false000152493100015249312024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 22, 2024

CHUY’S HOLDINGS, INC.

(Exact Name Of Registrant As Specified In Its Charter)

| | | | | | | | |

| Delaware | 001-35603 | 20-5717694 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

1623 Toomey Rd.

Austin, Texas 78704

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (512) 473-2783

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CHUY | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

In a press release dated February 22, 2024, Chuy's Holdings, Inc. (the "Company") announced financial results for the quarter and year ended December 31, 2023. The full text of the press release is furnished herewith as Exhibit 99.1 to this report.

This information is intended to be furnished under Item 2.02 of Form 8-K, “Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, whether made before or after the date of this report, regardless of any general incorporation language in the filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

Exhibit

Number | Description |

| Press Release dated February 22, 2024 |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

| |

| |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | CHUY’S HOLDINGS, INC. |

| | |

| By: | /s/ Jon W. Howie |

| | Jon W. Howie

Vice President and Chief Financial Officer |

Date: February 22, 2024

Chuy’s Holdings, Inc. Announces Fourth Quarter and Fiscal Year 2023 Financial Results

AUSTIN, Texas, February 22, 2024 - Chuy’s Holdings, Inc. (NASDAQ:CHUY) today announced financial results for the 14 week fourth quarter and the 53 week fiscal year ended December 31, 2023.

Highlights for the 14 week fourth quarter ended December 31, 2023, as compared to the 13 week fourth quarter ended December 25, 2022, were as follows:

•Revenue increased 11.8% to $116.3 million compared to $104.1 million in the fourth quarter of 2022. The extra operating week in fiscal 2023 contributed approximately $8.7 million in revenue.

•Comparable restaurant sales increased 0.3% as compared to the fourth quarter of 2022 (13 weeks vs. 13 weeks).

•Net income increased $3.0 million, or 121.2%, to $5.5 million, or $0.31 per diluted share, as compared to $2.5 million, or $0.14 per diluted share, in the fourth quarter of 2022.

•Adjusted net income(1) increased $2.9 million, or 58.3%, to $7.9 million, or $0.45 per diluted share, as compared to $5.0 million, or $0.27 per diluted share, in the fourth quarter of 2022.

•Restaurant-level operating margin(1) increased $5.6 million, or 31.6%, to $23.3 million as compared to $17.7 million in the fourth quarter of 2022. Restaurant-level operating margin(1) as a percentage of revenue increased 300 basis points to 20.0%, compared to 17.0% in the fourth quarter of 2022.

•Cash and cash equivalents were $67.8 million and the Company had no debt outstanding with $25.0 million available under its revolving credit facility.

Highlights for the 53 week fiscal year ended December 31, 2023, as compared to the 52 week fiscal year ended December 25, 2022, were as follows:

•Revenue increased 9.3% to $461.3 million compared to $422.2 million in fiscal 2022. The extra operating week in fiscal 2023 contributed approximately $8.7 million in revenue.

•Comparable restaurant sales increased 3.3% as compared to fiscal 2022 (52 weeks vs. 52 weeks).

•Net income increased $10.6 million, or 51.1%, to $31.5 million, or $1.76 per diluted share, as compared to $20.9 million, or $1.11 per diluted share, in fiscal 2022.

•Adjusted net income(1) increased $9.5 million, or 36.9%, to $35.3 million, or $1.97 per diluted share, as compared to $25.8 million, or $1.37 per diluted share, in fiscal 2022.

•Restaurant-level operating margin(1) increased $16.4 million, or 21.5%, to $93.1 million as compared to $76.7 million in fiscal 2022. Restaurant-level operating margin(1) as a percentage of revenue increased 200 basis points to 20.2%, compared to 18.2% in fiscal 2022.

(1)Adjusted net income and restaurant-level operating margin are non-GAAP measures. For reconciliations of adjusted net income and restaurant-level operating margin to the most directly comparable GAAP measure, see the accompanying financial tables. For a discussion of why we consider them useful, see “Non-GAAP Measures” below.

Steve Hislop, President and Chief Executive Officer of Chuy’s Holdings, Inc. stated, “I am proud of what our team accomplished in 2023 with continued revenue growth of 9.3% and comparable restaurant sales of approximately 3.3%. Our effective four-wall execution resulted in a 200 basis-point expansion of restaurant-level margins to over 20%

representing our best result in over a decade, excluding the covid-impacted 2021, and among the best in the industry. As we look ahead, we will continue to do what we do best – provide our customers with fresh, made-from-scratch food and drinks at an incredible value. Finally, we were thrilled to return approximately $28.9 million to shareholders during the year through share repurchases enabled by the ongoing strength of our operating model.”

