Cheniere Energy and Clean Energy Fuels Receive Bipartisan Support

September 02 2011 - 8:16AM

Marketwired

Natural gas is considered the cleanest-burning fossil fuel, and by

most estimates, electricity produced from natural gas results in

approximately half the Green House Gas emissions of coal-fired

power generation. President Obama has said that he believes natural

gas has "enormous" potential as a clean energy alternative to oil

and federal incentives to expand the use of natural gas in vehicles

are "an area of broad bipartisan agreement." The Bedford Report

examines investing opportunities in natural gas and provides stock

research on Cheniere Energy, Inc. (NYSE Amex: LNG) and Clean Energy

Fuels Corporation (NASDAQ: CLNE). Access to the full company

reports can be found at:

www.bedfordreport.com/LNG www.bedfordreport.com/CLNE

As Congress reconvenes this month, natural gas investors are

closely watching the status of the National Alternative

Transportation to Give Americans Solutions Act (NAT GAS Act). The

NAT GAS Act aims to provide incentives for the purchase of natural

gas trucks and to build refueling infrastructure across the US. In

what has become a rare occurrence in Washington these days, the NAT

GAS Act has received overwhelming bipartisan support. A bill

promoting natural gas vehicles was first introduced in 2008 by

archconservative Sen. James Inhofe (R-OK). The first NAT GAS Act

was soon introduced by a bipartisan coalition including Senate

Majority Leader Harry Reid (D-NV) and conservative champion Tom

Coburn (R-OK).

The Bedford Report releases equity research on the natural gas

sector so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.bedfordreport.com and get exclusive

access to our numerous analyst reports and industry

newsletters.

Clean Energy Fuels Corporation already has natural gas refueling

stations, and would likely be among the beneficiaries of the bill's

passage. Last month the company announced that it will receive $150

million from three investors. The company intends to use proceeds

from the sale to develop and operate liquefied natural gas fueling

stations. It will also use the money for delivery trucks and

offloading facilities.

Cheniere Energy is primarily engaged in Liquefied Natural Gas

related businesses, and owns and operates the Sabine Pass LNG

terminal and Creole Trail pipeline in Louisiana. Cheniere reported

a net loss of $47.2 million, or $0.67 per share, for the three

months ended June 30, 2011.

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

http://www.bedfordreport.com/disclaimer.php.

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

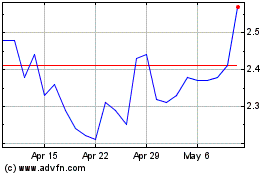

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

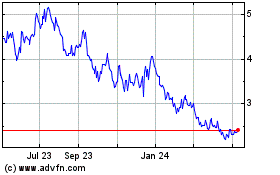

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024