Bear of the Day: Chart Industries (GTLS) - Bear of the Day

November 25 2013 - 4:14AM

Zacks

Chart Industries (GTLS) is a $2.7 billion global engineering

company that specializes in equipment primarily used in energy

processing applications such as liquefied natural gas (LNG) and in

the purification and storage of industrial gases for medical

fields.

But its 3rd-quarter earnings report on October 31,

which included a miss and guide lower, left investors and the stock

completely out of fuel as shares dropped over 27% in the last three

weeks.

Chart Industries, which was seen on the forefront

of systems required to support trucks that run on LNG, operates in

three segments: Energy and Chemicals, Distribution and Storage, and

Biomedical. The latter segment wasn't the problem area last

quarter.

According to analysts at Global Hunter Securities,

"GTLS printed a disappointing quarter in issues in its two banner

segments. The D&S segment missed on the top line due to

projects moving out the door slower than anticipated and E&C

missed as margins came in lower due to pricing issues."

The Chart for Chart

After the disappointing report, the stock and its

Zacks Rank tell a story that any investor caught with a "miss and

lower" quarter -- as opposed to "beat and raise" -- can relate

to.

GTLS shares fell to a Zacks #5 Rank on November 5

after several analysts revised their estimates lower. At the time,

the stock was still trading $102 and gave investors plenty of heads

up to plan their exit before dropping below $87 last week.

And GTLS actually went to Zacks #4 Rank on October

19 as some astute analysts began lowering their numbers ahead of

the company's quarterly report. It seems the love for this company

among many investors made them reluctant to let go of their shares

despite the warnings in the revision data.

The LNG Frontier

In the past two years, I have invested in two other

companies involved in using LNG for truck fuel. Westport

Innovations (WPRT) caught my eye in 2012 as a maker of engine

conversion kits, and not least because their "big brother" in the

business was Cummins (CMI).

While some companies like UPS and FedEx already run

expanding portions of their fleets with natural gas engines, the

idea for all of America's trucks to run on nat gas was popularized

by infamous energy tycoon T. Boone Pickens.

The billionaire oil man has spent several years

lobbying Congress to pass what is commonly known as the Natural Gas

Act. His plan for American energy independence and

economic/environmental stability was to have the government

subsidize the conversion of 18-wheelers from diesel to nat gas.

WPRT fortunes may have been tied to much to these

big expectations about government subsidies for truck engine

conversions and the stock has recently fallen to 18-month lows as

those "nat gas dreams" have not materialized.

Clean Energy Fuels (CLNE), one of the

leading LNG gas station operators (in part financed by Pickens)

hasn't had a much better year, with the stock basically stuck

between $12 and $14 for over 18 months since a peak above $24 in

early 2012. They remain unprofitable with EPS estimates still

trending downward.

Cheniere Energy (LNG) is the other nat gas

stock I've traded this year. They are the only company approved by

the Department of Energy to export LNG and CNG (compressed natural

gas) products. They are building the export facilities in Louisiana

and shares are up over 100% this year.

The Future for Chart

Given this mixed landscape for LNG-centered

businesses, it is no surprise what Global Hunter had to say about

Chart Industries recently...

"The market realized the issues that led to our

downgrade several months ago: that the LNG space is highly

competitive, large projects have a tendency to slip and costs are

often underestimated. We continue to believe that the macro story

is very strong and that GTLS will participate, but we feel that is

currently priced into the stock, thus we are not moving off of our

Neutral rating."

That was their view on November 4 when they lowered

EPS estimates for Q4 and the full year 2014. They also lowered

their price target on shares then to $107 from $115.

They were joined by 9 of 12 other analysts in

similar moves and this brought down the 2013 EPS consensus to $2.95

from $3.22. The full year 2014 consensus slipped to $4.03 from

$4.39. William Blair analysts lowered their EPS estimates but

maintained their $104 price target.

While GTLS may have superior technology that will

be in high demand when the trend of nat gas trucks accelerates,

right now the earnings revisions trends are saying to find another

ride.

Kevin Cook is a Senior Stock Strategist for

Zacks where he runs the Follow The Money portfolio.

CLEAN EGY FUELS (CLNE): Free Stock Analysis Report

CUMMINS INC (CMI): Free Stock Analysis Report

CHART INDUSTRIE (GTLS): Free Stock Analysis Report

CHENIERE ENERGY (LNG): Free Stock Analysis Report

WESTPORT INNOV (WPRT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

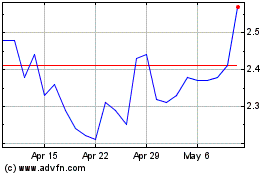

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

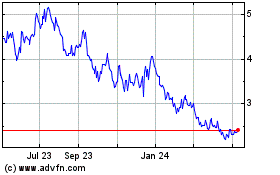

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024