Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-267550

$50,000,000

COSMOS HOLDINGS INC.

Shares of Common Stock

Shares of Preferred Stock

Warrants/Units

Subscription Rights

We may offer and sell the securities identified above from time to time in one or more offerings at prices and on terms that we will determine at the time of each offering, for an aggregate initial offering price of $50,000,000. This prospectus provides you with a general description of the securities that is not meant to be a complete description of each of the securities.

Each time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering and the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus with respect to that offering. You should carefully read this prospectus, the applicable prospectus supplement, as well as the documents incorporated or deemed to be incorporated by reference herein or therein, before you purchase any of our securities.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. These securities also may be resold by selling securityholders. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in an applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for further information.

No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

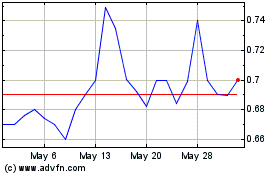

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “COSM.” On December 14, 2022, the last reported sales price of our Common Stock was $0.32.

Investing in our securities is highly speculative and involves a high degree of risk. You should carefully read and consider the “Risk Factors” beginning on page 9 of this prospectus before investing.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 15, 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, we may sell shares of Common Stock, Preferred Stock (including convertible preferred shares), warrants for equity securities, units and subscription rights comprised of any combination thereof from time to time in one or more offerings for up to an initial aggregate offering price of $50,000,000. By using a shelf registration statement, we may sell securities from time to time and in one or more offerings as described in this prospectus. This prospectus provides you with a general description of the securities we may offer. Each time that we offer and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable. However, no prospectus supplement will offer a security that is not registered and described in this prospectus at the time of its effectiveness. This prospectus, together with the applicable prospectus supplement and the documents incorporated by reference into this prospectus, includes all material information relating to the offering of securities under this prospectus. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement (and any applicable free writing prospectuses), the information and documents incorporated herein by reference and the additional information described under the heading “Where You Can Find More Information; Incorporation by Reference.”

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

You should rely only on the information contained in or incorporated by reference in this prospectus, any related free-writing prospectus or any prospectus supplement. We have not authorized anyone to provide you with any information or to make any representations other than those contained in or incorporated by reference into this prospectus, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in our annual report on Form 10-K for the fiscal year ended December 31, 2021 under the heading “Part II - Item 1A. Risk Factors,” and as described or may be described in any subsequent quarterly report on Form 10-Q, as well as in any applicable prospectus supplement and contained or to be contained in our filings with the SEC and incorporated by reference in this prospectus, together with all of the other information contained in this prospectus, or any applicable prospectus supplement. Accordingly, investors should not place undue reliance on this information.

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, applicable prospectus supplement or any related free writing prospectus.

These documents are not an offer to sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful, nor does this prospectus, any applicable supplement to this prospectus, or any applicable free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” for purposes of the safe harbor provisions provided by Section 27 of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, and the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based or the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings “Risk Factors,” contained in our annual report on Form 10-K for the fiscal year ended December 31, 2021, and as described or may be described in any subsequent quarterly report on Form 10-Q, as well as in any applicable prospectus supplement and contained or to be contained in our filings with the SEC and incorporated by reference in this prospectus, “Prospectus Summary,” and elsewhere in this prospectus.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available Information

We file annual reports, quarterly reports, current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). You may read or obtain a copy of these reports at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549, on official business days during the hours of 10:00 am to 3:00 pm. You may obtain information on the operation of the public reference room and its copy charges by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains registration statements, reports, proxy information statements and other information regarding registrants that file electronically with the SEC, which are available free of charge. The address of the website is http://www.sec.gov. If you do not have Internet access, requests for copies of such documents should be directed to George Terzis, the Company’s Chief Financial Officer, at Cosmos Holdings Inc., 141 West Jackson Boulevard, Suite 4236, Chicago, Illinois 60604.

Our website address is www.cosmoshold.com. The information on, or accessible through, our website, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Other documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement or documents incorporated by reference in the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries, and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) between the date of this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, which are “furnished” and are not deemed to have been “filed” with the SEC.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC since the end of the fiscal year ended December 31, 2021:

| (1) | Cosmos Holdings’ Schedule 14C Definitive Information Statement filed with the SEC on March 1, 2022; |

| (2) | Cosmos Holdings’ Schedule 14A Definitive Proxy Statement filed with the SEC on October 20, 2022; |

| (3) | Cosmos Holdings’ Annual Report on Form 10-K filed with the SEC on April 15, 2022; |

| (4) | Cosmos Holdings’ Quarterly Reports on Form 10-Q for the quarters ended March 31, 2022, June 30, 2022 and September 30, 2022 filed with the SEC on May 17, 2022, August 19, 2022 and November 14, 2022, respectively; |

| (5) | Cosmos Holdings’ Current Reports on Form 8-K filed with the SEC on February 28, 2022, March 1, 2022, April 28, 2022, May 18, 2022, July 25, 2022, July 29, 2022, August 23, 2022, September 27, 2022, October 3, 2022, October 18, 2022, November 16, 2022 and December 5, 2022, respectively; |

| (6) | Cosmos Holdings’ Registration Statement on Form S-1 and S-1/A (No. 333-265190) filed with the SEC on May 25, 2022 and June 07, 2022, respectively; |

| (7) | Cosmos Holdings’ Registration Statement on Form S-1 (No.333-267505) filed with the SEC on September 19, 2022, October 11, 2022, October 13, 2022 and October 14, 2022; and |

| (8) | Cosmos Holdings’ Registration Statement on Form S-1 MEF (No. 333-267917) filed with the SEC on October 17, 2022. |

A copy of any and all of the information included in the documents that have been incorporated by reference in this prospectus (excluding exhibits thereto, unless such exhibits have been specifically incorporated by reference into the information which this prospectus incorporates) but which are not delivered with this prospectus will be provided by us without charge to any person to whom this prospectus is delivered, upon the oral or written request of such person. Written requests should be directed to Cosmos Holdings Inc., 141 West Jackson Blvd., Suite 4236, Chicago, IL 60604, Attention: Corporate Secretary. Oral requests may be directed to the Secretary at (312) 536-3102.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including our financial statements and related notes thereto and the other documents incorporated by reference in this prospectus and the risks described under the “Risk Factors” section contained in our annual report on Form 10-K for the fiscal year ended December 31, 2021, and as described or may be described in any subsequent quarterly report on Form 10-Q as well as in any applicable prospectus supplement and contained or to be contained in our filings with the SEC and incorporated by reference in this prospectus. We note that our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

In this prospectus, unless otherwise noted, the terms “the Company,” “Cosmos,” “we,” “us,” and “our” refer to Cosmos Holdings Inc. d/b/a Cosmos Health.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution of this prospectus or any accompanying prospectus supplement in that jurisdiction. Persons who come into possession of this prospectus or any accompanying prospectus supplement in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus or any accompanying prospectus supplement applicable to that jurisdiction.

