Dime Community Bancshares, Inc. (NASDAQ: DCOM) (the "Company"), the

parent company of The Dime Savings Bank of Williamsburgh ("Dime"),

today reported consolidated net income of $10.0 million, or 30

cents per diluted share, for the quarter ended June 30, 2010

compared to $9.5 million, or 28 cents per diluted share, for the

quarter ended March 31, 2010 and $6.9 million, or 21 cents per

diluted share, for the quarter ended June 30, 2009.

HIGHLIGHTS FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2010

-- Total assets increased by $34.3 million to $4.15 billion at

June 30, 2010, as the Company increased its liquidity position,

which will provide greater flexibility in managing its balance

sheet for the remainder of 2010.

-- Net interest margin was 3.35%, compared to 3.46% in the March 2010

quarter. The average cost of deposits declined 4 basis points to 1.33%

from 1.37% during the March 2010 quarter.

-- Total loan credit costs were $3.8 million, or 9 cents per share after

taxes.

-- The Bank disposed of $32.2 million of non-performing loans held either

in its own portfolio or its portfolio of loans sold to Fannie Mae with

recourse obligation.

-- The disposal of $14.4 million of non-performing portfolio loans led to

a decline in non-performing assets to $19.6 million, or 0.47% of total

assets at June 30, 2010. Loans sold to Fannie Mae with recourse that

were delinquent 90 days or more declined from $16.4 million to

$618,000.

-- The allowance for loan losses increased to 124.9% of non-performing

loans at June 30, 2010.

-- Loans delinquent between 30 and 89 days decreased to $11.1 million at

June 30, 2010 compared to $19.7 million at March 31, 2010.

-- Real estate loan originations were $113.5 million, down from the

$146.4 million level in the March 2010 quarter, as the Bank was more

selective in making additions to the portfolio in the last quarter

given the aggressive pricing that began to characterize the multifamily

market.

-- Despite the asset growth experienced during the most recent quarter,

the Company's consolidated ratio of tangible capital to tangible assets

grew to 6.46% at June 30, 2010 from 6.35% at March 31, 2010.

The Company's earnings for the quarter ended June 30, 2010

reflected an after-tax other-than-temporary impairment ("OTTI")

charge of approximately $279,000 on two pooled bank trust preferred

securities, an additional after-tax charge of $98,000 on the

write-down of other real estate owned ("OREO") properties, and a

non-recurring addition of $292,000 to income tax expense to adjust

the deferred income tax benefit previously applied to the OTTI

charges recognized on several equity mutual fund investments.

Partially offsetting these items was a gain of $263,000 on the sale

of some mutual fund equity holdings on which the Company recognized

an OTTI charge in early 2009. The Company's earnings for the

quarter ended March 31, 2010 reflected an after-tax OTTI charge of

approximately $91,000 on three pooled bank trust preferred

securities, and an additional after-tax charge of $125,000 on the

write-down of OREO properties. Partially offsetting these items was

an after-tax gain of $160,000 on the sale of some mutual fund

equity holdings on which the Company recognized an OTTI charge in

early 2009. The Company's earnings for the quarter ended June 30,

2009 reflected an after-tax OTTI charge of approximately $486,000

on pooled bank trust preferred securities.

According to Vincent F. Palagiano, Chairman and Chief Executive

Officer of the Company, "We remain quite pleased by the operating

fundamentals that produced a 35% increase in core earnings per

share during the June 2010 quarter compared with the same quarter

of 2009. While net interest margin fell during the most recent

quarter, it reflected both our ongoing efforts to grow Individual

Retirement Account ("IRA") balances, as well as our election to

temporarily retain new deposits in liquid cash balances. IRAs,

which are looked upon as a very stable source of funding, have

grown 50% over the past 12 months, and the liquid cash balances are

expected to be prudently deployed during the remainder of 2010,

thus serving to benefit the net interest margin for the remainder

of the year."

Mr. Palagiano continued, "Non-performing assets declined over

35% during the June 2010 quarter, and were less than one-half of

one percent of total assets at June 30, 2010. The Company resolved

its two largest problematic borrower relationships during the

quarter ended June 30, 2010. In addition, delinquency levels

appear, at present, to be stabilizing, providing further evidence

that credit costs should remain manageable for the remainder of the

year."

Dime's net interest margin decreased to 3.35% during the quarter

ended June 30, 2010. Asset growth during the most recent quarter

was achieved at significantly lower average spreads than the 3.23%

level experienced during the March 2010 quarter, as management

retained a significant portion of the $132.4 million in deposit

balances gathered during the first six months of 2010 in liquid

cash balances, earning a negative interest rate spread. Overall,

the net interest margin of 3.35% realized during the June 2010

quarter remained far more favorable than the levels experienced

from 2005 through 2008, as the Bank continued to benefit from

historically low short-term interest rates. The Bank expects to

deploy a significant portion of the $164.7 million cash position

held at June 30, 2010 in a manner that should help to benefit the

net interest margin during the remainder of 2010.

Commercial Real Estate and Dime's Business Model

The term "commercial real estate" ("CRE") encompasses a variety

of collateral types. Dime's loan portfolio is collateralized

primarily by multifamily apartment buildings in New York City,

widely considered the least risky type of CRE. Further, significant

portions of these multifamily apartment buildings are subject to

rent regulation. In New York City, where residential vacancy rates

are low and there is limited available space to construct new

buildings, rent regulation has had the affect of keeping regulated

apartment rents below market rates. This factor enhances the

intrinsic value of Dime's already low-risk collateral, and,

management believes, is the primary reason for the Company's low

level of non-performing assets and delinquent loans compared to the

wider generic asset class designated as CRE.

NET INTEREST INCOME

Net interest income was $33.2 million during the June 2010

quarter, up $439,000 from the March 2010 quarter. An increase of

$171.7 million in the average balance of interest earning assets

more than offset a decline of 7 basis points in the net interest

spread between the yield on the Bank's interest earning assets and

the average cost of its interest bearing liabilities, accounting

for the growth in net interest income.

Net interest income exceeded the June 2009 quarterly level by

$6.9 million, driven by growth of 57 basis points in net interest

margin from the quarter ended June 30, 2009 to the quarter ended

June 30, 2010, reflecting declines of 71 basis points and 38 basis

points in the average cost of deposits and borrowings,

respectively, during the period.

Mr. Palagiano commented, "As we signaled in our previous

release, despite continued reductions in funding costs, the growth

in cash balances earning virtually no income served to reduce the

net interest margin experienced during the second quarter of 2010.

As we deploy these liquid funds during the remainder of 2010, we

anticipate that the net interest margin, which remains at a

historically favorable level, will improve."

