Dada Nexus Limited (NASDAQ: DADA, “Dada”, the “Company”, or “we”),

China’s leading local on-demand retail and delivery platform, today

announced its unaudited financial results for the third quarter

ended September 30, 2024.

“Our customer-centric high-quality growth

strategy and effective execution delivered impressive results in

the third quarter of 2024,” said Mr. Kevin Qing Guo, Chairman of

the Board of Dada. “Driven by our commitment to providing quality

products and instant delivery, JD NOW1 continued to build trust and

mindshare among users. The year-on-year growth in both monthly

transacting users2 and orders through the JD App maintained strong

momentum, increasing by over 100% in the third quarter of 2024.

Optimization to customer experience also fueled the growth in

repeat purchase rate. For Dada NOW3, we continued to strengthen our

partnerships with chain merchants and further enhanced delivery

service quality, contributing to a 46% year-over-year increase in

revenue for the first nine months. Going forward, we will continue

to execute our quality-focused approach prioritizing customer

experience and service excellence to create long-term value for

customers, business partners, delivery riders, and beyond.”

“We are pleased to have delivered solid results

this quarter with sequentially accelerated growth in order volume

and continuing improvements in operating efficiency,” said Mr.

Henry Jun Mao, Chief Financial Officer of Dada. “We are confident

that our focus on enriching supply, optimizing service, and

strengthening mindshare for our brand will lay a solid foundation

for sustainable growth in the future. Meanwhile, Dada NOW continued

to experience meaningful year-over-year growth in revenue,

primarily driven by the momentum in our chain merchant business.

Additionally, as a result of our high-quality development strategy

and ongoing efficiency optimization, our GAAP and non-GAAP net loss

margins4 narrowed by 4.1 and 3.7 percentage points quarter over

quarter, respectively.”

Third Quarter 2024 Financial

Results

Total net revenues were

RMB2,429.4 million in the third quarter of 2024, compared with

RMB2,621.8 million in the same quarter of 2023.

Beginning with the second quarter of 2024, the

Company changed the presentation of disaggregated revenues to

better reflect its lines of business. The table below sets forth

the disaggregation of revenues for the three months and nine months

ended September 30, 2024, respectively, with prior period financial

results retrospectively recast to conform to current period

presentation.

|

|

|

For the three months ended |

|

For the nine months ended |

|

|

|

September 30, 2023 |

|

June 30, 2024 |

|

September 30, 2024 |

|

YoY%Change |

|

September 30, 2023 |

|

September 30, 2024 |

|

YoY%Change |

|

|

|

(RMB in thousands, except percentage

data) |

|

Net revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JD NOW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commission fee |

|

397,528 |

|

371,006 |

|

331,719 |

|

(16.6 |

)% |

|

1,242,572 |

|

1,126,471 |

|

(9.3 |

)% |

|

Online advertising and marketing services |

|

480,344 |

|

128,805 |

|

66,392 |

|

(86.2 |

)% |

|

1,705,886 |

|

558,040 |

|

(67.3 |

)% |

|

Fulfillment services and others |

|

662,408 |

|

412,637 |

|

532,100 |

|

(19.7 |

)% |

|

1,994,765 |

|

1,436,686 |

|

(28.0 |

)% |

|

Subtotal |

|

1,540,280 |

|

912,448 |

|

930,211 |

|

(39.6 |

)% |

|

4,943,223 |

|

3,121,197 |

|

(36.9 |

)% |

|

Dada NOW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intra-city delivery services |

|

978,045 |

|

1,236,598 |

|

1,321,809 |

|

35.1 |

% |

|

2,484,075 |

|

3,602,859 |

|

45.0 |

% |

|

Last-mile delivery services |

|

63,851 |

|

153,265 |

|

129,222 |

|

102.4 |

% |

|

211,868 |

|

372,515 |

|

75.8 |

% |

|

Others |

|

39,663 |

|

47,596 |

|

48,197 |

|

21.5 |

% |

|

114,895 |

|

134,530 |

|

17.1 |

% |

|

Subtotal |

|

1,081,559 |

|

1,437,459 |

|

1,499,228 |

|

38.6 |

% |

|

2,810,838 |

|

4,109,904 |

|

46.2 |

% |

|

Total |

|

2,621,839 |

|

2,349,907 |

|

2,429,439 |

|

(7.3 |

)% |

|

7,754,061 |

|

7,231,101 |

|

(6.7 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Net

revenues generated from JD NOW was RMB930.2 million in the

third quarter of 2024, compared with RMB1,540.3 million in the

third quarter of 2023, mainly due to a decrease in online

advertising and marketing services revenues and a decrease in

fulfillment services and other revenues as a result of the full

rollout of delivery fee waiver program for orders exceeding RMB29

since February 2024.