Our Company

Cosmos Holdings Inc. together with its subsidiaries (hereinafter referred to collectively as “us”, “we”, or the “Company”) is an international healthcare group that was incorporated in 2009 and is headquartered in Chicago, Illinois. On August 2, 2022, the Company filed a Fictitious Firm Name Certificate in Nevada to do business under the name Cosmos Health, Inc. and will seek shareholder approval at its annual shareholders meeting scheduled for December 2, 2022 to amend its Articles of Incorporation for the name change. Cosmos Health is engaged in the nutraceuticals sector through its own proprietary lines of products “Sky Premium Life” and “Mediterranation.” Additionally, the Company is operating in the pharmaceutical sector through the provision of a broad line of branded generics and over-the-counter (“OTC”) medications and is involved in the healthcare distribution sector through its subsidiaries in Greece and UK serving retail pharmacies and wholesale distributors. Cosmos Health is strategically focused on the research and development (“R&D”) of novel patented nutraceuticals and intellectual property (“IP”) and specialized root extracts as well as on the R&D of proprietary complex generics and innovative OTC products. Cosmos has developed a global distribution platform and is currently expanding throughout Europe, Asia and North America. Currently, the Company has offices and distribution centers through its three wholly-owned subsidiaries: (i) Cosmos Holdings Inc., the parent company headquartered in Chicago, USA (ii) SkyPharm S.A., headquartered in Thessaloniki, Greece; (iii) Decahedron Ltd., head-quartered in Harlow, United Kingdom; and (iv) Cosmofarm S.A., headquartered in Athens, Greece.

The Company’s cross-border pharmaceutical business serves wholesale pharmaceutical distributors and independent retail pharmacies across the European Union (“EU”) through a network of two strategic distribution centers, one in Greece and one in the UK, as well as an additional warehousing facility. The Company focuses on leveraging its growing purchasing scale and supplier relationships to secure discounts and provide pharmaceuticals at reduced prices and on continuing to drive organic growth at attractive margins for its cross-border pharmaceutical wholesale business.

The Company operates in the business of full-line pharmaceutical wholesale distribution and serves approximately 1,500 independent retail pharmacies and 40 pharmaceutical wholesalers in Greece region by providing brand-name and generic pharmaceuticals, over-the-counter medicines, vitamins and nutraceuticals. We invest in technology to enhance safety, distribution and warehousing efficiency and reliability. Specifically, the Company operates a fully automated warehouse system with three robotic systems, two ROWA™ types and one A-frame type, that ensure 0% error selection rate, accelerate order fulfillment, and yield higher cost-efficiency in our distribution center.

Taking into consideration the growing demand of various vitamins and nutraceuticals, the Company entered the market with its own brand of nutraceuticals: Sky Premium Life® (“SPL”). Our current business has provided us with access to wholesalers both from the sourcing and the sales division of our wholesale business. We sell our products to vendors that supply us with pharmaceutical products as well as to our clients to whom we currently sell pharmaceutical products. We serve this demand by offering quality products to our existing network of wholesalers and pharmacies. Pharmacies are still the key channels for distribution and sales of nutraceuticals in the European market. The development and manufacturing of our own line is assigned to a related party which operates according to our specifications and GMP protocols.

Moreover, our nutraceutical products have penetrated several markets during 2021 and early 2022 through digital channels such as Amazon and Tmall. We focus on nutraceutical products because we foresee it as a relatively underpenetrated market throughout Europe with the potential of high growth opportunities due to its large market size and margin contribution as the demand for nutraceutical products is increasing globally.

Recent Sales of Unregistered Securities

On October 3, 2022, Cosmos Holdings Inc. (the “Company”) entered into a Warrant Exchange Agreement (the “Exchange Agreement”) with each holder of Warrants to purchase an aggregate of 21,238,256 shares of Common Stock issued pursuant to a Securities Purchase Agreement dated as of February 28, 2022, as described below. On October 20, 2022, each holder exchanged the existing warrants (the “Existing Warrants”) for new warrants (the “New Warrants”) to purchase twice the number of shares of Common Stock (the “Exchange Shares”). The New Warrants are exercisable at $0.12 per share for a seven-year period from the date of issuance. The Company agreed to register all of the Exchange Shares in a resale registration statement to be filed with the SEC within ninety (90) days from the Closing Date. As of December 14, 2022, there were 5,309,564 new Warrants outstanding held by the Company’s Chief Executive Officer, who has waived the Company’s obligation to register the Exchange Shares by December 31, 2022.

As additional consideration for the Exchange Agreement, the Company paid each Holder up to five hundred thousand ($500,000) U.S. Dollars, plus liquidated damages and interest paid by the Company to the Holders pursuant to a registration rights agreement relating to the initial registration of the shares underlying the Existing Warrants. The total liability amounted to $2,159,300 ($2,000,000 additional consideration plus $159,300 liquidated damages) and the Company has paid the entire liability to the corresponding U.S. Holders. As further consideration for the Exchange Agreement, all Holders shall have, in the aggregate, a thirty (30%) percent right of participation into all equity offerings in which there is a placement agent or underwriter for the eighteen (18) month period following the Closing Date. In the event that any Holder does not exercise its right of participation in any offering, the remaining Holders will not have the right to participate for more than its pro rata share.

