false000117320400011732042024-08-142024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 14, 2024 |

Cineverse Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-31810 |

22-3720962 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

224 W. 35th St. Suite 500, #947 |

|

New York, New York |

|

10001 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 212 206-8600 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

CLASS A COMMON STOCK, PAR VALUE $0.001 PER SHARE |

|

CNVS |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 14, 2024, Cineverse Corp. (the “Company”) issued a press release announcing its financial results for the three months ended June 30, 2024.

A copy of such press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

The information in this Item 2.02 of Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

August 14, 2024 |

By: |

/s/ Gary S. Loffredo |

|

|

Name: Title: |

Gary S. Loffredo

Chief Legal Officer, Secretary and Senior Advisor |

Exhibit 99.1

Cineverse Reports First Quarter Fiscal Year 2025 Results

Total Revenue of $9.1 Million

Total Direct Operating Margin of 51%

Selling, General, and Administrative Expenses decreased by $1.3 Million, or 17%

LOS ANGELES, August 14, 2024 – Cineverse Corp. (“Cineverse” or the “Company”) (NASDAQ: CNVS), a global streaming technology and entertainment company, today announced its financial results for its fiscal first quarter ended June 30, 2024 (“Q1 FY 2025”).

Q1 FY 2025 Highlights (all comparisons are to the prior year fiscal quarter ended June 30, 2023, or Q1 FY 2024):

For the fiscal quarter ended June 30, 2024, the Company’s initiatives to reduce operating costs continued to have a positive impact on our financial results contributing to a decrease in SG&A expenses of $1.3 million, or 17% and also helped increase our direct operating margin to 51% from 46% last year, above our previously stated target of 45% to 50%.

In addition, the Company began to execute on its previously approved share repurchase program and acquired approximately 184 thousand shares through June 30, 2024. The previously reported share repurchase program remains in place and will continue to be utilized as appropriate.

The Company’s Digital content library of approximately 66,000 titles was valued as of March 31, 2024 at approximately $39.8 million, a significant increase over the 2023 valuation and well above the $2.6 million book library valuation as of June 30, 2024.

The Company looks ahead in the next few quarters to the impact of our new sales initiatives, particularly for our proprietary Matchpoint technology, AI related products and omni-advertising programs, including our direct sales efforts from our new advertising team, and also from the release of the next installment of our horror franchise, Terrifier 3, on October 11, 2024.

Total monthly viewership across our channel portfolio increased 73% versus last year, driven in large part by successful new channel launches such as Dog Whisperer with Cesar Milan and Garfield and Friends. Combined with the rapid growth of our podcast business, where revenues were up 143% versus last year and we now have 44 podcasts airing, this should set the stage for our new ad sales team to drive significant growth over the next few quarters, particularly through direct ad sales.

•Total revenue of $9.1 million versus $13.0 million, mainly reflecting a reduction of $2.4 million in Streaming and Digital revenue, attributable to a $1.9 million decline in the Company's digital distribution revenue mostly resulting from content release timing impacts, as well as a $1.2 million decrease versus fiscal 2024 non-recurring revenue from the Company's legacy digital cinema business.

oThese decreases were partially offset by a $0.6 million, or 143%, increase in Podcast revenue. This success was driven by the growing popularity of the Company's Bloody Disgusting podcast content.

•The Company's direct operating expenses decreased by $2.5 million to $4.5 million from $7.0 million, at a direct operating margin of 51% versus 46% last year and above our previously stated margin target of 45% to 50%.

•SG&A expenses decreased $1.3 million, or 17%, primarily driven by $0.5 million from reduced legal and consulting costs, as well as a decrease of $0.4 million in compensation related costs, due to the Company's continued offshoring program to Cineverse Services India.

•Net loss attributable to common stockholders was $3.2 million, or $(0.20) earnings per share, down from net loss of $3.6 million, or $(0.37) earnings per share.

•Adjusted EBITDA improved by $0.1 million to ($1.4) million.

•Financial condition overview:

oCash and cash equivalents of $4.0 million as of June 30, 2024.

▪The maturity date of the Company's $7.5 million Line of Credit Facility has been extended to September 15, 2025.

▪Digital content library valued as of March 31, 2024 at approximately $39.8 million in a third-party appraisal, including the pre-release estimated value of Terrifier 3, compared to a book value of $2.6 million as of June 30, 2024.

