Current Report Filing (8-k)

March 16 2023 - 4:01PM

Edgar (US Regulatory)

0001866633FALSE00018666332023-03-162023-03-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported) March 16, 2023

Consensus Cloud Solutions, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Delaware | | 001-40750 | | 87-1139414 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

700 S. Flower Street, 15th Floor

Los Angeles, California 90017

(Address of principal executive offices) (Zip Code)

(323) 860-9200

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | CCSI | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01 Other Events.

As previously disclosed in its Current Report on Form 8-K filed on February 22, 2023 (the “Earnings 8-K”) and in its Form 12b-25 filed on March 2, 2023, during the completion of its annual report on Form 10-K for the fiscal year ending December 31, 2022 (the “Annual Report”), the Company identified unintentional errors primarily relating to (i) to an accounting practice in its SoHo business in which revenue was inadvertently grossed up with a corresponding offset to bad debt expense and (ii) the timing of revenue recognition of $2.2 million of revenue initially recognized in the third quarter of 2022, which, after review with its auditors, the Company has concluded should be reclassified as deferred revenue. As previously disclosed, the Company determined that its financial statements for the interim period ended September 30, 2022 ("Quarterly Report") should be restated (the “Restatement”) due to these unintentional errors and that it was unable to file, without unreasonable effort or expense, the Annual Report within the prescribed time period.

The Company’s review of the Annual Report and the Restatement of the Quarterly Report is ongoing. The Company will not be able to complete and file with the SEC the Annual Report within the fifteen-day period provided under Rule 12b-25.

The Company currently expects to file the Annual Report and the Restatement of the Quarterly Report within five (5) business days following the date of this report.

The Company has not as of the date hereof identified any material changes to the unaudited, preliminary financial data furnished in the Earnings 8-K as of or for the year ended December 31, 2022.

For avoidance of doubt and as previously disclosed in the Earnings 8-K, the Company had a year-end cash balance of approximately $94 million, representing cash deposits held by two of the top five largest commercial banks, as ranked by the Federal Reserve. The cash was not invested in fixed rate instruments. The Company does not have relationships with Silicon Valley Bank, Signature Bank or Credit Suisse.

The Company is still finalizing its financial closing process for the year ended December 31, 2022 and the Company’s audited financial results as of and for the year ended December 31, 2022 are not yet available. The unaudited, preliminary financial data for the year ended December 31, 2022 included in Earnings 8-K were prepared by, and is the responsibility of, the Company’s management. The Company’s auditor has not audited, reviewed, compiled or applied agreed-upon procedures with respect to such preliminary financial data. Accordingly, the Company’s auditor does not express an opinion or any other form of assurance with respect thereto. Upon completion of its financial closing procedures, the Company’s audited financial results may differ materially from its preliminary estimates.

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995: Certain statements in this press release are “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding: the Company’s timing of filing of the Annual Report and the Restatement of the Quarterly Report; the identification of no material changes from the unaudited preliminary results for the year ended December 31, 2022 reported on February 22, 2023, the Company’s plans to remediate the deficiencies, including material weaknesses, with respect to the Company’s internal control over financial reporting and disclosure controls and procedures; the impact of these matters on the Company’s performance and outlook; expectations concerning the Company’s performance and financial outlook; and any statements or assumptions underlying any of the foregoing. These forward-looking statements are based on management’s current expectations or beliefs and are subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. For a more detailed description of the risk factors and uncertainties affecting Consensus, refer to the 2021 Annual Report on Form 10-K filed by Consensus on April 15, 2022, and, when filed, the Company’s 2022 Annual Report on Form 10-K and the other reports filed by Consensus from time to time with the SEC, each of which is available at www.sec.gov.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | Consensus Cloud Solutions, Inc. (Registrant) |

| | | |

| Date: | March 16, 2023 | By: | /s/ Vithya Aubee |

| | | Vithya Aubee

Vice President and Secretary |

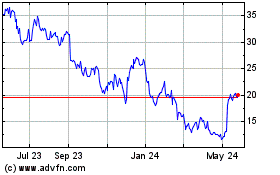

Concensus Cloud Solutions (NASDAQ:CCSI)

Historical Stock Chart

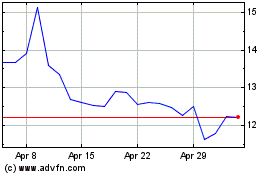

From Jun 2024 to Jul 2024

Concensus Cloud Solutions (NASDAQ:CCSI)

Historical Stock Chart

From Jul 2023 to Jul 2024