Hislop added, “We successfully opened one new restaurant during the fourth quarter and are pleased with the performance of our recent openings. As we look into 2024, we are encouraged by our robust pipeline of 6 to 8 new restaurants, focusing primarily on core markets where our concept is already proven with high AUVs and brand awareness. We have a long runway ahead of us and are excited by the opportunity to grow the Chuy’s brand and maximizing shareholder value in 2024 and beyond.”

Fourth Quarter 2023 Financial Results

Revenue was $116.3 million in the fourth quarter of 2023 compared to $104.1 million in the fourth quarter of 2022. The Company's fourth quarter of 2023 included 14 weeks as compared to 13 weeks in fiscal year 2022. Revenue attributed to the extra operating week was $8.7 million. In addition to the extra operating week, the increase was primarily related to an increase in our comparable restaurant sales as well as incremental revenue from an additional 62 operating weeks provided by new restaurants opened during and subsequent to the fourth quarter of 2022. For the fourth quarter of 2023, off-premise sales were approximately 31% of total revenue compared to approximately 29% during the same period in fiscal 2022.

Comparable restaurant sales increased 0.3% for the 13 week comparable period ended December 24, 2023 as compared to the same period last year primarily driven by a 3.4% increase in average check, partially offset by a 3.1% decrease in average weekly customers.

Total restaurant operating costs as a percentage of revenue decreased by approximately 300 basis points to 80.0% in the fourth quarter of 2023 from 83.0% in fiscal 2022 primarily driven by the following:

•Cost of sales decreased 240 basis points driven by overall commodity deflation of approximately 8% during the quarter as compared to the same period a year ago as well as leverage on a menu price increase taken subsequent to the fourth quarter of 2022.

•Labor costs increased 30 basis points largely as a result of hourly labor rate inflation of approximately 4% at comparable restaurants as well as an incremental improvement in our hourly labor staffing levels as compared to last year. This increase was partially offset by menu price increases taken subsequent to the fourth quarter of 2022.

•Operating costs increased 10 basis points primarily driven by higher delivery service charges as a result of increased delivery sales, an increase in restaurant repair and maintenance costs, and higher insurance premiums, partially offset by lower utility costs as compared to the fourth quarter of 2022.

•Occupancy costs decreased 100 basis points primarily as a result of sales leverage on fixed occupancy expenses.

General and administrative expenses increased to $8.1 million for the fourth quarter of 2023 compared to $6.5 million for the same period in fiscal 2022. The increase was primarily driven by higher performance-based bonuses and management salaries and an increase in computer services and fees. As a percentage of revenue, general and administrative expenses increased to 6.9% in the fourth quarter of 2023 from 6.2% in the fourth quarter of 2022.

Impairment, closed restaurant and other costs were $3.1 million ($2.4 million, net of tax or $0.14 per diluted share) during the fourth quarter of 2023 and $3.2 million ($2.5 million, net of tax or $0.14 per diluted share) during the same period last year. The decrease was primarily related to a decrease in non-cash loss on long-lived assets of an underperforming restaurant, partially offset by an increase in closed restaurant costs. Closed restaurant costs include rent expense, utilities, insurance and other costs required to maintain the remaining closed locations.

The effective income tax rate was 21.0% compared to 9.3% in the same period last year. The increase in the effective tax rate was mainly attributed to a decrease in the proportion of employee tax credits to annual pre-tax income and the settlement of the fiscal year 2016 IRS tax audit.

As a result of the foregoing, net income was $5.5 million, or $0.31 per diluted share in the fourth quarter of 2023 compared to $2.5 million, or $0.14 per diluted share, in the fourth quarter of 2022.

Adjusted net income was $7.9 million, or $0.45 per diluted share, in the fourth quarter of 2023 compared to $5.0 million, or $0.27 per diluted share, in the fourth quarter of 2022. Please see the reconciliation of net income to adjusted net income in the accompanying financial tables.

Development Update

During the fourth quarter of 2023, one restaurant was opened in Terrell, TX, which brings our total number of restaurants to 101 as of December 31, 2023.

