Current Report Filing (8-k)

February 14 2023 - 6:09AM

Edgar (US Regulatory)

false 0001789972 0001789972 2023-02-13 2023-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2023

CULLINAN ONCOLOGY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-39856 |

|

81-3879991 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

Cullinan Oncology, Inc.

One Main Street, Suite 1350

Cambridge, MA 02142

(Address of principal executive offices, including zip code)

(617) 410-4650

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

CGEM |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On February 13, 2023, Cullinan Oncology, Inc. (the “Company”) and Harbour BioMed US Inc. (“Harbour”) entered into a License and Collaboration Agreement (the “License Agreement”), pursuant to which Harbour granted to the Company an exclusive license for the development, manufacturing and commercialization of HBM7008 (CLN-418) in the U.S.

Under the terms of the License Agreement, the Company paid Harbour an upfront license fee of $25 million at signing. Harbour will be eligible to receive up to $148 million in milestone payments based on the achievement of pre-specified development and regulatory milestones. Harbour is also eligible to receive up to an additional $415 million in sales-based milestones as well as tiered royalties up to high teens on a licensed product-by-licensed product basis, as a percentage of U.S. commercial sales. In addition, under the License Agreement, Harbour will grant the Company certain intellectual property rights to enable the Company to perform its obligations and exercise its rights under the License Agreement.

Unless earlier terminated, the License Agreement will continue in effect until the expiration of the Company’s royalty obligations. The License Agreement may be terminated by either party for a material breach by the other party, subject to notice and cure provisions, or in the event of the other party’s insolvency. The Company may terminate the License Agreement for convenience by providing 90 days’ written notice to Harbour. In the License Agreement, each party made customary representations and warranties and agreed to customary covenants, including, without limitation, with respect to indemnification, for transactions of this type.

A copy of the License Agreement will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023.

| Item 2.02 |

Results of Operations and Financial Condition. |

In connection with entering into the License Agreement, the Company is updating its cash runway guidance. The Company ended 2022 with an unaudited cash and investments balance of $550 million, which included the impact of a $33 million investment to increase the Company’s ownership in its subsidiary, Cullinan Mica Corp., from 54% to 95%. After deducting the upfront license fee to Harbour, the Company’s cash and investment balance as of December 31, 2022 would have been $525 million. Based on the Company’s current operating plan, the Company expects its current cash resources to last into 2026. The cash and investments balance represents cash, cash equivalents, investments, and interest receivable.

The information contained in this Item 2.02 is unaudited and preliminary and does not present all information necessary for an understanding of the Company’s financial condition as of December 31, 2022 and its results of operations for the year ended December 31, 2022. The information in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 7.01 |

Regulation FD Disclosure. |

On February 13, 2023, the Company issued a press release announcing it entered into the License Agreement, a copy of which is being furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information in this Item 7.01 and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements, including express or implied statements regarding the Company’s beliefs and expectations regarding the Company’s cash runway. Any forward-looking statements in this Current Report on Form 8-K are based on management’s current expectations and beliefs of future events and are subject to known and unknown risks and uncertainties that may cause the Company’s actual results, performance or achievements to be materially different from any expressed or implied by the forward-looking statements. These risks include, but are not limited to, the risks and uncertainties discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”), including under the caption “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and subsequent filings with the SEC. While the Company may elect to update such forward-looking statements in the future, it disclaims any obligation to do so, even if subsequent events cause its views to change, except to the extent required by law. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this Current Report on Form 8-K. Moreover, except as required by law, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements included in this Current Report on Form 8-K. Any forward-looking statement included in this Current Report on Form 8-K speaks only as of the date on which it was made.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CULLINAN ONCOLOGY, INC. |

|

|

|

|

| Dated: February 13, 2023 |

|

|

|

By: |

|

/s/ Jeffrey Trigilio |

|

|

|

|

|

|

Jeffrey Trigilio |

|

|

|

|

|

|

Chief Financial Officer |

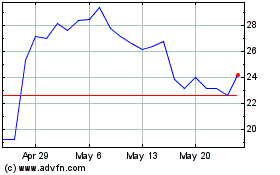

Cullinan Therapeutics (NASDAQ:CGEM)

Historical Stock Chart

From Jun 2024 to Jul 2024

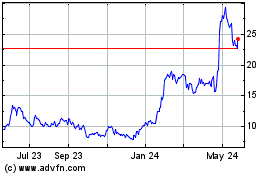

Cullinan Therapeutics (NASDAQ:CGEM)

Historical Stock Chart

From Jul 2023 to Jul 2024