- Net

revenues generated from Dada NOW increased by 38.6% from

RMB1,081.6 million in the third quarter of 2023 to RMB1,499.2

million in the third quarter of 2024, mainly driven by an increase

in order volume of intra-city delivery services provided to various

chain merchants.

Total costs and expenses were

RMB2,656.7 million in the third quarter of 2024, compared with

RMB2,862.6 million in the same quarter of 2023.

-

Operations and support costs were RMB1,731.7

million in the third quarter of 2024, compared with RMB1,711.2

million in the same quarter of 2023. The increase was primarily due

to an increase in rider cost as a result of the increasing order

volume of intra-city delivery services provided to various chain

merchants, offset by a decrease in online advertising and marketing

services costs.

- Selling

and marketing expenses were RMB717.4 million in the third

quarter of 2024, compared with RMB1,018.5 million in the same

quarter of 2023. The decrease was primarily due to a decrease in

promotional activities initiated by us on the JD NOW platform.

- General

and administrative expenses were RMB107.7 million in the

third quarter of 2024, compared with RMB29.1 million in the same

quarter of 2023. The increase was primarily due to an increase in

provision for credit loss and litigation related expenses.

-

Research and development expenses were RMB90.3

million in the third quarter of 2024, compared with RMB94.1 million

in the same quarter of 2023.

Loss from operations was

RMB226.8 million in the third quarter of 2024, compared with RMB

210.5 million in the same quarter of 2023.

Non-GAAP loss from

operations5 was RMB86.7 million in the

third quarter of 2024, compared with RMB52.4 million in the same

quarter of 2023.

Net loss was RMB197.3 million

in the third quarter of 2024, compared with RMB166.0 million in the

same quarter of 2023.

Non-GAAP net

loss6 was RMB59.4 million in the third

quarter of 2024, compared with RMB9.2 million in the same quarter

of 2023.

Basic and diluted net loss per ordinary

share was RMB0.19 in the third quarter of 2024, compared

with RMB0.16 for the third quarter of 2023.

Non-GAAP basic and diluted net loss per

ordinary share7 was RMB0.06 in the third

quarter of 2024, compared with RMB0.01 for the third quarter of

2023.

Supplemental Information

- The following

table sets forth the order volume and corresponding gross billings

of our on-demand delivery services.

|

|

|

For the three months ended |

|

For the nine months ended |

|

|

|

September30, 2023 |

|

June30, 2024 |

|

September30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

| Number of orders delivered8

(in millions) |

|

477.7 |

|

679.2 |

|

648.4 |

|

1,546.8 |

|

1,881.9 |

| Gross billings9 (RMB in

millions) |

|

2,323.1 |

|

3,008.0 |

|

3,098.2 |

|

7,136.1 |

|

8,635.3 |

|

|

|

|

|

|

|

|

|

|

|

|

Environment, Social Responsibility and

Governance (ESG)

- Dada further

extended care to riders’ families. Following the launch of the

“Riders’ Children Care Program” in the second quarter of 2023, Dada

has been providing financial supports for the children of delivery

riders’ who received offers from universities and colleges. In the

third quarter of 2024, following the 2024 National College Entrance

Examinations, Dada has sponsored multiple college-enrolled

children, awarding scholarships to support them in pursuit of their

dreams. These efforts aim to continually enhance the sense of

belonging and well-being of the riders on our platform.

- Dada

consistently cares for riders’ work and life through an enriched

rider care system. In the third quarter of 2024, Dada launched

various rider care activities in nearly 70 cities nationwide. In

addition to material distribution primarily focused on

summer-cooling supplies, Dada actively organized offline activities

to enhance engagement with riders and other outdoor workers.

Conference Call

The Company will host a conference call to

discuss the earnings at 8:30 p.m. Eastern Time on Wednesday,

November 13, 2024 (9:30 a.m. Beijing time on Thursday, November 14,

2024).Please register in advance of the conference using the link

provided below and dial in 10 minutes prior to the call.