On February 28, 2022, the Company entered into a securities purchase agreement, or the Purchase Agreement, with certain investors and the Company’s CEO, for a private placement of the Company’s securities (the “Private Placement”). The Private Placement consisted of the sale of 6,000 shares of the Company’s Series A Convertible Preferred Stock, or the Series A Shares, at a price of $1,000 per share, and 2,000,000 warrants to purchase shares of common stock, or the Warrants, for aggregate gross proceeds of approximately $6,000,000. The Series A Shares are convertible into the Company’s Common Stock as determined by dividing the number of Series A Shares to be converted by the lower of (i) $3.00 or (ii) 80% of the volume weighted average price for the Company’s Common Stock for the five (5) trading days immediately following the date of effectiveness of the Registration Statement. The holders of Series A Shares are not entitled to receive distributions in the event of liquidation, dissolution or winding up of the Company, either voluntary or involuntary.

The Company filed its initial registration statement on May 25, 2022 and thus accrued for liquidated damages payable to the Holders in the amount of $187,970, calculated as described above, for both the late filing of the registration statement (event) and the 1st anniversary (30 days following the event date) of the event. Following the effective date of the Company’s registration statement, the Series A Shares conversion price was adjusted to $0.62152. The Company recorded a deemed dividend in the amount of $8,189,515 upon reducing the conversion price from $3.00 to $0.62152 which was recorded as an increase to additional paid-in capital and an increase to accumulated deficit.

The Warrants are exercisable to purchase shares of common stock at $3.30 per share, or 110% of the Series A Shares’ initial conversion price and will expire five and one-half years following the initial exercise date of the Warrants. The Company determined that the 2,000,000 warrants are additional value being distributed to the preferred stockholders and presented the warrants’ fair value of $5,788,493 as a deemed dividend in the unaudited condensed consolidated statements of operations and comprehensive income (loss). The warrants were valued using the Black-Scholes option pricing model with the following terms: (a) exercise price of $3.30, (b) common stock fair value of $3.42, (c) volatility of 118%, (d) discount rate of 1.71%, and (e) dividend rate of 0%. The Company also recorded a deemed dividend in the amount of $8,480,379 upon reducing the conversion price from $3.00 to $0.62152 in order to account for the down-round effect of warrants during the second quarter of 2022. The warrants were valued using the Black-Scholes option pricing model with the following terms: (a) exercise price of $3.30, (b) common stock fair value of $1.07, (c) volatility of 107%, (d) discount rate of 2.99%, and (e) dividend rate of 0%.

The closing of the Private Placement occurred on February 28, 2022. As a condition to the closing of the sale, the Company’s common stock received conditional approval for listing and trading on the Nasdaq Capital Market and commenced trading on February 28, 2022, under the trading symbol “COSM.” Concurrent with the issuance of the Series A Shares, the Company executed a registration rights agreement (the “Registration Rights Agreement”) to register the resale of the shares of common stock issuable upon conversion of the Series A Shares and the shares of common stock issuable upon exercise of the warrants issued in connection with the Series A Shares. The registration statement was declared effective on June 7, 2022. The Company was required to pay an aggregate of $187,970 in liquidated damages under the Registration Rights Agreement.

The Series A Shares rank senior to all of the Company’s Common Stock and any other equity securities that the Company may issue in the future with respect to payment of dividends and distribution of assets upon liquidation, dissolution or winding up. While the Series A Shares are outstanding, the Company may not amend, alter or change adversely the powers, preferences or rights given to the Series A Shares, create, or authorize the creation of, any additional class or series of capital stock of the Company (or any security convertible into or exercisable for any class or series of capital stock of the Company), including any class or series of capital stock of the Company that ranks superior to or in parity with the Series A Shares, alter, amend, modify, or repeal its Articles of Incorporation or other charter documents in any manner that adversely affects any rights of the holders of Series A Shares, increase or decrease the number of authorized shares of Series A Shares, any agreement, commitment or transaction that would result in a Change of Control, any sale or disposition of any material assets outside of the ordinary course of business of the Company, any material change in the principal business of the Company, including the entry into any new line of business or exit of any current line of business, and circumvent a right or preference of the Series A Shares. Any holder of the Series A Shares has the right by written election to the Company to convert all or any portion of the outstanding Series A Shares. Immediately upon effectiveness of a registration statement registering for sale all of the Registrable Securities (as defined in the Registration Rights Agreement), all outstanding Series A Preferred Shares will automatically convert into Common Stock, subject to certain beneficial ownership limitations. As of December 14, 2022, there were no Series A Preferred Shares remaining outstanding.

Corporate Information

Our principal executive offices are located at 141 W. Jackson Blvd, Suite 4236, Chicago, Illinois 60604, and our telephone number is (312) 536-3102. Our website address is www.cosmoshold.com. Any information contained on, or that can be accessed through, our website is not incorporated by reference into, nor is it in any way part of this prospectus and should not be relied upon in connection with making any decision with respect to an investment in our securities. We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You may obtain any of the documents filed by us with the SEC at no cost from the SEC’s website at http://www.sec.gov.

Risks Associated with Our Business and this Offering

| | · | Our business and our ability to implement our business strategy are subject to numerous risks, as more fully described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 under Item 1A. “Risk Factors.” You should read these risks before you invest in our securities. We may be unable, for many reasons, including those that are beyond our control, to implement our business strategy. In particular, risks associated with our business include: |

| | | |

| | · | We have a history of significant losses since our inception and anticipate that we will continue to incur losses for the foreseeable future, and our future profitability is uncertain. |

| | | |

| | · | There is substantial doubt about our ability to continue as a going concern, which may affect our ability to obtain future financing and may require us to curtail our operations. We will need to raise additional capital to support our operations. |

| | | |

| | · | Our revenues are concentrated in the distribution and sale of branded and generic pharmaceuticals, nutraceuticals, OTC medications and medical devices. When these markets experience a downturn, demand for our products and revenues may be adversely affected. |

| | | |

| | · | We do not have the financial resources necessary to successfully complete our drug product development program, marketing and certain acquisitions. |

