Comstock Holding Companies Reports First Quarter 2020 Results

May 29 2020 - 9:00AM

On May 28, 2020, Comstock Holding Companies, Inc., (NASDAQ: CHCI)

(the “Company”), announced results for the three months ended March

31, 2020:

Highlights of First Quarter 2020, as

compared to First Quarter 2019:

- Total revenue increased by 43% to

$7.0 million during the first quarter 2020, as compared to $4.9

million during the same period of the prior year.

- Revenue from asset management

operations increased by 31% to $5.4 million during the first

quarter 2020, as compared to $4.2 million during the same period of

the prior year.

- Revenue from real estate services

increased by 110% to $1.5 million during the first quarter 2020,

compared to $0.7 million during the same period of the prior

year.

- Operating income of $0.2 million

resulting in approximately break-even net income during the first

quarter 2020, as compared to $0.4 million operating income and $0.1

million net income during the same period of the prior year.

- Assets under management (“AUM”)

increased during the first quarter 2020 as a result of the addition

of an approximately 140,000 square foot office building to the

Anchor Portfolio.

- The Company secured a $10 million

revolving capital line of credit, with a portion of the proceeds

used shortly after the end of the first quarter to retire 100% of

the Company’s 10% corporate debt obligation scheduled to mature in

2020, while enhancing the Company’s ability to pursue strategic

acquisitions and new revenue opportunities.

“In response to the Covid-19 pandemic, Comstock

has taken multiple steps in an effort to ensure the safety of our

workforce, construction subcontractors, residential and commercial

tenants, and visitors to all of the properties that Comstock

develops and manages,” said Christopher Clemente, Chairman and CEO

of Comstock Holding Companies Inc. “In addition to implementing

several safety protocols recommended by the CDC, we have also

expanded service offerings of our subsidiary, Comstock

Environmental Services, LLC, to include Covid-19 emergency response

and remediation services. While the long-term impacts of the

pandemic on real estate are still unclear, the financial

performance of our AUM properties to date and the stability

provided by long-term agreements related to our Anchor Portfolio,

gives me confidence that Comstock is well positioned to continue

expanding its assets under management, increasing revenue, and

delivering positive results. I look forward to speaking directly to

our shareholders at our June 17th annual meeting and to reporting

on our continued progress in future periods.”

About Comstock Holding Companies, Inc.

Comstock Holding Companies, Inc. (Nasdaq: CHCI) is a real estate

development, asset management and real estate services company that

has designed, developed, constructed and managed several thousand

residential units and millions of square feet of residential and

mixed-use projects throughout the Washington, D.C. metropolitan

market since 1985. In 2019, Comstock completed the disposition of

its for-sale homebuilding operation to focus exclusively on

commercial real estate investment, development, asset management

and real estate related services. Anchoring CHCI’s transition is a

long-term asset management agreement covering two of the largest

transit-oriented, mixed-use developments in the Washington, D.C.

area; Reston Station, a nearly 5 million square foot

transit-oriented and mixed-use development in Reston, Virginia, and

Loudoun Station, a nearly 2.5 million square foot transit-oriented,

mixed-use development in Ashburn, Virginia, and additional

development assets. Comstock has significant experience with

entitling, designing, developing, and managing a diverse range of

properties including apartments, condominiums, mixed-use

(residential and commercial) properties, large-scale commercial

parking garages and infrastructure projects.

Comstock Holding Companies, Inc. is publicly traded

on NASDAQ under the symbol CHCI. For more information,

visit www.ComstockCompanies.com.

Cautionary Statement Regarding Forward-Looking

Statements

This release may include "forward-looking" statements that are

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by use of words such as "anticipate,"

"believe," "estimate," "may," "intend," "expect," "will," "should,"

"seeks" or other similar expressions. Forward-looking statements

are based largely on our expectations and involve inherent risks

and uncertainties, many of which are beyond our control. Any number

of important factors could cause actual results to differ

materially from those in the forward-looking statements. Additional

information concerning important risk factors and uncertainties can

be found under the heading "Risk Factors" in our latest Annual

Report on Form 10-K, as filed with the Securities and Exchange

Commission. Comstock specifically disclaims any obligation to

update or revise any forward-looking statements, whether as a

result of new information, future developments or otherwise.

Company: Comstock Holding Companies, Inc.

Christopher Guthrie, 703-230-1292 Chief Financial Officer

Source: Comstock Holding Companies, Inc.

COMSTOCK HOLDING COMPANIES, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(Amounts in thousands, except share and per

share data)

|

|

|

March 31,2020 |

|

|

December 31,2019 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

7,180 |

|

|

$ |

3,511 |

|

|

Trade receivables |

|

|

1,510 |

|

|

|

1,886 |

|

|

Trade receivables - related parties |

|

|

3,336 |

|

|

|

3,644 |

|

|

Prepaid and other assets, net |

|

|

408 |

|

|

|

274 |

|

|

Total current assets |

|

|

12,434 |

|

|

|

9,315 |

|

|

|

|

|

|

|

|

|

|

|

|

Equity method investments at fair value |

|

|

8,230 |

|

|

|

8,421 |

|

|

Fixed assets, net |

|

|

239 |

|

|

|

278 |

|

|

Goodwill |

|

|

1,702 |

|

|

|

1,702 |

|

|

Intangible assets, net |

|

|

86 |

|

|

|

103 |

|

|

Operating lease right-of-use assets |

|

|

99 |

|

|

|

114 |

|

|

TOTAL ASSETS |

|

$ |

22,790 |

|

|

$ |

19,933 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accrued personnel costs |