PRE-REGISTER LINK:

https://s1.c-conf.com/diamondpass/10043239-5g83af.html

Upon registration, each participant will receive

details for the conference call, including dial-in numbers,

conference call passcode and a unique access PIN. To join the

conference, please dial the number provided, enter the passcode

followed by your PIN, and you will join the conference.

A telephone replay of the call will be available

after the conclusion of the conference call through November 21,

2024.

Dial-in numbers for the replay are as

follows:

| U.S./Canada |

1-855-883-1031 |

| Mainland China |

400-1209-216 |

| Hong Kong |

800-930-639 |

| Replay PIN |

10043239 |

| |

|

A live and archived webcast of the conference

call will be available on the Investor Relations section of Dada’s

website at https://ir.imdada.cn/.

Use of Non-GAAP Financial Measures

The Company also uses certain non-GAAP financial

measures in evaluating its business. For example, the Company uses

non-GAAP income/(loss) from operations, non-GAAP net income/(loss),

non-GAAP net margin, and non-GAAP net income/(loss) per ordinary

share as supplemental measures to review and assess its financial

and operating performance. Non-GAAP income/(loss) from operations

is income/(loss) from operations excluding the impact of

share-based compensation expenses and amortization of intangible

assets resulting from acquisitions. Non-GAAP net income/(loss) is

net income/(loss) excluding the impact of share-based compensation

expenses, amortization of intangible assets resulting from

acquisitions, and income tax benefit from amortization of such

intangible assets. Non-GAAP net margin is non-GAAP net

income/(loss) as a percentage of total net revenues. Non-GAAP net

income/(loss) per ordinary share is non-GAAP net income/(loss)

divided by weighted average number of shares used in calculating

non-GAAP net income/(loss) per ordinary share.

The Company presents the non-GAAP financial

measures because they are used by the Company’s management to

evaluate the Company’s financial and operating performance and

formulate business plans. Non-GAAP income/(loss) from operations

and non-GAAP net income/(loss) enable the Company’s management to

assess the Company’s financial and operating results without

considering the impact of share-based compensation expenses,

amortization of intangible assets resulting from acquisitions, and

income tax benefit from amortization of such intangible assets. The

Company also believes that the use of the non-GAAP financial

measures facilitates investors’ assessment of the Company’s

financial and operating performance.

The non-GAAP financial measures are not defined

under accounting principles generally accepted in the United States

of America (“U.S. GAAP”) and are not presented in accordance with

U.S. GAAP. The non-GAAP financial measures have limitations as

analytical tools. One of the key limitations of using non-GAAP

financial measures is that they do not reflect all items of income

and expense that affect the Company’s operations. Share-based

compensation expenses, amortization of intangible assets resulting

from acquisitions, and income tax benefit from amortization of such

intangible assets have been and may continue to be incurred in the

Company’s business and are not reflected in the presentation of

non-GAAP financial measures. Further, the non-GAAP financial

measures may differ from the non-GAAP financial measures used by

other companies, including peer companies, potentially limiting the

comparability of their financial results to the Company’s. In light

of the foregoing limitations, non-GAAP financial measures should

not be considered in isolation from or as an alternative to

financial measures prepared in accordance with U.S. GAAP.

The Company compensates for these limitations by

reconciling the non-GAAP financial measures to the nearest U.S.

GAAP performance measures, which should be considered when

evaluating the Company’s performance. For reconciliations of these

non-GAAP financial measures to the most directly comparable GAAP

financial measures, please see the section of the accompanying

tables titled, “Reconciliations of GAAP and Non-GAAP Results.”

Forward-Looking Statements

This press release contains statements that may

constitute “forward-looking” statements pursuant to the “safe

harbor” provisions of the U.S. Private Securities Litigation Reform

Act of 1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “likely to”

and similar statements. Among other things, quotations in this

announcement, contain forward-looking statements. Dada may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission (the “SEC”),

in its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not

historical facts, including statements about Dada’s beliefs, plans

and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: Dada’s strategies; Dada’s future business

development, financial condition and results of operations; Dada’s

ability to maintain its relationship with major strategic

investors; its ability to offer quality on-demand retail experience

and provide efficient on-demand delivery services; its ability to

maintain and enhance the recognition and reputation of its brands;

general economic and business conditions globally and in China and

assumptions underlying or related to any of the foregoing. Further

information regarding these and other risks is included in Dada’s

filings with the SEC. All information provided in this press

release is as of the date of this press release, and Dada does not

undertake any obligation to update any forward-looking statement,

except as required under applicable law.