| | | |

| | · | We are subject to various regulations and compliance requirements under both the European Union, the European Medicines Agency (the “EMA”), the Hellenic Ministry of Health and other related regulatory agencies. |

| | | |

| | · | We face significant competition, including competition from larger and better funded pharmaceutical enterprises. |

| | · | We are exposed to potential product liability or similar claims, and insurance against these claims may not be available to us at a reasonable rate in the future. Additionally, discovery of safety issues with our products could create product liability and could cause additional regulatory scrutiny and requirements for additional labeling, withdrawal of products from the market, and the imposition of fines or criminal penalties. |

| | | |

| | · | We may be unable to achieve and maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. |

| | | |

| | · | If you purchase our securities in this offering, you may incur dilution. |

| | | |

| | · | We will have broad discretion in the use of the net proceeds from this offering and may not use them effectively. As of December 13, 2022, Grigorios Siokas, our Chief Executive Officer, owned approximately 11.2% of our outstanding shares of common stock and 23.2% beneficially owned upon conversion of his derivative securities, which may give him the ability to control matters submitted to our stockholders for approval. |

| | | |

| | · | Risks associated with doing business internationally, as well as international economic conditions, the global COVID-19 pandemic, other market disruptions, supply-chain disruptions, geopolitical conflicts, including the war in Ukraine and other acts of war, macroeconomic events, and inflation could negatively impact our business and operations. |

| | | |

| | · | We have received a notice from Nasdaq of non-compliance with continued listing standards, which if we fail to comply with, our common stock could be delisted. |

RISK FACTORS

Investing in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the specific risk factors discussed in the sections entitled “Risk Factors” contained in our annual report on Form 10-K for the fiscal year ended December 31, 2021 under the heading “Item 1A. Risk Factors,” and as described or may be described in any subsequent quarterly report on Form 10-Q under the heading “Item 1A. Risk Factors,” as well as in any applicable prospectus supplement and contained or to be contained in our filings with the SEC and incorporated by reference in this prospectus, together with all of the other information contained in this prospectus, or any applicable prospectus supplement. For a description of these reports and documents, and information about where you can find them, see “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” If any of the risks or uncertainties described in our SEC filings or any prospectus supplement or any additional risks and uncertainties actually occur, our business, financial condition and results of operations could be materially and adversely affected. In that case, the trading price of our securities could decline and you might lose all or part of the value of your investment.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus and the documents incorporated herein by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical fact contained in this document and the materials accompanying this document are forward-looking statements. These statements are based on current expectations of future events. Frequently, but not always, forward-looking statements are identified by the use of the future tense and by words such as “believes,” “expects,” “anticipates,” “intends,” “may,” “could,” “would,” “predicts,” “anticipates,” “future,” “plans,” “continues,” “estimates” or similar expressions. Forward-looking statements are not guarantees of future performance and actual results could differ materially from those indicated by such forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by the forward-looking statements. These forward-looking statements speak only as of the date made and are subject to a number of known and unknown risks, uncertainties and assumptions, including the important factors incorporated by reference into this prospectus from our most recent Annual Report on Form 10-K and any subsequent Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act and in our other filings with the SEC, that may cause our actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements, whether as a result of any new information, future events, changed circumstances or otherwise.

USE OF PROCEEDS

Unless otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of securities under this prospectus for working capital and general corporate purposes, which may include operating expenses, research and development, and funding for pending or future acquisitions. We will set forth in a prospectus supplement relating to a specific offering any intended use for the net proceeds received from the sale of securities in that offering. We will have significant discretion in the use of any net proceeds. Investors will be relying on the judgment of our management regarding the application of the proceeds of any sale of securities. We may invest the net proceeds temporarily until we use them for their stated purpose, as applicable.

PLAN OF DISTRIBUTION

We may sell the securities offered by this prospectus from time to time in one or more transactions, including without limitation:

| | · | through underwriters or dealers; |

| | | |

| | · | directly to purchasers; |

| | | |

| | · | in a rights offering; |

| | | |

| | · | in “at the market” offerings, within the meaning of Rule 415(a)(4) of the Securities Act, to or through a market maker or into an existing trading market on an exchange or otherwise; |

| | | |

| | · | through agents; |

| | | |

| | · | through a combination of any of these methods; or |

| | | |

| | · | through any other method permitted by applicable law and described in a prospectus supplement. |

In addition, we may enter into derivative or hedging transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. In connection with such a transaction, the third parties may sell securities covered by and pursuant to this prospectus and any accompanying prospectus supplement. We may also loan or pledge securities covered by this prospectus and any accompanying prospectus supplement to third parties, who may sell the loaned securities or, in an event of default in the case of a pledge, sell the pledged securities pursuant to this prospectus and any accompanying prospectus supplement.

The prospectus supplement with respect to any offering of securities will include the following information:

| | · | the terms of the offering; |

| | | |

| | · | the names of any underwriters, dealers or direct purchasers; |

| | | |

| | · | the name or names of any managing underwriter or underwriters; |

| | | |

| | · | the purchase price or initial public offering price of the securities; |

| | | |

| | · | the net proceeds from the sale of the securities; |

| | | |

| | · | any delayed delivery arrangements; |

| | | |

| | · | any underwriting discounts, commissions and other items constituting underwriters’ compensation; |

| | | |

| | · | any discounts or concessions allowed or reallowed or paid to dealers; |

| | | |

| | · | any commissions paid to agents; and |

| | | |

| | · | any securities exchange on which the securities may be listed. |

Sale through Underwriters or Dealers

If underwriters are used in the sale, the underwriters will acquire the securities for their own account. The underwriters may resell the securities from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. Underwriters may offer securities to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting as underwriters. Unless we inform you otherwise in the applicable prospectus supplement, the obligations of the underwriters to purchase the securities will be subject to certain conditions, and the underwriters will be obligated to purchase all of the offered securities if they purchase any of them. The underwriters may change from time to time any initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers.