PROVISION/ALLOWANCE FOR LOAN LOSSES AND PROBLEM PORTFOLIO

LOANS

Non-performing loans were $18.7 million at June 30, 2010

compared to $29.5 million at March 31, 2010 and $12.9 million at

June 30, 2009. As a percentage of total loans, non-performing loans

totaled 0.54% at June 30, 2010, compared to 0.85% at March 31, 2010

and 0.40% at June 30, 2009. Loans delinquent between 30 and 89 days

declined during the most recent quarter to $11.1 million as of June

30, 2010 from $19.7 million at March 31, 2010. Loans delinquent

between 30 and 89 days totaled $17.6 million at June 30, 2009.

Charge-offs recorded on problem loans totaled $5.0 million

during the June 2010 quarter, compared to $769,000 in the March

2010 quarter and $528,000 in the June 2009 quarter. Approximately

$4.0 million, or nearly 80% of the total charge-offs experienced

during the June 2010 quarter, related to the resolution of five

non-performing loans held by an individual borrower. Write-downs of

principal or escrow balances on two additional problem borrower

relationships accounted for $726,000 of the remaining $1.0 million

of charge-offs experienced during the June 2010 quarter.

The Company recorded a $3.8 million provision to its allowance

for loan losses during the quarter ended June 30, 2010, compared to

$3.4 million during the quarter ended March 31, 2010. A portion of

the $3.8 million provision recognized during the most recent

quarter related to the charge-offs recognized on the resolution of

problem loans during the quarter, while the majority reflected

increases to losses deemed likely to be realized on both existing

and newly added non-performing loans. Provisions totaled $2.3

million during the quarter ended June 30, 2009. Since the Company

had previously provided for a significant portion of the

charge-offs experienced in the most recent quarter, charge-offs

exceeded the $3.8 million provision during the June 2010

quarter.

Mr. Palagiano stated, "The sequential quarterly decline in

non-performing loans reflected our continued commitment to both

recognize likely potential losses on problem loans in a timely

manner, and dispose of problematic loans prudently and

expeditiously. While the increase in charge-offs resulted in an

increase in loan credit costs from the March 2010 quarter to the

June 2010 quarter, we are pleased to have resolved our two largest

problem borrower relationships during the most recent quarter and

to see our allowance for loan losses once again exceed 100% of our

non-performing loans at June 30, 2010."

The timing and severity of charge-offs are unpredictable. At

June 30, 2010, the allowance for loan losses was $23.4 million, or

125% of non-performing loans.

NON-INTEREST INCOME

OTTI, Gain on the Sale of Other Assets, and Gains on Trading

Assets

During the quarter ended June 30, 2010, the pre-tax credit

component of OTTI charges totaled $508,000, compared to $166,000

during the previous linked quarter. At June 30, 2010, six of Dime's

eight trust preferred securities were deemed to meet the criteria

for OTTI. The increase in the credit component of OTTI charges

primarily reflected an increase in payment deferrals during the

June 2010 quarter within the collateral pool underlying one of

Dime's eight trust preferred collateralized debt obligation

securities.

At June 30, 2010, Dime had failed to receive contractual

principal or interest payments on two trust preferred securities

with an aggregate recorded balance of $593,000 ($2.3 million

excluding $1.7 million of unrealized losses included in accumulated

other comprehensive loss). Both securities are classified as

non-performing assets. In addition at June 30, 2010, Dime did not

receive a small portion of the interest due on two trust preferred

securities having an aggregate recorded balance of $243,000

($547,000 excluding the $304,000 total non-credit component of

OTTI). The remaining four trust preferred securities, with a total

cost basis of $10.2 million net of credit-related OTTI, are current

on all contractual obligations.

During the March 2010 quarter, the Company transferred $1.4

million of mutual fund investments earmarked for the future

settlement of certain benefits earned under the Company's Benefit

Maintenance Plan ("BMP") from available for sale to trading, moving

a pre-tax gain of $242,000 from other comprehensive income into

reported earnings as a result of the transfer. The Company

recognized losses of $66,000 on the trading securities during the

quarter ended June 30, 2010, which were fully offset by a reduction

in a component of BMP benefits expense.

During the June 2010 quarter, the Company elected to change some

of the BMP earmarked mutual fund investments. As a result of this

election, the Company recognized net gains of $263,000 on the sale

of $2.1 million of BMP earmarked mutual funds. The sales proceeds

were fully deployed into the purchase of the newly elected BMP

earmarked mutual funds.

During the three months ended March 31, 2010, the Company sold

mutual funds totaling $769,000, recognizing a pre-tax gain of

$327,000 on the sale. This gain represented a recovery from the

cost basis of these mutual funds subsequent to the recognition of

OTTI charges during the March 2009 quarter.

During the quarter ended June 30, 2010, the Company sold an OREO

property at its recorded balance. During the quarter ended June 30,

2009, Dime sold a property held as OREO recognizing a pre-tax loss

of $92,000 on the sale. The Company recognized pre-tax write-downs

of OREO totaling $157,000 and $200,000, respectively, during the

quarters ended June 30, 2010 and March 31, 2010. These write-downs,

which are reflected in non-interest expense, were deemed warranted

in order to reduce the recorded balance of OREO to their likely

disposal value.

Mortgage Banking Income and Delinquent Serviced Loans

During the quarter ended June 30, 2010, the Company sold two

multifamily loans totaling $11.6 million to a third party financial

institution without recourse, recognizing a pre-tax gain of

$121,000 on the sale. Otherwise, loan sales were negligible during

the quarters ended June 30, 2010 and March 31, 2010 and were

limited to one- to four-family residential mortgage loans. During

the June 2009 quarter, Dime sold an 80% participation in

approximately $124 million of multifamily loans from its portfolio

to a third-party financial institution other than Fannie Mae. The

loans were sold at par and without recourse, and Dime recognized a

pre-tax gain of approximately $635,000 ($0.01 per share after tax)

on the sale, which was reflected in core earnings for the June 2009

quarter.

Mortgage banking income totaled $303,000 and $211,000 during the

quarters ended June 30, 2010 and March 31, 2010, respectively. The

increase from the March 2010 quarter to the June 2010 quarter

primarily reflected the aforementioned $121,000 gain recognized on

the sale of the two multifamily loans during the June 2010 quarter.

Mortgage banking income totaled $856,000 during the quarter ended

June 30, 2009, reflecting the aforementioned $635,000 gain as well

as approximately $200,000 in servicing fee income.

From December 2002 through February 2009, Dime sold

approximately $660 million of multifamily loans to Fannie Mae with

a recourse obligation. This portfolio had an outstanding remaining

principal balance of $404.5 million at June 30, 2010.