Operational Developments During the Quarter

•Experienced an exceptional 73% growth in year-over-year increase in minutes watched.

•Set release date for “Terrifier 3” – the highly anticipated follow up to runaway hit, “Terrifier 2” – for October 11, 2024. Announced Iconic Events as theatrical distribution partner.

•Announced public Beta of the Company's AI-Powered content search and discovery tool, cineSearch. Subsequently announced partnerships with Gracenote, Vionlabs and Datatonic to enhance metadata, recommendations and genAI conversational capabilities.

•Podcast network saw exponential growth - yielding a 49% revenue surge over the last 60 days.

•Announced the capability to provide robust, cost-streaming workforce solution to Matchpoint customers through the Company's India-based Cineverse Services India.

•Expanded wildly successful Bob Ross Universe with episodes remastered in HD & 4K for the first time ever – along with exclusive new ambient viewing content “The Bob Ross Gallery Collection” series.

•Announced Titan Books as publisher for Terrifier 2 novelization – opening a new revenue stream to super-serve highly engaged fandom – available October 29, 2024.

•Announced launch of 9 Story Presents: Garfield and Friends FAST channel on Sling Freestream – bringing classic family IP to new generation with timing aligned to major motion picture release.

•Debuted Bloody Disgusting merchandise in exclusive branded Fan Shops in 1700 Walmart stores nationwide.

•Announced numerous channel launches on Xfinity, Xumo, Zone-ify and DIRECTV – driving additional distribution to unlock the potential for revenue growth.

•Announced a new distribution deal with Australia-based Network 10, a division of Paramount Global, to bring 10 play's FAST channels.

Operational Developments Subsequent to Quarter-End

•The Company’s new Matchpoint Sales team has signed its first long-term Matchpoint SaaS deals worth more than $250 thousand in revenue annually and has developed a robust pipeline of more than 20 deals for future potential revenue opportunities.

•Published Extensive Library of Video Content on Spotify.

•'Dog Whisperer With Cesar Millan' FAST Channel Goes Live on Pluto TV.

Management Commentary

Chris McGurk, Cineverse Chairman and CEO, stated, “This was a transition quarter for the Company. Although we continue to enjoy the benefits of our cost streamlining initiatives and resultant higher operating margins, we did not yet begin to record the revenue upsides during the quarter from our new sales teams and new sales initiatives for our proprietary Matchpoint technology, AI-based products and omni-advertising programs, particularly direct ad sales. We continue to build a robust sales pipeline in all those areas and fully expect to begin to record revenue upsides over the next few quarters as we close multiple deals already in the sales queue. Viewership across our streaming channel portfolio increased by 73% in terms of minutes watched. Combined with the rapid growth of our podcast business, this should set the stage for significant revenue upsides as we see the impact of our new sales team and their new sales initiatives, particularly direct ad sales, over the next several quarters. In addition, the next installment in our horror film franchise, Terrifier 3, is on target for theatrical release on October 11, 2024. We are marshalling all the resources of the Company to maximize profits from that release, not just in theatrical, but in all ancillary distribution markets as well, including video on demand, DVD/Blu-Ray, and particularly our Screambox horror streaming channel, where we saw a substantial increase in subscribers from the launch of Terrifier 2.

"Notably, we extended our $7.5 million line-of-credit with East West Bank until September 2025, further strengthening our financial flexibility. In addition, our digital content library was appraised at approximately $39.8 million, a significant increase over the valuation by the same third party a year earlier and far above the $2.6 million book value of the library. This library valuation alone is also significantly higher than our current market capitalization, which we believe continues to be severely undervalued. Reflecting that disparity, we purchased approximately 184,000 shares of Cineverse equity through June 30, 2024 and are continuing to utilize our previously reported stock repurchase program, as appropriate, since we believe repurchasing shares is a value-creating investment opportunity at current pricing levels.”

Erick Opeka, President and CSO of Cineverse, stated, “While we faced challenging year-over-year revenue comparisons due to the timing of digital content releases and legacy Digital Cinema non-recurring items, we made substantial progress in building out our content, advertising, and Matchpoint sales units during the quarter. We expect to see significant traction from these initiatives beginning in the current quarter. We've added six fully operational sales heads and are already seeing considerable results from their efforts.