About Dada Nexus Limited

Dada Nexus Limited is China’s leading local

on-demand retail and delivery platform. It operates JD NOW,

formerly known as JDDJ, one of China’s largest local on-demand

retail platforms for retailers and brand owners, and Dada NOW, a

leading local on-demand delivery platform open to merchants and

individual senders across various industries and product

categories. The Company’s two platforms are inter-connected and

mutually beneficial. The vast volume of on-demand delivery orders

from the JD NOW platform increases order volume and density for the

Dada NOW platform. Meanwhile, the Dada NOW platform enables

improved delivery experience for participants on the JD NOW

platform through its readily accessible fulfillment solutions and

strong on-demand delivery infrastructure.

For more information, please visit https://ir.imdada.cn/.

For investor inquiries, please contact:

Dada Nexus LimitedE-mail: ir@imdada.cn

ChristensenIn ChinaMr. Rene VanguestainePhone:

+86-178-1749-0483E-mail: rene.vanguestaine@christensencomms.comIn

USMs. Linda BergkampPhone: +1-480-614-3004

E-mail: linda.bergkamp@christensencomms.com

For media inquiries, please

contact:

Dada Nexus Limited E-mail: PR@imdada.cn

Appendix I

|

DADA NEXUS LIMITED |

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(RMB in thousands) |

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

|

December 31, 2023 |

|

September 30, 2024 |

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

1,893,032 |

|

2,776,695 |

|

|

Restricted cash |

|

519,207 |

|

67,394 |

|

|

Short-term investments |

|

1,558,315 |

|

— |

|

|

Accounts receivable, net |

|

386,768 |

|

1,159,595 |

|

|

Inventories |

|

9,270 |

|

11,815 |

|

|

Amount due from related parties |

|

1,287,080 |

|

667,018 |

|

|

Prepayments and other current assets |

|

415,326 |

|

307,428 |

|

|

Total current assets |

|

6,068,998 |

|

4,989,945 |

|

|

Non-current assets |

|

|

|

|

|

|

Property and equipment, net |

|

8,392 |

|

8,022 |

|

|

Intangible assets, net |

|

1,479,644 |

|

1,134,737 |

|

|

Operating lease right-of-use assets |

|

16,335 |

|

3,148 |

|

|

Other non-current assets |

|

512 |

|

146 |

|

|

Total non-current assets |

|

1,504,883 |

|

1,146,053 |

|

|

TOTAL ASSETS |

|

7,573,881 |

|

6,135,998 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

5,008 |

|

9,607 |

|

|

Payable to riders and drivers |

|

867,323 |

|

839,441 |

|

|

Amount due to related parties |

|

190,039 |

|

— |

|

|

Accrued expenses and other current liabilities |

|

922,483 |

|

540,529 |

|

|

Operating lease liabilities |

|

14,719 |

|

897 |

|

|

Total current liabilities |

|

1,999,572 |

|

1,390,474 |

|

|

Non-current liabilities |

|

|

|

|

|

|

Deferred tax liabilities |

|

16,979 |

|

10,716 |

|

|

Non-current operating lease liabilities |

|

414 |

|

488 |

|

|

Total non-current liabilities |

|

17,393 |

|

11,204 |

|

|

TOTAL LIABILITIES |

|

2,016,965 |

|

1,401,678 |

|

|

|

|

|

|

|

|

|

TOTAL SHAREHOLDERS’ EQUITY |

|

5,556,916 |

|

4,734,320 |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

7,573,881 |

|

6,135,998 |

|

|

|

|

|

|

|

|

|

DADA NEXUS LIMITED |

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME/(LOSS) |