Within the Fannie Mae portfolio, loans delinquent 90 days or

more were $618,000 at June 30, 2010 compared to $16.4 million at

March 31, 2010. During the quarter ended June 30, 2010, Dime

disposed of five non-performing loans within this portfolio

totaling $14.2 million. At June 30, 2010, there were $2.9 million

of loans delinquent between 30 and 89 days within the pool of loans

serviced for Fannie Mae, compared to $4.6 million at March 31,

2010. At June 30, 2009, there were $1.8 million of loans delinquent

90 days or more, and $17.2 million of loans delinquent between 30

and 89 days within the pool of loans serviced for Fannie Mae.

Dime's first loss position for loans sold to Fannie Mae was

$18.7 million as of June 30, 2010, against which a reserve of $3.0

million existed on that date. This reserve approximated 0.74% of

the remaining principal balance of loans in the Fannie Mae pool as

of June 30, 2010, and probable losses related to the entire

remaining pool of loans sold with recourse to Fannie Mae are

reflected in the $3.0 million reserve balance. Additions to the

reserve for the first loss position are charged against mortgage

banking (non-interest) income.

Other Components of Non-Interest Income

Other components of non-interest income totaled $2.4 million

during the quarter ended June 30, 2010, an increase of $550,000

from $1.9 million during the March 2010 quarter and up $467,000

from the June 2009 quarter. The increases from both the March 2010

and June 2009 quarters resulted from an increase of $409,000 in

rental income on leased properties, as the Company modified the

income recognition on these leased properties from strictly cash

basis to a straight line accrual methodology.

NON-INTEREST EXPENSE

Non-interest expense was $15.8 million during the quarter ended

June 30, 2010, a slight increase from the March 2010 quarter.

During the June 2010 quarter, the stock benefit plan portion of

compensation and benefits expense increased $125,000 as a result of

new stock awards granted in April 2010. Occupancy and equipment

increased $390,000 primarily as a result of the full transition of

operating lease rental expense from a strictly cash basis to a

straight line accrual methodology. Offsetting this increase was a

one-time adjustment during the quarter ended March 31, 2010, of

approximately $460,000 to the manner of expense recognition on a

component of the Company's BMP.

Compared to the June 2009 quarter, non-interest expense

increased $466,000 during the quarter ended June 30, 2010, due

primarily to increases of $904,000 in compensation and benefits,

$766,000 in occupancy and equipment expense and $567,000 in other

expenses, that were partially offset by a $1.8 million special FDIC

insurance assessment recognized during the June 2009 quarter. The

increase in compensation and benefits expense reflected ongoing

staff salary increases, new stock plan awards made in April 2010

and an adjustment of approximately $350,000 related to revised

actuarial valuations on the defined benefit costs associated with

both the Company's Employee Retirement Plan and BMP. The growth in

occupancy and equipment expense was primarily attributable to

increased rental expense on leased branches, reflecting both the

aforementioned transition of expense recognition as well as two

additional lease agreements that commenced in 2010. The growth in

other expenses primarily reflected higher marketing costs of

$412,000.

INCOME TAX EXPENSE

The Company's customary consolidated effective tax rate

approximates 37%, and approximated such during the quarter ended

June 30, 2010. During the three months ended March 31, 2010, the

Company recognized gains totaling $569,000 on both the sale of

mutual funds and the transfer of mutual funds into trading. From a

tax perspective, since: (i) these events triggered the reversal of

deferred tax assets previously recognized when the Company recorded

OTTI charges in March 2009; and (ii) the deferred tax assets on the

OTTI charges were established at a long-term rate approximating 45%

(significantly in excess of the current consolidated 37% tax rate),

their reversal created a higher effective tax rate of 41.3% during

the March 2010 quarter. The Company recorded an adjustment of

$291,000 to income taxes during the June 2010 quarter, that

effectively reduced the deferred tax benefit associated with the

OTTI charges on the mutual fund investments from the 45% long-term

rate to the current 37% consolidated income tax rate. The impact of

the OTTI charges on the pooled trust preferred securities reduced

the book income tax rate below the customary consolidated rate for

the quarter ended June 30, 2009 to 35%.

BALANCE SHEET

Total assets increased $34.4 million, to $4.15 billion, from

March 31, 2010 to June 30, 2010. The increase in assets was

experienced primarily in cash and due from banks, as management

elected to maintain additional liquidity that it expects to utilize

prudently during the remainder of 2010.

Total liabilities increased by $28.2 million during the most

recent quarter, as a result of the addition of $127.2 million in

deposits. The growth in deposits was achieved in both money market

accounts and certificates of deposit ("CDs"). Mortgagor escrow

balances decreased $21.5 million during the most recent quarter as

a result of semi-annual payments made by Dime on the behalf of

borrowers during the 2nd and 4th quarters of each year. In May

2010, the Company also repaid its maturing $25.0 million

subordinated note originally issued in 2000. This note carried a

contractual coupon of 9.25%. The Company also repaid $44.2 million

of maturing FHLBNY advances with a weighted average cost of 3.69%,

electing not to replace them during the June 2010 quarter as a

result of the deposit inflows experienced.

Real Estate Lending and Loan Amortization

Real estate loan originations, which were $146.4 million during

the March 2010 quarter, totaled $113.5 million during the quarter

ended June 30, 2010 and $111.4 million during the quarter ended

June 30, 2009. The average rate on real estate loan originations

during the June 2010 quarter was 5.52%, compared to 5.60% during

the quarter ended March 31, 2010 and 6.08% during the quarter ended

June 30, 2009.

Real estate loan amortization approximated 13% of the real

estate loan portfolio on an annualized basis during the quarter

ended June 30, 2010, up from 9% during each of the quarterly

periods ended March 31, 2010 and June 30, 2009. The increase in the

amortization rate reflected growth in refinancing activity on loans

approaching their contractual repricing date.

Deposits

Deposits increased $127.2 million from March 31, 2010 to June

30, 2010. Core deposits (i.e., non-CDs) grew $68.9 million during

this period fueled by an additional $56.8 million of money market

balances. CDs increased $58.3 million during the three months ended

June 30, 2010, due primarily to the success of a promotional

deposit gathering program on 15-month IRA CDs. As a result of a

multi-year effort, IRA deposits increased from $106.5 million, or

5.30% of total deposits, as of December 31, 2006, to $262.0

million, or 10.7% of total deposits, at June 30, 2010.