"Our licensing sales have increased substantially, and our sales team has gained significant early traction. This includes closing our first Matchpoint SaaS deal after quarter-end, as well as securing ad sales from major players like Disney, Universal, Neon, and Zocdoc during the quarter. Looking ahead, we anticipate being sold out of inventory on several verticals in the next quarter and expect significant acceleration in digital, licensing, and Matchpoint revenues from deals currently in negotiation. We're in the final stages of phase II development for our AI-based cineSearch product and expect a full consumer release within the next 60 days. We're also preparing the product for B2B licensing and are already in discussions with several Tier 1 OEMs.”

Opeka continued, “Our streaming consumption metrics have shown exceptional growth, with a 73% year-over-year increase in minutes watched. This surge in viewership provides us with a substantial inventory of ad space as we approach our busiest seasons, including Halloween, the election cycle, and holiday advertising. We're well-positioned to capitalize on these opportunities and expect this to translate into significant revenue growth in the coming quarters.

"Lastly, we are pursuing other exciting new opportunities in AI. We're in early discussions with multiple parties to license parts of our extensive content library for AI training purposes. Additionally, we are in discussion to represent AI training rights for other content owners, which could potentially add hundreds of thousands of titles to our existing library of more than 66,000 titles for this initiative. These developments position us at the forefront of the rapidly evolving entertainment technology landscape."

Conference Call

Cineverse will host a conference call at 4:30 p.m. ET (Wednesday, August 14, 2024), during which management will discuss the results of the fiscal first quarter ended June 30, 2024. To participate in the conference call, please use the following dial-in numbers:

United States (Local): +1 404 975 4839

United States (Toll-Free): +1 833 470 1428

Canada (Toll-Free): +1 833 950 0062

Access code: 417695

The conference call can also be accessed by webcast at the Investors section of the Company's website at https://investor.cineverse.com/events-and-presentations. Those who are unable to attend the live conference call may access the recording at the above webcast link, which will be made available shortly after the conclusion of the call.

About Cineverse

Cineverse’s advanced, proprietary technology drives the distribution of over 70,000 premium films, series, and podcasts to more than 150 million unique viewers monthly. From providing a complete streaming solution to some of the world’s most recognizable brands, to super-serving their own network of fan channels, Cineverse is powering the future of Entertainment. For more information, please visit www.cineverse.com. (NASDAQ: CNVS)

Safe Harbor Statement

Investors and readers are cautioned that certain statements contained in this document, as well as some statements in periodic press releases and some oral statements of Cineverse officials during presentations about Cineverse, along with Cineverse's filings with the Securities and Exchange Commission, including Cineverse's registration statements, quarterly reports on Form 10-Q and annual report on Form 10-K, are "forward-looking'' statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the "Act''). Forward-looking statements include statements that are predictive in nature, which depend upon or refer to future events or conditions, which include words such as "expects," "anticipates,'' "intends,'' "plans,'' "could," "might," "believes,'' "seeks," "estimates'' or similar expressions. In addition, any statements concerning future financial performance (including future revenues, earnings, or growth rates), ongoing business strategies or prospects, and possible future actions, which may be provided by Cineverse's management, are also forward-looking statements as defined by the Act. Forward-looking statements are based on current expectations and projections about future events and are subject to various risks, uncertainties, and assumptions about Cineverse, its technology, economic and market factors, and the industries in which Cineverse does business, among other things. These statements are not guarantees of future performance, and Cineverse undertakes no specific obligation or intention to update these statements after the date of this release.

For additional information, please contact:

Julie Milstead

424-281-5411

investorrelations@cineverse.com

|

|

|

|

|

|

|

|

|

CINEVERSE CORP. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands) |

|

|

|

As of |

|

|

|

June 30,

2024 |

|

|

March 31,

2024 |

|

|

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,955 |

|

|

$ |

5,167 |

|

Accounts receivable, net |

|

|

9,262 |

|

|

|

8,667 |

|

Unbilled revenue |

|

|

4,596 |

|

|

|

6,439 |

|

Employee retention tax credit |

|

|

79 |

|

|

|

1,671 |

|

Content advances |

|

|

12,226 |

|

|

|

9,345 |

|

Other current assets |

|

|

1,413 |

|

|

|

1,432 |

|

Total Current Assets |

|

|

31,531 |

|

|

|

32,721 |

|

Property and equipment, net |

|

|

2,722 |

|

|

|

2,276 |

|

Intangible assets, net |

|

|

18,238 |

|

|

|

18,328 |

|

Goodwill |

|

|

6,799 |

|

|

|

6,799 |

|

Content advances, net of current portion |

|

|

1,655 |

|

|

|

2,551 |

|

Other long-term assets |

|

|

1,397 |

|

|

|

1,703 |

|

Total Assets |

|

$ |

62,342 |

|

|

$ |

64,378 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

20,247 |

|

|

$ |

20,817 |

|

Line of credit, including unamortized debt issuance costs of $127 and $81, respectively |

|

|

4,690 |

|

|

|

6,301 |

|

Current portion of earnout and deferred consideration on purchase of business |

|

|

3,719 |

|

|

|

3,294 |

|

Term Loan, including unamortized debt issuance costs of $131 and $0, respectively |

|

|

3,103 |

|

|

|

— |

|

Operating lease liabilities |

|

|

338 |

|

|

|

401 |

|

Current portion of deferred revenue |

|

|

332 |

|

|

|

436 |

|

Total Current Liabilities |

|

|

32,429 |

|

|

|

31,249 |

|

Deferred consideration on purchase, net of current portion |

|

|

— |

|

|

|

457 |

|

Operating lease liabilities, net of current portion |

|

|

418 |

|

|

|

462 |

|

Other long-term liabilities |

|

|

58 |

|

|

|

59 |

|

Total Liabilities |

|

$ |

32,905 |

|

|

$ |

32,228 |

|

Stockholders’ Equity |

|

|

|

|

|

|

Preferred stock |

|

$ |

3,559 |

|

|

$ |

3,559 |

|

Common stock |

|

|

194 |

|

|

|

194 |

|

Additional paid-in capital |

|

|

546,554 |

|

|

|

545,996 |

|

Treasury stock, at cost |

|

|

(12,166 |

) |

|

|

(11,978 |

) |

Accumulated deficit |

|

|

(507,315 |

) |

|

|

(504,153 |

) |

Accumulated other comprehensive loss |

|

|

(290 |

) |

|

|

(345 |

) |

Total stockholders’ equity of Cineverse Corp. |

|

|

30,536 |

|

|

|

33,273 |

|

Deficit attributable to noncontrolling interest |

|

|

(1,099 |

) |

|

|

(1,122 |

) |

Total equity |

|

|

29,437 |

|

|

|

32,151 |

|

Total Liabilities and Equity |

|

$ |

62,342 |

|

|

$ |

64,378 |

|

|

|

|

|

|

|

|

|

|

CINEVERSE CORP. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(In thousands, except for per share data) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