During and after an offering through underwriters, the underwriters may purchase and sell the securities in the open market. These transactions may include overallotment and stabilizing transactions and purchases to cover syndicate short positions created in connection with the offering. The underwriters may also impose a penalty bid, which means that selling concessions allowed to syndicate members or other broker-dealers for the offered securities sold for their account may be reclaimed by the syndicate if the offered securities are repurchased by the syndicate in stabilizing or covering transactions. These activities may stabilize, maintain or otherwise affect the market price of the offered securities, which may be higher than the price that might otherwise prevail in the open market. If commenced, the underwriters may discontinue these activities at any time.

Some or all of the securities that we offer through this prospectus may be new issues of securities with no established trading market. Any underwriters to whom we sell our securities for public offering and sale may make a market in those securities, but they will not be obligated to do so and they may discontinue any market making at any time without notice. Accordingly, we cannot assure you of the liquidity of, or continued trading markets for, any securities that we offer.

If dealers are used in the sale of securities, we will sell the securities to them as principals. They may then resell those securities to the public at fixed prices or at varying prices determined by the dealers at the time of resale. We will include in the applicable prospectus supplement the names of the dealers and the terms of the transaction.

If agents are used in an offering, the names of the agents and the terms of the agency will be specified in a prospectus supplement. Unless otherwise indicated in a prospectus supplement, the agents will act on a best-efforts basis for the period of their appointment.

Dealers and agents named in a prospectus supplement may be underwriters as defined in the Securities Act and any discounts or commissions they receive from us and any profit on their resale of the securities may be treated as underwriting discounts and commissions under the Securities Act. We will identify in the applicable prospectus supplement any underwriters, dealers or agents and will describe their compensation. We may have agreements with the underwriters, dealers and agents to indemnify them against specified civil liabilities, including liabilities under the Securities Act.

Underwriters, dealers or agents and their associates may engage in other transactions with and perform other services for us in the ordinary course of business.

If so indicated in a prospectus supplement, we will authorize underwriters or other persons acting as our agents to solicit offers by institutional investors to purchase securities pursuant to contracts providing for payment and delivery on a future date. We may enter contracts with commercial and savings banks, insurance companies, pension funds, investment companies, educational and charitable institutions and other institutional investors. The obligations of any institutional investor will be subject to the condition that its purchase of the offered securities will not be illegal at the time of delivery. The underwriters and other agents will not be responsible for the validity or performance of contracts.

Direct Sales and Sales through Agents

We may sell the securities directly. In this case, no underwriters or agents would be involved. We may also sell the securities through agents designated by us from time to time. In the applicable prospectus supplement, we will name any agent involved in the offer or sale of the offered securities, and we will describe any commissions payable to the agent. Unless we inform you otherwise in the applicable prospectus supplement, any agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

We may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning of the Securities Act with respect to any sale of those securities. We will describe the terms of any sales of these securities in the applicable prospectus supplement.

At the Market Offerings

We may also sell the securities offered by any applicable prospectus supplement in “at the market offerings” within the meaning of Rule 415(a)(4) of the Securities Act, to or through a market maker or into an existing trading market, on an exchange or otherwise.

Remarketing Arrangements

Securities may also be offered and sold, if so indicated in the applicable prospectus supplement, in connection with a remarketing upon their purchase, in accordance with a redemption or repayment pursuant to their terms, or otherwise, by one or more remarketing firms, acting as principals for their own accounts or as agents for us. Any remarketing firm will be identified and the terms of its agreements, if any, with us and its compensation will be described in the applicable prospectus supplement.

Delayed Delivery Contracts

If we so indicate in the applicable prospectus supplement, we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions to purchase securities from us at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery on a specified date in the future.

The contracts would be subject only to those conditions described in the applicable prospectus supplement. The applicable prospectus supplement will describe the commission payable for solicitation of those contracts.

General Information

We may have agreements with the underwriters, dealers, agents and remarketing firms to indemnify them against certain civil liabilities, including liabilities under the Securities Act, or to contribute with respect to payments that the underwriters, dealers, agents or remarketing firms may be required to make. Underwriters, dealers, agents and remarketing firms may be customers of, engage in transactions with or perform services for us in the ordinary course of their businesses.

DESCRIPTION OF SECURITIES

Authorized and Outstanding Capital Stock

The following description sets forth certain general terms and provisions of the shares of Common Stock and shares of preferred stock to which any prospectus supplement may relate.

We have 400,000,000 shares of capital stock, par value $0.001 per share, authorized of which 300,000,000 are shares of Common Stock and 100,000,000 are shares of “blank check” preferred stock.

As of December 15, 2022, we had 194,030,197 shares of our common stock issued and outstanding, held by approximately 475 stockholders of record. The number of record holders does not include beneficial owners of common stock whose shares are held in the names of various broker-dealers and registered clearing agencies.

Common Stock

The holders of our Common Stock are entitled to one vote per share. In addition, the holders of our Common Stock will be entitled to receive dividends ratably, if any, are declared by our board of directors out of legally available funds; however, the current policy of our board of directors is to retain earnings, if any, for operations and growth. Upon liquidation, dissolution or winding-up, the holders of our Common Stock are entitled to share ratably in all assets that are legally available for distribution. The holders of our Common Stock have no preemptive, subscription, redemption or conversion rights. The rights, preferences and privileges of holders of our Common Stock are subject to, and may be adversely affected by, the rights of the holders of any series of preferred stock, which may be designated solely by action of our board of directors and issued in the future.

Preferred Stock

Our board of directors are authorized, subject to any limitations prescribed by law, without further vote or action by our stockholders, to issue from time-to-time shares of preferred stock in one or more series. Each series of preferred stock will have the number of shares, designations, preferences, voting powers, qualifications and special or relative rights or privileges as shall be determined by our board of directors, which may include, among others, dividend rights, voting rights, liquidation preferences, conversion rights and preemptive rights.

The ability to authorize “blank check” preferred stock makes it possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to acquire us. These and other provisions may have the effect of deferring hostile takeovers or delaying changes in control or management of our Company.