|

(RMB in thousands, except shares and per share

data) |

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the nine months ended |

|

|

|

|

September 30, 2023 |

|

June 30,2024 |

|

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

|

2,621,839 |

|

|

2,349,907 |

|

|

2,429,439 |

|

|

7,754,061 |

|

|

7,231,101 |

|

|

|

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Operations and support |

|

(1,711,235 |

) |

|

(1,735,748 |

) |

|

(1,731,655 |

) |

|

(4,611,401 |

) |

|

(5,307,430 |

) |

|

|

Selling and marketing |

|

(1,018,496 |

) |

|

(781,910 |

) |

|

(717,428 |

) |

|

(3,471,794 |

) |

|

(2,317,636 |

) |

|

|

General and administrative |

|

(29,050 |

) |

|

(48,123 |

) |

|

(107,723 |

) |

|

(164,048 |

) |

|

(206,409 |

) |

|

|

Research and development |

|

(94,097 |

) |

|

(85,364 |

) |

|

(90,314 |

) |

|

(324,856 |

) |

|

(269,737 |

) |

|

|

Other operating expenses |

|

(9,760 |

) |

|

(15,878 |

) |

|

(9,546 |

) |

|

(28,686 |

) |

|

(39,951 |

) |

|

|

Total costs and expenses |

|

(2,862,638 |

) |

|

(2,667,023 |

) |

|

(2,656,666 |

) |

|

(8,600,785 |

) |

|

(8,141,163 |

) |

|

|

Other operating income |

|

30,320 |

|

|

6,625 |

|

|

442 |

|

|

52,927 |

|

|

7,938 |

|

|

|

Loss from operations |

|

(210,479 |

) |

|

(310,491 |

) |

|

(226,785 |

) |

|

(793,797 |

) |

|

(902,124 |

) |

|

|

Other income/(expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expenses |

|

— |

|

|

— |

|

|

— |

|

|

(807 |

) |

|

— |

|

|

|

Others, net |

|

43,247 |

|

|

22,186 |

|

|

27,370 |

|

|

115,691 |

|

|

84,378 |

|

|

|

Total other income, net |

|

43,247 |

|

|

22,186 |

|

|

27,370 |

|

|

114,884 |

|

|

84,378 |

|

|

|

Loss before income tax benefit |

|

(167,232 |

) |

|

(288,305 |

) |

|

(199,415 |

) |

|

(678,913 |

) |

|

(817,746 |

) |

|

|

Income tax benefit |

|

1,253 |

|

|

2,074 |

|

|

2,088 |

|

|

3,759 |

|

|

6,217 |

|

|

|

Net loss |

|

(165,979 |

) |

|

(286,231 |

) |

|

(197,327 |

) |

|

(675,154 |

) |

|

(811,529 |

) |

|

|

Net loss per ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

(0.16 |

) |

|

(0.27 |

) |

|

(0.19 |

) |

|

(0.65 |

) |

|

(0.78 |

) |

|

|

Diluted |

|

(0.16 |

) |

|

(0.27 |

) |

|

(0.19 |

) |

|

(0.65 |

) |

|

(0.78 |

) |

|

|

Weighted average number of shares used in calculating net

loss per ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

1,042,045,692 |

|

|

1,043,972,124 |

|

|

1,039,661,914 |

|

|

1,037,646,433 |

|

|

1,046,833,812 |

|

|

|

Diluted |

|

1,042,045,692 |

|

|

1,043,972,124 |

|

|

1,039,661,914 |

|

|

1,037,646,433 |

|

|

1,046,833,812 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

(165,979 |

) |

|

(286,231 |

) |

|

(197,327 |

) |

|

(675,154 |

) |

|

(811,529 |

) |

|

|

Other comprehensive income/(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments, net of tax of nil |

|

(8,192 |

) |

|

22,834 |

|

|

(37,432 |

) |

|

122,892 |

|

|

(1,448 |

) |

|

|

Total comprehensive loss |

|

(174,171 |

) |

|

(263,397 |

) |

|

(234,759 |

) |

|

(552,262 |

) |

|

(812,977 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DADA NEXUS LIMITED |

