Statement of Changes in Beneficial Ownership (4)

June 12 2018 - 11:51AM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

TOTAL S.A.

|

2. Issuer Name

and

Ticker or Trading Symbol

Clean Energy Fuels Corp.

[

CLNE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

__

X

__ 10% Owner

_____ Officer (give title below)

_____ Other (specify below)

|

|

(Last)

(First)

(Middle)

2, PLACE JEAN MILLIER, LA DEFENSE 6

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

6/8/2018

|

|

(Street)

92400 COURBEVOIE, I0

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

6/8/2018

|

|

P

(1)

(2)

|

|

50856296

|

A

|

$1.64

|

50856296

|

I

|

By Total Marketing Services S.A.

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Stock Election Right (Right to Buy)

|

$1.64

|

6/8/2018

|

|

J

(1)

(2)

|

|

|

30498520

|

(2)

|

(2)

|

Common Stock

|

30498520

|

$1.64

|

0

|

D

|

|

|

Explanation of Responses:

|

|

(1)

|

As described in further detail in the Schedule 13D filed by TOTAL S.A. ("Total") and Total Marketing Services S.A. ("Purchaser" and together with Total, the "Reporting Persons") on May 18, 2018, Purchaser and Clean Energy Fuels Corp. (the "Issuer") entered into a stock purchase agreement on May 9, 2018 (the "Purchase Agreement"), pursuant to which (A) Purchaser agreed to purchase, and the Issuer agreed to sell and issue, 50,856,296 shares of the Issuer's common stock, par value $0.0001 per share ("Common Stock"), if certain closing conditions are satisfied or waived, including that the Issuer's stockholders approve (i) the issuance of all of the shares of Common Stock to be sold to Purchaser under the Purchase Agreement and

|

|

(2)

|

(Continued from Footnote 1) (ii) an amendment to the Issuer's Restated Certificate of Incorporation to increase the number of shares of Common Stock the Issuer is authorized to issue ("Issuer Stockholder Approval"), or (B) Purchaser would have had the right (the "Stock Election Right"), exercisable in its sole discretion, to purchase 30,498,520 shares of Common Stock in the event the Issuer did not obtain the Issuer Stockholder Approval. At the Issuer's 2018 annual meeting of stockholders held on June 8, 2018, the Issuer Stockholder Approval was obtained. As a result, the Stock Election Right has been replaced with Purchaser's obligation to purchase of 50,856,296 shares of Common Stock, subject to the other standard and customary closing conditions and other terms set forth in the Purchase Agreement. The closing of the transaction and the issuance of the shares of Common Stock to Purchaser is expected to occur on June 13, 2018.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

TOTAL S.A.

2, PLACE JEAN MILLIER

LA DEFENSE 6

92400 COURBEVOIE, I0

|

|

X

|

|

|

Total Marketing Services S.A.

24 COURS MICHELET

LA DEFENSE 10

92800 PUTEAUX, I0

|

|

X

|

|

|

Signatures

|

|

/s/ Antoine Larenaudie, Group Treasurer, on behalf of TOTAL S.A.

|

|

6/12/2018

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ Philippe Montanteme, Senior Vice President Strategy Marketing & Research, on behalf of Total Marketing Services S.A

|

|

6/12/2018

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

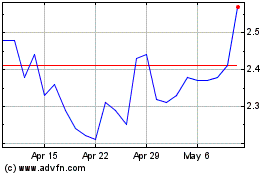

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

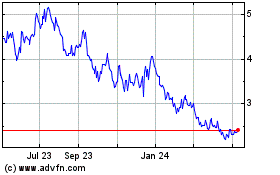

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024