It is not possible to state the actual effect of the issuance of any shares of preferred stock upon the rights of holders of our Common Stock until the board of directors determines the specific rights of the holders of our preferred stock. However, the effects might include, among other things:

| | · | Impairing dividend rights of our Common Stock; |

| | · | Diluting the voting power of our Common Stock; |

| | · | Impairing the liquidation rights of our Common Stock; and |

| | · | Delaying or preventing a change of control without further action by our stockholders. |

Series A Convertible Preferred Shares

We have designated 6,000,000 shares of our preferred stock as Series A Convertible Preferred (the “Series A Shares”), with a stated value of $1,000 per share. An aggregate of 6,000 Series A Shares were issued on February 28, 2022. As of December 14, 2022, there were no Series A Shares issued and outstanding. The Series A Shares are convertible into shares of the Company’s Common Stock at the lower of (i) $3.00 or (ii) 80% of the average VWAP for the Company’s Common Stock for the five (5) trading days immediately following the effectiveness of the resale registration statement. On June 14, 2022, the Conversion Price was reset to $0.62152 per share. The Series A Shares rank senior to all of the Company’s Common Stock and any other equity securities that the Company may issue in the future with respect to payment of dividends and distribution of assets upon liquidation, dissolution or winding up. While the Series A Shares are outstanding, the Company may not amend, alter or change adversely the powers, preferences or rights given to the Series A Shares, create, or authorize the creation of, any additional class or series of capital stock of the Company (or any security convertible into or exercisable for any class or series of capital stock of the Company), including any class or series of capital stock of the Company that ranks superior to or in parity with the Series A Shares, alter, amend, modify, or repeal its Articles of Incorporation or other charter documents in any manner that adversely affects any rights of the holders of Series A Shares, increase or decrease the number of authorized shares of Series A Shares, any agreement, commitment or transaction that would result in a Change of Control, any sale or disposition of any material assets outside of the ordinary course of business of the Company, any material change in the principal business of the Company, including the entry into any new line of business or exit of any current line of business, and circumvent a right or preference of the Series A Shares. Any holder of the Series A Shares shall have the right by written election to the Company to convert all or any portion of the outstanding shares of Series A Shares. Immediately upon effectiveness of a registration statement registering for resale all of the Series A Shares, all outstanding Series A Shares shall automatically convert into Common Stock, subject to certain beneficial ownership limitations. On July 29, 2022, the Company amended the Certificate of Designations of Rights and Preferences of Series A Convertible Preferred Stock to allow holders of Series A Shares the option to convert any portion of their Series A Preferred Shares into Common Stock of the Company, notwithstanding the beneficial ownership limitation, which was revised.

Warrants

As of December 14, 2022, there were 40,669,630 Warrants issued and outstanding exercisable to purchase by the holders thereof of up to 40,669,630 shares of Common Stock.

Exercisability. The Warrants are exercisable at any time for a period of five and one-half years after their original issuance. The Warrants are exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of the Common Stock underlying the Warrants under the Securities Act is effective and available for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of shares of Common Stock purchased upon such exercise. If a registration statement registering the issuance of the Common Stock underlying the Warrants under the Securities Act is not effective or available and an exemption from registration under the Securities Act is not available for the issuance of such shares, the holder may, in its sole discretion, elect to exercise the Warrants through a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of Common Stock determined according to the formula set forth in the Warrant. No fractional common shares will be issued in connection with the exercise of a Warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price.

Exercise Limitation. A holder will not have the right to exercise any portion of the Warrants if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or, upon election by a holder prior to the issuance of any pre-funded warrants, 9.99%) of the number of shares of Common Stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrants. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99%, upon at least 61 days’ prior notice from the holder to us with respect to any increase in such percentage.

Exercise Price. The exercise prices for the Warrants vary from $0.12 to $3.30 per share. The exercise price and number of shares of Common Stock issuable upon exercise will adjust in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting the Common Stock, as well as, in the case of the Warrants, certain issuances of equity securities at an effective price per share lower than the then applicable exercise price per share.

Transferability. Subject to applicable laws, the Warrants may be offered for sale, sold, transferred or assigned without our consent.

Rights as a Shareholder. Except as otherwise provided in the Warrants or by virtue of such holder’s ownership of our Common Stock, the holder of a Warrant does not have the rights or privileges of a holder of Common Stock, including any voting rights, until the holder exercises the Warrant.

Fundamental Transactions. In the event of a fundamental transaction, as described in the Warrants and generally including, with certain exceptions, any reorganization, recapitalization or reclassification of the Common Stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding shares of Common Stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding shares of Common Stock, the holders of the Warrants will be entitled to receive upon exercise of the Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the warrants immediately prior to such fundamental transaction. Additionally, as more fully described in the Warrants, in the event of certain fundamental transactions, the holders of the Warrants will be entitled to receive consideration in an amount equal to the Black Scholes value of the Warrants on the date of consummation of such transaction.

Public Offering

On October 17, 2022, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain institutional investors (the “Purchasers”), pursuant to which the Company agreed to issue and sell, in a public offering (the “Offering”), an aggregate of $7,500,000 of securities, consisting of (i) 62,500,000 shares of Common Stock, (ii) pre-funded Warrant in lieu of shares of Common Stock, and (iii) warrants to purchase 125,000,000 shares of Common Stock (the “Common Warrants” and collectively with the Pre-Funded Warrants, the “Warrants”). Under the terms of the Purchase Agreement, the Company agreed to sell one share of its Common Stock or a Pre-Funded Warrant and two Common Warrants for each share of Common Stock or Pre-Funded Warrant sold at a unit price of $0.12. For each of the 15,662,603 Pre-Funded Warrants sold in the Offering, the number of shares of Common Stock offered were decreased on a one-for-one basis. As of December 14, 2022, 15,329,270 Pre-funded Warrants have been exercised and 333,333 remain outstanding.

Series A and Series B Common Warrants

Duration and Exercise Price

An aggregate of 62,500,000 Series A Common Warrants and 62,500,000 Series B Common Warrants were sold by the Company on October 20, 2022 as part of the Public Offering. As of December 14, 2022, there were 12,650,000 Series A Warrants outstanding and 22,133,333 Series B Warrants outstanding.