Revenues |

|

$ |

9,127 |

|

|

$ |

12,980 |

|

Operating expenses |

|

|

|

|

|

|

Direct operating |

|

|

4,479 |

|

|

|

6,987 |

|

Selling, general and administrative |

|

|

6,563 |

|

|

|

7,888 |

|

Depreciation and amortization |

|

|

863 |

|

|

|

822 |

|

Total operating expenses |

|

|

11,905 |

|

|

|

15,697 |

|

Operating loss |

|

|

(2,778 |

) |

|

|

(2,717 |

) |

Interest expense |

|

|

(431 |

) |

|

|

(295 |

) |

Loss from investment in Metaverse, a related party |

|

|

3 |

|

|

|

— |

|

Other income (expense), net |

|

|

163 |

|

|

|

(504 |

) |

Net loss before income taxes |

|

|

(3,043 |

) |

|

|

(3,516 |

) |

Income tax expense |

|

|

(7 |

) |

|

|

(20 |

) |

Net loss |

|

|

(3,050 |

) |

|

|

(3,536 |

) |

Net income attributable to noncontrolling interest |

|

|

(23 |

) |

|

|

(14 |

) |

Net loss attributable to controlling interests |

|

|

(3,073 |

) |

|

|

(3,550 |

) |

Preferred stock dividends |

|

|

(89 |

) |

|

|

(88 |

) |

Net loss attributable to common stockholders |

|

$ |

(3,162 |

) |

|

$ |

(3,638 |

) |

Net loss per share attributable to common stockholders: |

|

|

|

|

|

|

Basic |

|

$ |

(0.20 |

) |

|

$ |

(0.37 |

) |

Diluted |

|

$ |

(0.20 |

) |

|

$ |

(0.37 |

) |

Weighted average shares of common stock outstanding: |

|

|

|

|

|

|

Basic |

|

|

15,702 |

|

|

|

9,879 |

|

Diluted |

|

|

15,702 |

|

|

|

9,879 |

|

Adjusted EBITDA

We define Adjusted EBITDA to be earnings before interest, taxes, depreciation and amortization, stock-based compensation expense, merger and acquisition costs, restructuring, transition and acquisitions expense, net, goodwill impairment and certain other items.

Adjusted EBITDA is not a measurement of financial performance under GAAP and may not be comparable to other similarly titled measures of other companies. We use Adjusted EBITDA as a financial metric to measure the financial performance of the business because management believes it provides additional information with respect to the performance of its fundamental business activities. For this reason, we believe Adjusted EBITDA will also be useful to others, including our stockholders, as a valuable financial metric.

We present Adjusted EBITDA because we believe that Adjusted EBITDA is a useful supplement to net income (loss) from continuing operations as an indicator of operating performance. We also believe that Adjusted EBITDA is a financial measure that is useful both to management and investors when evaluating our performance and comparing our performance with that of our competitors. We also use Adjusted EBITDA for planning purposes and to evaluate our financial performance because Adjusted EBITDA excludes certain incremental expenses or non-cash items, such as stock-based compensation charges, that we believe are not indicative of our ongoing operating performance.

We believe that Adjusted EBITDA is a performance measure and not a liquidity measure, and therefore a reconciliation between net income (loss) from operations and Adjusted EBITDA has been provided in the financial results. Adjusted EBITDA should not be considered as an alternative to net income (loss) from operations as an indicator of performance or as an alternative to cash flows from operating activities as an indicator of cash flows, in each case as determined in accordance with GAAP, or as a measure of liquidity. In addition, Adjusted EBITDA does not take into account changes in certain assets and liabilities as well as interest and income taxes that can affect cash flows. We do not intend the presentation of these non-GAAP measures to be considered in isolation or as a substitute for results prepared in accordance with GAAP. These non-GAAP measures should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP.

Following is the reconciliation of our consolidated net (loss) income to Adjusted EBITDA (in thousands):

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

Net loss |

|

$ |

(3,050 |

) |

|

$ |

(3,536 |

) |

Add Backs: |

|

|

|

|

|

|

Income tax expense |

|

|

7 |

|

|

|

20 |

|

Depreciation and amortization |

|

|

863 |

|

|

|

822 |

|

Interest expense |

|

|

431 |

|

|

|

295 |

|

Stock-based compensation |

|

|

470 |

|

|

|

409 |

|

Loss from equity investment in Metaverse, a related party |

|

|

3 |

|

|

|

— |

|

Other (income) expense, net |

|

|

(163 |

) |

|

|

36 |

|

Net income attributable to noncontrolling interest |

|

|

(23 |

) |

|

|

(14 |

) |

Transition-related costs |

|

|

27 |

|

|

|

468 |

|

Adjusted EBITDA |

|

$ |

(1,435 |

) |

|

$ |

(1,500 |

) |

v3.24.2.u1

Document And Entity Information

|

Aug. 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2024

|

| Entity Registrant Name |

Cineverse Corp.

|

| Entity Central Index Key |

0001173204

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-31810

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

22-3720962

|

| Entity Address, Address Line One |

224 W. 35th St.

|

| Entity Address, Address Line Two |

Suite 500, #947

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

212

|

| Local Phone Number |

206-8600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

CLASS A COMMON STOCK, PAR VALUE $0.001 PER SHARE

|

| Trading Symbol |

CNVS

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

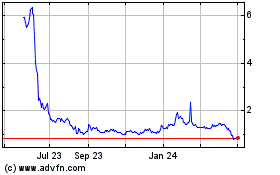

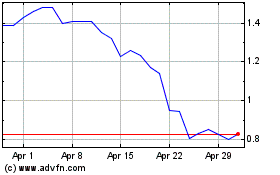

Cineverse (NASDAQ:CNVS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cineverse (NASDAQ:CNVS)

Historical Stock Chart

From Sep 2023 to Sep 2024