Share Repurchase Program

During the fourth quarter of 2023, the Company repurchased 167,535 shares of its common stock for a total of approximately $5.9 million. During the fiscal year ended December 31, 2023, the Company repurchased 789,963 shares of its common stock for a total of approximately $28.9 million. As of December 31, 2023, the Company had $21.1 million remaining under its share repurchase program. Repurchases of the Company’s outstanding common stock will be made in accordance with applicable securities laws and may be made at management’s discretion from time to time in the open market, through privately negotiated transactions or otherwise, including pursuant to Rule 10b5-1 trading plans.

2024 Outlook

The Company currently expects 2024 adjusted net income(1) per diluted share of $1.82 to $1.87. This compares to adjusted net income(1) per diluted share of $1.97 or $1.87 per diluted share, after excluding approximately $0.10 per diluted share from the extra week in 2023. The adjusted net income guidance for fiscal 2024 is based, in part, on the following annual assumptions:

•General and administrative expense of $30.0 to $31.0 million (on a 52-week comparable basis);

•Six to eight new restaurants;

•Net capital expenditures (net of tenant improvement allowances) of approximately $41 to $46 million;

•Restaurant pre-opening expenses of approximately $2.7 to $3.2 million;

•An effective annual tax rate (excluding unusual items) of approximately of 13% to 14%;

•Annual weighted diluted shares outstanding of approximately 17.4 million.

The Company does not provide a reconciliation of 2024 adjusted net income per diluted share or the most directly comparable forward-looking GAAP measure of net income per diluted share because the timing and nature of excluded items are unreasonably difficult to fully and accurately estimate. As a result, we are unable to assess the probable significance of the unavailable information.

(1)Adjusted net income is a non-GAAP measure. For a reconciliation of adjusted net income for fiscal 2023 to the most directly comparable GAAP measure, see the accompanying financial tables. For a discussion of why we consider adjusted net income useful, see “Non-GAAP Measures” below.

We report our financial statements on a fiscal calendar basis. Due to the 53rd week in fiscal year 2023, our financial statement comparison will be one week different year over year. However, we believe that reporting our comparable restaurant sales on a comparable calendar basis will help facilitate period-over-period comparisons.

The table below sets forth our fiscal and comparable calendar dates.

| | | | | | | | | | | | | | |

| | Fiscal Calendar Basis | | Comparable Calendar Basis |

| | | | |

| First Quarter | | January 1, 2024 - March 31, 2024 | | January 1, 2024 - March 31, 2024 |

| | vs. | | vs. |

| | December 26, 2022 - March 26, 2023 | | January 2, 2023 - April 2, 2023 |

| | | | |

| Second Quarter | | April 1, 2024 - June 30, 2024 | | April 1, 2024 - June 30, 2024 |

| | vs. | | vs. |

| | March 27, 2023 - June 25, 2023 | | April 3, 2023 - July 2, 2023 |

| | | | |

| Third Quarter | | July 1, 2024 - September 29, 2024 | | July 1, 2024 - September 29, 2024 |

| | vs. | | vs. |

| | June 26, 2023 - September 24, 2023 | | July 3, 2023 - October 1, 2023 |

| | | | |

| Fourth Quarter | | September 30, 2024 - December 29, 2024 | | September 30, 2024 - December 29, 2024 |

| | vs. | | vs. |

| | September 25, 2023 - December 31, 2023 | | October 2, 2023 - December 31, 2023 |

| | | | |

| Year | | January 1, 2024 - December 29, 2024 | | January 1, 2024 - December 29, 2024 |

| | vs. | | vs. |

| | December 26, 2022 - December 31, 2023 | | January 2, 2023 - December 31, 2023 |

The following definitions apply to these terms as used in this release:

Comparable restaurant sales reflect changes in sales for the comparable group of restaurants over a specified period of time as compared to that time in the prior year. We consider a restaurant to be comparable in the first full quarter following the 18th month of operations. Changes in comparable restaurant sales reflect changes in customer count trends as well as changes in average check. Our comparable restaurant base consisted of 94 restaurants at December 31, 2023.

Restaurant-level operating margin represents income from operations plus the sum of general and administrative expenses, restaurant pre-opening costs, impairment, closed restaurants and other costs, and depreciation.

Average check is calculated by dividing revenue by total entrées sold for a given time period. Average check reflects menu price increases as well as changes in menu mix.

Average weekly customers is measured by the number of entrées sold per week. Our management team uses this metric to measure changes in customer traffic.

