Fluor Wins Another Gold Project - Analyst Blog

February 20 2013 - 8:00AM

Zacks

Fluor Corporation

(FLR) recently received a series of follow–on contracts from

Toronto-based Barrick Gold Corp. The contracts are for the

Pascua-Lama mining project located on the Argentina/Chile border.

A contract win of a gold project is one of these and its

value is still undisclosed. The deal is included in the fourth

quarter of 2012 backlog of Fluor.

As per the deal, Fluor will be

responsible for the overall project management and construction

management for the Pascua location on the Chile side of the site.

The company will also take charge of construction management and

construction of the Lama location on the Argentina side in a 50/50

joint venture with Argentinian contractor Techint. Among all the

mining projects throughout the world Pascua-Lama project is said to

be one of the most important and difficult.

The Pascua-Lama mine site spans

across a region called Cordilera, on the border of Argentina and

Chile, at an altitude of 3,800 to 5,200 meters on the Andes

Mountains. When completed the mine is expected to produce an

average of 800,000 - 850,000 ounces of gold and 35 million ounces

of silver in its first full five years of operation.

The company recently completed the

Pueblo Viejo project of Barrick Gold in the Dominican Republic

successfully. The project involved a new processing facility for

one of the largest undeveloped gold resources in the world and had

the largest foreign investment in the nation’s history. It hopes to

maintain a cordial relation with Barrick Gold and is confident of

winning more such projects in the future. Fluor has the reputation

of handling difficult mining projects.

Fluor serves a diverse set of

industries worldwide, including oil and gas, chemical and

petrochemicals, transportation, mining and metals, power, life

sciences and manufacturing. It is also a primary service provider

to the U.S. federal government.

Fluor currently has a Zacks Rank #3

(Hold) while some of its competitors such as Jacobs

Engineering Group (JEC), Tyco International

Ltd. (TYC), Clean Energy Fuels Corp.

(CLNE) carry a Zacks Rank #2 (Buy).

CLEAN EGY FUELS (CLNE): Free Stock Analysis Report

FLUOR CORP-NEW (FLR): Free Stock Analysis Report

JACOBS ENGIN GR (JEC): Free Stock Analysis Report

TYCO INTL LTD (TYC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

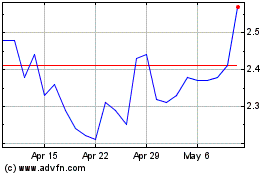

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

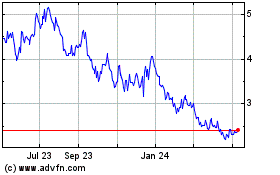

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024