|

Reconciliations of GAAP and Non-GAAP Results |

|

(RMB in thousands, except shares, per share and percentage

data) |

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the nine months ended |

|

|

|

|

September 30, 2023 |

|

June 30,2024 |

|

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(210,479 |

) |

|

(310,491 |

) |

|

(226,785 |

) |

|

(793,797 |

) |

|

(902,124 |

) |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation expenses |

|

36,868 |

|

|

25,545 |

|

|

21,465 |

|

|

116,569 |

|

|

62,131 |

|

|

|

Amortization of intangible assets resulting from acquisitions |

|

121,207 |

|

|

120,474 |

|

|

118,598 |

|

|

379,635 |

|

|

359,138 |

|

|

|

Non-GAAP loss from operations |

|

(52,404 |

) |

|

(164,472 |

) |

|

(86,722 |

) |

|

(297,593 |

) |

|

(480,855 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

(165,979 |

) |

|

(286,231 |

) |

|

(197,327 |

) |

|

(675,154 |

) |

|

(811,529 |

) |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation expenses |

|

36,868 |

|

|

25,545 |

|

|

21,465 |

|

|

116,569 |

|

|

62,131 |

|

|

|

Amortization of intangible assets resulting from acquisitions |

|

121,207 |

|

|

120,474 |

|

|

118,598 |

|

|

379,635 |

|

|

359,138 |

|

|

|

Income tax benefit |

|

(1,253 |

) |

|

(2,074 |

) |

|

(2,088 |

) |

|

(3,759 |

) |

|

(6,217 |

) |

|

|

Non-GAAP net loss |

|

(9,157 |

) |

|

(142,286 |

) |

|

(59,352 |

) |

|

(182,709 |

) |

|

(396,477 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

|

2,621,839 |

|

|

2,349,907 |

|

|

2,429,439 |

|

|

7,754,061 |

|

|

7,231,101 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net margin |

|

(6.3 |

)% |

|

(12.2 |

)% |

|

(8.1 |

)% |

|

(8.7 |

)% |

|

(11.2 |

)% |

|

|

Non-GAAP net margin |

|

(0.3 |

)% |

|

(6.1 |

)% |

|

(2.4 |

)% |

|

(2.4 |

)% |

|

(5.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net loss per ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

(0.01 |

) |

|

(0.14 |

) |

|

(0.06 |

) |

|

(0.18 |

) |

|

(0.38 |

) |

|

|

Diluted |

|

(0.01 |

) |

|

(0.14 |

) |

|

(0.06 |

) |

|

(0.18 |

) |

|

(0.38 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number

of shares used in calculating non-GAAP net loss per ordinary

share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

1,042,045,692 |

|

|

1,043,972,124 |

|

|

1,039,661,914 |

|

|

1,037,646,433 |

|

|

1,046,833,812 |

|

|

|

Diluted |

|

1,042,045,692 |

|

|

1,043,972,124 |

|

|

1,039,661,914 |

|

|

1,037,646,433 |

|

|

1,046,833,812 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___________________1 JD NOW was formerly known as JDDJ. JDDJ

brands were upgraded to JD NOW in May 2024.2 Monthly transacting

user refers to an online user account that placed at least one

order on our JD NOW platform in a given month, regardless of

whether the order was subsequently paid, cancelled, delivered,

returned, or refunded.3 Dada NOW was formerly known as Dada Now.

Dada Now brands were upgraded to Dada NOW in August 2024.4 Please

refer to “Use of Non-GAAP Financial Measures” for the definition of

non-GAAP net margin.5 Non-GAAP income/(loss) from operations

represents income/(loss) from operations excluding the impact of

share-based compensation expenses and amortization of intangible

assets resulting from acquisitions.6 Non-GAAP net income/(loss)

represents net income/(loss) excluding the impact of share-based

compensation expenses, amortization of intangible assets resulting

from acquisitions, and income tax benefit from amortization of such

intangible assets.7 Non-GAAP net income/(loss) per ordinary share

is non-GAAP net income/(loss) divided by weighted average number of

shares used in calculating non-GAAP net income/(loss) per ordinary

share.8 Number of orders delivered included orders directly placed

through Dada NOW by merchants and individual senders, and orders

fulfilled by Dada NOW for merchants on JD NOW.9 Refer to the gross

amount of services charges for abovementioned orders of the

on-demand delivery services, net of value-added tax.

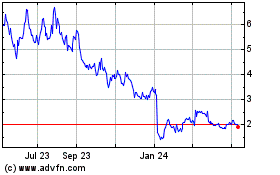

Dada Nexus (NASDAQ:DADA)

Historical Stock Chart

From Nov 2024 to Dec 2024

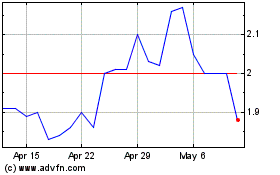

Dada Nexus (NASDAQ:DADA)

Historical Stock Chart

From Dec 2023 to Dec 2024