Operating margin represents income from operations as a percentage of our revenue. By monitoring and controlling our operating margins, we can gauge the overall profitability of our Company.

Total restaurant operating costs includes cost of sales, labor, operating, occupancy and marketing costs.

Conference Call

The Company will host a conference call to discuss financial results for the fourth quarter and fiscal year 2023 today at 5:00 p.m. Eastern Time. Steve Hislop, President and Chief Executive Officer, and Jon Howie, Vice President and Chief Financial Officer, will host the call.

The conference call can be accessed live over the phone by dialing 201-689-8560. A replay will be available after the call and can be accessed by dialing 412-317-6671; the passcode is 13743232. The replay will be available until Thursday, March 7, 2024.

The conference call will also be webcast live from the Company’s corporate website at www.chuys.com under the Investors section. An archive of the webcast will be available on the Company's corporate website shortly after the call has concluded.

About Chuy’s

Founded in Austin, Texas in 1982, Chuy's owns and operates full-service restaurants across 16 states serving a distinct menu of authentic, made from scratch Tex-Mex inspired dishes. Chuy's highly flavorful and freshly prepared fare is served in a fun, eclectic and irreverent atmosphere, while each location offers a unique, "unchained" look and feel, as expressed by the concept's motto "If you've seen one Chuy's, you've seen one Chuy's!" For further information about Chuy's, including the nearest location, visit the Chuy's website at www.chuys.com.

Forward-Looking Statements

Certain statements in this release that are not historical facts, including, without limitation, those relating to the Company’s 2024 outlook, including 2024 adjusted net income per diluted share, general and administrative expense, new restaurant openings, net capital expenditures, restaurant pre-opening expenses, effective annual tax rate and annual weighted diluted shares outstanding guidance, [organic growth opportunities ahead] and other statements that can often be identified by words such as “expect,” “believe,” “intend,” “estimate,” “plans” and similar expressions, and variations or negatives of these words are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. Such statements are based upon the current beliefs and expectations of management of the Company. Actual results may vary materially from those contained in forward-looking statements based on a number of factors including, without limitation, the actual number of restaurant openings, the sales at the Company’s restaurants, changes in restaurant development or operating costs, such as food and labor, the Company’s ability to leverage its existing management and infrastructure, changes in restaurant pre-opening expense, general and administrative expenses, capital expenditures, our effective tax rate, impairment, closed restaurant and other costs, changes in the number of diluted shares outstanding, strength of consumer spending, conditions beyond the Company’s control such as timing of holidays, weather, natural disasters, acts of war or terrorism, the timing and amount of repurchases of our common stock, if any, changes to the Company’s expected liquidity position, the possibility that the repurchase program may be suspended or discontinued and other factors disclosed from time to time in the Company’s filings with the U.S. Securities and Exchange Commission. Investors should take such risks into account when making investment decisions. Stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The Company undertakes no obligation to update any forward-looking statements, except as required by law.

Non-GAAP Measures

We prepare our financial statements in accordance with GAAP. Within our press release, we make reference to non-GAAP restaurant-level operating margin and adjusted net income. Restaurant-level operating margin represents income from operations plus the sum of general and administrative expenses, restaurant pre-opening costs, impairment, closed restaurant and other costs, and depreciation. Restaurant-level operating margin is presented because: (i) we believe it is a useful measure for investors to assess the operating performance of our restaurants without the effect of non-cash depreciation expense; and (ii) we use restaurant-level operating margin internally as a benchmark to evaluate our restaurant operating performance and to compare our performance to that of our competitors. Additionally, we present restaurant-level operating margin because it excludes the impact of general and administrative expenses, which are not incurred at the restaurant level, restaurant pre-opening costs, and impairment, closed restaurant and other costs. Although we incur pre-opening costs on an ongoing basis as we continue to open new restaurants, the pre-opening costs, and impairment, closed restaurant and other costs are not components of a restaurant's ongoing operating expenses. The use of restaurant-level operating margin thereby enables us and our investors to compare operating performance between periods and to compare our operating performance to the performance of our competitors. The measure is also widely used within the restaurant industry to evaluate restaurant-level productivity, efficiency and performance. The use of restaurant-level operating margin as a performance measure permits a comparative assessment of our operating performance relative to our performance based on our GAAP results, while isolating the effects of some items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies.