Each Common Warrant has an initial exercise price equal to $0.12 per share. The Common Warrants are immediately exercisable. One-half (the Series B Common Warrants) will expire on the seventh anniversary of the original issuance date and the other one-half (the Series A Common Warrants) will expire on the second anniversary date of issuance. The exercise price and number of shares of Common Stock issuable upon exercise is subject to appropriate proportional adjustment in the event of share dividends, share splits, reorganizations or similar events affecting our shares of Common Stock and the exercise price. The exercise price is subject to reset during the next twelve (12) months in the event of a reverse stock split.

Exercisability

The Common Warrants are exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice and, within the earlier of (i) two trading days and (ii) the number of trading days comprising the standard settlement period with respect to the shares of Common Stock as in effect on the date of delivery of the notice of exercise thereafter, payment in full for the number of shares of Common Stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder may not exercise any portion of the Common Warrant to the extent that the holder, together with its affiliates and any other persons acting as a group together with any such persons, would own more than 4.99% (or, at the election of the purchaser, 9.99%) of the number of ordinary shares outstanding immediately after exercise (the “Beneficial Ownership Limitation”); provided that a holder with a Beneficial Ownership Limitation of 4.99%, upon notice to us and effective 61 days after the date such notice is delivered to us, may increase the Beneficial Ownership Limitation so long as it in no event exceeds 9.99% of the number of shares of Common Stock outstanding immediately after exercise.

Cashless Exercise

If, at the time a holder exercises its Common Warrants, a registration statement registering the issuance of the shares of Common Stock underlying the Common Warrants under the Securities Act is not then effective or available for the issuance of such shares, then in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of Common Stock determined according to a formula set forth in the Common Warrants, which generally provides for a number of shares of Common Stock equal to (A) (1) the volume weighted average price on (x) the trading day preceding the notice of exercise, if the notice of exercise is executed and delivered on a day that is not a trading day or prior to the opening of “regular trading hours” on a trading day or (y) the trading day of the notice of exercise, if the notice of exercise is executed and delivered after the close of “regular trading hours” on such trading day, or (2) the bid price on the day of the notice of exercise, if the notice of exercise is executed during “regular trading hours” on a trading day and is delivered within two hours thereafter, less (B) the exercise price, multiplied by (C) the number of shares of Common Stock the Common Warrant was exercisable into, with such product then divided by the number determined under clause (A) in this sentence.

Fractional Shares

No fractional shares of Common Stock will be issued upon the exercise of the Common Warrants. Rather, we will, at our election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price or round up to the next whole share.

Transferability

Subject to applicable laws, a Common Warrant may be transferred at the option of the holder upon surrender of the Common Warrant to us together with the appropriate instruments of transfer and funds sufficient to pay any transfer taxes payable upon such transfer.

Trading Market

There is no trading market available for the Common Warrants on any securities exchange or nationally recognized trading system. We do not intend to list the Common Warrants on any securities exchange or nationally recognized trading system. The shares of Common Stock issuable upon exercise of the Common Warrants are currently listed on The Nasdaq Capital Market under the symbol “COSM.”

Rights as a Shareholder

Except as otherwise provided in the Common Warrants or by virtue of such holder’s ownership of the underlying shares of Common Stock, the holders of the Common Warrants do not have the rights or privileges of holders of our shares of Common Stock, including any voting rights, until they exercise their Common Warrants.

Fundamental Transaction

In the event of a fundamental transaction, as described in the Common Warrants and generally including any reorganization, recapitalization or reclassification of our shares of Common Stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding shares of Common Stock, the holders of the Common Warrants will be entitled to receive upon exercise of the Common Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the Common Warrants immediately prior to such fundamental transaction. Additionally, in the event of a fundamental transaction, we or any successor entity will, at the option of the holder of a Common Warrant exercisable at any time concurrently with or within 30 days after the consummation of the fundamental transaction (or, if later, the date of the public announcement thereof), purchase the Common Warrant from the holder by paying to the holder an amount of consideration equal to the value of the remaining unexercised portion of such Common Warrant on the date of consummation of the fundamental transaction based on the Black-Scholes option pricing model, determined pursuant to a formula set forth in the Common Warrants. The consideration paid to the holder will be the same type or form of consideration that was offered and paid to the holders of shares of Common Stock in connection with the fundamental transaction; provided that if no such consideration was offered or paid, the holders of shares of Common Stock will be deemed to have received shares of Common Stock of the successor entity in such fundamental transaction for purposes of this provision of the Common Warrants.

Senior Convertible Notes

January 7, 2021 Subscription Agreement

As of December 14, 2022, we have one outstanding unsecured convertible note with an aggregate principal balance of $100,000 convertible into 326,763 shares of our Common Stock. Information about the convertible notes is provided below.

Upon the consummation of a NEO listing, the total principal and accrued interest outstanding on the note will convert into shares of the Company’s common stock at a 25% discount to the prices of the common shares sold in the financing to be conducted in conjunction with the NEO listing. In the event that a NEO listing is not consummated on or before October 31, 2021, the note holder will have the option, in part or in full, to have the note repaid with interest, or convert the note into Company common stock at a 25% discount to the 30-day volume-weighted average price of the Common Shares on the most senior stock exchange in North American on which the common shares are trading prior to conversion.

The Company determined that the embedded conversion feature of the convertible promissory note meets the definition of a derivative liability which is accounted for separately. The Company determined a derivative liability exists and determined that the embedded derivative was valued at $456,570 which was recorded as a debt discount, and together with the original issue discount and transaction expenses of $43,000, in the aggregate of $499,570, is being amortized over the life of the loan. As of September 30, 2022 and December 31, 2021 the full amount of the debt discount has been amortized. As of September 30, 2022 and December 31, 2021, the fair value of the derivative liability was $0 and $5,822, respectively. For the nine months ended September 30, 2022 and 2021, the Company record a loss on the change in fair value of the derivative of $5,807 and a gain of $111,581, respectively.

Convertible Promissory Note

On September 17, 2021 (the “Issue Date”), the Company entered into a convertible promissory note with an unaffiliated third party.