During the June 2010 quarter, the rates required by depositors

on medium-term CDs as well as those available on medium term

advances from the FHLBNY remained well below the yields available

on the Bank's primary lending products, providing an opportunity

for the Bank to continue to extend the average duration of its

liabilities while maintaining its net interest margin at a

favorable level. Dime has extended the average duration of CDs from

approximately 8.6 months at June 30, 2009 to approximately 15.6

months at June 30, 2010. Depending upon continued favorable market

conditions, the mix of retail versus wholesale funding will be

managed opportunistically. Marketing efforts during the first six

months of 2010 continued to support sales of checking accounts and

medium-term CDs. While these promotional activities are expected to

continue, the significant liquidity level accumulated at June 30,

2010 should help management maintain pricing discipline on deposits

during the remainder of 2010.

During the most recent quarter, Dime opened its 24th retail

banking office, in Cedarhurst, New York. Despite adding the new

branch, average deposits per branch were $101.7 million at June 30,

2010, above the $100.5 million level at March 31, 2010, as well as

the $99.7 million level at June 30, 2009. Core deposits comprised

54% of total deposits at June 30, 2010, March 31, 2010 and June 30,

2009. The loan-to-deposit ratio was 142% at June 30, 2010,

unchanged from June 30, 2009 and down from 151% at March 31, 2010.

Dime's next de novo branch will be located in Garden City Park, New

York, and is anticipated to open in September 2010.

Stockholders' Equity

Stockholders' equity at June 30, 2010 totaled $314.7 million, or

7.59% of total assets, compared to $308.5 million, or 7.50% of

total assets, at March 31, 2010. After dividends, the Company's

tangible stockholders' equity increased to $264.1 million at June

30, 2010, from $257.6 million at March 31, 2010. The quarterly cash

dividend declared on July 22, 2010 represented a payout ratio of

47% of second quarter 2010 core earnings. At June 30, 2010, the

consolidated tangible stockholders' equity ratio was 6.46% of

tangible assets and tangible book value per share was $7.65.

The Company did not participate in the TARP program and thus has

no TARP capital.

There were no stock repurchases during the quarter ended June

30, 2010. As of June 30, 2010, the Company had an additional

1,124,549 shares remaining eligible for repurchase under its

twelfth stock repurchase program, approved in June 2007.

For the quarter ended June 30, 2010, the reported returns on

average stockholders' equity and average tangible equity were 12.8%

and 15.3%, respectively. The core returns on average stockholders'

equity and average tangible equity were 13.3% and 15.9%,

respectively. Core returns primarily exclude OTTI charges, gains on

the sale of securities, write-downs of OREO, other significant

non-recurring transactions and related income tax effects. Finally,

the core cash return on average tangible stockholders' equity (the

fundamental measure of new internally generated capital) was

17.1%.

OUTLOOK

The average cost of deposits decreased to 1.33% during the June

2010 quarter from 1.37% during the March 2010 quarter, as Dime

continued to take advantage of historically low short-term interest

rates to maintain pricing discipline on its deposits. Deposit

funding costs should remain at their historically low level for the

remainder of 2010.

Amortization rates (including prepayments and loan refinancing

activity), which approximated 13% on an annualized basis during the

most recent quarter, are expected to remain in the 10% to 15% range

during the third quarter of 2010.

Dime has no additional FDIC special assessments forecasted for

the third quarter of 2010.

At June 30, 2010, the loan commitment pipeline was approximately

$80.8 million, comprised primarily of multifamily residential

properties, with an approximate weighted average rate of 5.45%.

Operating expenses for the September 2010 quarter are expected

to approximate $15.2 million, assuming no further FDIC special

assessments or increases in deposit insurance premiums.

Loan credit costs were $3.8 million during the June 2010

quarter, $3.4 million during the March 2010 quarter, $4.0 million

during the December 2009 quarter and $2.3 million during the

September 2009 quarter. Management assumes that credit costs will

remain range bound for the near term, as the Bank continues its

practice of timely loss recognition and disposal of problematic

loans in both a judicious and expeditious manner.

ABOUT DIME COMMUNITY BANCSHARES

The Company (NASDAQ: DCOM) had $4.15 billion in consolidated

assets as of June 30, 2010, and is the parent company of Dime. Dime

was founded in 1864, is headquartered in Brooklyn, New York, and

currently has twenty-four branches located throughout Brooklyn,

Queens, the Bronx and Nassau County, New York. More information on

the Company and Dime can be found on the Dime's Internet website at

www.dime.com.

This News Release contains a number of forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended (the "Exchange Act"). These statements may be

identified by use of words such as "anticipate," "believe,"

"could," "estimate," "expect," "intend," "may," "outlook," "plan,"

"potential," "predict," "project," "should," "will," "would" and

similar terms and phrases, including references to assumptions.

Forward-looking statements are based upon various assumptions

and analyses made by the Company in light of management's

experience and its perception of historical trends, current

conditions and expected future developments, as well as other

factors it believes are appropriate under the circumstances. These

statements are not guarantees of future performance and are subject

to risks, uncertainties and other factors (many of which are beyond

the Company's control) that could cause actual results to differ

materially from future results expressed or implied by such

forward-looking statements. These factors include, without

limitation, the following: the timing and occurrence or

non-occurrence of events may be subject to circumstances beyond the

Company's control; there may be increases in competitive pressure

among financial institutions or from non-financial institutions;

changes in the interest rate environment may reduce interest

margins; changes in deposit flows, loan demand or real estate

values may adversely affect the business of Dime; changes in

accounting principles, policies or guidelines may cause the

Company's financial condition to be perceived differently; changes

in corporate and/or individual income tax laws may adversely affect

the Company's financial condition or results of operations; general

economic conditions, either nationally or locally in some or all

areas in which the Company conducts business, or conditions in the

securities markets or the banking industry may be less favorable

than the Company currently anticipates; legislation or regulatory

changes may adversely affect the Company's business; technological

changes may be more difficult or expensive than the Company

anticipates; success or consummation of new business initiatives

may be more difficult or expensive than the Company anticipates; or

litigation or other matters before regulatory agencies, whether

currently existing or commencing in the future, may delay the

occurrence or non-occurrence of events longer than the Company

anticipates.