Adjusted net income represents net income before impairment, closed restaurant and other costs, and the income tax effect of these adjustments. We believe the use of adjusted net income provides additional information to enable us and our investors to facilitate year-over-year performance comparisons and a comparison to the performance of our peers.

Restaurant-level operating margin and adjusted net income exclude various expenses as discussed above that may materially impact our consolidated results of operations. As a result, these measures are not indicative of the Company’s

consolidated results of operations. We present these measures exclusively as supplements to, and not substitutes for, net income or income from operations computed in accordance with GAAP. As supplemental disclosures, restaurant-level operating margin and adjusted net income should not be considered as alternatives to net income or income from operations as an indicator of our performance or as alternatives to any other measure determined in accordance with GAAP.

Chuy’s Holdings, Inc.

Condensed Consolidated Income Statements

(Unaudited, in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Year Ended |

| December 31, 2023 | December 25, 2022 | | December 31, 2023 | December 25, 2022 |

| Revenue | $ | 116,347 | | 100.0 | % | $ | 104,101 | | 100.0 | % | | $ | 461,310 | | 100.0 | % | $ | 422,215 | | 100.0 | % |

| | | | | | | | | |

| Costs and expenses: | | | | | | | | | |

| Cost of sales | 29,203 | | 25.1 | | 28,637 | | 27.5 | | | 115,870 | | 25.1 | | 114,903 | | 27.2 | |

| Labor | 35,851 | | 30.8 | | 31,779 | | 30.5 | | | 139,660 | | 30.3 | | 126,249 | | 29.9 | |

| Operating | 19,466 | | 16.7 | | 17,272 | | 16.6 | | | 75,487 | | 16.4 | | 68,436 | | 16.2 | |

| Occupancy | 6,964 | | 6.0 | | 7,266 | | 7.0 | | | 30,734 | | 6.7 | | 29,964 | | 7.1 | |

| General and administrative | 8,057 | | 6.9 | | 6,485 | | 6.2 | | | 31,446 | | 6.8 | | 26,333 | | 6.2 | |

| Marketing | 1,559 | | 1.4 | | 1,436 | | 1.4 | | | 6,411 | | 1.3 | | 6,004 | | 1.4 | |

| Restaurant pre-opening | 548 | | 0.5 | | 629 | | 0.6 | | | 1,985 | | 0.4 | | 1,362 | | 0.3 | |

| | | | | | | | | |

| Impairment, closed restaurant and other costs | 3,118 | | 2.7 | | 3,249 | | 3.1 | | | 4,988 | | 1.1 | | 6,452 | | 1.5 | |

| | | | | | | | | |

| Depreciation | 5,400 | | 4.5 | | 5,111 | | 5.0 | | | 21,140 | | 4.7 | | 20,176 | | 4.9 | |

| Total costs and expenses | 110,166 | | 94.6 | | 101,864 | | 97.9 | | | 427,721 | | 92.8 | | 399,879 | | 94.7 | |

| Income from operations | 6,181 | | 5.4 | | 2,237 | | 2.1 | | | 33,589 | | 7.2 | | 22,336 | | 5.3 | |

| Interest income, net | (755) | | (0.6) | | (494) | | (0.5) | | | (3,331) | | (0.8) | | (872) | | (0.2) | |

| Income before income taxes | 6,936 | | 6.0 | | 2,731 | | 2.6 | | | 36,920 | | 8.0 | | 23,208 | | 5.5 | |

| Income tax expense | 1,456 | | 1.3 | | 254 | | 0.2 | | | 5,410 | | 1.2 | | 2,353 | | 0.6 | |

| Net income | 5,480 | | 4.7 | % | 2,477 | | 2.4 | % | | 31,510 | | 6.8 | % | 20,855 | | 4.9 | % |

| | | | | | | | | |

| Net income per common share: Basic | $ | 0.32 | | | $ | 0.14 | | | | $ | 1.77 | | | $ | 1.12 | | |

| Net income per common share: Diluted | $ | 0.31 | | | $ | 0.14 | | | | $ | 1.76 | | | $ | 1.11 | | |

| | | | | | | | | |

| Weighted-average shares outstanding: Basic | 17,351,230 | | | 18,024,393 | | | | 17,823,187 | | | 18,682,255 | | |

| Weighted-average shares outstanding: Diluted | 17,462,866 | | | 18,150,724 | | | | 17,934,520 | | | 18,793,455 | | |

| | | | | | | | | |

Chuy’s Holdings, Inc.