|

$ |

458 |

|

|

$ |

2,916 |

|

|

Accounts payable |

|

|

593 |

|

|

|

1,438 |

|

|

Accrued liabilities |

|

|

601 |

|

|

|

166 |

|

|

Short term notes payable - due to affiliates, net of discount |

|

|

5,730 |

|

|

|

5,706 |

|

|

Short term operating lease liabilities |

|

|

49 |

|

|

|

— |

|

|

Short term notes payable |

|

|

104 |

|

|

|

77 |

|

|

Total current liabilities |

|

|

7,535 |

|

|

|

10,303 |

|

|

|

|

|

|

|

|

|

|

|

|

Long term notes payable - due to affiliates |

|

|

5,500 |

|

|

|

— |

|

|

Long term notes payable - net of deferred financing charges |

|

|

1,158 |

|

|

|

1,212 |

|

|

Long term operating lease liabilities, net of current portion |

|

|

50 |

|

|

|

61 |

|

|

TOTAL LIABILITIES |

|

|

14,243 |

|

|

|

11,576 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Series C preferred stock $0.01 par value, 20,000,000 shares

authorized, 3,440,690 issued and outstanding and liquidation

preference of $17,203 at March 31, 2020 and December 31, 2019 |

|

$ |

6,765 |

|

|

$ |

6,765 |

|

|

Class A common stock, $0.01 par value, 59,779,750 shares

authorized, 7,897,100 and 7,849,756 issued, and 7,811,530 and

7,764,186 outstanding at March 31, 2020 and December 31, 2019,

respectively |

|

|

79 |

|

|

|

78 |

|

|

Class B common stock, $0.01 par value, 220,250 shares authorized,

issued and outstanding at March 31, 2020 and December 31, 2019 |

|

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

|

199,573 |

|

|

|

199,372 |

|

|

Treasury stock, at cost (85,570 shares Class A common

stock) |

|

|

(2,662 |

) |

|

|

(2,662 |

) |

|

Accumulated deficit |

|

|

(195,210 |

) |

|

|

(195,198 |

) |

|

TOTAL COMSTOCK HOLDING COMPANIES, INC. EQUITY |

|

|

8,547 |

|

|

|

8,357 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

22,790 |

|

|

$ |

19,933 |

|

COMSTOCK HOLDING COMPANIES, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

OPERATIONS(Amounts in thousands, except per share

data)

|

|

|

Three Months Ended

March 31, |

|

|

|

|

2020 |

|

|

2019 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

Revenue—asset management |

|

$ |

5,435 |

|

|

$ |

4,154 |

|

|

Revenue—real estate services |

|

|

1,531 |

|

|

|

728 |

|

|

Total revenue |

|

|

6,966 |

|

|

|

4,882 |

|

| Expenses |

|

|

|

|

|

|

|

|

|

Direct costs - asset management |

|

|

4,632 |

|

|

|

3,667 |

|

|

Direct costs - real estate services |

|

|

1,381 |

|

|

|

494 |

|

|

General and administrative |

|

|

598 |

|

|

|

304 |

|

|

Selling and Marketing |

|

|

164 |

|

|

|

— |

|

| Operating income |

|

|

191 |

|

|

|

417 |

|

| Other income, net |

|

|

9 |

|

|

|

57 |

|

| Interest expense |

|

|

(164 |

) |

|

|

(18 |

) |

| Loss on equity method

investments carried at fair value |

|

|

(47 |

) |

|

|

— |

|

| (Loss) income before income

tax expense |

|

|

(11 |

) |

|

|

456 |

|

| Income tax expense |

|

|

1 |

|

|

|

— |

|

| Net (loss) income from

continuing operations |

|

|

(12 |

) |

|

|

456 |

|

| Net loss from discontinued

operations, net of tax |

|

|

— |

|

|

|

(371 |

) |

| Net (loss) income |

|

|

(12 |

) |

|

|

85 |

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income per share from

continuing operations |

|

|

|

|

|

|

|

|

|

Basic net income per share |

|

$ |

(0.00 |

) |

|

$ |

0.12 |

|

|

Diluted net income per share |

|

$ |

(0.00 |

) |

|

$ |

0.12 |

|

| Loss per share from

discontinued operations |

|

|

|

|

|

|

|

|

|

Basic net loss per share |

|

|

— |

|

|

$ |

(0.10 |

) |

|

Diluted net loss per share |

|

|

— |

|

|

$ |

(0.10 |

) |

|

|

|

|

|

|

|

|

|

|

| Basic weighted average shares

outstanding |

|

|

8,003 |

|

|

|

3,850 |

|

| Diluted weighted average

shares outstanding (continuing operations) |

|

|

8,003 |

|

|

|

3,965 |

|

| Diluted weighted average

shares outstanding (discontinued operations) |

|

|

— |

|

|

|

3,850 |

|

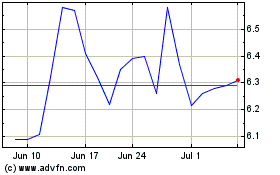

Comstock Holding Companies (NASDAQ:CHCI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Comstock Holding Companies (NASDAQ:CHCI)

Historical Stock Chart

From Dec 2023 to Dec 2024