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(In thousands except share amounts)

June 30, December 31, March 31,

2010 2009 2010

----------- ----------- -----------

ASSETS:

Cash and due from banks $ 164,655 $ 39,338 $ 114,069

Investment securities held to

maturity 7,165 7,240 7,306

Investment securities available for

sale 40,956 43,162 53,193

Trading securities 1,329 - 1,390

Mortgage-backed securities available

for sale 184,723 224,773 200,610

Federal funds sold and other

short-term investments 45,455 3,785 5,847

Real Estate Loans:

One-to-four family and

cooperative apartment 123,434 131,475 128,146

Multifamily and underlying

cooperative (1) 2,469,271 2,377,278 2,477,963

Commercial real estate (1) 837,523 834,724 844,998

Construction and land acquisition 26,127 44,544 29,830

Unearned discounts and net

deferred loan fees 4,476 4,017 4,239

----------- ----------- -----------

Total real estate loans 3,460,831 3,392,038 3,485,176

----------- ----------- -----------

Other loans 4,211 3,221 2,551

Allowance for loan losses (23,350) (21,505) (24,620)

----------- ----------- -----------

Total loans, net 3,441,692 3,373,754 3,463,107

----------- ----------- -----------

Loans held for sale 692 416 -

Premises and fixed assets, net 30,491 29,841 29,897

Federal Home Loan Bank of New York

capital stock 53,068 54,083 54,983

Other real estate owned, net 350 755 707

Goodwill 55,638 55,638 55,638

Other assets 122,081 119,489 127,193

----------- ----------- -----------

TOTAL ASSETS $ 4,148,295 $ 3,952,274 $ 4,113,940

=========== =========== ===========

LIABILITIES AND STOCKHOLDERS'

EQUITY:

Deposits:

Non-interest bearing checking $ 109,985 $ 106,449 $ 103,676

Interest Bearing Checking 106,226 114,416 109,199

Savings 314,747 302,340 305,955

Money Market 791,413 708,578 734,652

----------- ----------- -----------

Sub-total 1,322,371 1,231,783 1,253,482

----------- ----------- -----------

Certificates of deposit 1,117,444 985,053 1,059,128

----------- ----------- -----------

Total Due to Depositors 2,439,815 2,216,836 2,312,610

----------- ----------- -----------

Escrow and other deposits 77,699 65,895 99,187

Securities sold under agreements to

repurchase 195,000 230,000 195,000

Federal Home Loan Bank of New York

advances 1,020,525 1,009,675 1,064,675

Subordinated Notes Sold - 25,000 25,000

Trust Preferred Notes Payable 70,680 70,680 70,680

Other liabilities 29,849 39,415 38,248

----------- ----------- -----------

TOTAL LIABILITIES 3,833,568 3,657,501 3,805,400

----------- ----------- -----------

STOCKHOLDERS' EQUITY:

Common stock ($0.01 par, 125,000,000

shares authorized, 51,151,115

shares and 51,131,784 shares issued

at June 30, 2010 and December 31, 2009,

respectively and 34,547,769 shares and

34,395,531 shares outstanding at

June 30, 2010 and December 31, 2009,

respectively) 511 511 511

Additional paid-in capital 223,802 214,654 223,046

Retained earnings 317,088 306,787 311,748

Unallocated common stock of Employee

Stock Ownership Plan (3,586) (3,701) (3,644)

Unearned common stock of Restricted

Stock Awards (3,573) (2,505) (2,114)

Common stock held by the Benefit

Maintenance Plan (7,979) (8,007) (7,979)

Treasury stock (16,603,346 shares

and 16,736,253 shares at June 30,

2010, and December 31, 2009,

respectively) (206,259) (207,884) (208,036)

Accumulated other comprehensive

loss, net (5,277) (5,082) (4,992)

----------- ----------- -----------

TOTAL STOCKHOLDERS' EQUITY 314,727 294,773 308,540

----------- ----------- -----------

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY $ 4,148,295 $ 3,952,274 $ 4,113,940

=========== =========== ===========

(1) In reference to the discussion on page 2 of this release, while the

loans within both of these categories are often considered "commercial

real estate" in nature, they are classified separately in the statement

above to provide further emphasis upon the discrete composition of

their underlying real estate collateral.

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars In thousands except per share amounts)

For the Three Months Ended

----------------------------------

June 30, March 31, June 30,

2010 2010 2009

---------- ---------- ----------

Interest income:

Loans secured by real estate $ 51,068 $ 50,122 $ 47,662

Other loans 30 39 37

Mortgage-backed securities 2,082 2,271 2,969

Investment securities 312 407 194

Federal funds sold and

other short-term investments 681 742 858

---------- ---------- ----------

Total interest income 54,173 53,581 51,720

---------- ---------- ----------

Interest expense:

Deposits and escrow 8,010 7,593 11,718

Borrowed funds 12,958 13,222 13,713

---------- ---------- ----------

Total interest expense 20,968 20,815 25,431

---------- ---------- ----------

Net interest income 33,205 32,766 26,289

Provision for loan losses 3,834 3,447 2,252

---------- ---------- ----------

Net interest income after

provision for loan losses 29,371 29,319 24,037

---------- ---------- ----------

Non-interest income:

Service charges and other fees 945 936 879

Mortgage banking income (loss), net 303 211 856

Other than temporary impairment

("OTTI") charge on securities (1) (508) (166) (886)

Gain (loss) on sale of other real

estate owned and other assets 282 327 (92)

Gain (loss) on trading securities (66) 242 -

Other 1,501 960 1,101

---------- ---------- ----------

Total non-interest income (loss) 2,457 2,510 1,858

---------- ---------- ----------

Non-interest expense:

Compensation and benefits 8,522 8,886 7,618

Occupancy and equipment 2,648 2,258 1,882

Other 4,621 4,548 5,825

---------- ---------- ----------

Total non-interest expense 15,791 15,692 15,325

---------- ---------- ----------

Income before taxes 16,037 16,137 10,570

Income tax expense 6,033 6,667 3,654

---------- ---------- ----------

Net Income $ 10,004 $ 9,470 $ 6,916

========== ========== ==========

Earnings per Share:

Basic $ 0.30 $ 0.29 $ 0.21

========== ========== ==========

Diluted $ 0.30 $ 0.28 $ 0.21

========== ========== ==========

Average common shares outstanding for

Diluted EPS 33,341,885 33,249,082 33,026,554

For the Six Months Ended

----------------------

June 30, June 30,

2010 2009

---------- ----------

Interest income:

Loans secured by real estate $ 101,191 $ 95,991

Other loans 68 74

Mortgage-backed securities 4,354 6,249

Investment securities 719 439

Federal funds sold and

other short-term investments 1,423 1,361

---------- ----------

Total interest income 107,755 104,114

---------- ----------

Interest expense:

Deposits and escrow 15,603 25,930

Borrowed funds 26,181 27,755

---------- ----------

Total interest expense 41,784 53,685

---------- ----------

Net interest income 65,971 50,429

Provision for loan losses 7,281 4,892

---------- ----------

Net interest income after

provision for loan losses 58,690 45,537

---------- ----------

Non-interest income:

Service charges and other fees 1,881 1,742

Mortgage banking income (loss),

net 513 (312)

Other than temporary impairment

("OTTI") charge on securities (1) (673) (5,926)

Gain (loss) on sale of other real

estate owned and other assets 608 339

Gain (loss) on trading securities 177 -

Other 2,461 1,969

---------- ----------

Total non-interest income

(loss) 4,967 (2,188)

---------- ----------

Non-interest expense:

Compensation and benefits 17,409 15,418

Occupancy and equipment 4,906 3,968

Other 9,167 9,547

---------- ----------

Total non-interest expense 31,482 28,933

---------- ----------

Income before taxes 32,175 14,416

Income tax expense 12,701 4,650

---------- ----------

Net Income $ 19,474 $ 9,766

========== ==========

Earnings per Share:

Basic $ 0.59 $ 0.30

========== ==========

Diluted $ 0.58 $ 0.30

========== ==========

Average common shares outstanding for

Diluted EPS 33,295,701 32,956,106

(1) Total OTTI charges on securities were $521, $216 and $1,160 during the

three months ended June 30, 2010, March 31, 2010 and June 30, 2009,

respectively, and $736 and $7,264 during the six months ended June

30, 2010 and 2009, respectively. The non-credit component of

OTTI recognized in accumulated other comprehensive loss was $13, $50

and $274 during the three months ended June 30, 2010, March 31, 2010

and June 30, 2009, respectively, and $63 and $1,338 during the six

months ended June 30, 2010 and 2009, respectively.

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

Unaudited Core Earnings and Core Cash Earnings Reconciliations

(Dollars In thousands except per share amounts)

Core earnings and related data are "Non-GAAP Disclosures." These

disclosures present information which management considers useful to the

readers of this report since they present a measure of the results of the

Company's ongoing operations during the period (exclusive of gains or

losses on sales of securities and other real estate owned and other

material non-recurring items).

Core cash earnings and related data are also "Non-GAAP Disclosures." These

disclosures present information which management considers useful to the

readers of this report since they present a measure of the tangible equity

generated from operations during each period presented. Tangible

stockholders' equity is derived from stockholders' equity, with various

adjustment items that are based upon standards of the Company's primary

regulator, the Office of Thrift Supervision. Tangible stockholders' equity

generation is a significant financial measure since banks are subject to

regulatory requirements involving the maintenance of minimum tangible

capital levels. A reconciliation between GAAP stockholders' equity (GAAP

capital) and tangible stockholders' equity (regulatory capital) can be

found in the Company's Form 10-K for the year ended December 31, 2009.

The following tables present a reconciliation of GAAP net income and both

core earnings and core cash earnings, as well as financial performance

ratios determined based upon core earnings and core cash earnings, for each

of the periods presented:

For the Three Months Ended

----------------------------

June 30, March 31, June 30,

2010 2010 2009

-------- -------- --------

Net income as reported $ 10,004 $ 9,470 $ 6,916

Loss on sales or writedowns of other real

estate owned 157 200 92

OTTI charges on equity mutual funds - - -

OTTI charges on trust preferred securities 508 166 886

Gain on sale of securities (282) (327) -

Expense associated with prepayment of FHLBNY

advances - - -

Non-recurring income tax adjustment 292 - -

Tax effect of adjustments and other

non-recurring tax items (271) 16 (442)

-------- -------- --------

Core Earnings $ 10,408 $ 9,525 $ 7,452

-------- -------- --------

Cash Earnings Additions:

Non-cash stock benefit plan expense 779 660 665

-------- -------- --------

Core Cash Earnings $ 11,187 $ 10,185 $ 8,117

-------- -------- --------

Performance Ratios (Based upon Core

Earnings):

Core EPS (Diluted) $ 0.31 $ 0.29 $ 0.23

Core Return on Average Assets 0.99% 0.95% 0.74%

Core Return on Average Stockholders' Equity 13.32% 12.66% 10.60%

Core Return on Average Tangible Stockholders'

Equity 15.91% 15.25% 12.77%

Core Cash EPS (Diluted) $ 0.34 $ 0.31 $ 0.25

Core Cash Return on Average Assets 1.06% 1.01% 0.81%

Core Cash Return on Average Tangible

Stockholders' Equity 17.10% 16.31% 13.91%

For the Six Months Ended

------------------

June 30, June 30,

2010 2009

-------- --------

Net income as reported $ 19,474 $ 9,766

Loss on sales or writedowns of other real

estate owned 357 92

OTTI charges on equity mutual funds - 3,063

OTTI charges on trust preferred securities 673 2,863

Gain on sale of securities (608) (431)

Expense associated with prepayment of FHLBNY

advances - 185

Non-recurring income tax adjustment 291 -

Tax effect of adjustments and other

non-recurring tax items (254) (2,627)

-------- --------

Core Earnings $ 19,933 $ 12,911

-------- --------

Cash Earnings Additions:

Non-cash stock benefit plan expense 1,439 1,305

-------- --------

Core Cash Earnings $ 21,372 $ 14,216

-------- --------

Performance Ratios (Based upon Core

Earnings):

Core EPS (Diluted) $ 0.60 $ 0.39

Core Return on Average Assets 0.97% 0.64%

Core Return on Average Stockholders' Equity 13.00% 9.22%

Core Return on Average Tangible Stockholders'

Equity 15.60% 11.06%

Core Cash EPS (Diluted) $ 0.64 $ 0.43

Core Cash Return on Average Assets 1.04% 0.71%

Core Cash Return on Average Tangible

Stockholders' Equity 16.73% 12.18%

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED SELECTED FINANCIAL HIGHLIGHTS

(Dollars In thousands except per share amounts)

For the Three Months Ended

-------------------------------------

June 30, March 31, June 30,

2010 2010 2009

----------- ----------- -----------

Performance Ratios (Based upon

Reported Earnings):

Reported EPS (Diluted) $ 0.30 $ 0.28 $ 0.21

Return on Average Assets 0.95% 0.94% 0.69%

Return on Average Stockholders'

Equity 12.80% 12.59% 9.84%

Return on Average Tangible

Stockholders' Equity 15.29% 15.17% 11.85%

Net Interest Spread 3.16% 3.23% 2.54%

Net Interest Margin 3.35% 3.46% 2.78%

Non-interest Expense to Average

Assets 1.50% 1.56% 1.53%

Efficiency Ratio 43.92% 45.00% 52.62%

Effective Tax Rate 37.62% 41.31% 34.57%

Performance Ratios (Based upon Core

Earnings):