Reconciliation of GAAP Net Income and Net Income Per Share to Adjusted Results

(Unaudited, in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| Quarter Ended | | Year Ended | |

| December 31, 2023 | | December 25, 2022 | | December 31, 2023 | | December 25, 2022 | |

| Net income as reported | $ | 5,480 | | | $ | 2,477 | | | $ | 31,510 | | | $ | 20,855 | | |

| Impairment, closed restaurant and other costs | 3,118 | | | 3,249 | | | 4,988 | | | 6,452 | | |

| | | | | | | | |

| | | | | | | | |

Income tax effect on adjustment (1) | (719) | | | (749) | | | (1,150) | | | (1,487) | | |

| | | | | | | | |

| Adjusted net income | $ | 7,879 | | | $ | 4,977 | | | $ | 35,348 | | | $ | 25,820 | | |

| | | | | | | | |

| Adjusted net income per common share: basic | $ | 0.45 | | | $ | 0.28 | | | $ | 1.98 | | | $ | 1.38 | | |

| Adjusted net income per common share: diluted | $ | 0.45 | | | $ | 0.27 | | | $ | 1.97 | | | $ | 1.37 | | |

| | | | | | | | |

| Weighted-average shares outstanding: basic | 17,351,230 | | | 18,024,393 | | | 17,823,187 | | | 18,682,255 | | |

| Weighted-average shares outstanding: diluted | 17,462,866 | | | 18,150,724 | | | 17,934,520 | | | 18,793,455 | | |

(1)Reflects the tax expense associated with the adjustments for impairment, closed restaurant and other costs during the quarter ended and fiscal year ended December 31, 2023 and December 25, 2022. The Company uses its statutory rate to calculate the tax effect on adjustments.

Chuy’s Holdings, Inc.

Reconciliation of GAAP Income from Operations to Restaurant-Level Operating Margin

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Quarter Ended | | Year Ended |

| December 31, 2023 | | December 25, 2022 | | December 31, 2023 | | December 25, 2022 |

| Income from operations as reported | $ | 6,181 | | 5.4 | % | | $ | 2,237 | | 2.1 | % | | $ | 33,589 | | 7.2 | % | | $ | 22,336 | | 5.3 | % |

| General and administrative | 8,057 | | 6.9 | | | $ | 6,485 | | 6.2 | | | 31,446 | | 6.8 | | | 26,333 | | 6.2 | |

| Restaurant pre-opening expenses | 548 | | 0.5 | | | $ | 629 | | 0.6 | | | 1,985 | | 0.4 | | | 1,362 | | 0.3 | |

| | | | | | | | | | | |

| Impairment, closed restaurant and other costs | 3,118 | | 2.7 | | | $ | 3,249 | | 3.1 | | | 4,988 | | 1.1 | | | 6,452 | | 1.5 | |

| | | | | | | | | | | |

| Depreciation | 5,400 | | 4.5 | | | $ | 5,111 | | 5.0 | | | 21,140 | | 4.7 | | | 20,176 | | 4.9 | |

| Restaurant-level operating margin | $ | 23,304 | | 20.0 | % | | $ | 17,711 | | 17.0 | % | | $ | 93,148 | | 20.2 | % | | $ | 76,659 | | 18.2 | % |

Chuy’s Holdings, Inc.

Selected Balance Sheets Data

(Unaudited, in thousands)

| | | | | | | | | | | | | | |

| | December 31, 2023 | | December 25, 2022 |

| Cash and cash equivalents | | $ | 67,774 | | | $ | 78,028 | |

| Total assets | | 476,634 | | | 474,781 | |

| Long-term debt | | — | | | — | |

| Total stockholders’ equity | | 249,847 | | | 244,561 | |

Investor Relations

Jeff Priester

332-242-4370

investors@chuys.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

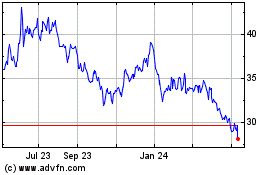

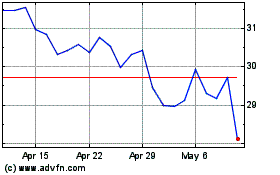

Chuy s (NASDAQ:CHUY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Chuy s (NASDAQ:CHUY)

Historical Stock Chart

From Jul 2023 to Jul 2024