The Company issued the convertible promissory note for a purchase price of $525,000 in principal amount for cash proceeds of $500,000. The note was issued with an original issue discount (“OID”) of $25,000, bears an interest rate of 10% per annum and matures on the earlier of (i) the consummation of the Company listing its common shares on the Nasdaq Stock Market or (ii) September 17, 2022.

Upon the consummation of a Nasdaq listing, the total principal and accrued interest outstanding on the note will convert into shares of the Company’s common stock at a 30% discount to the prices of the common shares sold in the financing to be conducted in conjunction with the Nasdaq listing, subject to a conversion floor of $3.00. The Company determined that the embedded conversion feature of the convertible promissory note meets the definition of a beneficial conversion feature which is accounted for separately as of December 31, 2021. The Company measured the beneficial conversion feature’s intrinsic value on September 17, 2021, at $294,000 which, together with the OID of $25,000 was recorded as a debt discount and is being amortized over the life of the loan. On January 1, 2022, the Company adopted ASU 2020-06 using the modified retrospective method. As a result of the adoption, on January 1, 2022, the Company recorded an increase to additional paid in capital of $294,000 and a decrease to accumulated deficit of $53,248. For the year ended December 31, 2021, $60,063 of the debt discount has been amortized. As of December 31, 2021, the Company had accrued a principal balance of $525,000, had accrued $15,166 in interest expense, and had remaining debt discount of $258,938 which resulted in a net convertible note payable of $266,063.

Transfer Agent

Our transfer agent for our Common Stock is Globex Transfer, LLC, located at 780 Deltona Blvd., Suite 202, Deltona, Florida, 32725.

DESCRIPTION OF WARRANTS

General

We may issue warrants for the purchase of our Preferred Stock, Common Stock, or any combination thereof. Warrants may be issued independently or together with our preferred shares or ordinary shares and may be attached to or separate from any offered securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a bank or trust company, as warrant agent. The warrant agent will act solely as our agent in connection with the warrants. The warrant agent will not have any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants. This summary of certain provisions of the warrants is not complete. For the terms of a particular series of warrants, you should refer to the prospectus supplement for that series of warrants and the warrant agreement for that particular series.

Equity Warrants

The prospectus supplement relating to a particular series of warrants to purchase our Common Stock or Preferred Stock will describe the terms of the warrants, including the following:

| | · | the title of the warrants; |

| | | |

| | · | the offering price for the warrants, if any; |

| | | |

| | · | the aggregate number of warrants; |

| | | |

| | · | the designation and terms of the Common Stock or Preferred Stock that may be purchased upon exercise of the warrants; |

| | · | if applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued with each security; |

| | | |

| | · | if applicable, the date from and after which the warrants and any securities issued with the warrants will be separately transferable; |

| | | |

| | · | the number of shares of Common Stock or Preferred Stock that may be purchased upon exercise of a warrant and the exercise price for the warrants; |

| | | |

| | · | the dates on which the right to exercise the warrants shall commence and expire; |

| | | |

| | · | if applicable, the minimum or maximum amount of the warrants that may be exercised at any one time; |

| | | |

| | · | the currency or currency units in which the offering price, if any, and the exercise price are payable; |

| | · | if applicable, a discussion of material U.S. federal income tax considerations; |

| | | |

| | · | the antidilution provisions of the warrants, if any; |

| | | |

| | · | the redemption or call provisions, if any, applicable to the warrants; |

| | | |

| | · | any provisions with respect to a holder’s right to require us to repurchase the warrants upon a change in control or similar event; and |

| | | |

| | · | any additional terms of the warrants, including procedures and limitations relating to the exchange, exercise and settlement of the warrants. |

Holders of equity warrants will not be entitled:

| | · | to vote, consent, or receive dividends; |

| | | |

| | · | receive notice as shareholders with respect to any meeting of shareholders for the election of our directors or any other matter; or |

| | | |

| | · | exercise any rights as shareholders. |

DESCRIPTION OF SUBSCRIPTION RIGHTS

We may issue subscription rights to purchase our shares of Common Stock or Preferred Stock. These subscription rights may be offered independently or together with any other security offered hereby and may or may not be transferable by the shareholder receiving the subscription rights in such offering. In connection with any offering of subscription rights, we may enter into a standby arrangement with one or more underwriters or other purchasers pursuant to which the underwriters or other purchasers may be required to purchase any securities remaining unsubscribed for after such offering.

The prospectus supplement relating to any subscription rights we offer, if any, will, to the extent applicable, include specific terms relating to the offering, including some or all of the following:

| | · | the price, if any, for the subscription rights; |

| | | |

| | · | the exercise price payable for our Common Stock or Preferred Stock upon the exercise of the subscription rights; |

| | | |

| | · | the number of subscription rights to be issued to each shareholder; |

| | | |

| | · | the number and terms of our Common Stock or Preferred Stock which may be purchased per each subscription right; |

| | | |

| | · | the extent to which the subscription rights are transferable; |

| | | |

| | · | any other terms of the subscription rights, including the terms, procedures and limitations relating to the exchange and exercise of the subscription rights; |

| | | |

| | · | the date on which the right to exercise the subscription rights shall commence, and the date on which the subscription rights shall expire; |

| | | |

| | · | the extent to which the subscription rights may include an over-subscription privilege with respect to unsubscribed securities or an over-allotment privilege to the extent the securities are fully subscribed; and |

| | | |

| | · | if applicable, the material terms of any standby underwriting or purchase arrangement which may be entered into by us in connection with the offering of subscription rights. |

The description in the applicable prospectus supplement of any subscription rights we offer will not necessarily be complete and will be qualified in its entirety by reference to the applicable subscription rights certificate, which will be filed with the SEC if we offer subscription rights. We urge you to read the applicable subscription rights certificate and any applicable prospectus supplement in their entirety.

DESCRIPTION OF UNITS

We may issue units consisting of some or all of the securities described above, in any combination, including Common Stock, Preferred Stock and/or warrants. The terms of these units will be set forth in a prospectus supplement. The description of the terms of these units in the related prospectus supplement will not be complete. You should refer to the applicable form of unit and unit agreement for complete information with respect to these units.

LEGAL MATTERS