Core EPS (Diluted) $ 0.31 $ 0.29 $ 0.23

Core Return on Average Assets 0.99% 0.95% 0.74%

Core Return on Average Stockholders'

Equity 13.32% 12.66% 10.60%

Core Return on Average Tangible

Stockholders' Equity 15.91% 15.25% 12.77%

Book Value and Tangible Book Value

Per Share:

Stated Book Value Per Share $ 9.11 $ 8.97 $ 8.24

Tangible Book Value Per Share 7.65 7.49 6.84

Average Balance Data:

Average Assets $ 4,211,629 $ 4,015,428 $ 4,011,473

Average Interest Earning Assets 3,961,750 3,790,014 3,786,577

Average Stockholders' Equity 312,634 300,874 281,202

Average Tangible Stockholders'

Equity 261,736 249,781 233,376

Average Loans 3,479,613 3,447,529 3,238,424

Average Deposits 2,419,758 2,247,985 2,298,966

Asset Quality Summary:

Net charge-offs $ 5,024 $ 769 $ 528

Nonperforming Loans 18,691 29,520 12,878

Nonperforming Loans/Total Loans 0.54% 0.85% 0.40%

Nonperforming Assets (1) 19,634 30,936 14,118

Nonperforming Assets/Total Assets 0.47% 0.75% 0.36%

Allowance for Loan Loss/Total Loans 0.67% 0.71% 0.62%

Allowance for Loan

Loss/Nonperforming Loans 124.93% 83.40% 155.23%

Loans Delinquent 30 to 89 Days at

period end $ 11,133 $ 19,688 $ 17,585

Regulatory Capital Ratios:

Consolidated Tangible Stockholders'

Equity to Tangible Assets at period end 6.46% 6.35% 6.00%

Tangible Capital Ratio (Bank Only) 7.70% 7.77% 7.63%

Leverage Capital Ratio (Bank Only) 7.70% 7.77% 7.63%

Risk Based Capital Ratio (Bank Only) 11.91% 11.79% 11.46%

For the Six Months Ended

------------------------

June 30, June 30,

2010 2009

----------- -----------

Performance Ratios (Based upon

Reported Earnings):

Reported EPS (Diluted) $ 0.58 $ 0.30

Return on Average Assets 0.95% 0.49%

Return on Average Stockholders'

Equity 12.70% 6.97%

Return on Average Tangible

Stockholders' Equity 15.24% 8.37%

Net Interest Spread 3.20% 2.39%

Net Interest Margin 3.40% 2.64%

Non-interest Expense to Average

Assets 1.53% 1.44%

Efficiency Ratio 44.45% 53.75%

Effective Tax Rate 39.47% 32.26%

Performance Ratios (Based upon Core

Earnings):

Core EPS (Diluted) $ 0.60 $ 0.39

Core Return on Average Assets 0.97% 0.64%

Core Return on Average Stockholders'

Equity 13.00% 9.22%

Core Return on Average Tangible

Stockholders' Equity 15.60% 11.06%

Book Value and Tangible Book Value

Per Share:

Stated Book Value Per Share $ 9.11 $ 8.24

Tangible Book Value Per Share 7.65 6.84

Average Balance Data:

Average Assets $ 4,113,529 $ 4,025,617

Average Interest Earning Assets 3,875,882 3,820,135

Average Stockholders' Equity 306,739 280,137

Average Tangible Stockholders'

Equity 255,490 233,416

Average Loans 3,463,572 3,274,715

Average Deposits 2,333,872 2,310,290

Asset Quality Summary:

Net charge-offs $ 5,793 $ 2,404

Nonperforming Loans 18,691 12,878

Nonperforming Loans/Total Loans 0.54% 0.40%

Nonperforming Assets (1) 19,634 14,118

Nonperforming Assets/Total Assets 0.47% 0.36%

Allowance for Loan Loss/Total Loans 0.67% 0.62%

Allowance for Loan

Loss/Nonperforming Loans 124.93% 155.23%

Loans Delinquent 30 to 89 Days at

period end $ 11,133 $ 17,585

Regulatory Capital Ratios:

Consolidated Tangible Stockholders'

Equity to Tangible Assets at period end 6.46% 6.00%

Tangible Capital Ratio (Bank Only) 7.70% 7.63%

Leverage Capital Ratio (Bank Only) 7.70% 7.63%

Risk Based Capital Ratio (Bank Only) 11.91% 11.46%

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED AVERAGE BALANCES AND NET INTEREST INCOME

(Dollars In thousands)

For the Three Months Ended

-----------------------------------

June 30, 2010

----------------------------------

Average

Average Yield/

Balance Interest Cost

----------- ---------- ----------

Assets:

Interest-earning assets:

Real estate loans $ 3,478,236 $ 51,068 5.87%

Other loans 1,377 30 8.71

Mortgage-backed securities 184,613 2,082 4.51

Investment securities 50,709 312 2.46

Other short-term investments 246,815 681 1.10

----------- ---------- ----------

Total interest earning assets 3,961,750 $ 54,173 5.47%

----------- ----------

Non-interest earning assets 249,879

-----------

Total assets $ 4,211,629

===========

Liabilities and Stockholders' Equity:

Interest-bearing liabilities:

Interest Bearing Checking $ 102,711 $ 191 0.75%

Money Market accounts 785,323 1,647 0.84

Savings accounts 311,201 200 0.26

Certificates of deposit 1,106,346 5,972 2.17

----------- ---------- ----------

Total interest bearing

deposits 2,305,581 8,010 1.39

Borrowed Funds 1,336,282 12,958 3.89

----------- ---------- ----------

Total interest-bearing

liabilities 3,641,863 $ 20,968 2.31%

----------- ---------- ----------

Non-interest bearing checking

accounts 114,177

Other non-interest-bearing

liabilities 142,955

-----------

Total liabilities 3,898,995

Stockholders' equity 312,634

-----------

Total liabilities and stockholders'

equity $ 4,211,629

===========

Net interest income $ 33,205

==========

Net interest spread 3.16%

==========

Net interest-earning assets $ 319,887

===========

Net interest margin 3.35%

==========

Ratio of interest-earning assets

to interest-bearing liabilities 108.78%

==========

Deposits (including non-interest

bearing checking accounts) $ 2,419,758 $ 8,010 1.33%

Interest earning assets (excluding

prepayment and other fees) 5.40%

For the Three Months Ended

-----------------------------------

March 31, 2010

----------------------------------

Average

Average Yield/

Balance Interest Cost

----------- ---------- ----------

Assets:

Interest-earning assets:

Real estate loans $ 3,446,103 $ 50,122 5.82%

Other loans 1,426 39 10.94

Mortgage-backed securities 206,466 2,271 4.40

Investment securities 57,159 407 2.85

Other short-term investments 78,860 742 3.76

----------- ---------- ----------

Total interest earning assets 3,790,014 $ 53,581 5.65%

----------- ----------

Non-interest earning assets 225,414

-----------

Total assets $ 4,015,428

===========

Liabilities and Stockholders' Equity:

Interest-bearing liabilities:

Interest Bearing Checking $ 104,117 $ 182 0.71%

Money Market accounts 716,696 1,710 0.97

Savings accounts 302,151 200 0.27

Certificates of deposit 1,015,951 5,501 2.20

----------- ---------- ----------

Total interest bearing

deposits 2,138,915 7,593 1.44

Borrowed Funds 1,344,911 13,222 3.99

----------- ---------- ----------

Total interest-bearing

liabilities 3,483,826 $ 20,815 2.42%

----------- ---------- ----------

Non-interest bearing checking

accounts 109,070

Other non-interest-bearing

liabilities 121,658

-----------

Total liabilities 3,714,554

Stockholders' equity 300,874

-----------

Total liabilities and stockholders'

equity $ 4,015,428

===========

Net interest income $ 32,766

==========

Net interest spread 3.23%

==========

Net interest-earning assets $ 306,188

===========

Net interest margin 3.46%

==========

Ratio of interest-earning assets

to interest-bearing liabilities 108.79%

==========

Deposits (including non-interest

bearing checking accounts) $ 2,247,985 $ 7,593 1.37%

Interest earning assets (excluding

prepayment and other fees) 5.62%

For the Three Months Ended

-----------------------------------

June 30, 2009

----------------------------------

Average

Average Yield/

Balance Interest Cost

----------- ---------- ----------

Assets:

Interest-earning assets:

Real estate loans $ 3,236,793 $ 47,662 5.89%

Other loans 1,631 37 9.07

Mortgage-backed securities 270,515 2,969 4.39

Investment securities 15,716 194 4.94

Other short-term investments 261,922 858 1.31

----------- ---------- ----------

Total interest earning assets 3,786,577 $ 51,720 5.46%

----------- ----------

Non-interest earning assets 224,896

-----------

Total assets $ 4,011,473

===========

Liabilities and Stockholders' Equity:

Interest-bearing liabilities:

Interest Bearing Checking $ 112,877 $ 256 0.91%

Money Market accounts 723,094 2,550 1.41

Savings accounts 288,944 307 0.43

Certificates of deposit 1,075,774 8,605 3.21

----------- ---------- ----------

Total interest bearing

deposits 2,200,689 11,718 2.14

Borrowed Funds 1,286,840 13,713 4.27

----------- ---------- ----------

Total interest-bearing

liabilities 3,487,529 $ 25,431 2.92%

----------- ---------- ----------

Non-interest bearing checking

accounts 98,277

Other non-interest-bearing

liabilities 144,465

-----------

Total liabilities 3,730,271

Stockholders' equity 281,202

-----------

Total liabilities and stockholders'

equity $ 4,011,473

===========

Net interest income $ 26,289

==========

Net interest spread 2.54%

==========

Net interest-earning assets $ 299,048

===========

Net interest margin 2.78%

==========

Ratio of interest-earning assets

to interest-bearing liabilities 108.57%

==========

Deposits (including non-interest

bearing checking accounts) $ 2,298,966 $ 11,718 2.04%

Interest earning assets (excluding

prepayment and other fees) 5.43%

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED SCHEDULE OF NON-PERFORMING ASSETS AND TROUBLED DEBT

RESTRUCTURINGS

(Dollars In thousands)

At At At

June 30, March 31, June 30,

2010 2010 2009

--------- --------- ----------

Non-Performing Loans

One- to four-family $ 634 $ 634 $ 578

Multifamily residential (1) 12,239 22,101 6,966

Commercial real estate (1) 4,277 4,694 2,398

Mixed Use 1,500 1,998 2,851

Cooperative apartment 25 71 83

Other 16 22 2

--------- --------- ----------

Total Non-Performing Loans (2) $ 18,691 $ 29,520 $ 12,878

--------- --------- ----------

Other Non-Performing Assets

Other real estate owned (3) 350 707 -

Pooled bank trust preferred securities 593 709 1,240

--------- --------- ----------

Total Non-Performing Assets $ 19,634 $ 30,936 $ 14,118

--------- --------- ----------

Troubled Debt Restructurings not included

in non-performing loans

Multifamily residential - - -

Commercial real estate - - -

Mixed Use 1,040 1,040 -

Other - - -

--------- --------- ----------

Total Troubled Debt Restructurings

("TDRs") (1) $ 1,040 $ 1,040 $ -

--------- --------- ----------

(1) In reference to the discussion on page 2 of this release, while the

loans within both of these categories are often considered "commercial

real estate" in nature, they are classified separately in the statement

above to provide further emphasis upon the discrete composition of

their underlying real estate collateral.

(2) Total non-performing loans include loans that have been modified in a

manner that would meet the criteria for a TDR should the loans return

to accrual status. These loans, which are excluded from the TDR amount

shown above, totaled $2.6 million and $15.7 million at June 30, 2010

and March 31, 2010, respectively. There were no such loans at

June 30, 2009.

(3) Amount was fully comprised of multifamily residential loans at

June 30, 2010 and March 31, 2010.

PROBLEM ASSETS AS A PERCENTAGE OF TANGIBLE CAPITAL AND RESERVES

At At

June 30, March 31,

2010 2010

--------- ---------

Total Non-Performing Assets $ 19,634 $ 30,936

Loans over 90 days past due on accrual

status - -

--------- ---------

PROBLEM ASSETS $ 19,634 $ 30,936

--------- ---------

Tier 1 Capital - Dime Savings Bank of

Williamsburgh $ 313,882 $ 314,018

Allowance for loan losses 23,350 24,620

--------- ---------

TANGIBLE CAPITAL PLUS RESERVES $ 337,232 $ 338,638

--------- ---------

PROBLEM ASSETS AS A PERCENTAGE OF

TANGIBLE CAPITAL AND RESERVES 5.8% 9.1%

Contact: Kenneth Ceonzo Director of Investor Relations

718-782-6200 extension 8279

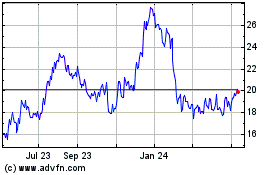

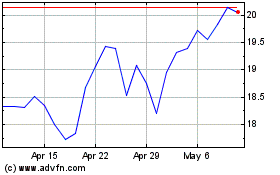

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Jul 2023 to Jul 2024