,222 3.99

----------- ---------- ----------

Total interest-bearing

liabilities 3,483,826 $ 20,815 2.42%

----------- ---------- ----------

Non-interest bearing checking

accounts 109,070

Other non-interest-bearing

liabilities 121,658

-----------

Total liabilities 3,714,554

Stockholders' equity 300,874

-----------

Total liabilities and stockholders'

equity $ 4,015,428

===========

Net interest income $ 32,766

==========

Net interest spread 3.23%

==========

Net interest-earning assets $ 306,188

===========

Net interest margin 3.46%

==========

Ratio of interest-earning assets

to interest-bearing liabilities 108.79%

==========

Deposits (including non-interest

bearing checking accounts) $ 2,247,985 $ 7,593 1.37%

Interest earning assets (excluding

prepayment and other fees) 5.62%

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED SCHEDULE OF NON-PERFORMING ASSETS AND TROUBLED DEBT

RESTRUCTURINGS

(Dollars In thousands)

At March 31, At December 31, At March 31,

Non-Performing Loans 2011 2010 2010

----------- ----------- ------------

One- to four-family and

cooperative apartment $ 62 $ 223 $ 705

Multifamily residential and

mixed use (1) 5,451 8,654 24,099

Commercial real estate (1) 13,667 11,274 4,694

Other 20 17 22

----------- ----------- ------------

Total Non-Performing Loans (2) $ 19,200 $ 20,168 $ 29,520

----------- ----------- ------------

Other Non-Performing Assets

Other real estate owned (3) - - 707

Pooled bank trust preferred

securities 570 564 709

----------- ----------- ------------

Total Non-Performing Assets $ 19,770 $ 20,732 $ 30,936

----------- ----------- ------------

Troubled Debt Restructurings

not included in non-performing

loans

Multifamily residential and

mixed use 2,090 2,098

Commercial real estate 8,729 8,736 -

Construction - - -

Mixed Use Commercial 1,582 1,588 1,040

Other - - -

----------- ----------- ------------

Total Troubled Debt

Restructurings ("TDRs") (1) $ 12,401 $ 12,422 $ 1,040

----------- ----------- ------------

(1) While the loans within both of these categories are often considered

"commercial real estate" in nature, they are classified separately in

the statement above to provide further emphasis upon the discrete

composition of their underlying real estate collateral.

(2) Total non-performing loans include some loans that have been modified

in a manner that would meet the criteria for a TDR. These non-accruing

TDR's, which totaled $7.4 million at March 31, 2011, $10.1 million at

December 31, 2010 and $15.7 million at March 31, 2010, respectively,

Are included in the non-performing loan table, but excluded from the

TDR amount shown above.

(3) Amount was fully comprised of multifamily residential loans at

March 31, 2010.

PROBLEM ASSETS AS A PERCENTAGE OF TANGIBLE CAPITAL AND RESERVES

At March 31, At December 31,

2011 2010

----------- -----------

Total Non-Performing Assets $ 19,770 $ 20,732

Loans over 90 days past due on

accrual status 4,033 (4) 8,340

----------- -----------

PROBLEM ASSETS $ 23,803 $ 29,072

----------- -----------

Tier 1 Capital - Dime Savings

Bank of Williamsburgh $ 334,234 $ 326,554

Allowance for loan losses 19,663 19,166

----------- -----------

TANGIBLE CAPITAL PLUS

RESERVES $ 353,897 $ 345,720

----------- -----------

PROBLEM ASSETS AS A PERCENTAGE

OF TANGIBLE CAPITAL AND

RESERVES 6.7% 8.4%

(4) These loans are expected to be either satisfied or re-financed during

2011, and are not expected to result in any loss of contractual

principal or interest. These loans are not included in non-performing

loans.

Contact: Kenneth Ceonzo Director of Investor Relations

718-782-6200 extension 8279

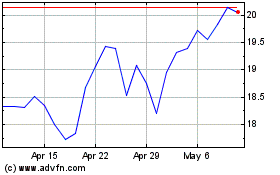

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Sep 2024 to Oct 2024

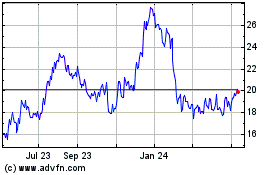

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Oct 2023 to Oct 2024